Isocyanate Market by Type (MDI, TDI, Aliphatic, Others) & Application (Rigid Foam, Flexible Foam, Paints & Coatings, Adhesive & Sealants, and Elastomers & Binders) - Global Trends & Forecast to 2019

[286 Pages Report] The isocyanate market is expected to grow with a healthy pace over the next five years to reach $38,729 million, by 2019. Asia-Pacific dominates the market due to high usage of isocyanate-based applications in its various end-user industries. Although the European economy has still not recovered from the Euro crisis, it will continue to be the second best market, followed by North America, and Middle east & Africa.

Consumer markets, including equipment and electronics, automotive and construction, in the emerging economies will present enormous opportunities for manufacturers and suppliers in the future especially the ones involved in infrastructure applications, so the boom in these sectors in emerging econmoies will increase the demand for the market and the products based on it. The factors that drive growth in the market include high demand from current & emerging applications, demand from emerging econmoies, and advancement in technology. Construction and automotive industry, a major end-user industry of isocyanate is on a boom globally This will increase the demand for isocyanate and isocyanate-based derivatives such as rigid foams, coatings, adhesives and sealants. Since, so any growth in these industries will directly impact the demand of these products.

The factors that are providing hindrance in the growth of this market are the high raw material cost and huge investments required in R&D and technology. As the major feedstock for isocyanate is derived from crude oil, the recent volatility in crude oil price has been reflected in the price of raw materials. Owing to the rising feedstock costs the major producers are increasing prices of isocyanate.

The market is analyzed in terms of revenue ($million) and consumption (KT) for all regions, and its respective major countries. The revenues from each region have been broken down by the major applications, namely, rigid foam, flexible foam, paints & coatings, adhesives & sealents, elastomers & binders, and other applications. Also, the types of isocyanate that are identified and included are TDI, MDI, aliphatic isocyanate, and other isocyanate.

For this report, various secondary sources such as encyclopedia, directories, technical handbooks, company annual reports, industry association publications,world economic outlook, trade websites, and databases have been referred to identify and collect information useful for this extensive commercial study of the market. The primary sources experts from related industries and suppliers—have been interviewed to obtain and verify critical information as well as to assess the future prospects and market estimations.

This report analyzes various marketing trends and establishes the most effective growth strategy in the market. It identifies market dynamics such as the drivers, restraints, opportunities, burning issues, and winning imperatives. Major companies such as Ashai Kasei (Japan), BASF SE (Germany), Bayer MaterialScience (Germany), Chemtura Corporation (U.S.), Dow Chemical Company ( U.S.), Evonik Industries (Germany), Hebei Cangzhou Dahua Group Co. Ltd (China), Huntsman Corporation (U.S.), Kumho Mitsui Chemicals Inc ( South Korea), Mitsui Chemicals Inc ( Japan), Vencorex (France), and Yantai Wanhua Polyurethanes Co. Ltd. (China) have also been profiled in this report.

Scope of the report

- On the basis of region:

- Asia-Pacific

- China

- Japan

- India

- Europe

- Germany

- Italy

- Belgium

- U.K.

- Russia

- North America

- U.S.

- Canada

- The Middle East & Africa

- Latin America

- Asia-Pacific

- On the basis of types of Isocyanate:

- Methylene diphenly diisocyanate (MDI)

- Toluene diisocyanate (TDI)

- Aliphatic isocyanate

- Others

- On the basis of application:

- Rigid foam

- Flexible foam

- Paints & coatings

- Adhesives & sealants

- Elastomers & binders

- Others

The isocyanate market is witnessing high growth on account of rising demand from existing and new applications that would become significant in the future, especially in the Asia-Pacific region. Europe holds the second largest market share followed by North America and the Middle East & Africa. In terms of individual countries, the market is dominated by China due to the increased usage of isocyanate in various end-user industries.

