IoT Insurance Market by Type (P&C, Health, Life), Application (Automotive & Transportation, Home & Commercial Buildings, Life & Health, Business & Enterprise, Consumer Electronics, Travel, Agriculture), and Geography - Global Forecast to 2022

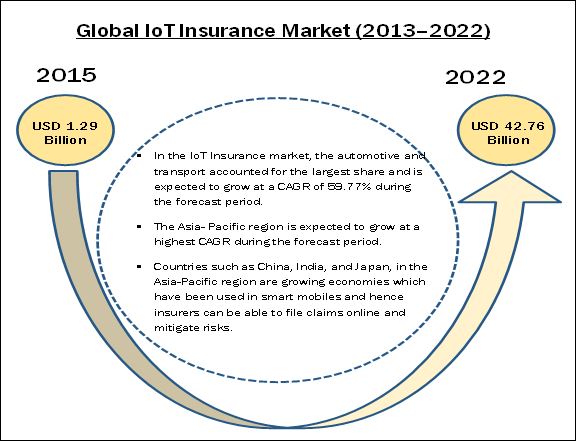

[110 Pages Report] The global IoT insurance market is expected to be worth USD 42.76 billion by 2022, growing at a CAGR of 65.89% during the forecast period. In this report, 2015 has been considered as the base year and the period between 2016 and 2022 has been considered as the forecast period for the study of the IoT insurance market.

The objective of the study of this report is:

- To define, describe, and forecast the global IoT Insurance market segmented on the basis of insurance type, insurance application, and geography

- To forecast the market size, in terms of value, for various segments with regard to four main regions, namely, North America, Europe, Asia-Pacific, and RoW

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets1 with respect to individual growth trends, future prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments of the global IoT insurance market

- To strategically profile key players, comprehensively analyze their market share and core competencies2, and detail the competitive landscape of the market

- To analyze competitive developments such as joint ventures, mergers and acquisitions, new product launches and developments, business expansions, and research and development in the global market

- To use the PEST analysis to access the market, along with the analysis of the value chain of the IoT Insurance market

Growing adoption of Internet of Things (IoT) products in developed and developing economies to drive the global IoT insurance market

Using IoT, insurers are able to create new products and services and attract customers by improving claim management and enhance customer engagement. The penetration of IoT in developed countries such as U.S., Canada, U.K., and Germany is very high. Most of the U.S. based industries such as IBM Corporation (U.S.), Oracle Corporation (U.S.), Microsoft Corporation (U.S.) and Google Inc. (U.S.) has been offering many IoT products and services for insurance industries. For Instance, IBM provides IoT insurance services that enables insurers to manage the risks in real time and improves the relationship with their policyholders. These products and services would help insurers to manage rules for quoting, underwriting, billing, policy management, claim systems and data automation.

In developing economies such as China, Japan, India, and Latin America among others have been adopted IoT based devices and networks for various applications such as energy, manufacturing, commercial and consumer sectors. The IoT insurance is a nascent market in developing regions, however the use of smart phones and broadband technologies would increase the need of IoT in insurance industries.

Market Dynamics

-

Drivers

- Growing adoption of Internet of Things (IoT) products in developed and developing economies Growing demand for cloud and other value added services in insurance industry

- Reduction in premium and risk related costs

- IoT enabled devices improves the services of insurance industry

-

Restraints

- Communication standards and data privacy concerns

-

Opportunities

- Increase in need of insurance for various IoT enabled applications such as auto, health, life, home and commercial

- New developments in insurance models

- Data generated from IoT improves business intelligence in insurance industry

- Increase in investments in IoT startups

-

Challenges

- Problems posed by legacy systems, and lack in customer engagement, awareness, skills, and procurement policies

Critical Questions

- How IoT will influence the insurance claims process?

- How will IoT enable insurers to embrace the shift to paying in advance?

The global IoT insurance market is estimated to grow at a CAGR of 65.89% to reach USD 42.76 billion by 2022. The growing adoption of Internet of Things (IoT) products in developed and developing economies, growing demand for cloud platform and other value-added services in the insurance industry are the major drivers for this market. The IoT-enabled devices provide intelligent data for insurers to help them track health, detect abnormalities, and reduce risks for policyholders. The real-time assessment of data would increase the relationship between the insurers and policyholders.

