Insulation Coatings Market by Type (Acrylic, Polyurethane, Epoxy, Mullite, YSZ), End-Use Industry (Aerospace, Automotive, Marine, Industrial, Building & Construction), & Region (North America, APAC, Europe, South America, & MEA)-Global Forecast to 2028

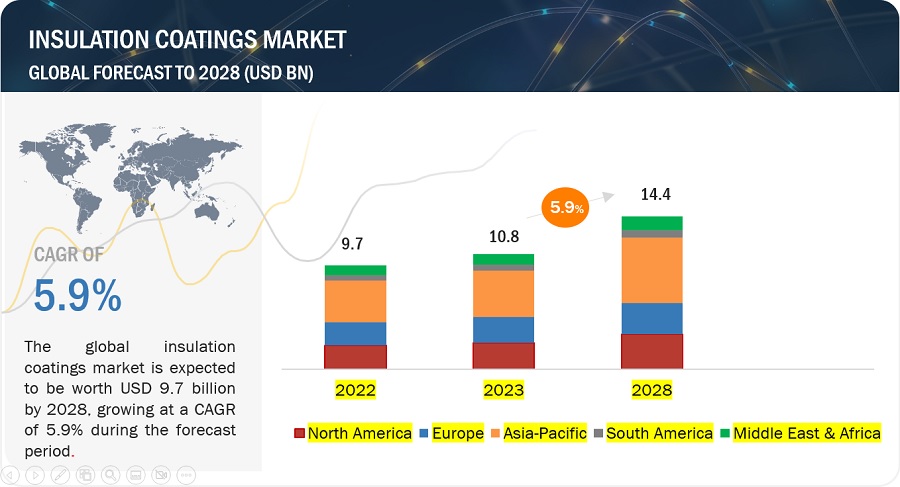

The insulation coatings market is estimated to be USD 9.7 billion in 2022 and is projected to reach USD 14.4 billion by 2028, at a CAGR of 5.9% between 2023 and 2028. Protection of equipment, pipelines, and other components from hazardous environments to make them energy efficient are the key drivers of the global insulation market during the forecast period.

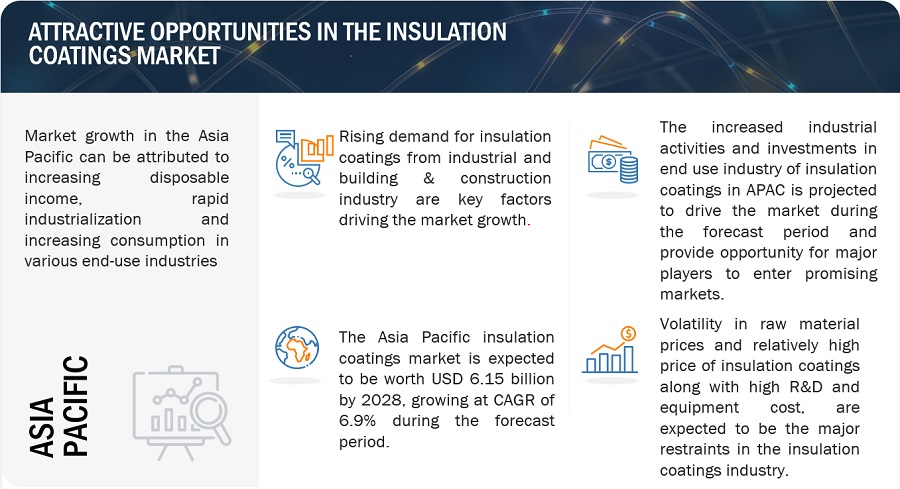

Attractive Opportunities in the Insulation Coatings Market

To know about the assumptions considered for the study, Request for Free Sample Report

Insulation coatings Market Dynamics

Driver: Growing construction and infrastructure development

The use of Insulation coatings in construction and infrastructure is expanding due to heightened focus on sustainability and energy efficiency. These coatings improve comfort, reduce heating/cooling expenses, and enhance building performance. They provide efficient thermal insulation, curbing energy use and emissions. Insulation coatings enhance sustainable construction by saving energy, reducing waste, and extending building life, fostering greener environments. These coatings provide versatile thermal insulation solutions across various building elements, suited for diverse projects. The rising adoption of sustainable building standards and the recognition of green certifications such as LEED (Leadership in Energy and Environmental Design) have significantly amplified the demand for these insulation coatings. This surge in demand serves as a catalyst for the promotion of energy-efficient methodologies within the construction sector.

Restraint: Volatility in raw material prices and relatively high price of insulation coatings

The production of insulation coatings relies on various raw materials like resins, pigments, additives, and solvents. Fluctuations in their availability and prices due to factors like supply-demand changes, geopolitical tensions, and economic conditions can lead to unpredictable costs. This cost volatility challenges effective planning, impacting profit margins, pricing strategies, and demand. Raw material price uncertainty disrupts supply chains, causing delays, creating market uncertainties, and reducing profitability. Additionally, surface preparation before applying coatings to prevent corrosion contributes to expenses, as well as thermal spray technology costs and processing downtimes. As a result, there is an increasing demand for traditional thermal insulation methods as they are more cost-effective.

Opportunities: Increasing adoption of advanced automotive electronics

The increasing demand for automotive electronics in the transportation sector is driven by rising income levels, safer driving needs, intelligent transport systems, and environmental concerns. Insulation coatings are vital in advanced automotive electronics, preventing short circuits, safeguarding components from moisture and elements, and offering thermal insulation. This demand is further fuelled by electric vehicle popularity and the industry's focus on energy efficiency. Insulation coatings are applied in various automotive components like electrical parts, batteries, sensors, and wiring. They enhance safety and performance, particularly in electric and hybrid vehicles, contributing to innovation and improved vehicle functionality.

Challenges: Competition with traditional insulation materials

To compete with traditional insulation systems like fiberglass and mineral wool, insulation coating manufacturers must focus on creating products with advanced thermal insulation capabilities. Insulation coatings offer innovative and more efficient solutions by addressing the limitations of traditional methods, promising improved thermal performance and benefits for various applications. However, existing insulation coating materials are relatively expensive, and application technology can add to costs, making the process expensive. Thus, a key challenge is to develop cost-effective insulation coatings to enhance market attractiveness by reducing overall expenses. Currently, no cost-competitive products match the effectiveness of traditional insulation materials, making the development of affordable coatings while maintaining performance standards a significant challenge for the market.