The market is anticipated to increase at a healthy rate annually, to reach $38,729 million, by 2019. Isocyanates are primarily used to produce rigid foam, flexible foam, paints & coatings, adhesives & sealants, elastomers & binders, and other applications. The rigid foam application is growing at a high rate, followed by the flexible foam application. The report covers the isocyanate market and its trends that concerns five regions, namely, Europe, North America, Asia-Pacific, The Middle East & Africa, and Latin America; and the major countries in each region such as China, Japan, India, North America, U.S., Canada, Germany, Italy, Belgium, U.K., Russia, and others.

The research and development cost involved in the isocyanate market in terms of man hours, material, and technology are significant. There is a lot of R&D required to develop new technologies that will help in reducing the cost of production. The growth in the market requires constant innovation and the introduction of new and improved products and technologies that meet the requirements of the customers. This has contributed largely to an enhanced focus on R&D by the players to bring new products as well as to decrease the cost of production by implementation of new technologies.

The raw materials used for the production of isocyanate include several products such as crude oil, benzene, propylene, toluene, and aniline. Different types of isocyanate require their own set of raw materials and ingredients, as MDI requires benzene and TDI requires toluene. Any change in the demand and supply of these raw materials canhave an impact on the industry. The volatility in crude oil price affects the raw material supply to the manufacturers, who in turn are forced to increase the prices of their isocyanate products to stem the losses. Isocyanate manufacturing process is highly toxic and hazardous, so the companies have to face many government regulations for isocyanate production.

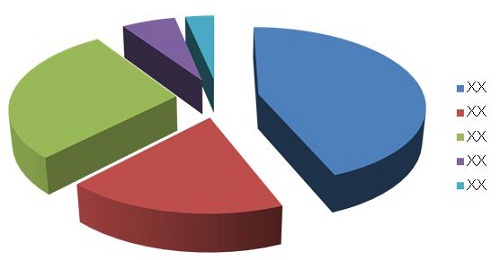

Isocyanate Market Share, by Region, 2013

Source: MarketsandMarkets Analysis

Asia-Pacific is the largest isocyanate market, almost all the developing economies will rise at the global level with China leading the world's top ten economies by GDP measured in PPP terms. Consumer markets, including equipment and electronics, automotive and construction, in the emerging economies will present enormous opportunities for manufacturers and suppliers in the future especially the ones involved in infrastructure applications.

