Industrial Maintenance as a Service Market by service (Inspection, Maintenance, Service), Location (On Shore, Off Shore), End User Industry (Oil & Gas, Manufacturing, Power Generation, Others) and Region-Global Forecast to 2030

Industrial maintenance is also defined as plant maintenance. Industrial maintenance helps to reduce breakdowns, increase uptime, and helps to promote overall reliability. In addition, industrial maintenance is the process that ensures that assets are kept in good working condition. Further, industrial maintenance services are widely used in various industries such as manufacturing, oil & gas, and other major industries. And owing to growing demand from the end users, these industries always work to the peak of their capabilities. Hence machinery maintenance is the primary requirement of these industries.

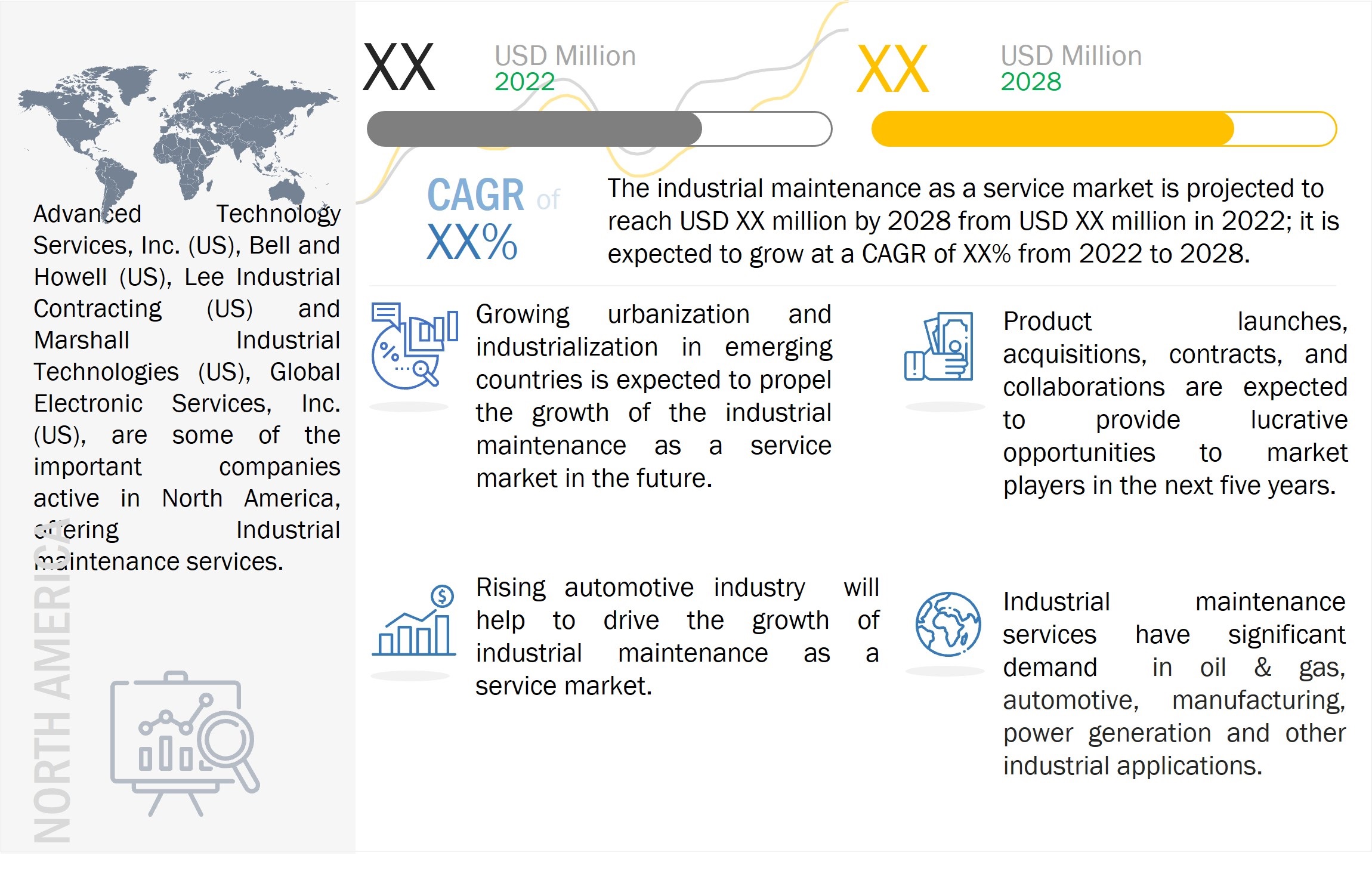

The industrial maintenance as a service market size is expected to grow from USD XX million in 2024 to USD XX million by 2030, at a CAGR of XX%. The key factor boosting market growth is the increasing population that helps to drive the demand in oil & gas, manufacturing, and other industries.

To know about the assumptions considered for the study, Request for Free Sample Report

Drivers: Rising urbanization and industrialization in emerging countries

Growing urbanization and industrialization are the primary factors responsible for increasing demand in the ecosystem of industrial maintenance and services. The machinery should always be well in working condition and requires timely maintenance. Hence, the growing necessity of maintenance services in industrial areas will help drive industrial maintenance growth as a service market.

