Insulated Concrete Form Market by Type (Flat, Grid (Screen, and Waffle), and Post & Lintel Systems), Material (Expanded polystyrene Foam, Polyurethane Foam), End-Use Industry (Residential, and Non-residential), and Region - Global Forecast to 2023

The insulated concrete form market is projected to reach USD 1.49 billion by 2023, at a CAGR of 5.95%. The base year considered for the study is 2017 and the forecast period is from 2018 to 2023.

The report aims at estimating the market size and future growth potential of the insulated concrete forms market across different segments, such as type, material, end-use industry, and region. It provides detailed information regarding major factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the market. It also aims to study individual growth trends, prospects, and contribution of various segments to the total market. The study also analyzes opportunities in the market for stakeholders and details of the competitive landscape for market leaders. It strategically profiles key players and comprehensively analyzes their core competencies.

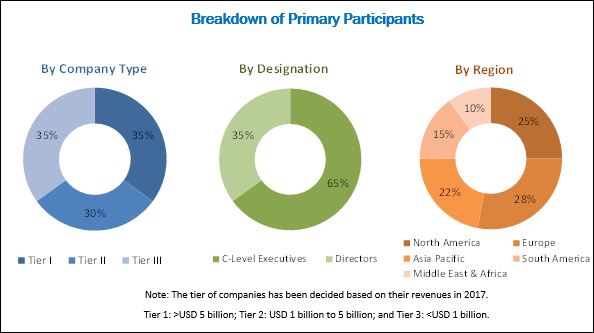

The research methodology used to estimate and forecast the size of the insulated concrete form market began with capturing data on key vendor revenues through secondary research. Secondary sources referred for this research study included associations, such as Insulated Concrete Form Association (ICFA), Insulated Concrete Forms Manufacturers Associations, American Concrete Institute, and Insulating Concrete Formwork (ICF) Association. Vendor offerings were taken into consideration to determine the market segmentation. A bottom-up procedure was employed to arrive at the overall size of the insulated concrete forms market by estimating the revenue of key players. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key personnel, such as CEOs, VPs, directors, and executives. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primaries is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Key Players in Insulated Concrete Form Market

The insulated concrete form value chain includes raw material manufacturers and suppliers, such as NUDURA Corporation (Canada), Quad-Lock Building Systems (Canada), AMVIC (Canada), Fox Blocks (US), and BASF (Germany). Products manufactured by these companies are used for residential and non-residential projects. The non-residential sector comprises commercial, industrial, healthcare, hospitality, educational & institutional, agricultural, utility, and sports-related constructions. The application of insulated concrete form in this sector covers the construction of new buildings and commercial structures, renovations, and remodeling. The insulated concrete form market is led by players that include NUDURA Corporation (Canada), Quad-Lock Building Systems (Canada), AMVIC (Canada), Fox Blocks (US), BASF (Germany), LOGIX Insulated Concrete Forms (UK), ConForm Global (US), KORE (Ireland), Polycrete International (Canada), LiteForm (US), Sunbloc (UK), Rastra (US), SuperForm Products (Denmark), Durisol (Australia), and Beco Products (UK).

Target Audience in Insulated Concrete Form Market

- Insulated Concrete Form Manufacturers

- Insulated Concrete Form Traders/Distributors/Suppliers

- Government Contractors

- Architects & Engineers

- Market Research and Consulting Firms

- Regulatory Bodies

- Research Organizations

- Association and Industry Bodies

- End-use Industries

Insulated Concrete Form Market Report Scope

The research report segments the insulated concrete form market into the following submarkets:

By Type:

- Flat Wall Systems

-

Grid Wall Systems

- Screen Grid Systems

- Waffle Grid Systems

- Post & Lintel Systems

By Material:

- Expanded Polystyrene Foam

- Polyurethane Foam

- Others (Cement-bonded Wood Fiber and Cellular Concrete)

By End-Use Industry:

- Residential

- Non-residential

By Region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Insulated Concrete Form Market Drivers

