Inspection Management Software Market by Component (Solution and Services), Deployment Mode, Organization Size, Vertical (Aerospace and Defense, Healthcare and Life Sciences) and Region - Global Forecast to 2026

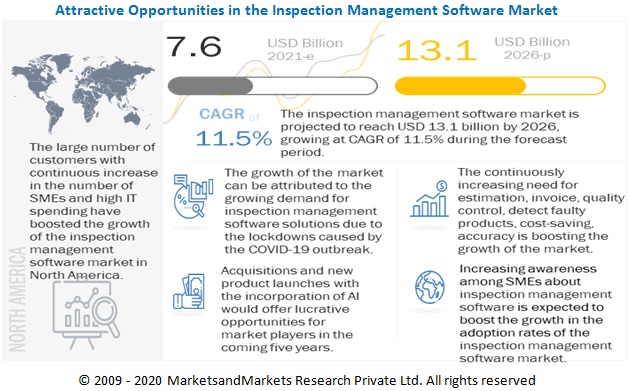

The global Inspection Management Software Market size is estimated to reach USD 13.1 billion by 2026 from USD 7.6 billion in 2021, at a Compound Annual Growth Rate (CAGR) of 11.5% during the forecast period. Inspection management software helps in scheduling, conducting, creating checklist, storing and tracking documents. It includes, audit management, asset management, risk management, third party inspection, compliance, quality management, training management.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Drivers: Availability of vast features including creating forms, checklists, scheduling, recording and tracking a task.

Inspection management software offers simple forms and checklists. The inspections follow up actions such as corrective actions and evaluate results with a rich reporting engine. Inspection management software helps create inspection checklists, assign inspection frequency and responsibility, track in-progress, missed and completed inspections, identify findings and corrective actions, and conduct inspections online or offline via mobile apps. This software schedule inspections, record results and track corrective actions to completion and helps reduce costs, increase efficiency and productivity, reduce risks, maintain compliances, and standardize reporting. This encourages companies to adopt inspection management software driving the growth of the market.

Restraints: High cost for installation and technical issue within inspection management software

A manufacturer, supplier, or mechanical subcontractor install the inspection software. The installer needs to follow the design documentation, quality assurance, code requirements, and manufacturer’s recommendations. This overall installation process is costly and sometimes companies face financial problems to install the software. The use of proper quality of materials, proper work sequences, particular type of equipment and inspections from time to time, and higher quality of design increases the cost but a higher quality of conformity with the design saves the investment.

Opportunities: Rapid growth of AR, IoT, and cloud technologies in operations

AR and IoT help inspectors and auditors to get their jobs done faster and more accurately. They can view task instructions, checklists, troubleshooting procedures, and get real-time video assistance from remote experts. Inspection apps can be built same day with no-code workflows or be integrated into the existing systems for an end-to-end digital record. Companies uses AR technology, which delivers on-premises, hybrid, and SaaS and creates a closed loop between the digital and physical worlds to transform everything into engineering, manufacturing, and servicing. Companies also include solutions for manufacturing execution, ERP, quality, supply chain planning and management, Industrial IoT, and analytics to connect people, systems, machines, and supply chains, enabling them to lead with precision, efficiency, and agility.

Challenges: Data integrity and security concerns

The data exchange and audit enhance the chances of data leakage during the inspection. Software implementation requires migration of data from an existing system to the new one. Ensuring data integrity throughout the process is critical, so understanding which data can be translated across systems and which cannot be a tough job. The danger with not keeping a close eye on data integrity during the migration is that user could lose important information related to customers. If information is lost or misconstrued during a transfer, the data could be compromised and unreliable. During the implementation phase, the project team must continue to verify the integrity of the data, potentially involving a third-party to moderate and ensure requirements are met.

Based on component, solution segment to be the larger contributor to the inspection management software market growth during the forecast period

An inspection is a planned examination or formal evaluation exercise. In engineering activities, inspection entails the application of measurements, tests, and gauges to specific characteristics of an object or activity. The most common method of achieving standardization, uniformity, and quality of workmanship is inspection. It is the cost-effective art of controlling product quality by comparing it to established standards and specifications. It aids in quality control, lowers manufacturing costs, eliminates scrap losses, and identifies the root causes of defective work. Inspection management software is a part of Quality Management Software (QMS). QMS provides features such as audit management, change control, complaint management, document control, supplier quality management, statistical process control, employee training management, corrective and preventive action, non-conformance management, QMS extensions, out of specification management, e-Signatures, analytics and reporting, design reviews, email notifications, traceability matrix, role-based security, and user dashboard. Whereas inspection management software efficiently deals with high-risk materials, tracking overall asset performance, and optimizing the supplier base. The goal is to optimize the business’s overall cost of quality. The tool provides all the documents that complete the inspection process. Inspection management service providers render a variety of services, which are categorized into consulting, implementation, and support and maintenance services. These services provide end-users with services for Inspection management software development and smooth installation, deployment, and maintenance of ongoing solutions. Certain service providers assist end-users in customized solution development for their organization.

