Industrial Sugar Market by Type (White Sugar, Brown Sugar, & Liquid Sugar), Application (Dairy Products, Bakery Products, Confectionery, Beverages, & Pharmaceuticals), Source (Sugarcane & Sugar Beet) and Region - Global Forecast to 2028

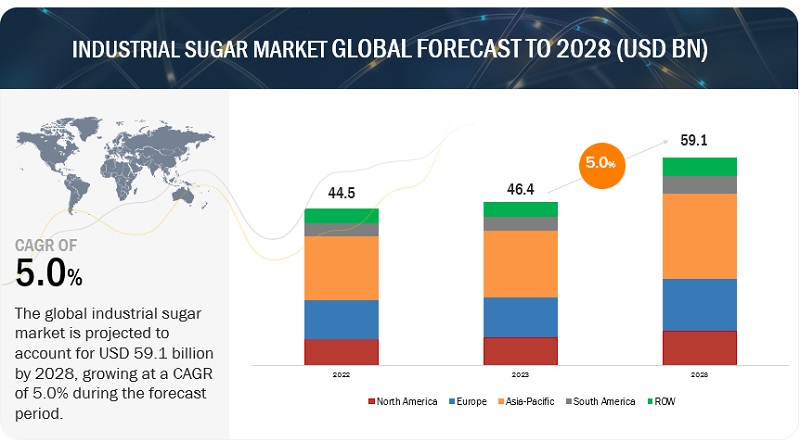

Industrial sugar market size was valued at USD 46.4 billion in 2023. The industrial sugar industry is projected to grow USD 59.1 billion by 2028, exhibiting a compound annual growth rate (CAGR) of 5.0% during the forecast period (2023 - 2028). Owing to the increase in demand for processed foods, consumer awareness and changing lifestyles drive the market.

To know about the assumptions considered for the study, Request for Free Sample Report

Industrial Sugar Market Dynamics

Driver : Growing industrial beet sugar market

The industrial sugar industry continues to grow rapidly. Key factors contributing to this growth are beet sugar, a significant industrial crop utilized in food processing and producing ethanol and biogas. Mainly in tropical countries, the sugar beet crop offers a valuable alternative to sugarcane. The industrial beet sugar market growth in production and consumption has historically showcased an upward trend. It is likely to develop at a rapid pace during the forecast period. Based on consumption in the industry, the beverages segment is anticipated to offer the highest market attractiveness in the global industrial beet sugar market. Furthermore, introducing a new class of customers and entering various new international players is expected to strengthen the growth of the industrial beet sugar industry globally during the forecast period.

Restraint : Rising demand for alternate sweeteners as sugar substitutes

MECAS/ISO (41) outlines major sweetener categories and types. The first division is between caloric and non-caloric sweeteners, with caloric further divided into sucrose (sugar), HFCS, glucose, dextrose, and crystalline fructose. Generally, non-caloric sweeteners are intensely sweet, owing to which only minute quantities are required for sweetening foods. However, different sweeteners have different applications according to their properties; hence, their ability to replace industrial sugar in various foods is difficult to predict. Moreover, high-intensity sweeteners (HIS) are not perfect substitutes for sugar in all products, which limits their usage, although some non-diet foodstuffs use a blend of sugar and HIS. As a sweetener, the major alternative sugar substitute is high fructose corn syrup (HFCS), which is often compared to industrial granulated sugar.

Opportunity: Access to new markets due to increasing cooperative sector

The cooperative sector is the sugar industry's largest component, including millions of farmers and thousands of operational mills. It has played a key role in developing the industrial sugar market and has been a critical component of key developing countries such as India. A strong farmer-miller relationship will be essential for developing productivity improvements. Given the scattered landholding structure, improvements in farm productivity can materialize only in the presence of a strong farmer-miller relationship. This will enable the mill to drive the adoption of better seed varieties, improve farm practices, and incentivize the mills to invest in extension services. A long farmer-miller relationship will also enable risk mitigation for both. The off-take risk for farmers will be addressed through assured cane off-take by the mill; and mills, on the other hand, would be assured of cane supplies. The relationship will enable farmers to access credit from banks based on off-take guarantees provided by the mills. The availability of crop insurance to protect against crop failure risk would also be encouraged by mills and may be partially funded.

To know about the assumptions considered for the study, download the pdf brochure

Challenge : The increasing cost of sugar production

According to a report by the International Sugar Organization, the average cost of producing sugar in the 2020-2021 season was around 21 cents per pound, up from about 18 cents per pound in the 2016-2017 season. The report also noted that the cost of production has been increasing faster than the price of sugar, which has put pressure on sugar producers' profitability. The increase in the cost of sugar production can be attributed to various factors such as rising labor costs, energy costs, raw material costs, environmental regulations, and climate change. Also, with a decline in the opportunities for low-cost production due to wage inflation, growth in costs associated with the investment in infrastructure, and a decrease in cultivable land, there has been an increase in the marginal cost of production, resulting in decreased profit margins.

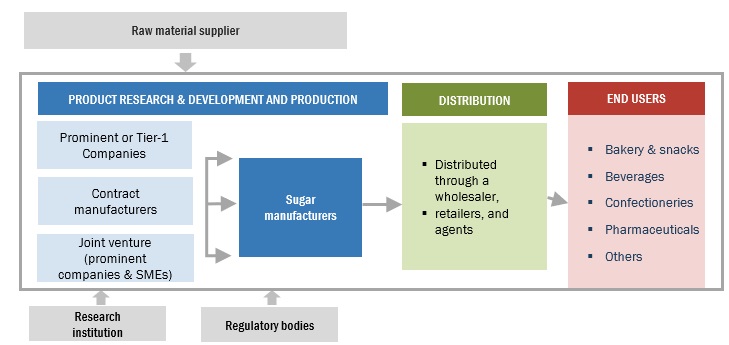

Industrial Sugar Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of industrial sugar. These companies have been operating in the market for several years and possess state-of-the-art technologies, a diversified product portfolio, and strong global sales and marketing networks. Prominent companies in this market include Südzucker AG (Germany), Cargill, Inc. (US), Associated British Foods plc (UK), Raízen (Brazil), Lantic Inc. (Germany), Mitr Phol Group (Thailand), AMERICAN CRYSTAL SUGAR (US), Louis Dreyfus Company (Netherlands), Tereos (France), and Michigan Sugar Company (US).

Increased shelf life of syrup sugar to boost its use in the food industry

Syrup-based sugar is becoming increasingly popular for various reasons. For instance, it is easier to use in certain applications, such as beverages and baked goods, as it dissolves more quickly than granulated sugar and provides a smoother texture. It also has a longer shelf life than granulated sugar, making it a more practical choice for products with longer shelf lives. Furthermore, some consumers may perceive syrup sugar as a healthier alternative to granulated sugar due to its lower glycemic index and the fact that it is less processed. These factors contribute to the growing demand for syrup sugar in various industries.

Sugar beet cultivation promotes environmental sustainability and ensures local food security

The global demand for sugar is on the rise. Coupled with shifts in diet and lifestyle, this trend has led to Egypt's decision to augment its domestic sugar production by promoting the cultivation of sugar beet, which has a lower water consumption than sugarcane. Canal Sugar, a subsidiary of Al Khaleej Sugar Refinery located in Dubai, established the largest factory for the production of sugar beet worldwide in Egypt in 2020. The factory boasts an impressive annual output capacity of 900,000 tons, making a significant contribution to Egypt's sugar production efforts. Similarly, in 2021, Al Khaleej Sugar Refinery obtained approval for constructing a sugar beetroot factory in Spain, mirroring its efforts in Egypt, thus expanding its operations into the processing of sugar beets. This strategic move increases the company's influence beyond its existing reach in North Africa and the Middle East.