Increasing demand for energy-efficient green buildings

Insulated concrete form is one of the components used to create building structures that are safe, energy-efficient, and sustainable. Insulated concrete form structures are energy-efficient, extremely durable, sound & fire resistant, and environment-friendly. Sustainable materials such as Expanded Polystyrene Foam (EPS) and polyurethane are used in the construction of insulated concrete form buildings that enhance energy efficiency and improve insulation of the construction space, which makes them excellent raw materials for these buildings. Insulated concrete form types, such as flat wall systems, grid systems, and post & lintel systems have the ability to absorb radiation and are easy to recycle, which makes the construction energy-efficient. There is a rise in demand for green buildings, especially in the European and North American markets. Various building regulations in these regions make players operating in the construction industry use sustainable and energy-efficient materials in both, non-residential and residential buildings. The European Commission (EC) initiated the Green Building Program in 2005, which aimed to improve the energy efficiency of residential as well as non-residential buildings in Europe. The program aims to make owners of both residential and non-residential buildings aware of the cost-effective measures to increase their energy savings.

Rise in construction activities

According to the International Monetary Fund, the construction industry has been growing at a rate of 10% for a few years now in Middle Eastern countries such as Saudi Arabia, the UAE, and Qatar. According to the Financial Express, the North American region is projected to witness the highest number of new constructions between 2017 and 2022. According to the Organisation for Economic Co-operation and Development (OECD), construction spending is expected to be 5.6% in the US, 6.0% in Canada, and 4.8% in Mexico. In the Asia Pacific region, the Make in India project, introduced by the Government of India in 2015, promotes new construction projects in the country. In 2009, the sub-prime crisis in the US caused a recession in the construction industry. However, the industry has recovered and is growing at a moderate pace. The global construction industry is expected to contribute one-tenth to the global GDP and is expected to reach about USD 8 trillion by 2030, as per Oxford Economics.

Insulated Concrete Form Market Restraints

High costs

The insulated concrete form industry has undergone many changes in terms of technological advancements and its applications. Materials that are used in the manufacturing of insulated concrete form are expensive compared to traditional alternatives. In addition, labor costs also add to the total cost of insulated concrete form. The high cost of raw material and the lack of skilled workforce result in an expensive process. This acts as an entry barrier for new players, which, in turn, restrains the commercialization of insulated concrete form. These factors are anticipated to restrict the growth of the insulated concrete form market during the forecast period.

Insulated Concrete Form Market Report Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further analysis of the insulated concrete forms market for additional countries

Company Information

- Detailed analysis and profiling of additional market players

The insulated concrete form market is estimated to be USD 1.11 billion in 2018 and is projected to reach USD 1.49 billion by 2023, at a CAGR of 5.95% from 2018 to 2023. The growth of the insulated concrete forms market can be attributed to rapid urbanization, increase in demand for energy-efficient green buildings, favorable government regulations, and rise in the number of construction activities worldwide. Based on material, the expanded polystyrene foam segment is projected to lead the insulated concrete form market from 2018 to 2023. The polyurethane foam segment of the insulated concrete forms market is projected to grow at the second-highest CAGR during the forecast period.

The insulated concrete form market has been segmented on the basis of type, material, end-use industry, and region. The residential segment is projected to be the fastest-growing end-use industry segment of the insulated concrete forms market during the forecast period. The gradual shift of building contractors and consumers toward cost-efficient, eco-friendly, and energy-efficient building techniques in emerging countries have created growth opportunities for the insulated concrete form market.

In terms of value, the expanded polystyrene foam material segment is projected to grow at the highest CAGR during the forecast period. This growth can be attributed to varied consumer preferences such as structural safety, comfort, energy efficiency, durability, and low maintenance costs. Properties of expanded polystyrene foam include lightweight, moisture resistance, durability, acoustic absorption, and low thermal conductivity. This material is increasingly used in insulated concrete form due to its closed cell structure that causes minimal water absorption and low vapor permanence. Expanded polystyrene foam is used as a construction material to provide insulation for walls, foundation, and roofs.

The construction industry witnessed a significant change with the introduction of insulated concrete form, as it provides flexibility to designers to modify and enhance the physical strength of the concrete Features associated with insulated concrete form, such as fire & sound resistance, high insulation values, and impact resistance, are driving the demand for insulated concrete form.

