loT in Construction Market by Offering (Hardware, Software, Services), Project Type (Commercial, Residential), Application (Remote Operations, Safety Management, Fleet Management, Predictive Maintenance, Others), and Region - Global Forecast to 2027

Updated on : April 04, 2024

IoT In Construction Market

The global IoT in construction market size was valued at USD 12.3 billion in 2022 and is projected to reach USD 26.5 billion by 2027, growing at 16.5% cagr from 2022 to 2027. The increase in safety concerns and productivity at construction site, rapid urbanization in developing countries is driving the growth of the market. Moreover increasing digitization of contruction industry across the globe results in increase in the requirement for Internet of Things (IoT) for the growth of the market in the near future.

Global Internet of Things (IoT) in Construction Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Internet of Things (IoT) in Construction Market Dynamics

DRIVERS: Increasing Productivity and safety due to the use of IoT on construction sites

IoT offers incredible advantages to the construction industry. The technology has already proven its merit in healthcare, manufacturing, automotive, and other industries where systems management and automation play a crucial role. With its many applications, loT has the potential to improve safety and increase productivity on construction sites.

Interconnectivity between devices and systems sync them to a central server for simplified monitoring. This allows supervisors to perform their tasks efficiently and makes them aware of all the aspects of a project. They also get to know about issues first-hand, which helps them tackle those issues quickly. IoT helps in reducing downtime and prevents machine failure. With the help of IoT, the movement, status, and progress of machinery can be controlled and reported in real-time with unprecedented precision. This connectivity is helpful to plan and coordinate other activities to increase productivity and reduce delays.

RESTRAINT: High initial cost of Internet of Things (IoT) in construction industry

Although IoT offers numerous benefits and cost savings in the construction sector, the initial cost for setting-up technology is high. For instance, the BIM software used for 3D modeling may cost between USD 3,000 to USD 5,000. The software requires a long duration of training. Apart from the software cost, the cost of training and services is also high. In some countries, wages provided to workers in the construction industry are very less. The construction companies also do not encourage the use of technology, as it increases the cost associated with the project.

OPPORTUNITIES: Growing Focus of APAC on IoT

Governments of India, China, Malaysia, and other Asian countries are spending excessively on infrastructure and construction to establish smart cities in the region. The APAC infrastructure market is expected to contribute approximately 60% to the global market by 2025, which is expected to play a positive role in driving the IoT in construction market. Governments of various Asian countries, such as Hong Kong, Singapore, and China, are making stringent laws to control accidents at construction sites. Strict rules have been imposed on those who violate these safety laws and put the worker's life at risk. As IoT offers high safety features in the construction industry, these laws are expected to provide growth opportunities to the loT in construction market of APAC in the near future.

CHALLENGES: Over-dependence on conventional methods

Digitization in the construction industry is relatively lower than that of other industries. Lack of digitization hampers productivity in the construction industry. Many times, large-scale construction projects take longer to finish than scheduled and go beyond the budget lowering financial returns for contractors. Project planning remains uncoordinated between the office and the field since the majority of the work is done on paper, which, in turn, leads to unsophisticated supply chain management. Lack of digitization also threatens the safety of workers and exposes them to possible fatality. The industry has not yet embraced new technologies that need upfront investment, even if the long-term benefits are significant. R&D spending in the construction industry runs way behind that of the other industries, which might be the challenge for the players present in the loT in construction market..

Software segment is driving the demand for IoT in construction market in 2020

On the basis of offering, the IoT in construction market has been classified into hardware, software, and services. The software segment is estimated to dominate the overall IoT in construction market. Continuous focus of the companies to develop software that reflects various parameters in the dashboard and increasing usage of analytics forbetter decision-making is driving the demand for the software segment.

Remote Operations is the largest application of Internet of Things (IoT) in construction market in 2020

On the basis of application, the 10T in construction market has been segmented into safety management, predictive maintenance, remote operations, fleet management, and others. Remote operation is the largest segment in the overall market during the forecast period. Growing usage of oT for machine control and real-time monitoring is responsible for the high market share of the remote operations application.

