Injection Molding Polyamide 6 Market by Grade (Reinforced PA6, Unreinforced PA6, Others), End-use Industry (Automotive, Electrical & Electronics, Industrial/Machinery, Consumer Goods & Appliances, Construction, Others), Region - Global Forecast to 2025

Updated on : June 18, 2024

Injection Molding Polyamide 6 Market

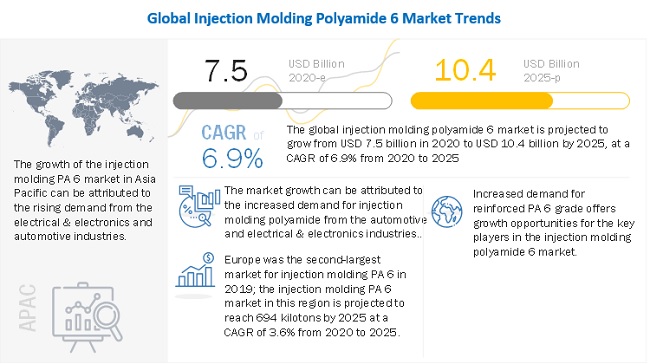

The injection molding polyamide 6 market is projected to grow from USD 7.5 billion in 2020 to USD 10.4 billion by 2025, at a CAGR of 6.9% from 2020 to 2025. The major reasons for the growth of the injection molding polyamide 6 market include growing end-use industries such as automotive, electrical & electronics, industrial/machinery, consumer goods & appliances, and construction. Excellent properties of polyamide 6, such as high impact strength, good abrasion & wear resistance, excellent surface appearance, better processability, and low-cost when compared to other grades of a polyamide such as a polyamide 66 (PA 66), is driving the growth of the injection molding polyamide 6 market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Injection molding polyamide 6 Market

The pandemic is estimated to have a huge impact on various factors of the value chain of injection molding polyamide 6, which is expected to reflect during the forecast period, especially in the year 2020. The various impact of COVID-19 are as follows:

Impact on raw material (Caprolactam): The demand for caprolactam from countries such as China, Taiwan, and India, was high due to the demand for polyamide 6 (nylon 6) resins. With the outbreak of COVID-19 and resultant lockdowns across the world, this demand decreased significantly from March to May 2020. The key buyers in the Asia Pacific either canceled their advanced orders or delayed their purchases. China accounts for about 50% of the global demand for caprolactam. Therefore, with the offset of nylon plant shutdowns in China in February and March, the demand for caprolactam declined drastically.

Further, the shutdown of automotive production in Europe during the lockdown has affected the demand for nylon 6 in Europe, which is the largest application of caprolactam. Thus, most of the nylon 6 resin manufacturers either canceled or postponed their orders for caprolactam. The demand for caprolactam was low during the second quarter of 2020 in Europe, due to the ongoing pandemic. Although some PA 6 plants resumed production during the second quarter, they were operating with low capacity in the region.

Impact on end-use industries: China is the major supplier of automotive parts across countries. The global supply chain has been disrupted adversely with the outbreak of COVID-19 and resultant lockdown in China in the first quarter of 2020. According to the Independent Commodity Intelligence Service (ICIS), automotive sales in Western Europe fell by 2.2% year-on-year in July. Among European countries, the UK registered the highest sales of 11.3% year-on-year, due to repressed demand after dealers reopened. The reduced demand is the result of overcapacity and high costs.

There was an economic impact of COVID -19 on the construction industry also. According to the International Monetary Fund (IMF), the real global gross domestic product (GDP) is estimated to shrink by ~3% in 2020. The impact of the COVID-19 on the construction industry is estimated to vary in different regions across the world. According to the IMF, lay-offs in the construction and other industries are expected in the US. In Europe, the building & construction industry is estimated to contract by 60-70% in 2020. However, the construction and automotive industries have resumed their operations in most parts of China. The economy in the country is estimated to grow by 4% in the second quarter of the year. According to the Financial Express, the construction industry in India incurred significant losses from April to June 2020. The construction industry in India is also estimated to witness a decline of 12-16% in investments in the current fiscal year compared with the previous year.

Injection Molding Polyamide 6 Market Dynamics

Driver: High demand from the automotive industry

The automotive industry is one of the largest end-use industries of injection molding polyamide 6. Polyamide 6 is widely used in hood applications such as engine covers, inlet manifolds, radiator end-caps, oil-pans, rocker valve cover due to its superior physical and chemical properties. For example, PA 6 has excellent mechanical properties, moldability, and ease of secondary processing, such as vibration welding (an important process to produce intake manifolds). Initially, only metal has been used under the hood, but it has been replaced rapidly by glass-fiber reinforced PA 6 in recent years. Increased stringent environmental norms to improve fuel efficiency is anticipated to drive the demand for lightweight vehicles and, thereby, injection molding PA 6 in the automotive industry during the forecast period.

Restraint: Increasing competition from substitutes

PA 6 and PA 66 are extensively used in the automotive industry. However, there are other grades of engineering plastics available in the market for various end-use industries such as automotive, electrical and electronics, and consumer goods. Some of the common substitutes of PA 6 are PA 66, Polypropylene (PP), Acrylonitrile Butadiene Styrene (ABS), Acrylonitrile Styrene Acrylate (ASA), Polybutylene Terephthalate (PBT), and Thermoplastic Polyurethane. Thus, the presence of substitutes is considered as a major restraint for the market growth. According to industry experts, ABS and propylene are used as a cheaper substitute of PA 6 in some of the automotive parts.

Opportunity: Growing demand for lightweight vehicles

The strength per unit weight is critical in new-generation vehicles. These vehicles are based on the principle of minimizing weight and maximizing the strength of different body parts of vehicles. The metals used in these vehicles are being replaced by advanced materials and thermoplastics to reduce the total vehicle weight. Weight reduction is made for various reasons, including reduced consumption of fuel, which results in reduced CO2 emissions. Injection molding polyamide 6 is an ideal solution for vehicle weight reduction. It is fast replacing metal parts in the automotive industry as it can be easily molded and mass-produced. Polyamide 6 is also cheaper in unit cost in comparison to metals, which makes it a cost-effective alternative.