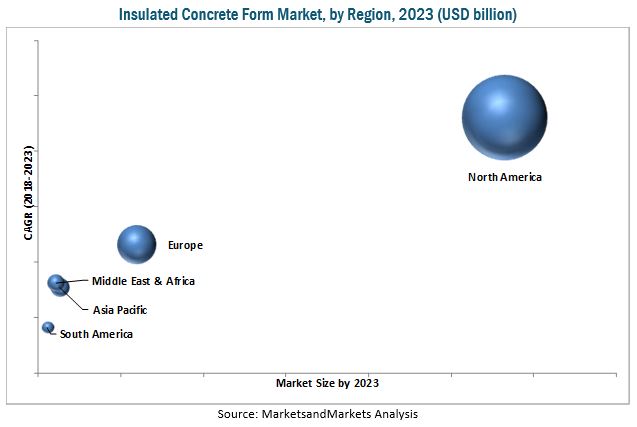

The North American region is the largest consumer of insulated concrete form products. The US, Canada, and Germany are among the major markets for insulated concrete form. The insulated concrete form market in North America is projected to grow at the highest CAGR during the forecast period. Increasing number of residential activities in the US, Canada, and Mexico is projected to drive the growth of the North America insulated concrete forms market. Additionally, government investments in the construction sector provide potential growth opportunities for the insulated concrete form market in this region.

Key Insulated Concrete Form Market Industry Players

Factors such weak economic conditions in several countries as the aftermath of the financial recession of 2008–2012 and high cost of raw materials are restricting the growth of the market. The insulated concrete forms market is led by players that include NUDURA Corporation (Canada), Quad-Lock Building Systems (Canada), AMVIC (Canada), Fox Blocks (US), BASF (Germany), LOGIX Insulated Concrete Forms (UK), ConForm Global (US), KORE (Ireland), Polycrete International (Canada), LiteForm (US), Sunbloc (UK), Rastra (US), SuperForm Products (Denmark), Durisol (Australia), and Beco Products (UK). Fox Blocks adopted the strategy of partnerships to cater to the rising demand for insulated concrete form worldwide.

Insulated Concrete Form Market Opportunities

Insulated Concrete Form Market Rapid Urbanization

The migration of rural population to urban areas and the conversion of towns into cities are increasing the demand for new construction projects, which, in turn, is stimulating the demand for insulated concrete form. According to the Asia Pacific Human Development Report published by the United Nations Development Programme, the total population in the Asia Pacific region is projected to reach 4.84 billion by 2050, of which 64% is projected to be urban population. A positive shift in the living standards is expected to generate the demand for comfortable, energy-efficient, and durable buildings. The growth in disposable income enables consumers to opt for new, latest, and environment-friendly construction materials.

Insulated Concrete Form Market Challenges

Lack of awareness regarding the latest technologies in emerging economies

The insulated concrete form market is growing at a significant pace, due to the high growth of the construction industry worldwide. However, there is a lack of awareness regarding the latest & upcoming construction technologies in some of the emerging countries of Asia Pacific, the Middle East & Africa, and South America. There is also a lack of awareness about the sustainability and energy efficiency of insulated concrete form in these regions. Hence, companies operating in the construction industry are undertaking initiatives to introduce these technologies and educate customers regarding the positive effects of insulated concrete form.

Economic downturn in major regions

The demand for the insulated concrete form is entirely dependent on the demand for construction activities, which is directly related to the global economic condition. After the recession in the global financial market, there was a decline in construction projects. Unemployment and low disposable income radically affected the GDP across countries. Countries such as Spain, Russia, Greece, Romania, and the UK are still affected by the economic slowdown that occurred between 2007 and 2009. Post the economic slowdown, the GDP of Russia declined to -3.7% in 2016, after registering a growth of 0.7% in 2015. With the decline in GDP, these countries witnessed a decrease in the number of infrastructural activities; demand for new construction was negligible. This affected the construction industry adversely, which in turn, is anticipated to affect the insulated concrete forms market.

Frequently Asked Questions (FAQ):

How big is the Insulated Concrete Form Market industry?

The insulated concrete form market is estimated to be USD 1.11 billion in 2018 and is projected to reach USD 1.49 billion by 2023, at a CAGR of 5.95% from 2018 to 2023.

Who leading market players in Insulated Concrete Form industry?

