IoT MVNO Market by Operational Model (Reseller, Service Operator, Full MVNO), Subscribers (Consumer, Enterprise), Enterprise (Manufacturing, Transportation & Logistics, Healthcare, Retail, Agriculture) and Region - Global Forecast to 2028

IoT MVNO Market Forecast & Statistics, Global Size

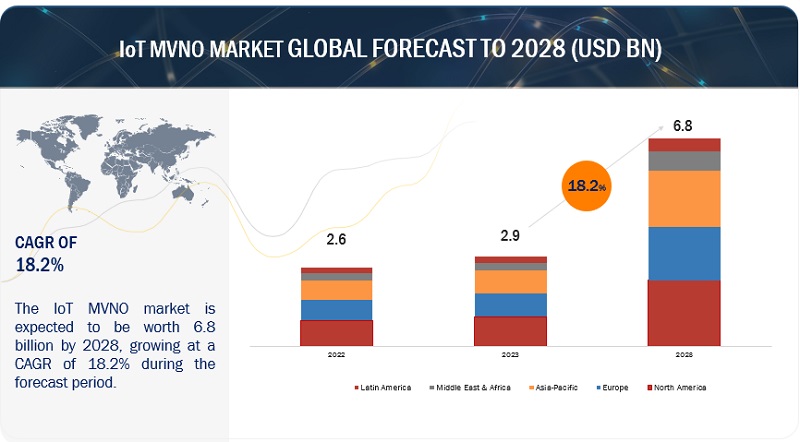

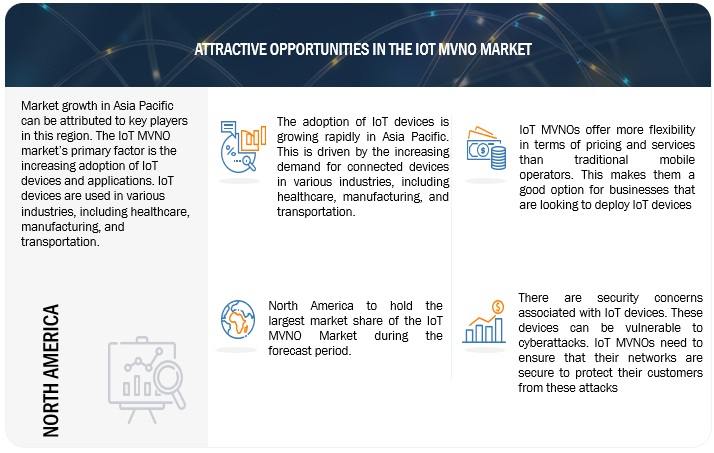

[211 Pages Report] The global IoT MVNO Market is anticipated to be valued at approximately $2.9 billion in 2023 and is projected to hit a revenue of around $6.8 billion by the end of 2028, projecting a CAGR of 18.2% between 2023 to 2028. The IoT MVNO market's primary factor is the increasing adoption of IoT devices and applications. IoT devices are being used in various industries, including healthcare, manufacturing, and transportation. This leads to increased demand for connectivity solutions supporting IoT devices.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

IoT MVNO Market Dynamics

Driver: Growing demand for IoT connectivity

As more and more devices are connected to the internet, there is a growing demand for connectivity solutions that are specifically designed for IoT. IoT MVNOs can provide these solutions by offering specialized services and connectivity plans tailored to the needs of IoT devices. IoT devices have different connectivity requirements compared to traditional mobile devices. For example, they often require low bandwidth and low power consumption. This has created a need for specialized connectivity solutions tailored to IoT devices' needs. MVNOs are well-positioned to provide these specialized solutions, as they can offer customized connectivity plans that meet the specific needs of IoT devices. IoT devices often require dedicated networks that are optimized for their unique requirements.

Restraint: Rapid increase in deployment costs

Deploying an IoT MVNO network can be costly due to the need for specialized connectivity solutions and dedicated networks. This can limit the adoption of IoT MVNO services, especially among smaller organizations that may not have the resources to invest in expensive connectivity solutions. High deployment costs can significantly affect the growth and adoption of IoT MVNO services. To overcome this challenge, MVNOs can explore partnerships and collaborations with other players in the IoT ecosystem, develop more cost-effective connectivity solutions, and invest in technologies that can reduce deployment costs, such as network virtualization and software-defined networking.

Opportunity: Increase in adoption of network virtualization

Network virtualization technologies, such as software-defined networking (SDN) and network function virtualization (NFV), can help MVNOs to reduce deployment costs and improve network agility. These technologies can also enable MVNOs to offer innovative connectivity solutions like network slicing and edge computing. Network virtualization technologies, such as software-defined networking (SDN) and network function virtualization (NFV), enable MVNOs to deploy and manage their networks more cost-effectively. By virtualizing network functions, MVNOs can reduce the need for expensive hardware and can use more flexible and scalable software-based solutions. Network virtualization can help MVNOs provide a better customer experience by offering more customized and tailored solutions. By virtualizing network functions, MVNOs can create specialized connectivity solutions for specific industries or use cases, which can provide a better fit for customers' needs.