Thus, the growing market for light weight vehicles is considered as an opportunity for injection molding polyamide 6 market.

Challenge: Low thermal stability and high moisture absorbing nature of PA 6

Polyamide 6 absorbs more water when compared to the polyamide 66 and has lower heat deflection temperatures. Thus, PA 6 is not suitable for applications that are exposed to water or high temperatures for a longer duration.

The high rate of water absorption and high equilibrium water content in PA 6 reduces its strength and stiffness. PA 6 is suitable only for short-term heat exposer as it starts to chemically break down and become brittle when exposed to long-term heat (140 degrees Celsius or above). Thus, the exposure of the PA 6 at the elevated temperature for a longer period is considered as a challenge. However, experts are working to develop better heat stabilizers, to enhance the thermal stability of PA 6.

Reinforced PA 6 is projected to grow at a very high CAGR during the forecast period.

By grade, reinforced PA6 grade is estimated to be the largest segment in the injection molding polyamide 6 market in 2020 and is estimated to record the fastest growth during the forecast period, in terms of value. It is majorly due to the excellent properties offered by the reinforced PA 6 and high demand for glass fiber reinforced PA 6 from the automotive industry. The reinforcing of polyamide 6 makes it suitable to be used across applications in the automotive, electrical & electronics, construction, consumer goods & appliances industries.

Automotive is projected to be a large consumer of injection molding polyamide 6 during the forecasted period.

The automotive end-use industry dominated the injection molding polyamide 6 market in 2020, both in terms of value and volume. Injection molding polyamide 6 is used in the automotive industry for weight reduction of vehicles. It is also cheaper in unit cost in comparison to metals, and other grades of commonly used thermoplastics such as polyamide 66, making it an economical alternative.

PA 6 has excellent tensile strength, stiffness, chemical resistance, heat resistance, wear resistance, and lubricity. Injection molding PA 6 is frequently used in the automotive parts manufacturing when a low-cost, high mechanical strength, rigid, and stable material is required. For example, PA 6 is extensively used in the door handles & radiator grills. PA 6 is also widely used in the hood, chassis, exterior, and interior applications in the automotive industry.

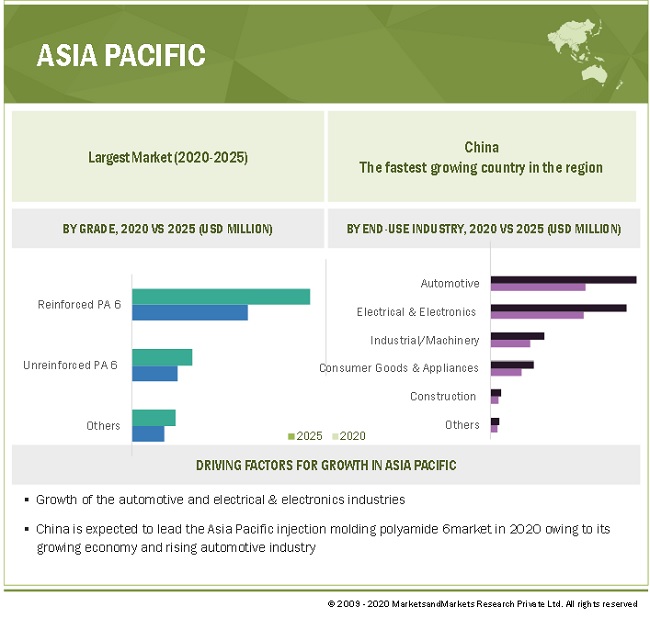

Asia Pacific dominated the injection molding polyamide 6 market in 2020.

Asia Pacific is estimated to account for the largest share of the injection molding polyamide 6 market in 2020. The growth of the automotive and electrical & electronics industries is responsible for driving the injection molding polyamide 6 market in this region. China is one of the key consumers of injection molding polyamide 6 in the region.

To know about the assumptions considered for the study, download the pdf brochure

Injection Molding Polyamide 6 Market Players

DSM, Lanxess Corporation, Radici Group, DOMO Chemicals, and BASF SE are some of the leading players operating in the injection molding polyamide 6 market.

Injection Molding Polyamide 6 Market Report Scope

|

Report Metric |

Details |

|

Market Size Available for Years |

2018–2025 |

|

Base Year Considered |

2019 |

|

Forecast Period |

2020–2025 |

|

Forecast Units |

Value (USD Million and USD Billion) and Volume (Kilotons) |

|

Segments Covered |

Grade, End-use Industry, and Region |

|

Geographies Covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies Covered |

The major market players include DSM (Netherlands), BASF SE (Germany), DOMO Chemicals (Belgium), Radici Group (Italy), Lanxess Corporation (Germany), Toray Industries, Inc. (Japan), Sabic (Saudi Arabia), RTP Company (US), Ube Industries Ltd. (Japan), DuPont (US), AdvanSix (US), LyondellBasell Industries Holdings B.V. (Netherlands), ADDIPLAST GROUP (Italy), Grupa Azoty (Poland), AD Majoris (France), Adell Plastics Inc. (US), AKAY PLASTIK (Turkey), Shanghai Pret Composites Co. Ltd. (China), YUH-DEAN Enterprise Co., Ltd. (Taiwan), are some of the key players in the injection molding polyamide 6 market (Total of 19 companies) |

This research report categorizes the injection molding polyamide 6 market based on grade, end-use industry, and region.

Based on End-use Industry, the injection molding polyamide 6 market has been segmented as follows:

- Automotive

- Electrical & Electronics

- Industrial/Machinery

- Consumer Goods & Appliances

- Construction

- Others (Aerospace & Defense, Resorts (patio, swimming pools, and observatory decks), Marine and Medical Plastics.

