IoT for Public Safety Market by Component (Platform, Solution, and Services), Application (Emergency Communication & Incident Management, Surveillance & Security, and Disaster Management), Vertical Market, and Region - Global Forecast to 2023

[134 Pages Report] The global IoT for public safety market size was valued at USD 851.3 million in 2017 and is projected to reach USD 2,045.0 million by 2023, at a Compound Annual Growth Rate (CAGR) of 15.9% during the forecast period. The base year considered for this study is 2017, and the forecast period is 20182023.

Objectives of the Study:

The key objective of the report is to define, describe, and forecast the IoT for public safety market size by component (platform, solution and services), application, vertical market, and region. The report provides detailed information on the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market. The report attempts to forecast the market size with respect to 5 major regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America. It strategically profiles the key market players and comprehensively analyzes their core competencies. The report also tracks and analyzes competitive developments, such as partnerships, agreements, and collaborations; mergers and acquisitions; and new product developments, in the market.

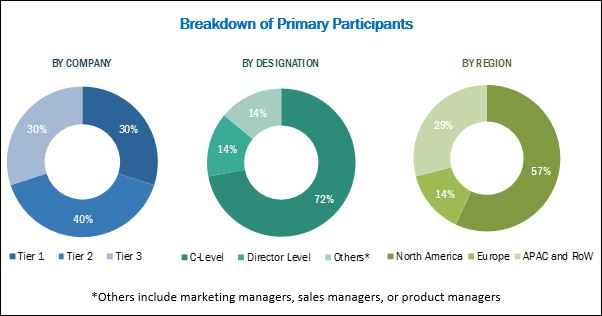

The research methodology used to estimate and forecast the IoT for public safety market size begins with the collection and analysis of the data on key vendor revenues through secondary sources, including annual reports and press releases; investor presentations of companies; conferences and associations (IEEE International Conference on Smart Grid and Smart Cities 2017, 6th International Conference on Smart Cities and Green ICT Systems 2017, 1st EAI International Conference on Smart Grid Assisted Internet of Things 2017, 1st EAI International Conference on Smart Grid Assisted Internet of Things 2017); technology journals and certified publications; and articles from recognized authors, directories, and databases. The vendor offerings have also been taken into consideration to determine the market segmentations. The bottom-up procedure was employed to arrive at the overall market size of the market from the revenue of the key players and their market shares. The IoT for public safety market expenditures across all regions, along with the geographic split in various segments, were considered to arrive at the overall market size. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primary participants is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The IoT for public safety market consists of vendors providing platform, solution, and associated services including system integration services, consulting services, and support and maintenance services to commercial clients across the globe.

Major players in the IoT for public safety market include IBM (US), Hitachi Vantara (US), NEC (Japan), Microsoft (US), Cisco Systems (US), Nokia Networks (Finland), Sierra Wireless (Canada), Telit (UK), and West Corporation (US). The other players include ThroughTek (Taiwan), Iskratel (Slovenia), IntelliVision (US), Star Controls (US), Carbyne (Israel), Securens (India), SmartCone Technologies (Canada), Kova Corporation (US), Esri (US), Cradlepoint (US), Endeavour Technology (Ireland), X-Systems (Netherlands), Yardarm Technologies (US), Tibbo Systems (Taiwan), CityShob, and SayVu Technologies (Israel). These leading companies have adopted new product launches and partnerships, agreements, and collaborations as the key growth strategies to improve their services and provide better solution and associated services to expand their market reach.

Key Target Audience

- IoT vendors

- Public safety solution providers

- Device and network providers

- Integration service providers

- Governments

- Public safety app developers

- Network infrastructure providers

- System integrators

The study answers several questions for the stakeholders, primarily, which market segments focus in the next 2 to 5 years for prioritizing efforts and investments.

