Insight Engines Market by Offering (Solutions and Services), Application (Search and Discovery, Knowledge Management, and Risk and Compliance Management), Technology, Deployment Mode, Organization Size, Vertical and Region - Global Forecast to 2028

Insight Engines Market Overview

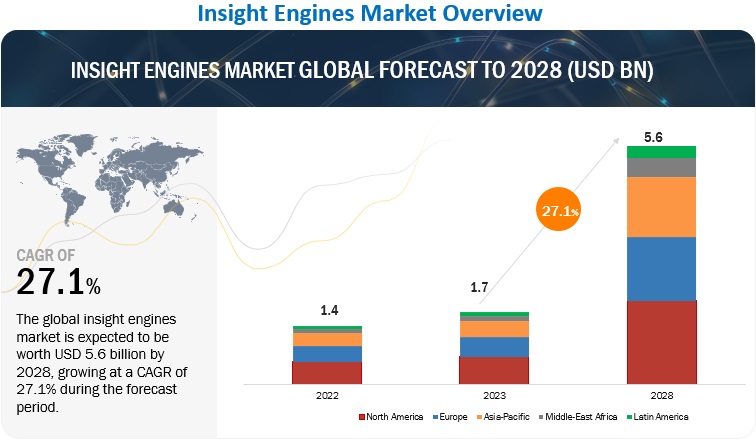

The global Insight Engines Market size is anticipated to grow at a CAGR of 27.1% during the forecast period, from USD 1.7 billion in 2023 to USD 5.6 billion by 2028. With the implementation of an insights engine, businesses tend to have a more efficient workflow, this is due to easy access to prior information and to better visualize the process to follow to achieve the desired results. It combines search and machine learning capabilities to deliver data for machines and information for users. It enbales businesses to provide timely data that delivers actionable insights.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Insight Engines Market Dynamics

Driver: Growing adoption of insight engines solutions in BFSI sector

Businesses in the BFSI sector are continually looking for methods to improve, speed up, and simplify banking for customers. The ability of advanced analytics to gain insights into operations and customers will be used by this sector. It will enable the BFSI sector to know historical performances which would further help them in making better business decisions. The BFSI sector uses insight engines to find and evaluate client sentiment by looking at social media and utilizing natural language processing to analyze talks regarding their facilities and service plans. Financial analysts will gather significant information to create accurate reports and improve their recommendations to clients and internal decision-makers. Insightful data utilization in banking has been proved to boost customer loyalty and profit margins, supporting the sector's growth as well. For instance, companies such as Morgan Stanley had deployed the Lucidworks Fusion platform, to implemented machine learning algorithms to optimize content development through personalized solutions with an intent to comprehend the requirements of its clients and drive actionable insights..

Restraint: Issues related with quality of data and its source validation

Poor data quality and inappropriate source validation could lead to a loss of revenue, clients, market share, and most significantly could result in severe penalties for data security violations. The scope of insight engines relies on better data quality and data source validation capabilities, and the need for highly secured access control, which needs to be set in line with the company's policies and regulations. The usage of unstructured and structured data as well as the participation of many stakeholders, including data stewards, custodians, and security teams, results in data silos, which can make it difficult to preserve the integrity of data sources and validate them. Data quality in different data silos is a matter of concern for all verticals. Redundancy of earlier technologies is another concern for enterprises due to the constantly evolving nature of data management systems, which accounts for the growth of data and IoT devices. Data frequently gets lost or distorted during the transition from legacy systems to new technologies because of the loss of linked data addresses. As a result, issues with data address quality and validation could seriously limit the growth of the insight engines market.

Opportunity: Growing adoption of cutting-edge technologies to offer predictive insights for businesses

The rising significance of predictive analytics can be gauged by the fact that most organizations today implement the latest technologies with predictive capabilities. Insight engine platforms are being used by businesses to collect, organize, and analyse consumer data in order to make predictions and business decisions that are more focused on the needs of the customer. Predictive analytics can be utilized in insight engines, which in turn can be used by marketing campaigns to determine consumer responses and purchases, as well as promote and cross-sell opportunities, by utilizing historical data, statistical algorithms, and real-time learning. Businesses have discovered that by integrating predictive analytics capabilities into their current processes, they may use the outcomes in conjunction with predictive models to estimate inventory and manage resources. Insight engine platforms, when used in conjunction with predictive models, can assist businesses in making crucial business decisions by analysing historical and current website data to forecast outcomes and improve customer and employee search experiences. This improves both customer experience and performance. Owing to such factors, the demand for predictive analytics among businesses is expected to be a huge future opportunity factor for the growth of the insight engines market.

Challenge: Shortage of trained and experienced workforce

The shortage of qualified workers with the necessary abilities is one of the main obstacles to the expansion of the insight engines market. Because of this, businesses occasionally cannot entirely depend on insight engine tools that produce errors. Therefore, if the outcomes of these tools are not adequately evaluated and confirmed, it could be harmful for the companies. In fact, problems with data governance and consistency can arise from such incorrectly checked data. To support the development of a culture of data-driven decision-making, business expertise is also necessary in addition to the relevant training. As a result, a large portion of business customers are anticipated to find the analytics capabilities gap to be one of their biggest obstacles. Additionally, because the concept of insight engines is still in its infancy, there is a shortage of experienced workers, which makes it difficult for suppliers to offer the best solutions..

By application search and discovery to register at the highest CAGR among applications during the forecast period

By application, the insight engines market is segmented into search and discovery, knowledge management, customer management, risk and compliance management, and other applications. Search and discovery segment to register at the highest CAGR among applications during the forecast period. Search & discovery is a capability that enables users to find, understand, and trust the information they need to make data-driven decisions. Data search & discovery is the foundational pillar of data culture. Many modern businesses are founded on their ability to use data to make smart and informed decisions in real time. But traditional enterprise search has proved ineffective in meeting the demands of the modern knowledge worker. People need the most accurate, relevant, and contextual information delivered to them, so enterprises have benefited from the rise of insight engines.