The IoT insurance market is segmented on the basis of insurance type into P&C insurance, life insurance, health insurance, and others. The property and casualty insurance uses data from IoT-based sensors, actuators, and other smart devices that are connected via the Internet for proactive management of risks and reduction in policy costs. IoT-enabled wearables and fitness devices plays a significant role in providing health-related data to insurers, helping them to monetize health and accordingly offer premiums to policyholders.

The IoT market, segmented by insurance applications, includes automotive and transportation, home and commercial buildings, life and health, consumer electronics and industrial machines, business and enterprise, agriculture, and travel. The automotive and transportation held the largest market share in 2015 due to the early adoption of usage-based insurance (UBI) with telematics in automobiles. Most of the car insurance companies in the U.S. have been offering UBI to their customers. Additionally, the in-built sensors and global positioning systems help insurers to track, locate, and analyze the vehicle and enable insurers to monitor the driving behaviors for claim process.

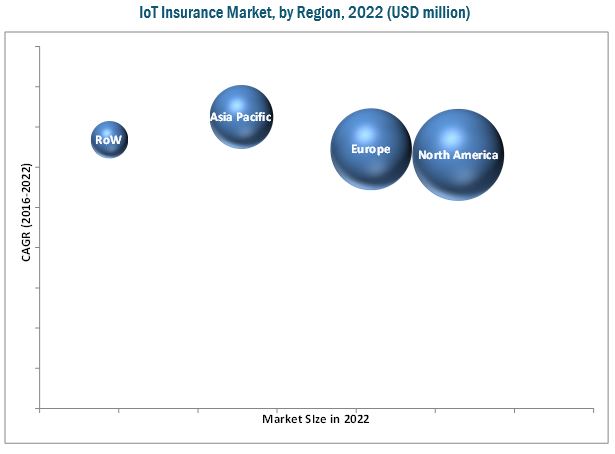

The APAC market is estimated to grow at the highest CAGR between 2016 and 2022. The development of IoT devices such as wearables, drones, Wi-Fi dongles, and inbuilt sensors that provide informative data to insurers would be the driving factor for the IoT insurance market in the APAC region.

IoT systems and software provide large amounts of real-time data that requires strong infrastructure offered by IoT vendors. These may lead to data loss and malfunctioning of the systems due to network failure and need to follow fixed communications standards for data transmission. Also, risks associated with the web of connected devices create privacy concerns, thus hindering the adoption of IoT by the insurers. These factors restrain the growth of IoT insurance in the market.

International Business Machines (IBM) Corporation (U.S.) is one of the major players in the IoT insurance market that offers IoT cloud platforms, IoT Watson, and other insurance services to insurance organizations. The company operates in five business segments, namely, Global Technology Services (GTS), Global Business Services (GBS), software, systems hardware, and global financing. IBM’s Watson IoT platform comprises data analytics software and solutions that help insurers to manage data from wearables, weather, and others in terms of insurance-specific analytics. These offerings provide easy and quick claims payments, monitoring, and risk management.

Increase in IoT’s real time data gathering and sharing capability would significantly improves the insurance predictive modeling for risk management and accelerate premium growth in the market

Connected Cars

In auto insurance, telematics connects sensors in automobiles with software apps in smart phones and captures driver behaviour for insurer analysis. The insurance business intelligence and insights gained through telematics improves pricing of policies, diminishes costs, and enhances value-added services for policyholders. The connected car implements embedded applications, in-cloud data management and user analytics. These solutions offer services to the insurance industries and insurer to be able to derive data from the sensor connected with cars. These solutions and services help to monitor and manage data from millions of vehicles in real time.

Connected Healthcare

Connected and intelligent devices leverage the opportunity for the health insurance industry. Healthcare and device manufacturing companies are developing the IoT driven healthcare systems with intelligent devices and sensors. These devices have the capability to transmit physiological data and information such as behaviour, environment, genomics, and mental health among others. For example, ITC Infotech’s IoT-driven Connected Health enables remote monitoring of a patient’s health and environment cost effectively. Data obtained from devices like health wearable are easy to share across system, making health care quick and responsive.

Logistics and Navigation

In insurance industry, the use of drones in logistic plays a major role. Walmart, Amazon, and others are using drones that help in inventory management in their business warehouses. This would enable insurers to track and improve package delivery and cargo delivery with safety. Additionally, for the navigation purpose, drones are used to track the goods from one location to another. These would help insurers to manage the goods where users would be able to identify and correct storage errors and help insurers to improve the overall quality of services provided to their internal or external policyholders. On-board camera and indoor geolocation technology are some of the IoT enabled devices which can be used for such applications.

