Industrial Nailer Market by Product Type (Brad, Coil, Roofing and Siding, Framing, Flooring), Operation (Pneumatic, Electric), End User (Packaging, Manufacturing, Construction, Wood Working, Metal Working) and Region − Global Forecast 2024 to 2030

An industrial nailer, also known as a nail gun, is used to drive nails into wood and other material. In addition, an industrial nailer is considered a professional hand tool used for straps, siding, fences, underfloor, exteriors, and roofing. Industrial nailers are usually powered by electromagnetism, compressed air (pneumatic), and highly flammable gases, namely butane and propane. Further, it is manufactured with a portable design and is a maintenance-free device. Moreover, the industrial nailer has a mechanically triggered locking system.

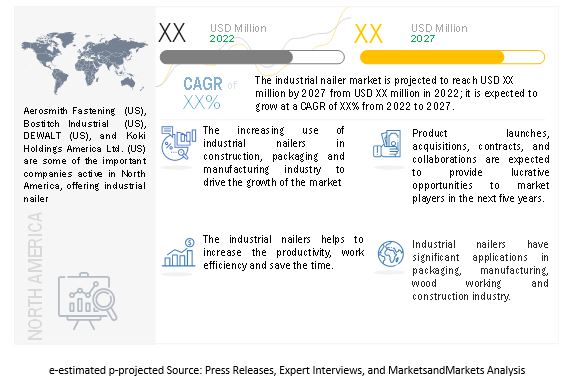

The global industrial nailer market size is expected to grow from USD XX million in 2024 to USD XX million by 2030, at a CAGR of XX%. The demand for automation in the manufacturing industry is the key factor boosting the market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Drivers: Increasing use of industrial nailers in construction, packaging, and manufacturing industry

The global industrial nailer market is projected to grow exponentially owing to rising demand for industrial nailers in several industries, namely construction, packaging, and manufacturing. The demand for industrial nailers is growing due to their superior capabilities. Industrial nailers help to increase productivity and work efficiency and save time. Moreover, these industrial nailers can replace industrial hand tools, including metalworking hammers, which are projected to drive the growth of the industrial nailers market during the forecast period.

Growing industrialization to drive the demand for industrial nailers

As industrialization is increasing rapidly worldwide, the cost of bulk products is expected to decrease. Further, it will lead to the demand for more efficient automation. Due to the growing industrialization - manufacturing demand, diversification, adoption, and implementation of newer technology will increase. This helps to drive the growth of the industrial nailers market to expand and prosper during the forecast period.

Challenges: Skilled workers to operate machinery associated with nailers leads to an increase in the labor cost

The equipment and machinery associated with industrial nailers are considered complex in the market. They can only be operated by well-trained and skilled workers, which further increases labor costs. This factor is the most growing challenge and can hinder the market and the near future. Additionally, workers must take some required safety precautions to use these devices because failure can lead to serious health hazards. These features are challenging and can disrupt the market.

Key players in the market

Aerosmith Fastening (US), APACH INDUSTRIAL CO., LTD. (Taiwan), John. Friedrich Behrens France (Germany), Bostitch Industrial (US), DEWALT (US), Koki Holdings America Ltd. (US), J-AIR Corporation (Japan), MAX Co., Ltd. (Japan), and Raimund BECK KG (Austria) are few key players in the industrial nailer market globally.

Recent Developments

- In May 2022, DEWALT announced the ATOMIC COMPACT SERIES 20V MAX Brushless Cordless 23 Ga. Pin Nailer (DCN623) for the woodworking industry

- In May 2020, DEWALT announced the 20V MAX 15° Coil Roofing Nailer (DCN45RN); this nailer is ideal for service and repair jobs, flashing and shingling around windows, small production work, skylights, and vents.

- In December 2020, MAX Co., Ltd. launched a lightweight coil nailer to provide safety and reliability for various construction activities.

TABLE OF CONTENTS

1 Introduction

1.1. Study Objective

1.2. Market Definition

1.2.1. Inclusions and Exclusions

1.3. Market Scope

1.3.1. Markets Covered

1.3.2. Geographic Scope

1.3.3. Years considered for the study

1.4. Currency

1.5. Limitations

1.6. Market Stakeholders

2 Research Methodology

2.1. Research Data

2.1.1. Secondary and Primary Research

2.1.2. Secondar Data

2.1.3. Primary Data

2.2. Market Size Estimation

2.2.1. Bottom-up Approach

2.2.2. Top-down Approach

2.3. Data Triangulation

2.4. Research Assumptions

2.5. Risk Assessment

3 Executive Summary

4 Premium Insights

5 Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.2.4. Challenges

5.3. Value Chain Analysis

5.4. Ecosystem

5.5. Pricing Analysis

5.5.1. Average Selling Prices (ASP) of Key Players

5.5.2. Average Selling Prices (ASP) Trend

5.6. Trends/Disruptions Impacting Customers

5.7. Technology Analysis

5.8. Porter’s Five Forces Analysis

5.9. Key Stakeholders & Buying Criteria

5.9.1. Key Stakeholders in Buying Process

5.9.2. Buying Criteria

5.10. Case Study

5.11. Trade Analysis

5.12. Patents Analysis

5.13. Key Conferences & Events

5.14. Tariff and Regulatory Landscape

5.14.1. Regulatory Bodies, Government Agencies, and Other Organizations

5.14.2. Regulations and Standards

6 Industrial Nailer Market, By Product Type

6.1. Introduction

6.2. Brad Nailer

6.3. Coil Nailer

6.4. Roofing and Siding Nailer

6.5. Framing Nailer

6.6. Flooring Nailer

7 Industrial Nailer Market, By Operation

7.1. Introduction

7.2. Pneumatic

7.3. Electric

8 Industrial Nailer Market, By End Users

8.1. Introduction

8.2. Packaging

8.3. Manufacturing

8.4. Construction

8.5. Wood Working

8.6. Metal Working

9 Industrial Nailer Market, By Region

9.1. Introduction

9.2. North America

9.3. Europe

9.4. APAC

9.5. RoW

10 Competitive Landscape

10.1. Introduction

10.2. Key Player Strategies/ Right to Win

10.3. Top 5 Company Revenue Analysis

10.4. Market Share Analysis

10.5. Company Evaluation Quadrant

10.5.1. Star

10.5.2. Emerging Leader

10.5.3. Pervasive

10.5.4. Participant

10.6. Startup/SME Evaluation Matrix

10.6.1. Progressive Companies

10.6.2. Responsive Companies

10.6.3. Dynamic Companies

10.6.4. Starting Blocks

10.7. Industrial Nailer Market: Company Footprint

10.8. Competitive Benchmarking

10.9. Competitive Situation and Trends

11 Company Profiles

11.1. Introduction

11.2. Key Players

11.2.1. Aerosmith Fastening

11.2.2. Apach Industrial Co., Ltd.

11.2.3. Behrens AG (BeA)

11.2.4. Bostitch Industria

11.2.5. DEWALT

11.2.6. Hitachi Koki USA, Ltd.

11.2.7. J AIR

11.2.8. MAX Co., Ltd.

11.2.9. Raimund Beck KG

11.2.10. THE BOSTON WIRE STITCHER

11.3. Other Key Players

12 Adjacent & Related Market

13 Appendix

Note: The above-mentioned table of content is tentative, and we may change the content once we start working on the study.

Growth opportunities and latent adjacency in Industrial Nailer Market