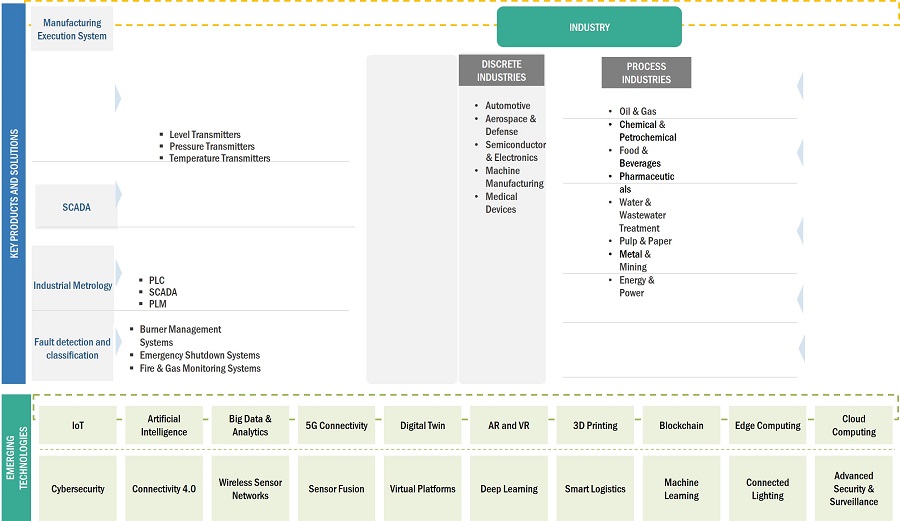

Industrial Software Market by Type (Manufacturing Execution System, SCADA, Human Machine Interface, Robotic Software, Fault Detection and Classification, Al in manufacturing, Industrial Metrology), End-use (Process, Discrete) - Global Forecast to 2029

Updated on : August 29, 2025

Industrial Software Market Summary

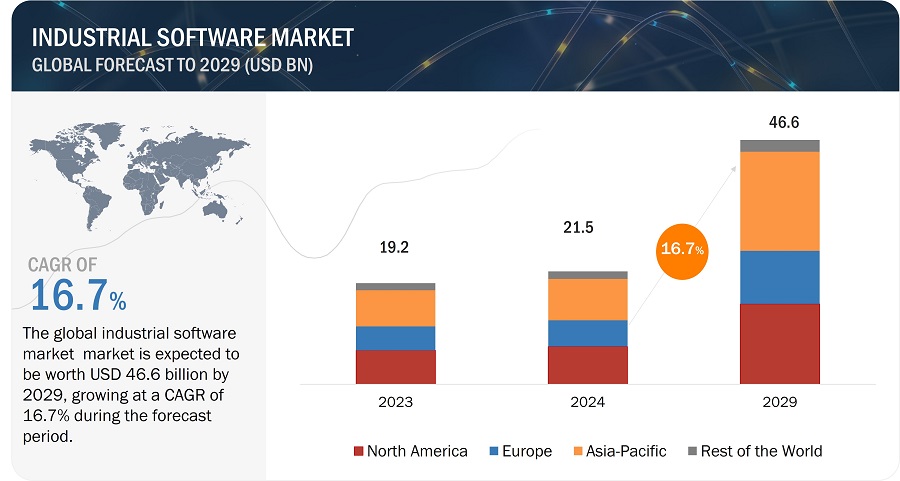

The global Industrial Software Market was valued at USD 21.5 billion in 2024 and is projected to grow from USD 24.36 billion in 2025 to USD 46.6 billion by 2029, at a CAGR of 16.7% during the forecast period. The market's growth is driven by the rapid adoption of digital transformation technologies such as IoT, AI, and cloud computing, which enhance operational efficiency and predictive maintenance across various industries. Additionally, government investments in AI, HMI, and IIoT, coupled with the increasing demand for fault detection and classification solutions, are pivotal in advancing the industrial software market.

Key Takeaways:

• The global Industrial Software Market was valued at USD 21.5 billion in 2024 and is projected to grow from USD 24.36 billion in 2025 to USD 46.6 billion by 2029, at a CAGR of 16.7% during the forecast period.

• By Technology: The integration of AI and machine learning into the industrial sector is revolutionizing automation and real-time decision-making, while cloud computing facilitates enhanced data analysis and storage capabilities.

• By Application: The adoption of digital twins for simulation and optimization is gaining momentum, enabling industries to improve system operations and maintenance strategies.

• By End User: Manufacturing and process industries, driven by Industry 4.0 and 5.0 technologies, are at the forefront of adopting industrial software for improved operational efficiency and human-machine collaboration.

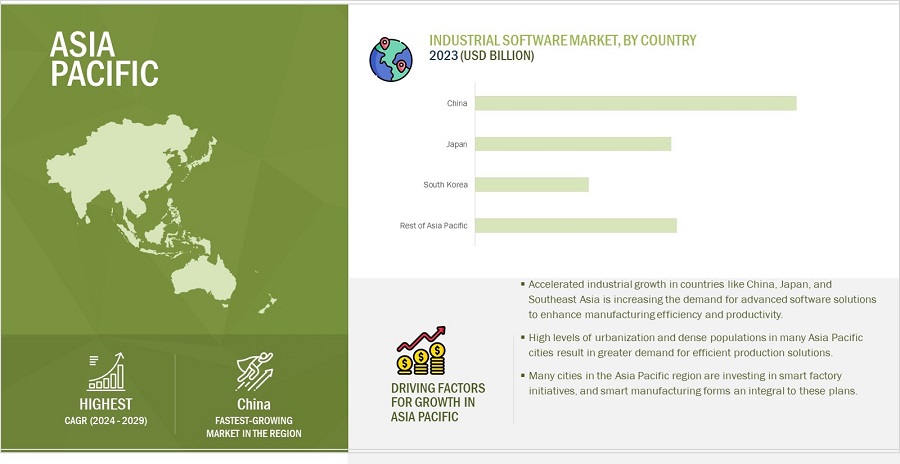

• By Region: ASIA PACIFIC is expected to grow fastest at a 19.1% CAGR, driven by rapid industrialization, technological innovations, and increased investments in digital infrastructure.

• Market Dynamics: The market is propelled by the need for connected supply chains, real-time data analysis for predictive maintenance, and the integration of innovative solutions such as MES with ERP and PLM systems.

• Challenges: High installation and maintenance costs pose significant hurdles, particularly for SMEs, alongside the complexities of integrating new solutions with existing legacy systems.

