Industrial Margarine Market by Type (Spreadable, All Purpose, and Butter Blend), Application (Bakery, Confectionery, Convenience Food, Sauces, and Spreads & Toppings), Form (Hard and Soft), Source (Plant and Animal), and Region - Global Forecast to 2022

[118 Pages Report] The industrial margarine market was valued at USD 2.17 Billion in 2016 and is projected to grow at a CAGR of 3.5%, to reach USD 2.66 Billion by 2022. The base year considered for the study is 2016 and the forecast period is from 2017 to 2022. The basic objective of the report is to define, segment, and project the global market size for industrial margarine on the basis of application, type, form, source, and region. It also helps to understand the structure of this market by identifying its various segments. The other objectives include analyzing the opportunities in the market for stakeholders and providing a competitive landscape of market trends, analyzing the macro and micro indicators of this market to provide factor analysis, and to project the size of the industrial margarine market.

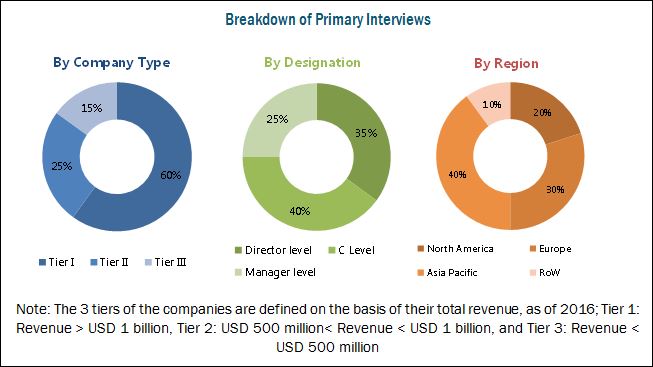

This report includes estimations of the market size in terms of value (USD million) and volume (kilotons). Both, top-down and bottom-up approaches have been used to estimate and validate the size of the global industrial margarine market and to estimate the size of various other dependent submarkets in the overall market. The key players in the market have been identified through secondary research, some of the sources are press releases, paid databases such as Factiva and Bloomberg, annual reports, and financial journals; their market share in respective regions have also been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and were verified through primary sources. The figure below shows the breakdown of profiles of industry experts that participated in the primary discussions.

To know about the assumptions considered for the study, download the PDF brochure

The key players that are profiled in the report include Congara (US), Bunge (Germany), Puratos (Belgium), Associated British Foods (US), Fuij Oil (Japan), Richardson International (Italy), Royale Lacroix (Belgium), Aigremont (Belgium), Vandemoortele (Belgium), NMGK Group (Russia), EFCO Group (Russia), and Wilmar International (Singapore).

The report is targeted at the existing players in the industry, which include the following:

- Regulatory and research organizations

- Raw material producers, suppliers, and distributors

- Equipment manufacturers, traders, distributors, and dealers

- Industrial margarine manufacturers, traders, distributors, and dealers

The study answers several questions for stakeholders, primarily which market segments to focus on in the next two to five years for prioritizing efforts and investments.

Scope of the Report

On the basis of Application, the industrial margarine market has been segmented into:

- Bakery

- Spreads, sauces, and toppings

- Confectionery

- Convenience food

- Others (desserts & snacks)

On the basis of Type, the industrial margarine market has been segmented into:

- Spreadable

- All purpose

- Butter blend

On the basis of Form, the market has been segmented into:

- Hard

- Soft

On the basis of Source, the market has been segmented into:

- Plant

- Animal

On the basis of Region, the market has been segmented into:

- North America

- Europe

- Asia Pacific

- RoW (South Africa, the Middle East, and Africa)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Regional Analysis

- Further breakdown of the Rest of Europe industrial margarine market into Russia, Belgium, Netherlands, and Sweden.

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Factors such as lower prices of margarine as well as lower fat content as compared to butter are driving the industrial margarine industry. In addition to this, the rapid growth of the bakery and confectionery industries in rapidly developing economies is projected to drive the demand for industrial margarine.

On the basis of application, the bakery industry accounted for the largest share, followed by the confectionery industry, in 2016. The growth in the bakery, confectionery, and convenience food sectors is fueling the demand for margarine as it is a cost-effective substitute for butter.

The industrial margarine market, on the basis of type, is segmented into spreadable, all purpose, and butter blend margarine. The all purpose segment accounted for the largest market share in 2016 as it can be used for baking, frying, and spreading. It is widely used for in the bakery products industry.