Based on vertical, healthcare and telecom segment is to be a larger dominator to the inspection management software market during the forecast period.

Certainty Software is an excellent choice for a wide range of audit and inspection tasks in the telecommunications industry. Certainty is an ideal solution for collecting, managing, and reporting audit and inspection results and corrective actions to ensure compliance, reduce risk, and improve performance across the business, from contractor evaluations and energy isolation audits to fall protection and working at height safety inspections. In order to provide global solutions for customers, ACTIA has created a software solution for the end-to-end management of vehicle inspection centers. ACTIA has various vehicle inspection management modules such as, appointment module, inspection module, supervision module, check-out module, lounge module, delivery module. There is another vehicle inspection company on automotive industry named as Alliance Inspection Management. It provides consumer and dealer-based vehicle inspections, as well as full floorplan audit services. Their extensive offering of services are assembly plants, rail yards, ports, customer homes, dealerships, and auctions, inspect the condition of various new, off-lease, and fleet vehicles.

Based on organization size, the large enterprise segment to grow at a higher growth rate during the forecast period

SMEs can used inspection management software as it provides features like, inventory management, production management, accounting management, audit trial, document management.EQMS of large enterprises includes change control management, investigation, CAPA, market compliant, audit management, risk management and training management. This Provide real-time business data to all stakeholders, electronic records, and signatures. Maximum productivity and reduced costs are crucial factors for these enterprises, as they have limited budgets to keep track of crowdsourced ideas. Hence, these enterprises take advantage of the freely available public cloud storage or limited on-premises inspection management software. SMEs have a lower volume of enterprise data generated as compared to large enterprises. This saves the overall cost related to the installation of inspection management software. To increase the efficiency of business processes across global offices, many large enterprises are switching from traditional business processes to digitalization. To increase employee productivity and maintain a competitive edge in the market, SMEs are adopting inspection management software across the globe.

To know about the assumptions considered for the study, download the pdf brochure

North America is the overall leader in the adoption and implementation of the inspection management software and services, followed by Europe, which is witnessing a record growth in demonstrating and adopting inspection management software. Lockdowns imposed because of the COVID-19 outbreak have shut down economies and are affecting every aspect of North America's supply chain. This also caused various industries to shift their normal manufacturing processes to produce essential medical supplies, PPE kits, and more. Due to the pandemic, transportation issues increase and affected the global supply chain industry. The end-user in the supply chain seeks suppliers who will provide them with high-quality products at reasonable prices and on time. Due to pandemic, the sales of automotive vehicles have been dropped by 47% in the US so the companies have built online platform for customers where they can have 3600 view of vehicle, inspections, checking quality, and compare prices from others.

Key Market Players

The inspection management software market is dominated by companies such as SAP (Germany), Oracle (US), Siemens (Germany), Dassault Systemes (France), PTC (US), Hexagon (Sweden), Wolters Kluwer (Netherlands), Ideagen (UK), Autodesk (US), Veeva Systems (US), ETQ (US), Gensuite (US), Intelex (Canada), IQS (US), MasterControl (US), MetricStream (US), Penta Technologies (Canada), Pilgrim (US), Plex (US), ReachOutSuite (US), Cority (Canada), ComplianceQuest (US), Omnex Systems (US), Field Eagle (US), MoonVision (Austria), Thrive Technologies (US), Sparta Systems (US), Aras (US), AssurX (US), and Qualityze (US).