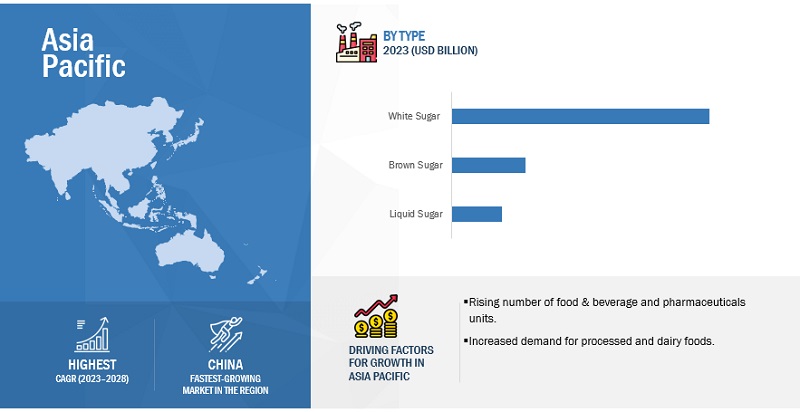

Asia Pacific is expected to dominate the industrial sugar market during the forecast period

Asia Pacific is the dominant market for industrial sugar and is projected to grow at the highest CAGR from 2023 to 2028. The application of sugar in the region is estimated to increase at a high pace due to the demand from the processed foods industry. China, India, Japan, and other Southeast Asian countries are the major countries covered in this study. The rising purchasing power, the rapid growth of the middle-class population, and the increasing consumer demand for processed products present promising prospects for growth and diversification in the region's food sector.

The expected growth in the number of food processing units in this region is further projected to boost the supply and consumption of sugar. The food processing sectors in countries such as China and India are export-oriented. The processing sector is of prime importance in these countries as players focus on technology adoption and automation. This is expected to positively impact the industrial sugar market in the region.

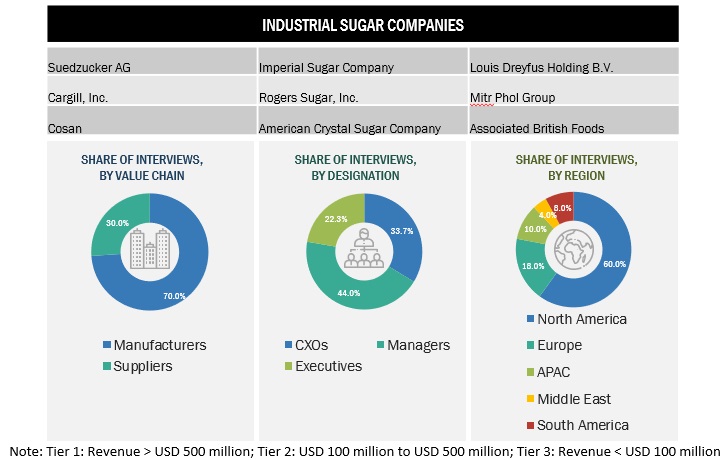

Industrial Sugar Market: Key Market Players

The key players in this include Südzucker AG (Germany), Cargill, Inc. (US), Associated British Foods plc (UK), Raízen (Brazil), Lantic Inc. (Germany), Mitr Phol Group (Thailand), AMERICAN CRYSTAL SUGAR (US), Louis Dreyfus Company (Netherlands), Tereos (France), and Michigan Sugar Company (US). These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Industrial Sugar Market Report Scope

|

Report Metric |

Details |

|

Market size estimation |

2023–2028 |

|

Base year considered |

2022 |

|

Forecast period considered |

2023–2028 |

|

Units considered |

Value (USD Billion), Volume (KT) |

|

Segments Covered |

Type, Source, Form, Application, Region |

|

Regions covered |

North America, South America, Europe, Asia Pacific, and RoW |

|

Companies studied |

|

Industrial Sugar Market Report Segmentation:

|

By Type |

By Source |

By Form |

By Application |

By Region |

|

|

|

|

|

Industrial Sugar Market Recent Developments

- In August 2022, Raízen, the world's largest sugar exporting company, and ASR Group, the world's largest refiner and marketer of cane sugar, announced a partnership that sets the standard for sustainable raw cane sugar supply chains globally.

- In July 2021, Al Khaleej Sugar announced the construction of a new sugar factory in Merida, Spain. This expands the company's operations beyond the Middle East and North Africa, as it seeks to enter the sugar-beet processing industry. The company begun construction of the new factory in 2022 and invested approximately USD 590 million. The factory has a production capacity of up to 900,000 metric tons of sugar annually.

- In February 2021, Raízen, an integrated energy company and a benchmark in biofuels and bioelectricity, signed a commercial agreement to incorporate the assets of Biosev, a Brazilian subsidiary of Louis Dreyfus Holding. The deal includes nine production units strategically located in Brazil (six in São Paulo, two in Mato Grosso do Sul, and one in Minas Gerais), with a total installed sugarcane processing capacity of up to 32 million tons. The agreement also includes power cogeneration, with an export capacity of up to 1.3 GWh of electricity/year, covering an area of 280,000 hectares of planted sugarcane.

Frequently Asked Questions (FAQ):

Which are the major companies in the Industrial sugar market? What are their major strategies to strengthen their market presence?

The key players in this Südzucker AG (Germany), Cargill, Inc. (US), Associated British Foods plc (UK), Raízen (Brazil), Lantic Inc. (Germany), Mitr Phol Group (Thailand), AMERICAN CRYSTAL SUGAR (US), Louis Dreyfus Company (Netherlands), Tereos (France), Michigan Sugar Company (US). These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

What are the drivers and opportunities for the Industrial sugar market?

The industrial sugar market is expected to witness significant growth. Traditional industrial sugar remains a key ingredient in many products due to its low cost and availability. The increasing demand for convenience foods and beverages has resulted in the growth of this industry and subsequently increased demand for industrial sugar.

Which region is expected to hold the highest market share?

The market in Asia Pacific will dominate the market share in 2023, showcasing strong demand for industrial sugar products in the region. The food and beverage industry is the largest consumer of industrial sugar in the region, due to the high demand for sweeteners and other sugar-based ingredients in various food and beverage products. Additionally, the pharmaceutical and personal care industries are also driving the growth of the industrial sugar market in the region, as sugar is widely used in the production of medicines and cosmetic products.

What is the total CAGR expected to be recorded for the industrial sugar market during 2023-2028?

The CAGR is expected to record a CAGR of 5.0 % from 2023-2028.

What are the key challenges faced in the industrial sugar market?

The continuous fluctuation of sugar prices due to the factors such as supply chain distruption and adverse weather conditions such as floods and droughts are the major key challenges for the industrial sugar market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC FACTORSCONTRIBUTION OF TOP SUGAR-PRODUCING COUNTRIES TO GLOBAL SUGAR TRADERISE IN PRODUCTION OF SUGARCANE AND SUGAR BEET

-

5.3 MARKET DYNAMICSDRIVERS- Rise in global consumption of sugar and growth in international trade- Increasing use of sugar by-products in industries- Rising use of beet sugar as raw material in beverage productionRESTRAINTS- Need for water-consuming monoculture production- Increasing popularity of alternate sweeteners as sugar substitutesOPPORTUNITIES- Growing need to explore potential of sugarcane crops using energy optimization- Increasing development of global sugar industry- Preferential trade agreements governing sugar importsCHALLENGES- Fluctuations in price and availability of sugar- High cost of producing sugar

- 6.1 INTRODUCTION

-

6.2 VALUE CHAIN ANALYSISRESEARCH & DEVELOPMENT AND RAW MATERIAL SOURCINGMANUFACTURINGDISTRIBUTIONEND USERS

- 6.3 SUPPLY CHAIN ANALYSIS

-

6.4 MARKET MAP AND ECOSYSTEM ANALYSISDEMAND SIDESUPPLY SIDE

-

6.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSESREVENUE SHIFT AND NEW REVENUE POCKETS IN INDUSTRIAL SUGAR MARKET