Challenge: Lack of interoperability of solutions

Interoperability is a critical factor for the success of the IoT MVNO market, as it allows devices and platforms from different manufacturers to communicate and work together seamlessly. The lack of interoperability can create challenges for MVNOs and limit their ability to provide end-to-end solutions. IoT solutions require integrating multiple devices and platforms, including sensors, gateways, cloud platforms, and analytics tools. Interoperability allows MVNOs to integrate these components seamlessly, providing a more efficient and effective solution. Lack of interoperability can result in vendor lock-in, where customers are limited to using devices and platforms from a single vendor. This can limit innovation and increase costs, as customers are unable to take advantage of the latest technology from other vendors.

Market Ecosystem

Prominent companies in this market include well-established, financially stable software and solutions providers. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. KDDI (Japan), KORE Wireless (US), Sierra Wireless (Canada), Twilio (US), Asahi Net (Japan), Telit (US), BICS (Belgium), Lycamobile (UK), Wireless Logic (UK), Truphone (UK) are some of the major players operating in this ecosystem.

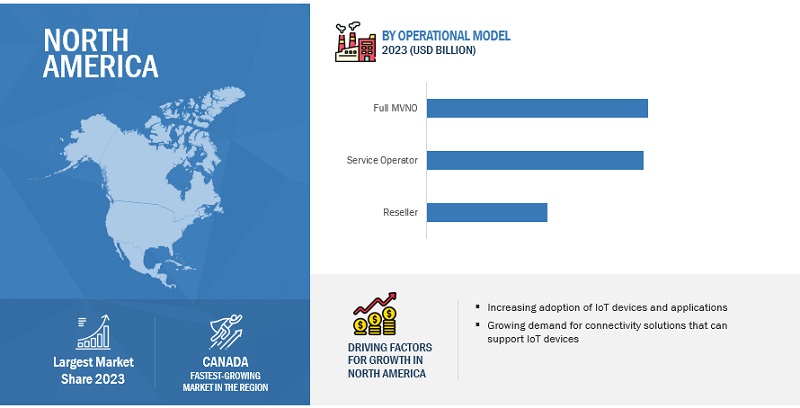

Based on the operational model, the service operator segment is expected to grow at the highest CAGR during the forecast period

Within the service operator model, MVNOs have more control over customer-facing elements, enabling the model to integrate better with its own services and systems. In supplementary to the reseller operational model, service operator MVNOs manage all customer care processes, including Customer Relationship Management (CRM), customer support, self-care, and billing processes from flexible account lifecycle, complex tariff bundles, packages, voice, data, and SMS services.

Based on subscribers, the enterprise segment to hold the largest market size during the forecast period

The adoption of IoT devices and applications is growing rapidly in enterprises. This is being driven by the increasing demand for connected devices in a variety of industries, including healthcare, manufacturing, and transportation. IoT devices can be used in a variety of different ways. This means enterprises need flexible connectivity solutions tailored to their IoT devices' specific needs. IoT MVNOs offer flexible connectivity solutions that can be tailored to the specific needs of enterprises.

Based on region, the North American segment is expected to have the largest market share during the forecast period

IoT MVNO services are expected to see huge growth in North America due to the convergence of the IT and telecom sectors. This convergence is expected to open huge opportunities for enterprise customers in North America for IoT MVNO services. IoT MVNOs offer attractive opportunities to the mature telecom industry as they come up with reduced OPEX, attractive prices, customized service plans, and others for new businesses and consumers. The countries included in the market analysis for North America are the US and Canada. The US is the most prominent market in the region due to the presence of prominent end users, such as large enterprises and SMEs.

Market Players:

The major players in the IoT MVNO market are KDDI (Japan), KORE Wireless (US), Sierra Wireless (Canada), Twilio (US), Asahi Net (Japan), Telit (US), BICS (Belgium), Lycamobile (UK), Wireless Logic (UK), Truphone (UK), Aeris Communications (US), Cubic Telecom (Ireland), Hologram (US), 1NCE (Germany), 1OT (Estonia), Soracom (Japan), Onomondo (Denmark), etc. These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and enhancements, and acquisitions to expand their footprint in the IoT MVNO market.

IoT MVNO Market Report Scope

|

Report Metrics |

Details |

|

Revenue Forecast Size in 2028 |

USD 6.8 billion |

|

Market Size Value in 2023 |

USD 2.9 billion |

|

Market Growth Rate |

18.2% CAGR |

|

Key Market Drivers |

Growing demand for IoT connectivity |

|

Key Market Opportunities |

Increase in adoption of network virtualization |

|

Fastest Growing Market |

North America |

|

Market size available for years |

2023-2028 |

|

Forecast period |

2023–2028 |

|

Base Year |

2022 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments Covered |

Operational Model, Subscribers, Enterprise, and Region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

|

Companies covered |

KDDI (Japan), KORE Wireless (US), Sierra Wireless (Canada), Twilio (US), Asahi Net (Japan), Telit (US), BICS (Belgium), Lycamobile (UK), Wireless Logic (UK), Truphone (UK), Aeris Communications (US), Cubic Telecom (Ireland), Hologram (US), 1NCE (Germany), 1OT (Estonia), Soracom (Japan), Onomondo (Denmark) |