In conclusion, the industrial software market is poised for substantial growth, fueled by technological advancements and increasing demand for sophisticated software solutions. Companies are investing in cutting-edge technologies to remain competitive and meet the evolving needs of the industrial sector. The trend towards cloud-based solutions and the integration of AI and IoT are expected to further propel market expansion, while overcoming cost and integration challenges will be crucial for sustained growth.

The industrial software market is being propelled by the rapid adoption of digital transformation technologies, including IoT, AI, and cloud computing. This shift facilitates improved operational efficiency and predictive maintenance in manufacturing, energy, and other industries. Emerging trends include the integration of AI for advanced automation and using digital twins for simulation and optimization. Disruptions are primarily due to the increasing need for cybersecurity, the challenge of legacy system integration, and the rise of new market entrants offering innovative, cost-effective solutions.

Industrial Software Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Industrial Software Market Trends & Dynamics

Driver: Rapid adoption of Industry 4.0/5.0 technologies in manufacturing and process industries

The rapid adoption of Industry 4.0 and 5.0 technologies in manufacturing and process industries is revolutionizing the industrial software industry . Industry 4.0, characterized by integrating IoT, AI, and data analytics, enhances automation, operational efficiency, and real-time decision-making capabilities. This is further extended by Industry 5.0, which emphasizes human-machine collaboration, sustainability, and resilience. These advancements drive demand for sophisticated software solutions to manage complex, interconnected systems and provide actionable insights. As a result, companies are increasingly investing in advanced software platforms to stay competitive, optimize production processes, and ensure high-quality outputs. This surge is also creating a ripple effect, encouraging innovation and the development of new, more adaptive software products tailored to the evolving needs of the industrial sector.

Restraint: High installation and maintenance cost of industrial software

The substantial implementation costs of industrial software, including Supervisory Control and Data Acquisition (SCADA), Manufacturing Execution Systems (MES), Human-Machine Interfaces (HMI), and robotic software, pose significant challenges for businesses in various industries. The initial expenses for acquiring licenses, hardware, and infrastructure are particularly burdensome for small and medium-sized enterprises (SMEs) with limited financial resources. Furthermore, integrating and customizing these software solutions often require extensive planning, implementation, and training, further escalating costs. Ongoing expenses for maintenance, upgrades, and support services add to the total cost of ownership over the software's lifecycle. Compliance with standards and regulations in highly regulated industries incurs additional fees, increasing the overall financial burden.

Opportunity: Integration of industrial software such as MES with ERP and PLM solutions

The integration of industrial software like Manufacturing Execution Systems (MES) as well as SCADA or robotic software with Enterprise Resource Planning (ERP) and Product Lifecycle Management (PLM) solutions presents significant opportunities for the industrial software industry . This convergence allows for seamless data flow and synchronization across various business processes, enhancing overall operational efficiency and decision-making. By integrating MES with ERP, companies can achieve real-time visibility into production operations, inventory management, and financials, leading to optimized resource utilization and cost savings. Coupling MES with PLM enables better management of product development cycles, ensuring that manufacturing processes are aligned with design specifications and quality standards. This holistic approach improves production accuracy and speed and fosters innovation by providing a comprehensive view of the product lifecycle from inception to delivery. As businesses increasingly seek to leverage integrated systems for greater agility and competitiveness, the demand for sophisticated industrial software solutions that facilitate such integration is expected to rise, driving growth and innovation in the market.

Challenge: Susceptibility of industrial software like MES, SCADA, and HMI to cyberattacks

The susceptibility of industrial software like Manufacturing Execution Systems (MES), Supervisory Control and Data Acquisition (SCADA), and Human-Machine Interfaces (HMI) to cyberattacks presents a critical challenge for industries. These systems are integral to the operations of critical infrastructure and manufacturing processes, making them prime targets for cybercriminals. A successful attack can lead to operational disruptions, data breaches, and even physical damage to equipment, resulting in significant financial losses and safety risks. The increasing connectivity and integration of these systems with IT networks, while beneficial for operational efficiency, also expand the attack surface, making it easier for malicious actors to exploit vulnerabilities. Ensuring robust cybersecurity measures, such as regular software updates, network segmentation, and comprehensive monitoring, is essential to protect these systems. However, implementing these measures can be complex and costly, especially for organizations with legacy systems that may not be designed with modern security features. Consequently, the threat of cyberattacks remains a significant concern, necessitating continuous vigilance and investment in advanced security solutions to safeguard industrial operations.

Industrial Software Market Ecosystem

The Industrial software market is competitive, with major companies such as Siemens (Germany), Rockwell Automation (US), ABB (Switzerland), Emerson Electric Co.(US), and General Electric (US), among others, are the significant providers of industrial software and numerous small- and medium-sized vital enterprises. Many players offer industrial software solutions, while many players and details offer integration services. These integration services are widely required in various processes and discrete industry applications.

Industrial Software Market Segmentation

Based on the type, the MES segment is expected to account for the largest market sharein 2023.

Manufacturing Execution Systems (MES) are poised to contribute a significant market share in the industrial software market due to their critical role in bridging the gap between enterprise-level planning and shop floor execution. MES solutions provide real-time monitoring, control, and optimization of manufacturing processes, significantly enhancing production efficiency, quality, and compliance with industry standards. As industries increasingly adopt smart manufacturing and Industry 4.0 practices, the demand for MES is growing. These systems enable seamless integration with other critical enterprise systems, such as ERP and PLM, fostering a more agile and responsive manufacturing environment. Additionally, MES provides valuable insights through data analytics, helping manufacturers make informed decisions, reduce downtime, and improve overall operational performance. This comprehensive functionality and the drive toward digital transformation are key factors propelling MES to capture a substantial share of the industrial software market.

Based on the end-user, the segment for the discrete manufacturing industry is projected to contribute significantly to the market share during the forecast period.

Discrete industries such as automotive, aerospace, and electronics are expected to contribute a significant market share in the industrial software market due to their complex manufacturing processes and high demand for precision and efficiency. These industries require advanced software solutions to manage intricate production workflows, ensure stringent quality control, and comply with rigorous regulatory standards. In particular, the automotive and aerospace sectors rely heavily on sophisticated software for design, simulation, and manufacturing execution to produce high-quality, reliable products. Additionally, the electronics industry, characterized by rapid innovation and short product lifecycles, benefits significantly from integrated software systems that enhance flexibility and speed in production. The push towards smart manufacturing and digital transformation in these sectors further drives the adoption of industrial software as companies seek to leverage data analytics, IoT, and automation to remain competitive and meet market demands. Consequently, the inherent complexity and high-tech nature of these discrete industries make them prime contributors to the growth of the industrial software market.