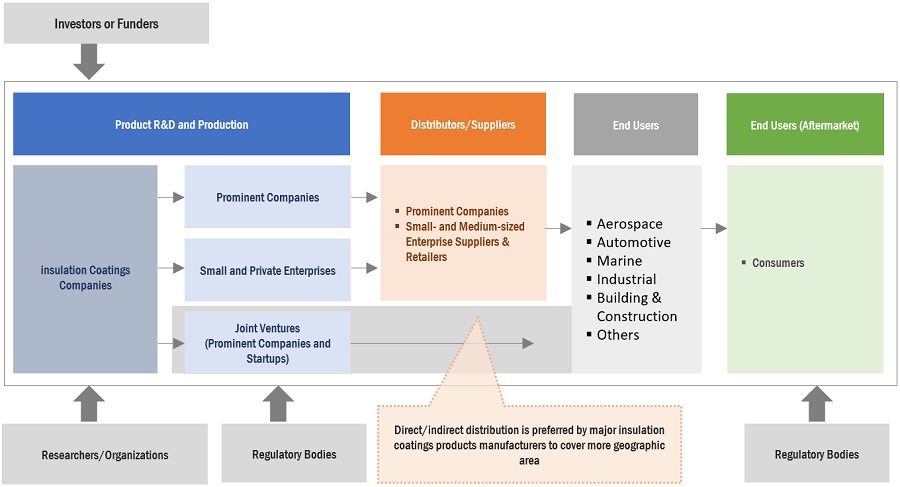

ECOSYSTEM

By Type, Acrylic-based conformal coatings accounted for the highest market share in 2022

Acrylic-based Insulation coatings are waterborne acrylic insulation coatings hold the majority market share in Insulation coatings. These coatings are preferred over traditional materials due to their low maintenance and CUI prevention capabilities. They can be easily applied using user-friendly spray equipment and are effective for temperatures up to 150°C (302°F). Water-based acrylic insulation coatings can endure even higher temperatures, up to 177°C (350.6°F).

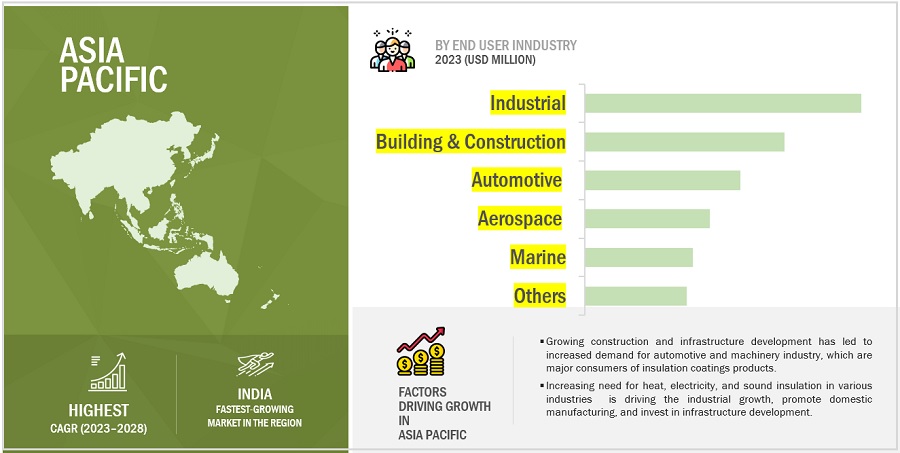

By End Use Industry, Industrial is the fastest-growing Industry of Insulation coatings market in 2022

The insulation coatings market is segmented by end-use industry into industrial, building and construction, aerospace, automotive, marine, and others. Among these, industrial is the largest end-use sector for insulation coatings, primarily utilized for thermal insulation. These coatings prevent workplace heat-related injuries by reducing heat dissipation from machinery, ensuring worker safety, and maintaining appropriate temperatures. Thermal coatings also aid in controlling chemical temperatures. Moreover, electrical insulation coatings enhance design flexibility and workplace safety.

Asia Pacific is projected to account for the highest CAGR in the insulation coatings market during the forecast period

APAC is estimated to be the largest market for insulation coatings and is also projected to register the fastest CAGR of 6.9% during the forecast period. India is expected to account for the largest share of the market in APAC till 2028. The increasing industrial activities, investment in end use industry of insulation coatings and labour costs in these countries are the main drivers for insulation coatings market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Insulation coatings market comprises key manufacturers such as AkzoNobel (Netherland), PPG (US), Sherwin-Williams Company (US), Kansai Paint Co., Ltd. (Japan), Jotun Group (Norway), Nippon Paint Holdings Co., Ltd. (Japan), Axalta Coating System (US), Hempel (Denmark), Seal For Life Industries (US), Carboline (US), and Sharpshell Engineering (South Africa) and others. Expansions, acquisitions, joint ventures, and new product developments are some of the major strategies adopted by these key players to enhance their positions in the insulation coatings market. Major focus was given to the new product development due to the changing requirements of transportation and electronics product consumers across the world.

Scope of the report:

|

Report Metric |

Details |

|

Years Considered |

2021–2028 |

|

Base year |

2022 |

|

Forecast period |

2023–2028 |

|

Unit considered |

Value (USD Million/Billion), Volume (Kiloton) |

|

Segments |

Type, End-Use Industry, and Region |

|

Regions |

North America, Asia Pacific, Europe, Middle East & Africa, and South America |

|

Companies |

AkzoNobel (Netherland), PPG (US), Sherwin-Williams Company (US), Kansai Paint Co., Ltd. (Japan), Jotun Group (Norway), Nippon Paint Holdings Co., Ltd. (Japan), Axalta Coating System (US), Hempel (Denmark), Seal For Life Industries (US), Carboline (US), and Sharpshell Engineering (South Africa) and Others. |

This research report categorizes the insulation coatings market on the basis of type, end use industry, and region.

On the basis of type:

- Acrylic

- Epoxy

- Polyurethane

- YSZ

- Mullite

- Others

On the basis of end use industry:

- Aerospace

- Automotive

- Marine

- Industrial

- Building & Construction

- Others

On the basis of region

- North America

- Asia Pacific

- Europe

- Middle East & Africa

- South America

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- On April 17, 2023, AkzoNobel introduces cutting-edge fillers designed to enhance bodyshop performance. These advanced one-stop, fast-drying filler systems are specifically developed to optimize efficiency and cost-effectiveness without compromising product quality. Currently, they are available in selected European markets.

- On February 3, 2022, McLaren Racing and AkzoNobel have extended and expanded their enduring partnership with a new multi-year agreement. This renewed commitment marks the continuation of their successful 13-year collaboration while also paving the way for exploring fresh opportunities in the realms of sustainability, technological innovation, and product development.

- On June 29, 2023, PPG and Satys, a French industrial group specializing in aircraft sealing, painting, and surface treatment, have formed a partnership to offer electrocoating (e-coat) services for original equipment manufacturer (OEM) aircraft components.

