Infrared Emitter & Receiver Market by Spectral Range (Near IR, SWIR, MWIR, LWIR, and FAR IR), Vertical (Automotive, Industrial, Military & Aerospace, & Others), Application & Geography - Global Trend & Forecast to 2020

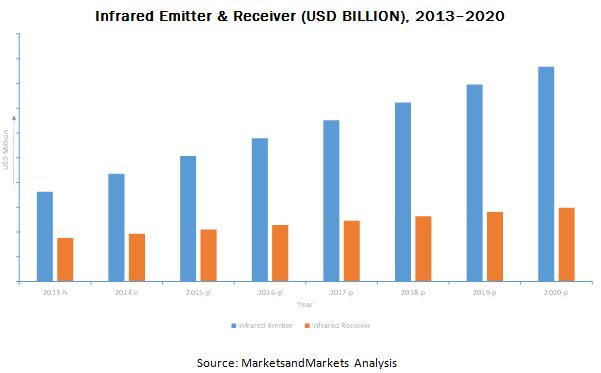

The markets for infrared emitter and receiver are estimated to grow at a CAGR of 11.3% and 7.2%, respectively, between 2015 and 2020, to reach USD 867.1 Million and 298.4 Million, respectively, by 2020, given the growing security & surveillance market across all major geographies. The growing threat of international terrorism coupled with increased spending on military and defense is pushing the adoption of infrared imaging and sensing technologies in the security & surveillance and military & aerospace sectors. These are the major forces driving the growth of the infrared emitter & receiver market. Furthermore, the growing investment in interactive technologies such as gesture recognition in consumer electronics and machine vision in industrial monitoring has significantly boosted the adoption of infrared emitters & receivers.

This research study involves the extensive use of secondary sources, directories, and databases (such as Hoovers, Bloomberg Business, Factiva, and OneSource) to identify and collect information useful for this study. The research methodology is explained below.

- Analysis of all the industry verticals using infrared emitters & receivers across the globe

- Analysis of various types of infrared emitters & receivers sold to these industries

- Analysis of the penetration of infrared emitters & receivers sold to these industries considered for the study

- Estimation of percentage share of infrared emitter & receivers in various industries

- Analyzing the market trends in various regions and countries, supported by the ongoing research & development in these respective regions

- Overall market sizes finalized by triangulation with supply-side data which includes the product developments, supply chain, and estimated sales of infrared emitter & receiver.

The infrared emitter market is estimated to exhibit rapid growth potential till 2020. The total market for infrared emitter is expected to reach USD 867.1 Million by 2020, at a CAGR of 11.3% between 2015 and 2020.

On the basis of industry verticals, the market has been segmented into automotive, consumer electronics, telecommunication, military & aerospace, industrial, healthcare, security & surveillance, imaging, and others. The security & surveillance market is expected to dominate the vertical market of infrared emitters & receivers, as infrared emitters & receivers are extensively used for security camera, night vision, and thermal imaging among others.

The infrared emitter & receiver market is segmented on the basis of applications into thermal heating, sensing, monitoring & detection, imaging, data transmission, and others. Currently, for infrared emitters, the sensing, monitoring, & detection application dominates the market because of the high demand in multiple verticals of security & surveillance, industrial, and consumer electronics, where infrared-based sensors are the key components. Furthermore, the consumer electronics and security & surveillance industry are both expected to grow at a very rapid pace among all other industries. The growth in these two industries is attributed to the growing adoption of infrared emitters. For infrared receiver, the imaging application is the dominating the market, as infrared receivers are used in various critical imaging applications in the form of sensors or detectors, mostly in security & surveillance, military & aerospace, and industrial applications. Furthermore, the high growth in the security & surveillance industry is boosting the market for infrared receivers.

The spectral ranges covered in this report are near IR, short wavelength infrared (SWIR), long wavelength infrared (LWIR), medium wavelength infrared (MWIR), and far IR, The near infrared market is expected to dominate both infrared emitter and receiver markets.