Industrial Software Market Regional Analysis

Based on region, Asia Pacific is projected to grow fastest for the industrial software market.

The industrial software market in Asia Pacific includes China, Japan, South Korea, and the rest of Asia Pacific. Projected to exhibit the highest Compound Annual Growth Rate (CAGR) between 2024 and 2029, the Asia Pacific region's industrial software market is poised for significant expansion. Rapid industrialization and urbanization in countries such as China, India, and Southeast Asian nations are driving substantial investments in manufacturing and infrastructure. These regions embrace Industry 4.0 technologies to enhance productivity, efficiency, and competitiveness. For instance, China's "Made in China 2025" initiative aims to upgrade its manufacturing sector through intelligent manufacturing and industrial automation, creating substantial demand for industrial software like MES, SCADA, and ERP systems.

Additionally, the burgeoning electronics and automotive industries in the region are increasingly adopting advanced software solutions to manage complex production processes and ensure high-quality outputs. Furthermore, favorable government policies and incentives supporting digital transformation and intelligent factory initiatives are accelerating the adoption of industrial software. The region's large and growing base of SMEs, which are progressively digitalizing their operations, also contributes to the market's expansion. These instances illustrate why the Asia Pacific is poised for the highest growth in the industrial software market.

Industrial Software Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Industrial Software Companies: Key players

The industrial software companies is dominated by a few globally established players such as

- Siemens (Germany),

- Rockwell Automation (US),

- ABB (Switzerland),

- Emerson Electric Co.(US), and

- General Electric (US), among others.

Industrial Software Market Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 21.5 billion in 2024 |

| Projected Market Size | USD 46.6 billion by 2029 |

| Growth Rate | At CAGR of 16.7% |

|

Market Size Availability for Years |

2020–2029 |

|

Base Year |

2023 |

|

Forecast Period |

2024–2029 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

Type, End Use |

|

Geographies Covered |

North America, Europe, Asia Pacific, and Rest of the world |

|

Companies Covered |

Siemens (Germany), Rockwell Automation (US), ABB (Switzerland), Emerson Electric Co. (US), and General Electric (US), among others, |

Industrial Software Market Size Highlights

This research report categorizes the industrial software market based on type & end-use and region

|

Segment |

Subsegment |

|

Based on Type: |

|

|

Based on End-use |

|

|

Based on Region: |

|

Recent Developments in Industrial Software Industry

- In February 2023, Siemens launched low-code personalization for Opcenter Execution Foundation with Mendix embedded, and two Siemens solutions joined forces. This software allows manufacturers to create user experiences that fit their business processes and specific industry needs.

- In October 2023, Siemens Digital Industries Software and CEA-List, a technological research institute focused on intelligent digital systems research, announced the signing of a memorandum of understanding to collaborate on research to further extend and enhance digital twin capabilities with artificial intelligence (AI) and explore greater integration of embedded software on virtual and hybrid platforms.

- In April 2023, in collaboration with Microsoft, Cisco, Ericsson, PTC, and ODVA, Rockwell Automation planned to accelerate digital transformation in manufacturing. The company will join forces with its PartnerNetwork ecosystem and demonstrate solutions that meet the customers' demand for digital transformation.

- In July 2022, Rockwell Automation entered a partnership deal with Dragos, an industrial cybersecurity company. This partnership will help improve Rockwell Automation's operational technology incident response readiness.

Frequently Asked Questions (FAQs)

Which are the major companies in the industrial software market? What are their significant strategies to strengthen their market presence?

The major companies in the industrial software market are – Siemens (Germany), Rockwell Automation (US), ABB (Switzerland), Emerson Electric Co.(US), and General Electric (US), among others, and so on. The significant strategies these players adopt are product launches and developments, contracts, collaborations, acquisitions, and expansions.

What is the region's potential industrial software market?

The Asia Pacific region is expected to grow fastest in the industrial software market.

What are the opportunities for new market entrants?

Opportunities in the industrial software market arise from the growth of the automotive and electronics sectors due to the growing mobility trend and integration of transportation with advanced technologies.

What are the drivers and opportunities for the industrial software market?

Drivers and opportunities in the industrial software market include the increasing adoption of Industry 4.0 technologies like IoT and AI, which enhance operational efficiency and decision-making. Additionally, the demand for integrated software solutions that connect MES, ERP, and PLM systems to optimize manufacturing processes and ensure compliance is growing, especially in sectors like automotive, aerospace, and electronics.

Who are the major end users of the industry expected to drive the market's growth in the next five years?

The significant consumers for industrial software are electronics, automotive, pharmaceuticals, and other industries.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing need for connected supply chain in manufacturing sector- Increasing importance of real-time data in performing process analysis and predictive maintenance- Integration of AI and ML into discrete and process industries- Government-led investments in AI, HMI, and IIoT- Increasing demand for fault detection and classification solutionsRESTRAINTS- High installation and maintenance costs- Complexities associated with integrating components with existing infrastructure- Requirement for high level of technical expertiseOPPORTUNITIES- Integration of MES with enterprise resource planning and product lifecycle management solutions- Rising shift from on-premises to cloud-based SCADA systems- Increasing adoption of cloud services to store and analyze metrological dataCHALLENGES- Susceptibility to cyberattacks- High operational costs of 3D metrology systems

- 5.3 SUPPLY CHAIN ANALYSIS

-

5.4 ECOSYSTEM ANALYSIS

- 5.5 INVESTMENT AND FUNDING SCENARIO

-

5.6 PRICING ANALYSISINDICATIVE LICENSE/SUBSCRIPTION COST OF KEY PLAYERSINDICATIVE LICENSE/SUBSCRIPTION COST, BY REGION

-

5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.8 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- IoT- Cloud computing- AI- Next-generation SCADACOMPLEMENTARY TECHNOLOGIES- 5GADJACENT TECHNOLOGIES- Next-generation HMI