Table of Contents

1 Introduction (Page No. - 22)

1.1 Key Deliverables

1.2 Report Description

1.3 Markets Covered

1.4 Stakeholders

1.5 Research Methodology

1.5.1 Market Size Estimation

1.5.2 Key Data Points Taken From Secondary Sources

1.5.3 List of Secondary Data Sources

1.5.4 Key Data Points Taken From Primary Sources

1.5.5 Assumptions Made For This Report

2 Executive Summary (Page No. - 29)

3 Premium Insights (Page No. - 32)

3.1 Isocyanate Market Segmentation

3.2 Asia-Pacific– Best Market to Invest

3.3 Asia-Pacific–to Continue Driving the Isocyanate Market

3.4 Methylene Diphenyl Diisocyanate: the Largest Type of Isocyanate

3.5 Rigid Polyurethane Foam Industry– Growing At the Highest Rate

3.6 MDI Is the Dominant Player in Terms of Market Size

3.7 BASF Is the Largest Producer of Isocyanate

3.8 Most Companies Relied on Capacity Expansions For Growth

3.9 Bayer Materialscience– the Most Active Player in Isocyanate Market

4 Isocynate Market Overview (Page No. - 42)

4.1 Isocyanate Introduction

4.2 Value Chain Analysis

4.3 Burning Issues

4.3.1 Pricing & toxicity Issues

4.4 Winning Imperatives

4.4.1 Focus on Expansion & Innovation

4.5 Methylene Diphenyl Diisocyanate (MDI)

4.5.1 Types & Applications

4.5.2 Production

4.5.3 Drivers

4.5.3.1 Growth in End-User Industries

4.5.3.2 Compliance With Energy Regulations

4.5.3.3 Growing Market in Asia-Pacific

4.5.4 Restraints

4.5.4.1 Rising Costs of Feedstock

4.5.5 Opportunities

4.5.5.1 Phosgene Free MDI Production Process

4.6 TDI (toluene Diisocyanate)

4.6.1 Types & Applications

4.6.2 Production

4.6.3 Drivers

4.6.3.1 Growth in End-Use Industries

4.6.3.2 Growth in Emerging Economies

4.6.4 Restraints

4.6.4.1 Rising toluene Costs

4.6.5 Opportunities

4.6.5.1 Scope in the Automotive Industry

4.7 Aliphatic Isocyanate

4.7.1 Production

4.7.1.1 HDI

4.7.1.2 IPDI

4.7.1.3 H12MDI

4.7.2 Drivers

4.7.2.1 Growth in End-Use Industries

4.7.2.2 Growth in Emerging Economies

4.7.3 Restraints

4.7.4 Opportunities

4.7.4.1 Scope in the Construction Industry

4.8 Raw Material Analysis

4.8.1 Crude Oil

4.8.2 Propylene

4.8.3 Aniline

4.8.4 Benzene

4.8.5 toluene

4.8.6 Phosgene

4.9 Market Share Analysis

4.10 Price Analysis

4.10.1 MDI

4.10.2 TDI

4.11 Porter’s Five Forces Analysis

4.11.1 Suppliers’ Bargaining Power

4.11.2 Buyers’ Bargaining Power

4.11.3 Threat of New Entrants

4.11.4 Threat of Substitutes

4.11.5 Degree of Competition

5 Isocyanate Market, By Type (Page No. - 89)

5.1 Introduction

5.2 Market Share of Isocyanate, By Type

5.2.1 MDI Continues to Boost the Market

5.2.2 MDI

5.2.2.1 MDI Has Been Around For A Long Time

5.2.2.2 BASF: the Largest Producer of MDI

5.2.2.3 Emerging Economies Driving the Consumption

5.2.2.4 Rigid Foams: A Major Application of MDI

5.2.3 TDI

5.2.3.1 Asia-Pacific Driving the Demand

5.2.3.2 Flexible Foam Is Consumed in Large Quantities

5.2.4 Aliphatic Isocyanate

5.2.4.1 Market in Asia-Pacific Experiencing Significant Surge

5.2.4.2 Paints & Coatings: the Major Applications

5.2.5 Other Isocyanate

5.2.5.1 Other Isocyanate Are Used in Specific Applications

5.2.5.2 Several Types of Isocyanate Yet to Be Commercialized

6 Isocyanate Market, By Application (Page No. - 115)

6.1 Introduction

6.2 Isocyanate Market Analysis, By Application

6.2.1 Rigid Foams to Experience Maximum Growth

6.2.2 Rigid Foams

6.2.2.1 Refrigerators & Construction Consume Large Quantities of Rigid Foam

6.2.2.2 Rigid Foam: the Demand Driven By Developing Economies

6.2.3 Flexible Foams

6.2.3.1 Flexible Foam offers Unique Property of Weight Reduction, Attracting Automotive Manufacturers

6.2.3.2 Increasing Industrialization in Developing Economies Driving Market Growth

6.2.4 Paints & Coatings

6.2.4.1 Paints & Coatings: Growing Demand Will Drive the Market