The geographic analysis in this report covers the North America, Europe, Asia-Pacific, and Rest of the World (RoW). The cross-segmentation data included in the report provides insight into the regional markets. The Asia-Pacific (APAC) currently dominates in terms of market size and is also expected to grow at the highest CAGR during the forecast period. The fast growth of infrared emitter and receiver market in Asia-Pacific is mainly attributed to the growth on the emerging economies such as India and China. Moreover, Asia-Pacific is also the hub for major OEMs for various infrared-related products, which makes it a highly lucrative market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package

1.6 Stakeholders

1.7 Limitations

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

2.4.1 Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 30)

4.1 Attractive Market Opportunities in the Infrared Emitter and Receiver Market

4.2 Infrared Emitter Market, By Spectral Range

4.3 Infrared Receiver Market, By Vertical

4.4 Infrared Emitter Market, By Application Type

4.5 Infrared Receiver Market, By Geography

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Spectral Range

5.2.2 By Industry Vertical

5.2.3 By Application

5.2.4 By Geography

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Growth of the Automotive Sector

5.3.1.2 Increasing Demand for Ir Leds in the Surveillance Sector

5.3.1.3 Decreasing Price of Ir Receivers

5.3.1.4 Night Vision Capability in Military Applications

5.3.2 Restraints

5.3.2.1 Availability of A Viable Alternative Heating Technology

5.3.2.2 Legislative Barriers in Military Applications

5.3.3 Opportunities

5.3.3.1 Use of Uncooled Ir Camera for Remote Sensing and Hyperspectral Imaging in the Camera

5.3.4 Winning Imperatives

5.3.4.1 Focus on Automotive and Security Applications

6 Industry Trends (Page No. - 43)

6.1 Introduction

6.2 Value Chain Analysis

6.2.1 Research and Development

6.2.2 Infrared Emitters and Receivers Component Manufacturers

6.2.3 Key Distributors

6.2.4 End Users

6.3 Key Industry Trends

6.4 Porter’s Five Forces

6.4.1 Bargaining Power of Suppliers

6.4.2 Bargaining Power of Buyers

6.4.3 Threat of New Entrants

6.4.4 Threat of Substitutes

7 By Spectral Range (Page No. - 50)

7.1 Introduction

7.2 Near Infrared

7.3 Short Wavelength Infrared (SWIR)

7.4 Medium Wavelength Infrared (MWIR)

7.5 Long Wavelength Infrared (LWIR)

7.6 Far Infrared

8 By Vertical (Page No. - 58)

8.1 Introduction

8.2 Automotive

8.2.1 Automotive Manufacturing

8.2.2 Wheel & Electronic Stability Control

8.2.3 Automotive Night Vision

8.2.4 Car Locking Systems

8.2.5 Automated Guided Vehicles

8.3 Consumer Electronics

8.3.1 Proximity Sensors

8.3.2 Smartphones & Tablets

8.3.3 ATMS and Interactive Kiosks

8.3.4 Photographic Equipment

8.4 Telecommunication

8.4.1 Irda Transceivers

8.4.2 Fiber Optic Communication

8.4.3 Line-Of-Sight Wireless Communication

8.5 Security & Surveillance

8.5.1 Surveillance Cameras

8.5.2 Smoke & Fire Alarms

8.5.3 Home Security Systems

8.6 Military & Aerospace

8.6.1 Night Vision

8.6.2 Weapon Guidance and Target Acquisition Systems

8.6.3 Monitoring & Measurement Systems

8.7 Industrial

8.7.1 Industrial Heating

8.7.2 Industrial Remote Control

8.7.3 Monitoring & Measurement Systems

8.8 Healthcare

8.8.1 Surgery

8.8.2 Sterilizing

8.8.3 Manufacturing

8.8.4 Medical Imaging

8.8.5 Health Monitoring

8.9 Others

8.9.1 Home Automation & Lighting Systems

9 By Application Type (Page No. - 88)

9.1 Introduction

9.2 Thermal Heating

9.3 Sensing, Monitoring, & Detection

9.4 Imaging

9.4.1 Gesture Recognition

9.4.2 Machine Vision

9.5 Data Transmission

9.6 Others

9.6.1 Spectroscopy

10 Market, By Geography (Page No. - 99)

10.1 Introduction

10.2 North America

10.3 Europe

10.4 Asia-Pacific

10.5 Rest of the World

11 Competitive Landscape (Page No. - 117)

11.1 Introduction

11.2 Market Ranking of Players, 2014

11.3 Competitive Situation and Trends

11.3.1 New Product Launches and Developments

11.3.2 Product Expansion

11.3.3 Mergers & Acquisitions

12 Company Profiles (Page No. - 122)

(Overview, Products and Services, Financials, Strategy & Development)*

12.1 Rohm Semiconductor

12.2 Lite-On Technology, Inc.

12.3 Vishay Intertechnology, Inc.

12.4 Osram Opto Semiconductors GmbH

12.5 Honeywell International, Inc.

12.6 Cree, Inc.

12.7 Flir Systems Inc.

12.8 Murata Manufacturing Co., Ltd.

12.9 Koninklijke Philips N.V.

12.10 Texas Instruments Inc.

12.11 Raytek Corporation

12.12 Ulis

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies

13 Appendix (Page No. - 153)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Introducing RT: Real Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