Based on Grade, the injection molding polyamide 6 market has been segmented as follows:

- Reinforced PA 6

- Unreinforced PA 6

- Others (Mineral Filled and Heat Stabilized/Flame Retardant)

Based on Region, the injection molding polyamide 6 market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In February 2020, DSM announced to expand the capacity of its high-performance materials compounding plant in Evansville, Indiana, US. DSM will enhance the site to produce the next generation of advanced materials, including bio-based thermoplastics. The project is expected to be completed in the third quarter of 2021. The expansion will help to meet increased regional demand for high-performance materials such as Akulon PA6/PA66, Arnite PET/PBT, Arnitel TPC, EcoPaXX PA410, ForTii PA4T/PPA, and Stanyl PA46 in North America.

- In April 2020, DOMO Chemicals extended its partnership with Ultrapolymers as a European pan distributor for DOMO’s products. Ultrapolymers will distribute a complete DOMO portfolio of PA 6 and PA 66, PPA, and PPS based technical polymers in all the countries in Europe.

Frequently Asked Questions (FAQ):

What is the current size of the global injection molding polyamide 6 market?

The global injection molding polyamide 6 market is projected to grow from USD 7.5 billion in 2020 to USD 10.4 billion by 2025, at a CAGR of 6.9% from 2020 to 2025.

Who are the star in the global injection molding polyamide 6 market?

Companies such as DSM, BASF SE, Radici Group, DOMO Chemicals, Sabic, and Lanxess Corporation, fall under the stars’ category. These are leading players in the injection molding polyamide 6s market, globally, and are some of the leading players operating in the injection molding polyamide 6 market. These players have adopted strategies such as business & capacity expansions, new product launches, product developments, partnerships, acquisitions, R&D expansions and mergers, to increase their presence in the global market.

What is the COVID-19 impact on injection molding polyamide 6 value chain?

COVID-19 outbreak is expected to have significant impact on the global demand for injection molding polyamide 6 in the automotive industry. The outbreak and the spread of the COVID-19 led to major supply chain disruptions across the world, thereby resulting in non-delivery of raw material (caprolactam), used for manufacturing injection molding polyamide 6 market. in the Middle East. Also, this demand for automotive decreased significantly from March to June 2020. For instance, according to the European Automobile Manufacturers’ Association (ACEA), vehicle production in Europe is estimated to decrease by 24% in 2020 compared with 2019, from 21.2 million vehicles to 16.0 million. However, a slight improvement in operations of automobile production plants is expected from July 2020 onwards with control over COVID-19 cases and ease in lockdown restrictions in countries such as Germany and the UK. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 21)

1.1 OBJECTIVES OF THE STUDY

1.2 COMPETITIVE INTELLIGENCE

1.3 MARKET DEFINITION

1.4 SCOPE OF THE STUDY

1.4.1 YEARS CONSIDERED FOR STUDY

1.5 CURRENCY

1.6 PACKAGE SIZE

1.7 LIMITATIONS

1.8 STAKEHOLDERS

1.9 INJECTION MOLDING POLYAMIDE 6 MARKET: INCLUSIONS & EXCLUSIONS

2 RESEARCH METHODOLOGY (Page No. - 24)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key insights from primary sources

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

3 EXECUTIVE SUMMARY (Page No. - 31)

4 PREMIUM INSIGHTS (Page No. - 34)

4.1 ATTRACTIVE OPPORTUNITIES IN INJECTION MOLDING POLYAMIDE 6 MARKET

4.2 INJECTION MOLDING POLYAMIDE 6 MARKET, BY END-USE INDUSTRY

4.3 INJECTION MOLDING POLYAMIDE 6 MARKET, BY GRADE

4.4 INJECTION MOLDING POLYAMIDE 6 MARKET, BY REGION

4.5 ASIA PACIFIC INJECTION MOLDING POLYAMIDE 6 MARKET, BY COUNTRY & END-USE INDUSTRY

5 MARKET OVERVIEW (Page No. - 37)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 High demand from the automotive industry

5.2.1.2 Shortage of polyamide 66 and its escalating prices

5.2.2 RESTRAINTS

5.2.2.1 Increasing competition from substitutes

5.2.3 OPPORTUNITIES

5.2.3.1 Growing demand for lightweight vehicles

5.2.3.2 Low crude oil prices

5.2.4 CHALLENGES

5.2.4.1 Low thermal stability and high moisture absorbing nature of PA 6

5.2.4.2 Liquidity crunch due to COVID-19 among end-use industries

5.3 INJECTION MOLDING POLYAMIDE 6: ADJACENT & RELATED MARKETS

5.4 PORTER’S FIVE FORCES ANALYSIS

5.4.1 THREAT OF NEW ENTRANTS

5.4.2 THREAT OF SUBSTITUTES

5.4.3 BARGAINING POWER OF SUPPLIERS

5.4.4 BARGAINING POWER OF BUYERS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

6 VALUE CHAIN ANALYSIS (Page No. - 43)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

6.2.1 RAW MATERIAL

6.2.2 RESEARCH AND DEVELOPMENT

6.2.3 MANUFACTURING

6.2.4 DISTRIBUTION NETWORK

6.2.5 END-USE INDUSTRY

7 CASE STUDY (Page No. - 45)

7.1 CASE STUDY ANALYSIS

8 INJECTION MOLDING POLYAMIDE 6 MARKET, BY MANUFACTURING TECHNOLOGY (Page No. - 46)

8.1 INTRODUCTION

8.2 INJECTION MOLDING

8.3 KEY PARAMETERS IMPACTING QUALITY OF INJECTION MOLDING PA 6 PRODUCTS:

9 COVID-19 IMPACT ON INJECTION MOLDING POLYAMIDE 6 MARKET (Page No. - 47)

9.1 INTRODUCTION

9.2 IMPACT OF COVID-19 ON POLYAMIDE 6 SUPPLY CHAIN

9.2.1 IMPACT ON RAW MATERIAL - CAPROLACTAM

9.2.1.1 Asia Pacific

9.2.1.2 Europe

9.2.1.3 North America

9.2.2 IMPACT ON INJECTION MOLDING POLYAMIDE 6 (PA 6/NYLON 6)

9.2.2.1 Asia Pacific

9.2.2.2 Europe

9.2.2.3 North America

9.2.3 END-USE INDUSTRIES

9.2.3.1 Impact of COVID-19 on the automotive industry

9.2.3.2 Economic impact of COVID-19 on the construction industry

10 INJECTION MOLDING POLYAMIDE 6 MARKET, BY GRADE (Page No. - 50)

10.1 INTRODUCTION

10.2 REINFORCED PA 6

10.3 UNREINFORCED PA 6

10.4 OTHERS

11 INJECTION MOLDING POLYAMIDE 6 MARKET, BY END-USE INDUSTRY (Page No. - 56)

11.1 INTRODUCTION

11.2 AUTOMOTIVE

11.2.1 GROWING DEMAND FOR LIGHTWEIGHT BODY COMPONENTS AND EFFICIENT FUEL SYSTEMS IN AUTOMOTIVE INDUSTRY IS LIKELY TO DRIVE MARKET FOR INJECTION MOLDING POLYAMIDE 6