- On May 05, 2023, Sherwin-Williams High Performance Flooring has introduced an innovative addition to its seamless resinous flooring range, known as SofTop Comfort flooring systems. This new offering provides not only comfort but also delivers exceptional aesthetics and sustainability, further enriching their diverse flooring portfolio.

- On November 08, 2022, The Sherwin-Williams Company has completed the acquisition of Specialized Industrial Coatings Holding (SIC Holding), a German-based venture co-owned by Peter Möhrle Holding and GP Capital UG. SIC Holding encompasses Oskar Nolte GmbH and Klumpp Coatings GmbH.

- On May 08, 2023, KANSAI HELIOS Coatings GmbH ("KANSAI HELIOS"), a European subsidiary of Kansai Paint Co., Ltd. ("Kansai Paint"), has successfully finalized the acquisition of the global Railway Coatings business assets from Becker Industrie SAS ("Beckers"), a company under the Beckers Group.

Frequently Asked Questions (FAQ):

What are the major drivers driving the growth of the insulation coatings market?

The major driving factors for the insulation coatings market are the growing construction and infrastructure development, rising construction and infrastructure development which has led to increased demand for automotive and machinery industry, and increasing need for heat, electricity, and sound insulation in various industries is driving the industrial growth, promote domestic manufacturing, and invest in infrastructure development.

What are the major challenges in the insulation coatings market?

The major challenging factor faced by the insulation coatings market are stringent government regulations and competition with traditional insulation materials.

What are the restraining factors in the insulation coatings market?

The major restraining factor faced by the insulation coatings market is volatility in raw material prices and relatively high price of insulation coatings.

What is the key opportunity in the insulation coatings market?

Increasing adoption of advanced automotive electronics is the key opportunity in the insulation coatings market.

What are the end-use industries where insulation coatings components are used?

The insulation coatings components are majorly used in aerospace, automotive, marine, industrial, building & construction, and other industries.

What are the different types of insulation coatings?

The different types of insulation coatings are acrylic, polyurethane, epoxy, mullite, and YSZ.

What are the emerging applications for insulation coatings?

With the development of new applications, the demand for insulation coatings is expected to witness substantial growth during the forecast period. For instance, electric vehicles require insulation coating in battery systems and other components. The rising EV production and government initiatives to promote EV sales are expected to generate newer opportunities for the market players in the insulation coatings market in the coming years. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing need for heat, electricity, and sound insulation in various industries- Growing construction and infrastructure development- Prevention of corrosion under insulation (CUI)RESTRAINTS- Volatility in raw material and insulation coating prices- High R&D and equipment costOPPORTUNITIES- Increasing adoption of advanced automotive electronics- Newer application areas for Insulation coatingsCHALLENGES- Stringent government regulations- Competition with traditional Insulation materials

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSBARGAINING POWER OF SUPPLIERSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.4 VALUE CHAIN ANALYSIS

-

5.5 TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSESREVENUE SHIFT FOR INSULATION COATING PLAYERS

-

5.6 TARIFF AND REGULATORY LANDSCAPETHE NATIONAL GREEN BUILDING STANDARD (NGBS)

-

5.7 REGULATORY BODIES AND GOVERNMENT AGENCIESTHE AMERICAN SOCIETY OF HEATING, REFRIGERATING, AND AIR CONDITIONING ENGINEERS (ASHRAE) STANDARD 189.1THE AMERICAN COATINGS ASSOCIATION (ACA)

-

5.8 SUPPLY CHAIN ANALYSISRAW MATERIAL SUPPLIERSINSULATION COATING MANUFACTURERSDISTRIBUTORS AND SUPPLIERSEND USERS

-

5.9 ECOSYSTEM MAPPING

-

5.10 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.11 KEY CONFERENCES & EVENTS IN 2023–2024

- 5.12 TRADE ANALYSIS

-

5.13 PATENT ANALYSISDOCUMENT ANALYSISJURISDICTION ANALYSISTOP COMPANIES/APPLICANTS

-

5.14 CASE STUDYEVALUATING EFFICACY OF INSULATION COATINGS- Introduction- Background- Challenge- Insulation coatings solutions- Enhancement of indoor comfort and reduction of energy consumption in medium-sized commercial building- Benefits and results- Manufacturing processes- Future developments and trends- Conclusion

-

5.15 MACROECONOMIC INDICATORSGDP TRENDS & FORECAST

- 5.16 PRICING ANALYSIS

- 5.17 RECESSION IMPACT: REALISTIC, OPTIMISTIC, AND PESSIMISTIC SCENARIOS

-

6.1 INTRODUCTIONLOW MAINTENANCE REQUIREMENTS AND ABILITY TO EFFECTIVELY PREVENT CORROSION TO DRIVE MARKET

-

6.2 ACRYLICLOW MAINTENANCE AND ABILITY TO PREVENT CUI TO DRIVE MARKET

-

6.3 EPOXYINCREASING USE IN ELECTRICAL APPLICATIONS TO DRIVE MARKET

-

6.4 POLYURETHANEINCREASING USE IN INDUSTRIAL AND BUILDING & CONSTRUCTION SECTORS TO DRIVE MARKET

-

6.5 YTTRIA STABILIZED ZIRCONIAINCREASING DEMAND FROM HIGH-END APPLICATIONS TO DRIVE MARKET

-

6.6 MULLITEINCREASING USE OF TURBINE AND DIESEL ENGINES TO DRIVE MARKET

- 6.7 OTHERS

- 7.1 INTRODUCTION

-

7.2 AEROSPACETHE CONSTANT PURSUIT OF SAFETY, EFFICIENCY, AND PERFORMANCE OPTIMIZATION TO DRIVE THE MARKET

-

7.3 AUTOMOTIVEADVANCED VEHICLE PERFORMANCE AND SUSTAINABILITY TO DRIVE MARKET

-

7.4 MARINEGROWING SHIPPING INDUSTRY TO DRIVE MARKET

-

7.5 BUILDING & CONSTRUCTIONGROWING CONSTRUCTION INDUSTRY TO DRIVE MARKET

-

7.6 INDUSTRIALGROWING DEMAND FROM INDUSTRIAL SECTORS TO DRIVE MARKET

- 7.7 OTHERS

- 8.1 INTRODUCTION

-

8.2 ASIA PACIFICRECESSION IMPACTCHINA- Increasing demand from construction, automotive, aerospace, and marine industries to drive marketINDIA- Growing construction and automotive sectors to drive demandJAPAN- Strong demand for affordable and sustainable housing to drive marketSOUTH KOREA- Increasing demand from aerospace industry to drive marketINDONESIA- Economic growth projections and trends to drive marketVIETNAM- Increasing government focus on policy enhancement to drive marketMALAYSIA- Strong rebound and projected expansion to drive marketREST OF ASIA PACIFIC