-

6.6 TECHNOLOGICAL ANALYSISDIGITALIZATIONGENETIC ENGINEERING

-

6.7 PRICING ANALYSISAVERAGE SELLING PRICE OFFERED BY KEY PLAYERS FOR SUGAR TYPES

-

6.8 PATENT ANALYSIS

-

6.9 TRADE ANALYSISEXPORT SCENARIOIMPORT SCENARIO

- 6.10 KEY CONFERENCES & EVENTS

-

6.11 CASE STUDIESCASE STUDY 1: SUGARPHARM MADE SIGNIFICANT INVESTMENTS TO OVERCOME SUPPLY CHAIN AND REGULATORY CHALLENGESCASE STUDY 2: CARGILL UTILIZED ITS EXPERTISE TO IMPROVE TECHNOLOGY USED FOR MANUFACTURING NATURAL SWEETENERS

-

6.12 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS- North America: List of regulatory bodies, government agencies, and other organizations- Europe: List of regulatory bodies, government agencies, and other organizations- Asia Pacific: List of regulatory bodies, government agencies, and other organizations- Rest of the World: List of regulatory bodies, government agencies, and other organizations

-

6.13 REGULATORY FRAMEWORKINTRODUCTIONREGULATIONS, BY REGION- US- Europe- China- India- Brazil

-

6.14 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYTHREAT FROM NEW ENTRANTSTHREAT FROM SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERS

-

6.15 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 7.1 INTRODUCTION

-

7.2 GRANULATEDGROWING DEMAND FOR PROCESSED FOODS TO BOOST GROWTH OF GRANULATED SUGAR

-

7.3 POWDEREDPOPULARITY OF BAKERY AND CONFECTIONERY PRODUCTS TO DRIVE POWDERED SUGAR MARKET IN DEVELOPING COUNTRIES

-

7.4 SYRUPINCREASED SHELF LIFE OF SYRUP SUGAR TO BOOST USE IN FOOD INDUSTRY

- 8.1 INTRODUCTION

-

8.2 SUGARCANERISING CONSUMPTION OF BAKERY ITEMS TO PROPEL DEMAND FOR NATURAL AND NON-GMO SUGARCANE

-

8.3 SUGAR BEETSUGAR BEET CULTIVATION TO PROMOTE ENVIRONMENTAL SUSTAINABILITY AND ENSURE LOCAL FOOD SECURITY

- 9.1 INTRODUCTION

-

9.2 WHITE SUGARVERSATILITY AND AVAILABILITY OF WHITE SUGAR TO DRIVE ITS POPULARITY AS IMPORTANT INGREDIENT IN FOOD INDUSTRY

-

9.3 BROWN SUGARPOPULARITY OF BROWN SUGAR EXPECTED TO RISE WITH CONSUMERS SEEKING HEALTHY AND ETHICAL FOOD OPTIONS

-

9.4 LIQUID SUGARADAPTABILITY AND CONSISTENCY OF LIQUID SUGAR TO ENHANCE USE IN FOOD SECTOR

- 10.1 INTRODUCTION

-

10.2 DAIRY PRODUCTSRISE IN POPULARITY OF CREAM, MILK, AND CHEESE TO DRIVE GROWTH OF INDUSTRIAL SUGAR MARKET

-

10.3 BAKERY PRODUCTSINCREASED CONSUMPTION OF BAKERY PRODUCTS DUE TO RISING PER CAPITA INCOMES TO PROPEL MARKET FOR INDUSTRIAL SUGAR

-

10.4 CONFECTIONERYRISING CONSUMPTION OF GUMMIES AND JELLIES AMONG YOUTH TO BOOST GROWTH OF INDUSTRIAL SUGAR

-

10.5 BEVERAGESINCREASING INCLINATION TOWARD REFRESHMENT DRINKS TO BOOST USE OF SUGAR IN BEVERAGES

-

10.6 CANNED & FROZEN FOODSGROWING POPULARITY OF CANNED FRUITS AND ICE CREAMS TO DRIVE MARKET FOR INDUSTRIAL SUGAR

-

10.7 PHARMACEUTICALSRISING USE OF HIGH-QUALITY SUGAR IN PHARMA FORMULATIONS TO BOOST GROWTH OF INDUSTRIAL SUGAR MARKET

- 10.8 OTHER APPLICATIONS

- 11.1 INTRODUCTION

-

11.2 INDUSTRIAL SUGAR MARKET: RECESSION IMPACTMAJOR RECESSION INDICATORS

-

11.3 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Production capacity expansion of manufacturers in US to boost growth of industrial sugar marketCANADA- Extensive distribution networks to boost sales of industrial sugar in CanadaMEXICO- Strong presence of packaged food industry and robust retail sector to drive industrial sugar market growth

-

11.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Rising consumption of bakery and processed food products to drive growth of industrial sugar marketJAPAN- Japan’s flourishing food industry to drive demand for industrial sugarINDIA- Supportive government policies to fuel market growth of industrial sugarAUSTRALIA & NEW ZEALAND- Improved sugarcane yields in recent years to boost production of industrial sugarTHAILAND- Expanding food & beverage industry of Thailand to boost adoption of industrial sugarREST OF ASIA PACIFIC

-

11.5 EUROPEEUROPE: RECESSION IMPACTGERMANY- Rising sugar prices to affect overall industrial sugar marketFRANCE- Infrastructural modernization by major companies to boost industrial sugar marketUK- Rising popularity of confectionery and beverages to propel market for industrial sugarITALY- Rising demand for sugar-based products in food & beverage industry to drive growth of industrial sugarSPAIN- Increasing investments by foreign players to set up sugar factories to boost adoption of sugar and sugar-related productsRUSSIA- Rising popularity of convenience products, such as bakery and beverages, to boost growth of industrial sugarREST OF EUROPE

-

11.6 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACTBRAZIL- Favorable production conditions and strong distribution network to boost industrial sugar marketARGENTINA- Price control impositions by government to drive growth of industrial sugar marketREST OF SOUTH AMERICA

-

11.7 REST OF THE WORLDREST OF THE WORLD: RECESSION IMPACTAFRICA- High domestic consumption of sugar to propel growth of industrial sugar marketMIDDLE EAST- Rising demand for bakery products to drive success of industrial sugar market

- 12.1 OVERVIEW

- 12.2 MARKET SHARE ANALYSIS

- 12.3 HISTORICAL REVENUE ANALYSIS FOR KEY PLAYERS

-

12.4 EVALUATION QUADRANT MATRIX FOR KEY PLAYERSSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

- 12.5 INDUSTRIAL SUGAR MARKET: PRODUCT FOOTPRINT (KEY PLAYERS)

-

12.6 EVALUATION QUADRANT MATRIX FOR OTHER PLAYERSPROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

-

12.7 COMPETITIVE SCENARIODEALSOTHERS

-

13.1 KEY PLAYERSSÜDZUCKER AG- Business overview- Products offered- MnM viewCARGILL, INC.- Business overview- Products offered- Recent developments- MnM viewASSOCIATED BRITISH FOODS PLC- Business overview- Products offered- MnM viewRAÍZEN- Business overview- Products offered- Recent developments- MnM viewLANTIC INC.- Business overview- Products offered- MnM viewMITR PHOL GROUP- Business overview- Products offered- MnM viewAMERICAN CRYSTAL SUGAR COMPANY- Business overview- Products offered- MnM viewLOUIS DREYFUS COMPANY- Business overview- Products offered- MnM viewTEREOS- Business overview- Products offered- MnM viewMICHIGAN SUGAR COMPANY- Business overview- Products offered- MnM viewDWARIKESH SUGAR INDUSTRIES LIMITED- Business overview- Products offered- MnM viewCANAL SUGAR- Business overview- Products offered- MnM viewAL KHALEEJ SUGAR- Business overview- Products offered- MnM viewRAJSHREE SUGARS & CHEMICALS LIMITED (RSCL)- Business overview- Products offered- MnM viewRANA GROUP- Products offered- MnM view

-

13.2 OTHER PLAYERSSHREE RENUKA SUGARSUPPER GANGES SUGAR & INDUSTRIES LIMITEDBAJAJ HINDUSTHAN SUGAR LTD.NILE SUGARBANNARI AMMAN GROUPDHAMPUR BIO ORGANICS LIMITEDDHANRAJ SUGARS PVT. LTD.THAI SUGAR GROUPMEHTA GROUPDALMIA BHARAT GROUP