-

5.9 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

-

5.10 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.11 CASE STUDY ANALYSISELMWOOD RECLAIMED TIMBER ADOPTED SIEMENS’ APS SOLUTION TO IMPROVE DELIVERY TIMELINESS AND ELIMINATE MANUAL SCHEDULING ISSUESPHARMA COMPANY DEPLOYED SIEMENS’ MES OPCENTER EXECUTION DEVICE FOR AUTOMATED AND PAPERLESS MANUFACTURINGSAFRAN CERAMICS INSTALLED INFODREAM’S MES SOFTWARE TO MONITOR AND DIGITALIZE PRODUCTION PROCESSESLONZA ACHIEVED COMPLIANCE WITH FDA REGULATIONS AND REDUCED DATA ENTRY ERRORS WITH ROCKWELL AUTOMATION’S FACTORYTALK PHARMASUITEMADTREE BREWING AND THERMALTECH ENGINEERING CHOSE INDUCTIVE AUTOMATION’S IGNITION TO IMPROVE PRODUCTION AND ANALYSISOVARRO OFFERED EMS STREAM WEBSCADA PLATFORM TO PROVIDE REAL-TIME INSIGHTS INTO MANUFACTURING PROCESSES

-

5.12 TRADE ANALYSISIMPORT DATA (HS CODE 903289)EXPORT DATA (HS CODE 903289)

-

5.13 PATENT ANALYSIS

- 5.14 KEY CONFERENCES AND EVENTS, 2024–2025

-

5.15 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSMAJOR STANDARDS RELATED TO INDUSTRIAL SOFTWARE MARKETREGULATIONS

-

6.1 LATEST TRENDS IN INDUSTRIAL SOFTWARE MARKETIIOTAI AND MLDIGITAL TWINSCLOUD COMPUTINGEDGE COMPUTINGCYBERSECURITYSUSTAINABILITY AND GREEN MANUFACTURINGADVANCED ROBOTICS AND AUTOMATION5G CONNECTIVITYBIG DATA ANALYTICSUSER-FRIENDLY INTERFACES AND CUSTOMIZATIONBLOCKCHAIN

- 7.1 INTRODUCTION

-

7.2 MESBY DEPLOYMENT- On-premises- On-demand- Hybrid

-

7.3 SCADAINCREASING NEED TO MANAGE CONFIDENTIAL DATA TO BOOST DEMAND

-

7.4 HMIBY DEPLOYMENT- On-premises- Cloud-based

-

7.5 AI IN MANUFACTURINGAI SOLUTIONS- By deploymentAI PLATFORMS- By platform type

-

7.6 ROBOTIC SOFTWAREBY TYPE- Simulation- Predictive maintenance- Communication management- Data management and analysis- Recognition

-

7.7 FAULT DETECTION AND CLASSIFICATIONRISING CRITICALITY OF INFRASTRUCTURE SYSTEMS TO FOSTER SEGMENTAL GROWTH

-

7.8 INDUSTRIAL METROLOGYABILITY TO FACILITATE REAL-TIME COLLABORATION AMONG MULTIPLE USERS TO DRIVE DEMAND

- 8.1 INTRODUCTION

-

8.2 PROCESS INDUSTRIESFOOD & BEVERAGES- Growing demand for processed food among expanding population to boost demandOIL & GAS- Improved decision-making through comprehensive data insights to accelerate demandCHEMICAL- Rising reliance of chemical manufacturers on automated solutions to fuel market growthPHARMACEUTICALS- Pressing need for infection-free environment to drive marketENERGY & POWER- Growing industrialization to spur demandWATER & WASTEWATER TREATMENT- Increasing need to tackle sewage and wastewater challenges to foster segmental growthOTHER PROCESS INDUSTRIES

-

8.3 DISCRETE INDUSTRIESAUTOMOTIVE- Ability to identify manufacturing and maintenance issues to drive demandAEROSPACE- Increasing focus on improving product quality and shortening production cycle to fuel market growthELECTRONICS & SEMICONDUCTORS- Rising data volume from manufacturing value chain to accelerate demandOTHER DISCRETE INDUSTRIES

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICARECESSION IMPACT ON INDUSTRIAL SOFTWARE MARKET IN NORTH AMERICAUS- Government-led initiatives to develop manufacturing technologies to boost demandCANADA- Increasing adoption of SCADA, AI, and IIoT in manufacturing sector to drive demandMEXICO- Thriving manufacturing sector to fuel market growth

-

9.3 EUROPERECESSION IMPACT ON INDUSTRIAL SOFTWARE MARKET IN EUROPEUK- Growing number of startups and SMEs to offer lucrative growth opportunitiesGERMANY- Rising demand for remote monitoring in automobile companies to drive marketFRANCE- Increasing emphasis on modernizing production systems and developing advanced production processes to spur demandREST OF EUROPE

-

9.4 ASIA PACIFICRECESSION IMPACT ON INDUSTRIAL SOFTWARE MARKET IN ASIA PACIFICCHINA- Government-led initiatives to develop IIoT capabilities in semiconductor and manufacturing sectors to accelerate demandJAPAN- Introduction of Society 5.0 to offer lucrative growth opportunitiesSOUTH KOREA- Thriving manufacturing sector to drive marketREST OF ASIA PACIFIC

-

9.5 ROWRECESSION IMPACT ON INDUSTRIAL SOFTWARE MARKET IN ROWSOUTH AMERICA- Growing adoption of IoT-based devices in manufacturing sector to foster market growthMIDDLE EAST & AFRICA- Rising focus of oil & gas companies on improving productivity and reducing waste to spike demand- GCC- Africa & Rest of Middle East

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2019–2024

- 10.3 MARKET SHARE ANALYSIS, 2023

- 10.4 REVENUE ANALYSIS, 2019–2023

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 BRAND/PRODUCT COMPARISON

-

10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT: KEY PLAYERS, 2023- Company footprint- Deployment footprint- End-user industry footprint- Region footprint

-

10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023- Detailed list of key startups/SMEs- Competitive benchmarking of key startups/SMEs

-

10.9 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHES/DEVELOPMENTSDEALSOTHERS

-

11.1 KEY PLAYERSSIEMENS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSAP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewROCKWELL AUTOMATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHONEYWELL INTERNATIONAL INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewABB- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGENERAL ELECTRIC COMPANY- Business overview- Products/Solutions/Services offered- Recent developmentsOMRON CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsORACLE- Business overview- Products/Solutions/Services offeredMITSUBISHI ELECTRIC CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsHEXAGON AB- Business overview- Products/Solutions/Services offered- Recent developments

-

11.2 OTHER PLAYERS42QDASSAULT SYSTÈMESRENISHAW PLCNIKON CORPORATIONEPICOR SOFTWARE CORPORATIONYOKOGAWA ELECTRIC CORPORATIONAPPLIED MATERIALS, INC.SPARKCOGNITIONAIBRAIN INC.COGNEX CORPORATIONEMERSON ELECTRIC CO.MICROSOFTTELEDYNE TECHNOLOGIES INCORPORATEDSCHNEIDER ELECTRICGOOGLE