11.3 ELECTRICAL & ELECTRONICS

11.3.1 ELECTRICAL & MECHANICAL PROPERTIES OF PA 6 DRIVE ITS DEMAND IN THIS INDUSTRY

11.4 INDUSTRIAL/MACHINERY

11.4.1 HEAVY-DUTY APPLICATIONS OF INJECTION MOLDING POLYAMIDE 6 DRIVES ITS DEMAND IN INDUSTRIAL/MACHINERY INDUSTRY

11.5 CONSUMER GOODS & APPLIANCES

11.5.1 GROWING REPLACEMENT OF METALS WITH ENGINEERED PLASTICS IN CONSUMER GOODS INDUSTRY IS PROPELLING THE GROWTH OF PA 6 MARKET

11.6 CONSTRUCTION

11.6.1 NEW PRODUCT LAUNCHES BY COMPANIES AND WIDE APPLICATIONS OF PA 6 ARE DRIVING ITS DEMAND IN CONSTRUCTION INDUSTRY

11.7 OTHERS

12 INJECTION MOLDING POLYAMIDE 6 MARKET, BY REGION (Page No. - 69)

12.1 INTRODUCTION

12.2 ASIA PACIFIC

12.2.1 CHINA

12.2.1.1 Growth of automotive industry and the presence of raw material manufacturers drive the market in China

12.2.2 JAPAN

12.2.2.1 Growing demand for engineering plastics in the automotive industry is driving the market in this country

12.2.3 INDIA

12.2.3.1 Growing industrialization is expected to increase the demand for the injection molding PA 6 in the country

12.2.4 SOUTH KOREA

12.2.4.1 High demand from the electrical & electronic industry is likely to propel the demand for injection molding PA 6

12.2.5 TAIWAN

12.2.5.1 The electrical & electronics segment dominated the injection molding PA 6 market in Taiwan

12.2.6 THAILAND

12.2.6.1 The well-established petrochemical industry in Thailand is contributing to the growth of the market

12.2.7 REST OF ASIA PACIFIC

12.2.7.1 The growing production of automotive and consumer electronics in the country is fueling the demand for injection molding PA 6