6.2.5 Elastomers & Binder

6.2.5.1 Isocyanate offer Superior Stress Recovery & Resistance Properties

6.2.5.2 Significant Demand in Asia-Pacific

6.2.6 Adhesives & Sealants

6.2.6.1 Demand Driven By Enhanced Usage in Automotive & Construction Sectors

6.2.6.2 Rising Automobiles & Constructions in Asia-Pacific Fuelling the Market Growth

6.2.7 Other Applications

6.2.7.1 Isocyanate Are Used in Various Other Applications

6.2.7.2 Asia-Pacific: A Major Consumer

7 Isocyanate Market, By Geography (Page No. - 136)

7.1 Isocyanate Market Segmentation

7.2 Isocyanate Market Estimates, By Region

7.3 Asia-Pacific to Drive the Isocyanate Market

7.3.1 Asia-Pacific

7.3.1.1 Driven By Thriving Economies

7.3.1.2 the Asia-Pacific Market to Grow At A Rapid Pace

7.3.1.3 China

7.3.1.3.1 China: Biggest Consumer of Isocyanate

7.3.1.3.2 Increase in Demand & Prices Drives the Growth in China

7.3.1.4 Japan

7.3.1.4.1 Japan–Still Reeling Under the Effects of the Natural Disasters

7.3.1.4.2 Japan Has Been one of the Pioneer Markets of Isocyanate

7.3.1.5 India

7.3.1.5.1 India: An Emerging Market

7.3.1.5.2 India: High Potential With Strong Growth

7.3.1.6 Rest of the Asia-Pacific

7.3.1.6.1 the Region Boasts of Thriving Economies

7.3.1.6.2 Rest of the Asia-Pacific: Huge Possibility For Growth

7.3.2 North America

7.3.2.1 North America Sustaining on Strong Demand

7.3.2.2 U.S.: The Largest Consumer of Isocyanate Market in North America

7.3.2.3 U.S.

7.3.2.3.1 The Isocyanate Market Is Driven By Demand From End-User Industries

7.3.2.4 Canada

7.3.2.4.1 Canada: Huge Potential For the Isocyanate Market

7.3.2.4.2 Canadian Market: Experiencing High Growth

7.3.3 Europe

7.3.3.1 Europe:–One of the Major Markets For Isocyanate

7.3.3.2 Germany

7.3.3.2.1 Germany: Consumes Significant Quantities of Isocyanate

7.3.3.2.2 Germany: Strong Potential With Attention of Major Isocyanate Players

7.3.3.3 Italy

7.3.3.3.1 Italy: the Mature Market For Isocyanate

7.3.3.3.2 Italy: Pursuit For Efficiency Fuelling the Market Growth

7.3.3.4 Belgium

7.3.3.4.1 Belgium: Still Recovering From the Euro Crisis

7.3.3.4.2 Belgium: Expected to Have A Marginal Growth

7.3.3.5 U.K.

7.3.3.5.1 U.K.: Poised For Better Growth

7.3.3.5.2 U.K.: Rising Demand and Increasing Prices Lifting the Market

7.3.3.6 Russia

7.3.3.6.1 Russia: Uncertainty in the Market

7.3.3.6.2 Russia: Market to Remain Subdued

7.3.3.7 Rest of Europe

7.3.3.7.1 Rest of Europe: Better Economic Conditions

7.3.3.7.2 Rest of Europe: Market to Grow At A Slow Rate

7.3.4 the Middle East & Africa

7.3.4.1 Infrastructure Development Prevalent in the Middle East & Africa

7.3.4.2 the Market Is Anticipated to Remain Underdeveloped

7.3.5 Latin America

7.3.5.1 Developing Economies Estimated to Drive the Future Growth

7.3.5.2 Latin America to Grow At A Significant Pace

8 Competitive Landscape (Page No. - 217)

8.1 Introduction

8.2 Strategic Developments

8.2.1 Capacity Expansion: the Most Preferred Strategic Approach

8.2.2 Asia-Pacific: the Most Active Region

8.2.3 Bayer Materialscience & Yantai Wanhua Polyurethanes Co. Ltd: the Most Active Participants

8.2.3.1 Capacity Expansion

8.2.3.2 Geographic Expansion

8.2.3.3 R&D Activity

8.2.3.4 Acquisition

8.2.3.5 Others

9 Company Profiles (Overview, Financial*, Products & Services, Strategy, and Developments) (Page No. - 235)

9.1 Asahi Kasei Chemicals Corp.

9.2 BASF SE

9.3 Bayer Materialscience Ag

9.4 Chemtura Corporation

9.5 Dow Chemical Company

9.6 Evonik Industries

9.7 Hebei Cangzhou Dahua Group Co. Ltd.

9.8 Huntsman International Llc

9.9 Kumho Mitsui Chemicals Inc.

9.10 Mitsui Chemicals Inc.

9.11 Vencorex

9.12 Yantai Wanhua Polyurethanes Co. Ltd.

*Details Might Not Be Captured in Case of Unlisted Companies.