This research report categorizes the IoT MVNO market to forecast revenues and analyze trends in each of the following submarkets:

Based on the Operational Model:

- Reseller

- Service Operator

- Full MVNO

Based on Subscribers:

- Enterprise

- Consumer

Based on Enterprise:

- Manufacturing

- Transportation & Logistics

- Healthcare

- Retail

- Energy & Utilities

- Agriculture

- Others

By Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Australia and New Zealand

- Rest of Asia Pacific

-

Middle East & Africa

- UAE

- KSA

- South Africa

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In May 2023, KORE Wireless announced the launch of its new vertical offering in retail solutions. The retail industry is rapidly undergoing a digital transformation, and KORE has aligned its portfolio to offer high-bandwidth solutions to meet these needs. The KORE Retail solution includes high bandwidth 5G cellular connectivity through fixed wireless access (FWA) to provide high-speed internet access traditionally available through wireline solutions.

- In March 2023, Aeris Communications announced the closing of the purchase of Ericsson's IoT Accelerator (IoT-A) and Connected Vehicle Cloud (CVC) businesses and related assets. Ericsson will establish a small stake in the new Aeris. The Aeris serves thousands of customers across a wide range of industries – including healthcare, fleet, utilities, and automotive.

- In January 2023, Truphone, a global mobile virtual network operator, launched a new IoT platform. The platform offers businesses a secure and reliable way to connect their IoT devices.

- In January 2023, Semtech Corporation and Sierra Wireless, Inc. announced the completion of Semtech's acquisition of Sierra Wireless in an all-cash transaction representing a total enterprise value of approximately USD 1.2 billion. This transaction nearly doubles Semtech's annual revenue and adds approximately USD 100 million of high-margin IoT Cloud services recurring revenue.

- In January 2023, Sierra Wireless, a subsidiary of Semtech Corporation, announced the introduction of Smart Connectivity Premium with eUICC capabilities and extended connectivity coverage in the United States.

Frequently Asked Questions (FAQ):

What is the definition of IoT MVNO market?

An IoT MVNO, or Internet of Things Mobile Virtual Network Operator, is a mobile virtual network operator (MVNO) that provides connectivity services to Internet of Things (IoT) devices. IoT MVNOs typically offer various features and benefits designed to meet the specific needs of IoT devices, such as low data rates, long battery life, and global coverage. IoT MVNOs can be a valuable option for businesses looking to connect their IoT devices to the internet. By using an IoT MVNO, businesses can save money on connectivity costs and get the features and benefits needed to ensure that their IoT devices are always connected and up-to-date.

What is the market size of the IoT MVNO market?

The IoT MVNO market size is projected to grow from USD 2.9 billion in 2023 to USD 6.8 billion by 2028, at a CAGR of 18.2% during the forecast period.

What are the major drivers in the IoT MVNO market?

Growing demand for IoT connectivity: As more and more devices are connected to the internet, there is a growing demand for connectivity solutions that are specifically designed for IoT. IoT MVNOs can provide these solutions by offering specialized services and connectivity plans tailored to the needs of IoT devices. IoT devices have different connectivity requirements compared to traditional mobile devices. For example, they often require low bandwidth and low power consumption. This has created a need for specialized connectivity solutions tailored to IoT devices' needs. MVNOs are well-positioned to provide these specialized solutions, as they can offer customized connectivity plans that meet the specific needs of IoT devices. IoT devices often require dedicated networks that are optimized for their unique requirements.

Who are the key players operating in the IoT MVNO market?

The major players in the IoT MVNO market are KDDI (Japan), KORE Wireless (US), Sierra Wireless (Canada), Twilio (US), Asahi Net (Japan), Telit (US), BICS (Belgium), Lycamobile (UK), Wireless Logic (UK), Truphone (UK), Aeris Communications (US), Cubic Telecom (Ireland), Hologram (US), 1NCE (Germany), 1OT (Estonia), Soracom (Japan), Onomondo (Denmark), These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches, and product enhancements, and acquisitions to expand their footprint in the IoT MVNO market.

What are the opportunities for new market entrants in the IoT MVNO market?

Increase in adoption of network virtualization: Network virtualization technologies, such as software-defined networking (SDN) and network function virtualization (NFV), can help MVNOs to reduce deployment costs and improve network agility. These technologies can also enable MVNOs to offer innovative connectivity solutions like network slicing and edge computing. By virtualizing network functions, MVNOs can reduce the need for expensive hardware and can use more flexible and scalable software-based solutions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

-

5.1 MARKET OVERVIEWINTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing demand for IoT connectivity- Increasing adoption of cloud computing- Growing need for IoT security- Increased need for efficient cellular networkRESTRAINTS- Rapid increase in deployment costs- Increasing security and privacy concernsOPPORTUNITIES- Increase in adoption of network virtualization- Acceleration of IP and cloud data trafficCHALLENGES- Excessive cost of equipment- Lack of interoperability of solutions