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2020-2026 |

|

Base year considered |

2021 |

|

Forecast period |

2021-2026 |

|

CAGR |

11.5% |

|

Segments covered |

Component, organization size, deployment mode, vertical and Region |

|

Regions covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

SAP (Germany), Oracle (US), Siemens (Germany), Dassault Systemes (France), PTC (US), Hexagon (Sweden), Wolters Kluwer (Netherlands), Ideagen (UK), Autodesk (US), Veeva Systems (US), ETQ (US), Gensuite (US), Intelex (Canada), IQS (US), MasterControl (US), MetricStream (US), Penta Technologies (Canada), Pilgrim (US), Plex (US), ReachOutSuite (US), Cority (Canada), ComplianceQuest (US), Omnex Systems (US), Field Eagle (US), MoonVision (Austria), Thrive Technologies (US), Sparta Systems (US), Aras (US), AssurX (US), and Qualityze (US). |

This research report categorizes the inspection management software market to forecast revenue and analyze trends in each of the following submarkets:

Based on the Component:

- Solution

- Services

Based on the Organization Size:

- Large Enterprises

- SMEs

Based on Deployment mode:

- cloud

- on-premise

Based on Vertical:

- Aerospace and Defense

- Manufacturing

- Automotive

- Energy and Utilities

- Transport and Logistics

- Consumer goods and Retail

- Telecom

- Healthcare and Lifesciences

- Others* (hospitality, government, chemical, metal and mining, and construction)

Based on Regions:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- Rest of APAC

-

MEA

- Kingdom of Saudi Arabia

- UAE

- Rest of MEA

-

Latin America

- Brazil

- Rest of Latin America

Recent Developments

- In September 2021, SAP partnered with Amazon Business to expand buyer’s choice. With this partnership and technology integration, Amazon Business becomes a source of supply for Spot Buy, a capability within SAP Ariba solutions for users to purchase items from trusted suppliers.

- In September 2020, Siemens launched 3WA series. 3WA circuit breakers meet low-voltage power distribution requirements in digital environments. They support software-based planning and engineering, digital testing, and monitoring.

- In January 2022, Autodesk acquired Moxion. The acquisition will expand Autodesk's cloud platform for media and entertainment upstream, expand production, and bring new customers who can assist better integration across production chain.

Frequently Asked Questions (FAQ):

What is the market size of Inspection Management Software Market?

What is the growth rate (CAGR) of Inspection Management Software Market?

What are the key opportunities in the Inspection Management Software Market?

Who are the key players in Inspection Management Software Market?

Who will be the leading hub for Inspection Management Software Market?

What is the Inspection Management Software Market Segmentation?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 21)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2020

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 6 INSPECTION MANAGEMENT SOFTWARE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

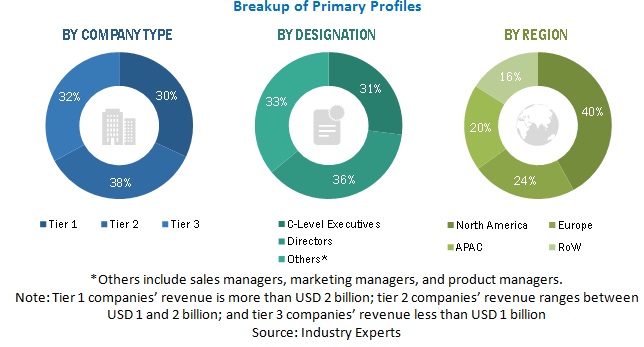

2.1.2.1 Breakup of primary profiles

FIGURE 7 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

TABLE 2 PRIMARY RESPONDENTS: MARKET

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 9 INSPECTION MANAGEMENT SOFTWARE MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY SIDE): REVENUE OF INSPECTION MANAGEMENT SOFTWARE FROM VENDORS

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF INSPECTION MANAGEMENT SOFTWARE VENDORS

FIGURE 12 MARKET SIZE ESTIMATION METHODOLOGY – (SUPPLY SIDE): ILLUSTRATION OF VENDOR REVENUE ESTIMATION

FIGURE 13 MARKET SIZE ESTIMATION METHODOLOGY – (SUPPLY SIDE): CAGR PROJECTIONS FROM THE SUPPLY SIDE

FIGURE 14 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM INSPECTION MANAGEMENT SOFTWARE AND SERVICES

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 15 INSPECTION MANAGEMENT SOFTWARE MARKET: GLOBAL SNAPSHOT

FIGURE 16 TOP GROWING SEGMENTS IN THE MARKET

FIGURE 17 INSPECTION MANAGEMENT SOFTWARE SOLUTION SEGMENT TO HOLD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 18 LARGE ENTERPRISES SEGMENT TO HOLD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 19 ON-PREMISES SEGMENT TO HOLD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 20 TOP VERTICALS IN THE MARKET (USD MILLION)

FIGURE 21 NORTH AMERICA TO HOLD THE LARGEST MARKET SHARE DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN THE MARKET