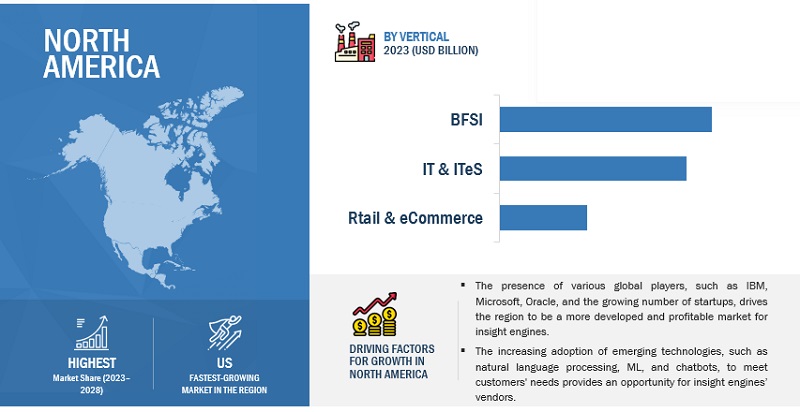

North America to account for the largest market size during the forecast period

North America is expected to have the largest market share in the insight engine market. The major countries covered in North America are the US and Canada. The North American region, the primary adopter of insight engine technology, is the major revenue-generating region in the global insight engines market. North America secures the major share of the global insight engines market owing to the highest adoption of emerging technologies, such as natural language processing, voice recognition techniques, and chatbots. There are various factors that are contributing to the growth of the insight engines market in this region. These factors include rapidly growing big data, IoT evolution, and lower cost of ownership of cloud-based platforms. These factors are also responsible for the adoption of insight engine solutions across the region. Moreover, various industry verticals, such as IT and ITeS, telecom, healthcare, media and entertainment, retail, and transportation, are adopting insight engine tools to resolve customers’ queries quickly.

Key Market Players

The insight engines market vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. Key players operating in the insight engines market include Microsoft (US), IBM (US), OpenText (Canada), SAP (Germany), Oracle (US), Elastic (US), Expert.ai (Italy), Almawave (Italy), Mindbreeze (Austria), Squirro (Switzerland), Sinequa (France), Coveo (Canada), Lucidworks (US), SearchBlox (US), Attivio (US), o9 Solutions (US), Celonis (US), Squiz (Australia), IntraFind (Germany), Fletch (US), Veritone (US), Progress (US), Upland Software (US), ForwardLane (US), Tecnotree (Finland), Comintelli (Sweden), Activeviam (US), Dun & Bradstreet (US), Prevedere (US), Stravito (Sweden), xFind (Israel), Turing Labs (US), Rampfy (Brazil), Raffle.ai (Denmark), Pecan AI (Israel), Omnisearch (Canada), and Fosfor (India)

Scope of the Report

|

Report Metrics |

Details |

|

Market size value in 2023 |

USD 1.7 billion |

|

Revenue forecast for 2028 |

USD 5.6 billion |

|

Growth Rate |

27.1% CAGR |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2023 |

|

Forecast period |

2023–2028 |

|

Forecast units |

USD Billion |

|

Segments covered |

Offering, Application, Technology, Deployment Mode, Organization Size, Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America |

|

Companies covered |

Microsoft (US), IBM (US), OpenText (Canada), SAP (Germany), Oracle (US), Elastic (US), Expert.ai (Italy), Almawave (Italy), Mindbreeze (Austria), Squirro (Switzerland), Sinequa (France), Coveo (Canada), Lucidworks (US), SearchBlox (US), Attivio (US), o9 Solutions (US), Celonis (US), Squiz (Australia), IntraFind (Germany), Fletch (US), Veritone (US), Progress (US), Upland Software (US), ForwardLane (US), Tecnotree (Finland), Comintelli (Sweden), Activeviam (US), Dun & Bradstreet (US), Prevedere (US), Stravito (Sweden), xFind (Israel), Turing Labs (US), Rampfy (Brazil), Raffle.ai (Denmark), Pecan AI (Israel), Omnisearch (Canada), and Fosfor (India) |

This research report categorizes the insight engines market based on offering, application, technology, deployment mode, organization size, vertical, and region.

By Component:

- Solutions

-

Services

- Consulting and training

- Deployment & integration

- Support & maintenance services

By Application:

- Search and Discovery

- Customer Management

- Knowledge Management

- Risk and Compliance Management

- Other Applications

By Technology:

-

Natural Language Processing

- Semantic Analysis

- Syntactic Analysis

-

Machine Learning

- Graph Database

- Collaborative Filtering

- Clustering

By Deployment Mode:

- Cloud

- On-premises

By Organization Size:

- Large enterprises

- SMEs

By Vertical:

- Banking, financial services, and insurance

- IT & ITeS

- Retail & eCommerce

- Healthcare & life sciences

- Telecom

- Manufacturing

- Government

- Other Verticals

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

-

Middle East & Africa

- UAE

- Saudi Arabia

- Israel

- South Africa

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Recent Developments:

- In November 2021, IBM announced the enhancement of IBM Watson discovery. With this new enhancement would help business users in industries to enhance customer care and accelerate business processes by uncovering insights and synthesizing information from complex documents.

- In October 2022, Elastic announced the new feature and enhancement of the elastic observability solution, which enables customers to obtain more thorough and hassle-free insight across all applications, services, and infrastructure layers.