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

-

14.3 SUGAR SUBSTITUTES MARKETMARKET DEFINITIONMARKET OVERVIEWSUGAR SUBSTITUTES MARKET, BY APPLICATION

-

14.4 SUGAR TOPPINGS MARKETMARKET DEFINITIONMARKET OVERVIEWSUGAR TOPPINGS MARKET, BY TYPE

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2018–2022

- TABLE 2 INDUSTRIAL SUGAR MARKET SNAPSHOT, 2023 VS. 2028 (BY VOLUME)

- TABLE 3 GLOBAL SUGAR TRADE, BY KEY SUGAR-PRODUCING COUNTRY, 2018–2022 (THOUSAND METRIC TONS)

- TABLE 4 AREA HARVESTED FOR SUGAR BEET AND SUGARCANE PRODUCTION, 2018–2022 (THOUSAND HECTARES)

- TABLE 5 SUGAR BEET AND SUGARCANE PRODUCTION, 2018–2022 (THOUSAND METRIC TONS)

- TABLE 6 ECOSYSTEM ANALYSIS

- TABLE 7 AVERAGE SELLING PRICE OFFERED BY KEY PLAYERS FOR SUGAR TYPES, 2022 (USD/TON)

- TABLE 8 WHITE SUGAR: AVERAGE SELLING PRICE, BY REGION, 2018–2022 (USD/TON)

- TABLE 9 BROWN SUGAR: AVERAGE SELLING PRICE, BY REGION, 2018–2022 (USD/TON)

- TABLE 10 LIQUID SUGAR: AVERAGE SELLING PRICE, BY REGION, 2018–2022 (USD/TON)

- TABLE 11 MAJOR PATENTS IN INDUSTRIAL SUGAR MARKET, 2019–2022

- TABLE 12 EXPORT VALUE OF SUGAR FOR KEY COUNTRIES, 2021 (USD THOUSAND)

- TABLE 13 IMPORT VALUE OF SUGAR FOR KEY COUNTRIES, 2021 (USD THOUSAND)

- TABLE 14 KEY CONFERENCES & EVENTS, 2023

- TABLE 15 PORTER’S FIVE FORCES ANALYSIS

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP END USERS

- TABLE 17 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- TABLE 18 INDUSTRIAL SUGAR MARKET, BY FORM, 2018–2022 (USD BILLION)

- TABLE 19 INDUSTRIAL SUGAR MARKET, BY FORM, 2023–2028 (USD BILLION)

- TABLE 20 INDUSTRIAL SUGAR MARKET, BY FORM, 2018–2022 (KT)

- TABLE 21 INDUSTRIAL SUGAR MARKET, BY FORM, 2023–2028 (KT)

- TABLE 22 GRANULATED: INDUSTRIAL SUGAR MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 23 GRANULATED: INDUSTRIAL SUGAR MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 24 GRANULATED: INDUSTRIAL SUGAR MARKET, BY REGION, 2018–2022 (KT)

- TABLE 25 GRANULATED: INDUSTRIAL SUGAR MARKET, BY REGION, 2023–2028 (KT)

- TABLE 26 POWDERED: INDUSTRIAL SUGAR MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 27 POWDERED: INDUSTRIAL SUGAR MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 28 POWDERED: INDUSTRIAL SUGAR MARKET, BY REGION, 2018–2022 (KT)

- TABLE 29 POWDERED: INDUSTRIAL SUGAR MARKET, BY REGION, 2023–2028 (KT)

- TABLE 30 SYRUP: INDUSTRIAL SUGAR MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 31 SYRUP: INDUSTRIAL SUGAR MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 32 SYRUP: INDUSTRIAL SUGAR MARKET, BY REGION, 2018–2022 (KT)

- TABLE 33 SYRUP: INDUSTRIAL SUGAR MARKET, BY REGION, 2023–2028 (KT)

- TABLE 34 INDUSTRIAL SUGAR MARKET, BY SOURCE, 2018–2022 (KT)

- TABLE 35 INDUSTRIAL SUGAR MARKET, BY SOURCE, 2023–2028 (KT)

- TABLE 36 SUGARCANE: INDUSTRIAL SUGAR MARKET, BY REGION, 2018–2022 (KT)

- TABLE 37 SUGARCANE: INDUSTRIAL SUGAR MARKET, BY REGION, 2023–2028 (KT)

- TABLE 38 SUGAR BEET: INDUSTRIAL SUGAR MARKET, BY REGION, 2018–2022 (KT)

- TABLE 39 SUGAR BEET: INDUSTRIAL SUGAR MARKET, BY REGION, 2023–2028 (KT)

- TABLE 40 INDUSTRIAL SUGAR MARKET, BY TYPE, 2018–2022 (USD BILLION)

- TABLE 41 INDUSTRIAL SUGAR MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 42 INDUSTRIAL SUGAR MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 43 INDUSTRIAL SUGAR MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 44 WHITE SUGAR: INDUSTRIAL SUGAR MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 45 WHITE SUGAR: INDUSTRIAL SUGAR MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 46 WHITE SUGAR: INDUSTRIAL SUGAR MARKET, BY REGION, 2018–2022 (KT)

- TABLE 47 WHITE SUGAR: INDUSTRIAL SUGAR MARKET, BY REGION, 2023–2028 (KT)

- TABLE 48 BROWN SUGAR: INDUSTRIAL SUGAR MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 49 BROWN SUGAR: INDUSTRIAL SUGAR MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 50 BROWN SUGAR: INDUSTRIAL SUGAR MARKET, BY REGION, 2018–2022 (KT)

- TABLE 51 BROWN SUGAR: INDUSTRIAL SUGAR MARKET, BY REGION, 2023–2028 (KT)

- TABLE 52 LIQUID SUGAR: INDUSTRIAL SUGAR MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 53 LIQUID SUGAR: INDUSTRIAL SUGAR MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 54 LIQUID SUGAR: INDUSTRIAL SUGAR MARKET, BY REGION, 2018–2022 (KT)

- TABLE 55 LIQUID SUGAR: INDUSTRIAL SUGAR MARKET, BY REGION, 2023–2028 (KT)

- TABLE 56 INDUSTRIAL SUGAR MARKET, BY APPLICATION, 2018–2022 (KT)

- TABLE 57 INDUSTRIAL SUGAR MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 58 DAIRY PRODUCTS: INDUSTRIAL SUGAR MARKET, BY REGION, 2018–2022 (KT)

- TABLE 59 DAIRY PRODUCTS: INDUSTRIAL SUGAR MARKET, BY REGION, 2023–2028 (KT)

- TABLE 60 BAKERY PRODUCTS: INDUSTRIAL SUGAR MARKET, BY REGION, 2018–2022 (KT)

- TABLE 61 BAKERY PRODUCTS: INDUSTRIAL SUGAR MARKET, BY REGION, 2023–2028 (KT)

- TABLE 62 CONFECTIONERY: INDUSTRIAL SUGAR MARKET, BY REGION, 2018–2022 (KT)

- TABLE 63 CONFECTIONERY: INDUSTRIAL SUGAR MARKET, BY REGION, 2023–2028 (KT)

- TABLE 64 BEVERAGES: INDUSTRIAL SUGAR MARKET, BY REGION, 2018–2022 (KT)

- TABLE 65 BEVERAGES: INDUSTRIAL SUGAR MARKET, BY REGION, 2023–2028 (KT)

- TABLE 66 CANNED & FROZEN FOODS: INDUSTRIAL SUGAR MARKET, BY REGION, 2018–2022 (KT)

- TABLE 67 CANNED & FROZEN FOODS: INDUSTRIAL SUGAR MARKET, BY REGION, 2023–2028 (KT)

- TABLE 68 PHARMACEUTICALS: INDUSTRIAL SUGAR MARKET, BY REGION, 2018–2022 (KT)

- TABLE 69 PHARMACEUTICALS: INDUSTRIAL SUGAR MARKET, BY REGION, 2023–2028 (KT)

- TABLE 70 OTHER APPLICATIONS: INDUSTRIAL SUGAR MARKET, BY REGION, 2018–2022 (KT)