FIGURE 22 DRASTIC GEOGRAPHIC CHANGE AND TECHNOLOGICAL EVOLUTION TO DRIVE INSPECTION MANAGEMENT SOFTWARE GROWTH

4.2 INSPECTION MANAGEMENT SOFTWARE MARKET, BY COMPONENT (2021 VS. 2026)

FIGURE 23 SOLUTION SEGMENT TO HOLD A LARGER MARKET SHARE DURING THE FORECAST PERIOD

4.3 MARKET, BY ORGANIZATION SIZE (2021 VS. 2026)

FIGURE 24 LARGE ENTERPRISES TO HOLD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

4.4 MARKET, BY DEPLOYMENT MODE (2021 VS. 2026)

FIGURE 25 ON-PREMISES SEGMENT TO HOLD A LARGER MARKET SHARE DURING THE FORECAST PERIOD

4.5 MARKET, BY VERTICAL (2021 VS. 2026)

FIGURE 26 TELECOM VERTICAL TO GROW AT THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

4.6 MARKET INVESTMENT SCENARIO

FIGURE 27 ASIA PACIFIC TO EMERGE AS THE BEST MARKET FOR INVESTMENTS IN THE NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 56)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 28 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: INSPECTION MANAGEMENT SOFTWARE

5.2.1 DRIVERS

5.2.1.1 Availability of vast features including creating forms, checklists, scheduling, recording, and tracking a task

5.2.1.2 Creating estimation, invoices, quality control of raw materials

5.2.1.3 Need to detect faulty products in production

5.2.1.4 Need of accuracy, cost-saving, auditing of a product

5.2.1.5 Growing need for streamlining business process flows in inspections activities

5.2.2 RESTRAINTS

5.2.2.1 High cost of installation and technical issues within inspection management software

5.2.2.2 Safety and security issues within the production process

5.2.3 OPPORTUNITIES

5.2.3.1 Rapid growth of AR, IoT, and cloud technologies in operations

5.2.3.2 High demand for SMEs toward inspection management software

5.2.4 CHALLENGES

5.2.4.1 Data integrity and security concerns

5.2.4.2 Lack of adequate resources and inadequate software training tools

5.3 CASE STUDY ANALYSIS

5.3.1 USE CASE 1: HEALTHCARE

5.3.2 USE CASE 2: MANUFACTURING

5.3.3 USE CASE 3: AUTOMOTIVE

5.3.4 USE CASE 4: PLUMBING

5.3.5 USE CASE 5: TRANSPORT

5.4 PORTER’S FIVE FORCES ANALYSIS

FIGURE 29 INSPECTION MANAGEMENT SOFTWARE: PORTER’S FIVE FORCES ANALYSIS

TABLE 4 INSPECTION MANAGEMENT SOFTWARE: PORTER’S FIVE FORCES ANALYSIS

5.4.1 THREAT OF NEW ENTRANTS

5.4.2 THREAT OF SUBSTITUTES

5.4.3 BARGAINING POWER OF SUPPLIERS

5.4.4 BARGAINING POWER OF BUYERS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 ECOSYSTEM

FIGURE 30 INSPECTION MANAGEMENT SOFTWARE MARKET: ECOSYSTEM

5.6 COVID-19 DRIVEN MARKET DYNAMICS

5.6.1 DRIVERS AND OPPORTUNITIES

5.6.2 RESTRAINTS AND CHALLENGES

5.7 SUPPLY CHAIN ANALYSIS

FIGURE 31 MARKET: SUPPLY CHAIN ANALYSIS

TABLE 5 MARKET: SUPPLY CHAIN

5.8 PRICING ANALYSIS

TABLE 6 PRICING ANALYSIS: MARKET

5.9 PATENT ANALYSIS

FIGURE 32 NUMBER OF PATENTS DOCUMENTS PUBLISHED (2011–2021)

FIGURE 33 TOP FIVE PATENT OWNERS (GLOBAL)

TABLE 7 TOP TEN PATENT APPLICANTS

5.10 TECHNOLOGICAL ANALYSIS

5.10.1 CLOUD COMPUTING

5.10.2 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

5.10.3 BIG DATA

5.10.4 BLOCKCHAIN

5.10.5 INTERNET OF THINGS

5.11 REGULATIONS

5.11.1 NORTH AMERICA

5.11.2 EUROPE

5.11.3 ASIA PACIFIC

5.11.4 MIDDLE EAST AND SOUTH AFRICA

5.11.5 LATIN AMERICA

5.12 TRENDS/DISRUPTIONS IMPACTING BUYERS

FIGURE 34 MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

6 INSPECTION MANAGEMENT SOFTWARE MARKET, BY COMPONENT (Page No. - 75)

6.1 INTRODUCTION

FIGURE 35 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

6.1.1 COMPONENTS: MARKET DRIVERS

6.1.2 COMPONENTS: COVID-19 IMPACT

TABLE 8 MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 9 COMPONENTS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.2 SOLUTION