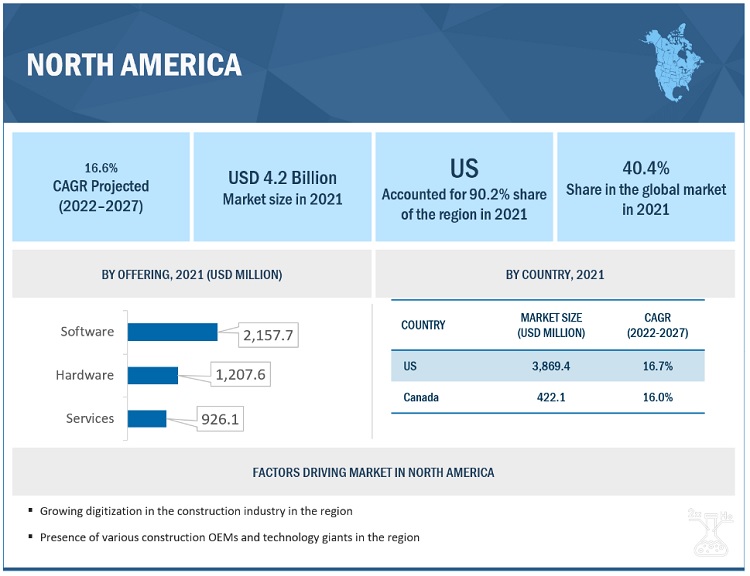

North America holds the largest market share for IoT in construction market.

North America was the largest loT in construction market in 2018, and the trend is expected to remain the same. The North American region is segmented into the US and Canada. The large market share of North America is attributed to the multiple construction OEMs embracing the use of loT in the construction in the region. Many players operating in the IoT in construction market, including Oracle Corporation, Caterpillar Inc., and CalAmp Corp., are headquartered in the region. There is growing investment in infrastructure and construction projects in the region, which is playing a major role in the growing adoption of loT in the North American construction industry.

To know about the assumptions considered for the study, download the pdf brochure

IoT In Construction Market Players

The IoT in construction market is highly competitive due to the presence of several players with a strong foothold in the market and multiple smaller domestic players. Caterpillar Inc. (US), Oracle Corporation (US), Hitachi Ltd. (Japan), CalAmp Corp. (US), Sigfox (France), and Autodesk Inc. (US) are the key players operating in the loT in construction market.

IoT In Construction Market Report Scope

|

Report Metric |

Details |

|

Market Size Availability for Years |

2017–2024 |

|

Base Year |

2018 |

|

Forecast Period |

2019–2024 |

|

Units considered |

Value (USD Million), Volume (Kiloton) |

|

Segments |

Project Type, Offering, Application, and Region |

|

Regions |

North America, Europe, APAC, MEA, and Latin America |

|

Companies |

The IoT in construction market comprises major players such as Caterpillar Inc. (US), Sigfox (France), Oracle Corporation (US), CalAmp Corp. (US), Losant IoT (US), Giatec Scientific, Inc. (Canada), WorldSensing (Spain), Kore Wireless (US), Trimble Inc. (US), and Autodesk Inc. (US). Total 20 major players covered. |

This research report categorizes the IoT in Construction market based on project type, application, offering, and region. It forecasts revenue growth and analyzes trends in each of these submarkets.

IoT In Construction Market, By Application:

- Remote Operations

- Safety Management

- Fleet Management

- Predictive Maintenance

- Others

IoT In Construction Market, By Project Type:

- Commercial

- Residential

IoT In Construction Market, By Offering:

- Hardware

- Software

- Services

IoT In Construction Market, By Region

- Asia Pacific (APAC)

- North America

- Europe

- Latin America

- Middle East & Africa (MEA)

Recent Developments

- In October 2019, Trimble Inc. announced the acquisition of the US-based Azteca Systems LLC (also known as Cityworks). This acquisition will help Trimble to expand its portfolio for Architecture, Engineering, and Construction (AEC) firms and software system integrators.

- In April 2019, WorldSensing expanded its footprint in the APAC region by establishing a regional office in Singapore to cater to the growing demand for oT in the construction industry.

- In February 2019, The company acquired Car Track, S.A. DE C.V. (Mexico) and TRACKER (UK) in order to expand its offerings in the connected vehicle and asset tracking solutions and increase its international foothold.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the Internet of Things (IoT) in construction market during 2022-2027?

The global Internet of Things (IoT) in construction market is expected to record a CAGR of 16.5% from 2022–2027.