-

8.3 NORTH AMERICARECESSION IMPACTUS- Growing demand in construction industry to drive marketCANADA- Rising demand from aerospace industry to drive marketMEXICO- Increasing demand from automotive, aerospace, and building & construction sectors to drive market

-

8.4 EUROPERECESSION IMPACTGERMANY- Stringent building safety codes and fire safety regulations for commercial buildings to drive marketUK- Rising demand for eco-friendly solutions with low VOC formulations to drive marketFRANCE- Government efforts to expand aerospace industry to drive marketRUSSIA- Growing automotive industry to drive marketITALY- Rising demand from aerospace & defense industry to drive marketREST OF EUROPE

-

8.5 SOUTH AMERICARECESSION IMPACTBRAZIL- Heavy investments in end-use industries to drive marketARGENTINA- Well-established automotive industry to drive marketREST OF SOUTH AMERICA

-

8.6 MIDDLE EAST & AFRICARECESSION IMPACTSOUTH AFRICA- Foreign direct investment in industrial, building & construction, and automotive industries to drive marketSAUDI ARABIA- Boosting efficacy of oil and gas activities to drive marketREST OF MIDDLE EAST & AFRICA- Diversification in non-oil sectors to drive market

- 9.1 INTRODUCTION

- 9.2 MARKET SHARE ANALYSIS

- 9.3 KEY PLAYER STRATEGIES

- 9.4 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

-

9.5 COMPANY EVALUATION MATRIXSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

9.6 STARTUPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 9.7 COMPETITIVE BENCHMARKING

-

9.8 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALSOTHERS

-

10.1 KEY PLAYERSAKZONOBEL- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPPG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSHERWIN-WILLIAMS COMPANY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKANSAI PAINT CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewJOTUN GROUP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNIPPON PAINT HOLDINGS CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAXALTA COATING SYSTEMS- Business overview- Products/Solutions/Services offered- Recent developmentsHEMPEL- Business overview- Products/Solutions/Services offered- Recent developmentsSEAL FOR LIFE INDUSTRIES- Business overview- Products/Solutions/Services offered- Recent developmentsCARBOLINE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSHARPSHELL ENGINEERING- Business overview- Products/Solutions/Services offered

-

10.2 OTHER PLAYERSCABOT CORPORATIONTEMP-COATSK FORMULATIONS INDIA PVT. LTD.LINCOLN INDUSTRIESTHE BAYOU COMPANIESSPI COATINGSRUST-OLEUM CORPORATIONSHREE HANS ENTERPRISESGENERAL COATINGS MANUFACTURING CORP.STARSHIELD TECHNOLOGIES PVT. LTD.BERGER PAINTS INDIA LIMITEDMASCO CORPORATIONBECKERS GROUPTIGER COATINGS GMBH & CO. KGDIAMOND VOGEL PAINT COMPANY

- 11.1 INTRODUCTION

- 11.2 LIMITATIONS

- 11.3 PAINTS & COATINGS MARKET

- 11.4 PAINTS & COATINGS MARKET, BY REGION

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 RELATED REPORTS

- 12.4 AUTHOR DETAILS

- TABLE 1 INSULATION COATINGS MARKET: PORTER’S FIVE FORCE ANALYSIS

- TABLE 2 INSULATION COATINGS MARKET: SUPPLY CHAIN ANALYSIS

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY APPLICATIONS (%)

- TABLE 4 KEY BUYING CRITERIA FOR KEY END-USE INDUSTRY

- TABLE 5 INSULATION COATINGS MARKET: DETAILED CONFERENCES & EVENTS

- TABLE 6 INSULATION FIBERS AND INSULATION FIBER BUNDLES, IMPORT DATA, HS CODE: 9001, 2022 (USD MILLION)

- TABLE 7 INSULATION FIBERS AND INSULATION FIBER BUNDLES, EXPORT DATA, HS CODE: 9001, 2022 (USD MILLION)

- TABLE 8 PATENTS BY SAMSUNG DISPLAY CO. LTD.

- TABLE 9 PATENTS BY SAMSUNG ELECTRONICS CO., LTD.

- TABLE 10 PATENTS BY SUMITOMO WIRING SYSTEMS

- TABLE 11 US: PATENT OWNERS BETWEEN 2013 AND 2022

- TABLE 12 WORLD GDP GROWTH PROJECTION, 2021–2028 (USD TRILLION)

- TABLE 13 INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 14 INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 15 INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (KILOTON)

- TABLE 16 INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 17 ACRYLIC INSULATION COATINGS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 18 ACRYLIC INSULATION COATINGS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 19 ACRYLIC INSULATION COATINGS MARKET, BY REGION, 2019–2021 (KILOTON)

- TABLE 20 ACRYLIC INSULATION COATINGS MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 21 EPOXY INSULATION COATINGS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 22 EPOXY INSULATION COATINGS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 23 EPOXY INSULATION COATINGS MARKET, BY REGION, 2019–2021 (KILOTON)

- TABLE 24 EPOXY INSULATION COATINGS MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 25 POLYURETHANE INSULATION COATINGS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 26 POLYURETHANE INSULATION COATINGS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 27 POLYURETHANE INSULATION COATINGS MARKET, BY REGION, 2019–2021 (KILOTON)

- TABLE 28 POLYURETHANE INSULATION COATINGS MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 29 YSZ INSULATION COATINGS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 30 YSZ INSULATION COATINGS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 31 YSZ INSULATION COATINGS MARKET, BY REGION, 2019–2021 (KILOTON)

- TABLE 32 YSZ INSULATION COATINGS MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 33 MULLITE INSULATION COATINGS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 34 MULLITE INSULATION COATINGS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 35 MULLITE INSULATION COATINGS MARKET, BY REGION, 2019–2021 (KILOTON)

- TABLE 36 MULLITE INSULATION COATINGS MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 37 OTHER INSULATION COATINGS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 38 OTHER INSULATION COATINGS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 39 OTHER INSULATION COATINGS MARKET, BY REGION, 2019–2021 (KILOTON)

- TABLE 40 OTHER INSULATION COATINGS MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 41 INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 42 INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 43 INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 44 INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 45 INSULATION COATINGS MARKET IN AEROSPACE, BY REGION, 2019–2021 (USD MILLION)

- TABLE 46 INSULATION COATINGS MARKET IN AEROSPACE, BY REGION, 2022–2028 (USD MILLION)

- TABLE 47 INSULATION COATINGS MARKET IN AEROSPACE, BY REGION, 2019–2021 (KILOTON)