-

5.3 INDUSTRY TRENDSBRIEF HISTORY OF IOT MVNOECOSYSTEM ANALYSISTECHNOLOGY ROADMAP OF IOT MVNO MARKET- Short-term roadmap (2023-2025)- Mid-term roadmap (2026-2028)- Long-term roadmap (2029-2030)CASE STUDY ANALYSIS- Case Study 1: Smart Utility- Case Study 2: Payment Services- Case Study 3: Network Connectivity- Case Study 4: Smart City- Case Study 5: Smart Transportation/ Electric VehicleVALUE CHAIN ANALYSISREGULATORY LANDSCAPE- GENERAL DATA PROTECTION REGULATION- PERSONAL INFORMATION PROTECTION AND ELECTRONIC DOCUMENTS ACT- CLOUD SECURITY ALLIANCE SECURITY TRUST ASSURANCE AND RISK- SOC2- DIGITAL MILLENNIUM COPYRIGHT ACT- ANTI-CYBERSQUATTING CONSUMER PROTECTION ACTPATENT ANALYSISKEY CONFERENCES & EVENTS, 2022–2023PRICING ANALYSISPORTER’S FIVE FORCES MODEL- Threat of new entrants- Threat of substitutes- Bargaining power of buyers- Bargaining power of suppliers- Intensity of competitive rivalryKEY STAKEHOLDERS & BUYING CRITERIA- Key Stakeholders in Buying Criteria- Buying CriteriaIOT MVNO IMPACT ON ADJACENT NICHE TECHNOLOGIES- Network Function Virtualization (NFV)- Software Defined Network (SDN)- Artificial Intelligence- Edge Computing- BlockchainBEST PRACTICES OF IOT MVNO MARKETIOT MVNO SOFTWARE APPLICATIONS AND USE CASESCURRENT AND EMERGING BUSINESS MODELS- CaaS Model- Managed Services Model- Revenue Sharing Model- PaaS Model

-

6.1 INTRODUCTIONOPERATIONAL MODEL: IOT MVNO MARKET DRIVERS

-

6.2 RESELLERINCREASING USE OF CLOUD-BASED MANAGEMENT SOLUTIONS FOR IOT DEVICES

-

6.3 SERVICE OPERATORCOMPLETE CONTROL OF SERVICE OPERATORS OVER BUSINESS AND SERVICE OFFERINGS WITH THEIR OWN INFRASTRUCTURE

-

6.4 FULL MVNOFULL CALL CONTROL AND COMPLETE SERVICE DEVELOPMENT FLEXIBILITY

-

7.1 INTRODUCTIONTYPE: IOT MVNO MARKET DRIVERS

-

7.2 CONSUMERMARKETS TO SHIFT FOCUS FROM SUPPLY TO DEMAND-DRIVEN REALITY

-

7.3 ENTERPRISEMORE SCALABLE AND FASTER SERVICES TO BE DEPLOYED

-

8.1 INTRODUCTIONTYPE: IOT MVNO MARKET DRIVERS

-

8.2 MANUFACTURINGMANUFACTURERS TO IMPROVE THEIR OPERATIONS AND GAIN COMPETITIVE EDGEMANUFACTURING: DRIVERS- Manufacturing: IoT MVNO Use Cases

-

8.3 TRANSPORTATION AND LOGISTICSTRACK LOCATION OF ASSETS AND MONITOR CONDITION OF VEHICLESTRANSPORTATION AND LOGISTICS: DRIVERS- Transportation and Logistics: IoT MVNO Use Cases

-

8.4 HEALTHCAREIOT MVNO TO MONITOR PATIENTS WITH CHRONIC CONDITIONS, AND COLLECT DATA ON PATIENT VITAL SIGNSHEALTHCARE: DRIVERS- Healthcare: IoT MVNO Use Cases

-

8.5 RETAILIMPROVING INVENTORY MANAGEMENT AND CUSTOMER SERVICERETAIL: DRIVERS- Retail: IoT MVNO Use Cases

-

8.6 ENERGY AND UTILITYIMPROVING POWER GRID RELIABILITY AND ENVIRONMENTAL SUSTAINABILITYENERGY AND UTILITY: DRIVERS- Energy and Utility: IoT MVNO Use Cases

-

8.7 AGRICULTUREIMPROVING CROP YIELDS AND REDUCING COSTSAGRICULTURE: DRIVERS- Agriculture: IoT MVNO Use Cases

-

8.8 OTHERSOTHERS: DRIVERS- Others: IoT MVNO Use Cases

-

9.1 INTRODUCTIONNORTH AMERICA: RECESSION IMPACTNORTH AMERICA: IOT MVNO MARKET DRIVERSUS- Regulatory environment with government initiatives and policies to support IoT innovation and connectivityCANADA- Proliferation of IoT devices and applications to create demand for reliable and scalable connectivity services

-

9.2 EUROPEEUROPE: RECESSION IMPACTEUROPE: IOT MVNO MARKET DRIVERSUK- Principles by government to ensure that IoT MVNO achieves its potentialGERMANY- Advanced telecom infrastructure to include extensive 4G and 5G network coverageREST OF EUROPE- European countries with established regulations and standards to support IoT deployments and ensure data privacy and security