What are the driving factors for the Internet of Things (IoT) in construction?

Increase in safety concerns and productivity, growth in construction industry due to rapid urbanization, and Industry 4.0 driving the need for digital construction.

Which are the significant players operating in the Internet of Things (IoT) in construction market?

Caterpillar Inc. (US), Oracle Corporation (US), Hitachi Ltd. (Japan), CalAmp Corp. (US), Sigfox (France), and Autodesk Inc. (US) are the key players operating in the loT in construction market.

Which region will lead the Internet of Things (IoT) in construction market in the future?

North America is expected to lead the Internet of Things (IoT) in construction market during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

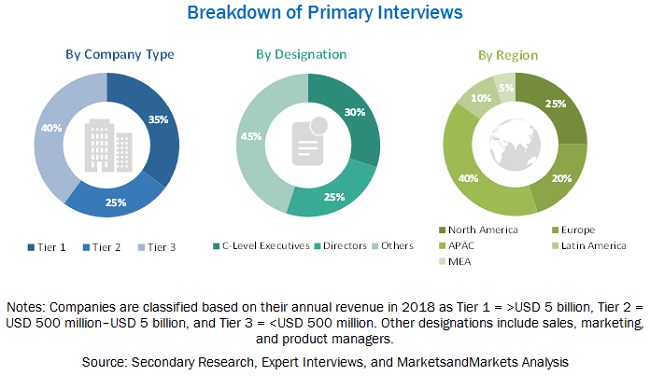

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Supply-Side Analysis

2.2.2 Demand-Side Analysis

2.3 Data Triangulation

2.4 Limitations

2.5 Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Growth Opportunities in the IoT in Construction Market

4.2 Market, By Project Type

4.3 Market, By Application and Country

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Construction Industry Due to Rapid Urbanization in Developing Countries