- In May 2022, Elastic partnered with Microsoft, which would facilitate the use of Elastic Cloud on Azure to find, observe, and safeguard applications, data, and infrastructure more easily.

- In February 2022, Mindbreeze partnered with BLUE Consult GmbH in the field of intelligent knowledge management. With Mindbreeze InSpire solution, BLUE Consult GmbH wAS able to make the most crucial aspects of its customer’s information, facts, and knowledge available swiftly and easily.

Frequently Asked Questions (FAQ):

What is insight engine?

An insight engine, is also called cognitive search or enterprise knowledge discovery and management, is an enterprise platform that makes key enterprise insights accessible to the users when they need themneeded. It combines search with machine learning capabilities to provide information for users and data for machinesusers with information and machine data. The goal of an insight engine is to provide timely data that delivers actionable insights..

Which countries are considered in the European region?

The European insight engines market covers the UK, Germany, France, Italy, Spain, and the rest of Europe.

Which are key verticals adopting insight engines solutions and services?

Key verticals adopting insight engines solutions and services include IT and ITeS, retail and eCommerce, healthcare and life sciences, manufacturing, government, telecom, and other verticals (media & entertainment, education, transportation and logistics, and energy and utilities)..

Which are the key drivers supporting the market growth for insight engines?

The key drivers supporting the market growth include increasing use of structured data, growing adoption of insight engine solution in BFSI sector, demand for enhanced and more effective strategic risk management and growing demand for demand advanced search and natural access for in-depth analysis.

Who are the key vendors in the insight engines market?

Key players operating in the insight engines market include Microsoft (US), IBM (US), OpenText (Canada), SAP (Germany), Oracle (US), Elastic (US), Expert.ai (Italy), Almawave (Italy), Mindbreeze (Austria), Squirro (Switzerland), Sinequa (France), Coveo (Canada), Lucidworks (US), SearchBlox (US), Attivio (US), o9 Solutions (US), Celonis (US), Squiz (Australia), IntraFind (Germany), Fletch (US), Veritone (US), Progress (US), Upland Software (US), ForwardLane (US), Tecnotree (Finland), Comintelli (Sweden), Activeviam (US), Dun & Bradstreet (US), Prevedere (US), Stravito (Sweden), xFind (Israel), Turing Labs (US), Rampfy (Brazil), Raffle.ai (Denmark), Pecan AI (Israel), Omnisearch (Canada), and Fosfor (India).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing use of structured data- Growing adoption of insight engines solutions in BFSI sector- Demand for enhanced and more effective strategic risk management- Growing demand for advanced search and natural access to in- depth analysisRESTRAINTS- Data quality and source validation issuesOPPORTUNITIES- Growing data volumes and sophisticated algorithms raising adoption of AI technologies for data insights- Growing adoption of cutting-edge technologies to offer predictive insights for businesses- Rising adoption of data-driven decision-making to enhance customer experienceCHALLENGES- Data security and privacy concerns- Lack of trained and skilled personnel

- 5.3 BRIEF HISTORY OF INSIGHT ENGINES TECHNOLOGY

-

5.4 INSIGHT ENGINES MARKET: ECOSYSTEM

- 5.5 SUPPLY CHAIN ANALYSIS

-

5.6 CASE STUDY ANALYSISHEALTHCARE AND LIFE SCIENCES- Coveo enabled Life Extension to provide relevant and personalized experience to customersBANKING, FINANCIAL SERVICES, AND INSURANCE- Bank of England intended to drive innovation with Squirro Cognitive Search- Plexus Law selected Expert.ai to deliver better user experience with improved accuracyRETAIL AND ECOMMERCE- Lucidworks enabled Goop to streamline its merchandising control over its search engineTELECOM- Comintelli provided VodafoneZiggo central place where knowledge and insights can be shared easily across departmentsENERGY & UTILITY- Mindbreeze helped leading energy companies reduce ticket processing time and save countless hoursEDUCATION- Squiz enabled University of North Dakota to deliver relevant information for each query

-

5.7 TECHNOLOGY ANALYSISINSIGHT ENGINES AND ARTIFICIAL INTELLIGENCEINSIGHT ENGINES AND NATURAL LANGUAGE PROCESSINGINSIGHT ENGINES AND MACHINE LEARNINGINSIGHT ENGINES AND DATA INTEGRATION

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 REGULATORY LANDSCAPEHEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACTGENERAL DATA PROTECTION REGULATIONGRAMM–LEACH–BLILEY ACTTHE INTERNATIONAL ORGANIZATION FOR STANDARDIZATION STANDARD 27001HEALTH LEVEL SEVEN INTERNATIONALCOMMUNICATIONS DECENCY ACT

-

5.10 PRICING MODEL ANALYSISINDICATIVE PRICING ANALYSIS BY VARIOUS PRICING MODELS

-

5.11 PATENT ANALYSISMETHODOLOGYDOCUMENT TYPEINNOVATION AND PATENT APPLICATIONSTOP APPLICANTS

-

5.12 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.13 TRENDS/DISRUPTIONS IMPACTING BUYERS OF INSIGHT ENGINES MARKET

- 5.14 TYPES OF INSIGHT ENGINES

- 5.15 BENEFITS OF INSIGHT ENGINES

- 5.16 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.17 ASSESSMENT BY INSIGHT ENGINES’ VARIABLESARCHITECTURECONNECTIVITYINTELLIGENCESECURITYCONTENT PROCESSINGCUSTOMIZATION

