Industrial Ethernet Market Size, Share & Industry Trends Growth Analysis Report by Offering (Hardware, Software, Services), Protocol (PROFINET, EtherNet/IP), End-use Industry (Automotive & Transportation, Electrical & Electronics) and Region - Global Growth Driver and Industry Forecast to 2028

Updated on : Sep 16, 2024

Industrial Ethernet Market Size & Share

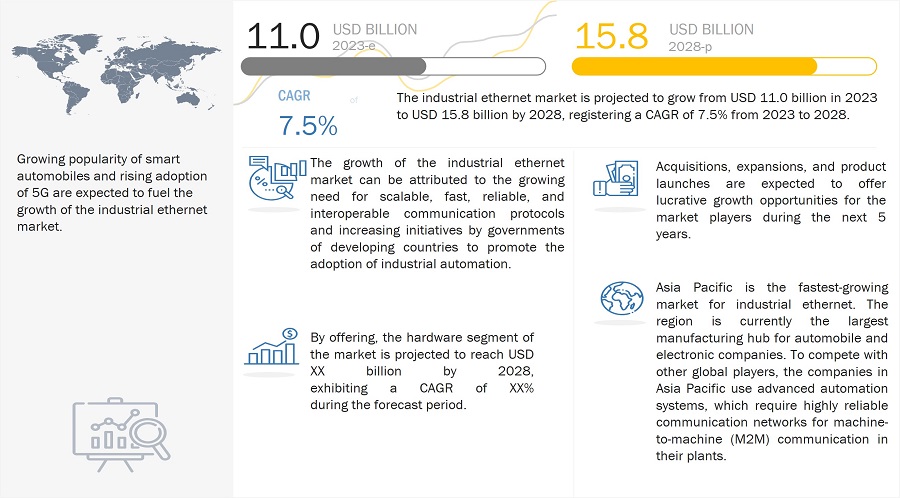

The global industrial ethernet market size is projected to grow from USD 11.0 billion in 2023 to USD 15.8 billion by 2028; it is expected to record at a CAGR of 7.5% during the forecast period. Growing popularity of smart automobiles and rising adoption of 5G are expected to fuel the growth of the industrial ethernet industry.

Industrial Ethernet Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Industrial Ethernet Market Segment

Service segment to account for the largest share of the industrial ethernet market by 2028

Rapid changes in network infrastructure and the growing adoption of IIoT have led to the adoption of cloud and virtualization. This has significantly increased the pressure on network administrators to manage the network infrastructure. Hence, manufacturing industries are outsourcing network services to ensure better network management quality and reduced operating costs. Companies are adopting remote network monitoring services, which are expected to boost the services market during the forecast period.

Industrial Ethernet Market for MODBUS–TCP protocol to grow with significant CAGR during the forecast period

MODBUS–TCP can interact with EtherNet/IP and other industrial Ethernet protocols (i.e., HTTP, FTP, and Telnet) without any non-standard network interface cards and/or switching infrastructure, and thus, offering a high level of interoperability for industrial communication network devices.

Industrial Ethernet Market for Engineering/Fabrication to have significant CAGR during the forecast period

The industrial ethernet is mainly used in engineering design and fabrication of metal, steel, and other structural parts manufacturing. In the fabrication industry, different networking technologies can be implemented.

For instance, the Industrial ethernet ensures consistent, uninterrupted mobile connectivity for workers, vehicles, and equipment while extending connectivity outside the plant (transportation yard and interconnected buildings). It also supports features such as data security and allows workers to coordinate workforce activities and communicate in real-time for better safety management and increasing productivity.