Key players operating in the insulated concrete form market include NUDURA Corporation (Canada), Quad-Lock Building Systems (Canada), AMVIC (Canada), Fox Blocks (US), BASF (Germany), LOGIX Insulated Concrete Forms (UK), ConForm Global (US), KORE (Ireland), Polycrete International (Canada), LiteForm (US), Sunbloc (UK), Rastra (US), SuperForm Products (Denmark), Durisol (Australia), and Beco Products (UK).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Regional Scope

1.3.2 Periodization Considered

1.4 Currency Considered

1.5 Units Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Analysis

2.2.2.1 Rising Population

2.2.2.2 Emerging Economies, GDP (Purchasing Power Parity)

2.2.3 Supply-Side Analysis

2.2.3.1 Regulations

2.2.3.2 Research & Development

2.3 Market Size Estimation

2.4 Data Triangulation

2.5 Market Share Estimation

2.6 Research Assumptions & Limitations

2.6.1 Assumptions

2.6.2 Limitations

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 34)

4.1 Emerging Economies to Witness High Demand for Insulated Concrete Form

4.3 Insulated Concrete Form Market, By Material

4.4 Insulated Concrete Forms Market, By End-Use Industry, 2018

4.5 Insulated Concrete Form Market, By Country

5 Market Overview (Page No. - 37)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 Increasing Demand for Energy-Efficient Green Buildings

5.1.1.2 Rise in Construction Activities

5.1.1.3 Favorable Government Regulations

5.1.2 Restraints

5.1.2.1 High Costs

5.1.3 Opportunities

5.1.3.1 Rapid Urbanization

5.1.4 Challenges

5.1.4.1 Lack of Awareness Regarding the Latest Technologies in Emerging Economies

5.1.4.2 Economic Downturn in Major Regions

6 Insulated Concrete Form Market, By Type (Page No. - 41)

6.1 Introduction

6.2 Flat Wall Systems

6.3 Grid Systems

6.3.1 Screen Grid Systems

6.3.2 Waffle Grid Systems

6.4 Post and Lintel Systems

7 Insulated Concrete Forms Market, By Material (Page No. - 43)

7.1 Introduction

7.2 Expanded Polystyrene Foam

7.3 Polyurethane Foam

7.4 Others

8 Insulated Concrete Form, By End-Use Industry (Page No. - 47)

8.1 Introduction

8.2 Residential

8.3 Non-Residential

9 Insulated Concrete Form Market, By Region (Page No. - 50)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 Germany

9.3.2 UK

9.3.3 France

9.3.4 Russia

9.3.5 Rest of Europe

9.4 Asia Pacific

9.4.1 Australia

9.4.2 China

9.4.3 Japan

9.4.4 India

9.4.5 Rest of Asia Pacific

9.5 Middle East & Africa

9.5.1 South Africa

9.5.2 Saudi Arabia

9.5.3 UAE

9.5.4 Turkey

9.5.5 Rest of Middle East & Africa

9.6 South America

9.6.1 Brazil

9.6.2 Argentina

9.6.3 Rest of South America

10 Competitive Landscape (Page No. - 94)

11 Company Profiles (Page No. - 95)

11.1 Nudura Corporation

11.1.1 Business Overview

11.1.2 Products Offered

11.1.3 SWOT Analysis

11.1.4 MnM View

11.2 Quad-Lock Building Systems

11.2.1 Business Overview

11.2.2 Products Offered

11.2.3 SWOT Analysis

11.2.4 MnM View

11.3 Amvic

11.3.1 Business Overview

11.3.2 Products Offered

11.3.3 SWOT Analysis

11.3.4 MnM View

11.4 Fox Blocks

11.4.1 Business Overview

11.4.2 Products Offered

11.4.3 Recent Developments

11.4.4 SWOT Analysis

11.4.5 MnM View

11.5 BASF

11.5.1 Business Overview

11.5.2 Products Offered

11.5.3 SWOT Analysis

11.5.4 MnM View

11.6 Logix Insulated Concrete Forms

11.6.1 Business Overview

11.6.2 Products Offered

11.6.3 MnM View

11.7 Conform Global

11.7.1 Business Overview

11.7.2 Products Offered

11.8 Kore

11.8.1 Business Overview

11.8.2 Products Offered

11.9 Polycrete International

11.9.1 Business Overview

11.9.2 Products Offered

11.10 Liteform

11.10.1 Business Overview

11.10.2 Products Offered

11.11 Additional Company Profiles

11.11.1 Sunbloc

11.11.2 Rastra

11.11.3 Superform Products

11.11.4 Durisol

11.11.5 Beco Products

12 Appendix (Page No. - 111)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

List of Tables (77 Tables)