-

5.18 ASSESSMENT BY INSIGHT TYPEDESCRIPTIVEPREDICTIVEPRESCRIPTIVE

- 5.19 CURRENT & EMERGING BUSINESS MODELS

- 5.20 FUTURE DIRECTION INSIGHT ENGINES MARKET LANDSCAPE

-

5.21 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.22 ASSESSMENT BY SEARCH TYPEINTERNAL SEARCHEXTERNAL SEARCH

-

6.1 INTRODUCTIONOFFERING: MARKET DRIVERS

-

6.2 SOLUTIONSENHANCED BUSINESS OPERATIONS AND OPERATIONAL EFFECTIVENESS TO DRIVE DEMAND FOR SOLUTIONS

-

6.3 SERVICESCONSULTING AND TRAINING- Growing need from organizations to comply with various labor laws and regulations to drive demandDEPLOYMENT AND INTEGRATION- Lack of integral requirements to implement insight engines and need for proficient solutions to drive demandSUPPORT AND MAINTENANCE- Increasing deployment of insight engines solutions to drive demand for support and maintenance services

-

7.1 INTRODUCTIONAPPLICATION: MARKET DRIVERS

-

7.2 RISK AND COMPLIANCE MANAGEMENTNEED TO ENHANCE BUSINESS PERFORMANCE, MANAGE RISKS, AND MEET REGULATORY COMPLIANCE CHALLENGES TO DRIVE DEMAND

-

7.3 SEARCH AND DISCOVERYRISING NEED FOR ADVANCED SEARCH AND ACCESS TO IN- DEPTH INSIGHTS TO DRIVE DEMAND FOR INSIGHT ENGINE SOLUTIONS

-

7.4 CUSTOMER MANAGEMENTINCREASED NEED FOR UNDERSTANDING CUSTOMER BEHAVIOR AND SMART CUSTOMER SUPPORT TO DRIVE DEMAND

-

7.5 KNOWLEDGE MANAGEMENTRISING NEED TO GAIN INSIGHTS TO MAKE SMART AND INFORMED DECISIONS TO BOOST MARKET

- 7.6 OTHER APPLICATIONS

- 8.1 INTRODUCTION

- 8.2 TECHNOLOGY: INSIGHT ENGINES MARKET DRIVERS

-

8.3 NATURAL LANGUAGE PROCESSINGNEED TO COMPREHEND HUMAN VOICES AND EVALUATE LANGUAGES AND DATA SETS TO DRIVE DEMAND- Semantic analysis- Syntactic analysis

-

8.4 MACHINE LEARNINGRISING NEED TO ANALYZE USER BEHAVIOR AND IDENTIFY RELEVANCE IN SEARCH RESULTS TO DRIVE DEMAND- Graph database- Collaborative filtering- Clustering

-

9.1 INTRODUCTIONDEPLOYMENT MODE: MARKET DRIVERS

-

9.2 ON-PREMISESRELIABILITY FOR HIGH-LEVEL CONTROL AND SECURITY, DATA PROTECTION, AND ANALYSIS IMPROVEMENT TO BOOST DEMAND

-

9.3 CLOUDLOW DEPLOYMENT COST AND EASY UPGRADABILITY AND ACCESSIBILITY TO DRIVE DEMAND

-

10.1 INTRODUCTIONORGANIZATION SIZE: MARKET DRIVERS

-

10.2 SMALL AND MEDIUM-SIZED ENTERPRISESINTENSE COMPETITION TO IMPROVE STRATEGIC BUSINESS DECISIONS TO DRIVE DEMAND FOR INSIGHT ENGINES SOLUTIONS

-

10.3 LARGE ENTERPRISESINTELLIGENT SEARCH FOR EXTRACTING VALUABLE INSIGHTS TO DRIVE DEMAND FOR INSIGHT ENGINES SOLUTIONS

-

11.1 INTRODUCTIONVERTICAL: INSIGHT ENGINES MARKET DRIVERS

-

11.2 BANKING, FINANCIAL SERVICES, AND INSURANCENEED TO OPTIMIZE FINANCIAL DATA REPORTING, RISK ASSESSMENTS, AND FRAUD DETECTION TO DRIVE MARKET

-

11.3 IT AND ITESREQUIREMENTS TO IMPROVE EFFICIENCY, FACILITATE INNOVATION, AND MAINTAIN REGULATORY COMPLIANCE TO DRIVE MARKET

-

11.4 RETAIL AND ECOMMERCENEED TO UNDERSTAND TARGET MARKETS, DETECT FRAUD AND THEFT, AND ENHANCE CUSTOMER EXPERIENCE TO BOOST MARKET

-

11.5 HEALTHCARE AND LIFE SCIENCESRISING FOCUS ON IMPROVING PATIENT MANAGEMENT AND EXPERIENCE TO DRIVE DEMAND FOR INSIGHT ENGINE SOLUTIONS

-

11.6 TELECOMNEED TO AUTOMATE NETWORK OPERATIONS AND MAXIMIZE NETWORK PROFITABILITY TO PROPEL MARKET

-

11.7 MANUFACTURINGABILITY TO PREDICT GLOBAL SUPPLY CHAIN COSTS AND CONSUMER DEMAND TO DRIVE MARKET

-

11.8 GOVERNMENTREQUIREMENT FOR UNDERSTANDING CONSTITUENT NEEDS AND IMPROVING CUSTOMER SERVICE TO BOOST MARKET

- 11.9 OTHER VERTICALS

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICANORTH AMERICA: INSIGHT ENGINES MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- Need for fast access to documents and data to drive demand for insight engines solutions and servicesCANADA- Strong startup ecosystem and focus of businesses on data-driven decision-making to drive market

-

12.3 EUROPEEUROPE: INSIGHT ENGINES MARKET DRIVERSEUROPE: RECESSION IMPACTUK- Continued transition toward online services due to relative ease and speedy growth to boost marketGERMANY- Rapid adoption of cutting-edge solutions for maintaining competitive business environment to propel marketFRANCE- Significant potential for Al and increasing funding to drive adoption of insight engines solutionsITALY- Growing adoption of insight engine solutions in healthcare and life sciences to boost marketSPAIN- Need for growing volume of data from various sources and more personalized experience to drive marketREST OF EUROPE