-

9.3 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTAPAC: IOT MVNO MARKET DRIVERSCHINA- "Made in China 2025" plan and "Internet Plus" strategy, to emphasize integration of IoT technologiesJAPAN- Robust IoT ecosystem to consist of device manufacturers, platform providers, system integrators, and research institutionsAUSTRALIA AND NEW ZEALAND- Implementing smart initiatives to develop smart cities, renewable energy projects, and environmental monitoring solutionsREST OF ASIA PACIFIC- Presence of strong manufacturing ecosystem, with several global manufacturing hubs

-

9.4 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: RECESSION IMPACTMIDDLE EAST AND AFRICA: IOT MVNO MARKET DRIVERSUAE- Favorable regulatory environment, infrastructure development, and focus on data privacy and security to promote growthKSA- Country to investing heavily in infrastructure development, including smart cities and IoT projectsSOUTH AFRICA- Government to launch initiatives to support IoT adoption and digital transformationREST OF MIDDLE EAST AND AFRICA

-

9.5 LATIN AMERICALATIN AMERICA: RECESSION IMPACTLATIN AMERICA: IOT MVNO MARKET DRIVERSBRAZIL- Collaboration with government entities, enterprises, and solution providers to provide opportunities for IoT MVNOsMEXICO- Government to support for IoT adoption and digital transformation with initiatives like National Digital Strategy and National IoT PlanREST OF LATIN AMERICA- IoT adoption across various industries, such as agriculture, manufacturing, energy, and logistics

- 10.1 INTRODUCTION

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 HISTORICAL REVENUE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS OF KEY PLAYERS

- 10.5 EVALUATION QUADRANT MATRIX METHODOLOGY FOR KEY PLAYERS

-

10.6 EVALUATION QUADRANT MATRIX FOR KEY PLAYERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 10.7 EVALUATION QUADRANT MATRIX METHODOLOGY FOR STARTUPS/SMES

-

10.8 EVALUATION QUADRANT MATRIX FOR STARTUPS/SMESPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

10.9 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

-

11.1 KEY PLAYERSKORE WIRELESS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKDDI CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSEMTECH CORPORATION- Business overview- Products/Solutions/Services offered- MnM viewGIESECKE+DEVRIENT (G+D)- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTWILIO- Business overview- Product/Solutions/Services offered- Recent developments- MnM viewBICS- Business overview- Products/Solutions/Services offeredTELUS CORPORATIONU-BLOXORBCOMMTELIT

-

11.2 SMES/STARTUPSAERIS COMMUNICATIONSCUBIC TELECOM1NCETRUPHONEHOLOGRAM1OTSORACOMONOMONDODATAXOOMAIRLINQEMNIFYWIRELESS LOGICASAHI NET

- 12.1 INTRODUCTION

-

12.2 IOT PROFESSIONAL SERVICES MARKETMARKET DEFINITIONMARKET OVERVIEWIOT PROFESSIONAL SERVICES MARKET, BY SERVICE TYPEIOT PROFESSIONAL SERVICES MARKET, BY ORGANIZATION SIZEIOT PROFESSIONAL SERVICES MARKET, BY DEPLOYMENT TYPEIOT PROFESSIONAL SERVICES MARKET, BY APPLICATIONIOT PROFESSIONAL SERVICES MARKET, BY REGION

-

12.3 5G IOT MARKETMARKET DEFINITIONMARKET OVERVIEW5G IOT MARKET, BY COMPONENT5G IOT MARKET, BY NETWORK TYPE5G IOT MARKET, BY ORGANIZATION SIZE5G IOT MARKET, BY TYPE5G IOT MARKET, BY END USER5G IOT MARKET, BY REGION

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2020–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 IOT MVNO MARKET AND GROWTH RATE, 2020–2028 (USD MILLION, Y-O-Y GROWTH)

- TABLE 4 IOT MVNO MARKET: ECOSYSTEM

- TABLE 5 TOP 20 PATENTS OWNERS (US) IN LAST 10 YEARS

- TABLE 6 DETAILED LIST OF CONFERENCES & EVENTS, 2023

- TABLE 7 AVERAGE SELLING PRICE RANGES OF SUBSCRIPTION-BASED/ PAY-AS-YOU-GO IOT MVNO SERVICES

- TABLE 8 IMPACT OF EACH FORCE ON IOT MVNO MARKET

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 10 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 11 IOT MVNO MARKET, BY OPERATIONAL MODEL, 2018–2022 (USD MILLION)

- TABLE 12 IOT MVNO MARKET, BY OPERATIONAL MODEL, 2023–2028 (USD MILLION)

- TABLE 13 RESELLER: IOT MVNO MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 14 RESELLER: IOT MVNO MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 15 SERVICE OPERATOR: IOT MVNO MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 16 SERVICE OPERATOR: IOT MVNO MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 17 FULL MVNO: IOT MVNO MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 18 FULL MVNO: IOT MVNO MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 19 IOT MVNO MARKET, BY SUBSCRIBER, 2018–2022 (USD MILLION)