Critical questions would be;

- How IoT will change the insurance industry?

- Where will implementation of IoT take the insurance industry in the mid to long term?

- What are threats insurance companies can face with the implementation of IoT?

Table of Contents

1 Introduction (Page No. - 11)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographical Scope

1.3.3 Years Considered for the Study

1.4 Currency and Pricing

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

2.4.1 Assumptions

3 Executive Summary (Page No. - 23)

4 Market Overview (Page No. - 26)

4.1 Introduction

4.2 Market Segmentation

4.2.1 IoT Insurance Market, By Insurance Type

4.2.2 Market, By Insurance Application

4.2.3 Market, By Geography

4.3 Market Dynamics

4.3.1 Drivers

4.3.1.1 Growing Adoption of Internet of Things (IoT) Products in Developed and Developing Economies

4.3.1.2 Growing Demand of Cloud Platform and Other Value Added Services in Insurance Industry

4.3.1.3 Reduction in Premium and Risk Related Costs

4.3.1.4 IoT Enabled Devices Improves the Insurance Services

4.3.2 Restraints

4.3.2.1 Communication Standards and Data Privacy Concerns

4.3.3 Opportunities

4.3.3.1 Increasing Need of Insurance for Various IoT Enabled Applications Such as Automobiles, Healthcare, Life, Home and Commercial Setors