-

12.4 ASIA PACIFICASIA PACIFIC: INSIGHT ENGINES MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTINDIA- Growing adoption of technologies and expanding economy to drive demand for insight engines solutionsJAPAN- Ability to generate insights from large volumes of data through various sources to drive market growthCHINA- Government's efforts for R&D activities and investments from foreign enterprises to drive marketSOUTH KOREA- Government initiatives to facilitate digital economy to drive marketREST OF ASIA PACIFIC

-

12.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: INSIGHT ENGINES MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTSAUDI ARABIA- Government initiatives to build country’s digital capabilities and infrastructure to drive demand for insight engines solutionsUAE- Ability to embrace cutting-edge technologies to drive adoption of insight engines solutionsSOUTH AFRICA- Extraction of insights for identifying patterns from massive data sets to drive adoption of insight engines solutionsISRAEL- Ability to create valuable customer experience to drive demand for insight engines solutionsREST OF MIDDLE EAST & AFRICA

-

12.6 LATIN AMERICALATIN AMERICA: INSIGHT ENGINES MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTBRAZIL- Investments by startups in cutting-edge technologies to fuel demand for insight engines solutionsMEXICO- Rising support for implementing high-performance insight engines and analytics technologies to drive marketARGENTINA- Increasing application of insight engines solutions in various industry verticals to spur market growthREST OF LATIN AMERICA

- 13.1 OVERVIEW

- 13.2 STRATEGIES ADOPTED BY KEY PLAYERS

-

13.3 REVENUE ANALYSISHISTORICAL REVENUE ANALYSIS

- 13.4 MARKET SHARE ANALYSIS

-

13.5 PRODUCT COMPARISONSAP ANALYTICS CLOUDELASTICSEARCHLUCIDWORKS FUSIONSQUIRRO INSIGHT ENGINESMINDBREEZE INSPIRE

-

13.6 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPETITIVE BENCHMARKING

-

13.7 STARTUP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSSTARTUPS/SMES COMPETITIVE BENCHMARKING

-

13.8 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALS

- 14.1 INTRODUCTION

-

14.2 MAJOR PLAYERSMICROSOFT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewIBM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewORACLE- Business overview- Products/Solutions/Services offered- MnM viewSAP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewOPENTEXT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewELASTIC- Business overview- Products/Solutions/Services offered- Recent developmentsEXPERT.AI- Business overview- Products/Solutions/Services offered- Recent developmentsALMAWAVE- Business overview- Products/Solutions/Services offered- Recent developmentsMINDBREEZE- Business overview- Products/Solutions/Services offered- Recent developmentsSQUIRRO- Business overview- Products/Solutions/Services offered- Recent developmentsSINEQUA- Business overview- Products/Solutions/Services offered- Recent developmentsCOVEO- Business overview- Products/Solutions/Services offered- Recent developmentsLUCIDWORKS- Business overview- Products/Solutions/Services offered- Recent developmentsSEARCHBLOX- Business overview- Products/Solutions/Services offered- Recent developmentsATTIVIO- Business overview- Products/Solutions/Services offered- Recent developments

-

14.3 OTHER KEY PLAYERSO9 SOLUTIONSCELONISSQUIZINTRAFINDFLETCHVERITONEPROGRESSUPLAND SOFTWAREFORWARDLANETECNOTREECOMINTELLIACTIVEVIAMDUN & BRADSTREETPREVEDERESTRAVITOXFINDTURING LABSRAMPFYRAFFLE.AIPECAN AIOMNISEARCHFOSFOR

- 15.1 INTRODUCTION

-

15.2 ADVANCED ANALYTICS MARKET – GLOBAL FORECAST TO 2026MARKET DEFINITIONMARKET OVERVIEWADVANCED ANALYTICS MARKET, BY COMPONENTADVANCED ANALYTICS MARKET, BY BUSINESS FUNCTIONADVANCED ANALYTICS MARKET, BY TYPEADVANCED ANALYTICS MARKET, BY DEPLOYMENT MODEADVANCED ANALYTICS MARKET, BY ORGANIZATION SIZEADVANCED ANALYTICS MARKET, BY VERTICALADVANCED ANALYTICS MARKET, BY REGION

-

15.3 DATA DISCOVERY MARKET – GLOBAL FORECAST TO 2025MARKET DEFINITIONMARKET OVERVIEWDATA DISCOVERY MARKET, BY COMPONENTDATA DISCOVERY MARKET, BY ORGANIZATION SIZEDATA DISCOVERY MARKET, BY DEPLOYMENT MODEDATA DISCOVERY MARKET, BY FUNCTIONALITYDATA DISCOVERY MARKET, BY APPLICATIONDATA DISCOVERY MARKET, BY VERTICALDATA DISCOVERY MARKET, BY REGION

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

- TABLE 1 FACTOR ANALYSIS

- TABLE 2 GLOBAL INSIGHT ENGINES MARKET SIZE AND GROWTH RATE, 2018–2022 (USD MILLION, Y-O-Y %)

- TABLE 3 GLOBAL MARKET SIZE AND GROWTH RATE, 2023–2028 (USD MILLION, Y-O-Y %)

- TABLE 4 MARKET: ECOSYSTEM

- TABLE 5 MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 6 AVERAGE SELLING PRICING ANALYSIS, 2023