Industrial Ethernet Switch Market Growth and Trends

Industrial Ethernet Market Regional Analysis

Asia Pacific to grow at the highest CAGR in the industrial ethernet market during the forecast period

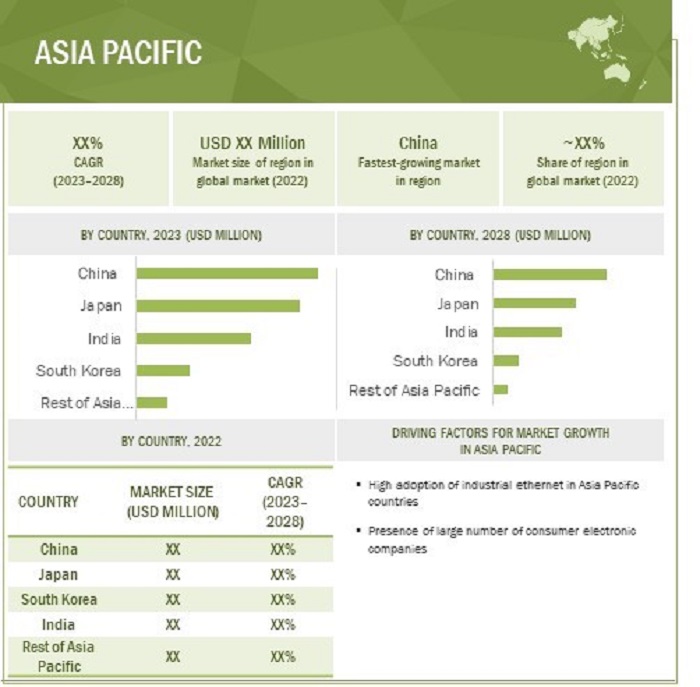

Asia Pacific is currently the largest manufacturing hub for automobile and electronic companies. To compete with other global players, the industrial ethernet companies in Asia Pacific use advanced automation systems, which require highly reliable communication networks that can help in machine-to-machine (M2M) communication in the plants.

The manufacturing companies in Asia Pacific extensively adopt the smart factory concept for implementing advanced manufacturing technologies on the factory floor. This innovative concept has transformed the manufacturing sector in Asia Pacific and has increased the implementation of smart automation in factories. The growing acceptance of Industrial Revolution 4.0 in Asia Pacific is also a factor driving the growth of the regional market.

Industrial Ethernet Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Industrial Ethernet Companies - Key Market Players

- Cisco (US),

- Siemens (Germany),

- Rockwell Automation (US),

- OMRON (Japan),

- Moxa (Taiwan),

- Belden( US),

- Huawei Technologies (China),

- SICK (Germany),

- Schneider Electric (France), and

- ABB (Switzerland) are few major industrial ethernet companies.

Recent Developments in Industrial Ethernet Industry

- In November 2022, Siemens launched its new Industrial Edge Management System, an optimized license management solution, as well as new devices at the SPS trade fair in Nuremberg, Germany from November 8 to 10, 2022. The newly launched management systems will bring Operational Technology (OT) and IT closer together in industrial production, enabling a seamless flow of data from the field level to the cloud.

- In October 2022, OMRON signed a pan-European distribution agreement with Conrad Electronic, the Germany-based sourcing platform for technical supplies operating in 17 European countries.

Recession Impact

The market for industrial ethernet might experience slow down due to the coming recession in 2023 and 2024. The companies in the industrial ethernet market have a strong base in the North American and European regions. As the recession is expected to have a major impact in these regions, the overall market for industrial ethernet industry is expected to witness a slow growth rate during the years 2023 and 2024. Automotive & transportation, electrical & electronics, and oil & gas are some of the major industries in this market to be affected by the coming recession.

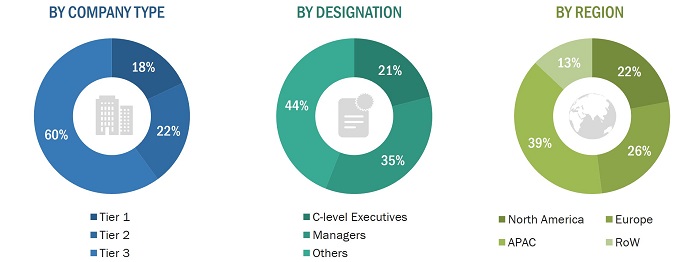

In-depth interviews have been conducted with chief executive officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the industrial ethernet marketplace.