On the basis of source, margarine sourced from plants accounted for a larger market share in 2016, followed by margarine sourced from animals. Plants as a source are preferred by margarine manufacturers as they provide a uniform base and control the level of hydrogenation. They are also opted by the vegan and vegetarian population, further driving this segment.

On the basis of form, the hard form of margarine accounted for a larger market share in 2016, as the hard form of margarine is preferred in baking applications, especially for pastry or cake making.

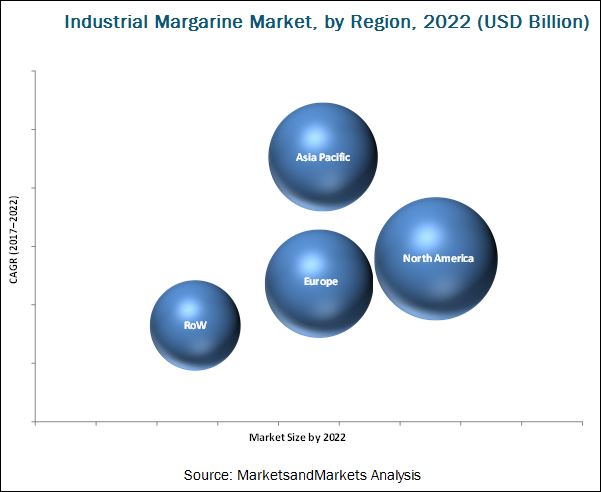

North America accounted for the largest market share of the industrial margarine market in 2016. This market is driven by the health-conscious consumers due to the growing incidences of diseases such as diabetes, high-blood pressure, and constipation that has been fueling the market for margarine. The food manufacturers in the US are therefore concentrating on producing margarine products that do not contain any trans-fat.

The major restraining factor for the industrial margarine market is the stringent international regulations as regulatory approval of a food ingredient is critical. Obtaining regulatory approval for a new ingredient can be a costly and time-consuming process.

Companies such as Conagra (US), Bunge (US), and Puratos (Belgium) have acquired a leading market position through the provision of a broad product portfolio, along with a focus on diverse end-user segments. They are also focused on innovations and are geographically diversified.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Periodization Considered for the Study

1.5 Currency

1.6 Unit Considered

1.7 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.2 Market Share Estimation

2.2.1 Secondary Data

2.2.1.1 Key Data From Secondary Sources

2.2.2 Primary Data

2.2.2.1 Key Industry Insights

2.2.2.2 Breakdown of Primaries

2.3 Market Size Estimation

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions and Limitations

2.5.1 Assumptions

2.5.2 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Market Opportunities for Industrial Margarine Manufacturers

4.2 Industrial Margarine Market, By Region

4.3 North America: Market for Industrial Margarine, By Country & Application

4.4 Market, By Application & Region

4.5 Market, By Country

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Consumption of Margarine & Changing Tastes and Preferences of Consumers in Developing Markets

5.2.1.2 Growth of the Food Industry

5.2.1.3 Low Price of Margarine

5.2.2 Restraints

5.2.2.1 Compliance With International Quality Standards and Stringent Regulations

5.2.3 Opportunities

5.2.3.1 Growing Convenience Food Industry

5.2.4 Challenges

5.2.4.1 Rising Health Awareness and Obesity Concerns

6 Industrial Margarine Market, By Application (Page No. - 40)

6.1 Introduction

6.2 Bakery

6.3 Spreads, Sauces, and Toppings

6.4 Confectionery

6.5 Convenience Food

6.6 Others

7 Industrial Margarine Market, By Type (Page No. - 47)

7.1 Introduction

7.2 Spreadable Margarine

7.3 All-Purpose Industrial Margarine

7.4 Butter Blend

8 Industrial Margarine Market, By Source (Page No. - 52)

8.1 Introduction

8.2 Animal Source

8.3 Plant Source

9 Industrial Margarine Market, By Form (Page No. - 56)

9.1 Introduction

9.2 Hard Industrial Margarine

9.3 Soft Industrial Margarine

10 Industrial Margarine Market, By Region (Page No. - 60)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 UK

10.3.2 France

10.3.3 Germany

10.3.4 Italy

10.3.5 Spain

10.3.6 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 Australia & New Zealand

10.4.5 Rest of Asia Pacific

10.5 Rest of the World (RoW)

10.5.1 South America

10.5.2 Middle East

10.5.3 Africa

11 Competitive Landscape (Page No. - 85)

11.1 Overview

11.2 Company Ranking Analysis

11.3 Acquisitions

11.4 Expansions

11.5 Joint Ventures

12 Company Profiles (Page No. - 88)

(Business Overview, Product Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 Conagra

