InGaAs Camera Market by Camera Cooling technology (Cooled camera, Uncooled Camera), Scanning Type (Area Scan Camera, Line Scan Camera), Application (Military & Defense, Industrial Automation, Scientific Research), and Geography - Global Forecast to (2025-2035)

InGaAs Camera Market Forecast 2025 to 2035

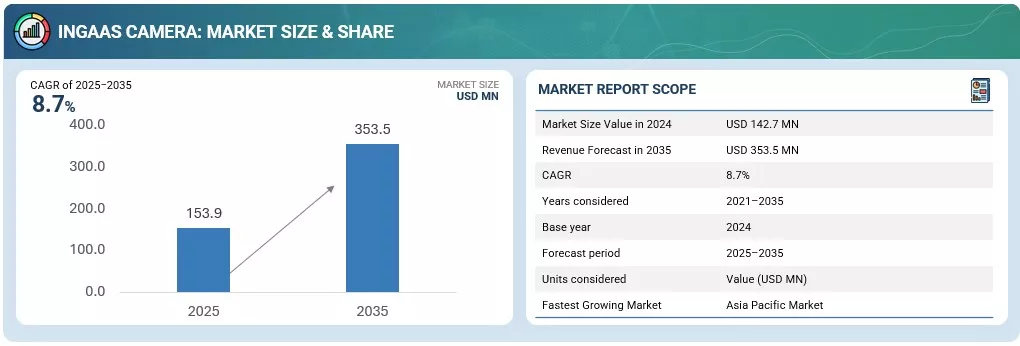

The global InGaAs Camera market was valued at USD 142.7 million in 2024 and is estimated to reach USD 353.5 million by 2035, at a CAGR of 8.7% between 2025 and 2035.

The global Indium Gallium Arsenide or InGaAs camera market is poised for substantial growth during the forecast period from 2025 to 2035 driven by rapid technological advancements across imaging and sensing applications. InGaAs cameras are highly sensitive to near infrared light typically in the range of 900 nm to 1700 nm which makes them an indispensable tool for a wide range of applications including military and defense industrial automation and scientific research. The increasing demand for high performance imaging solutions in these sectors coupled with advancements in sensor design manufacturing and processing technologies is expected to propel market expansion.

The InGaAs camera market is witnessing a rising interest in shortwave infrared or SWIR imaging which enables users to capture high contrast images in low light or challenging atmospheric conditions. Unlike conventional silicon based cameras InGaAs cameras can detect wavelengths beyond visible light thereby offering superior detection capabilities for various industrial and security applications. Growing emphasis on automation quality inspection and advanced surveillance is boosting adoption across both government and commercial sectors.

Market Overview and Key Drivers

The global market for InGaAs cameras is being influenced by several factors such as the increasing need for non destructive testing high speed inspection and scientific imaging. Industries such as semiconductors electronics aerospace defense food and beverage and medical diagnostics are integrating these cameras to enhance process accuracy and reliability. In the defense sector the deployment of InGaAs cameras in night vision systems target acquisition and surveillance has become increasingly significant due to their ability to operate efficiently under low visibility conditions.

Another major growth driver is the rising use of InGaAs cameras in industrial automation where they are utilized for machine vision applications including material inspection product sorting defect detection and process monitoring. The cameras’ capability to identify materials based on chemical composition moisture content or thermal behavior provides a strong competitive advantage for industrial manufacturers seeking precision and efficiency. Moreover the advent of AI based imaging solutions and the integration of InGaAs cameras with machine learning algorithms are transforming industrial and scientific applications.

In research institutions and laboratories InGaAs cameras are playing a vital role in spectroscopy fluorescence imaging and optical coherence tomography. Their ability to deliver highly accurate data in near infrared wavelengths makes them ideal for advanced scientific research particularly in physics chemistry biology and material sciences. In addition increasing investments in space research and astronomy are further expanding the market since InGaAs cameras are often used for celestial imaging and satellite payload systems.

By Camera Cooling Technology

The InGaAs camera market is segmented based on camera cooling technology into cooled and uncooled cameras. Each type offers distinct advantages depending on the application and performance requirements.

Cooled InGaAs cameras are equipped with thermoelectric or cryogenic cooling systems that minimize sensor noise and enhance image quality even in extremely low light environments. These cameras are primarily used in scientific research spectroscopy and defense applications where superior sensitivity and precision are required. The cooling mechanism allows for long exposure times without increasing dark current noise thus delivering high fidelity imaging. However the complexity and cost of cooled systems limit their use in commercial or cost sensitive applications. Despite this limitation the scientific community continues to prefer cooled InGaAs cameras due to their unmatched accuracy and stability.