List of Tables (157 Tables)

Table 1 Types of MDI

Table 2 Impact of Major Drivers on the Global MDI Market, 2013-2019

Table 3 Types of TDI

Table 4 Impact of Major Drivers on the Global TDI Market, 2013-2019

Table 5 top 10 Largest Economies By Gdp in Terms of Ppp, 2010 & 2020

Table 6 10 Largest Global Economies’ total Gdp in Terms of Ppp, (2020)

Table 7 Types & Applications

Table 8 Impact of Major Drivers on the Global Aliphatic Isocyanate Market, 2013-2019

Table 9 Asia-Pacific: Construction Spending Growth Rate, By Country, 2013-2018

Table 10 Asia-Pacific: Constuction Spending, 2012 ($Billion)

Table 11 Crude Oil Prices, By Type, 2011-2015 ($/Barrel)

Table 12 Propylene Bulk Prices, 2013-2019 ($/Ton)

Table 13 Aniline Bulk Prices, 2013-2019 ($/Ton)

Table 14 Benzene Bulk Prices, 2013-2019 ($/Ton)

Table 15 toulene Bulk Prices, 2013-2019($/Ton)

Table 16 Global MDI Capacity, 2013 (KT/Year)

Table 17 Global TDI Capacity, 2013 (KT/Year)

Table 18 Global HDI Capacity, 2013 (KT/Year)

Table 19 Average MDI Price, By Geography, 2012-2019 ($/Ton)

Table 20 Average TDI Price, By Geography, 2012-2019 ($/Ton)

Table 21 Average Aliphatic Isocyanates Price, Bygeography, 2012-2019 ($/Ton)

Table 22 Isocynates Market Size, By Type, 2014-2019 (KT)

Table 23 Isocynates Market Size, By Type, 2014-2019 ($Million)

Table 24 MDI Market Size, By Region, 2014-2019 (KT)

Table 25 MDI Market Size, By Region, 2014-2019 ($Million)

Table 26 MDI Market Size, By Application, 2014-2019 (KT)

Table 27 MDI Market Size, By Application, 2014-2019 ($Million)

Table 28 Companies That offer TDI

Table 29 TDI Market Size, By Region, 2014-2019 (KT)

Table 30 TDI Market Size, By Region, 2014-2019 ($Million)

Table 31 TDI Market Size, By Application, 2014-2019 (KT)

Table 32 TDI Market Size, By Application, 2014-2019 ($Million)

Table 33 Companies That offer Aliphatic Isocyanates

Table 34 Aliphatic Isocyanate Market Size, By Region, 2014-2019 (KT)

Table 35 Aliphatic Isocyanate Market Size, By Region, 2014-2019 ($Million)

Table 36 Aliphatic Isocyanate Market Size, By Application, 2014-2019 (KT)

Table 37 Aliphatic Isocyanate Market Size, By Application, 2014-2019 ($Million)

Table 38 Other Isocyanate Market Size, By Region, 2014-2019, (KT)

Table 39 Other Isocyanate Market Size, By Region, 2014-2019 ($Million)

Table 40 Other Isocyanate Market Size, By Application, 2012-2019 (KT)

Table 41 Other Isocyanate Market Size, By Application, 2012-2019 ($Million)

Table 42 Isocyanate: Industrywide Applications

Table 43 Isocyanate Market Size, By Application, 2012-2019 (KT)

Table 44 Isocyanate Market Size, By Application, 2012-2019 ($Million)

Table 45 Rigid Foam Market Size, By Region, 2012-2019 (KT)

Table 46 Rigid Foam Market Size, By Region, 2012-2019 ($Million)

Table 47 Flexible Foam Market Size, By Region, 2012-2019 (KT)

Table 48 Flexible Foam Market Size, By Region, 2012-2019 ($Million)

Table 49 Paints & Coating Market Size, By Region, 2012-2019, (KT)

Table 50 Paints & Coating Market Size, By Region, 2012-2019 ($Million)

Table 51 Elastomers & Binders Market Size, By Region, 2012-2019 (KT)

Table 52 Elastomers & Binders Market Size, By Region, 2012-2019 ($Million)

Table 53 Adhesives & Sealants Market Size, By Region, 2012-2019(KT)

