IoT Monetization Market Case Studies, and Use Cases, by Application (Retail, Industrial, Automotive & Transportation, Building & Home Automation, Consumer Electronics, Energy, Agriculture, and Healthcare) and Geography - Global Forecast to 2022

IoT monetization market was valued at USD 23.09 billion in 2015 and is expected to reach USD 443.27 billion by 2022, at a CAGR of 52.98% during the forecast period. The base year used for this study is 2015, and the forecast period considered is between 2016 and 2022. Internet of things has been a defining trend since the last decade with trillions of revenue expected from billions of connected devices. These connected devices are expected to generate a huge amount of data to be used by the companies to bring in innovation and automation in their businesses. The increase in revenue with the use of IoT would help all the diverse applications to grow. This aspiring technology is all set to bring in a transformation in the way of living and workstyle of human beings, thereby bringing in a new revolution for interactions between machines and human beings.

Market Dynamics

Drivers

- Increasing Internet connectivity

- Increased use of smartphones and other connected devices

- Growing adoption of cloud platforms

- Evolution of high-speed networking technologies

Restraints

- Lack of common communication standards across platforms

- Lack of power-efficient devices

Opportunities

- Significant number of investments in the IoT monetization market

- Significant government funding worldwide for R&D in IoT

Challenge

- Ensuring the security and privacy of the data collected

Increasing Internet connectivity and increased use of smartphones and other connected devices are the major drivers for the IoT monetization market

The use and penetration of the Internet or broadband facilities has increased in the last decade; it is high in the developed countries such as the U.S., Japan, and Germany. According to the census bureau of America’s current population survey (CPS) data documents, the continuous rise in broadband facilities among the people in the U.S. is particularly high for domestic use. The increasing number of Internet users all over the world is expected to strengthen the overall market for IoT monetization.

The ever-increasing penetration of smartphones and tablets and the rising demand for connected devices are some of the driving factors for the growth of the IoT monetization market. Smartphones are increasingly becoming a primary device for using email, accessing websites, storing key data, synchronizing work and personal calendars, accessing enterprise applications, and conducting online transactions.

The objectives of the study are as follows:

- To define, describe, and forecast the Internet of Things (IoT) monetization market on the basis of application and geography

- To forecast the market size, in terms of value, for various applications with regard to four main regions—North America, Europe, Asia-Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and contributions to the total market

- To use the Porter’s five forces model to gauge the entry barriers to this market and market roadmaps to study the evolution and timeline of the market

- To strategically profile key players, comprehensively analyze their core competencies, and describe the competitive landscape of the market

- To analyze competitive developments such as mergers & acquisitions, new product developments, and R&D in the global market

The IoT monetization market was valued at USD 23.09 billion in 2015 and is expected to reach USD 443.27 billion by 2022, at a CAGR of 52.98% during the forecast period. The increasing Internet connectivity, increased use of smartphones and other connected devices, and growing adoption of cloud platforms are the major drivers for the IoT monetization market. The use and penetration of the Internet or broadband facilities has increased over the last decade, the rate of which is high in the developed countries such as the U.S., Japan, and Germany. This factor is expected to propel the growth of the market during the forecast period.

The scope of this report covers the IoT monetization market on the basis of application and geography. Automotive & transportation applications are expected to hold the largest share of the overall market during the forecast period. The rising adoption of IoT by automotive manufacturers is driving the growth of the market for automotive & transportation applications. The market for consumer electronics applications is expected to grow at a high rate between 2016 and 2022. The increasing use of consumer electronics in building smart cities, smart buildings, and smart offices is expected to boost the demand for smart consumer electronics. With the emergence of a number of smart appliances that can connect to the Internet and smartphones, the market for consumer electronics applications is expected to grow during the forecast period.