- By Company Type: Tier 1 - 18%, Tier 2 – 22%, and Tier 3 - 60%

- By Designation: C-Level Executives - 21%, Managers - 35%, and Others – 44%

- By Region: North America - 22%, Europe - 26%, Asia Pacific (APAC)- 39%, and RoW - 13%

Industrial Ethernet Market Trends

Driver: Increasing initiatives by governments of developing countries to promote adoption of industrial automation

The governments of developing countries worldwide are supporting the development of various industries to achieve holistic growth. This has led to an increase in the adoption of various automation and communication components and technologies for the structural development of industries. Governments are highly focused on the process and discrete industries. For instance, the Government of Singapore has partnered with various associations, such as the Singapore Food Manufacturing Association (SFMA) and the Food Innovation Resource Centre, to implement the latest automation solutions, including SCADA, PLC, DCS, robots, and cables, in the food & beverage industry.

The Government of Malaysia introduced a 200% automation capital allowance (ACA) in its 2015 budget to encourage labor-intensive manufacturing industries, such as textile, rubber, and plastics, to adopt the latest automation technologies to improve their overall productivity. Under ACA, the government writes off capital expenditure for manufacturing companies within 3 years (an initial allowance of 40% and an annual allowance of 20%).

India is one of the emerging countries with a fast-growing manufacturing sector. The formulation of the National Manufacturing Policy (NMP) by the central government has increased the development of its manufacturing sector. The government has also launched the Make in India policy to encourage companies to implement automation processes in their manufacturing plants. Thus, the measures taken by the governments to support the adoption of industrial control and factory automation are expected to fuel the growth of the market during the forecast period.

Restraint: Absence of standardization in industrial communication protocols and interfaces

Industrial equipment or devices communicate through various interfaces, technologies, and protocols. The absence of standardization in these communication interfaces and protocols might result in the misrepresentation of data. It also can complicate the integration of systems and hinder the use of plug-and-play features for unrelated systems. This is one of the major restraints for the industrial ethernet market in coming years.

Opportunity: Emergence of 5G to create lucrative opportunities for market players

Industrial communication is a vital element of Industry 4.0. The demand for 5G technology is growing in the manufacturing industry, as 5G helps to overcome the shortcomings of other wireless systems. With the onset of 5G technology, the manufacturing industry will experience a major transformation. With the increasing demand of 5G the demand for industrial ethernet will also increase.

Challenge: Harsh field site conditions-high-voltage transients, severe shocks and vibrations, and extremely high temperatures

Industrial Ethernet devices are deployed in remote field locations which are prone to the effects of unfavorable and harsh conditions, such as high-voltage transients, shocks and vibrations, and extremely high temperatures. High voltage transients result from electrostatic discharge (ESD), bursts, electrical fast transients (EFT), and lightning strikes. These are a few challenges faced in industrial ethernet technology deployment. Therefore, there is a requirement for robust industrial communication equipment to withstand harsh conditions.

Industrial Ethernet Market Report Scope

|

Report Metric |

Details |

|

Estimated Market Size |

USD 11.0 billion in 2023 |

|

Projected Market Size |

USD 15.8 billion by 2028 |

|

Growth Rate |

CAGR of 7.5% |

|

Market Size Available for Years |

2023–2028 |

|

Estimated Year |

2023 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

USD Million/USD Billion |

|

Segments Covered |

By offering, protocol, and end-use industry and Region |

|

Regions Covered |

North America, Asia Pacific, Europe, and RoW |

|

Companies Covered |

Siemens (Germany), Rockwell Automation (US), Cisco (US), Belden (US), Omron (Japan), Moxa (Taiwan), Huawei Technologies (Sweden), SICK (Germany), Schneider Electric (France), and ABB (Switzerland). |

Industrial Ethernet Market Highlights

This research report categorizes the industrial ethernet market based on by offering, protocol, and end-use industry and Region

|

Aspect |

Details |

|

Based on Offering: |

|

|

Based on Protocol: |

|

|

Based on End-use Industry: |

|

|

Based on the Region: |

|

Frequently Asked Questions (FAQ):

What are the key strategies adopted by the major companies in the industrial ethernet market?