Table 54 Adhesives & Sealants Market Size, By Region, 2012-2019 ($Million)

Table 55 Other Application Market Size, By Region, 2012-2019 (KT)

Table 56 Other Application Market Size, By Region, 2012-2019 ($Million)

Table 57 Isocyanate Market Size, By Region, 2012-2019 (KT)

Table 58 Isocyanate Market Size, By Region, 2012-2019 ($Million)

Table 59 Asia-Pacific: Isocyanate Market Size, By Application, 2012–2019 (KT)

Table 60 Asia-Pacific: Isocyanate Mkt Size, By Application, 2012–2019 ($Million)

Table 61 Asia-Pacific: Isocyanate Market Size, By Type, 2012–2019 (KT)

Table 62 Asia-Pacific: Isocyanate Market Size, By Type, 2012–2019 ($Million)

Table 63 Asia-Pacific: Isocyanate Market Size, By Country, 2012-2019 (KT)

Table 64 Asia-Pacific: Isocyanate Market Size, By Country, 2012-2019 ($Million)

Table 65 China: Isocyanate Mkt Size, By Application, 2012-2019 (KT)

Table 66 China: Isocyanate Market Size, By Application, 2012-2019 ($Million)

Table 67 China: Isocyanate Market Size, By Type, 2012–2019 (KT)

Table 68 China: Isocyanate Market Size, By Type, 2012–2019 ($Million)

Table 69 Japan: Isocyanate Market Size, By Application, 2012–2019 (KT)

Table 70 Japan: Isocyanate Mkt Size, By Application, 2012–2019 ($Million)

Table 71 Japan: Isocyanate Market Size, By Type, 2012–2019 (KT)

Table 72 Japan: Isocyanate Market Size, By Type, 2012–2019 ($Million)

Table 73 India: Isocyanate Mkt Size, By Application, 2012–2019 (KT)

Table 74 India: Isocyanate Market Size, By Application, 2012–2019 ($Million)

Table 75 India: Isocyanate Market Size, By Type, 2012-2019 (KT)

Table 76 India: Isocyanate Market Size, By Type, 2012-2019 ($Million)

Table 77 Rest of the Asia-Pacific: Mkt Size, By Application, 2012–2019 (KT)

Table 78 Rest of the Asia-Pacific: Isocyanate Market Size, By Application, 2012–2019 ($Million)

Table 79 Rest of the Asia-Pacific: Isocyanate Market Size, By Type, 2012–2019 (KT)

Table 80 Rest of Asia-Pacific: Isocyanate Market Size, By Type, 2012–2019 ($Million)

Table 81 North America: Mkt Size, By Application, 2012–2019 ($Million)

Table 82 North America: Isocyanate Market Size, By Application, 2012–2019 ($Million)

Table 83 North America: Isocyanate Market Size, By Type, 2012- 2019 (KT)

Table 84 North America: Isocyanate Market Size, By Type, 2012–2019 ($Million)

Table 85 North America: Isocyanate Market Size, By Country, 2012–2019 (KT)

Table 86 North America: Isocyanate Market Size, By Country, 2012–2019 ($Million)

Table 87 U.S.: Mkt Size, By Application, 2012–2019 (KT)

Table 88 U.S.: Isocyanate Market Size, By Application, 2012–2019 ($Million)

Table 89 U.S.: Isocyanate Market Size, By Type, 2012–2019 (KT)

Table 90 U.S.: Isocyanate Market Size, By Type, 2012–2019 ($Million)

Table 91 Canada: Mkt Size, By Application, 2012–2019 (KT)

Table 92 Canada: Isocyanate Market Size, By Application, 2012–2019 ($Million)

Table 93 Canada: Isocyanate Market Size, By Type, 2012–2019 (KT)

Table 94 Canada: Isocyanate Market Size, By Type, 2012–2019 ($Million)

Table 95 Europe: Mkt Size, By Application, 2012–2019 (KT)

Table 96 Europe: Isocyanate Market Size, By Application, 2012-2019 ($Million)

Table 97 Europe: Isocyanate Market Size, By Type, 2012-2019 (KT)