Scope of the Report

The research report segments the IoT for public safety market into the following submarkets:

By Component:

- Platform

- Solution

- Services

By Platform:

- Device management

- Application management

- Network management

By Service:

- System integration services

- Consulting services

- Support and maintenance services

By Application:

- Emergency communication and incident Management

- Critical infrastructure security

- Surveillance and security

- Disaster management

By Vertical:

- Smart building and home automation

- Homeland security

- Smart utilities

- Smart healthcare

- Smart manufacturing

- Smart transportation

- Others (Smart retail and Smart education)

By Region:

- North America

- Europe

- APAC

- MEA

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the North American market into the US and Canada

- Further breakdown of the European market into the UK, Germany, and France

Company Information

- Detailed analysis and profiling of additional market players

The IoT for public safety market is segmented on the basis of components (platform, solution, and services), applications, vertical markets, and regions.

IoT is revolutionizing the public safety by offering reliable and secure communication to the first responders and citizens. As public safety and security is the priority of the governments across the world; they have to ensure the safety of citizens, organizations, and financial institutions from external threats. They heavily rely on the public safety and security solutions, such as surveillance systems, communication networks, and biometric & authentication system, to safeguard the lives of citizens. In this scenario, reliable IoT platform and solutions play a vital role to offer advance safety and security smart devices, applications, and critical communication networks to safeguard citizens in case of critical emergencies.

The platform segment of IoT for public safety market includes device management, application management, and network management. The IoT platforms enable central monitoring and control of each activity that takes place in organizations across the verticals. In the public safety arena, the IoT platform integrates reliable public safety and security solutions, and empowers legal bodies of cities to achieve the goal of public safety to safeguard citizens in case of emergencies.

The application segment comprises various applications such as emergency communication and incident management, critical infrastructure security, surveillance and security, and disaster management. Among them, the surveillance and security application is one of the major application areas of the IoT for public safety, which holds a significant share in the overall IoT for public safety market. Surveillance and security systems include several types of surveillance cameras, monitors, storages, and surveillance software, such as video analytics and video generic applications, and IoT platforms. The IoT platform collects the data from these devices, analyzes the data, and provides this data to public safety agencies for preventing and responding in emergency situations.

Services are evolving as an important aspect, as IoT for public safety vendors offer integrated services packages, along with application software packages to their commercial customers. Services are evolving as an important aspect, as vendors are offering integrated services packages, along with their public safety platforms and solutions. The services segment of the IoT for public safety market is broadly categorized into 3 segments, namely, system integration services, consulting services, and support and maintenance services. The public sector, including governments and law enforcement bodies, has realized the importance of IoT for public safety solutions and its associated services to overcome the safety and security challenges faced by citizens in cities.

The IoT for public safety by vertical covers smart building and home automation, homeland security, smart utilities, smart healthcare, smart manufacturing, smart transportation, and others (smart retail and smart education).

The IoT for public safety solutions help avert and minimize the impact of terrorist attacks, cyberattacks, and natural disasters on the economy. Many states around the world have public safety departments and agencies whose primary responsibility is to deploy IoT public safety solutions to protect the public and limit the effects of the criminal attacks and natural calamities. The citizens are usually dependent on the government and public departments for their day-to-day safety and security requirements. Furthermore, people have started demanding for effective responses to all types of crises by public sector safety agencies.

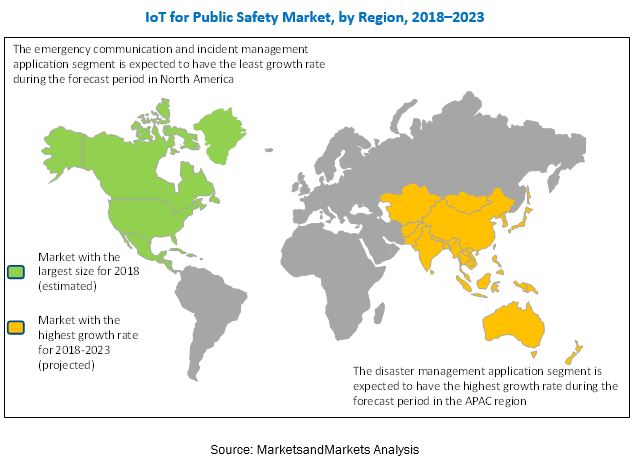

North America is expected to account for the largest market share and dominate the market during the forecast period. The region is witnessing emerging trends, such as IoT and smart cities which have made public safety agencies, government bodies, and enterprises realize the significance of IoT for public safety solutions and services. Asia Pacific (APAC) has witnessed an advanced and dynamic adoption of new technologies and has always been a lucrative region. The IoT for public safety market in APAC is expected to grow at the highest CAGR during the forecast period. APAC is also highly focused on smart cities projects, which is driving the demand for public safety solutions, such as surveillance systems, advanced cameras, scanning and screening systems, and high-tech communication networks.