Partnerships and collaborations have been and continue to be the major strategies adopted by the key players to grow in the industrial ethernet market.

Which region will dominate the industrial ethernet market?

Asia Pacific will dominate the industrial ethernet market.

Which are the major companies in the industrial ethernet market?

Cisco (US), Siemens (Germany), Rockwell Automation (US), OMRON (Japan), Moxa (Taiwan), are the key companies in this market.

What are the drivers for new market entrants?

The emergence of the Industrial Internet of Things (IIoT) has opened new growth avenues for the expansion of the industrial ethernet market.

Which end user industry is expected to drive the growth of the market in the next five years?

Water and wastewater is expected to lead the market during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing need for scalable, fast, reliable, and interoperable communication protocols- Increasing initiatives by governments of developing countries to promote adoption of industrial automation- Growing popularity of smart automobilesRESTRAINTS- Absence of standardization in industrial communication protocols and interfacesOPPORTUNITIES- Emergence of 5GCHALLENGES- Cybersecurity threats- Harsh field site conditions—high-voltage transients, severe shocks and vibrations, and extremely high temperatures

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 KEY STAGES IN INDUSTRIAL ETHERNET VALUE CHAINRESEARCH AND DEVELOPMENTCOMPONENT MANUFACTURINGSYSTEM INTEGRATIONMARKETING AND SALESPOST-SALES SERVICES

-

5.5 USE CASES ANALYSISEDGE SOLUTIONS OF ADVANTECH TO ENABLE REAL-TIME OIL TANKER MONITORINGPULP MOLDING EQUIPMENT MANUFACTURER IMPLEMENTED ROCKWELL AUTOMATION’S SOLUTIONSOSSID IMPROVES MACHINERY RELIABILITY AND PERFORMANCE USING MITSUBISHI ELECTRIC’S AUTOMATION PORTFOLIO

-

5.6 TARIFF REGULATORY BODIESETHERCAT TECHNOLOGY GROUP (ETG)INTERNATIONAL ELECTROTECHNICAL COMMISSION (IEC)IEEEINTERNATIONAL ORGANIZATION FOR STANDARDIZATION (ISO)PROFIBUS USER ORGANIZATION (PNO)IEEE 802.3CG- 10BASE – t1s- 10base – t1lADVANTECH PROVIDED WISE-PAAS END-TO-CLOUD IOT TOTAL SOLUTION FOR REMOTE VIDEO SURVEILLANCE AND DEVICE STATUS MONITORING AND CONTROL FOR AUTOMOTIVE INSPECTION CENTEROPTIMA CONTROL SOLUTIONS (UK) AND ROCKWELL AUTOMATION (US) PROVIDED AUTOMATED MONITORING SOLUTION TO BISCUIT MANUFACTURERADVANTECH (TAIWAN) PROVIDED PLANT MONITORING SOLUTION FOR WIND POWER PLANT

- 6.1 INTRODUCTION

-

6.2 HARDWARESWITCHES- Switches provide high security and durability in mission-critical environmentsGATEWAYS- Gateways help in data transfer between sensor nodes and other configured devices using different protocolsROUTERS- Routers help transfer information from one network to anotherCONTROLLERS AND CONNECTORS- Controllers help decide priority of event processing to ensure proper functioning of overall systemCOMMUNICATION INTERFACES AND CONVERTERS- Converters facilitate connection between two dissimilar media typesPOWER SUPPLY DEVICES- Power management integrated circuits (PMICs) provide high level of performance and integration solutions for various industrial communication applicationsOTHERS

-

6.3 SOFTWARENETWORKING MANAGEMENT SOFTWARE OPTIMIZES NETWORK EFFICIENCY AND MINIMIZES TOTAL COST OF OWNERSHIP

-

6.4 SERVICESINDUSTRIAL COMMUNICATION SERVICES MAINLY INCLUDE INSTALLATION, NETWORK SECURITY, AND NETWORK MONITORING SERVICES