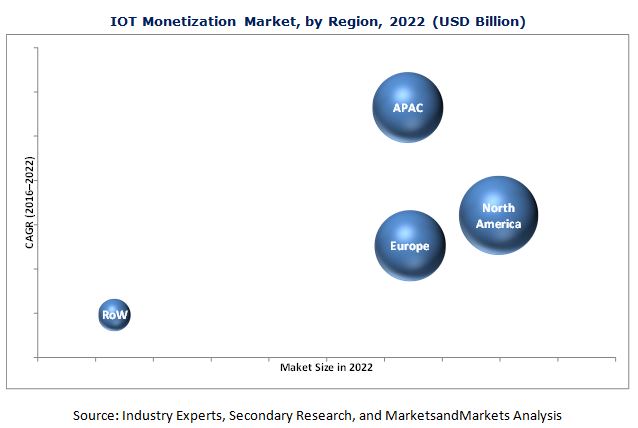

North America held the largest share of the IoT monetization market in 2015. The U.S. is a major contributor to the growth of the market in North America. The high growth of the market in North America can be attributed to the fast adoption of new technology by the masses and the presence of several IoT companies in the region, especially in the U.S.; these companies offers a wide range of IoT devices for applications in the retail, industrial, consumer electronics, healthcare, automotive & transportation, and other sectors.

The IoT monetization market in APAC is expected to grow at a high rate between 2016 and 2022. The increasing use of IoT in industrial and automotive & transportation applications in APAC is driving the market in this region. The strong support of government in countries such as China and India to thrive on the digital innovation is also boosting the growth of the market in APAC. In addition, factors such as economies of scale and cross-sector partnerships are fueling the growth of the market in this region. The use of mobile IoT in APAC is also likely to increase in the coming years.

Automotive & transportation, industrial, and retail applications would lead the IoT monetization market

Automotive & Transportation

The automotive & transportation sector covers connected cars and intelligent transportation systems (ITSs) such as sensors and communication & traffic control technologies. These communication & traffic control technologies assist states, cities, and towns worldwide to meet the increasing demand for surface transportation systems. Vehicle detection and surveillance technologies are an integral part of ITSs as they gather all or a part of the data used in these systems. The systems are being continuously developed to provide enhanced speed monitoring, traffic counting, presence detection, headway measurement, and vehicle classification.

Industrial

IoT plays a key role in industrial applications. The connection of objects through embedded smart devices or through the use of unique detectors and data carriers assist in communicating with an intelligent supporting network infrastructure and information systems; this would optimize production processes and help in monitoring the entire lifecycle of objects-from production to dumping. By tagging items and containers, greater transparency can be obtained about the status of the shop floor, location and disposition of materials, and status of production machines. Nowadays, the manufacturing industry is facing several issues such as fluctuations in regulations across different regions, rising employer costs, and frequent breakdown of machines.

Retail

The retail sector deals with a large number of people, and IoT in the retail sector caters to the demands and needs of these customers. Retailers are focusing on gaining maximum advantage through IoT solutions and discovering various functional areas in which IoT could draw major revenue benefits, along with providing innovative solutions to their customers. The use of IoT in these functional areas would help retailers improve their business efficiency and draw better customer retention. The concept of IoT in retail has revolutionized the way retailers interact with their customers.

Critical questions which the report answers

- What are the major use-cases in IoT monetization?

- Which are the major companies using IoT as a tool for monetization?

- Which countries would lead the IoT monetization market?

Factors such as lack of common communication standards across platforms and lack of power-efficient devices are restraining the growth of the IoT monetization market. This report discusses the drivers, restraints, opportunities, and challenges pertaining to the market. In addition, it analyzes the current market scenario and forecasts the market size till 2022.

Some of the major companies operating in the IoT monetization market are PTC, Inc. (U.S.), IBM Corp. (U.S.), Intel Corp. (U.S.), Cisco Systems, Inc. (U.S.), General Electric Co. (U.S.), Oracle Corp. (U.S.), Google Inc. (U.S.), Microsoft Corp. (U.S.), SAP SE (Germany), and Amdocs Ltd. (U.S.).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitation

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

2.4.1 Assumptions

3 Executive Summary (Page No. - 24)

4 Market Overview (Page No. - 29)

4.1 Introduction

4.2 Market Segmentation

4.2.1 Market, By Application

4.2.2 Market, By Geography

4.3 Market Evolution

4.4 IoT Monetization Model

4.5 Market Dynamics: IoT Monetization Market

4.5.1 Drivers

4.5.1.1 Increasing Internet Connectivity

4.5.1.2 Increased Use of Smartphones and Other Connected Devices

4.5.1.3 Growing Adoption of Cloud Platforms

4.5.2 Restraints

4.5.2.1 Lack of Common Communication Standards Across Platforms

4.5.2.2 Lack of Power-Efficient Devices

4.5.3 Opportunities

4.5.3.1 Significant Number of Investments in the Market

4.5.3.2 Significant Government Funding Worldwide for R&D in Iot

4.5.4 Challenges

4.5.4.1 Ensuring the Security and Privacy of the Data Collected

5 Industry Trends (Page No. - 38)

5.1 Introduction

5.2 Key Trends in the IoT Monetization Market

5.3 Porter’s Five Forces Analysis

5.3.1 Bargaining Power of Suppliers

5.3.2 Bargaining Power of Buyers

5.3.3 Threat of New Entrants

5.3.4 Threat of Substitutes

5.3.5 Intensity of Competitive Rivalry

6 IoT Monetization Market, By Application (Page No. - 45)

6.1 Introduction

6.2 Promising Applications for IoT Monetization

6.2.1 Retail

6.2.1.1 IoT in Retail: Case Study

6.2.1.2 Use Cases of IoT in Retail Applications

6.2.2 Industrial

6.2.2.1 IoT in Industrial: Case Study

6.2.2.2 Use Cases of IoT in Industrial Applications

6.2.3 Automotive & Transportation

6.2.3.1 IoT in Automotive & Transportation: Case Study

6.2.3.2 Use Cases of IoT in Automotive & Transportation Applications

6.2.4 Agriculture

6.2.4.1 Use Cases of IoT in Agriculture Applications

6.2.5 Energy

6.2.5.1 IoT in Energy: Case Study

6.2.5.2 Use Cases of IoT in Energy Applications

6.2.6 Building & Home Automation

6.2.6.1 IoT in Building & Home Automation: Case Study

6.2.6.2 Use Cases of IoT in Building & Home Automation Applications

6.2.7 Consumer Electronics

6.2.7.1 Use Cases of IoT in Consumer Electronics Applications

6.2.8 Healthcare

6.2.8.1 IoT in Healthcare: Case Study

6.2.8.2 Use Cases of IoT in Healthcare

6.2.9 Others

6.2.9.1 Use Cases of IoT in Other Applications

6.2.10 Case Study: Smart City (Barcelona, Spain)

7 Geographical Analysis (Page No. - 65)

7.1 Introduction

7.2 Geographical Analysis of IoT Monetization

7.2.1 North America

7.2.2 Europe

7.2.3 Asia-Pacific (APAC)

7.2.4 Rest of the World (RoW)

8 Competitive Landscape (Page No. - 68)

8.1 Introduction

8.2 Competitive Scenario

8.2.1 New Product Launches

8.2.2 Partnerships

8.2.3 Agreements & Collaborations

8.2.4 Acquisitions & Expansions

9 Company Profile (Page No. - 74)

(Overview, Financial*, Products & Services, Strategy, and Developments)

9.1 Introduction

9.2 PTC, Inc.

9.3 International Business Machine Corp.

9.4 General Electric Co.

9.5 SAP SE

9.6 Cisco Systems, Inc.

9.7 Amdocs Ltd.

9.8 Intel Corp.

9.9 Oracle Corp.

9.10 Google Inc.

9.11 Microsoft Corp.

9.12 Key Innovators

*Details Might Not Be Captured in Case of Unlisted Companies

10 Appendix (Page No. - 105)

10.1 Insights of Industry Experts

10.2 Discussion Guide

10.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

10.4 Introducing RT: Real-Time Market Intelligence

10.5 Available Customization

10.6 Related Reports

List of Tables (14 Tables)

Table 1 Major Impact of Intensity of Competitive Rivalry and Bargaining Power of Suppliers on the Overall IoT Monetization Market