- TABLE 71 OTHER APPLICATIONS: INDUSTRIAL SUGAR MARKET, BY REGION, 2023–2028 (KT)

- TABLE 72 INDUSTRIAL SUGAR MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 73 INDUSTRIAL SUGAR MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 74 INDUSTRIAL SUGAR MARKET, BY REGION, 2018–2022 (KT)

- TABLE 75 INDUSTRIAL SUGAR MARKET, BY REGION, 2023–2028 (KT)

- TABLE 76 NORTH AMERICA: INDUSTRIAL SUGAR MARKET, BY COUNTRY, 2018–2022 (KT)

- TABLE 77 NORTH AMERICA: INDUSTRIAL SUGAR MARKET, BY COUNTRY, 2023–2028 (KT)

- TABLE 78 NORTH AMERICA: INDUSTRIAL SUGAR MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 79 NORTH AMERICA: INDUSTRIAL SUGAR MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 80 NORTH AMERICA: INDUSTRIAL SUGAR MARKET, BY TYPE, 2018–2022 (USD BILLION)

- TABLE 81 NORTH AMERICA: INDUSTRIAL SUGAR MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 82 NORTH AMERICA: INDUSTRIAL SUGAR MARKET, BY FORM, 2018–2022 (KT)

- TABLE 83 NORTH AMERICA: INDUSTRIAL SUGAR MARKET, BY FORM, 2023–2028 (KT)

- TABLE 84 NORTH AMERICA: INDUSTRIAL SUGAR MARKET, BY FORM, 2018–2022 (USD BILLION)

- TABLE 85 NORTH AMERICA: INDUSTRIAL SUGAR MARKET, BY FORM, 2023–2028 (USD BILLION)

- TABLE 86 NORTH AMERICA: INDUSTRIAL SUGAR MARKET, BY APPLICATION, 2018–2022 (KT)

- TABLE 87 NORTH AMERICA: INDUSTRIAL SUGAR MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 88 NORTH AMERICA: INDUSTRIAL SUGAR MARKET, BY SOURCE, 2018–2022 (KT)

- TABLE 89 NORTH AMERICA: INDUSTRIAL SUGAR MARKET, BY SOURCE, 2023–2028 (KT)

- TABLE 90 US: INDUSTRIAL SUGAR MARKET, BY FORM, 2018–2022 (KT)

- TABLE 91 US: INDUSTRIAL SUGAR MARKET, BY FORM, 2023–2028 (KT)

- TABLE 92 CANADA: INDUSTRIAL SUGAR MARKET, BY FORM, 2018–2022 (KT)

- TABLE 93 CANADA: INDUSTRIAL SUGAR MARKET, BY FORM, 2023–2028 (KT)

- TABLE 94 MEXICO: INDUSTRIAL SUGAR MARKET, BY FORM, 2018–2022 (KT)

- TABLE 95 MEXICO: INDUSTRIAL SUGAR MARKET, BY FORM, 2023–2028 (KT)

- TABLE 97 ASIA PACIFIC: INDUSTRIAL SUGAR MARKET, BY COUNTRY, 2023–2028 (KT)

- TABLE 98 ASIA PACIFIC: INDUSTRIAL SUGAR MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 99 ASIA PACIFIC: INDUSTRIAL SUGAR MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 100 ASIA PACIFIC: INDUSTRIAL SUGAR MARKET, BY TYPE, 2018–2022 (USD BILLION)

- TABLE 101 ASIA PACIFIC: INDUSTRIAL SUGAR MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 102 ASIA PACIFIC: INDUSTRIAL SUGAR MARKET, BY FORM, 2018–2022 (KT)

- TABLE 103 ASIA PACIFIC: INDUSTRIAL SUGAR MARKET, BY FORM, 2023–2028 (KT)

- TABLE 104 ASIA PACIFIC: INDUSTRIAL SUGAR MARKET, BY FORM, 2018–2022 (USD BILLION)

- TABLE 105 ASIA PACIFIC: INDUSTRIAL SUGAR MARKET, BY FORM, 2023–2028 (USD BILLION)

- TABLE 106 ASIA PACIFIC: INDUSTRIAL SUGAR MARKET, BY APPLICATION, 2018–2022 (KT)

- TABLE 107 ASIA PACIFIC: INDUSTRIAL SUGAR MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 108 ASIA PACIFIC: INDUSTRIAL SUGAR MARKET, BY SOURCE, 2018–2022 (KT)

- TABLE 109 ASIA PACIFIC: INDUSTRIAL SUGAR MARKET, BY SOURCE, 2023–2028 (KT)

- TABLE 110 CHINA: INDUSTRIAL SUGAR MARKET, BY FORM, 2018–2022 (KT)

- TABLE 111 CHINA: INDUSTRIAL SUGAR MARKET, BY FORM, 2023–2028 (KT)

- TABLE 112 JAPAN: INDUSTRIAL SUGAR MARKET, BY FORM, 2018–2022 (KT)

- TABLE 113 JAPAN: INDUSTRIAL SUGAR MARKET, BY FORM, 2023–2028 (KT)

- TABLE 114 INDIA: INDUSTRIAL SUGAR MARKET, BY FORM, 2018–2022 (KT)

- TABLE 115 INDIA: INDUSTRIAL SUGAR MARKET, BY FORM, 2023–2028 (KT)

- TABLE 116 AUSTRALIA & NEW ZEALAND: INDUSTRIAL SUGAR MARKET, BY FORM, 2018–2022 (KT)

- TABLE 117 AUSTRALIA & NEW ZEALAND: INDUSTRIAL SUGAR MARKET, BY FORM, 2023–2028 (KT)

- TABLE 118 THAILAND: INDUSTRIAL SUGAR MARKET, BY FORM, 2018–2022 (KT)

- TABLE 119 THAILAND: INDUSTRIAL SUGAR MARKET, BY FORM, 2023–2028 (KT)

- TABLE 120 REST OF ASIA PACIFIC: INDUSTRIAL SUGAR MARKET, BY FORM, 2018–2022 (KT)

- TABLE 121 REST OF ASIA PACIFIC: INDUSTRIAL SUGAR MARKET, BY FORM, 2023–2028 (KT)

- TABLE 122 EUROPE: INDUSTRIAL SUGAR MARKET, BY COUNTRY, 2018–2022 (KT)

- TABLE 123 EUROPE: INDUSTRIAL SUGAR MARKET, BY COUNTRY, 2023–2028 (KT)

- TABLE 124 EUROPE: INDUSTRIAL SUGAR MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 125 EUROPE: INDUSTRIAL SUGAR MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 126 EUROPE: INDUSTRIAL SUGAR MARKET, BY TYPE, 2018–2022 (USD BILLION)

- TABLE 127 EUROPE: INDUSTRIAL SUGAR MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 128 EUROPE: INDUSTRIAL SUGAR MARKET, BY FORM, 2018–2022 (KT)

- TABLE 129 EUROPE: INDUSTRIAL SUGAR MARKET, BY FORM, 2023–2028 (KT)

- TABLE 130 EUROPE: INDUSTRIAL SUGAR MARKET, BY FORM, 2018–2022 (USD BILLION)

- TABLE 131 EUROPE: INDUSTRIAL SUGAR MARKET, BY FORM, 2023–2028 (USD BILLION)

- TABLE 132 EUROPE: INDUSTRIAL SUGAR MARKET, BY APPLICATION, 2018–2022 (KT)

- TABLE 133 EUROPE: INDUSTRIAL SUGAR MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 134 EUROPE: INDUSTRIAL SUGAR MARKET, BY SOURCE, 2018–2022 (KT)

- TABLE 135 EUROPE: INDUSTRIAL SUGAR MARKET, BY SOURCE, 2023–2028 (KT)

- TABLE 136 GERMANY: INDUSTRIAL SUGAR MARKET, BY FORM, 2018–2022 (KT)

- TABLE 137 GERMANY: INDUSTRIAL SUGAR MARKET, BY FORM, 2023–2028 (KT)

- TABLE 138 FRANCE: INDUSTRIAL SUGAR MARKET, BY FORM, 2018–2022 (KT)