Uncooled InGaAs cameras on the other hand have gained popularity in industrial and commercial sectors due to their lower cost compact design and ease of integration. These cameras do not require additional cooling systems which reduces maintenance and energy consumption. Uncooled technology has evolved rapidly over the past decade allowing manufacturers to produce high performance devices suitable for real time inspection and process monitoring. As automation continues to grow in manufacturing and logistics the demand for uncooled InGaAs cameras is expected to rise significantly. They offer a practical balance between performance and affordability making them an ideal choice for production line quality control and environmental monitoring.

The advancement in sensor materials and fabrication technologies has narrowed the performance gap between cooled and uncooled InGaAs cameras. New innovations in low noise uncooled detectors are providing competitive alternatives to traditional cooled models in many fields thereby expanding market accessibility and encouraging broader adoption across emerging economies.

By Scanning Type

Based on scanning type the market is divided into area scan cameras and line scan cameras. Each serves specific applications and operational requirements in imaging systems.

Area scan InGaAs cameras capture a two dimensional image in a single exposure making them suitable for applications where the entire field of view needs to be captured simultaneously. These cameras are widely used in surveillance microscopy and scientific imaging. Their ability to generate high resolution images across a defined area makes them ideal for tasks like precision inspection object recognition and automated analysis. In industrial environments area scan cameras are integrated with robotic systems for component alignment quality verification and defect detection. The integration of SWIR imaging with area scan capabilities enables better identification of concealed features and contaminants that are not visible under standard illumination.

Line scan InGaAs cameras on the other hand capture one line of an image at a time which is then reconstructed to form a complete picture. This type of camera is particularly useful for continuous processes such as conveyor belt inspection web inspection and hyperspectral imaging. Industries such as textiles pharmaceuticals and semiconductor manufacturing rely on line scan cameras for high speed accurate inspection of moving materials. They offer unmatched performance in detecting small variations and defects during production ensuring high quality output. The increasing automation in manufacturing and the need for faster inspection cycles are boosting the adoption of line scan InGaAs cameras across various industries.

Technological advancements are also enhancing the functionality of both area and line scan cameras. Integration with machine vision systems AI and cloud based analytics enables real time monitoring predictive maintenance and enhanced decision making. As a result the demand for both scanning types is projected to rise steadily throughout the forecast period.

By Application

The InGaAs camera market is segmented by application into military and defense industrial automation and scientific research. Each of these segments demonstrates distinct trends and growth opportunities.

In the military and defense segment InGaAs cameras are essential for surveillance reconnaissance and target tracking in low light or adverse weather conditions. The ability of these cameras to detect objects based on heat and reflectivity in the near infrared range provides a tactical advantage on the battlefield. They are used in border security missile guidance systems night vision devices and unmanned aerial vehicles. Governments around the world are investing heavily in advanced imaging systems for national security which is expected to fuel growth in this segment. Additionally the miniaturization of sensors and the development of lightweight compact InGaAs modules have broadened their use in portable and drone based applications.

The industrial automation segment represents another key area of growth for the InGaAs camera market. As industries move towards smart manufacturing and Industry 4.0 solutions the integration of machine vision technologies has become critical. InGaAs cameras are used in sorting inspection and quality control processes where conventional cameras fall short due to limited wavelength sensitivity. For example in the semiconductor industry these cameras assist in wafer inspection and contamination detection while in the food industry they help identify bruised or spoiled products. Their ability to analyze material composition using shortwave infrared imaging supports sustainable and efficient production practices.

In scientific research InGaAs cameras are used extensively in spectroscopy biomedical imaging astronomy and materials science. They provide high sensitivity and dynamic range which are essential for capturing precise data during experiments. Research institutions rely on these cameras for studying molecular interactions optical coherence tomography and environmental monitoring. The growing emphasis on renewable energy particularly in solar cell research is also driving demand as InGaAs cameras are used to analyze photovoltaic materials and performance. Furthermore the emergence of hyperspectral imaging and quantum optics research has expanded the scope of scientific applications where these cameras play a crucial role.

Geographical Analysis

Geographically the InGaAs camera market spans North America Europe Asia Pacific Latin America and the Middle East and Africa. Each region presents unique growth drivers and market dynamics.