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS

- TABLE 1 BENEFITS OF MES

- TABLE 2 ROLES OF COMPANIES IN INDUSTRIAL SOFTWARE ECOSYSTEM

- TABLE 3 INDICATIVE LICENSE/SUBSCRIPTION COST OF MES OFFERED BY THREE KEY PLAYERS (USD)

- TABLE 4 INDICATIVE SUBSCRIPTION COST OF MES (USD)

- TABLE 5 INDICATIVE COST RANGE OF MES (USD)

- TABLE 6 INDUSTRIAL SOFTWARE MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 7 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY DISCRETE INDUSTRY (%)

- TABLE 8 KEY BUYING CRITERIA, BY DISCRETE INDUSTRY

- TABLE 9 LIST OF APPLIED/GRANTED PATENTS RELATED TO INDUSTRIAL SOFTWARE, 2021–2024

- TABLE 10 INDUSTRIAL SOFTWARE MARKET: LIST OF CONFERENCES AND EVENTS, 2024–2025

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 MAJOR COMMUNICATION STANDARDS FOR SCADA SYSTEMS

- TABLE 16 INDUSTRIAL SOFTWARE MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 17 INDUSTRIAL SOFTWARE MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 18 MES: INDUSTRIAL SOFTWARE MARKET, BY DEPLOYMENT, 2020–2023 (USD MILLION)

- TABLE 19 MES: INDUSTRIAL SOFTWARE MARKET, BY DEPLOYMENT, 2024–2029 (USD MILLION)

- TABLE 20 MES: INDUSTRIAL SOFTWARE MARKET, BY END-USER INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 21 MES: INDUSTRIAL SOFTWARE MARKET, BY END-USER INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 22 MES: INDUSTRIAL SOFTWARE MARKET, BY PROCESS INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 23 MES: INDUSTRIAL SOFTWARE MARKET, BY PROCESS INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 24 MES: INDUSTRIAL SOFTWARE MARKET, BY DISCRETE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 25 MES: INDUSTRIAL SOFTWARE MARKET, BY DISCRETE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 26 MES: INDUSTRIAL SOFTWARE MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 27 MES: INDUSTRIAL SOFTWARE MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 28 SCADA: INDUSTRIAL SOFTWARE MARKET, BY END-USER INDUSTRY, 2020–2023 (USD MILLION).

- TABLE 29 SCADA: INDUSTRIAL SOFTWARE MARKET, BY END-USER INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 30 SCADA: INDUSTRIAL SOFTWARE MARKET, BY PROCESS INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 31 SCADA: INDUSTRIAL SOFTWARE MARKET, BY PROCESS INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 32 SCADA: INDUSTRIAL SOFTWARE MARKET, BY DISCRETE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 33 SCADA: INDUSTRIAL SOFTWARE MARKET, BY DISCRETE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 34 SCADA: INDUSTRIAL SOFTWARE MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 35 SCADA: INDUSTRIAL SOFTWARE MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 36 HMI: INDUSTRIAL SOFTWARE MARKET, BY DEPLOYMENT, 2020–2023 (USD MILLION)

- TABLE 37 HMI: INDUSTRIAL SOFTWARE MARKET, BY DEPLOYMENT, 2024–2029 (USD MILLION)

- TABLE 38 HMI: INDUSTRIAL SOFTWARE MARKET, BY END-USER INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 39 HMI: INDUSTRIAL SOFTWARE MARKET, BY END-USER INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 40 HMI: INDUSTRIAL SOFTWARE MARKET, BY PROCESS INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 41 HMI: INDUSTRIAL SOFTWARE MARKET, BY PROCESS INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 42 HMI: INDUSTRIAL SOFTWARE MARKET, BY DISCRETE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 43 HMI: INDUSTRIAL SOFTWARE MARKET, BY DISCRETE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 44 HMI: INDUSTRIAL SOFTWARE MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 45 HMI: INDUSTRIAL SOFTWARE MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 46 AI IN MANUFACTURING: INDUSTRIAL SOFTWARE MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 47 AI IN MANUFACTURING: INDUSTRIAL SOFTWARE MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 48 AI SOLUTIONS: AI IN MANUFACTURING MARKET, BY DEPLOYMENT, 2020–2023 (USD MILLION)

- TABLE 49 AI SOLUTIONS: AI IN MANUFACTURING MARKET, BY DEPLOYMENT, 2024–2029 (USD MILLION)

- TABLE 50 AI PLATFORMS: AI IN MANUFACTURING MARKET, BY PLATFORM TYPE, 2020–2023 (USD MILLION)

- TABLE 51 AI PLATFORMS: AI IN MANUFACTURING MARKET, BY PLATFORM TYPE, 2024–2029 (USD MILLION)