- TABLE 139 FRANCE: INDUSTRIAL SUGAR MARKET, BY FORM, 2023–2028 (KT)

- TABLE 140 UK: INDUSTRIAL SUGAR MARKET, BY FORM, 2018–2022 (KT)

- TABLE 141 UK: INDUSTRIAL SUGAR MARKET, BY FORM, 2023–2028 (KT)

- TABLE 142 ITALY: INDUSTRIAL SUGAR MARKET, BY FORM, 2018–2022 (KT)

- TABLE 143 ITALY: INDUSTRIAL SUGAR MARKET, BY FORM, 2023–2028 (KT)

- TABLE 144 SPAIN: INDUSTRIAL SUGAR MARKET, BY FORM, 2018–2022 (KT)

- TABLE 145 SPAIN: INDUSTRIAL SUGAR MARKET, BY FORM, 2023–2028 (KT)

- TABLE 146 RUSSIA: INDUSTRIAL SUGAR MARKET, BY FORM, 2018–2022 (KT)

- TABLE 147 RUSSIA: INDUSTRIAL SUGAR MARKET, BY FORM, 2023–2028 (KT)

- TABLE 148 REST OF EUROPE: INDUSTRIAL SUGAR MARKET, BY FORM, 2018–2022 (KT)

- TABLE 149 REST OF EUROPE: INDUSTRIAL SUGAR MARKET, BY FORM, 2023–2028 (KT)

- TABLE 150 SOUTH AMERICA: INDUSTRIAL SUGAR MARKET, BY COUNTRY, 2018–2022 (KT)

- TABLE 151 SOUTH AMERICA: INDUSTRIAL SUGAR MARKET, BY COUNTRY, 2023–2028 (KT)

- TABLE 152 SOUTH AMERICA: INDUSTRIAL SUGAR MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 153 SOUTH AMERICA: INDUSTRIAL SUGAR MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 154 SOUTH AMERICA: INDUSTRIAL SUGAR MARKET, BY TYPE, 2018–2022 (USD BILLION)

- TABLE 155 SOUTH AMERICA: INDUSTRIAL SUGAR MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 156 SOUTH AMERICA: INDUSTRIAL SUGAR MARKET, BY FORM, 2018–2022 (KT)

- TABLE 157 SOUTH AMERICA: INDUSTRIAL SUGAR MARKET, BY FORM, 2023–2028 (KT)

- TABLE 158 SOUTH AMERICA: INDUSTRIAL SUGAR MARKET, BY FORM, 2018–2022 (USD BILLION)

- TABLE 159 SOUTH AMERICA: INDUSTRIAL SUGAR MARKET, BY FORM, 2023–2028 (USD BILLION)

- TABLE 160 SOUTH AMERICA: INDUSTRIAL SUGAR MARKET, BY APPLICATION, 2018–2022 (KT)

- TABLE 161 SOUTH AMERICA: INDUSTRIAL SUGAR MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 162 SOUTH AMERICA: INDUSTRIAL SUGAR MARKET, BY SOURCE, 2018–2022 (KT)

- TABLE 163 SOUTH AMERICA: INDUSTRIAL SUGAR MARKET, BY SOURCE, 2023–2028 (KT)

- TABLE 164 BRAZIL: INDUSTRIAL SUGAR MARKET, BY FORM, 2018–2022 (KT)

- TABLE 165 BRAZIL: INDUSTRIAL SUGAR MARKET, BY FORM, 2023–2028 (KT)

- TABLE 166 ARGENTINA: INDUSTRIAL SUGAR MARKET, BY FORM, 2018–2022 (KT)

- TABLE 167 ARGENTINA: INDUSTRIAL SUGAR MARKET, BY FORM, 2023–2028 (KT)

- TABLE 168 REST OF SOUTH AMERICA: INDUSTRIAL SUGAR MARKET, BY FORM, 2018–2022 (KT)

- TABLE 169 REST OF SOUTH AMERICA: INDUSTRIAL SUGAR MARKET, BY FORM, 2023–2028 (KT)

- TABLE 170 ROW: INDUSTRIAL SUGAR MARKET, BY REGION, 2018–2022 (KT)

- TABLE 171 ROW: INDUSTRIAL SUGAR MARKET, BY REGION, 2023–2028 (KT)

- TABLE 172 ROW: INDUSTRIAL SUGAR MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 173 ROW: INDUSTRIAL SUGAR MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 174 ROW: INDUSTRIAL SUGAR MARKET, BY TYPE, 2018–2022 (USD BILLION)

- TABLE 175 ROW: INDUSTRIAL SUGAR MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 176 ROW: INDUSTRIAL SUGAR MARKET, BY FORM, 2018–2022 (KT)

- TABLE 177 ROW: INDUSTRIAL SUGAR MARKET, BY FORM, 2023–2028 (KT)

- TABLE 178 ROW: INDUSTRIAL SUGAR MARKET, BY FORM, 2018–2022 (USD BILLION)

- TABLE 179 ROW: INDUSTRIAL SUGAR MARKET, BY FORM, 2023–2028 (USD BILLION)

- TABLE 180 ROW: INDUSTRIAL SUGAR MARKET, BY APPLICATION, 2018–2022 (KT)

- TABLE 181 ROW: INDUSTRIAL SUGAR MARKET, BY APPLICATION, 2023–2028 (KT)

- TABLE 182 ROW: INDUSTRIAL SUGAR MARKET, BY SOURCE, 2018–2022 (KT)

- TABLE 183 ROW: INDUSTRIAL SUGAR MARKET, BY SOURCE, 2023–2028 (KT)

- TABLE 184 AFRICA: INDUSTRIAL SUGAR MARKET, BY FORM, 2018–2022 (KT)

- TABLE 185 AFRICA: INDUSTRIAL SUGAR MARKET, BY FORM, 2023–2028 (KT)

- TABLE 186 MIDDLE EAST: INDUSTRIAL SUGAR MARKET, BY FORM, 2018–2022 (KT)

- TABLE 187 MIDDLE EAST: INDUSTRIAL SUGAR MARKET, BY FORM, 2023–2028 (KT)