12.3 EUROPE

12.3.1 GERMANY

12.3.1.1 Germany is the leading consumer of injection molding polyamide 6 in Europe

12.3.2 FRANCE

12.3.2.1 Increased demand for polyamide 6 across end-use industries drive the market in France

12.3.3 UK

12.3.3.1 The growing automotive industry is fueling the market in the UK

12.3.4 ITALY

12.3.4.1 Presence of leading manufacturers fuel the market in Italy

12.3.5 BELGIUM

12.3.5.1 Growth of automotive industry and presence of leading players fuel the market in Belgium

12.3.6 SPAIN

12.3.6.1 The automotive industry is driving the injection molding polyamide 6 market in Spain

12.3.7 REST OF EUROPE

12.4 NORTH AMERICA

12.4.1 US

12.4.1.1 Increasing demand from the automotive industry is propelling the US market

12.4.2 MEXICO

12.4.2.1 High export of electronics products is generating a demand for injection molding polyamide 6 in the country

12.4.3 CANADA

12.4.3.1 Demand from automotive OEMs is driving demand for injection molding polyamide 6 in the country

12.5 MIDDLE EAST & AFRICA

12.5.1 SAUDI ARABIA

12.5.1.1 Increasing population and urbanization are expected to drive the market in the country

12.5.2 SOUTH AFRICA

12.5.2.1 High demand for injection molding PA 6 in the automotive industry is driving the market

12.5.3 REST OF MIDDLE EAST & AFRICA

12.6 SOUTH AMERICA

12.6.1 BRAZIL

12.6.1.1 Easy availability of resources and government initiatives are driving the market in the country

12.6.2 ARGENTINA

12.6.2.1 Increased vehicles sales fuel the market for injection molding polyamide 6

12.6.3 REST OF SOUTH AMERICA

12.6.3.1 Demographic shifts and urbanization are expected to increase the demand from end-use industries

13 COMPETITIVE LANDSCAPE (Page No. - 129)

13.1 OVERVIEW

13.2 MARKET EVALUATION FRAMEWORK

13.3 MARKET SHARE ANALYSIS

13.3.1 MARKET SHARE ANALYSIS OF TOP PLAYERS IN INJECTION MOLDING POLYAMIDE 6 MARKET

13.3.2 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS IN THE INJECTION MOLDING POLYAMIDE 6 MARKET

13.4 COMPANY EVALUATION QUADRANT MATRIX DEFINITIONS AND METHODOLOGY, 2019

13.4.1 STAR

13.4.2 EMERGING LEADERS

13.4.3 PERVASIVE

13.4.4 PARTICIPANTS

13.5 STRENGTH OF PRODUCT PORTFOLIO

13.6 BUSINESS STRATEGY EXCELLENCE

13.7 SME MATRIX, 2019

13.7.1 STAR

13.7.2 EMERGING COMPANIES

13.7.3 PERVASIVE

13.7.4 EMERGING LEADERS

13.8 KEY MARKET DEVELOPMENTS

14 COMPANY PROFILES (Page No. - 145)

14.1 DSM

14.1.1 BUSINESS OVERVIEW

14.1.2 PRODUCTS OFFERED

14.1.3 RECENT DEVELOPMENTS

14.1.4 MNM VIEW

14.1.4.1 Key strengths/right to win

14.1.4.2 Strategic choices made

14.1.4.3 Weaknesses and competitive threats

14.1.5 IMPACT OF COVID-19

14.2 BASF SE

14.2.1 BUSINESS OVERVIEW

14.2.2 PRODUCTS OFFERED

14.2.3 RECENT DEVELOPMENTS

14.2.4 MNM VIEW

14.2.4.1 Key strengths/right to win

14.2.4.2 Strategic choices made

14.2.4.3 Weaknesses and competitive threats

14.3 DOMO CHEMICALS

14.3.1 BUSINESS OVERVIEW

14.3.2 PRODUCTS OFFERED

14.3.3 RECENT DEVELOPMENTS

14.3.4 IMPACT OF COVID-19

14.3.5 MNM VIEW

14.3.5.1 Key strengths/right to win

14.3.5.2 Strategic choices made

14.3.5.3 Weaknesses and competitive threats

14.4 RADICI GROUP

14.4.1 BUSINESS OVERVIEW

14.4.2 PRODUCTS OFFERED

14.4.3 RECENT DEVELOPMENTS

14.4.4 MNM VIEW

14.4.4.1 Key strengths/right to win

14.4.4.2 Strategic choices made

14.4.4.3 Weaknesses and competitive threats

14.4.5 IMPACT OF COVID-19

14.5 LANXESS CORPORATION

14.5.1 PRODUCTS OFFERED

14.5.2 RECENT DEVELOPMENTS

14.5.3 MNM VIEW

14.5.3.1 Key strengths/right to win

14.5.3.2 Strategic choices made

14.5.3.3 Weaknesses and competitive threats

14.6 TORAY INDUSTRIES, INC.

14.6.1 BUSINESS OVERVIEW

14.6.2 PRODUCTS OFFERED

14.6.3 RECENT DEVELOPMENTS

14.7 SABIC

14.7.1 BUSINESS OVERVIEW

14.7.2 PRODUCTS OFFERED

14.7.3 RECENT DEVELOPMENTS

14.8 RTP COMPANY

14.8.1 BUSINESS OVERVIEW

14.8.2 PRODUCTS OFFERED

14.8.3 RECENT DEVELOPMENTS

14.9 UBE INDUSTRIES LIMITED

14.9.1 BUSINESS OVERVIEW

14.9.2 PRODUCTS OFFERED

14.9.3 RECENT DEVELOPMENTS

14.9.4 IMPACT OF COVID-19

14.10 DUPONT

14.10.1 BUSINESS OVERVIEW

14.10.2 PRODUCTS OFFERED

14.10.3 RECENT DEVELOPMENTS

14.11 ADVANSIX

14.11.1 BUSINESS OVERVIEW

14.11.2 PRODUCTS OFFERED

14.11.3 RECENT DEVELOPMENTS

14.12 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.

14.12.1 BUSINESS OVERVIEW

14.12.2 PRODUCTS OFFERED

14.12.3 RECENT DEVELOPMENTS

14.13 ADDIPLAST GROUP

14.13.1 BUSINESS OVERVIEW

14.13.2 PRODUCTS OFFERED

14.13.3 RECENT DEVELOPMENTS

14.14 GRUPA AZOTY

14.14.1 BUSINESS OVERVIEW

14.14.2 PRODUCTS OFFERED

14.14.3 RECENT DEVELOPMENTS

14.15 OTHER COMPANIES

14.15.1 AD MAJORIS

14.15.2 ADELL PLASTICS INC.

14.15.3 AKAY PLASTIK

14.15.4 SHANGHAI PRET COMPOSITES CO.LTD.

14.15.5 YUH-DEAN ENTERPRISE CO., LTD.

15 APPENDIX (Page No. - 175)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

LIST OF TABLES (158 TABLES)

TABLE 1 APPLICATIONS OF PA 6 IN AUTOMOTIVE INDUSTRY

TABLE 2 COMMON SUBSTITUTE TO INJECTION MOLDING PA 6 AND THEIR APPLICATIONS

TABLE 3 INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (KILOTONS)

TABLE 4 INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (USD MILLION)

TABLE 5 INJECTION MOLDING POLYAMIDE 6 MARKET IN REINFORCED PA6 GRADE, BY REGION, 2018–2025 (USD MILLION)

TABLE 6 INJECTION MOLDING POLYAMIDE 6 MARKET SIZE IN REINFORCED PA6, BY REGION, 2018–2025 (KILOTONS)

TABLE 7 INJECTION MOLDING POLYAMIDE 6 MARKET SIZE IN UNREINFORCED PA6, BY REGION, 2018–2025 (USD MILLION)

TABLE 8 INJECTION MOLDING POLYAMIDE 6 MARKET SIZE IN UNREINFORCED PA6, BY REGION, 2018–2025 (KILOTONS)

TABLE 9 INJECTION MOLDING POLYAMIDE 6 MARKET SIZE IN OTHER PA6 GRADES, BY REGION, 2018–2025 (USD MILLION)

TABLE 10 INJECTION MOLDING POLYAMIDE 6 MARKET SIZE IN OTHER PA6 GRADES, BY REGION, 2018–2025 (KILOTONS)

TABLE 11 INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 12 INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTONS)

TABLE 13 APPLICATIONS OF INJECTION MOLDING UNREINFORCED PA 6 IN AUTOMOTIVE INDUSTRY

TABLE 14 APPLICATIONS OF INJECTION MOLDING REINFORCED PA 6 IN AUTOMOTIVE INDUSTRY

TABLE 15 INJECTION MOLDING POLYAMIDE 6 MARKET FOR AUTOMOTIVE, BY REGION, 2018–2025 (USD MILLION)

TABLE 16 INJECTION MOLDING POLYAMIDE 6 MARKET SIZE IN AUTOMOTIVE, BY REGION, 2018–2025 (KILOTONS)