Table 1 Urbanization Trend in Asia Pacific, 1990–2050

Table 2 Insulated Concrete Form Market Size, By Material, 2016–2023 (USD Million)

Table 3 Insulated Concrete Forms Market Size, By Material, 2016–2023 (Million Square Feet)

Table 4 Insulated Concrete Form Size, By End-Use Industry, 2016–2023 (USD Million)

Table 5 Insulated Concrete Form Size, By End-Use Industry, 2016–2023 (Million Square Feet)

Table 6 Insulated Concrete Form Market Size, By Region, 2016-2023 (USD Million)

Table 7 Insulated Concrete Forms Market Size, By Region, 2016-2023 (Million Square Feet)

Table 8 North America: Insulated Concrete Form Market Size, By Country, 2015-2022 (USD Million)

Table 9 North America: Market Size, By Country, 2016–2023 (Million Square Feet)

Table 10 North America: Market Size, By Material, 2016–2023 (USD Million)

Table 11 North America: Market Size, By Material, 2016–2023 (Million Square Feet)

Table 12 North America: Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 13 North America: Insulated Concrete Forms Market Size, By End-Use Industry, 2016–2023 (Million Square Feet)

Table 14 US: Insulated Concrete Form Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 15 US: Insulated Concrete Forms Market Size, By End-Use Industry, 2016–2023 (Million Square Feet)

Table 16 Canada: Insulated Concrete Form Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 17 Canada: Insulated Concrete Forms Market Size, By End-Use Industry, 2016–2023 (Million Square Feet)

Table 18 Mexico: Insulated Concrete Form Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 19 Mexico: Insulated Concrete Forms Market Size, By End-Use Industry, 2016–2023 (Million Square Feet)

Table 20 Europe: Insulated Concrete Form Market Size, By Country, 2016–2023 (USD Million)

Table 21 Europe: Market Size, By Country, 2016–2023 (Million Square Feet)

Table 22 Europe: Market Size, By Material, 2016–2023 (USD Million)

Table 23 Europe: Market Size, By Material, 2016–2023 (Million Square Feet)

Table 24 Europe: Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 25 Europe: Insulated Concrete Forms Market Size, By End-Use Industry, 2016–2023 (Million Square Feet)

Table 26 Germany: By Form Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 27 Germany: By Form Market Size, By End-Use Industry, 2016–2023 (Million Square Feet)

Table 28 UK: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 29 UK: By Market Size, By End-Use Industry, 2016–2023 (Million Square Feet)

Table 30 France: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 31 France: By Market Size, By End-Use Industry, 2016–2023 (Million Square Feet)

Table 32 Russia: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 33 Russia: By Market Size, By End-Use Industry, 2016–2023 (Million Square Feet)

Table 34 Rest of Europe: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 35 Rest of Europe: By Market Size, By End-Use Industry, 2016–2023 (Million Square Feet)

Table 36 Asia Pacific: By Market Size, By Country, 2016–2023 (USD Million)

Table 37 Asia Pacific: By Market Size, By Country, 2016–2023 (Million Square Feet)

Table 38 Asia Pacific: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 39 Asia Pacific: By Market Size, By End-Use Industry, 2016–2023 (Million Square Feet)

Table 40 Australia: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 41 Australia: By Market Size, By End-Use Industry, 2016–2023 (Million Square Feet)

Table 42 China: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 43 China: By Market Size, By End-Use Industry, 2016–2023 (Million Square Feet)

Table 44 Japan: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 45 Japan: By Market Size, By End-Use Industry, 2016–2023 (Million Square Feet)

Table 46 India: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 47 India: By Market Size, By End-Use Industry, 2016–2023 (Million Square Feet)

Table 48 Rest of Asia Pacific: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 49 Rest of Asia Pacific: By Market Size, By End-Use Industry, 2016–2023 (Million Square Feet)