- TABLE 188 MARKET SHARE ANALYSIS

- TABLE 189 COMPANY TYPE FOOTPRINT

- TABLE 190 COMPANY APPLICATION FOOTPRINT

- TABLE 191 COMPANY SOURCE FOOTPRINT

- TABLE 192 COMPANY FORM FOOTPRINT

- TABLE 193 COMPANY REGIONAL FOOTPRINT

- TABLE 194 OVERALL COMPANY FOOTPRINT

- TABLE 195 INDUSTRIAL SUGAR MARKET: DETAILED LIST OF OTHER PLAYERS

- TABLE 196 INDUSTRIAL SUGAR MARKET: DEALS, 2021–2022

- TABLE 197 INDUSTRIAL SUGAR MARKET: OTHERS, 2021

- TABLE 198 SÜDZUCKER AG: BUSINESS OVERVIEW

- TABLE 199 SÜDZUCKER AG: PRODUCTS OFFERED

- TABLE 200 CARGILL, INC.: BUSINESS OVERVIEW

- TABLE 201 CARGILL, INC.: PRODUCTS OFFERED

- TABLE 202 CARGILL, INC.: OTHERS

- TABLE 203 ASSOCIATED BRITISH FOODS PLC: BUSINESS OVERVIEW

- TABLE 204 ASSOCIATED BRITISH FOODS PLC: PRODUCTS OFFERED

- TABLE 205 RAÍZEN: BUSINESS OVERVIEW

- TABLE 206 RAÍZEN: PRODUCTS OFFERED

- TABLE 207 RAÍZEN: DEALS

- TABLE 208 LANTIC INC.: BUSINESS OVERVIEW

- TABLE 209 LANTIC INC.: PRODUCTS OFFERED

- TABLE 210 MITR PHOL GROUP: BUSINESS OVERVIEW

- TABLE 211 MITR PHOL GROUP: PRODUCTS OFFERED

- TABLE 212 AMERICAN CRYSTAL SUGAR COMPANY: BUSINESS OVERVIEW

- TABLE 213 AMERICAN CRYSTAL SUGAR COMPANY: PRODUCTS OFFERED

- TABLE 214 LOUIS DREYFUS COMPANY: BUSINESS OVERVIEW

- TABLE 215 LOUIS DREYFUS COMPANY: PRODUCTS OFFERED

- TABLE 216 TEREOS: BUSINESS OVERVIEW

- TABLE 217 TEREOS: PRODUCTS OFFERED

- TABLE 218 MICHIGAN SUGAR COMPANY: BUSINESS OVERVIEW

- TABLE 219 MICHIGAN SUGAR COMPANY: PRODUCTS OFFERED

- TABLE 220 DWARIKESH SUGAR INDUSTRIES LIMITED: BUSINESS OVERVIEW

- TABLE 221 DWARIKESH SUGAR INDUSTRIES LIMITED: PRODUCTS OFFERED

- TABLE 222 CANAL SUGAR: BUSINESS OVERVIEW

- TABLE 223 CANAL SUGAR: PRODUCTS OFFERED

- TABLE 224 AL KHALEEJ SUGAR: BUSINESS OVERVIEW

- TABLE 225 AL KHALEEJ SUGAR: PRODUCTS OFFERED

- TABLE 226 RAJSHREE SUGARS & CHEMICALS LIMITED (RSCL): BUSINESS OVERVIEW

- TABLE 227 RAJSHREE SUGARS & CHEMICALS LIMITED (RSCL): PRODUCTS OFFERED

- TABLE 228 RANA GROUP: BUSINESS OVERVIEW

- TABLE 229 RANA GROUP: PRODUCTS OFFERED

- TABLE 230 SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 231 SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 232 SUGAR TOPPINGS MARKET, BY TYPE, 2014–2021 (USD MILLION)

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 INDUSTRIAL SUGAR MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS (TOP-DOWN APPROACH)

- FIGURE 3 INDUSTRIAL SUGAR MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 DATA TRIANGULATION

- FIGURE 5 INDUSTRIAL SUGAR MARKET, BY TYPE, 2023 VS. 2028 (USD BILLION)

- FIGURE 6 INDUSTRIAL SUGAR MARKET, BY APPLICATION, 2023 VS. 2028 (KT)

- FIGURE 7 INDUSTRIAL SUGAR MARKET, BY FORM, 2023 VS. 2028 (KT)

- FIGURE 8 INDUSTRIAL SUGAR MARKET, BY SOURCE, 2023 VS. 2028 (KT)

- FIGURE 9 INDUSTRIAL SUGAR MARKET, BY REGION, 2022 (BY VOLUME)

- FIGURE 10 INCREASING USE OF INDUSTRIAL BEET SUGAR AND VALUE ADDITION OF SUGAR BY-PRODUCTS TO DRIVE GROWTH OF INDUSTRIAL SUGAR MARKET

- FIGURE 11 WHITE SUGAR SEGMENT AND INDIA ACCOUNTED FOR SIGNIFICANT MARKET SHARE IN 2022

- FIGURE 12 BEVERAGES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2028

- FIGURE 13 WHITE SUGAR SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 14 GRANULATED SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2028

- FIGURE 15 SUGARCANE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 16 MARKET DYNAMICS

- FIGURE 17 BY-PRODUCTS OF SUGARCANE

- FIGURE 18 GLOBAL SUGAR BEET PRODUCTION, 2011–2021 (MILLION TONS)

- FIGURE 19 FAIR AND REMUNERATIVE PRICE (FRP) OF SUGARCANE PAYABLE BY SUGAR FACTORIES IN INDIA, 2019–2023 (RS. PER QUINTAL)

- FIGURE 20 VALUE CHAIN ANALYSIS

- FIGURE 21 SUPPLY CHAIN ANALYSIS

- FIGURE 22 ECOSYSTEM MAP

- FIGURE 23 REVENUE SHIFT IMPACTING TRENDS/DISRUPTIONS IN INDUSTRIAL SUGAR MARKET

- FIGURE 24 AVERAGE SELLING PRICE OFFERED BY KEY PLAYERS FOR SUGAR TYPES

- FIGURE 25 AVERAGE SELLING PRICE, BY SUGAR TYPE, 2018–2021 (USD/TON)

- FIGURE 26 NUMBER OF PATENTS GRANTED FOR INDUSTRIAL SUGAR, 2011–2022

- FIGURE 27 REGIONAL ANALYSIS OF PATENTS GRANTED FOR INDUSTRIAL SUGAR, 2019–2022

- FIGURE 28 EXPORT VALUE OF SUGAR FOR KEY COUNTRIES, 2018–2021 (USD THOUSAND)

- FIGURE 29 IMPORT VALUE OF SUGAR FOR KEY COUNTRIES, 2018–2021 (USD THOUSAND)

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP APPLICATIONS

- FIGURE 31 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 32 INDUSTRIAL SUGAR MARKET, BY FORM, 2023 VS. 2028 (USD BILLION)

- FIGURE 33 INDUSTRIAL SUGAR MARKET, BY SOURCE, 2023 VS. 2028 (KT)

- FIGURE 34 INDUSTRIAL SUGAR MARKET, BY TYPE, 2023 VS. 2028 (USD BILLION)

- FIGURE 35 INDUSTRIAL SUGAR MARKET, BY APPLICATION, 2023 VS. 2028 (KT)

- FIGURE 36 INDUSTRIAL SUGAR MARKET, BY REGION, 2023 VS. 2028 (USD MILLION)

- FIGURE 37 CHINA TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 38 MAJOR RECESSION INDICATORS

- FIGURE 39 WORLD INFLATION RATE, 2011–2021

- FIGURE 40 GLOBAL GDP, 2011–2021 (USD TRILLION)

- FIGURE 41 RECESSION INDICATORS AND THEIR IMPACT ON INDUSTRIAL SUGAR MARKET

- FIGURE 42 INDUSTRIAL SUGAR MARKET: EARLIER FORECAST VS. RECESSION FORECAST

- FIGURE 43 NORTH AMERICA: INFLATION RATE, BY COUNTRY, 2017–2021

- FIGURE 44 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 45 ASIA PACIFIC: INFLATION RATE, BY COUNTRY, 2017–2021

- FIGURE 46 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- FIGURE 47 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 48 EUROPE: INFLATION RATE, BY COUNTRY, 2017–2021

- FIGURE 49 EUROPE: RECESSION IMPACT ANALYSIS

- FIGURE 50 EUROPE: MARKET SNAPSHOT

- FIGURE 51 SOUTH AMERICA: INFLATION RATE, BY COUNTRY, 2017–2021

- FIGURE 52 SOUTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 53 REST OF THE WORLD: INFLATION RATE, BY COUNTRY, 2017–2021

- FIGURE 54 REST OF THE WORLD: RECESSION IMPACT ANALYSIS

- FIGURE 55 SEGMENTAL REVENUE ANALYSIS FOR KEY PLAYERS, 2018–2022 (USD BILLION)