List of Tables (90 Tables)

Table 1 Infrared Emitter and Receiver Market Size, 2013–2020 (USD Million)

Table 2 Growth in the Automotive Sector Expected to Drive the Growth of the Infrared Emitter and Receiver Market

Table 3 Use of Alternate Heating Technology Restrains Market Growth

Table 4 Use of Uncooled Cameras in Imaging Presents A Key Growth Area for Infrared Emitter and Receiver Market

Table 5 Infrared Emitter Market Size, By Spectral Range, 2013–2020 (USD Million)

Table 6 Infrared Receiver Market Size, By Spectral Range, 2013–2020 (USD Million)

Table 7 Near Infrared Emitter Market Size, By Vertical, 2013–2020 (USD Million)

Table 8 Near Infrared Receiver Market Size, By Application, 2013–2020 (USD Million)

Table 9 SWIR Emitter Market Size, By Vertical, 2013–2020 (USD Million)

Table 10 SWIR Receiver Market Size, By Application, 2013–2020 (USD Million)

Table 11 MWIR Emitter Market Size, By Vertical, 2013–2020 (USD Million)

Table 12 MWIR Receiver Market Size, By Application, 2013–2020 (USD Million)

Table 13 LWIR Emitter Market Size, By Vertical, 2013–2020 (USD Million)

Table 14 LWIR Receiver Market Size, By Application, 2013–2020 (USD Million)

Table 15 Far Infrared Emitter Market Size, By Vertical, 2013–2020 (USD Million)

Table 16 Far Infrared Receiver Market Size, By Application, 2013–2020 (USD Million)

Table 17 Infrared Emitter Market Size, By Vertical, 2013–2020 (USD Million)

Table 18 Infrared Receiver Market Size, By Vertical, 2013–2020 (USD Million)

Table 19 Automotive: Infrared Emitter Market Size, By Spectral Range, 2013–2020 (USD Million)

Table 20 Automotive: Infrared Emitter Market Size, By Application, 2013–2020 (USD Million)

Table 21 Automotive: Infrared Receiver Market Size, By Application, 2013–2020 (USD Million)

Table 22 Automotive: Infrared Emitter Market Size, By Region, 2013–2020 (USD Million)

Table 23 Automotive: Infrared Receiver Market Size, By Region, 2013–2020 (USD Million)

Table 24 Consumer Electronics: Infrared Emitter Market Size, By Application, 2013–2020 (USD Million)

Table 25 Consumer Electronics: Infrared Receiver Market Size, By Application, 2013–2020 (USD Million)

Table 26 Consumer Electronics: Infrared Emitter Market Size, By Region, 2013–2020 (USD Million)

Table 27 Consumer Electronics: Infrared Receiver Market Size, By Region, 2013–2020 (USD Million)

Table 28 Telecommunication: Infrared Emitter Market Size, By Application, 2013–2020 (USD Million)

Table 29 Telecommunication: Infrared Receiver Market Size, By Application, 2013–2020 (USD Million)

Table 30 Telecommunication: Infrared Emitter Market Size, By Region, 2013–2020 (USD Million)

Table 31 Telecommunication: Infrared Receiver Market Size, By Region, 2013–2020 (USD Million)

Table 32 Security & Surveillance: Infrared Emitter Market Size, By Application, 2013–2020 (USD Million)

Table 33 Security & Surveillance: Infrared Receiver Market Size, By Application, 2013–2020 (USD Million)

Table 34 Security & Surveillance: Infrared Emitter Market Size, By Region, 2013–2020 (USD Million)

Table 35 Security & Surveillance: Infrared Receiver Market Size, By Region, 2013–2020 (USD Million)

Table 36 Military & Aerospace: Infrared Emitter Market Size, By Application, 2013–2020 (USD Million)