- 7.1 INTRODUCTION

-

7.2 PROFINETPROFINET SUPPLEMENTS EXISTING PROFIBUS TECHNOLOGIES BY PROVIDING FAST DATA COMMUNICATION

-

7.3 ETHERNET/IPETHERNET/IP WIDELY USED IN HYBRID AND PROCESS INDUSTRIES

-

7.4 ETHERCATETHERCAT SPECIFICALLY DESIGNED FOR FAST CONTROL DEMAND APPLICATIONS

-

7.5 MODBUS-TCPMODBUS-TCP OFFERS HIGH LEVEL OF INTEROPERABILITY FOR INDUSTRIAL COMMUNICATION NETWORK DEVICES

-

7.6 POWERLINKETHERNET POWERLINK ENABLES TRANSFER OF TIME-CRITICAL DATA IN SHORT DURATION

-

7.7 SERCOS IIISERCOS III SUITABLE FOR COMMUNICATIONS IN PROCESS INDUSTRIES AS IT ENSURES LOW LATENCY IN DATA TRANSFER

-

7.8 CC-LINK IECC-LINK IE SUPPORTS FLEXIBLE WIRING TOPOLOGIES, SUCH AS STAR, RING, AND LINE CONFIGURATION

- 8.1 INTRODUCTION

-

8.2 AUTOMOTIVE & TRANSPORTATIONINCREASING IMPLEMENTATION OF SMART MANUFACTURING TECHNOLOGIES IN AUTOMOBILE MANUFACTURING PLANTS TO BOOST ADOPTION OF INDUSTRIAL ETHERNET

-

8.3 ELECTRICAL & ELECTRONICSINCREASING DEMAND FOR INDUSTRIAL ETHERNET SOLUTIONS IN ELECTRICAL & ELECTRONICS INDUSTRY TO MINIMIZE DOWNTIME, RUN OPERATIONS AT FULL SPEED, AND INCREASE PRODUCTIVITY

-

8.4 AEROSPACE & DEFENSEINCREASING DEPLOYMENT OF INDUSTRIAL ETHERNET SOLUTIONS IN AEROSPACE & DEFENSE INDUSTRY TO ENSURE EFFECTIVE MANUFACTURING PROCESSES

-

8.5 OIL & GASINCREASING OFFSHORE OIL AND GAS ACTIVITIES FUELING ADOPTION OF AUTOMATION SOLUTIONS IN OIL & GAS INDUSTRY

-

8.6 CHEMICAL & FERTILIZERGROWING USE OF INDUSTRIAL ETHERNET IN CHEMICAL INDUSTRY TO INCREASE SAFETY, EFFICIENCY, AND SUSTAINABILITY

-

8.7 FOOD & BEVERAGEINCREASING TREND OF AUTOMATION IN FOOD & BEVERAGE INDUSTRY THROUGHOUT MANUFACTURING PROCESS TO FUEL DEMAND FOR INDUSTRIAL ETHERNET

-

8.8 PHARMACEUTICALINCREASING DEPLOYMENT OF AUTOMATION AND SENSING TECHNOLOGIES IN PHARMACEUTICAL INDUSTRY TO FUEL MARKET GROWTH

-

8.9 ENERGY & POWERCOMMUNICATION NETWORKS PLAY INTEGRAL ROLE IN DATA AND INFORMATION EXCHANGE IN ENERGY & POWER PLANTS

-

8.10 MININGDEPLOYMENT OF AUTOMATION IN MINING & METALS INDUSTRY FOR IMPROVED PRODUCTIVITY AND ENHANCED WORKFORCE SAFETY TO BOOST MARKET GROWTH

-

8.11 ENGINEERING/FABRICATIONNETWORKING TECHNOLOGIES ENSURE CONSISTENT, UNINTERRUPTED MOBILE CONNECTIVITY FOR WORKERS IN ENGINEERING AND FABRICATION APPLICATIONS