5.2.1.2 Increasing Productivity and Safety Due to the Use of IoT on the Construction Site

5.2.1.3 Industry 4.0 Driving the Need for Digital Construction

5.2.2 Restraints

5.2.2.1 High Initial Cost

5.2.3 Opportunities

5.2.3.1 Growing Focus of APAC on Iot

5.2.4 Challenges

5.2.4.1 Over-Dependence on Conventional Methods

6 IoT in Construction Market, By Project Type (Page No. - 34)

6.1 Introduction

6.2 Commercial

6.2.1 Commercial is the Largest Project Type Segment

6.3 Residential

6.3.1 Growing Usage of IoT in Eth North America is Driving the Demand for the Residential Segment

7 IoT in Construction Market, By Offering (Page No. - 38)

7.1 Introduction

7.2 Hardware

7.2.1 Presence of Multiple Sensor Manufacturers in North America Driving the Hardware Segment

7.3 Software

7.3.1 Growing Usage of Building Information Modelling (Bim) is Driving the Demand for Software Segment

7.4 Services

7.4.1 Services is the Fastest-Growing Segment

8 IoT in Construction Market, By Application (Page No. - 43)

8.1 Introduction

8.2 Safety Management

8.2.1 Growing Number of Accidents in Workplace is Driving the Demand for IoT to Improve Safety

8.3 Remote Operations

8.3.1 Remote Operations is the Largest Segment in the IoT in Construction Market

8.4 Predictive Maintenance

8.4.1 Predictive Maintenance is the Fastest-Growing Segment

8.5 Fleet Management

8.5.1 North America is the Leading Market in Fleet Management

8.6 Others

9 Regional Analysis (Page No. - 49)

9.1 Introduction

9.2 North America

9.2.1 North America, By Application

9.2.2 North America, By Offering

9.2.3 North America, By Project Type

9.2.4 North America, By Country

9.2.4.1 US

9.2.4.2 Canada

9.3 Europe

9.3.1 Europe, By Application

9.3.2 Europe, By Offering

9.3.3 Europe, By Project Type

9.3.4 Europe, By Country

9.3.4.1 Germany

9.3.4.2 France

9.3.4.3 UK

9.3.4.4 Italy

9.4 APAC

9.4.1 APAC, By Application

9.4.2 APAC, By Offering

9.4.3 APAC, By Project Type

9.4.4 APAC, By Country

9.4.4.1 China

9.4.4.2 South Korea

9.4.4.3 Japan

9.5 Latin America

9.5.1 Latin America, By Application

9.5.2 Latin America, By Offering

9.5.3 Latin America, By Project Type

9.5.4 Latin America, By Country

9.5.4.1 Brazil

9.5.4.2 Mexico

9.6 MEA

9.6.1 MEA, By Application

9.6.2 MEA, By Offering

9.6.3 MEA, By Project Type

9.6.4 MEA, By Country

9.6.4.1 UAE

9.6.4.2 Saudi Arabia

10 Competitive Landscape (Page No. - 75)

10.1 Introduction

10.2 Competitive Leadership Mapping

10.2.1 Visionary Leaders

10.2.2 Dynamic Differentiators

10.2.3 Innovators

10.2.4 Emerging Companies

10.3 Strength of Product Portfolio

10.4 Business Strategy Excellence

10.5 Market Ranking

10.6 Competitive Scenario

10.6.1 New Product Developments/Launches

10.6.2 Expansions

10.6.3 Acquisitions

10.6.4 Partnerships

11 Company Profiles (Page No. - 83)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, Winning Imperatives, Current Focus and Strategies, Threat From Competition, Right to Win)*

11.1 Caterpillar Inc.

11.2 Autodesk Inc.

11.3 Oracle Corporation

11.4 Trimble Inc.

11.5 Kore Wireless

11.6 Worldsensing

11.7 Giatec Scientific Inc.

11.8 Losant IoT

11.9 Sigfox

11.10 Calamp Corp.

11.11 Other Players

11.11.1 Tenna

11.11.2 Hitachi, LTD

11.11.3 Longview Iot

11.11.4 Dronedeploy

11.11.5 Wakecap Technologies

11.11.6 Pillar Technologies, Inc.

11.11.7 IoT Factory

11.11.8 Iotium

11.11.9 Smartbarrel

11.11.10 Procore Technologies, Inc.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, Winning Imperatives, Current Focus and Strategies, Threat From Competition, Right to Win Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 108)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (65 Tables)

Table 1 IoT in Construction, Market Size, 2017–2024

Table 2 IoT in Construction, Market Size, By Project Type, 2017–2024 (USD Million)

Table 3 Commercial: IoT in Construciton, Market Size, By Region, 2017–2024 (USD Million)

Table 4 Residential: IoT in Construciton, Market Size, By Region, 2017–2024 (USD Million)

Table 5 IoT in Construction Market, By Offering, 2017–2024 (USD Million)

Table 6 Hardware: IoT in Construction Market Size, By Region, 2017–2024 (USD Million)

Table 7 Software: IoT in Construction Market Size, By Region, 2017–2024 (USD Million)

Table 8 Services: IoT in Construction, Market Size, By Region, 2017–2024 (USD Million)

Table 9 IoT in Construction Market Size, By Application, 2017–2024 (USD Million)

Table 10 Safety Management: IoT in Construction Market Size, By Region, 2017–2024 (USD Million)

Table 11 Remote Operations: IoT in Construction Market Size, By Region, 2017–2024 (USD Million)

Table 12 Predictive Maintenance: IoT in Construction, Market Size, By Region, 2017–2024 (USD Million)

Table 13 Fleet Management: IoT in Construction, Market Size, By Region, 2017–2024 (USD Million)

Table 14 Other Applications: IoT in Construction, Market Size, By Region, 2017–2024 (USD Million)

Table 15 IoT in Construction Market Size, By Region, 2017–2024 (USD Million)

Table 16 North America: IoT in Construction Market, By Application, 2017–2024 (USD Million)

Table 17 North America: Market, By Offering, 2017–2024 (USD Million)

Table 18 North America: Market, By Project Type, 2017–2024 (USD Million)

Table 19 North America: Market, By Country, 2017–2024 (USD Million)

Table 20 US: IoT in Construction Market, By Application, 2017–2024 (USD Million)

Table 21 US: Market, By Project Type, 2017–2024 (USD Million)

Table 22 Canada: IoT in Construction Market, By Application, 2017–2024 (USD Million)

Table 23 Canada: Market, By Project Type, 2017–2024 (USD Million)

Table 24 Europe: IoT in Construction Market, By Application, 2017–2024 (USD Million)

Table 25 Europe: Market, By Offering, 2017–2024 (USD Million)

Table 26 Europe: Market, By Project Type, 2017–2024 (USD Million)