Table 98 Europe: Isocyanate Market Size, By Type, 2012-2019 ($Million)

Table 99 Europe: Isocyanate Market Size, By Country, 2012-2019 (KT)

Table 100 Europe: Isocyanate Market Size, By Country, 2012-2019 ($Million)

Table 101 Germany: Mkt Size, By Application, 2012-2019 (KT)

Table 102 Germany: Isocyanate Market Size, By Application, 2012-2019 ($Million)

Table 103 Germany: Isocyanate Market Size, By Type, 2012-2019 (KT)

Table 104 Germany: Isocyanate Market Size, By Type, 2012-2019 ($Million)

Table 105 Italy: Mkt Size, By Application, 2012-2019 (KT)

Table 106 Italy: Isocyanate Market Size, By Application, 2012-2019 ($Million)

Table 107 Italy: Isocyanate Market Size, By Type, 2012-2019 (KT)

Table 108 Italy: Isocyanate Market Size, By Type, 2012-2019 ($Million)

Table 109 Belgium: Mkt Size, By Application, 2012-2019 (KT)

Table 110 Belgium: Isocyanate Market Size, By Application, 2012-2019 ($Million)

Table 111 Belgium: Isocyanate Market Size, By Type, 2012-2019 (KT)

Table 112 Belgium: Isocyanate Market Size, By Type, 2012-2019 ($Million)

Table 113 U.K.: Mkt Size, By Application, 2012-2019 (KT)

Table 114 U.K.: Isocyanate Market Size, By Application, 2012-2019 ($Million)

Table 115 U.K.: Isocyanate Market Size, By Type, 2012-2019 (KT)

Table 116 U.K.: Isocyanate Market Size, By Type, 2012-2019 ($Million)

Table 117 Russia: Mkt Size, By Application, 2012-2019 (KT)

Table 118 Russia: Isocyanate Market Size, By Application, 2012-2019 ($Million)

Table 119 Russia: Isocyanate Market Size, By Type, 2012-2019 (KT)

Table 120 Russia: Isocyanate Market Size, By Type, 2012-2019 ($Million)

Table 121 Rest of Europe: Mkt Size, By Application, 2012-2019 (KT)

Table 122 Rest of Europe: Isocyanate Market Size, By Application, 2012-2019 ($Million)

Table 123 Rest of Europe: Isocyanate Market Size, By Type, 2012-2019 (KT)

Table 124 Rest of Europe: Isocyanate Market Size, By Type, 2012-2019 ($Million)

Table 125 the Middle East & Africa: Mkt Size, By Application, 2012–2019 (KT)

Table 126 the Middle East & Africa: Isocyanate Market Size, By Application, 2012–2019 ($Million)

Table 127 the Middle East & Africa: Isocyanate Market Size, By Type, 2012–2019 (KT)

Table 128 the Middle East & Africa: Isocyanate Market Size, By Type, 2012–2019 ($Million)

Table 129 Latin America: Mkt Size, By Application, 2012–2019 (KT)

Table 130 Latin America: Isocyanate Market Size, By Application, 2012–2019 ($Million)

Table 131 Latin America: Isocyanate Market Size, By Type, 2012–2019 (KT)

Table 132 Latin America: Isocyanate Market Size, By Type, 2012–2019 ($Million)

Table 133 Capacity Expansion, 2010-2014

Table 134 Geographic Expansion, 2010-2014

Table 135 R&D Activity, 2010-2014

Table 136 Acquisition, 2010-2014

Table 137 Others, 2009-2014

Table 138 Asahi Kasei: Isocyanate Production Plants and Capacities (Tons/Year)

Table 139 Ashai Kasei: Isocyanate Products & Applications

Table 140 BASF: Isocyanate Production Plants & Capacities (Tons/Year)

Table 141 BASF: Isocyanate Products & Applications

Table 142 Bayer Materialscience: Isocyanate Production Plants & Capacities (Tons/Year)

Table 143 Bayer Materialscience :Isocyanate Products & Applications

Table 144 Chemtura Corporation: Isocyanate Products & Applications

Table 145 Dow Chemical: Isocyanate Production Plants & Capacities (Tons/Year)