- TABLE 20 IOT MVNO MARKET, BY SUBSCRIBER, 2023–2028 (USD MILLION)

- TABLE 21 CONSUMER: IOT MVNO MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 22 CONSUMER: IOT MVNO MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 ENTERPRISE: IOT MVNO MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 24 ENTERPRISE: IOT MVNO MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 IOT MVNO MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 26 IOT MVNO MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 27 MANUFACTURING: IOT MVNO MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 28 MANUFACTURING: IOT MVNO MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 TRANSPORTATION AND LOGISTICS: IOT MVNO MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 30 TRANSPORTATION AND LOGISTICS: IOT MVNO MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 HEALTHCARE: IOT MVNO MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 32 HEALTHCARE: IOT MVNO MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 RETAIL: IOT MVNO MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 34 RETAIL: IOT MVNO MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 ENERGY AND UTILITY: IOT MVNO MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 36 ENERGY AND UTILITY: IOT MVNO MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 AGRICULTURE: IOT MVNO MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 38 AGRICULTURE: IOT MVNO MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 OTHERS: IOT MVNO MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 40 OTHERS: IOT MVNO MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 IOT MVNO MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 42 IOT MVNO MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 NORTH AMERICA: IOT MVNO MARKET, BY OPERATIONAL MODEL, 2018–2022 (USD MILLION)

- TABLE 44 NORTH AMERICA: IOT MVNO MARKET, BY OPERATIONAL MODEL, 2023–2028 (USD MILLION)

- TABLE 45 NORTH AMERICA: IOT MVNO MARKET, BY SUBSCRIBER, 2018–2022 (USD MILLION)

- TABLE 46 NORTH AMERICA: IOT MVNO MARKET, BY SUBSCRIBER, 2023–2028 (USD MILLION)

- TABLE 47 NORTH AMERICA: IOT MVNO MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 48 NORTH AMERICA: IOT MVNO MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 49 NORTH AMERICA: IOT MVNO MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 50 NORTH AMERICA: IOT MVNO MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 51 EUROPE: IOT MVNO MARKET, BY OPERATIONAL MODEL, 2018–2022 (USD MILLION)

- TABLE 52 EUROPE: IOT MVNO MARKET, BY OPERATIONAL MODEL, 2023–2028 (USD MILLION)

- TABLE 53 EUROPE: IOT MVNO MARKET, BY SUBSCRIBER, 2018–2022 (USD MILLION)

- TABLE 54 EUROPE: IOT MVNO MARKET, BY SUBSCRIBER, 2023–2028 (USD MILLION)

- TABLE 55 EUROPE: IOT MVNO MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 56 EUROPE: IOT MVNO MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 57 EUROPE: IOT MVNO MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 58 EUROPE: IOT MVNO MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 59 ASIA PACIFIC: IOT MVNO MARKET, BY OPERATIONAL MODEL, 2018–2022 (USD MILLION)

- TABLE 60 ASIA PACIFIC: IOT MVNO MARKET, BY OPERATIONAL MODEL, 2023–2028 (USD MILLION)

- TABLE 61 ASIA PACIFIC: IOT MVNO MARKET, BY SUBSCRIBER, 2018–2022 (USD MILLION)

- TABLE 62 ASIA PACIFIC: IOT MVNO MARKET, BY SUBSCRIBER, 2023–2028 (USD MILLION)

- TABLE 63 ASIA PACIFIC: IOT MVNO MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 64 ASIA PACIFIC: IOT MVNO MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 65 ASIA PACIFIC: IOT MVNO MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 66 ASIA PACIFIC: IOT MVNO MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 67 MIDDLE EAST AND AFRICA: IOT MVNO MARKET, BY OPERATIONAL MODEL, 2018–2022 (USD MILLION)

- TABLE 68 MIDDLE EAST AND AFRICA: IOT MVNO MARKET, BY OPERATIONAL MODEL, 2023–2028 (USD MILLION)

- TABLE 69 MIDDLE EAST AND AFRICA: IOT MVNO MARKET, BY SUBSCRIBER, 2018–2022 (USD MILLION)

- TABLE 70 MIDDLE EAST AND AFRICA: IOT MVNO MARKET, BY SUBSCRIBER, 2023–2028 (USD MILLION)

- TABLE 71 MIDDLE EAST AND AFRICA: IOT MVNO MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 72 MIDDLE EAST AND AFRICA: IOT MVNO MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 73 MIDDLE EAST AND AFRICA: IOT MVNO MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 74 MIDDLE EAST AND AFRICA: IOT MVNO MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 75 LATIN AMERICA: IOT MVNO MARKET, BY OPERATIONAL MODEL, 2018–2022 (USD MILLION)

- TABLE 76 LATIN AMERICA: IOT MVNO MARKET, BY OPERATIONAL MODEL, 2023–2028 (USD MILLION)

- TABLE 77 LATIN AMERICA: IOT MVNO MARKET, BY SUBSCRIBER, 2018–2022 (USD MILLION)