Table 27 Europe: Market, By Country, 2017–2024 (USD Million)

Table 28 Germany: IoT in Construction Market, By Application, 2017–2024 (USD Million)

Table 29 Germany: Market, By Project Type, 2017–2024 (USD Million)

Table 30 France: IoT in Construction Market Size, By Application, 2017–2024 (USD Million)

Table 31 France: Market Size, By Project Type, 2017–2024 (USD Million)

Table 32 UK: IoT in Construction Market Size, By Application, 2017–2024 (USD Million)

Table 33 UK: Market Size, By Project Type, 2017–2024 (USD Million)

Table 34 Italy: IoT in Construction Market Size, By Application, 2017–2024 (USD Million)

Table 35 Italy: Market Size, By Project Type, 2017–2024 (USD Million)

Table 36 APAC: IoT in Construction Market Size, By Application, 2017–2024 (USD Million)

Table 37 APAC: Market Size, By Offering, 2017–2024 (USD Million)

Table 38 APAC: Market, By Project Type, 2017–2024 (USD Million)

Table 39 APAC: Market, By Country, 2017–2024 (USD Million)

Table 40 China: IoT in Construction Market, By Application, 2017–2024 (USD Million)

Table 41 China: Market, By Project Type, 2017–2024 (USD Million)

Table 42 South Korea: IoT in Construction Market Size, By Application, 2017–2024 (USD Million)

Table 43 South Korea: Market Size, By Project Type, 2017–2024 (USD Million)

Table 44 Japan: IoT in Construction Market Size, By Application, 2017–2024 (USD Million)

Table 45 Japan: Market Size, By Project Type, 2017–2024 (USD Million)

Table 46 Latin America: IoT in Construction Market Size, By Application, 2017–2024 (USD Million)

Table 47 Latin America: Market Size, By Offering, 2017–2024 (USD Million)

Table 48 Latin America: Market Size, By Project Type, 2017–2024 (USD Million)

Table 49 Latin America: Market Size, By Country, 2017–2024 (USD Million)

Table 50 Brazil: IoT in Construction Market Size, By Application, 2017–2024 (USD Million)

Table 51 Brazil: Market Size, By Project Type, 2017–2024 (USD Million)

Table 52 Mexico: IoT in Construction Market Size, By Application, 2017–2024 (USD Million)

Table 53 Mexico: Market Size, By Project Type, 2017–2024 (USD Million)

Table 54 MEA: IoT in Construction Market Size, By Application, 2017–2024 (USD Million)

Table 55 MEA: Market Size, By Project Type, 2017–2024 (USD Million)

Table 56 MEA: Market Size, By Project Type, 2017–2024 (USD Million)

Table 57 MEA: Market Size, By Project Type, 2017–2024 (USD Million)

Table 58 UAE: IoT in Construction Market Size, By Application, 2017–2024 (USD Million)

Table 59 UAE: Market Size, By Project Type, 2017–2024 (USD Million)

Table 60 Saudi Arabia: IoT in Construction Market Size, By Application, 2017–2024 (USD Million)

Table 61 Saudi Arabia: Market Size, By Project Type, 2017–2024 (USD Million)

Table 62 New Product Developments/Launches, 2017–2019

Table 63 Expansions, 2019

Table 64 Acquisitions, 2017–2019

Table 65 Partnerships, 2017–2019

List of Figures (36 Figures)

Figure 1 IoT in Construction Market: Research Methodology

Figure 2 Market Size Estimation Methodology: Supply-Side Approach

Figure 3 Market Size Estimation Methodology: Demand-Side Approach

Figure 4 IoT in Construction Market: Data Triangulation

Figure 5 Software Segment Dominated the IoT in Construction Market in 2018

Figure 6 Remote Operations Was the Major Application of IoT in Construction Market in 2018

Figure 7 Commercial Segment Dominated the IoT in Construction Market in 2018

Figure 8 The US is the Largest Market for IoT in Construction

Figure 9 APAC to Register the Highest CAGR Between 2019 and 2024

Figure 10 High Demand From North America to Drive the IoT in Construction Market

Figure 11 Commercial to Be the Fastest-Growing Segment of the IoT in Construction Market