4.3.3.2 New Developments in the Insurance Models

4.3.3.3 Data Generated From IoT Improves Business Intelligence in the Insurance Industry

4.3.3.4 Increasing Investments in IoT Insurance Startups

4.3.4 Challenges

4.3.4.1 Problem Posed By Legacy Systems, and Lack in Customer Engagement, Awareness, Skills, and Procurement Policies

4.4 Regulatory Implications

5 Industry Trends (Page No. - 34)

5.1 Introduction

5.2 Value Chain Analysis

5.3 Industry Trends

5.3.1 New Revenue Streams and Product Opportunities

5.3.1.1 Strategic Planning Initiatives

5.3.1.2 Building Strong Relation Between Policyholder and Insurer

5.3.1.3 Risk Modules That Moves From Reactive Compensation to Proactive Protection

5.3.2 Technological Innovations

5.4 Pest Analysis

5.4.1 Political Factors

5.4.2 Economic Factors

5.4.3 Social Factors

5.4.4 Technological Factors

6 IoT Insurance Market, By Insurance Type (Page No. - 39)

6.1 Introduction

6.2 Property and Casualty (P&C) Insurance

6.2.1 IoT in Property and Casualty (P&C) Insurance: Case Study

6.3 Health Insurance

6.3.1 IoT in Health Insurance: Case Study

6.4 Life Insurance

6.4.1 IoT in Life Insurance: Case Study

6.5 Others

6.5.1 Warranty Insurance

6.5.2 Farmers Insurance

6.5.3 Cyber Insurance

6.5.4 Pet Insurance

6.5.5 Savings and Investments Insurance

6.5.6 Pension Insurance

7 IoT Insurance Market, By Insurance Application (Page No. - 45)

7.1 Introduction

7.2 Automotive and Transportation

7.2.1 Connected Cars

7.2.2 Fleet Management

7.2.3 Insurance Telematics

7.2.4 Stolen Vehicle Recovery

7.2.5 Supply Chain Optimization and Inventory Management

7.2.6 Logistic and Navigation

7.3 Home and Commercial Buildings

7.3.1 Connected Home

7.3.2 Security and Emergency

7.3.3 Proactive Loss Prevention

7.4 Life and Health

7.4.1 Patient Health Monitoring

7.4.2 Connected Healthcare

7.4.3 Lifestyle and Fitness Monitoring

7.5 Business and Enterprise

7.5.1 Profile Authentication and Verification

7.5.2 Business-Specific Risks and Fraud Mitigation

7.5.3 Workforce Management

7.6 Consumer Electronics and Industrial Machines

7.6.1 Product Based Diagnostics

7.6.2 Warranty Management

7.7 Travel

7.7.1 Situational Awareness

7.8 Agriculture

7.8.1 Livestock Monitoring

7.8.2 Climate Monitoring and Forecasting

8 IoT Insurance Market, By Geography (Page No. - 58)

8.1 Introduction

8.2 North America

8.3 Europe

8.4 Asia Pacific

8.5 Rest of the World (RoW)

9 Competitive Landscape (Page No. - 63)

9.1 Introduction

9.2 Ranking of Top 5 Players in the Market

9.3 Competitive Analysis

9.4 Recent Developments

9.4.1 New Product Launches & Developments: IoT Insurance Market

9.4.2 Partnerships, Collaboration & Joint Ventures: IoT Insurance Market

9.4.3 Mergers & Acquisition: IoT Insurance Market

9.4.4 Others

10 Company Profile (Page No. - 72)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

10.1 Introduction

10.2 International Business Machines Corporation

10.3 SAP SE

10.4 Oracle Corporation

10.5 Google Inc.

10.6 Microsoft Corporation

10.7 Cisco Systems Inc.

10.8 Accenture PLC

10.9 Verisk Analytics, Inc.

10.10 Concirrus

10.11 Lexisnexis

10.12 Zonoff, Inc.

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

11 Insurance Companies Outlook (Page No. - 101)

11.1 Axa Insurance

11.1.1 Overview:

11.1.2 Key Strategiesfor IoT Insurance :

11.2 American Family Insurance

11.2.1 Overview:

11.2.2 Key Strategiesfor IoT Insurance :

11.3 American International Group, Inc.

11.3.1 Overview:

11.3.2 Key Strategies for IoT Insurance :

11.4 Allianz Se

11.4.1 Overview:

11.4.2 Key Strategies for IoT Insurance :

11.5 Berkshire Hathaway Inc.

11.5.1 Overview:

11.5.2 Key Strategies for IoT Insurance :

11.6 Zurich Insurance Group Ltd.

11.6.1 Overview:

11.6.2 Key Strategies for IoT Insurance:

12 Appendix (Page No. - 107)

12.1 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.2 Introducing RT: Real Time Market Intelligence

12.3 Author Details

List of Tables (15 Tables)

Table 1 Market Size and Growth, 2013–2022 (USD Million, Y-O-Y %)

Table 2 Global IoT Insurance Market Size By Insurance Applications, 2013–2022 (USD Million)

Table 3 Automotive and Transportation Market Size By Geography, 2013–2022 (USD Million)

Table 4 Home and Commercial Buildings Market Size By Geography, 2013–2022 (USD Million)

Table 5 Life and Health Market Size By Geography, 2013–2022 (USD Million)

Table 6 Business and Enterprise Market Size By Geography, 2013–2022 (USD Million)

Table 7 Consumer Electronics and Industrial Machines Market Size By Geography, 2013–2022 (USD Million)

Table 8 Travel Market Size By Geography, 2013–2022 (USD Million)

Table 9 Agriculture Market Size By Geography, 2013–2022 (USD Million)

Table 10 Global Market Size, By Geography, 2013–2022 (USD Million)

Table 11 Ranking of Top 5 Players in the Market

Table 12 New Product Launches & Developments, 2013–2016

Table 13 Partnerships, Joint Ventures, Collaborations, and Expansions, 2013–2016

Table 14 Mergers & Acquisition, 2013–2016

Table 15 Others, 2013–2016: IoT Insurance Market

List of Figures (31 Figures)

Figure 1 Overview of Markets Covered

Figure 2 IoT Insurance Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Assumptions of the Research Study

Figure 6 The Automotive and Transportation Application is Expected to Witness the Highest Growth Rate During the Forecast Period

Figure 7 North America Held the Highest Market Share for Market in 2015

Figure 8 IoT Insurance Market, By Geography

Figure 9 Demand of Cloud Platform and Other Value Added Services in Insurance Industry Would Drive the Market

Figure 10 Value Chain of IoT Insurance Market

Figure 11 Agriculture Application in Market Held the Highest CAGR During Forecast Period

Figure 12 Life and Health Market in North America Held the Highest Share in 2015

Figure 13 Agriculture Market Size is Expected to Grow at Highest CAGR in APAC Region

Figure 14 Geographic Snapshot: Market has High Growth Rate in Developing Economies

Figure 15 North America is Expected to Have A Major Share of IoT Insurance Market in 2015

Figure 16 Companies Adopted Strategic Alliances as the Key Growth Strategy Between 2013 and 2016

Figure 17 Market Evaluation Framework: (2014–2016)

Figure 18 Battle for Market Share for IoT Insurance: New Product Launches & Developments and Partnerships Were the Key Strategies