Budget constraints for deploying smart devices is expected to be one of the restraining factors for the growth of IoT for public safety market. However, recent developments, new product launches, and mergers and acquisitions undertaken by the major market players are expected to boost the market growth.

The study measures and evaluates key offerings and strategies of the major market vendors, including IBM (US), Hitachi Vantara (US), NEC (Japan), Microsoft (US), Cisco Systems (US), Nokia Networks (Finland), Sierra Wireless (Canada), Telit (UK), and West Corporation (US). The other players include ThroughTek (Taiwan), Iskratel (Slovenia), IntelliVision (US), Star Controls (US), Carbyne (Israel), Securens (India), SmartCone Technologies (Canada), Kova Corporation (US), Esri (US), Cradlepoint (US), Endeavour Technology (Ireland), X-Systems (Netherlands), Yardarm Technologies (US), Tibbo Systems (Taiwan), CityShob, and SayVu Technologies (Israel). These companies offer reliable IoT for public safety platform, solution, and associated services to commercial clients across regions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Attractive Market Opportunities in the IoT for Public Safety Market

4.2 Market Share of Top 3 Vertical Markets and Regions

4.3 Market By Region

4.4 Market Investment Scenario

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Number of Smart City Initiatives Across the Globe

5.2.1.2 Threats to National Security and Public Safety

5.2.1.3 Increasing Adoption of Ml and Ai-Based Public Safety Solutions

5.2.1.4 Growing Demand for Unmanned Devices and Remote Surveillance

5.2.2 Restraints

5.2.2.1 Budget Constraints for Deploying Smart Devices

5.2.3 Opportunities

5.2.3.1 Growing Adoption of the IoT Technology Across Verticals

5.2.3.2 Upgradation of the Public Safety Infrastructure

5.2.4 Challenges

5.2.4.1 Management and Storage of Large Volumes of Unstructured Data

5.2.4.2 Lack of Experienced and Qualified Workforce for Public Safety

6 IoT for Public Safety Market, By Component (Page No. - 36)

6.1 Introduction

6.2 Platform

6.3 Solution

6.4 Services

7 Market By Platform (Page No. - 41)

7.1 Introduction

7.2 Device Management

7.3 Application Management

7.4 Network Management

8 IoT for Public Safety Market, By Service (Page No. - 46)

8.1 Introduction

8.2 System Integration Services

8.3 Consulting Services

8.4 Support and Maintenance Services

9 Market By Application (Page No. - 51)

9.1 Introduction

9.2 Emergency Communication and Incident Management

9.3 Critical Infrastructure Security

9.4 Surveillance and Security

9.5 Disaster Management

10 IoT for Public Safety Market, By Vertical Market (Page No. - 57)

10.1 Introduction

10.2 Smart Building and Home Automation

10.3 Homeland Security

10.4 Smart Utilities

10.5 Smart Healthcare

10.6 Smart Manufacturing

10.7 Smart Transportation

10.8 Others

11 IoT for Public Safety Market, By Region (Page No. - 66)

11.1 Introduction

11.2 North America

11.3 Europe

11.4 Asia Pacific

11.5 Middle East and Africa

11.6 Latin America

12 Competitive Landscape (Page No. - 84)

12.1 Overview

12.2 Market Ranking

12.3 Competitive Scenario

12.3.1 New Product Launches and Product Enhancements

12.3.2 Partnerships, Collaborations, and Agreements

12.3.3 Mergers and Acquisitions

13 Company Profiles (Page No. - 88)

(Business Overview, Products and Solutions Offered, Recent Developments, SWOT Analysis, and MnM View)*