- TABLE 7 PATENTS FILED, 2013–2022

- TABLE 8 TOP TWENTY PATENT OWNERS IN MARKET, 2013–2022

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2023–2024

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 16 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 17 MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 18 INSIGHT ENGINES MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 19 SOLUTIONS: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 20 SOLUTIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 21 SERVICES: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 22 SERVICES: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 23 SERVICES: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 24 SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 CONSULTING AND TRAINING: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 26 CONSULTING AND TRAINING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 DEPLOYMENT AND INTEGRATION: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 28 DEPLOYMENT AND INTEGRATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 SUPPORT AND MAINTENANCE: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 30 SUPPORT AND MAINTENANCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 32 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 33 RISK AND COMPLIANCE MANAGEMENT: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 34 RISK AND COMPLIANCE MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 SEARCH AND DISCOVERY: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 36 SEARCH AND DISCOVERY: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 CUSTOMER MANAGEMENT: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 38 CUSTOMER MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 KNOWLEDGE MANAGEMENT: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 40 KNOWLEDGE MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 OTHER APPLICATIONS: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 42 OTHER APPLICATIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 INSIGHT ENGINES MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 44 MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 45 NATURAL LANGUAGE PROCESSING: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 46 NATURAL LANGUAGE PROCESSING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 MACHINE LEARNING: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 48 MACHINE LEARNING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 50 MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 51 ON-PREMISES: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 52 ON-PREMISES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 CLOUD: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 54 CLOUD: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 56 MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 57 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 58 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 LARGE ENTERPRISES: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 60 LARGE ENTERPRISES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 62 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 63 BANKING, FINANCIAL SERVICES, AND INSURANCE: INSIGHT ENGINES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 64 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 IT AND ITES: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 66 IT AND ITES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 RETAIL AND ECOMMERCE: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 68 RETAIL AND ECOMMERCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 69 HEALTHCARE AND LIFE SCIENCES: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 70 HEALTHCARE AND LIFE SCIENCES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 TELECOM: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 72 TELECOM: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 MANUFACTURING: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 74 MANUFACTURING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 75 GOVERNMENT: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 76 GOVERNMENT: INSIGHT ENGINES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 77 OTHER VERTICALS: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 78 OTHER VERTICALS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 80 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 81 NORTH AMERICA: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 82 NORTH AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: INSIGHT ENGINES MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 84 NORTH AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 85 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 86 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 88 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 90 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 92 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 93 NORTH AMERICA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 94 NORTH AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 96 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 97 EUROPE: INSIGHT ENGINES MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 98 EUROPE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 99 EUROPE: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 100 EUROPE: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 101 EUROPE: MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 102 EUROPE: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 103 EUROPE: MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 104 EUROPE: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 105 EUROPE: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 106 EUROPE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 107 EUROPE: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 108 EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 109 EUROPE: INSIGHT ENGINES MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 110 EUROPE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 111 EUROPE: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 112 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 113 ASIA PACIFIC: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 114 ASIA PACIFIC: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 115 ASIA PACIFIC: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 116 ASIA PACIFIC: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 117 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 118 ASIA PACIFIC: INSIGHT ENGINES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 119 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 120 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 121 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 122 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 123 ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 124 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 125 ASIA PACIFIC: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 126 ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 127 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 128 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: INSIGHT ENGINES MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 132 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 138 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 139 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 145 LATIN AMERICA: INSIGHT ENGINES MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 146 LATIN AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 147 LATIN AMERICA: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 148 LATIN AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 149 LATIN AMERICA: MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 150 LATIN AMERICA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 151 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 152 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 153 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 154 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 155 LATIN AMERICA: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 156 LATIN AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 157 LATIN AMERICA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 158 LATIN AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 159 LATIN AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 160 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 161 OVERVIEW OF STRATEGIES ADOPTED BY KEY INSIGHT ENGINES VENDORS

- TABLE 162 MARKET: DEGREE OF COMPETITION

- TABLE 163 COMPARATIVE ANALYSIS OF INSIGHT ENGINES PRODUCTS

- TABLE 164 INSIGHT ENGINES MARKET: PRODUCT FOOTPRINT ANALYSIS OF KEY PLAYERS, 2022

- TABLE 165 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 166 MARKET: PRODUCT FOOTPRINT ANALYSIS OF STARTUPS/ SMES PLAYERS, 2023

- TABLE 167 SERVICE/PRODUCT LAUNCHES, 2020–2023

- TABLE 168 DEALS, 2020–2023

- TABLE 169 MICROSOFT: BUSINESS OVERVIEW

- TABLE 170 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 172 MICROSOFT: DEALS

- TABLE 173 IBM: BUSINESS OVERVIEW

- TABLE 174 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 176 IBM: DEALS

- TABLE 177 ORACLE: BUSINESS OVERVIEW

- TABLE 178 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 SAP: BUSINESS OVERVIEW

- TABLE 180 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 181 SAP: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 182 SAP: DEALS

- TABLE 183 OPENTEXT: BUSINESS OVERVIEW

- TABLE 184 OPENTEXT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 OPENTEXT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 186 OPENTEXT: DEALS

- TABLE 187 ELASTIC: BUSINESS OVERVIEW

- TABLE 188 ELASTIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 ELASTIC: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 190 ELASTIC: DEALS

- TABLE 191 EXPERT.AI: BUSINESS OVERVIEW

- TABLE 192 EXPERT.AI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 EXPERT.AI: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 194 EXPERT.AI: DEALS

- TABLE 195 ALMAWAVE: BUSINESS OVERVIEW

- TABLE 196 ALMAWAVE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 ALMAWAVE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 198 ALMAWAVE: DEALS

- TABLE 199 MINDBREEZE: BUSINESS OVERVIEW

- TABLE 200 MINDBREEZE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 MINDBREEZE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 202 MINDBREEZE: DEALS