Table 37 Military & Aerospace: Infrared Receiver Market Size, By Application, 2013–2020 (USD Million)

Table 38 Military & Aerospace: Infrared Emitter Market Size, By Region, 2013–2020 (USD Million)

Table 39 Military & Aerospace: Infrared Receiver Market Size, By Region, 2013–2020 (USD Million)

Table 40 Industrial: Infrared Emitter Market Size, By Spectral Range, 2013–2020 (USD Million)

Table 41 Industrial: Infrared Emitter Market Size, By Application, 2013–2020 (USD Million)

Table 42 Industrial: Infrared Receiver Market Size, By Application, 2013–2020 (USD Million)

Table 43 Industrial: Infrared Emitter Market Size, By Region, 2013–2020 (USD Million)

Table 44 Industrial: Infrared Receiver Market Size, By Region, 2013–2020 (USD Million)

Table 45 Healthcare: Infrared Emitter Market Size, By Spectral Range, 2013–2020 (USD Million)

Table 46 Healthcare: Infrared Emitter Market Size, By Application, –2020 (USD Million)

Table 47 Healthcare: Infrared Receiver Market Size, By Application, 2013–2020 (USD Million)

Table 48 Healthcare: Infrared Emitter Market Size, By Region, 2013–2020 (USD Million)

Table 49 Healthcare: Infrared Receiver Market Size, By Region, 2013–2020 (USD Million)

Table 50 Others: Infrared Emitter Market Size, By Spectral Range, 2013–2020 (USD Million)

Table 51 Others: Infrared Emitter Market Size, By Application, 2013–2020 (USD Million)

Table 52 Others: Infrared Receiver Market Size, By Application, 2013–2020 (USD Million)

Table 53 Others: Infrared Emitter Market Size, By Region, 2013–2020 (USD Million)

Table 54 Others: Infrared Receiver Market Size, By Region, 2013–2020 (USD Million)

Table 55 Infrared Emitter Market Size, By Application, 2013–2020 (USD Million)

Table 56 Infrared Receiver Market Size, By Application, 2013–2020 (USD Million)

Table 57 Thermal Heating: Infrared Emitter Market Size, By Vertical, 2013–2020 (USD Million)

Table 58 Sensing, Monitoring, & Detection: Infrared Emitter Market Size, By Vertical, 2013–2020 (USD Million)

Table 59 Sensing, Monitoring, & Detection: Infrared Receiver Market Size, By Vertical, 2013–2020 (USD Million)

Table 60 Sensing, Monitoring, & Detection: Infrared Receiver Market Size, By Spectral Range, 2013–2020 (USD Million)

Table 61 Imaging: Infrared Emitter Market Size, By Vertical, 2013–2020 (USD Million)

Table 62 Imaging: Infrared Receiver Market Size, By Vertical, 2013–2020 (USD Million)

Table 63 Imaging: Infrared Receiver Market Size, By Spectral Range, 2013–2020 (USD Million)

Table 64 Data Transmission: Infrared Emitter Market Size, By Vertical, 2013–2020 (USD Million)

Table 65 Data Transmission: Infrared Receiver Market Size, By Vertical, 2013–2020 (USD Million)

Table 66 Others: Infrared Emitter Market Size, By Vertical, 2013–2020 (USD Million)

Table 67 Others: Infrared Receiver Market Size, By Vertical, 2013–2020 (USD Million)

Table 68 Others: Infrared Receiver Market Size, By Spectral Range, 2013–2020 (USD Million)

Table 69 Infrared Emitter Market Size, By Region, 2013–2020 (USD Million)

Table 70 Infrared Receiver Market Size, By Region, 2013–2020 (USD Million)

Table 71 North America: Infrared Emitter Market Size, By Country, 2013–2020 (USD Million)

Table 72 North America: Infrared Emitter Market Size, By Vertical, 2013–2020 (USD Million)

Table 73 North America: Infrared Receiver Market Size, By Country, 2013–2020 (USD Million)

Table 74 North America: Infrared Receiver Market Size, By Vertical, 2013–2020 (USD Million)

Table 75 Europe: Infrared Emitter Market Size, By Country, 2013–2020 (USD Million)

Table 76 Europe: Infrared Emitter Market Size, By Vertical, 2013–2020 (USD Million)