North America holds a dominant position in the global market due to strong demand from defense research and industrial sectors. The presence of leading manufacturers research institutions and technological innovators has established a robust ecosystem for InGaAs camera development. The US government’s investments in defense and space programs are further driving adoption. In addition the region’s strong focus on automation and quality assurance across industries such as semiconductors and aerospace contributes to sustained growth.

Europe is another significant market characterized by growing applications in scientific research and industrial automation. Countries such as Germany France and the United Kingdom are leading in manufacturing and process innovation. European research organizations and universities are also adopting InGaAs cameras for advanced imaging and spectroscopy applications. The region’s emphasis on environmental monitoring and renewable energy projects supports steady market expansion.

The Asia Pacific region is expected to experience the fastest growth during the forecast period due to rapid industrialization and technological advancement. Countries like China Japan South Korea and India are investing heavily in manufacturing automation defense modernization and research initiatives. The expanding semiconductor industry in this region is a major driver for InGaAs camera adoption. Additionally increasing government support for scientific research and infrastructure development is creating new opportunities for both local and international camera manufacturers.

Latin America and the Middle East and Africa are emerging markets with growing interest in industrial inspection and security applications. Although these regions currently hold a smaller market share rising awareness of the benefits of SWIR imaging and the need for enhanced surveillance capabilities are expected to stimulate demand in the coming years.

Technological Developments and Industry Trends

Technological innovations are shaping the future of the InGaAs camera market. Continuous improvements in sensor fabrication miniaturization and image processing are enhancing the performance and affordability of these cameras. Hybrid imaging technologies that combine visible and infrared sensors in a single device are becoming increasingly popular enabling versatile imaging solutions across multiple spectral ranges.

Integration with artificial intelligence and machine learning is revolutionizing data processing and analysis in real time applications. Smart cameras capable of autonomous defect detection pattern recognition and predictive maintenance are being deployed in manufacturing and logistics environments. Additionally the trend towards compact lightweight and energy efficient designs is encouraging broader adoption in portable devices and unmanned systems.

Another notable trend is the rise of hyperspectral and multispectral imaging where InGaAs cameras play a critical role in differentiating materials and substances based on their spectral signatures. This technology is gaining traction in agriculture mineral exploration and environmental science. Moreover advancements in connectivity such as USB 3.0 and GigE Vision interfaces are improving data transmission speed and compatibility with modern computing systems.

Market Outlook

From 2025 to 2035 the global InGaAs camera market is projected to witness significant growth driven by increasing investments in automation defense and research sectors. The demand for compact high performance cameras capable of operating across various environmental conditions will continue to rise. Cooled cameras will maintain a strong presence in high end applications while uncooled models are expected to dominate volume sales due to cost efficiency and versatility.

The market will also benefit from collaboration between camera manufacturers sensor developers and software companies to deliver integrated imaging solutions. As governments and industries focus on sustainable and intelligent technologies the use of InGaAs cameras in renewable energy agriculture and environmental monitoring will expand further.

Overall the InGaAs camera market stands at the intersection of technological innovation and industrial transformation. With continued research and product development the industry is expected to evolve rapidly offering enhanced imaging capabilities that will redefine how we see and analyze the world beyond the visible spectrum.

Market Key Players

Some of the major players in this market are Hamamatsu (Japan), First Sensor (Germany), Jenoptik (Germany), Teledyne Technologies (US), Luna (US), Lumentum (US), Laser Components (Germany), Albis Optoelectronics (Switzerland), Thorlabs (US), Sensors Unlimited (US), FLIR Systems (US), Xenics (Belgium), New Imaging Technologies (France), Allied Vision Technologies (Germany), Raptor Photonics (UK), Sofradir (France), Princeton Instruments (US), Photon (Canada), Fermionics Opto-Technology (US), AC Photonics (US), GPD Optoelectronics (US), New England Photoconductor (US), QPHOTONICS (US), Episensors (US), and IRCameras (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst of InGaAs Camera Market

FAQ

1. What is an InGaAs Camera?

Answer:

An InGaAs (Indium Gallium Arsenide) camera is a specialized imaging device designed to capture light in the short-wave infrared (SWIR) spectrum—typically in the 900 nm to 1700 nm range. Unlike standard silicon-based cameras, InGaAs cameras can detect objects in low-light or obscured environments, making them valuable in industrial inspection, defense, and medical diagnostics.