TABLE 10 SOLUTION: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3 SERVICES

TABLE 11 SERVICES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7 INSPECTION MANAGEMENT SOFTWARE MARKET, BY DEPLOYMENT MODE (Page No. - 80)

7.1 INTRODUCTION

FIGURE 36 CLOUD SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

7.1.1 DEPLOYMENT MODES: MARKET DRIVERS

7.1.2 DEPLOYMENT MODES: COVID-19 IMPACT

TABLE 12 MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

7.2 ON-PREMISES

TABLE 13 ON PREMISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7.3 CLOUD

TABLE 14 CLOUD: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8 INSPECTION MANAGEMENT SOFTWARE MARKET, BY ORGANIZATION SIZE (Page No. - 84)

8.1 INTRODUCTION

FIGURE 37 SMALL AND MEDIUM ENTERPRISES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

8.1.1 ORGANIZATION SIZE: MARKET DRIVERS

8.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

TABLE 15 MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

8.2 LARGE ENTERPRISES

TABLE 16 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 17 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9 INSPECTION MANAGEMENT SOFTWARE MARKET, BY VERTICAL (Page No. - 88)

9.1 INTRODUCTION

FIGURE 38 CONSUMER GOODS AND RETAIL SEGMENT TO HOLD THE LARGEST MARKET SHARE DURING THE FORECAST PERIOD

9.1.1 VERTICALS: MARKET DRIVERS

9.1.2 VERTICALS: COVID-19 IMPACT

TABLE 18 MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

9.2 AEROSPACE AND DEFENSE

TABLE 19 AEROSPACE AND DEFENSE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.3 AUTOMOTIVE

TABLE 20 AUTOMOTIVE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.4 CONSUMER GOODS AND RETAIL

TABLE 21 CONSUMER GOODS AND RETAIL: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.5 ENERGY AND UTILITIES

TABLE 22 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.6 HEALTHCARE AND LIFE SCIENCES

TABLE 23 HEALTHCARE AND LIFE SCIENCES: INSPECTION MANAGEMENT SOFTWARE MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.7 MANUFACTURING

TABLE 24 MANUFACTURING: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.8 TELECOM

TABLE 25 TELECOM: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.9 TRANSPORT AND LOGISTICS

TABLE 26 TRANSPORT AND LOGISTICS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.10 OTHER VERTICALS

TABLE 27 OTHER VERTICALS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10 INSPECTION MANAGEMENT SOFTWARE MARKET, BY REGION (Page No. - 97)

10.1 INTRODUCTION

FIGURE 39 NORTH AMERICA TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 28 MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET DRIVERS

10.2.2 NORTH AMERICA: COVID-19 IMPACT

FIGURE 40 NORTH AMERICA: MARKET SNAPSHOT

TABLE 29 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 30 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 31 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 32 NORTH AMERICA: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 33 NORTH AMERICA: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 34 NORTH AMERICA: INSPECTION MANAGEMENT SOFTWARE MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 35 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.2.3 UNITED STATES

TABLE 36 UNITED STATES: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 37 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 38 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.2.4 CANADA

TABLE 39 CANADA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 40 CANADA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 41 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: INSPECTION MANAGEMENT SOFTWARE MARKET DRIVERS

10.3.2 EUROPE: COVID-19 IMPACT

TABLE 42 EUROPE: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 43 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 44 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 45 EUROPE: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 46 EUROPE: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 47 EUROPE: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 48 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.3.3 UNITED KINGDOM

TABLE 49 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 50 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 51 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.3.4 GERMANY

TABLE 52 GERMANY: INSPECTION MANAGEMENT SOFTWARE MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 53 GERMANY: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 54 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.3.5 FRANCE

TABLE 55 FRANCE: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 56 FRANCE: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 57 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 58 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 59 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 60 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 41 ASIA PACIFIC: MARKET SNAPSHOT

10.4.1 ASIA PACIFIC: INSPECTION MANAGEMENT SOFTWARE MARKET DRIVERS

10.4.2 ASIA PACIFIC: COVID-19 IMPACT

TABLE 61 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 62 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 63 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 64 ASIA PACIFIC: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 65 ASIA PACIFIC: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 66 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 67 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.4.3 CHINA