Table 2 Market, By Application, 2013–2022 (USD Billion)

Table 3 Market for Retail Applications, By Region, 2013–2022 (USD Million)

Table 4 Market for Industrial Applications, By Region, 2013–2022 (USD Million)

Table 5 Market for Agriculture Applications, By Region, 2013–2022 (USD Million)

Table 6 Market for Energy Applications, By Region, 2013–2022 (USD Million)

Table 7 Market for Building & Home Automation Applications, By Region, 2013–2022 (USD Million)

Table 8 Market for Consumer Electronics Applications, By Region, 2013–2022 (USD Million)

Table 9 Market for Healthcare Applications, By Region, 2013–2022 (USD Million)

Table 10 Market, By Region, 2013–2022 (USD Billion)

Table 11 New Product Launches, 2016

Table 12 Partnership, 2016

Table 13 Agreements & Collaborations, 2016

Table 14 Acquisitions & Expansions, 2015–2016

List of Figures (46 Figures)

Figure 1 Overview of the Micromarkets Covered

Figure 2 Global IoT Monetization Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Market, 2013–2022 (USD Billion)

Figure 7 Market for Consumer Electronics Expected to Grow at the Highest Rate Between 2016 and 2022

Figure 8 North America Held the Largest Share of the Market in 2015

Figure 9 Region-Wise Market Size for Top 2 IoT Monetization Applications, 2015

Figure 10 Geographical Scope of IoT Monetization

Figure 11 Market Evolution of IoT Monetization

Figure 12 IoT Monetization Model

Figure 13 Increased Internet Connectivity Would Enhance the Growth of the Market

Figure 14 Percentage of Households With Internet Access and Individuals Using the Internet, 2015

Figure 15 Shipments of Smartphones, 2012–2017

Figure 16 IoT Monetization: Porter’s Five Forces Analysis, 2015

Figure 17 Market: Porter’s Five Forces Analysis

Figure 18 Core Competencies Likely to Help the Suppliers to Maintain A High Bargaining Power

Figure 19 Medium Impact of the Bargaining Power of Buyers Due to the Increase in the Number of Suppliers in the Market

Figure 20 High Capital Requirement Poses as A Major Challenge for New Entrants

Figure 21 Medium Impact of Threat of Substitutes on the Market

Figure 22 High Intensity of Competitive Rivalry Due to the Presence of A Significant Number of Players in the Market

Figure 23 Market for Consumer Electronics Applications Likely to Grow at the Highest Rate During the Forecast Period

Figure 24 Geographic Snapshot: Market in APAC to Grow at the Highest Rate During the Forecast Period

Figure 25 Market Share, By Region, 2015

Figure 26 Companies Adopted New Product Launches as the Key Growth Strategy Between 2013 and 2016

Figure 27 Market Evaluation Framework—New Product Launches Fueled Market Growth Between 2013 and 2016

Figure 28 Battle for Market Share in the Market: New Product Launches and Partnerships Were the Key Strategies

Figure 29 Geographic Revenue Mix of Major Players

Figure 30 PTC, Inc.: Company Snapshot

Figure 31 PTC, Inc.: SWOT Analysis

Figure 32 IBM Corp.: Company Snapshot

Figure 33 IBM: SWOT Analysis

Figure 34 General Electric Co.: Company Snapshot

Figure 35 General Electric: SWOT Analysis

Figure 36 SAP SE: Company Snapshot

Figure 37 SAP SE: SWOT Analysis

Figure 38 Cisco Systems, Inc.: Company Snapshot

Figure 39 Cisco Systems, Inc.: SWOT Analysis

Figure 40 Amdocs Ltd.: Company Snapshot

Figure 41 Amdocs Ltd.: SWOT Analysis

Figure 42 Intel Corp.: Company Snapshot

Figure 43 Oracle Corp.: Company Snapshot

Figure 44 Google Inc.: Company Snapshot

Figure 45 Microsoft Corp.: Company Snapshot

Figure 46 Marketsandmarkets Knowledge Store: Semiconductors & Electronics Industry Snapshot