2. What are the major applications of InGaAs Cameras?

Answer:

InGaAs cameras are widely used in industrial automation, defense surveillance, scientific research, semiconductor inspection, agriculture monitoring, and medical imaging. Their ability to detect hidden defects and measure heat patterns makes them ideal for quality control and predictive maintenance.

3. Which factors are driving the growth of the InGaAs Camera Market?

Answer:

The market growth is driven by the increasing demand for high-performance imaging solutions, rising defense spending, growth in industrial automation, and technological advancements in SWIR imaging sensors. Additionally, the integration of AI and IoT in imaging systems is creating new revenue opportunities.

4. Who are the key players in the InGaAs Camera Market?

Answer:

Leading companies include Teledyne Technologies Incorporated, FLIR Systems, Inc., Hamamatsu Photonics K.K., Xenics NV, and Sensors Unlimited, Inc. These firms focus on R&D, product miniaturization, and AI-based imaging capabilities to strengthen their global presence.

5. What is the future outlook of the InGaAs Camera Market?

Answer:

The market is projected to grow significantly through 2030, driven by AI-enhanced machine vision, miniaturized SWIR cameras, and increasing use in agriculture and healthcare. North America currently leads the market, while Asia-Pacific is expected to witness the fastest CAGR due to expanding manufacturing and defense investments.

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities for Market

4.2 Market, By Scanning Type

4.3 Market, By Application

4.4 Global Market, By Application

4.5 Market, By Geography

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 High Demand for Line Scan InGaAs Cameras for Machine Vision Applications

5.2.1.2 High Penetration of InGaAs Cameras in Military and Defense

5.2.1.3 Increasing Demand for InGaAs Cameras in Security, Surveillance, and Firefighting

5.2.2 Restraints

5.2.2.1 Stringent Import and Export Regulations

5.2.3 Opportunities

5.2.3.1 Emerging Application Areas of InGaAs Cameras

5.2.4 Challenges

5.2.4.1 High Cost of InGaAs Cameras

5.3 Value Chain Analysis

6 InGaAs Detector Market (Page No. - 38)

6.1 Introduction

6.2 InGaAs Pin Photodiodes

6.3 InGaAs Linear Image Sensors

6.4 InGaAs Area Image Sensors

7 InGaAs Camera Market, By Camera Cooling Technology (Page No. - 40)

7.1 Introduction

7.2 Cooled Camera

7.3 Uncooled Camera

8 InGaAs Camera Market, By Scanning Type (Page No. - 45)

8.1 Introduction

8.2 Area Scan Camera

8.3 Line Scan Camera

9 InGaAs Camera Market, By Application (Page No. - 53)

9.1 Introduction

9.2 Military and Defense

9.3 Industrial Automation

9.4 Surveillance, Safety, and Security

9.5 Scientific Research

9.6 Others

10 Geographic Analysis (Page No. - 61)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 UK

10.3.2 Germany

10.3.3 France

10.3.4 Rest of Europe

10.4 APAC

10.4.1 China

10.4.2 Japan

10.4.3 South Korea

10.4.4 India

10.4.5 Rest of APAC

10.5 RoW

10.5.1 Middle East

10.5.2 South America

10.5.3 Africa

11 Competitive Landscape (Page No. - 83)

11.1 Introduction

11.2 Market Ranking Analysis, 2016

11.3 Competitive Scenario

11.3.1 Product Launches and Developments

11.3.2 Partnerships, Contracts, Acquisitions, and Agreements

12 Company Profiles (Page No. - 87)

12.1 Key Players

(Business Overview, Products Offered, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments, Key Relationships)*

12.1.1 Hamamatsu

12.1.2 First Sensor

12.1.3 Jenoptik

12.1.4 Teledyne Technologies

12.1.5 Luna Innovations

12.1.6 Lumentum Holdings

12.1.7 Laser Components

12.1.8 Albis Optoelectronics

12.1.9 Thorlabs

12.1.10 Sensors Unlimited

12.1.11 Flir

12.1.12 Xenics

12.1.13 New Imaging Technologies

12.1.14 Allied Vision Technologies

12.1.15 Raptor Photonics

12.1.16 Sofradir

12.1.17 Princeton Instruments

12.1.18 Photon

*Details on Business Overview, Products Offered, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments, Key Relationships Might Not Be Captured in Case of Unlisted Companies.