- TABLE 48 INSULATION COATINGS MARKET IN AEROSPACE, BY REGION, 2022–2028 (KILOTON)

- TABLE 49 INSULATION COATINGS MARKET IN AUTOMOTIVE, BY REGION, 2019–2021 (USD MILLION)

- TABLE 50 INSULATION COATINGS MARKET IN AUTOMOTIVE, BY REGION, 2022–2028 (USD MILLION)

- TABLE 51 INSULATION COATINGS MARKET IN AUTOMOTIVE, BY REGION, 2019–2021 (KILOTON)

- TABLE 52 INSULATION COATINGS MARKET IN AUTOMOTIVE, BY REGION, 2022–2028 (KILOTON)

- TABLE 53 INSULATION COATINGS MARKET IN MARINE, BY REGION, 2019–2021 (USD MILLION)

- TABLE 54 INSULATION COATINGS MARKET IN MARINE, BY REGION, 2022–2028 (USD MILLION)

- TABLE 55 INSULATION COATINGS MARKET IN MARINE, BY REGION, 2019–2021 (KILOTON)

- TABLE 56 INSULATION COATINGS MARKET IN MARINE, BY REGION, 2022–2028 (KILOTON)

- TABLE 57 INSULATION COATINGS MARKET IN BUILDING & CONSTRUCTION, BY REGION, 2019–2021 (USD MILLION)

- TABLE 58 INSULATION COATINGS MARKET IN BUILDING & CONSTRUCTION, BY REGION, 2022–2028 (USD MILLION)

- TABLE 59 INSULATION COATINGS MARKET IN BUILDING & CONSTRUCTION, BY REGION, 2019–2021 (KILOTON)

- TABLE 60 INSULATION COATINGS MARKET IN BUILDING & CONSTRUCTION, BY REGION, 2022–2028 (KILOTON)

- TABLE 61 INSULATION COATINGS MARKET IN INDUSTRIAL, BY REGION, 2019–2021 (USD MILLION)

- TABLE 62 INSULATION COATINGS MARKET IN INDUSTRIAL, BY REGION, 2022–2028 (USD MILLION)

- TABLE 63 INSULATION COATINGS MARKET IN INDUSTRIAL, BY REGION, 2019–2021 (KILOTON)

- TABLE 64 INSULATION COATINGS MARKET IN INDUSTRIAL, BY REGION, 2022–2028 (KILOTON)

- TABLE 65 APPLICATIONS OF INSULATION COATINGS IN INDUSTRIAL SEGMENT, BY TYPE

- TABLE 66 APPLICATIONS OF INSULATION COATINGS IN INDUSTRIAL SEGMENT, BY END-USE INDUSTRY

- TABLE 67 INSULATION COATINGS MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2019–2021 (USD MILLION)

- TABLE 68 INSULATION COATINGS MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2022–2028 (USD MILLION)

- TABLE 69 INSULATION COATINGS MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2019–2021 (KILOTON)

- TABLE 70 INSULATION COATINGS MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2022–2028 (KILOTON)

- TABLE 71 INSULATION COATINGS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 72 INSULATION COATINGS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 73 INSULATION COATINGS MARKET, BY REGION, 2019–2021 (KILOTON)

- TABLE 74 INSULATION COATINGS MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 75 ASIA PACIFIC: INSULATION COATINGS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 76 ASIA PACIFIC: INSULATION COATINGS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 77 ASIA PACIFIC: INSULATION COATINGS MARKET, BY COUNTRY, 2019–2021 (KILOTON)

- TABLE 78 ASIA PACIFIC: INSULATION COATINGS MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 79 ASIA PACIFIC: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 80 ASIA PACIFIC: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 81 ASIA PACIFIC: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (KILOTON)

- TABLE 82 ASIA PACIFIC: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 83 ASIA PACIFIC: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 84 ASIA PACIFIC: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 85 ASIA PACIFIC: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 86 ASIA PACIFIC: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 87 CHINA: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 88 CHINA: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 89 CHINA: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (KILOTON)

- TABLE 90 CHINA: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 91 CHINA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 92 CHINA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 93 CHINA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 94 CHINA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 95 INDIA: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 96 INDIA: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 97 INDIA: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (KILOTON)

- TABLE 98 INDIA: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 99 INDIA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 100 INDIA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 101 INDIA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 102 INDIA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 103 JAPAN: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 104 JAPAN: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 105 JAPAN: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (KILOTON)

- TABLE 106 JAPAN: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 107 JAPAN: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 108 JAPAN: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 109 JAPAN: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 110 JAPAN: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 111 SOUTH KOREA: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 112 SOUTH KOREA: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 113 SOUTH KOREA: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (KILOTON)

- TABLE 114 SOUTH KOREA: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 115 SOUTH KOREA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 116 SOUTH KOREA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 117 SOUTH KOREA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 118 SOUTH KOREA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 119 INDONESIA: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 120 INDONESIA: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 121 INDONESIA: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (KILOTON)

- TABLE 122 INDONESIA: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 123 INDONESIA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 124 INDONESIA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 125 INDONESIA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 126 INDONESIA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 127 VIETNAM: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 128 VIETNAM: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 129 VIETNAM: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (KILOTON)

- TABLE 130 VIETNAM: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 131 VIETNAM: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 132 VIETNAM: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 133 VIETNAM: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 134 VIETNAM: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 135 MALAYSIA: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 136 MALAYSIA: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 137 MALAYSIA: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (KILOTON)

- TABLE 138 MALAYSIA: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 139 MALAYSIA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 140 MALAYSIA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 141 MALAYSIA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 142 MALAYSIA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 143 REST OF ASIA PACIFIC: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 144 REST OF ASIA PACIFIC: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 145 REST OF ASIA PACIFIC: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (KILOTON)

- TABLE 146 REST OF ASIA PACIFIC: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 147 REST OF ASIA PACIFIC: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 148 REST OF ASIA PACIFIC: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 149 REST OF ASIA PACIFIC: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 150 REST OF ASIA PACIFIC: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 151 NORTH AMERICA: INSULATION COATINGS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 152 NORTH AMERICA: INSULATION COATINGS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 153 NORTH AMERICA: INSULATION COATINGS MARKET, BY COUNTRY, 2019–2021 (KILOTON)

- TABLE 154 NORTH AMERICA: INSULATION COATINGS MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 155 NORTH AMERICA: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 156 NORTH AMERICA: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 157 NORTH AMERICA: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (KILOTON)

- TABLE 158 NORTH AMERICA: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 159 NORTH AMERICA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 160 NORTH AMERICA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 161 NORTH AMERICA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 162 NORTH AMERICA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 163 US: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 164 US: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 165 US: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (KILOTON)