TABLE 17 APPLICATION OF INJECTION MOLDING UNREINFORCED PA 6 IN ELECTRICAL & ELECTRONICS INDUSTRY

TABLE 18 APPLICATIONS OF INJECTION MOLDING REINFORCED PA 6 IN ELECTRICAL & ELECTRONICS INDUSTRY

TABLE 19 INJECTION MOLDING POLYAMIDE 6 MARKET SIZE FOR ELECTRICAL & ELECTRONICS, BY REGION, 2018–2025 (USD MILLION)

TABLE 20 INJECTION MOLDING POLYAMIDE 6 MARKET SIZE FOR ELECTRICAL & ELECTRONICS, BY REGION, 2018–2025 (KILOTONS)

TABLE 21 APPLICATIONS OF INJECTION MOLDING UNREINFORCED PA 6 IN INDUSTRIAL/MACHINERY INDUSTRY

TABLE 22 APPLICATIONS OF INJECTION MOLDING REINFORCED PA 6 IN INDUSTRIAL/MACHINERY INDUSTRY

TABLE 23 INJECTION MOLDING POLYAMIDE 6 MARKET FOR INDUSTRIAL/MACHINERY, BY REGION, 2018–2025 (USD MILLION)

TABLE 24 INJECTION MOLDING POLYAMIDE 6 MARKET FOR INDUSTRIAL/MACHINERY, BY REGION, 2018–2025 (KILOTONS)

TABLE 25 APPLICATION OF INJECTION MOLDING UNREINFORCED PA 6 IN CONSUMER GOODS & APPLIANCES INDUSTRY

TABLE 26 APPLICATIONS OF INJECTION MOLDING REINFORCED PA 6 IN CONSUMER GOODS & APPLIANCES INDUSTRY

TABLE 27 INJECTION MOLDING POLYAMIDE 6 MARKET FOR CONSUMER GOODS & APPLIANCES, BY REGION, 2018–2025 (USD MILLION)

TABLE 28 INJECTION MOLDING POLYAMIDE 6 MARKET FOR CONSUMER GOODS & APPLIANCES, BY REGION, 2018–2025 (KILOTONS)

TABLE 29 EXTERIOR APPLICATIONS OF INJECTION MOLDING PA 6 IN CONSTRUCTION INDUSTRY

TABLE 30 APPLICATIONS OF INJECTION MOLDING PA 6 IN CONSTRUCTION INDUSTRY

TABLE 31 OTHER APPLICATIONS OF INJECTION MOLDING PA 6 IN CONSTRUCTION INDUSTRY

TABLE 32 INJECTION MOLDING POLYAMIDE 6 MARKET SIZE FOR CONSTRUCTION, BY REGION, 2018–2025 (USD MILLION)

TABLE 33 INJECTION MOLDING POLYAMIDE 6 MARKET FOR CONSTRUCTION, BY REGION, 2018–2025 (KILOTONS)

TABLE 34 INJECTION MOLDING POLYAMIDE 6 MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2025 (USD MILLION)

TABLE 35 INJECTION MOLDING POLYAMIDE 6 MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2025 (KILOTONS)

TABLE 36 INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 37 INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY REGION, 2018–2025 (KILOTONS)

TABLE 38 ASIA PACIFIC: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 39 ASIA PACIFIC: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTONS)

TABLE 40 ASIA PACIFIC: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (USD MILLION)

TABLE 41 ASIA PACIFIC: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (KILOTONS)

TABLE 42 MAJOR CHINESE PLAYERS PRODUCING CAPROLACTAM AND RELATED TECHNOLOGIES

TABLE 43 CHINA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 44 CHINA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTONS)

TABLE 45 CHINA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (USD MILLION)

TABLE 46 CHINA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (KILOTONS)

TABLE 47 JAPAN: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 48 JAPAN: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTONS)

TABLE 49 JAPAN: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (USD MILLION)

TABLE 50 JAPAN: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (KILOTONS)

TABLE 51 INDIA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 52 INDIA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTONS)

TABLE 53 INDIA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (USD MILLION)

TABLE 54 INDIA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (KILOTONS)

TABLE 55 SOUTH KOREA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 56 SOUTH KOREA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTONS)

TABLE 57 SOUTH KOREA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (USD MILLION)

TABLE 58 SOUTH KOREA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (KILOTONS)

TABLE 59 TAIWAN: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 60 TAIWAN: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTONS)

TABLE 61 TAIWAN: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (USD MILLION)

TABLE 62 TAIWAN: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (KILOTONS)

TABLE 63 THAILAND: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 64 THAILAND: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTONS)

TABLE 65 THAILAND: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (USD MILLION)

TABLE 66 THAILAND: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (KILOTONS)

TABLE 67 REST OF ASIA PACIFIC: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 68 REST OF ASIA PACIFIC: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTONS)

TABLE 69 REST OF ASIA PACIFIC: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (USD MILLION)

TABLE 70 REST OF ASIA PACIFIC: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (KILOTONS)

TABLE 71 EUROPE: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 72 EUROPE: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTONS)

TABLE 73 EUROPE: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (USD MILLION)

TABLE 74 EUROPE: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (KILOTONS)

TABLE 75 GERMANY INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 76 GERMANY: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTONS)

TABLE 77 GERMANY: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (USD MILLION)

TABLE 78 GERMANY: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (KILOTONS)

TABLE 79 FRANCE INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 80 FRANCE: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTONS)

TABLE 81 FRANCE: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (USD MILLION)

TABLE 82 FRANCE: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (KILOTONS)

TABLE 83 UK INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 84 UK: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTONS)

TABLE 85 UK: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (USD MILLION)

TABLE 86 UK: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (KILOTONS)

TABLE 87 ITALY INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 88 ITALY: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTONS)

TABLE 89 ITALY: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (USD MILLION)

TABLE 90 ITALY: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (KILOTONS)

TABLE 91 BELGIUM INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 92 BELGIUM: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTONS)

TABLE 93 BELGIUM: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (USD MILLION)

TABLE 94 BELGIUM: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (KILOTONS)

TABLE 95 SPAIN INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 96 SPAIN: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTONS)