- TABLE 52 AI IN MANUFACTURING: INDUSTRIAL SOFTWARE MARKET, BY END-USER INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 53 AI IN MANUFACTURING: INDUSTRIAL SOFTWARE MARKET, BY END-USER INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 54 AI IN MANUFACTURING: INDUSTRIAL SOFTWARE MARKET, BY PROCESS INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 55 AI IN MANUFACTURING: INDUSTRIAL SOFTWARE MARKET, BY PROCESS INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 56 AI IN MANUFACTURING: INDUSTRIAL SOFTWARE MARKET, BY DISCRETE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 57 AI IN MANUFACTURING: INDUSTRIAL SOFTWARE MARKET, BY DISCRETE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 58 AI IN MANUFACTURING: INDUSTRIAL SOFTWARE MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 59 AI IN MANUFACTURING: INDUSTRIAL SOFTWARE MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 60 ROBOTIC SOFTWARE: INDUSTRIAL SOFTWARE MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 61 ROBOTIC SOFTWARE: INDUSTRIAL SOFTWARE MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 62 ROBOTIC SOFTWARE: INDUSTRIAL SOFTWARE MARKET, BY END-USER INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 63 ROBOTIC SOFTWARE: INDUSTRIAL SOFTWARE MARKET, BY END-USER INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 64 ROBOTIC SOFTWARE: INDUSTRIAL SOFTWARE MARKET, BY PROCESS INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 65 ROBOTIC SOFTWARE: INDUSTRIAL SOFTWARE MARKET, BY PROCESS INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 66 ROBOTIC SOFTWARE: INDUSTRIAL SOFTWARE MARKET, BY DISCRETE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 67 ROBOTIC SOFTWARE: INDUSTRIAL SOFTWARE MARKET, BY DISCRETE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 68 ROBOTIC SOFTWARE: INDUSTRIAL SOFTWARE MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 69 ROBOTIC SOFTWARE: INDUSTRIAL SOFTWARE MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 70 FAULT DETECTION AND CLASSIFICATION: INDUSTRIAL SOFTWARE MARKET, BY END-USER INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 71 FAULT DETECTION AND CLASSIFICATION: INDUSTRIAL SOFTWARE MARKET, BY END-USER INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 72 FAULT DETECTION AND CLASSIFICATION: INDUSTRIAL SOFTWARE MARKET, BY PROCESS INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 73 FAULT DETECTION AND CLASSIFICATION: INDUSTRIAL SOFTWARE MARKET, BY PROCESS INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 74 FAULT DETECTION AND CLASSIFICATION: INDUSTRIAL SOFTWARE MARKET, BY DISCRETE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 75 FAULT DETECTION AND CLASSIFICATION: INDUSTRIAL SOFTWARE MARKET, BY DISCRETE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 76 FAULT DETECTION AND CLASSIFICATION: INDUSTRIAL SOFTWARE MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 77 FAULT DETECTION AND CLASSIFICATION: INDUSTRIAL SOFTWARE MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 78 INDUSTRIAL METROLOGY: INDUSTRIAL SOFTWARE MARKET, BY END-USER INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 79 INDUSTRIAL METROLOGY: INDUSTRIAL SOFTWARE MARKET, BY END-USER INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 80 INDUSTRIAL METROLOGY: INDUSTRIAL SOFTWARE MARKET, BY PROCESS INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 81 INDUSTRIAL METROLOGY: INDUSTRIAL SOFTWARE MARKET, BY PROCESS INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 82 INDUSTRIAL METROLOGY: INDUSTRIAL SOFTWARE MARKET, BY DISCRETE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 83 INDUSTRIAL METROLOGY: INDUSTRIAL SOFTWARE MARKET, BY DISCRETE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 84 INDUSTRIAL METROLOGY: INDUSTRIAL SOFTWARE MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 85 INDUSTRIAL METROLOGY: INDUSTRIAL SOFTWARE MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 86 INDUSTRIAL SOFTWARE MARKET, BY END-USER INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 87 INDUSTRIAL SOFTWARE MARKET, BY END-USER INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 88 INDUSTRIAL SOFTWARE MARKET, BY PROCESS INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 89 INDUSTRIAL SOFTWARE MARKET, BY PROCESS INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 90 PROCESS INDUSTRY: INDUSTRIAL SOFTWARE MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 91 PROCESS INDUSTRY: INDUSTRIAL SOFTWARE MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 92 INDUSTRIAL SOFTWARE MARKET, BY DISCRETE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 93 INDUSTRIAL SOFTWARE MARKET, BY DISCRETE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 94 DISCRETE INDUSTRY: INDUSTRIAL SOFTWARE MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 95 DISCRETE INDUSTRY: INDUSTRIAL SOFTWARE MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 96 INDUSTRIAL SOFTWARE MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 97 INDUSTRIAL SOFTWARE MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 98 NORTH AMERICA: INDUSTRIAL SOFTWARE MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 99 NORTH AMERICA: INDUSTRIAL SOFTWARE MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 100 NORTH AMERICA: INDUSTRIAL SOFTWARE MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 101 NORTH AMERICA: INDUSTRIAL SOFTWARE MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 102 EUROPE: INDUSTRIAL SOFTWARE MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 103 EUROPE: INDUSTRIAL SOFTWARE MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 104 EUROPE: INDUSTRIAL SOFTWARE MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 105 EUROPE: INDUSTRIAL SOFTWARE MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 106 ASIA PACIFIC: INDUSTRIAL SOFTWARE MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 107 ASIA PACIFIC: INDUSTRIAL SOFTWARE MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 108 ASIA PACIFIC: INDUSTRIAL SOFTWARE MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 109 ASIA PACIFIC: INDUSTRIAL SOFTWARE MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 110 ROW: INDUSTRIAL SOFTWARE MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 111 ROW: INDUSTRIAL SOFTWARE MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 112 ROW: INDUSTRIAL SOFTWARE MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 113 ROW: INDUSTRIAL SOFTWARE MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 114 MIDDLE EAST & AFRICA: INDUSTRIAL SOFTWARE MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 115 MIDDLE EAST & AFRICA: INDUSTRIAL SOFTWARE MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 116 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2019–2024

- TABLE 117 INDUSTRIAL SOFTWARE MARKET: DEGREE OF COMPETITION, 2023

- TABLE 118 INDUSTRIAL SOFTWARE MARKET: COMPANY DEPLOYMENT FOOTPRINT

- TABLE 119 INDUSTRIAL SOFTWARE MARKET: END-USER INDUSTRY FOOTPRINT

- TABLE 120 INDUSTRIAL SOFTWARE MARKET: REGION FOOTPRINT

- TABLE 121 INDUSTRIAL SOFTWARE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 122 INDUSTRIAL SOFTWARE MARKET FOR MES TECHNOLOGY: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 123 INDUSTRIAL SOFTWARE MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, JULY 2019–APRIL 2024

- TABLE 124 INDUSTRIAL SOFTWARE MARKET: DEALS, JULY 2019– APRIL 2024

- TABLE 125 INDUSTRIAL SOFTWARE MARKET: OTHERS, JULY 2019– APRIL 2024

- TABLE 126 SIEMENS: COMPANY OVERVIEW

- TABLE 127 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 128 SIEMENS: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 129 SIEMENS: DEALS

- TABLE 130 SAP: COMPANY OVERVIEW

- TABLE 131 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 132 SAP: DEALS

- TABLE 133 ROCKWELL AUTOMATION: COMPANY OVERVIEW

- TABLE 134 ROCKWELL AUTOMATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 135 ROCKWELL AUTOMATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 136 ROCKWELL AUTOMATION: DEALS

- TABLE 137 ROCKWELL AUTOMATION: OTHERS

- TABLE 138 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 139 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 140 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 141 ABB: COMPANY OVERVIEW

- TABLE 142 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 143 ABB: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 144 ABB: DEALS

- TABLE 145 GENERAL ELECTRIC COMPANY: COMPANY OVERVIEW

- TABLE 146 GENERAL ELECTRIC COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 147 GENERAL ELECTRIC COMPANY: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 148 GENERAL ELECTRIC COMPANY: DEALS