- TABLE 166 US: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 167 US: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 168 US: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 169 US: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 170 US: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 171 CANADA: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 172 CANADA: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 173 CANADA: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (KILOTON)

- TABLE 174 CANADA: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 175 CANADA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 176 CANADA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 177 CANADA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 178 CANADA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 179 MEXICO: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 180 MEXICO: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 181 MEXICO: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (KILOTON)

- TABLE 182 MEXICO: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 183 MEXICO: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 184 MEXICO: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 185 MEXICO: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 186 MEXICO: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 187 EUROPE: INSULATION COATINGS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 188 EUROPE: INSULATION COATINGS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 189 EUROPE: INSULATION COATINGS MARKET, BY COUNTRY, 2019–2021 (KILOTON)

- TABLE 190 EUROPE: INSULATION COATINGS MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 191 EUROPE: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 192 EUROPE: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 193 EUROPE: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (KILOTON)

- TABLE 194 EUROPE: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 195 EUROPE: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 196 EUROPE: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 197 EUROPE: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 198 EUROPE: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 199 GERMANY: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 200 GERMANY: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 201 GERMANY: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (KILOTON)

- TABLE 202 GERMANY: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 203 GERMANY: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 204 GERMANY: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 205 GERMANY: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 206 GERMANY: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 207 UK: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 208 UK: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 209 UK: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (KILOTON)

- TABLE 210 UK: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 211 UK: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 212 UK: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 213 UK: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 214 UK: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 215 FRANCE: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 216 FRANCE: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 217 FRANCE: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (KILOTON)

- TABLE 218 FRANCE: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 219 FRANCE: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 220 FRANCE: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 221 FRANCE: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 222 FRANCE: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 223 RUSSIA: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 224 RUSSIA: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 225 RUSSIA: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (KILOTON)

- TABLE 226 RUSSIA: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 227 RUSSIA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 228 RUSSIA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 229 RUSSIA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 230 RUSSIA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 231 ITALY: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 232 ITALY: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 233 ITALY: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (KILOTON)

- TABLE 234 ITALY: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 235 ITALY: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 236 ITALY: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 237 ITALY: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 238 ITALY: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 239 REST OF EUROPE: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 240 REST OF EUROPE: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 241 REST OF EUROPE: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (KILOTON)

- TABLE 242 REST OF EUROPE: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 243 REST OF EUROPE: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 244 REST OF EUROPE: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 245 REST OF EUROPE: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 246 REST OF EUROPE: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 247 SOUTH AMERICA: INSULATION COATINGS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 248 SOUTH AMERICA: INSULATION COATINGS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 249 SOUTH AMERICA: INSULATION COATINGS MARKET, BY COUNTRY, 2019–2021 (KILOTON)

- TABLE 250 SOUTH AMERICA: INSULATION COATINGS MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 251 SOUTH AMERICA: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 252 SOUTH AMERICA: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 253 SOUTH AMERICA: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (KILOTON)

- TABLE 254 SOUTH AMERICA: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 255 SOUTH AMERICA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 256 SOUTH AMERICA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 257 SOUTH AMERICA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 258 SOUTH AMERICA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 259 BRAZIL: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 260 BRAZIL: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 261 BRAZIL: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (KILOTON)

- TABLE 262 BRAZIL: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 263 BRAZIL: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 264 BRAZIL: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 265 BRAZIL: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 266 BRAZIL: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 267 ARGENTINA: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 268 ARGENTINA: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 269 ARGENTINA: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (KILOTON)

- TABLE 270 ARGENTINA: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 271 ARGENTINA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 272 ARGENTINA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 273 ARGENTINA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 274 ARGENTINA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 275 REST OF SOUTH AMERICA: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 276 REST OF SOUTH AMERICA: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 277 REST OF SOUTH AMERICA: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (KILOTON)

- TABLE 278 REST OF SOUTH AMERICA: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 279 REST OF SOUTH AMERICA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 280 REST OF SOUTH AMERICA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 281 REST OF SOUTH AMERICA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 282 REST OF SOUTH AMERICA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 283 MIDDLE EAST & AFRICA: INSULATION COATINGS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 284 MIDDLE EAST & AFRICA: INSULATION COATINGS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 285 MIDDLE EAST & AFRICA: INSULATION COATINGS MARKET, BY COUNTRY, 2019–2021 (KILOTON)

- TABLE 286 MIDDLE EAST & AFRICA: INSULATION COATINGS MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 287 MIDDLE EAST & AFRICA: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 288 MIDDLE EAST & AFRICA: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 289 MIDDLE EAST & AFRICA: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (KILOTON)

- TABLE 290 MIDDLE EAST & AFRICA: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 291 MIDDLE EAST & AFRICA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 292 MIDDLE EAST & AFRICA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 293 MIDDLE EAST & AFRICA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 294 MIDDLE EAST & AFRICA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 295 SOUTH AFRICA: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 296 SOUTH AFRICA: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 297 SOUTH AFRICA: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (KILOTON)

- TABLE 298 SOUTH AFRICA: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 299 SOUTH AFRICA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 300 SOUTH AFRICA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 301 SOUTH AFRICA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 302 SOUTH AFRICA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 303 SAUDI ARABIA: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 304 SAUDI ARABIA: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 305 SAUDI ARABIA: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (KILOTON)

- TABLE 306 SAUDI ARABIA: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 307 SAUDI ARABIA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 308 SAUDI ARABIA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 309 SAUDI ARABIA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 310 SAUDI ARABIA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 311 REST OF MIDDLE EAST & AFRICA: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 312 REST OF MIDDLE EAST & AFRICA: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 313 REST OF MIDDLE EAST & AFRICA: INSULATION COATINGS MARKET, BY TYPE, 2019–2021 (KILOTON)

- TABLE 314 REST OF MIDDLE EAST & AFRICA: INSULATION COATINGS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 315 REST OF MIDDLE EAST & AFRICA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD MILLION)

- TABLE 316 REST OF MIDDLE EAST & AFRICA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 317 REST OF MIDDLE EAST & AFRICA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (KILOTON)

- TABLE 318 REST OF MIDDLE EAST & AFRICA: INSULATION COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 319 PAINTS & COATINGS MARKET: DEGREE OF COMPETITION (2022)

- TABLE 320 STRATEGIC POSITIONING OF KEY PLAYERS

- TABLE 321 INSULATION COATINGS MARKET: DETAILED LIST OF KEY PLAYERS

- TABLE 322 INSULATION COATINGS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 323 INSULATION COATINGS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS BY REGION