TABLE 97 SPAIN: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (USD MILLION)

TABLE 98 SPAIN: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (KILOTONS)

TABLE 99 REST OF EUROPE INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 100 REST OF EUROPE INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTONS)

TABLE 101 REST OF EUROPE INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (USD MILLION)

TABLE 102 REST OF EUROPE INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (KILOTONS)

TABLE 103 NORTH AMERICA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 104 NORTH AMERICA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTONS)

TABLE 105 NORTH AMERICA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (USD MILLION)

TABLE 106 NORTH AMERICA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (KILOTONS)

TABLE 107 US: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 108 US: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTONS)

TABLE 109 US: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (USD MILLION)

TABLE 110 US: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (KILOTONS)

TABLE 111 MEXICO: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 112 MEXICO: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTONS)

TABLE 113 MEXICO: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (USD MILLION)

TABLE 114 MEXICO: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (KILOTONS)

TABLE 115 CANADA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 116 CANADA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTONS)

TABLE 117 CANADA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (USD MILLION)

TABLE 118 CANADA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (KILOTONS)

TABLE 119 MIDDLE EAST & AFRICA INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 120 MIDDLE EAST & AFRICA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTONS)

TABLE 121 MIDDLE EAST & AFRICA: INJECTION MOLDING POLYAMIDE 6MARKET SIZE, BY GRADE, 2018–2025 (USD MILLION)

TABLE 122 MIDDLE EAST & AFRICA: INJECTION MOLDING POLYAMIDE 6MARKET SIZE, BY GRADE, 2018–2025 (KILOTONS)

TABLE 123 SAUDI ARABIA INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 124 SAUDI ARABIA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTONS)

TABLE 125 SAUDI ARABIA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (USD MILLION)

TABLE 126 SAUDI ARABIA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (KILOTONS)

TABLE 127 SOUTH AFRICA INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 128 SOUTH AFRICA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTONS)

TABLE 129 SOUTH AFRICA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (USD MILLION)

TABLE 130 SOUTH AFRICA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (KILOTONS)

TABLE 131 REST OF MIDDLE EAST & AFRICA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 132 REST OF MIDDLE EAST & AFRICA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTONS)

TABLE 133 REST OF MIDDLE EAST & AFRICA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (USD MILLION)

TABLE 134 REST OF MIDDLE EAST & AFRICA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (KILOTONS)

TABLE 135 SOUTH AMERICA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 136 SOUTH AMERICA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTONS)

TABLE 137 SOUTH AMERICA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 138 SOUTH AMERICA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTONS)

TABLE 139 SOUTH AMERICA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (USD MILLION)

TABLE 140 SOUTH AMERICA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (KILOTONS)

TABLE 141 BRAZIL: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 142 BRAZIL: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTONS)

TABLE 143 BRAZIL: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (USD MILLION)

TABLE 144 BRAZIL: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (KILOTONS)

TABLE 145 ARGENTINA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 146 ARGENTINA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTONS)

TABLE 147 ARGENTINA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (USD MILLION)

TABLE 148 ARGENTINA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (KILOTONS)

TABLE 149 REST OF SOUTH AMERICA INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 150 REST OF SOUTH AMERICA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTONS)

TABLE 151 REST OF SOUTH AMERICA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (USD MILLION)

TABLE 152 REST OF SOUTH AMERICA: INJECTION MOLDING POLYAMIDE 6 MARKET SIZE, BY GRADE, 2018–2025 (KILOTONS)

TABLE 153 EXPANSIONS, 2017–2020

TABLE 154 NEW PRODUCT LAUNCHES, 2017–2020

TABLE 155 PRODUCT DEVELOPMENTS, 2017–2020

TABLE 156 PARTNERSHIPS, 2017–2020

TABLE 157 ACQUISITIONS, 2017–2020

TABLE 158 MERGERS, 2017–2020

LIST OF FIGURES (41 FIGURES)

FIGURE 1 INJECTION MOLDING POLYAMIDE 6 MARKET SEGMENTATION

FIGURE 2 INJECTION MOLDING POLYAMIDE 6 MARKET: RESEARCH DESIGN

FIGURE 3 PRIMARY AND SECONDARY RESEARCH ESTIMATION

FIGURE 4 INJECTION MOLDING POLYAMIDE 6 MARKET: BOTTOM-UP APPROACH

FIGURE 5 INJECTION MOLDING POLYAMIDE 6 MARKET: TOP-DOWN APPROACH

FIGURE 6 INJECTION MOLDING POLYAMIDE 6 MARKET: DATA TRIANGULATION

FIGURE 7 AUTOMOTIVE SEGMENT EXPECTED TO LEAD INJECTION MOLDING POLYAMIDE 6 MARKET FROM 2020 TO 2025

FIGURE 8 REINFORCED POLYAMIDE 6 SEGMENT PROJECTED TO GROW AT THE HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 9 ASIA PACIFIC EXPECTED TO BE THE FASTEST-GROWING MARKET FOR INJECTION MOLDING POLYAMIDE 6 DURING FORECAST PERIOD

FIGURE 10 GROWING AUTOMOTIVE INDUSTRY EXPECTED TO DRIVE THE MARKET FOR INJECTION MOLDING PA 6 DURING FORECAST PERIOD

FIGURE 11 AUTOMOTIVE SEGMENT EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 12 UNREINFORCED SEGMENT PROJECTED TO LEAD INJECTION MOLDING POLYAMIDE 6 MARKET DURING FORECAST PERIOD

FIGURE 13 INJECTION MOLDING POLYAMIDE 6 MARKET IN ASIA PACIFIC EXPECTED TO GROW AT THE HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 14 ELECTRICAL & ELECTRONICS SEGMENT ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF INJECTION MOLDING POLYAMIDE 6 MARKET IN ASIA PACIFIC IN 2020

FIGURE 15 INJECTION MOLDING POLYAMIDE 6 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 16 INJECTION MOLDING POLYAMIDE 6 MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 17 VALUE CHAIN ANALYSIS FOR POLYAMIDE 6