13.1 IBM

13.2 Hitachi Vantara

13.3 NEC

13.4 Microsoft

13.5 Cisco Systems

13.6 Sierra Wireless

13.7 Telit

13.8 West Corporation

13.9 Nokia Networks

13.10 Throughtek

13.11 Iskratel

13.12 Intellivision

13.13 Star Controls

13.14 Carbyne

13.15 Securens

13.16 Smartcone Technologies

13.17 Kova

13.18 ESRI

13.19 Cradlepoint

13.20 Endeavour Technology

13.21 X-Systems

13.22 Yardarm Technologies

13.23 Tibbo Systems

13.24 Cityshob

13.25 Sayvu

*Details on Business Overview, Products and Solutions Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 125)

14.1 Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (56 Tables)

Table 1 IoT for Public Safety Market Size and Growth Rate, 20162023 (USD Million, Y-O-Y %)

Table 2 Market Size By Component, 20162023 (USD Million)

Table 3 Platform: Market Size By Region, 20162023 (USD Million)

Table 4 Solution: Market Size By Region, 20162023 (USD Million)

Table 5 Services: Market Size By Region, 20162023 (USD Million)

Table 6 IoT for Public Safety Market Size, By Platform, 20162023 (USD Million)

Table 7 Device Management: Market Size By Region, 20162023 (USD Million)

Table 8 Application Management: Market Size By Region, 20162023 (USD Million)

Table 9 Network Management: Market Size By Region, 20162023 (USD Million)

Table 10 IoT for Public Safety Market Size By Service, 20162023 (USD Million)

Table 11 System Integration Services: Market Size By Region, 20162023 (USD Million)

Table 12 Consulting Services: Market Size By Region, 20162023 (USD Million)

Table 13 Support and Maintenance Services: Market Size By Region, 20162023 (USD Million)

Table 14 IoT for Public Safety Market Size, By Application, 20162023 (USD Million)

Table 15 Emergency Communication and Incident Management: Market Size By Region, 20162023 (USD Million)

Table 16 Critical Infrastructure Security: Market Size By Region, 20162023 (USD Million)

Table 17 Surveillance and Security: Market Size By Region, 20162023 (USD Million)

Table 18 Disaster Management: Market Size By Region, 20162023 (USD Million)

Table 19 IoT for Public Safety Market Size, By Vertical Market, 20162023 (USD Million)

Table 20 Smart Building and Home Automation: Market Size By Region, 20162023 (USD Million)

Table 21 Homeland Security: Market Size By Region, 20162023 (USD Million)

Table 22 Smart Utilities: Market Size By Region, 20162023 (USD Million)

Table 23 Smart Healthcare: Market Size By Region, 20162023 (USD Million)

Table 24 Smart Manufacturing: Market Size By Region, 20162023 (USD Million)

Table 25 Smart Transportation: Market Size By Region, 20162023 (USD Million)

Table 26 Others: Market Size By Region, 20162023 (USD Million)

Table 27 IoT for Public Safety Market Size, By Region, 20162023 (USD Million)

Table 28 North America: Market Size By Component, 20162023 (USD Million)

Table 29 North America: Market Size By Platform, 20162023 (USD Million)

Table 30 North America: Market Size By Service, 20162023 (USD Million)

Table 31 North America: Market Size By Application, 20162023 (USD Million)

Table 32 North America: Market Size By Vertical Market, 20162023 (USD Million)

Table 33 Europe: IoT for Public Safety Market Size, By Component, 20162023 (USD Million)

Table 34 Europe: Market Size By Platform, 20162023 (USD Million)

Table 35 Europe: Market Size By Service, 20162023 (USD Million)

Table 36 Europe: Market Size By Application, 20162023 (USD Million)

Table 37 Europe: Market Size By Vertical Market, 20162023 (USD Million)

Table 38 Asia Pacific: IoT for Public Safety Market Size, By Component, 20162023 (USD Million)

Table 39 Asia Pacific: Market Size By Platform, 20162023 (USD Million)

Table 40 Asia Pacific: Market Size By Service, 20162023 (USD Million)