Table 77 Europe: Infrared Receiver Market Size, By Country, 2013–2020 (USD Million)

Table 78 Europe: Infrared Receiver Market Size, By Vertical, 2013–2020 (USD Million)

Table 79 APAC: Infrared Emitter Market Size, By Country, 2013–2020 (USD Million)

Table 80 APAC: Infrared Emitter Market Size, By Vertical, 2013–2020 (USD Million)

Table 81 APAC: Infrared Receiver Market Size, By Country, 2013–2020 (USD Million)

Table 82 APAC: Infrared Receiver Market Size, By Vertical, 2013–2020 (USD Million)

Table 83 RoW: Infrared Emitter Market Size, By Region, 2013–2020 (USD Million)

Table 84 RoW: Infrared Emitter Market Size, By Vertical, 2013–2020 (USD Million)

Table 85 RoW: Infrared Receiver Market Size, By Region, 2013–2020 (USD Million)

Table 86 RoW: Infrared Receiver Market Size, By Vertical, 2013–2020 (USD Million)

Table 87 Infrared Emitter & Receiver Market Rankings, By Key Player, 2014

Table 88 New Product Launches & Developments in Infrared Emitter & Receiver Market, 2015

Table 89 Product Expansions in the Infrared Emitter & Receiver Market, 2015

Table 90 Other Developments

List of Figures (72 Figures)

Figure 1 Infrared Emitter and Receiver Market

Figure 2 Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Infrared Emitter and Receiver Market Size, 2015–2020

Figure 7 Infrared Emitter Market, By Spectral Range, 2015–2020

Figure 8 Infrared Receiver Market, By Application Type, 2014

Figure 9 Infrared Emitter Market, By Vertical: Security & Surveillance Expected to Dominate the Market During the Forecast Period

Figure 10 Infrared Receiver Market, By Geography, 2014

Figure 11 Infrared Emitter Market has Lucrative Opportunities

Figure 12 Infrared Receiver Market has Lucrative Opportunities

Figure 13 Near Infrared Spectral Range Expected to Dominate the Ir Emitter Market During the Forecast Period

Figure 14 Security & Surveillance Expected to Grow at the Highest Rate During the Forecast Period

Figure 15 Sensing, Monitoring, & Detection to Hold the Largest Share Among Applications By 2020

Figure 16 APAC Market Expected to Grow at the Highest Rate for Infrared Receivers Between 2014 and 2020

Figure 17 Infrared Emitter and Receiver Market: Segmentation

Figure 18 Infrared Emitter & Receiver Market Segmentation: By Spectral Range

Figure 19 Infrared Emitter & Receiver Market Segmentation: By Industry Vertical

Figure 20 Infrared Emitter & Receiver Market Segmentation: By Application

Figure 21 Infrared Emitter and Receiver Market, By Geography

Figure 22 Market Dynamics: Overview

Figure 23 Growth of Ir Led Market 2014–2020 (USD Million)

Figure 24 Growth of Night Vision Devices Market 2014-2020 (USD Billion)

Figure 25 Different Standards of Organizations on Infrared Technology

Figure 26 Infrared Emitter and Receiver Market: Value Chain Analysis

Figure 27 Vertical Integration—The Leading Trend Among Key Market Players

Figure 28 Porter’s Five Forces Analysis for the Infrared Emitter & Receiver Market

Figure 29 Porter’s Five Forces: Impact Analysis

Figure 30 Bargaining Power of Suppliers in the Infrared Emitter & Reciever Market, 2014

Figure 31 Bargaining Power of Buyers in Infrared Emitter & Receiver Market, 2014

Figure 32 Threat of New Entrants in the Infrared Emitter & Receiver Market, 2014

Figure 33 Threat of Substitutes in the Infrared Emitter & Receiver Market, 2014

Figure 34 Competitive Rivalry in Infrared Emitter & Receiver Market, 2014

Figure 35 Ir Emitter and Detector Market, By Vertical

Figure 36 Ir Emitter Market Size for Consumer Electronics, 2015-2020 (USD Million)

Figure 37 Ir Emitter Market Size for Consumer Electronics, 2015-2020 (USD Million)

Figure 38 Ir Emitter Market Size for Security & Surveillance, 2015-2020 (USD Million)

Figure 39 Ir Emitter Market for Military & Aerospace, By Spectral Range, 2015-2020 (USD Million)