12.2 Key Innovators

12.2.1 Fermionics Opto-Technology

12.2.2 AC Photonics

12.2.3 GPD Optoelectronics

12.2.4 New England Photoconductor

12.2.5 Qphotonics

12.2.6 Episensors

12.2.7 Ircameras

12.3 Other Key Players

12.3.1 Roithner Lasertechnik

12.3.2 Excelitas

12.3.3 Discovery Semiconductors

12.3.4 Kyosemi Corporation

12.3.5 Cosemi Technologies

12.3.6 Voxtel

12.3.7 Necsel IP

12.3.8 Semiconductor Devices

12.3.9 Edmund Optics

12.3.10 Precision Micro-Optics

13 Appendix (Page No. - 143)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (63 Tables)

Table 1 Market, By Camera Cooling Technology, 2015–2023 (USD Million)

Table 2 Cooled InGaAs Camera Market, By Application, 2015–2023 (USD Million)

Table 3 Cooled InGaAs Camera Market, By Region, 2015–2023 (USD Million)

Table 4 Uncooled InGaAs Camera Market, By Application, 2015–2023 (USD Million)

Table 5 Uncooled InGaAs Camera Market, By Region, 2015–2023 (USD Million)

Table 6 Market, By Scanning Type, 2015–2023 (USD Million)

Table 7 Area Scan InGaAs Camera, By Region, 2015–2023 (USD Million)

Table 8 Area Scan InGaAs Camera in North America, By Country, 2015–2023 (USD Million)

Table 9 Area Scan InGaAs Camera in Europe, By Country, 2015–2023 (USD Million)

Table 10 Area Scan InGaAs Camera in APAC, By Country, 2015–2023 (USD Million)

Table 11 Area Scan InGaAs Camera in RoW, By Region, 2015–2023 (USD Million)

Table 12 Line Scan InGaAs Camera Market, By Region, 2015-2023 (USD Million)

Table 13 Line Scan InGaAs Camera in North America, By Country, 2015–2023 (USD Million)

Table 14 Line Scan InGaAs Camera in Europe, By Country, 2015–2023 (USD Million)

Table 15 Line Scan InGaAs Camera in APAC, By Country, 2015–2023 (USD Million)

Table 16 Line Scan InGaAs Camera in RoW, By Region, 2015–2023 (USD Million)

Table 17 Market, By Application, 2015–2023 (USD Million)

Table 18 Market for Military and Defense, By Region, 2015—2023 (USD Million)

Table 19 Market for Military and Defense, By Scanning Type, 2015–2023 (USD Million)

Table 20 Market for Industrial Automation, By Region, 2015–2023 (USD Million)

Table 21 Market for Industrial Automation, By Scanning Type, 2015–2023 (USD Million)

Table 22 Market for Surveillance, Safety, and Security, By Region, 2015–2023 (USD Million)

Table 23 Market for Surveillance, Safety, and Security, By Scanning Type, 2015–2023 (USD Million)

Table 24 Market for Scientific Research, By Region, 2015–2023 (USD Million)

Table 25 Market for Scientific Research, By Scanning Type, 2015–2023 (USD Million)

Table 26 Market for Others, By Region, 2015–2023 (USD Million)

Table 27 Market for Others, By Scanning Type, 2015–2023 (USD Million)

Table 28 Market, By Region, 2015-2023 (USD Million)

Table 29 Market in North America, By Country, 2015–2023 (USD Million)

Table 30 Market in North America, By Application, 2015–2023 (USD Million)

Table 31 Market in North America, By Camera Cooling Technology, 2015–2023 (USD Million)

Table 32 Market in North America, By Scanning Type, 2015–2023 (USD Million)

Table 33 Market in US, By Scanning Type, 2015–2023 (USD Million)

Table 34 Market in Canada, By Scanning Type, 2015–2023 (USD Million)

Table 35 Market in Mexico, By Scanning Type, 2015–2023 (USD Million)

Table 36 Market in Europe, By Country, 2015–2023 (USD Million)

Table 37 Market in Europe, By Application, 2015–2023 (USD Million)

Table 38 Market in Europe, By Camera Cooling Technology, 2015–2023 (USD Million)

Table 39 Market in Europe, By Scanning Type, 2015–2023 (USD Million)

Table 40 Market in UK, By Scanning Type, 2015–2023 (USD Million)

Table 41 Market in Germany, By Scanning Type, 2015–2023 (USD Million)

Table 42 Market in France, By Scanning Type, 2015–2023 (USD Million)