FIGURE 18 ASSESMENT OF ASIA PACIFIC INJECTION MOLDING POLYAMIDE 6 MARKET

FIGURE 19 INJECTION MOLDING PROCESS

FIGURE 20 REINFORCED PA6 EXPECTED TO LEAD INJECTION MOLDING POLYAMIDE 6 MARKET DURING FORECAST PERIOD

FIGURE 21 AUTOMOTIVE INDUSTRY EXPECTED TO LEAD INJECTION MOLDING POLYAMIDE 6 MARKET DURING THE FORECAST PERIOD

FIGURE 22 CHINA ACCOUNTED FOR THE LARGEST SHARE OF INJECTION MOLDING POLYAMIDE 6 MARKET IN 2019

FIGURE 23 ASIA PACIFIC: INJECTION MOLDING POLYAMIDE 6 MARKET SNAPSHOT

FIGURE 24 EUROPE: INJECTION MOLDING POLYAMIDE 6 MARKET SNAPSHOT

FIGURE 25 NORTH AMERICA: INJECTION MOLDING POLYAMIDE 6 MARKET SNAPSHOT

FIGURE 26 COMPANIES ADOPTED ORGANIC AND INORGANIC GROWTH STRATEGIES BETWEEN JANUARY 2017 AND SEPTEMBER 2020

FIGURE 27 MARKET EVALUATION FRAMEWORK: 2020 SAW CAPACITY EXPANSIONS LEADING THIS SPACE

FIGURE 28 LEADING PLAYERS IN INJECTION MOLDING POLYAMIDE 6 MARKET

FIGURE 29 INJECTION MOLDING POLYAMIDE 6 MARKET: COMPETITIVE LANDSCAPE MAPPING, 2019

FIGURE 30 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN INJECTION MOLDING POLYAMIDE 6 MARKET

FIGURE 31 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN INJECTION MOLDING POLYAMIDE 6 MARKET

FIGURE 32 INJECTION MOLDING POLYAMIDE 6 MARKET: EMERGING COMPANIES COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 33 DSM: COMPANY SNAPSHOT

FIGURE 34 BASF SE: COMPANY SNAPSHOT

FIGURE 35 LANXESS CORPORATION: COMPANY SNAPSHOT

FIGURE 36 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

FIGURE 37 SABIC: COMPANY SNAPSHOT

FIGURE 38 UBE INDUSTRIES LIMITED: COMPANY SNAPSHOT

FIGURE 39 DUPONT: COMPANY SNAPSHOT

FIGURE 40 ADVANSIX: COMPANY SNAPSHOT

FIGURE 41 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.: COMPANY SNAPSHOT

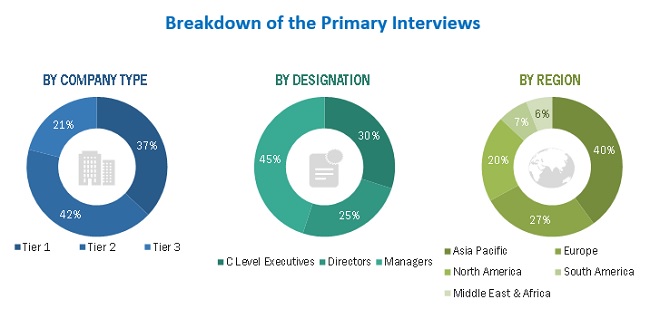

The study involved four major activities in estimating the current size of the injection molding polyamide 6 market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the injection molding polyamide 6 value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this study include Hoovers, Bloomberg, BusinessWeek, and Dun & Bradstreet, which were referred for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles by recognized authors, authenticated directories, and databases. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research.

Primary Research

The injection molding polyamide 6 market comprises several stakeholders, such as raw material suppliers, manufacturers, distributors, service providers, end-product manufacturers, and regulatory organizations in the supply chain.

As part of the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report on the injection molding polyamide 6 market. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the injection molding polyamide 6 market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various end-use industries.

To know about the assumptions considered for the study, download the pdf brochure

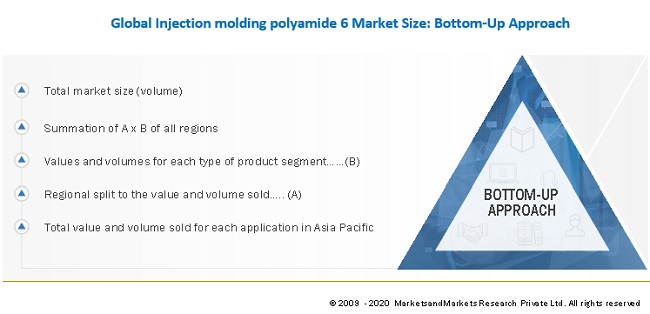

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the injection molding polyamide 6 market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the injection molding polyamide 6 market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition to this, the market size was validated using both top-down and bottom-up approaches.

Report Objectives

Market Intelligence

- To determine and project the size of the injection molding polyamide 6 market with respect to type, end-use industry, and region, over five years, from 2020 to 2025

- To identify attractive opportunities in the market by determining the largest and the fastest-growing segments across key regions

- To project the size of the market segments, in terms of value and volume, with respect to six regions: Asia Pacific, North America, Europe, the Middle East, Africa, and South America

- To provide detailed information regarding the crucial factors influencing the growth of the market (drivers, opportunities, restraints, and challenges)

- To analyze competitive developments, such as business & capacity expansions, new product launches, product developments, partnerships, acquisitions, R&D expansions and mergers in the injection molding polyamide 6 market

- To analyze the demand-side factors based on the impact of macroeconomic and microeconomic factors on different segments of the market across different regions

Competitive Intelligence

- To identify and profile key players in the injection molding polyamide 6 market

- To determine the market share of key players operating in the market

- To provide a comparative analysis of market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- To understand the competitive landscape of the market and identify key growth strategies adopted by the leading players across key regions

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Further country-level breakdown of the Rest of Europe into Denmark, Poland, the Netherlands, Switzerland, Sweden, Russia, and Turkey in the injection molding polyamide 6 market

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Growth opportunities and latent adjacency in Injection Molding Polyamide 6 Market