Table 41 Asia Pacific: Market Size By Application, 20162023 (USD Million)

Table 42 Asia Pacific: Market Size By Vertical Market, 20162023 (USD Million)

Table 43 Middle East and Africa: IoT for Public Safety Market Size, By Component, 20162023 (USD Million)

Table 44 Middle East and Africa: Market Size, By Platform, 20162023 (USD Million)

Table 45 Middle East and Africa: Market Size, By Service, 20162023 (USD Million)

Table 46 Middle East and Africa: Market Size, By Application, 20162023 (USD Million)

Table 47 Middle East and Africa: Market Size, By Vertical Market, 20162023 (USD Million)

Table 48 Latin America: IoT for Public Safety Market Size, By Component, 20162023 (USD Million)

Table 49 Latin America: Market Size By Platform, 20162023 (USD Million)

Table 50 Latin America: Market Size By Service, 20162023 (USD Million)

Table 51 Latin America: Market Size By Application, 20162023 (USD Million)

Table 52 Latin America: Market Size By Vertical Market, 20162023 (USD Million)

Table 53 Market Ranking for the IoT for Public Safety Market, 2018

Table 54 New Product Launches and Product Enhancements, 20172018

Table 55 Partnerships, Collaborations, and Agreements, 20172018

Table 56 Mergers and Acquisitions, 20162017

List of Figures (36 Figures)

Figure 1 IoT for Public Safety Market Segmentation

Figure 2 Market Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Market Research Assumptions

Figure 8 Market Top 3 Segments, 2018

Figure 9 Market By Service, 2018

Figure 10 Increasing Number of Smart City Projects and Growing Adoption of Ml and Ai-Based Public Safety Solutions are Expected to Drive the IoT for Public Safety Market

Figure 11 Smart Building and Home Automation Vertical Market and North America are Estimated to Hold the Largest Market Shares in 2018

Figure 12 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 13 Asia Pacific is Expected to Emerge as the Best Market for Investments Over the Next 5 Years

Figure 14 IoT for Public Safety Market: Drivers, Restraints, Opportunities, and Challenges

Figure 15 Solution Segment is Expected to Account for the Largest Market Size During the Forecast Period

Figure 16 Asia Pacific is Expected to Be the Fastest-Growing Region in the Services Segment During the Forecast Period

Figure 17 Device Management Platform is Expected to Account for the Largest Market Size During the Forecast Period

Figure 18 Asia Pacific is Expected to Exhibit the Highest CAGR in the Device Management Segment During the Forecast Period

Figure 19 System Integration Services Segment is Expected to Account for the Largest Market Size During the Forecast Period

Figure 20 Asia Pacific is Expected to Be the Fastest-Growing Region in the System Integration Services Segment During the Forecast Period

Figure 21 Surveillance and Security Application is Expected to Account for the Largest Market Size During the Forecast Period

Figure 22 Asia Pacific is Expected to Be the Fastest-Growing Region in the Surveillance and Security Segment During the Forecast Period

Figure 23 Homeland Security Vertical Market is Expected to Have the Largest Market Size During the Forecast Period

Figure 24 North America is Expected to Have the Largest Market Size in the Homeland Security Vertical Market During the Forecast Period

Figure 25 Asia Pacific is Expected to Be the Fastest-Growing Region in the IoT for Public Safety Market During the Forecast Period

Figure 26 North America: Market Snapshot

Figure 27 Solution Segment is Expected to Account for the Largest Market Size in North America During the Forecast Period

Figure 28 Asia Pacific: Market Snapshot

Figure 29 Surveillance and Security Application is Expected to Account for the Largest Market Size in Asia Pacific During the Forecast Period

Figure 30 Key Developments By the Leading Players in the IoT for Public Safety Market During 20162018

Figure 31 IBM: Company Snapshot

Figure 32 NEC: Company Snapshot

Figure 33 Microsoft: Company Snapshot

Figure 34 Cisco Systems: Company Snapshot

Figure 35 Sierra Wireless: Company Snapshot

Figure 36 Telit: Company Snapshot

Growth opportunities and latent adjacency in IoT for Public Safety Market