Table 43 Market in RoE, By Scanning Type, 2015–2023 (USD Million)

Table 44 Market in APAC, By Country, 2015–2023 (USD Million)

Table 45 Market in APAC, By Application, 2015–2023 (USD Million)

Table 46 Market in APAC, By Camera Cooling Technology, 2015–2023 (USD Million)

Table 47 Market in APAC, By Scanning Type, 2015–2023 (USD Million)

Table 48 Market in China, By Scanning Type, 2015–2023 (USD Million)

Table 49 Market in Japan, By Scanning Type, 2015–2023 (USD Million)

Table 50 Market in South Korea, By Scanning Type, 2015–2023 (USD Million)

Table 51 Market in India, By Scanning Type, 2015–2023 (USD Million)

Table 52 Market in India, By Scanning Type, 2015–2023 (USD Million)

Table 53 Market in RoW, By Country, 2015–2023 (USD Million)

Table 54 Market in RoW, By Application, 2015–2023 (USD Million)

Table 55 Market in RoW, By Camera Cooling Technology, 2015–2023 (USD Million)

Table 56 Market in RoW, By Scanning Type, 2015–2023 (USD Million)

Table 57 Market in Middle East, By Scanning Type, 2015–2023 (USD Million)

Table 58 Market in South America, By Scanning Type, 2015–2023 (USD Million)

Table 59 Market in Africa, By Scanning Type, 2015–2023 (USD Thousand)

Table 60 InGaAs Detector Manufacturers

Table 61 InGaAs Camera Manufacturers

Table 62 5 Most Recent Product Launches in Market

Table 63 Partnerships, Contracts, Acquisitions, and Agreements in the Market

List of Figures (42 Figures)

Figure 1 Market: Segmentation

Figure 2 Market: Research Design

Figure 3 Bottom-Up Approach to Arrive at Market Size

Figure 4 Top-Down Approach to Arrive at Market Size

Figure 5 Data Triangulation

Figure 6 Assumptions of the Research Study

Figure 7 Market Snapshot (2015–2023)

Figure 8 Market, By Scanning Type, 2015–2023

Figure 9 Market, By Cooling Technology, 2015–2023

Figure 10 Uncooled InGaAs Camera Market Expected to Grow at Highest CAGR During Forecast Period

Figure 11 Military and Defence to Lead the Market By Application in 2023

Figure 12 Market, By Region

Figure 13 Military and Defense to Drive Growth of Market During Forecast Period

Figure 14 Area Scan Camera Expected to Hold Larger Share of Market By 2023

Figure 15 Military and Defense Expected to Hold Largest Share of Market During Forecast Period

Figure 16 China to Register Highest Market Share in 2017

Figure 17 APAC Expected to Register Highest CAGR in this Market Between 2017 and 2023

Figure 18 Drivers, Restraints, Opportunities, & Challenges in this Market

Figure 19 Value Chain Analysis: Major Value is Added During R&D and Manufacturing Phases

Figure 20 InGaAs Detector Market, 2015–2023 (USD Million)

Figure 21 Market Segmentation: By Camera Cooling Technology

Figure 22 Uncooled Cameras to Register Highest CAGR in this Market During Forecast Period

Figure 23 Industrial Automation to Grow at Highest CAGR in Uncooled Market During Forecast Period

Figure 24 Market: By Scanning Type

Figure 25 Line Scan Cameras to Register Highest CAGR in this Market During Forecast Period

Figure 26 Line Scan Camera

Figure 27 Market Segmentation, By Application

Figure 28 Industrial Automation to Register Highest CAGR in this Market

Figure 29 Market: By Geography

Figure 30 Geographic Snapshot of Market (2017–2023)

Figure 31 North America: Snapshot of this Market

Figure 32 Europe: Snapshot of this Market

Figure 33 APAC: Snapshot of this Market

Figure 34 RoW: Snapshot of this Market

Figure 35 Companies in this Market Adopted Product Launches as Key Growth Strategy Between January 2014 and October 2017

Figure 36 Hamamatsu: Company Snapshot

Figure 37 First Sensor: Company Snapshot

Figure 38 Jenoptik AG: Company Snapshot

Figure 39 Teledyne Technologies: Company Snapshot

Figure 40 Luna Innovations: Company Snapshot

Figure 41 Lumentum: Company Snapshot

Figure 42 Flir Systems: Company Snapshot

Growth opportunities and latent adjacency in InGaAs Camera Market