- FIGURE 56 EVALUATION QUADRANT MATRIX FOR KEY PLAYERS, 2022

- FIGURE 57 EVALUATION QUADRANT MATRIX FOR OTHER PLAYERS, 2022

- FIGURE 58 SÜDZUCKER AG: COMPANY SNAPSHOT

- FIGURE 59 CARGILL, INC.: COMPANY SNAPSHOT

- FIGURE 60 ASSOCIATED BRITISH FOODS PLC: COMPANY SNAPSHOT

- FIGURE 61 RAÍZEN: COMPANY SNAPSHOT

- FIGURE 62 LANTIC INC.: COMPANY SNAPSHOT

- FIGURE 63 LOUIS DREYFUS COMPANY: COMPANY SNAPSHOT

- FIGURE 64 TEREOS: COMPANY SNAPSHOT

- FIGURE 65 DWARIKESH SUGAR INDUSTRIES LIMITED: COMPANY SNAPSHOT

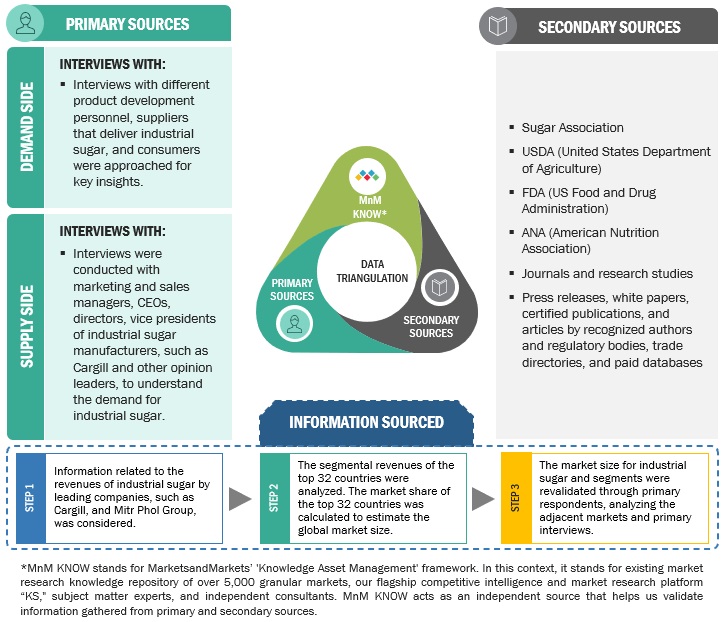

This research involves the extensive use of secondary sources; directories; and databases (Bloomberg and Factiva) to identify and collect information useful for a technical, market-oriented, and commercial study of the industrial sugar market. In-depth interviews were conducted with various primary respondents, such as key industry participants, Subject Matter Experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and to assess prospects.

Secondary Research

In the secondary research process, various sources, such as the AFND (Association of Health Food Nutrition and Dietetics), USDA (United States Department of Agriculture), FDA (US Food and Drug Administration), ANA (American Nutrition Association), and American Society for Nutrition were referred to identify and collect information for this study. The secondary sources also include clinical studies and journals, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Primary Research

The industrial sugar market comprises several stakeholders, including industrial sugar manufacturers, suppliers and organizations in the supply chain. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary interviewees from the supply side include research institutions involved in R&D to introduce technology, industrial sugar distributors and wholesalers, importers & exporters of industrial sugar, and industrial sugar manufacturers. Primary sources from the demand side include key opinion leaders, executives, vice presidents, and CEOs of sports and golf landscape-developing companies through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

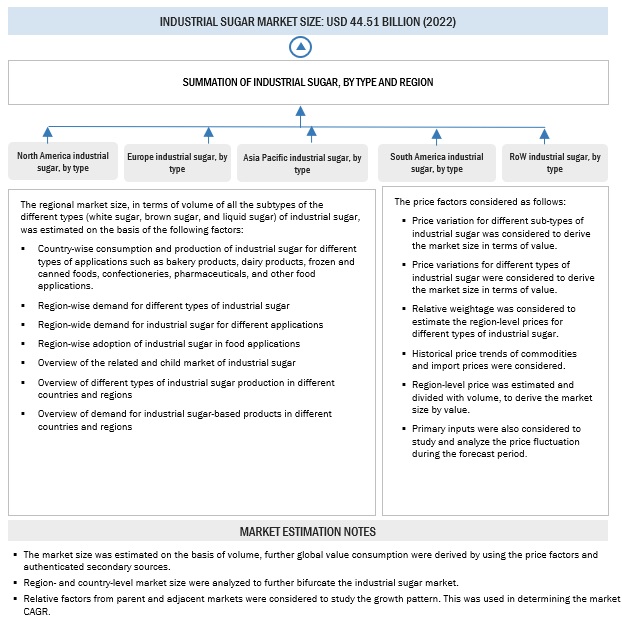

Industrial Sugar Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the industrial sugar industry. These approaches were extensively used to determine the size of the subsegments in the market. The research methodology used to estimate the market size includes the following details:

-

Top-down approach:

- The key industry and market players were identified through extensive secondary research.

- The industry's supply chain and market size were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- The adjacent market—the sugar substitutes and sugar topping market—was considered to validate further the market details of industrial sugar.

-

Bottom-up approach:

- The market size was analyzed based on the share of each type of industrial sugar and its penetration within the application and form at regional and country levels. Thus, the global market was estimated with a bottom-up approach of the type at the country level.

- Other factors include demand within the supply chain including the food industry; function trends; pricing trends; adoption rate and price factors; patents registered; and organic and inorganic growth attempts.

- All macroeconomic and microeconomic factors affecting the industrial sugar market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Market Size Estimation: Bottom-up approach

In the bottom-up approach, each country's market size for industrial sugar and the product types and application, including sports and recreational, was arrived at through secondary sources, such as annual reports, investor presentations, journals, and government publications. The bottom-up procedure was also implemented on the data extracted from secondary research to validate the market segment sizes obtained.

The penetration rate of each solution of industrial sugar as a percentage of the application sector in each country was calculated from secondary sources. Country-level data for industrial sugar were estimated based on the adoption rate of each solution of industrial sugar within the application sector. The mode of application of each product type was tracked via product mapping and studied for its penetration level to estimate the market size at the regional level. Each product type was studied for its commercially available mode of application and product type. The market size arrived at was further validated by primary respondents.

Industrial Sugar Market Size Estimation: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Industrial sugar market size estimation methodology: top-down approach

For the calculation of each type of specific market segment, the most appropriate, immediate parent and peer market sizes were used for implementing the top-down procedure.

Secondary reports from CropLife Europe, the US Environment Protection Agency, the Plant Protection Association of India, and the International Association for the Plant Protection Sciences were considered. Further, appropriate weightage was assigned to the data derived from each parameter to arrive at the final shares for each region. The regional demand-supply trends, presence of manufacturing units, and regulatory scenario were also analyzed to further validate the shares arrived at. These shares were then confirmed with primary respondents from across regions.

Industrial Sugar Market Size Estimation: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall industrial sugar market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

The industrial sugar industry refers to the production, trade, and consumption of sugar as a raw material or ingredient in various industries, such as food and beverage, pharmaceuticals, cosmetics, and others. Industrial sugar is typically produced in large quantities from sugarcane or sugar beets and is used as a sweetener, preservative, or texturizer in various products. The market includes both white sugar and other forms of sugar such as brown sugar, liquid sugar, and powdered sugar, which are used in different industrial applications. The industrial sugar market is influenced by factors such as global supply and demand, government policies, technological advancements, and changing consumer preferences.

- According to the USDA, sugar is defined as “any grade or type of saccharine products derived, directly or indirectly, from sugarcane, sugar beets, sugarcane molasses, sugar beet molasses or in-process beet sugar whether domestically produced or imported and consisting of, or containing, sucrose or invert sugar, including raw sugar, refined crystalline sugar, edible molasses, edible cane syrup, liquid sugar, and in-process cane sugar.

Key Stakeholders

- Supply-side: Farmers and raw material suppliers, distributors, importers, and exporters

- Demand-side: Manufacturers, millers, and corporate factory owners, and research organizations

- Regulatory-side: International Sugar Organization (ISO), World Sugar Research Organization (WSRO), American Sugarbeet Growers Association, National Sugar Development Council in Nigeria, and Confederation of European Beet Growers.

Industrial Sugar Market Report Objectives

Market Intelligence

- Determining and projecting the size of the market based on source, type, form, application, and region over a five-year period ranging from 2023 to 2028.

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across the key regions

-

Analyzing the demand-side factors based on the following:

- Impact of macro- and micro-economic factors on the market

- Shifts in demand patterns across different subsegments and regions.

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders.

- To strategically profile the key players and comprehensively analyze their core competencies.

- To analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & development (R&D) in the industrial sugar market

Competitive Intelligence

- Identifying and profiling the key market players in the industrial sugar industry

-

Providing a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key region.

- Analyzing the value chain and regulatory frameworks across regions and their impact on prominent market players

- Providing insights into the key investments and product innovations and technology in the industrial sugar market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe industrial sugar market, by key country

- Further breakdown of the Rest of South America industrial sugar industry, by key country

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Industrial Sugar Market