- TABLE 203 SQUIRRO: BUSINESS OVERVIEW

- TABLE 204 SQUIRRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 SQUIRRO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 206 SQUIRRO: DEALS

- TABLE 207 SINEQUA: BUSINESS OVERVIEW

- TABLE 208 SINEQUA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 SINEQUA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 210 SINEQUA: DEALS

- TABLE 211 COVEO: BUSINESS OVERVIEW

- TABLE 212 COVEO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 COVEO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 214 COVEO: DEALS

- TABLE 215 LUCIDWORKS: BUSINESS OVERVIEW

- TABLE 216 LUCIDWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 LUCIDWORKS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 218 LUCIDWORKS: DEALS

- TABLE 219 SEARCHBLOX: BUSINESS OVERVIEW

- TABLE 220 SEARCHBLOX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 SEARCHBLOX: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 222 ATTIVIO: BUSINESS OVERVIEW

- TABLE 223 ATTIVIO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 ATTIVIO: DEALS

- TABLE 225 ADVANCED ANALYTICS MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

- TABLE 226 ADVANCED ANALYTICS MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

- TABLE 227 ADVANCED ANALYTICS MARKET, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

- TABLE 228 ADVANCED ANALYTICS MARKET, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

- TABLE 229 ADVANCED ANALYTICS MARKET, BY TYPE, 2016–2020 (USD MILLION)

- TABLE 230 ADVANCED ANALYTICS MARKET, BY TYPE, 2021–2026 (USD MILLION)

- TABLE 231 ADVANCED ANALYTICS MARKET, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

- TABLE 232 ADVANCED ANALYTICS MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

- TABLE 233 ADVANCED ANALYTICS MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

- TABLE 234 ADVANCED ANALYTICS MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

- TABLE 235 ADVANCED ANALYTICS MARKET, BY VERTICAL, 2016–2020 (USD MILLION)

- TABLE 236 ADVANCED ANALYTICS MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

- TABLE 237 ADVANCED ANALYTICS MARKET, BY REGION, 2016–2020 (USD MILLION)

- TABLE 238 ADVANCED ANALYTICS MARKET, BY REGION, 2021–2026 (USD MILLION)

- TABLE 239 DATA DISCOVERY MARKET, BY COMPONENT, 2014–2019 (USD MILLION)

- TABLE 240 DATA DISCOVERY MARKET, BY COMPONENT, 2019–2025 (USD MILLION)

- TABLE 241 DATA DISCOVERY MARKET, BY SERVICE, 2014–2019 (USD MILLION)

- TABLE 242 DATA DISCOVERY MARKET, BY SERVICE, 2019–2025 (USD MILLION)

- TABLE 243 PROFESSIONAL SERVICES: DATA DISCOVERY MARKET, BY TYPE, 2014–2019 (USD MILLION)

- TABLE 244 PROFESSIONAL SERVICES: DATA DISCOVERY MARKET, BY TYPE, 2019–2025 (USD MILLION)

- TABLE 245 DATA DISCOVERY MARKET, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

- TABLE 246 DATA DISCOVERY MARKET, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

- TABLE 247 DATA DISCOVERY MARKET, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

- TABLE 248 DATA DISCOVERY MARKET, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

- TABLE 249 CLOUD: DATA DISCOVERY MARKET, BY TYPE, 2014–2019 (USD MILLION)

- TABLE 250 CLOUD: DATA DISCOVERY MARKET, BY TYPE, 2019–2025 (USD MILLION)

- TABLE 251 DATA DISCOVERY MARKET, BY FUNCTIONALITY, 2014–2019 (USD MILLION)

- TABLE 252 DATA DISCOVERY MARKET, BY FUNCTIONALITY, 2019–2025 (USD MILLION)

- TABLE 253 DATA DISCOVERY MARKET, BY APPLICATION, 2014–2019 (USD MILLION)

- TABLE 254 DATA DISCOVERY MARKET, BY APPLICATION, 2019–2025 (USD MILLION)

- TABLE 255 DATA DISCOVERY MARKET, BY VERTICAL, 2014–2019 (USD MILLION)

- TABLE 256 DATA DISCOVERY MARKET, BY VERTICAL, 2019–2025 (USD MILLION)

- TABLE 257 DATA DISCOVERY MARKET, BY REGION, 2014–2019 (USD MILLION)

- TABLE 258 DATA DISCOVERY MARKET, BY REGION, 2019–2025 (USD MILLION)

- FIGURE 1 INSIGHT ENGINES MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION

- FIGURE 3 INSIGHT ENGINES MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY-SIDE): REVENUE FROM SOLUTIONS/SERVICES OF INSIGHT ENGINES MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/ SERVICES OF MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/ SERVICES OF MARKET

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF INSIGHT ENGINES THROUGH OVERALL SPENDING

- FIGURE 8 SOLUTIONS SEGMENT TO DOMINATE MARKET IN 2023

- FIGURE 9 MACHINE LEARNING SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE IN 2023

- FIGURE 10 SEARCH AND DISCOVERY SEGMENT TO HOLD LARGEST MARKET SIZE IN 2023

- FIGURE 11 LARGE ENTERPRISES SEGMENT TO HOLD LARGER MARKET SHARE IN 2023

- FIGURE 12 CLOUD SEGMENT TO HOLD LARGER MARKET SIZE IN 2023

- FIGURE 13 IT AND ITES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 RISING DEMAND TO EMBRACE AI-POWERED SEARCH EXPERIENCE ACROSS BFSI AND RETAIL AND ECOMMERCE SECTORS TO DRIVE MARKET GROWTH

- FIGURE 16 INSIGHT ENGINES MARKET TO WITNESS MINOR DECLINE IN Y-O-Y GROWTH IN 2023

- FIGURE 17 SEARCH AND DISCOVERY SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 MACHINE LEARNING AND IT AND ITES SEGMENTS TO HOLD LARGEST MARKET SHARES IN NORTH AMERICA IN 2023