Table 146 Dow Chemical: Isocyanate Product & Applications

Table 147 Evonik Industries: Isocyanate Products & Applications

Table 148 Cangzhou Dahua: Isocyanate Production Plants & Capacities (Tons/Year)

Table 149 Huntsman: Isocyanate Production Plant & Capacities (Tons/Year)

Table 150 Huntsman: Isocyanate Products & Applications

Table 151 Kumho Mitsui Chemicals: Isocyanate Products & Applications

Table 152 Mitsui Chemicals: Isocyanate Production Plants Capacities (Tons/Year)

Table 153 Mitsui Chemicals: Isocyanate Products & Applications

Table 154 Vencorex: HDI Production Plants & Capacities (Tons/Year)

Table 155 Vencorex: Isocyanate Products & Applications

Table 156 Yantai Wanhua: Isocyanate Production Plants & Capacities (Tons/Year)

Table 157 Yantai Wanhua: Isocyanate Products & Applications

List of Figures (44 Figures)

Figure 1 Isocyanate Mkt Share, By Geography, Application, & Type, 2013 (%)

Figure 2 Isocyanate: Market Segmentation

Figure 3 Isocyanate Mkt Growth Matrix

Figure 4 Isocyanate Mkt Size (Value), By Region, 2012-2019 ($Million)

Figure 5 Isocyanate Mkt Size (Value), By Region & Type, 2013 ($Million)

Figure 6 Isocyanate Mkt Size (Value), By Application, 2014–2019

Figure 7 Isocyanate Mkt Share, By Type, 2013–2019

Figure 8 Isocyanate Mkt Share, By Company (%)

Figure 9 Competitive Developments, By Year, 2009–2014

Figure 10 Comptetive Developments of Top 5 Companies, 2010-2013

Figure 11 Growth Strategies of Top 5 Companies, 2009-2014

Figure 12 Value Chain For the Mkt

Figure 13 Global Construction Market, By Geography 2010-2020

Figure 14 Global Automotive Production, By Geography, 2011-2018

Figure 15 Paints & Coatings Market Size, 2014-2019 ($Million)

Figure 16 Global Sealants Market, By Geography, 2014-2019 ($Million)

Figure 17 Global Adhesive Market Size, By Geography, 2014-2019 ($Million)

Figure 18 Asia-Pacific: Paints and Coatings Market Size, 2014-2019 ($Million)

Figure 19 Raw Material Price Trends, 2011-2019 ($/Ton)

Figure 20 Global Aniline Production Market Share (Volume), By Geography, 2012

Figure 21 Toluene Market Share (Volume), By Geography, 2012

Figure 22 Phosgene Market Share (Volume), By Geography, 2012

Figure 23 Global MDI Market Share, By Company, 2013

Figure 24 Global TDI Market Share, By Company, 2013

Figure 25 Global HDI Market Share, By Company, 2013

Figure 26 Porter’s Five Forces Analysis

Figure 27 Isocyanate Mkt Segmentation, By Type

Figure 28 Isocyanate Mkt Share, By Type, 2013-2019

Figure 29 Companies That offer MDI

Figure 30 Isocyanate Mkt Segmentation, By Application

Figure 31 Isocyanate Mkt Share, By Application, 2013-2019

Figure 32 Isocyanate Mkt Segmentation, By Region

Figure 33 Isocyanate Market Share, By Geography, 2013

Figure 34 Isocyanate Mkt Share, By Geography, 2019

Figure 35 Competitive Developments, By Growth Strategy, 2009-2014

Figure 36 Competitive Developments, By Year, 2009-2014

Figure 37 Competitive Developments, By Geography, 2010-2014

Figure 38 Competitive Developments, By Company, 2010-2014

Figure 39 Growth Strategies of Top 5 Companies, 2010–2014

Figure 40 Capacity Expansion, 2010–2014

Figure 41 Geographic Expansion, 2010-2014

Figure 42 R&D Activity, 2010-2014

Figure 43 Acquisition, 2009-2014

Figure 44 Others, 2009-2014

Growth opportunities and latent adjacency in Isocyanate Market