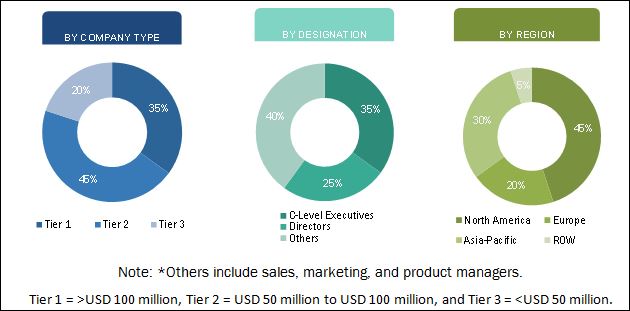

The research methodologies include the use of primary and secondary data. Both, top-down and bottom-up approaches have been used to estimate and validate the size of the market as well as of the other dependent submarkets in the overall IoT monetization market. Key players in the market have been identified through secondary research. The secondary sources include references from IEEE Internet of Things, IoT Journal, International Telecommunication Union (ITU), Consumer Electronics Association, Global Retail Marketing Association, Planet Retail, Marklines Co., Ltd. (Automotive Industry Portal), The European Automobile Manufacturers' Association (ACEA), and Society of Indian Automobile Manufactures (SIAM), among others. The research methodology includes the study of the annual and financial reports of the top market players and extensive interviews for key insights with industry leaders such as CEOs, VPs, directors, and marketing executives. All the percentage shares and breakdowns have been determined by using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The breakdown of the profiles of primaries has been depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The value chain of the IoT monetization market includes cloud platform providers, solution & service providers for IoT, hardware device manufacturers, and software vendors. The major companies that are part of the value chain include PTC, Inc. (U.S.), IBM Corp. (U.S.), Intel Corp. (U.S.), Cisco Systems, Inc. (U.S.), General Electric Co. (U.S.), Oracle Corp. (U.S.), Google Inc. (U.S.), Microsoft Corp. (U.S.), SAP SE (Germany), Infosys Ltd. (India), Tata Consultancy Services (India), Robert Bosch GmbH (Germany), and Amdocs Ltd. (U.S.), among others.

Major Market Developments

- In September 2016, SAP SE, Nippon Telegraph, and Telephone Corporation (Japan) partnered to develop an IoT solution for connected transportation safety solutions for collecting and analyzing vehicle-related data with NTT’s hitoe, a jointly developed sensing fabric by Toray Industries, Inc. (Japan) and NTT.

- In June 2016, PTC unveiled an agile software solution, Agileworx, at the business event called LiveWorx, held in Massachusetts. This solution would help the product engineering teams to innovate their products and would improve time-to-market.

- In June 2016, Cisco collaborated with IBM Corp. (U.S.) to provide solutions on IoT. With this collaboration, businesses and organizations in remote and autonomous locations would be able to tap the combined power of IBMs Watson IoT and business analytics technologies and Cisco’s edge analytics capabilities.

Target Audience:

- Communication network providers

- IoT device manufacturers (OEMs)

- IoT software and solution vendors

- Distributors and traders

- Research organizations and consulting companies

- IoT associations, organizations, forums, and alliances

- Government bodies such as regulating authorities and policy makers

- Venture capitalists, private equity firms, and startup companies

“The study answers several questions for the target audiences, primarily which market segments to focus on in the next two to five years for prioritizing efforts and investments.”

Report Scope:

In this report, the IoT monetization market has been segmented on the basis of:

IoT monetization Market, by Application:

- Retail

- Healthcare

- Automotive & Transportation

- Industrial

- Building & Home Automation

- Agriculture

- Energy

- Consumer Electronics

- Others

IoT monetization Market, by Geography:

- North America

- Europe

- Asia-Pacific (APAC)

- Rest of the World (RoW)

Critical questions which the report answers

- What are the major use-cases in IoT monetization?

- Which are the major companies using IoT as a tool for monetization?

- Which countries would lead the IoT monetization market?

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Company Profiles

- Detailed analysis of the major companies present in the IoT monetization market

Growth opportunities and latent adjacency in IoT Monetization Market