Table 50 Middle East & Africa: By Market Size, By Country, 2016–2023 (USD Million)

Table 51 Middle East & Africa: By Market Size, By Country, 2016–2023 (Million Square Feet)

Table 52 Middle East & Africa: By Market Size, By Material, 2016–2023 (USD Million)

Table 53 Middle East & Africa: By Market Size, By Material, 2016–2023 (Million Square Feet)

Table 54 Middle East & Africa: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 55 Middle East & Africa: By Market Size, By End-Use Industry, 2016–2023 (Million Square Feet)

Table 56 South Africa: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 57 South Africa: By Market Size, By End-Use Industry, 2016–2023 (Million Square Feet)

Table 58 Saudi Arabia: By Form Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 59 Saudi Arabia: By Market Size, By End-Use Industry, 2016–2023 (Million Square Feet)

Table 60 UAE: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 61 UAE: By Market Size, By End-Use Industry, 2016–2023 (Million Square Feet)

Table 62 Turkey: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 63 Turkey: By Market Size, By End-Use Industry, 2016–2023 (Million Square Feet)

Table 64 Rest of Middle East & Africa: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 65 Rest of Middle East & Africa: By Market Size, By End-Use Industry, 2016–2023 (Million Square Feet)

Table 66 South America: By Market Size, By Country, 2016–2023 (USD Million)

Table 67 South America: By Market Size, By Country, 2016–2023 (Million Square Feet)

Table 68 South America: By Market Size, By Material, 2016–2023 (USD Million)

Table 69 South America: By Market Size, By Material, 2016–2023 (Million Square Feet)

Table 70 South America: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 71 South America: By Market Size, By End-Use Industry, 2016–2023 (Million Square Feet)

Table 72 Brazil: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 73 Brazil: By Market Size, By End-Use Industry, 2016–2023 (Million Square Feet)

Table 74 Argentina: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 75 Argentina: By Market Size, By End-Use Industry, 2016–2023 (Million Square Feet)

Table 76 Rest of South America: By Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 77 Rest of South America: By Market Size, By End-Use Industry, 2016–2023 (Million Square Feet)

List of Figures (30 Figures)

Figure 1 Market Segmentation

Figure 2 Insulated Concrete Form Market, By Region

Figure 3 Insulated Concrete Forms Market: Research Design

Figure 4 Breakdown of Primaries

Figure 5 Global Population, 1950-2050

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Data Triangulation

Figure 9 The Expanded Polystyrene Foam Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 10 The Residential Segment is Projected to Lead the Insulated Concrete Forms Market During the Forecast Period

Figure 11 North America Was the Largest Market for Insulated Concrete Form in 2017

Figure 12 Rise in Construction Activities in Emerging Economies Offer Attractive Growth Opportunities to the Insulated Concrete Form Market

Figure 13 The Expanded Polystyrene Form Segment Expected to Grow at the Highest Rate During the Forecast Period

Figure 14 The Residential Segment is Estimated to Lead the Insulated Concrete Forms Market in 2018

Figure 15 Insulated Concrete Form Market in the US is Projected to Grow at the Highest Rate From 2018 to 2023

Figure 16 Increasing Demand for Green Buildings and Rise in Construction Activities are Key Drivers of the Insulated Concrete Form Market

Figure 17 Expanded Polystyrene Foam to Lead Insulated Concrete Form Market in Terms of Value During the Forecast Period (USD Million)

Figure 18 Insulated Concrete Forms Market Size, By End-Use Industry, 2018 & 2023 (USD Million)

Figure 19 Geographical Snapshot: Insulated Concrete Form Market Growth Rate, 2018–2023

Figure 20 North America: Market Snapshot

Figure 21 Nudura Corporation: Company Snapshot

Figure 22 Quad-Lock Building Systems: Company Snapshot

Figure 23 Amvic: Company Snapshot

Figure 24 Fox Blocks: Company Snapshot

Figure 25 BASF: Company Snapshot

Figure 26 Logix Insulated Concrete Forms: Company Snapshot

Figure 27 Conform Global: Company Snapshot

Figure 28 Kore: Company Snapshot

Figure 29 Polycrete International: Company Snapshot

Figure 30 Liteform: Company Snapshot

Growth opportunities and latent adjacency in Insulated Concrete Form Market