- FIGURE 19 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: MARKET

- FIGURE 21 HISTORY: MARKET

- FIGURE 22 SUPPLY CHAIN ANALYSIS: MARKET

- FIGURE 23 MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 24 TOTAL NUMBER OF PATENTS GRANTED, 2013–2022

- FIGURE 25 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST TEN YEARS, 2013–2022

- FIGURE 26 INSIGHT ENGINES MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 28 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 29 SOLUTIONS SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 30 SUPPORT AND MAINTENANCE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 31 SEARCH AND DISCOVERY SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 32 MACHINE LEARNING SEGMENT TO HOLD HIGHER GROWTH RATE DURING FORECAST PERIOD

- FIGURE 33 CLOUD DEPLOYMENT MODE TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 34 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 35 IT AND ITES VERTICAL TO GROW AT HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 36 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 39 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 40 HISTORICAL REVENUE ANALYSIS OF TOP PLAYERS, 2020–2022 (USD MILLION)

- FIGURE 41 MARKET SHARE ANALYSIS FOR KEY COMPANIES, 2022

- FIGURE 42 KEY INSIGHT ENGINES MARKET PLAYERS, COMPANY EVALUATION QUADRANT, 2022

- FIGURE 43 STARTUPS/SMES INSIGHT ENGINES PLAYERS, COMPANY EVALUATION QUADRANT, 2022

- FIGURE 44 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 45 IBM: COMPANY SNAPSHOT

- FIGURE 46 ORACLE: COMPANY SNAPSHOT

- FIGURE 47 SAP: COMPANY SNAPSHOT

- FIGURE 48 OPENTEXT: COMPANY SNAPSHOT

- FIGURE 49 ELASTIC: COMPANY SNAPSHOT

- FIGURE 50 EXPERT.AI: COMPANY SNAPSHOT

- FIGURE 51 ALMAWAVE: COMPANY SNAPSHOT

- FIGURE 52 COVEO: COMPANY SNAPSHOT

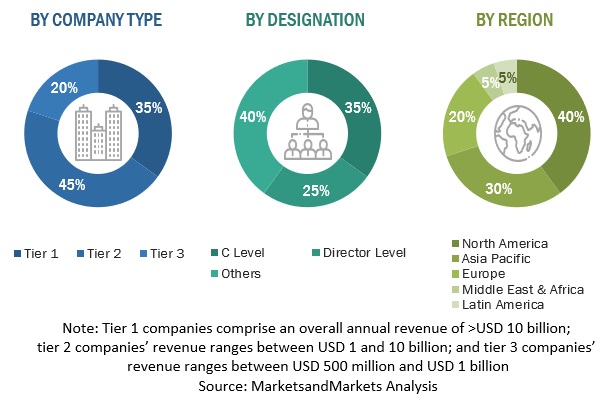

The research study for the insight engines market involved extensive secondary sources, directories, journals, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred insight engine providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors' websites. Additionally, insight engines spending on various countries was extracted from the respective sources. Secondary research was mainly used to obtain key information related to the industry’s value chain and supply chain to identify key players based on solutions, services, market classification, and segmentation according to offerings of major players, industry trends related to solutions, services, deployment modes, technology, applications, verticals, and regions, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and insight engines expertise, related key executives from insight engines solution vendors, SIs, professional service providers, and industry associations, and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using insight engines solutions, were interviewed. Interviews were done to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of insight engines solutions and services, which would impact the overall insight engines market.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Insight Engines Market Size Estimation

For making market estimates and forecasting for insight engines and the other dependent submarkets, top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global market for insight engines, using the revenue from the key companies and their offerings in the market. With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

In the top-down approach, an exhaustive list of all the vendors offering solutions and services in the insight engines market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor's offerings were evaluated based on the breadth of solutions and services, deployment modes, applications, and verticals. The aggregate of all the companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

In the bottom-up approach, the adoption rate of insight engines solutions and services among different end users in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of insight engines solutions and services among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

All the possible parameters that affect the market covered in the research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For the conversion of various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service’s website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency, USD, remains constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors.

- Demand/end-user analysis: End users operating in verticals across regions are analyzed in terms of market spending on insight engines based on some of the key use cases. These factors for the insight engines industry per region are separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor is derived by averaging various market influencers, including recent developments, regulations, mergers and acquisitions, enterprise/SME adoption, startup ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Insight Engines Market Definition

An insight engine, also called cognitive search or enterprise knowledge discovery and management, is an enterprise platform that makes key enterprise insights accessible to users when needed. It combines search with machine learning capabilities to provide users with information and machine data.

According to Coveo, an insight engine combines keyword search, data connectors, UI components, and machine learning to provide customers and employees alike with more relevant information and personalized experiences.

Key Stakeholders

- Insight Engines Vendors

- Insight Engines Service Vendors

- Support and Maintenance Service Providers

- System Integrators (SIs)/Migration Service Providers

- Value-added Resellers (VARs) And Distributors

- Distributors And Value-added Resellers (VARs)

- System Integrators (SIs)

- Independent Software Vendors (ISV)

- Third-party Providers

- Technology Providers

Report Objectives

- To define, describe, and predict the insight engines market by offering, deployment mode, technology, application, organization size, vertical, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the insight engines market

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the insight engines market

- To analyze the impact of recession across all regions in the insight engines market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American market for insinght engines market

- Further breakup of the European market for insight engines market

- Further breakup of the Asia Pacific market for insight engines market

- Further breakup of the Latin American market for insight engines market

- Further breakup of the Middle East & Africa market for insight engines market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Insight Engines Market