TABLE 68 CHINA: INSPECTION MANAGEMENT SOFTWARE MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 69 CHINA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 70 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.4.4 JAPAN

TABLE 71 JAPAN: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 72 JAPAN: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 73 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.4.5 INDIA

TABLE 74 INDIA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 75 INDIA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 76 INDIA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.4.6 REST OF ASIA PACIFIC

TABLE 77 REST OF ASIA PACIFIC: INSPECTION MANAGEMENT SOFTWARE MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 78 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 79 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: MARKET DRIVERS

10.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

TABLE 80 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 81 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 82 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 83 MIDDLE EAST AND AFRICA: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 84 MIDDLE EAST AND AFRICA: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 85 MIDDLE EAST AND AFRICA: INSPECTION MANAGEMENT SOFTWARE MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 86 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.5.3 KINGDOM OF SAUDI ARABIA

TABLE 87 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 88 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 89 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.5.4 UNITED ARAB EMIRATES

TABLE 90 UNITED ARAB EMIRATES: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 91 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 92 UNITED ARAB EMIRATES: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.5.5 REST OF MIDDLE EAST AND AFRICA

TABLE 93 REST OF MIDDLE EAST AND AFRICA: INSPECTION MANAGEMENT SOFTWARE MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 94 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 95 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: MARKET DRIVERS

10.6.2 LATIN AMERICA: COVID-19 IMPACT

TABLE 96 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 97 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 98 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 99 LATIN AMERICA: LARGE ENTERPRISES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 100 LATIN AMERICA: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 101 LATIN AMERICA: INSPECTION MANAGEMENT SOFTWARE MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 102 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.6.3 BRAZIL

TABLE 103 BRAZIL: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 104 BRAZIL: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 105 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.6.4 REST LATIN AMERICA

TABLE 106 REST LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 107 REST LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 108 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 132)

11.1 INTRODUCTION

FIGURE 42 MARKET EVALUATION FRAMEWORK

11.2 MARKET RANKING

FIGURE 43 MARKET RANKING 2021

11.3 HISTORICAL REVENUE ANALYSIS OF TOP VENDORS

FIGURE 44 HISTORICAL REVENUE ANALYSIS

11.4 COMPANY EVALUATION QUADRANT

FIGURE 45 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

11.4.1 STAR

11.4.2 EMERGING LEADER

11.4.3 PERVASIVE

11.4.4 PARTICIPANT

TABLE 109 GLOBAL COMPANY FOOTPRINT

TABLE 110 COMPANY VERTICAL FOOTPRINT (1/2)

TABLE 111 COMPANY VERTICAL FOOTPRINT (2/2)