12.2 Bunge

12.3 Puratos

12.4 Wilmar International

12.5 Associated British Foods

12.6 Fuji Oil

12.7 Vandemoortele

12.8 NMGK Group

12.9 EFKO Group

12.10 Royale Lacroix

12.11 Richardson International

12.12 Aigremont

*Details on Business Overview, Product Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 112)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (80 Tables)

Table 1 US Dollar Exchange Rate Considered for Study, 20142016

Table 2 Industrial Margarine Market Size, By Application, 20152022 (USD Million)

Table 3 Market Size, By Application, 20152022 (KT)

Table 4 Bakery: Industrial Margarine Market Size, By Region, 20152022 (USD Million)

Table 5 Bakery: Market Size, By Region, 20152022 (KT)

Table 6 Spreads, Sauces, and Toppings: Industrial Margarine Market Size, By Region, 20152022 (USD Million)

Table 7 Spreads, Sauces, and Toppings: Market Size, By Region, 20152022 (KT)

Table 8 Confectionery: Market Size for Industrial Margarine, By Region, 20152022 (USD Million)

Table 9 Confectionery: Market Size, By Region, 20152022 (KT)

Table 10 Convenience Food: Industrial Margarine Market Size, By Region, 20152022 (USD Million)

Table 11 Convenience Food: Market Size, By Region, 20152022 (KT)

Table 12 Others: Market Size for Industrial Margarine, By Region, 20152022 (USD Million)

Table 13 Others: Market Size, By Region, 20152022 (KT)

Table 14 Market Size for Industrial Margarine, By Type, 20152022 (USD Million)

Table 15 Market Size, By Type, 20152022 (KT)

Table 16 Spreadable Industrial Margarine Market Size, By Region, 20152022 (USD Million)

Table 17 Market Size, By Region, 20152022 (KT)

Table 18 All-Purpose Industrial Margarine Market Size, By Region, 20152022 (USD Million)

Table 19 Market Size, By Region, 20152022 (KT)

Table 20 Butter Blend Industrial Margarine Market Size, By Region, 20152022 (USD Million)

Table 21 Market Size, By Region, 20152022 (KT)

Table 22 Market Size for Industrial Margarine, By Source, 2015-2022 (USD Million)

Table 23 Market Size, By Source, 2015-2022 (KT)

Table 24 Animal-Sourced Industrial Margarine Market Size, By Region, 2015-2022 (USD Million)

Table 25 Market Size, By Region, 2015-2022 (KT)

Table 26 Plant-Sourced Industrial Margarine Market Size, By Region, 2015-2022 (USD Million)

Table 27 Market Size, By Region, 2015-2022 (KT)

Table 28 Market Size for Industrial Margarine, By Form, 20152022 (USD Million)

Table 29 Market Size, By Form, 20152022 (KT)

Table 30 Hard Industrial Margarine Market Size, By Region, 20152022 (USD Million)

Table 31 Market Size, By Region, 20152022 (KT)

Table 32 Soft Industrial Margarine Market Size, By Region, 20152022 (USD Million)

Table 33 Market Size, By Region, 20152022 (KT)

Table 34 Market Size for Industrial Margarine, By Region, 20152022 (USD Million)

Table 35 Market Size, By Region, 20152022 (KT)

Table 36 North America: Industrial Margarine Market Size, By Application, 20152022 (USD Million)

Table 37 North America: Market Size, By Application, 20152022 (KT)

Table 38 North America: Market Size, By Type, 20152022 (USD Million)

Table 39 North America: Market Size, By Type, 20152022 (KT)

Table 40 North America: Market Size, By Source, 20152022 (USD Million)

Table 41 North America: Market Size, By Source, 20152022 (KT)

Table 42 North America: Market Size, By Form, 20152022 (USD Million)

Table 43 North America: Market Size, By Form, 20152022 (KT)

Table 44 North America: Market Size, By Country, 20152022 (USD Million)

Table 45 North America: Market Size, By Country, 20152022 (KT)

Table 46 Europe: Industrial Margarine Market Size, By Application, 20152022 (USD Million)

Table 47 Europe: Market Size, By Application, 20152022 (KT)

Table 48 Europe: Market Size, By Type, 20152022 (USD Million)

Table 49 Europe: Market Size, By Type, 20152022 (KT)