Figure 12 Remote Operations Was A Major Application and the US the Major Market

Figure 13 Drivers, Restraints, Opportunities, and Challenges in IoT in Construction Market

Figure 14 Commercial Segment to Grow at A Higher CAGR

Figure 15 North America to the Leading Market in the Software Segment

Figure 16 Services to Be the Fastest-Growing Segment During the Forecast Period

Figure 17 North America to Dominate the Software Segment

Figure 18 Predictive Maintenance to Register the Highest CAGR

Figure 19 North America to Dominate the IoT Market in the Remote Operations Segment

Figure 20 China to Be the Fastest-Growing Market for IoT in Construction Between 2019 and 2024

Figure 21 North America: Market Snapshot

Figure 22 Europe: Market Snapshot

Figure 23 APAC: Market Snapshot

Figure 24 Latin America: Market Snapshot

Figure 25 MEA: Market Snapshot

Figure 26 Companies Adopted Acquisition as the Key Growth Strategy Between 2017 and 2019

Figure 27 Market: Competitive Leadership Mapping, 2018

Figure 28 Caterpillar Inc.: Company Snapshot

Figure 29 Caterpillar Inc.: SWOT Analysis

Figure 30 Autodesk Inc.: Company Snapshot

Figure 31 Autodesk Inc.: SWOT Analysis

Figure 32 Oracle Corporation: Company Snapshot

Figure 33 Oracle Corporation: SWOT Analysis

Figure 34 Trimble Inc.: Company Snapshot

Figure 35 Trimble Inc.: SWOT Analysis

Figure 36 Calamp Corp.: Company Snapshot

The IoT in construction market was valued at USD 7.8 billion in 2019 and is projected to reach USD 16.8 billion by 2024, at a CAGR of 16.5% during the forecast period. The demand for IoT in construction is expected to increase significantly during the forecast period owing to its widespread usage in remote operations, safety management, predictive maintenance, fleet management, and other applications. In this study, the years considered to estimate the market size for IoT in construction are listed below:

- Base Year – 2018

- Estimated Year – 2019

- Projected Year – 2024

- Forecast Period – 2019–2024

2018 is considered as the base year for company profiles. Where information was not available for the base year, the previous year was considered.

Objectives of the Study:

- To analyze and forecast the size of the IoT in construction market, in terms of value

- To provide detailed information regarding key factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the IoT in construction market

- To define, describe, and forecast the IoT in construction market based on application, project type, offering, and region

- To analyze and forecast the size of the IoT in construction market in North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East & Africa (MEA)

- To strategically profile key players operating in the IoT in construction market and analyze their core competencies

- To analyze market opportunities and the competitive landscape for stakeholders and market leaders

- To analyze competitive developments, such as partnerships, expansions, acquisitions, and new product developments/launches undertaken by the key market players

Various secondary sources, such as Factiva, Hoovers, and Manta, have been used to gain insights into the IoT in construction market. Experts from leading companies in the IoT in construction market have been interviewed to verify and collect critical information and assess the trends in the market. The top-down, bottom-up, and data triangulation approaches have been implemented to calculate the exact values of the overall parent and each individual market sizes.

To know about the assumptions considered for the study, download the pdf brochure

The market for IoT in Construction has a diversified and established ecosystem comprising upstream players, such as raw material suppliers, and downstream stakeholders, including manufacturers, vendors, and end users of IoT in Construction, as well as various government organizations. The leading players operating in the IoT in construction market include Caterpillar Inc. (US), Sigfox (France), Oracle Corporation (US), CalAmp Corp. (US), Losant IoT (US), Giatec Scientific, Inc. (Canada), WorldSensing (Spain), Kore Wireless (US), Trimble Inc. (US), and Autodesk Inc. (US).

Target Audience

- Construction companies

- Construction original equipment manufacturers

- Hardware, software, or service provider

- Industry associations

“This study answers several questions for stakeholders, primarily which market segments they need to focus on in the next 2–5 years to prioritize their efforts and investments.”

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific needs of the companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the APAC IoT in construction market

- Further breakdown of the North America IoT in construction market

- Further breakdown of the Europe IoT in construction market

- Further breakdown of the Latin America IoT in construction market

- Further breakdown of the MEA IoT in construction market

Company Information

- Detailed analysis and profiles of additional ten market players

Growth opportunities and latent adjacency in loT in Construction Market