The growing automotive industry drives the demand for repair and maintenance services

The automotive industry is one of the leading industries worldwide, which is rising significantly. And it is necessary to take proper action to keep the machinery working properly in the facility. Automotive maintenance services include testing and inspecting the condition of vehicle subsystems that come under the automotive maintenance services. Further, regular maintenance is required because it ensures the safety, drivability, reliability, comfort, and longevity of different vehicles. Additionally, automotive repair services are considered the aftermarket maintenance of vehicles, which are necessary to improve the vehicle's life by replacing the products. These products include cabin filters, oil filters, air filters, tires, wear and tear parts, vehicle batteries, wiper blades, and others.

Challenges: Lack of skilled workforce

One of the most critical challenges in industrial maintenance as a service market is the lack of skilled mechanics that helps to provide maintenance services for a wide range of industries such as oil & gas, automotive, manufacturing, and more. For instance, the rising complexities in various automobiles are leading to the demand for a highly skilled workforce with a diverse knowledge of various technologies currently trending in the automobile industry.

Key Market Players:

Advanced Technology Services, Inc. (US), Bell and Howell (US), Bilfinger SE (Germany), Caverion Corporation (Finland), Global Electronic Services, Inc. (US), Global Offshore Engineering (Singapore), Kirti Telnet Pvt. Ltd. (India), Lee Industrial Contracting (US) and Marshall Industrial Technologies (US) are few key players in the Industrial maintenance as a service market globally.

- In August 2022, Bilfinger SE was awarded a multi-million dollar annual contract for the routine mechanical maintenance scope in the Gulf of Mexico (GOM) for Shell’s oil & gas platform.

- In May 2022, Caverion Corporation acquired the industrial service specialist WT-Service Oy, which provides industrial maintenance, installation, and project services in Finland. This acquisition will help to strengthen the regional footprint of Caverion Corporation.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 Introduction

1.1. Study Objective

1.2. Market Definition

1.2.1. Inclusions and Exclusions

1.3. Market Scope

1.3.1. Markets Covered

1.3.2. Geographic Scope

1.3.3. Years considered for the study

1.4. Currency

1.5. Limitations

1.6. Market Stakeholders

2 Research Methodology

2.1. Research Data

2.1.1. Secondary and Primary Research

2.1.2. Secondar Data

2.1.3. Primary Data

2.2. Market Size Estimation

2.2.1. Bottom-up Approach

2.2.2. Top-down Approach

2.3. Data Triangulation

2.4. Research Assumptions

2.5. Risk Assessment

3 Executive Summary

4 Premium Insights

5 Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.2.4. Challenges

5.3. Value Chain Analysis

5.4. Ecosystem

5.5. Pricing Analysis

5.5.1. Average Selling Prices (ASP) of Key Players

5.5.2. Average Selling Prices (ASP) Trend

5.6. Trends/Disruptions Impacting Customers

5.7. Technology Analysis

5.8. Porter’s Five Forces Analysis

5.9. Key Stakeholders & Buying Criteria

5.9.1. Key Stakeholders in Buying Process

5.9.2. Buying Criteria

5.10. Case Study

5.11. Trade Analysis

5.12. Patents Analysis

5.13. Key Conferences & Events

5.14. Tariff and Regulatory Landscape

5.14.1. Regulatory Bodies, Government Agencies, and Other Organizations

5.14.2. Regulations and Standards

6 Industrial Maintenance as a Service Market, By Service

6.1. Introduction

6.2. Inspection

6.3. Maintenance

6.4. Service

7 Industrial Maintenance as a Service Market, By Location

7.1. Introduction

7.2. On Shore

7.3. Off Shore

8 Industrial Maintenance as a Service Market, By End User Industry

8.1. Introduction

8.2. Oil & Gas

8.3. Manufacturing

8.3.1. Automotive

8.3.2. Consumer Goods

8.3.3. Electronics

8.3.4. Others

8.4. Power Generation

8.5. Others

9 Industrial Maintenance as a Service Market, By Region

9.1. Introduction

9.2. North America

9.3. Europe

9.4. Asia Pacific

9.5. RoW

10 Competitive Landscape

10.1. Introduction

10.2. Key Player Strategies/ Right to Win

10.3. Top 5 Company Revenue Analysis

10.4. Market Share Analysis

10.5. Company Evaluation Quadrant

10.5.1. Star

10.5.2. Emerging Leader

10.5.3. Pervasive

10.5.4. Participant

10.6. Startup/SME Evaluation Matrix

10.6.1. Progressive Companies

10.6.2. Responsive Companies

10.6.3. Dynamic Companies

10.6.4. Starting Blocks

10.7. Industrial Maintenance as a Service Market: Company Footprint

10.8. Competitive Benchmarking

10.9. Competitive Situation and Trends

11 Company Profiles

11.1. Introduction

11.2. Key Players

11.2.1. Advanced Technology Services Inc.

11.2.2. Bell and Howell

11.2.3. Bilfinger SE

11.2.4. Caverion Corporation

11.2.5. Global Electronic Services, Inc.

11.2.6. GLOBAL OFFSHORE ENGINEERING

11.2.7. Kirti Telnet Pvt. Ltd

11.2.8. Lee Industrial Contracting

11.2.9. Marshall Industrial Technologies

11.2.10. Meidensha Corporation

11.2.11. Naes Corporation

11.2.12. Petrofac Limited

11.2.13. SGK India Engineering Pvt Ltd.

11.2.14. Siemens

11.2.15. Total Resource Management (IDCON)

11.2.16. Baker Huges Company

11.2.17. Valmet

12 Adjacent & Related Market

13 Appendix

Growth opportunities and latent adjacency in Industrial Maintenance as a Service Market