- TABLE 149 OMRON CORPORATION: COMPANY OVERVIEW

- TABLE 150 OMRON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 151 OMRON CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 152 OMRON CORPORATION: DEALS

- TABLE 153 ORACLE: COMPANY OVERVIEW

- TABLE 154 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 155 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 156 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 157 MITSUBISHI ELECTRIC CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 158 MITSUBISHI ELECTRIC CORPORATION: DEALS

- TABLE 159 HEXAGON AB: COMPANY OVERVIEW

- TABLE 160 HEXAGON AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 HEXAGON AB: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 162 HEXAGON AB: DEALS

- FIGURE 1 INDUSTRIAL SOFTWARE MARKET SEGMENTATION

- FIGURE 2 INDUSTRIAL SOFTWARE MARKET SIZE ESTIMATION PROCESS FLOW

- FIGURE 3 INDUSTRIAL SOFTWARE MARKET: RESEARCH DESIGN

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE GENERATED BY KEY PLAYERS

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 AI IN MANUFACTURING TECHNOLOGY TO ACCOUNT FOR LARGEST MARKET SHARE IN 2029

- FIGURE 9 DISCRETE INDUSTRIES TO HOLD LARGER MARKET SHARE IN 2029

- FIGURE 10 PHARMACEUTICALS INDUSTRY TO CLAIM LARGEST MARKET SHARE IN 2029

- FIGURE 11 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 RISING DEPLOYMENT OF INTEGRATED SOFTWARE SOLUTIONS IN MANUFACTURING FACILITIES TO DRIVE MARKET

- FIGURE 13 MES TECHNOLOGY TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 14 DISCRETE INDUSTRIES TO CAPTURE LARGER MARKET SHARE IN 2024

- FIGURE 15 AUTOMOTIVE INDUSTRY TO HOLD LARGER MARKET SHARE IN 2029

- FIGURE 16 CHINA TO REGISTER HIGHEST CAGR IN GLOBAL INDUSTRIAL SOFTWARE MARKET DURING FORECAST PERIOD

- FIGURE 17 INDUSTRIAL SOFTWARE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 INDUSTRIAL SOFTWARE MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 19 INDUSTRIAL SOFTWARE MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 20 INDUSTRIAL SOFTWARE MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 21 INDUSTRIAL SOFTWARE MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 22 INDUSTRIAL SOFTWARE MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 23 INDUSTRIAL SOFTWARE ECOSYSTEM ANALYSIS

- FIGURE 24 INVESTMENT AND FUNDING SCENARIO

- FIGURE 25 INDICATIVE COST OF LICENSES/SUBSCRIPTIONS OF MES OFFERED BY THREE KEY PLAYERS (USD)

- FIGURE 26 INDICATIVE LICENSE/SUBSCRIPTION COST OF MES, 2020–2023 (USD)

- FIGURE 27 INDICATIVE LICENSE/SUBSCRIPTION COST OF MES, BY REGION, 2020–2023 (USD)

- FIGURE 28 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- FIGURE 29 INDUSTRIAL SOFTWARE MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY DISCRETE INDUSTRY

- FIGURE 31 KEY BUYING CRITERIA, BY DISCRETE INDUSTRY

- FIGURE 32 IMPORT DATA FOR HS CODE 903289-COMPLIANT PRODUCTS, BY COUNTRY, 2019–2023 (USD MILLION)

- FIGURE 33 EXPORT DATA FOR HS CODE 903289-COMPLIANT PRODUCTS, BY COUNTRY, 2019–2023 (USD MILLION)

- FIGURE 34 NUMBER OF PATENTS APPLIED AND GRANTED FOR INDUSTRIAL SOFTWARE SOLUTIONS, 2014–2023

- FIGURE 35 INDUSTRIAL SOFTWARE MARKET, BY TECHNOLOGY

- FIGURE 36 MES TECHNOLOGY TO LEAD MARKET IN 2024

- FIGURE 37 ADVANTAGES OF SOFTWARE-INTEGRATED SCADA SYSTEMS

- FIGURE 38 INDUSTRIAL SOFTWARE MARKET, BY END-USER INDUSTRY

- FIGURE 39 PHARMACEUTICALS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2024

- FIGURE 40 AUTOMOTIVE SEGMENT TO DOMINATE MARKET IN 2029

- FIGURE 41 INDUSTRIAL SOFTWARE MARKET, BY REGION

- FIGURE 42 NORTH AMERICA: INDUSTRIAL SOFTWARE MARKET SNAPSHOT

- FIGURE 43 EUROPE: INDUSTRIAL SOFTWARE MARKET SNAPSHOT

- FIGURE 44 ASIA PACIFIC: INDUSTRIAL SOFTWARE MARKET SNAPSHOT

- FIGURE 45 INDUSTRIAL SOFTWARE MARKET SHARE ANALYSIS, 2023

- FIGURE 46 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2019–2023

- FIGURE 47 COMPANY VALUATION, 2023

- FIGURE 48 FINANCIAL METRICS (EV/EBITDA), 2023

- FIGURE 49 BRAND/PRODUCT COMPARISON

- FIGURE 50 INDUSTRIAL SOFTWARE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 51 INDUSTRIAL SOFTWARE MARKET: COMPANY FOOTPRINT

- FIGURE 52 INDUSTRIAL SOFTWARE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 53 SIEMENS: COMPANY SNAPSHOT

- FIGURE 54 SAP: COMPANY SNAPSHOT

- FIGURE 55 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

- FIGURE 56 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 57 ABB: COMPANY SNAPSHOT

- FIGURE 58 OMRON CORPORATION: COMPANY SNAPSHOT

- FIGURE 59 ORACLE: COMPANY SNAPSHOT

- FIGURE 60 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 61 HEXAGON AB: COMPANY SNAPSHOT

The study utilized four major activities to estimate the industrial software market size. Exhaustive secondary research was conducted to gather information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Finally, market breakdown and data triangulation methods were utilized to estimate the market size for different segments and subsegments.