Table 50 Europe: Market Size, By Source, 20152022 (USD Million)

Table 51 Europe: Market Size, By Source, 20152022 (KT)

Table 52 Europe: Market Size, By Form, 20152022 (USD Million)

Table 53 Europe: Market Size, By Form, 20152022 (KT)

Table 54 Europe: Market Size, By Country, 20152022 (USD Million)

Table 55 Europe: Market Size, By Country, 20152022 (KT)

Table 56 Asia Pacific: Industrial Margarine Market Size, By Application, 20152022 (USD Million)

Table 57 Asia Pacific: Market Size, By Application, 20152022 (KT)

Table 58 Asia Pacific: Market Size, By Type, 20152022 (USD Million)

Table 59 Asia Pacific: Market Size, By Type, 20152022 (KT)

Table 60 Asia Pacific: Market Size, By Source, 20152022 (USD Million)

Table 61 Asia Pacific: Market Size, By Source, 20152022 (KT)

Table 62 Asia Pacific: Market Size, By Form, 20152022 (USD Million)

Table 63 Asia Pacific: Market Size, By Form, 20152022 (KT)

Table 64 Asia Pacific: Market Size, By Country, 20152022 (USD Million)

Table 65 Asia Pacific: Market Size, By Country, 20152022 (KT)

Table 66 Organoleptic Requirements to Be Fulfilled By Margarine Manufacturers in China

Table 67 Fssai Standards and Regulations for Bakery and Industrial Margarine.

Table 68 RoW: Industrial Margarine Market Size, By Application, 20152022 (USD Million)

Table 69 RoW: Market Size, By Application, 20152022 (KT)

Table 70 RoW: Market Size, By Type, 20152022 (USD Million)

Table 71 RoW: Market Size, By Type, 20152022 (KT)

Table 72 RoW: Market Size, By Source, 20152022 (USD Million)

Table 73 RoW: Market Size, By Source, 20152022 (KT)

Table 74 RoW: Market Size, By Form, 20152022 (USD Million)

Table 75 RoW: Market Size, By Form, 20152022 (KT)

Table 76 RoW: Market Size, By Region, 20152022 (USD Million)

Table 77 RoW: Market Size, By Region, 20152022 (KT)

Table 78 Acquisitions, 20132017

Table 79 Expansions, 20132015

Table 80 Joint Ventures, 20162017

List of Figures (34 Figures)

Figure 1 Market: Segmentation

Figure 2 Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Market Size Estimation: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Market Breakdown & Data Triangulation

Figure 7 Industrial Margarine Market Size, By Type, 20172022

Figure 8 Market Size, By Application, 2017 vs 2022

Figure 9 Market Size, By Form, 20172022

Figure 10 Market Size, By Source, 20172022

Figure 11 Market Share, By Region

Figure 12 Attractive Growth Opportunities in the Industrial Margarine Market for Equipment Manufacturers Between 2017 & 2022

Figure 13 Market Size of Industrial Margarine From 2017 to 2022

Figure 14 US is Estimated to Account for the Largest Share of this Market in 2017

Figure 15 Bakery Application Estimated to Dominate the global Market Across All Regions in 2017

Figure 16 Indias Industrial Margarine Market to Grow at the Highest CAGR Among the Key Markets of Each Region

Figure 17 Low Prices of Margarine to Drive the Industrial Margarine Market Growth

Figure 18 GDP of Top Countries in Asia Pacific (20142016)

Figure 19 US Fast Food Industry Trend, 20102020

Figure 20 Estimated Percentage of Youth Suffering From Obesity: Us, 2013-2014

Figure 21 North American Industrial Margarine Market: A Snapshot

Figure 22 Asia Pacific Industrial Margarine Market: A Snapshot

Figure 23 Key Developments By Leading Players in the Industrial Margarine Market, 20122017

Figure 24 Conagra: Company Snapshot

Figure 25 Conagra Foods: SWOT Analysis

Figure 26 Bunge : Company Snapshot

Figure 27 Bunge : SWOT Analysis

Figure 28 Puratos: SWOT Analysis

Figure 29 Wilmar International: Company Snapshot

Figure 30 Wilmar International: SWOT Analysis

Figure 31 Associated British Foods: Company Snapshot

Figure 32 Associated British Foods: SWOT Analysis

Figure 33 Fuji Oil: Company Snapshot

Figure 34 Vandemoortele: Company Snapshot

Growth opportunities and latent adjacency in Industrial Margarine Market