Figure 40 Ir Emitter Market Size for Healthcare Vertical, By Spectral Range 2015-2020 (USD Million)

Figure 41 Ir Receiver Market Size for Others Vertical, By Region, 2015-2020 (USD Million)

Figure 42 Ir Emitter and Receiver Market, By Application

Figure 43 Ir Receiver Market Size, By Application, 2015-2020 (USD Million)

Figure 44 Infrared Receiver Market Size for Data Transmission, 2013–2020 (USD Million)

Figure 45 Infrared Emitter Market Geographic Snapshot: China Expected to Grow at the Highest Rate Between 2015 and 2020

Figure 46 Infrared Receiver Market Geographic Snapshot: India Expected to Experience the Highest Growth Rate Between 2015 and 2020

Figure 47 North America: Infrared Emitter Market Snapshot

Figure 48 North America: Infrared Receiver Market Snapshot

Figure 49 Europe: Infrared Emitter Market Snapshot

Figure 50 Europe: Infrared Receiver Market Snapshot

Figure 51 APAC: Infrared Emitter Market Snapshot

Figure 52 APAC: Infrared Receiver Market Snapshot

Figure 53 Companies Adopted Product Innovation as the Key Growth Strategy

Figure 54 Battle for Market Share: New Product Launches the Key Strategy Between 2013 and 2015

Figure 55 Geographic Revenue Mix of Major Players in Infrared Emitter and Receiver Market

Figure 56 Rohm Semiconductor: Company Snapshot

Figure 57 Lite-On Technology, Inc.: Company Snapshot

Figure 58 Lite-On Technology, Inc.: SWOT Analysis

Figure 59 Vishay Intertechnology, Inc.: Company Snapshot

Figure 60 Vishay Intertechnology, Inc.: SWOT Analysis

Figure 61 Osram Opto Semiconductors GmbH: Company Snapshot

Figure 62 Osram Opto Semiconductors GmbH: SWOT Analysis

Figure 63 Honeywell International, Inc.: Company Snapshot

Figure 64 Honeywell International, Inc.: SWOT Analysis

Figure 65 Cree, Inc.: Company Snapshot

Figure 66 Flir Systems, Inc.: Company Snapshot

Figure 67 Flir Systems, Inc.: SWOT Analysis

Figure 68 Murata Manufacturing Co., Ltd.: Company Snapshot

Figure 69 Murata Manufacturing Co., Ltd.: SWOT Analysis

Figure 70 Koninklijke Philips N.V.: Company Snapshot

Figure 71 Texas Instruments Inc.: Company Snapshot

Figure 72 Texas Instruments Inc.: SWOT Analysis

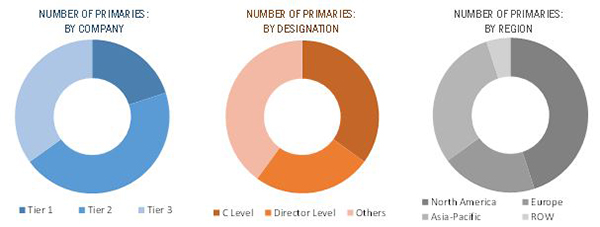

After arriving at the overall market size, the total market has been split into several segments and subsegments and confirmed with the key industry experts. The figure below shows the breakdown of primaries on the basis of company, designation, and region conducted during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The market covered under this report has been segmented as follows:

This report categorizes the global infrared emitter & receiver market on the basis of industry verticals, spectral range, applications, and geography. It also covers the market dynamics and emerging trends and technologies in the market.

Market, by vertical:

On the basis of industry verticals, the market has been segmented into automotive, military & aerospace, consumer electronics, telecommunication, industrial, healthcare, security & surveillance, and others

Market, by spectral range:

Based on infrared spectral range, the market has been segmented into near IR, short-wavelength infrared, (SWIR), middle-wavelength infrared (MWIR), long-wavelength Infrared (LWIR), and far IR.

Market, by application:

On the basis of application, the market has been segmented into thermal heating, sensing, monitoring & detection, imaging, and others

Market, by geography:

The geographic analysis covers North America, Europe, Asia-Pacific, and Rest of the World (RoW). The cross-segmentation data included in the report provides insight into the regional markets.

Available customizations:

The available customizations for the report offer further country-wise breakdown for all the applications.

Company information

Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Infrared Emitter & Receiver Market