Secondary Research

In the secondary research process, various sources were used to identify and collect information on the industrial software market for this study. Secondary sources for this research study include corporate filings (such as annual reports, investor presentations, and financial statements), trade, business, and professional associations, white papers, certified publications, articles by recognized authors, directories, and databases. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

List of key secondary sources

|

SOURCE |

WEB LINK |

|

Automation Industry Association |

www.aia-india.org |

|

Manufacturing Enterprise Solutions Association (MESA) |

https://www.mesa.org/en/index.asp |

|

International Society of Automation (ISA) |

https://www.isa.org/ |

|

Measurement, Control & Automation Association (MCAA) |

https://themcaa.org/ |

|

User Association of Automation Technology in Process Industries (NAMUR) |

https://www.namur.net/en/index.html |

|

The Industrial Interoperability Standard (The OPC Foundation) |

https://opcfoundation.org/ |

Primary Research

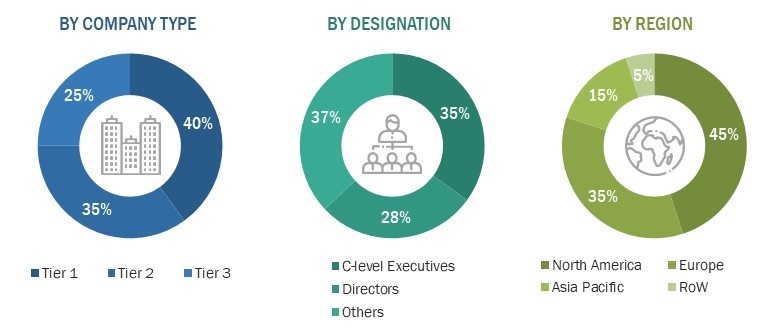

Primary interviews were conducted to gather insights on market statistics, revenue data, market breakdowns, size estimations, and forecasting. Additionally, primary research was used to comprehend the various technology, type, end-use, and regional trends. Interviews with stakeholders from the demand side, including CIOs, CTOs, CSOs, and customer/end-user installation teams using industrial software offerings and processes, were also conducted to understand their perspective on suppliers, products, component providers, and their current and future use of industrial software, which will impact the overall market. Several primary interviews were conducted across major countries in North America, Europe, Asia Pacific, the Middle East, Africa, and Latin America.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were utilized to estimate and validate the size of the industrial software market and its submarkets. Secondary research was conducted to identify the key players in the market, and primary and secondary research was used to determine their market share in specific regions. The process involved studying top players’ annual and financial reports and conducting extensive interviews with industry leaders such as CEOs, VPs, directors, and marketing executives. Secondary sources were used to determine all percentage shares and breakdowns, verified through primary sources. All parameters that could impact the markets covered in this research study were accounted for, analyzed in detail, verified through primary research, and consolidated to obtain the final quantitative and qualitative data.

Global Industrial Software Market Size: Botton Up Approach

- Identifying end users that are either using or will use industrial software.

- Tracking leading companies and system integrators operating across various industries.

- Deriving the size of the industrial software by type market through the data sanity method; analyzing revenues of more than 25 critical providers through their annual reports and press releases and summing them up to estimate the overall market size.

- Analyzing the use cases across different regions and companies

- Tracking the ongoing and upcoming installation contracts, acquisitions, expansions, and product launches by various companies and forecasting the market size based on these developments and other critical parameters.

- Conduct multiple discussions with key opinion leaders to understand industrial software components offered by companies to various applications and analyze the breakdown of the scope of work carried out by each major company providing industrial software components.

- Carrying out the market trend analysis to obtain the CAGR of the industrial software with respect to their types in the said market by understanding the industry penetration rate and analyzing the demand and supply of software in different verticals.

- Assigning a percentage to the overall revenue or, in a few cases, to each company's segmental revenues to derive their revenues from the sale of industrial software. This percentage for each company has been assigned based on their product portfolios.

- Verifying and crosschecking the estimates at every level through discussions with key opinion leaders, including CEOs, directors, operations managers, and domain experts at MarketsandMarkets

- Studying various paid and unpaid information sources, such as annual reports, press releases, and white papers

Global Industrial Software Market Size: Top-Down Approach

The top-down approach has been used to estimate and validate the total size of the industrial software market.

- Information related to the revenue of key manufacturers and providers of Industrial software components was studied and analyzed to estimate the global size of the Industrial software market.

- Multiple discussions were conducted with key opinion leaders to understand the demand for industrial software solutions and analyze the breakdown of the scope of work carried out by each significant company.

- Revenue, geographic presence, critical applications served, and diverse offerings of all identified players in the Industrial software market were studied to estimate and arrive at the percentage split of different market segments.

- All major players in the Industrial software market were identified through secondary research and verified through brief discussions with industry experts.

- Multiple discussions were conducted with key opinion leaders of all key companies developing Industrial software solutions to validate the market split based on type, industry, and region.

- Geographic splits were estimated using secondary sources based on factors such as the number of players offering industrial software solutions in a specific country or region and the industries for which these players provide the solutions.

Data Triangulation

Once the overall size of the industrial software market was determined using the methods described above, it was divided into multiple segments and subsegments. Market engineering was performed for each segment and subsegment using market breakdown and data triangulation methods, as applicable, to obtain accurate statistics. Various factors and trends from the demand and supply sides were studied to triangulate the data. The market was validated using both top-down and bottom-up approaches.

Market Definition

The industrial software market encompasses software solutions specifically designed to optimize and manage various industrial processes and operations across different sectors, such as manufacturing, energy, automotive, pharmaceuticals, and more. These software solutions include but are not limited to Manufacturing Execution Systems (MES), Supervisory Control and Data Acquisition (SCADA), Human Machine Interface (HMI), AI in Manufacturing, Robotic Software, and various analytics and optimization tools. Industrial software facilitates automation, real-time monitoring, data integration, and decision support to enhance efficiency, productivity, quality, and compliance within industrial settings. The market serves industries seeking to leverage digital technologies to achieve operational excellence, meet regulatory requirements, and adapt to evolving market demands in an increasingly competitive global landscape.

Key Stakeholders

- Providers and distributors in industrial software

- End users

- System integrators

- Mobile application developers

- Networking and communication service providers

- Governments, financial institutions, and investment communities

- Research organizations

Report Objectives

- To define, describe, and forecast the industrial software market based on type & end-use, and region

- To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete value chain and allied industry segments and perform a market value chain analysis.

- To provide ecosystem analysis, case study analysis, patent analysis, technology analysis, pricing analysis, Porter’s five forces analysis, key stakeholders and buying criteria, key conferences and events, and regulatory bodies, government agencies, and regulations pertaining to the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2.

- Analyzing the opportunities in the market for stakeholders and describing the market's competitive landscape.

- To analyze competitive developments such as collaborations, agreements, contracts, partnerships, mergers & acquisitions, product launches, and research & development (R&D) in the market

- To analyze the impact of the recession on the industrial software market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the industrial software market

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company in the industrial software market.

Growth opportunities and latent adjacency in Industrial Software Market