TABLE 112 COMPANY REGION FOOTPRINT

FIGURE 46 INSPECTION MANAGEMENT SOFTWARE MARKET: COMPANY EVALUATION QUADRANT

11.5 COMPETITIVE SCENARIO

11.5.1 MARKET NEW PRODUCT LAUNCHES

TABLE 113 MARKET: NEW PRODUCT LAUNCHES, 2019–2021

11.5.2 MARKET DEALS

TABLE 114 MARKET: DEALS, 2020–2022

11.5.3 INSPECTION MANAGEMENT SOFTWARE OTHER DEVELOPMENTS

TABLE 115 MARKET: OTHER DEVELOPMENTS, 2021–2022

12 COMPANY PROFILES (Page No. - 143)

12.1 KEY PLAYERS

(Business Overview, Products, Recent Developments, MnM View)*

12.1.1 SAP

TABLE 116 SAP: BUSINESS OVERVIEW

FIGURE 47 SAP: SNAPSHOT

TABLE 117 SAP: PRODUCTS OFFERED

TABLE 118 SAP: INSPECTION MANAGEMENT SOFTWARE: DEALS

12.1.2 ORACLE

TABLE 119 ORACLE: BUSINESS OVERVIEW

FIGURE 48 ORACLE: SNAPSHOT

TABLE 120 ORACLE: PRODUCTS OFFERED

TABLE 121 ORACLE: INSPECTION MANAGEMENT SOFTWARE: OTHER

12.1.3 SIEMENS

TABLE 122 SIEMENS: BUSINESS OVERVIEW

FIGURE 49 SIEMENS: SNAPSHOT

TABLE 123 SIEMENS: PRODUCTS OFFERED

TABLE 124 SIEMENS: INSPECTION MANAGEMENT SOFTWARE: PRODUCT LAUNCH

TABLE 125 SIEMENS: INSPECTION MANAGEMENT SOFTWARE: DEALS

12.1.4 DASSAULT SYSTEMES

TABLE 126 DASSAULT SYSTEMES: BUSINESS OVERVIEW

FIGURE 50 DASSAULT SYSTEMES: SNAPSHOT

TABLE 127 DASSAULT SYSTEMES: PRODUCTS OFFERED

TABLE 128 DASSAULT SYSTEMES: INSPECTION MANAGEMENT SOFTWARE: DEALS

12.1.5 PTC

TABLE 129 PTC: BUSINESS OVERVIEW

FIGURE 51 PTC: SNAPSHOT

TABLE 130 PTC: PRODUCTS OFFERED

TABLE 131 PTC: INSPECTION MANAGEMENT SOFTWARE: DEALS

12.1.6 HEXAGON

TABLE 132 HEXAGON: BUSINESS OVERVIEW

FIGURE 52 HEXAGON: SNAPSHOT

TABLE 133 HEXAGON: PRODUCTS OFFERED

TABLE 134 HEXAGON: INSPECTION MANAGEMENT SOFTWARE: PRODUCT LAUNCH

TABLE 135 HEXAGON: INSPECTION MANAGEMENT SOFTWARE: DEALS

12.1.7 WOLTERS KLUWER

TABLE 136 WOLTERS KLUWER: BUSINESS OVERVIEW

FIGURE 53 WOLTERS KLUWER: SNAPSHOT

TABLE 137 WOLTERS KLUWER: PRODUCTS OFFERED

TABLE 138 WOLTERS KLUWER: INSPECTION MANAGEMENT SOFTWARE: PRODUCT LAUNCH

TABLE 139 WOLTERS KLUWER: INSPECTION MANAGEMENT SOFTWARE: DEALS

12.1.8 IDEAGEN

TABLE 140 IDEAGEN: BUSINESS OVERVIEW

FIGURE 54 IDEAGEN: SNAPSHOT

TABLE 141 IDEAGEN: PRODUCTS OFFERED

TABLE 142 IDEAGEN: INSPECTION MANAGEMENT SOFTWARE: PRODUCT LAUNCH

12.1.9 AUTODESK

TABLE 143 AUTODESK: BUSINESS OVERVIEW

FIGURE 55 AUTODESK: SNAPSHOT

TABLE 144 AUTODESK: PRODUCTS OFFERED

TABLE 145 AUTODESK: INSPECTION MANAGEMENT SOFTWARE: DEALS

12.1.10 VEEVA SYSTEMS

TABLE 146 VEEVA SYSTEMS BUSINESS OVERVIEW

FIGURE 56 VEEVA SYSTEMS: SNAPSHOT

TABLE 147 VEEVA SYSTEMS: PRODUCTS OFFERED

TABLE 148 VEEVA SYSTEMS: INSPECTION MANAGEMENT SOFTWARE: PRODUCT LAUNCH

12.1.11 ETQ

12.1.12 GENSUITE

12.1.13 INTELEX

12.1.14 IQS

12.1.15 MASTERCONTROL

12.1.16 METRICSTREAM

12.1.17 PENTA TECHNOLOGIES

12.1.18 PILGRIM

12.1.19 PLEX

12.1.20 REACHOUTSUITE

12.1.21 CORITY

12.1.22 COMPLIANCEQUEST

12.1.23 OMNEX SYSTEMS

12.1.24 FIELD EAGLE

12.1.25 MOONVISION

12.1.26 THRIVE TECHNOLOGIES

12.1.27 SPARTA SYSTEMS

12.1.28 ARAS

12.1.29 ASSURX

12.1.30 QUALITYZE

*Details on Business Overview, Products, Recent Developments, MnM View might not be captured in case of unlisted companies.