- TABLE 324 INSULATION COATINGS MARKET: PRODUCT LAUNCHES, 2019–2023

- TABLE 325 DEALS, 2019–2023

- TABLE 326 OTHERS, 2019–2023

- TABLE 327 AKZONOBEL: COMPANY OVERVIEW

- TABLE 328 AKZONOBEL: PRODUCT LAUNCHES

- TABLE 329 AKZONOBEL: DEALS

- TABLE 330 AKZONOBEL: OTHERS

- TABLE 331 PPG: COMPANY OVERVIEW

- TABLE 332 PPG: DEALS

- TABLE 333 PPG: OTHERS

- TABLE 334 SHERWIN-WILLIAMS COMPANY: COMPANY OVERVIEW

- TABLE 335 SHERWIN-WILLIAMS COMPANY: PRODUCT LAUNCHES

- TABLE 336 SHERWIN-WILLIAMS COMPANY: DEALS

- TABLE 337 SHERWIN-WILLIAMS COMPANY: OTHERS

- TABLE 338 KANSAI PAINT CO., LTD.: BUSINESS OVERVIEW

- TABLE 339 KANSAI PAINT CO., LTD.: DEALS

- TABLE 340 JOTUN GROUP: COMPANY OVERVIEW

- TABLE 341 JOTUN GROUP: PRODUCT LAUNCHES

- TABLE 342 JOTUN GROUP: DEALS

- TABLE 343 JOTUN GROUP: OTHERS

- TABLE 344 NIPPON PAINT HOLDINGS CO., LTD.: COMPANY OVERVIEW

- TABLE 345 NIPPON PAINT HOLDINGS CO., LTD.: PRODUCT LAUNCH

- TABLE 346 NIPPON PAINT HOLDINGS CO., LTD.: DEALS

- TABLE 347 NIPPON PAINT HOLDINGS CO., LTD.: OTHERS

- TABLE 348 AXALTA COATING SYSTEMS: COMPANY OVERVIEW

- TABLE 349 AXALTA COATING SYSTEMS: PRODUCT LAUNCH

- TABLE 350 AXALTA COATING SYSTEMS: DEALS

- TABLE 351 AXALTA COATING SYSTEMS: OTHERS

- TABLE 352 HEMPEL: BUSINESS OVERVIEW

- TABLE 353 HEMPEL: PRODUCT LAUNCHES

- TABLE 354 HEMPEL: DEALS

- TABLE 355 HEMPEL: OTHERS

- TABLE 356 SEAL FOR LIFE INDUSTRIES: COMPANY OVERVIEW

- TABLE 357 SEAL FOR LIFE INDUSTRIES: DEALS

- TABLE 358 CARBOLINE: COMPANY OVERVIEW

- TABLE 359 CARBOLINE.: PRODUCT LAUNCHES

- TABLE 360 CARBOLINE: DEALS

- TABLE 361 SHARPSHELL ENGINEERING: BUSINESS OVERVIEW

- TABLE 362 CABOT CORPORATION: COMPANY OVERVIEW

- TABLE 363 TEMP-COAT: COMPANY OVERVIEW

- TABLE 364 SK FORMULATIONS INDIA PVT. LTD.: COMPANY OVERVIEW

- TABLE 365 LINCOLN INDUSTRIES: COMPANY OVERVIEW

- TABLE 366 THE BAYOU COMPANIES: COMPANY OVERVIEW

- TABLE 367 MLD TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 368 RUST-OLEUM CORPORATION: COMPANY OVERVIEW

- TABLE 369 SHREE HANS ENTERPRISES: COMPANY OVERVIEW

- TABLE 370 GENERAL COATINGS MANUFACTURING CORP.: COMPANY OVERVIEW

- TABLE 371 STARSHIELD TECHNOLOGIES PVT. LTD.: COMPANY OVERVIEW

- TABLE 372 BERGER PAINTS INDIA LIMITED: COMPANY OVERVIEW

- TABLE 373 MASCO CORPORATION: COMPANY OVERVIEW

- TABLE 374 BECKERS GROUP: COMPANY OVERVIEW

- TABLE 375 TIGER COATINGS GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 376 DIAMOND VOGEL PAINT COMPANY: COMPANY OVERVIEW

- TABLE 377 PAINTS & COATINGS MARKET SNAPSHOT, 2021 VS. 2026

- TABLE 378 PAINTS & COATINGS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 379 PAINTS & COATINGS MARKET, BY REGION, 2021–2026 (USD MILLION)

- TABLE 380 PAINTS & COATINGS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 381 PAINTS & COATINGS MARKET, BY REGION, 2021–2026 (KILOTON)

- FIGURE 1 INSULATION COATINGS MARKET SEGMENTATION

- FIGURE 2 INSULATION COATINGS MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION: BASED ON COMPANY REVENUES

- FIGURE 4 MARKET SIZE ESTIMATION: FROM GLOBAL PAINTS & COATINGS MARKET

- FIGURE 5 INSULATION COATINGS MARKET: DATA TRIANGULATION

- FIGURE 6 ACRYLIC ACCOUNTED FOR LARGEST SEGMENT OF OVERALL INSULATION COATINGS MARKET IN 2022

- FIGURE 7 AUTOMOTIVE TO BE FASTEST-GROWING END-USE INDUSTRY BETWEEN 2023 AND 2028

- FIGURE 8 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 9 INCREASING DEMAND FOR ENERGY-EFFICIENT MATERIALS TO DRIVE MARKET DURING FORECAST PERIOD

- FIGURE 10 ACRYLIC SEGMENT ACCOUNTED FOR LARGEST SHARE IN ASIA PACIFIC

- FIGURE 11 AUTOMOTIVE TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 12 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN INSULATION COATINGS MARKET

- FIGURE 14 INSULATION COATINGS MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 15 PRODUCTION PROCESS OF OVERALL PRICE OF INSULATION COATINGS

- FIGURE 16 REVENUE SHIFT FOR INSULATION COATING MANUFACTURERS

- FIGURE 17 SUPPLY CHAIN OF INSULATION COATINGS INDUSTRY

- FIGURE 18 INSULATION COATINGS MARKET: ECOSYSTEM MAPPING

- FIGURE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY END-USE INDUSTRY

- FIGURE 20 KEY BUYING CRITERIA FOR KEY END-USE INDUSTRY

- FIGURE 21 GRANTED PATENTS ACCOUNTED FOR 8% OF ALL PATENTS BETWEEN 2013 AND 2022

- FIGURE 22 NUMBER OF PATENTS BETWEEN 2013 AND 2022

- FIGURE 23 NUMBER OF PATENTS, BY JURISDICTION

- FIGURE 24 TOP TEN COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- FIGURE 25 ACRYLIC TO LEAD INSULATION COATINGS MARKET DURING FORECAST PERIOD