Figure 19 International Business Machines Corporation: Company Snapshot

Figure 20 International Business Machines Corporation: SWOT Analysis

Figure 21 SAP SE: Company Snapshot

Figure 22 SAP SE: SWOT Analysis

Figure 23 Oracle Corporation: Company Snapshot

Figure 24 Oracle Corporation: SWOT Analysis

Figure 25 Google Inc.: Company Snapshot

Figure 26 Google Inc.: SWOT Analysis

Figure 27 Microsoft Corporation: Company Snapshot

Figure 28 Microsoft Corporation: SWOT Analysis

Figure 29 Cisco Systems Inc.: Company Snapshot

Figure 30 Accenture PLC: Company Snapshot

Figure 31 Verisk Analytics, Inc.: Company Snapshot

The top-down and bottom-up approaches have been considered to estimate the size of the IoT insurance market. This research study involves an extensive usage of secondary sources, directories, and databases (such as Factiva and OneSource) to identify and collect information useful for the technical and market-oriented study of IoT insurance types and applications.

The points below explain the research methodology applied:

- This entire research methodology includes the study of annual and financial reports of top players, presentations, press releases, journals, paid databases, and interviews with industry experts.

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments in the global IoT insurance market.

- Competitive developments such as mergers and acquisitions, new product launches and developments, and research and development in the global market have been analyzed.

- All the percentage splits and segment breakdown of the market are based on secondary and primary research.

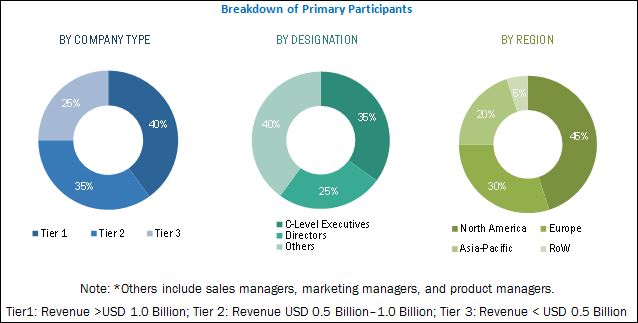

The figure below shows the breakdown of primaries on the basis of company types, designations, and regions conducted during the research study.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem:

The IoT insurance ecosystems comprises OEMs such as Google Inc. (U.S.), and Lemonade Inc. (U.S.) among others; the system manufacturers, software providers, and connectivity providers includes SAP SE (Germany), IBM Corporation (U.S.), Cisco Systems, Inc. (U.S.), Oracle Corporation (U.S), Zonoff Inc. (U.S.), and Accenture PLC (Ireland); service providers includes LexisNexis (U.S.), IBM Corporation (U.S.), SAP SE (Germany) and others. The end users are the insurance companies such as AXA Insurance (France), American Family Insurance (U.S.), American International Group, Inc. (U.S.), and Allianz SE (Germany), among others.

Scope of the Report:

|

Report Metric |

Details |

|

Base year |

2015 |

|

Forecast period |

2016–2022 |

|

Units |

Value (USD) |

|

Segments covered |

Type, End User, Offerings, and Region |

|

Geographic regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

OEMs such as Google Inc. (U.S.), and Lemonade Inc. (U.S.) among others; the system manufacturers, software providers, and connectivity providers includes SAP SE (Germany), IBM Corporation (U.S.), Cisco Systems, Inc. (U.S.), Oracle Corporation (U.S), Zonoff Inc. (U.S.), and Accenture PLC (Ireland); service providers includes LexisNexis (U.S.), IBM Corporation (U.S.), SAP SE (Germany) |

The Target Audience:

- IoT software solution providers

- Cloud service providers

- Original equipment manufacturers (OEMs)

- IoT product manufacturers

- Research organizations

- Technology standards organizations, forums, alliances, and associations

- Technology investors

- Governments, financial institutions, and investment communities

- Analysts and strategic business planners

Scope of the Report:

This report categorizes the global market for IoT insurance on the basis of insurance type, insurance application, and region.

By Insurance Type:

- Property and Casualty (P&C) Insurance

- Health Insurance

- Life Insurance

-

Others

- Warranty Insurance

- Farmers’ Insurance

- Cyber Insurance

- Pet Insurance

- Savings and Investments Insurance

- Pension Insurance

By Insurance Application:

- Automotive and Transportation

- Home and Commercial Buildings

- Life and Health

- Business and Enterprise

- Consumer Electronics and Industrial Machines

- Travel

- Agriculture

By Region:

- North America

- Europe

- APAC

- RoW

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Growth opportunities and latent adjacency in IoT Insurance Market