- TABLE 78 LATIN AMERICA: IOT MVNO MARKET, BY SUBSCRIBER, 2023–2028 (USD MILLION)

- TABLE 79 LATIN AMERICA: IOT MVNO MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 80 LATIN AMERICA: IOT MVNO MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 81 LATIN AMERICA: IOT MVNO MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 82 LATIN AMERICA: IOT MVNO MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 83 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 84 IOT MVNO MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 85 PRODUCT LAUNCHES, 2021–2023

- TABLE 86 DEALS, 2020–2023

- TABLE 87 KORE WIRELESS: BUSINESS OVERVIEW

- TABLE 88 KORE WIRELESS: SOLUTIONS/SERVICES OFFERED

- TABLE 89 KORE WIRELESS: SOLUTION/SERVICE LAUNCHES

- TABLE 90 KORE WIRELESS: IOT MVNO: DEALS

- TABLE 91 KDDI CORPORATION: BUSINESS OVERVIEW

- TABLE 92 KDDI CORPORATION: SOLUTIONS/SERVICES OFFERED

- TABLE 93 KDDI CORPORATION: SOLUTION/SERVICE LAUNCHES

- TABLE 94 KDDI CORPORATION: IOT MVNO: DEALS

- TABLE 95 SEMTECH CORPORATION: BUSINESS OVERVIEW

- TABLE 96 SEMTECH CORPORATION: SOLUTIONS/SERVICES OFFERED

- TABLE 97 SEMTECH CORPORATION: IOT MVNO: DEALS

- TABLE 98 G+D: BUSINESS OVERVIEW

- TABLE 99 G+D: SOLUTIONS/SERVICES OFFERED

- TABLE 100 G+D: SOLUTION/SERVICE LAUNCHES

- TABLE 101 G+D: IOT MVNO: DEALS

- TABLE 102 TWILIO: BUSINESS OVERVIEW

- TABLE 103 TWILIO: SOLUTIONS/SERVICES OFFERED

- TABLE 104 TWILIO: SOLUTION/SERVICE LAUNCHES

- TABLE 105 TWILIO: DEALS

- TABLE 106 BICS: BUSINESS OVERVIEW

- TABLE 107 BICS: SOLUTIONS/SERVICES OFFERED

- TABLE 108 BICS:DEALS

- TABLE 109 IOT PROFESSIONAL SERVICES MARKET, BY SERVICE TYPE, 2016–2021 (USD BILLION)

- TABLE 110 IOT PROFESSIONAL SERVICES MARKET, BY SERVICE TYPE, 2022–2027 (USD BILLION)

- TABLE 111 IOT PROFESSIONAL SERVICES MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD BILLION)

- TABLE 112 IOT PROFESSIONAL SERVICES MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 113 IOT PROFESSIONAL SERVICES MARKET, BY DEPLOYMENT TYPE, 2016–2021 (USD BILLION)

- TABLE 114 IOT PROFESSIONAL SERVICES MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD BILLION)

- TABLE 115 IOT PROFESSIONAL SERVICES MARKET, BY APPLICATION, 2016–2021 (USD BILLION)

- TABLE 116 IOT PROFESSIONAL SERVICES MARKET, BY APPLICATION, 2022–2027 (USD BILLION)

- TABLE 117 IOT PROFESSIONAL SERVICES MARKET, BY REGION, 2016–2021 (USD BILLION)

- TABLE 118 IOT PROFESSIONAL SERVICES MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 119 5G IOT MARKET, BY COMPONENT, 2020–2028 (USD MILLION)

- TABLE 120 5G IOT MARKET, BY SERVICE, 2020–2028 (USD MILLION)

- TABLE 121 5G IOT MARKET, BY PROFESSIONAL SERVICE, 2020–2028 (USD MILLION)

- TABLE 122 5G IOT MARKET, BY NETWORK TYPE, 2020–2028 (USD MILLION)

- TABLE 123 5G IOT MARKET, BY ORGANIZATION SIZE, 2020–2028 (USD MILLION)

- TABLE 124 5G IOT MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 125 5G IOT MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 126 5G IOT MARKET, BY REGION, 2020–2028 (USD MILLION)

- FIGURE 1 IOT MVNO MARKET SEGMENTATION

- FIGURE 2 IOT MVNO MARKET: GEOGRAPHIC SCOPE

- FIGURE 3 IOT MVNO MARKET: RESEARCH DESIGN

- FIGURE 4 RESEARCH METHODOLOGY: APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY, APPROACH 1: SUPPLY-SIDE ANALYSIS OF REVENUE FROM SOLUTIONS AND SERVICES IN IOT MVNO MARKET

- FIGURE 6 BOTTOM-UP APPROACH

- FIGURE 7 TOP-DOWN APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 IOT MVNO MARKET TO WITNESS SLIGHT DIP IN Y-O-Y IN 2023