- FIGURE 26 INDUSTRIAL SEGMENT TO LEAD INSULATION COATINGS MARKET DURING FORECAST PERIOD

- FIGURE 27 REGIONAL SNAPSHOT: INDIA TO BE FASTEST-GROWING INSULATION COATINGS MARKET

- FIGURE 28 ASIA PACIFIC: INSULATION COATINGS MARKET SNAPSHOT

- FIGURE 29 NORTH AMERICA: INSULATION COATINGS MARKET SNAPSHOT

- FIGURE 30 EUROPE: INSULATION COATINGS MARKET SNAPSHOT

- FIGURE 31 COMPANIES ADOPTED PARTNERSHIP & COLLABORATION AS KEY GROWTH STRATEGY BETWEEN 2019 AND 2023

- FIGURE 32 RANKING OF KEY PLAYERS IN INSULATION COATINGS MARKET, 2022

- FIGURE 33 MARKET SHARE OF INSULATION COATING MANUFACTURERS, 2022

- FIGURE 34 TOP FIVE PLAYERS DOMINATED MARKET IN LAST THREE YEARS

- FIGURE 35 INSULATION COATINGS MARKET: COMPANY EVALUATION MATRIX

- FIGURE 36 SMES MATRIX: INSULATION COATINGS MARKET

- FIGURE 37 AKZONOBEL: COMPANY SNAPSHOT

- FIGURE 38 PPG: COMPANY SNAPSHOT

- FIGURE 39 SHERWIN-WILLIAMS COMPANY: COMPANY SNAPSHOT

- FIGURE 40 KANSAI PAINT CO., LTD.: COMPANY SNAPSHOT

- FIGURE 41 JOTUN GROUP: COMPANY SNAPSHOT

- FIGURE 42 NIPPON PAINT HOLDINGS CO., LTD.: COMPANY SNAPSHOT

- FIGURE 43 AXALTA COATING SYSTEMS: COMPANY SNAPSHOT

- FIGURE 44 HEMPEL: COMPANY SNAPSHOT

- FIGURE 45 ACRYLIC TO BE MOST WIDELY USED RESIN TYPE FOR ARCHITECTURAL PAINTS & COATINGS

- FIGURE 46 ACRYLIC TO BE FASTEST-GROWING RESIN TYPE FOR INDUSTRIAL PAINTS & COATINGS

- FIGURE 47 WATERBORNE TECHNOLOGY TO ACCOUNT FOR LARGEST SHARE OF ARCHITECTURAL PAINTS & COATINGS MARKET

- FIGURE 48 WATERBORNE TECHNOLOGY TO ACCOUNT FOR SECOND-LARGEST SHARE OF INDUSTRIAL PAINTS & COATINGS MARKET

- FIGURE 49 INDUSTRIAL SEGMENT TO ACCOUNT FOR LARGER SHARE

- FIGURE 50 ASIA PACIFIC TO BE FASTEST GROWING PAINTS & COATINGS MARKET

The study involved four major activities for estimating the current size of the global insulation coatings market. Exhaustive secondary research was carried out to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of insulation coatings through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the insulation coatings market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, edana.org, associations were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

Insulation coatings market comprises several stakeholders such as raw material suppliers, technology developers, insulation coatings companies, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of the end use applications. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

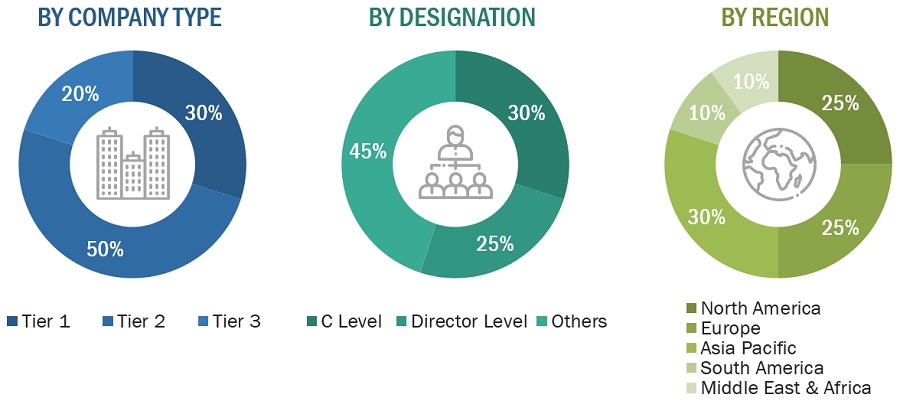

Following is the breakdown of primary respondents—

To know about the assumptions considered for the study, download the pdf brochure

Notes: Others include sales, marketing, and product managers.

Tier 1: >USD 5 Billion; Tier 2: USD 1 Billion– USD 5 Billion; and Tier 3: <USD 1 Billion.

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global insulation coatings market and to estimate the sizes of various other dependent submarkets. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players along with extensive interviews with key officials, such as directors and marketing executives.

The overall market size has been used in the top-down approach to estimate the sizes of other individual markets mentioned in the segmentation through percentage splits derived using secondary and primary sources.

For calculating each type of specific market segment, the size of the most appropriate immediate parent market has been considered for implementing the top-down approach. The bottom-up approach has also been implemented for data extracted from secondary research to validate the market sizes, in terms of value and volume, obtained for each segment.

The exact values of the overall parent and individual markets have been determined and confirmed through the data triangulation procedure and validation of data through primary interviews. The data triangulation procedure implemented for this study is explained in the next section.

Data Triangulation

Following the estimating process described above to determine the total market size, the market was divided into a number of segments and sub-segments. In order to complete the process of estimating the overall market size and determine the precise statistics for all segments and sub-segments, the data triangulation and market breakdown processes were used, where applicable. By examining multiple factors and trends from both the supply and demand sides, the data was triangulated. In addition, both top-down and bottom-up methods were used to validate the market size. After that, it was verified through primary interviews. As a result, there are three sources for each data segment: a top-down approach, a bottom-up approach, and expert interviews. The data was assumed to be correct when the values arrived at from the three sources matched.

Report Objectives

- To define, describe, and forecast the global breathable films market on the basis of type, end-use industry, and region

- To forecast the market size, in terms of value and volume, of the regions, namely, North America, Europe, Asia Pacific, and Rest of the World.

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micro markets with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and details of a competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their key developments such as new product launches, capacity expansions, mergers & acquisitions, and partnerships in the insulation coatings market

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Country Information:

- Insulation Coatings market analysis for additional countries

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Pricing Analysis:

- Detailed pricing analysis for each type of insulation coatings products

Growth opportunities and latent adjacency in Insulation Coatings Market

Information related to manufacturers technical data of insulation coating material products