13 ADJACENT/RELATED MARKET (Page No. - 193)

13.1 INTRODUCTION

13.1.1 RELATED MARKET

13.1.2 LIMITATIONS

13.2 EGRC MARKET

TABLE 149 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE, BY END USER, 2015–2020 (USD MILLION)

TABLE 150 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE, BY END USER, 2020–2026 (USD MILLION)

TABLE 151 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN BANKING, FINANCIAL SERVICES, AND INSURANCE, BY REGION, 2015–2020 (USD MILLION)

TABLE 152 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN BANKING, FINANCIAL SERVICES, AND INSURANCE, BY REGION, 2020–2026 (USD MILLION)

TABLE 153 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN TELECOMMUNICATION, BY REGION, 2015–2020 (USD MILLION)

TABLE 154 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN TELECOMMUNICATION, BY REGION, 2020–2026 (USD MILLION)

TABLE 155 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN ENERGY AND UTILITIES, BY REGION, 2015–2020 (USD MILLION)

TABLE 156 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN ENERGY AND UTILITIES, BY REGION, 2020–2026 (USD MILLION)

TABLE 157 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN GOVERNMENT, BY REGION, 2015–2020 (USD MILLION)

TABLE 158 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN GOVERNMENT, BY REGION, 2020–2026 (USD MILLION)

TABLE 159 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN HEALTHCARE, BY REGION, 2015–2020 (USD MILLION)

TABLE 160 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN HEALTHCARE, BY REGION, 2020–2026 (USD MILLION)

TABLE 161 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN MANUFACTURING, BY REGION, 2015–2020 (USD MILLION)

TABLE 162 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN MANUFACTURING, BY REGION, 2020–2026 (USD MILLION)

TABLE 163 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN MINING AND NATURAL RESOURCES, BY REGION, 2015–2020 (USD MILLION)

TABLE 164 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN MINING AND NATURAL RESOURCES, BY REGION, 2020–2026 (USD MILLION)

TABLE 165 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN RETAIL AND CONSUMER GOODS, BY REGION, 2015–2020 (USD MILLION)

TABLE 166 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN RETAIL AND CONSUMER GOODS, BY REGION, 2020–2026 (USD MILLION)

TABLE 167 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN IT, BY REGION, 2015–2020 (USD MILLION)

TABLE 168 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN IT, BY REGION, 2020–2026 (USD MILLION)

TABLE 169 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN TRANSPORT AND LOGISTICS, BY REGION, 2015–2020 (USD MILLION)

TABLE 170 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET SIZE IN TRANSPORT AND LOGISTICS, BY REGION, 2020–2026 (USD MILLION)

13.3 SUPPLY CHAIN MANAGEMENT MARKET

TABLE 171 SUPPLY CHAIN MANAGEMENT MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 172 SUPPLY CHAIN MANAGEMENT MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 173 NORTH AMERICA: SUPPLY CHAIN MANAGEMENT MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 174 NORTH AMERICA: SUPPLY CHAIN MANAGEMENT MARKET SIZE, BY COMPONENT, 2019–2026 (USD MILLION)

TABLE 175 NORTH AMERICA: SUPPLY CHAIN MANAGEMENT MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 176 NORTH AMERICA: SUPPLY CHAIN MANAGEMENT MARKET SIZE, BY VERTICAL, 2019–2026 (USD MILLION)

TABLE 177 NORTH AMERICA: SUPPLY CHAIN MANAGEMENT MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 178 NORTH AMERICA: SUPPLY CHAIN MANAGEMENT MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

14 APPENDIX (Page No. - 205)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

The study involved 4 major activities to estimate the current market size of inspection management software market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

The market size of companies offering inspection management software was derived on the basis of the secondary data available through paid and unpaid sources, and by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their solution capabilities and business strategies. In the secondary research process, various sources were referred to, for identifying and collecting information for the study. Secondary sources included annual reports, press releases, and investor presentations of companies and product data sheets; white papers; journals; certified publications; and articles from recognized authors, government websites, directories, and databases. Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market-and technology-oriented perspectives; all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from inspection management software vendors, industry associations, and independent consultants; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, latest trends disrupting the market, new use cases implemented, data of revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technology and region. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), the installation teams of end users using inspection management software, and digital initiatives project teams, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current use of inspection management software solution, which would affect the overall inspection management software market.

The following figure depicts the breakup of the primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the inspection management software market and various other dependent subsegments. The research methodology used to estimate the market size included the following:

- Key players in the market were identified through secondary research, and their revenue contributions in respective countries were determined through primary and secondary research.

- This entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives.

- All percentage splits and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both, the demand and supply sides, in the inspection management software market.

Report Objectives

- To describe and forecast the global inspection management software market based on component, game type, deployment mode, end user and region

- To forecast the market size of regional segments: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To strategically analyze the market’s subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To comprehensively analyze the core competencies of key players

- To track and analyze COVID-19 impact and competitive developments, such as mergers and acquisitions, new product developments, and partnerships and collaborations, in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs and on best effort basis for profiling of additional market players.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Inspection Management Software Market