- FIGURE 11 IOT MVNO MARKET SHARE, BY REGION, 2023

- FIGURE 12 GROWING DEMAND FOR CONNECTED DEVICES TO DRIVE MARKET DURING FORECAST PERIOD

- FIGURE 13 SERVICE OPERATOR SEGMENT TO DOMINATE MARKET IN 2023

- FIGURE 14 ENTERPRISE TO DOMINATE MARKET IN 2023

- FIGURE 15 TRANSPORTATION AND LOGISTICS SEGMENT TO ACCOUNT FOR SIGNIFICANT MARKET SHARES IN 2023

- FIGURE 16 IOT MVNO MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 IOT MVNO MARKET: VALUE CHAIN ANALYSIS

- FIGURE 18 NUMBER OF PATENTS GRANTED, 2013–2022

- FIGURE 19 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS

- FIGURE 20 PORTER’S FIVE FORCES MODEL: IOT MVNO MARKET

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE ENTERPRISES

- FIGURE 22 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 23 SERVICE OPERATOR SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 24 ENTERPRISE SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 25 TRANSPORTATION LOGISTICS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 26 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 27 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 28 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS, 2020–2022 (USD MILLION)

- FIGURE 29 EVALUATION QUADRANT MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 30 EVALUATION QUADRANT MATRIX FOR KEY PLAYERS, 2023

- FIGURE 31 EVALUATION QUADRANT MATRIX FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- FIGURE 32 EVALUATION QUADRANT MATRIX FOR STARTUPS/SMES, 2023

- FIGURE 33 KORE WIRELESS: COMPANY SNAPSHOT

- FIGURE 34 KDDI CORPORATION: COMPANY SNAPSHOT

- FIGURE 35 SEMTECH CORPORATION: COMPANY SNAPSHOT

- FIGURE 36 G+D: COMPANY SNAPSHOT

- FIGURE 37 TWILIO: COMPANY SNAPSHOT

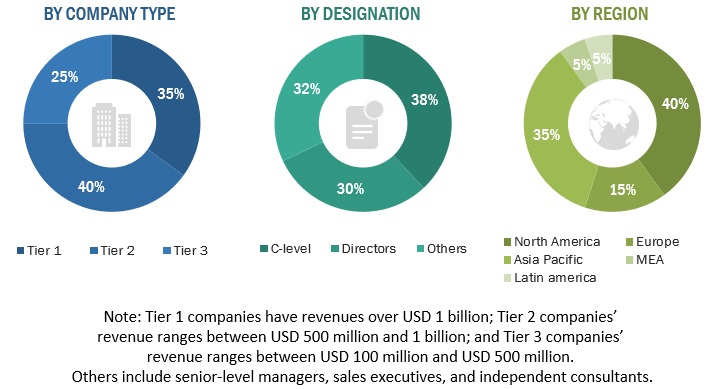

This research study involved extensive secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect information useful for this technical, market-oriented, and commercial study of the IoT MVNO market. Primary sources were industry experts from core and related industries, preferred system developers, service providers, resellers, partners, and organizations related to the various segments of the industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants and subject-matter experts, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects. These included key industry participants, subject-matter experts, C-level executives of key companies, and industry consultants.

Secondary Research

The market share and revenue of the company offering IoT MVNO services were identified. The secondary data was available through paid and unpaid sources by analyzing the product portfolio of major companies in the ecosystem and rating them based on their performance and quality. In the secondary research process, various sources were referred to for identifying and collecting information for this study. In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases.

Primary Research

Various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report in the primary research process. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Information Security Officers (CISOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the IoT MVNO market.

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the global IoT MVNO market and the size of various other dependent sub-segments. The research methodology used to estimate the market size includes the following details:

- Analyzing the size of the global IoT MVNO and then identifying revenues generated through the technology

- Identifying the key players in the market and their revenue contribution in the respective regions

- Estimating the size of the IoT MVNO market

- Estimating the market size of other IoT MVNO technology providers

IoT MVNO Market Size: Botton Up Approach

IoT MVNO Market Size: Top Down Approach

Data Triangulation

After arriving at the overall market size, the IoT MVNO market was divided into several segments and subsegments. The data triangulation procedures were used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

An IoT MVNO is a mobile virtual network operator (MVNO) that provides connectivity services to Internet of Things (IoT) devices. IoT MVNOs typically offer various features and benefits designed to meet the specific needs of IoT devices, such as low data rates, long battery life, and global coverage. IoT MVNOs can be a valuable option for businesses looking to connect their IoT devices to the internet. By using an IoT MVNO, businesses can save money on connectivity costs and get the features and benefits they need to ensure that their IoT devices are always connected and up-to-date.

Key Stakeholders

- Senior Management

- Finance/Procurement Department

- R&D Department

- Technology Providers

- Content Developers

- Venue Owners

- Investors and venture capitalists

Report Objectives

- To determine and forecast the global IoT MVNO market by operational model, subscribers, enterprise vertical, and region from 2023 to 2028

- To analyze the various macroeconomic and microeconomic factors affecting the market growth

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa, Latin America

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the IoT MVNO market

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall IoT MVNO market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the IoT MVNO market

- To profile the key market players; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market

- To track and analyze competitive developments, such as mergers & acquisitions, product developments, partnerships & collaborations, and research & development (R&D) activities, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the MEA market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in IoT MVNO Market