-

8.12 WATER & WASTEWATERGROWING ADOPTION OF LOW-COST, LOW-POWER SENSORS AND EDGE-COMPUTING DEVICES TO INCREASE EFFICIENCY IN WATER & WASTEWATER OPERATIONS TO BOOST MARKET GROWTH

- 8.13 OTHERS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICAUS- Ideal environment for innovation facilitated advancements in industrial ethernetCANADA- Growing investments in process and discrete industries to contribute to market growthMEXICO- Rapid adoption of smart manufacturing procedures to drive market

-

9.3 EUROPEUK- Growing adoption of automation to fuel market growthGERMANY- Technological innovations related to automotive sector to fuel market growthFRANCE- Government focus on promoting industrial sectors to fuel adoption of industrial ethernet solutionsITALY- Focus on smart factories to fuel market growthSPAIN- Development of automotive sector to drive marketREST OF EUROPE

-

9.4 ASIA PACIFICCHINA- Growing use of industrial ethernet networks and solutions in automotive sector to boost market growthJAPAN- Ongoing technological developments in different industries to lead to deployment of advanced and highly precise automation solutionsINDIA- Ongoing government initiatives for automation of different industries to fuel market growthSOUTH KOREA- Growing adoption of industrial ethernet by electronic goods manufacturing companies to drive marketREST OF ASIA PACIFIC

-

9.5 REST OF THE WORLDSOUTH AMERICA- Rising deployment of factory automation solutions in different industries to boost marketMIDDLE EAST- Growing adoption of automation solutions in oil & gas industry to fuel market growthAFRICA- Production increase in food & beverage, automotive, and pharmaceutical industries to drive market

- 10.1 INTRODUCTION

-

10.2 COMPANY EVALUATION QUADRANTINDUSTRIAL ETHERNET MARKET- Stars- Emerging leaders- Pervasive players- Participants

-

10.3 COMPETITIVE SITUATIONS AND TRENDSPRODUCT LAUNCHES

-

11.1 KEY PLAYERSSIEMENS- Business overview- Products offered- Recent developments- MnM viewROCKWELL AUTOMATION- Business overview- Products offered- Recent developments- MnM viewCISCO SYSTEMS- Business overview- Products offered- Recent developments- MnM viewOMRON- Business overview- Products offered- Recent developments- MnM viewMOXA- Business overview- Products offered- Recent developments- MnM viewBELDEN- Business overview- Products offered- Recent developmentsHUAWEI TECHNOLOGIES- Business overview- Products offered- Recent developmentsSICK- Business overview- Products offered- Recent developmentsSCHNEIDER ELECTRIC- Business overview- Recent developmentsABB- Business overview- Recent developments

-

11.2 OTHER PLAYERSGE GRID SOLUTIONSADVANTECHHMS NETWORKSIFM ELECTRONICWEIDMULLERPATTONBECKHOFF AUTOMATIONHONEYWELLAAEONTURCKBOSCH REXROTHHITACHIERICSSONMITSUBISHI ELECTRIC GROUPCHAOS PRIME

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 ANALYSIS OF RISK FACTORS

- TABLE 2 INDUSTRIAL ETHERNET MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 3 INDUSTRIAL ETHERNET MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 4 INDUSTRIAL ETHERNET MARKET, BY HARDWARE, 2018–2022 (USD MILLION)

- TABLE 5 INDUSTRIAL ETHERNET MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 6 INDUSTRIAL ETHERNET MARKET, BY HARDWARE, 2018–2022(THOUSAND UNITS)

- TABLE 7 INDUSTRIAL ETHERNET MARKET, BY HARDWARE, 2023–2028 (THOUSAND UNITS)

- TABLE 8 INDUSTRIAL ETHERNET MARKET, BY PROTOCOL, 2018–2022 (USD MILLION)

- TABLE 9 INDUSTRIAL ETHERNET MARKET, BY PROTOCOL, 2023–2028 (USD MILLION)

- TABLE 10 INDUSTRIAL ETHERNET MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 11 INDUSTRIAL ETHERNET MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 12 INDUSTRIAL ETHERNET MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2018–2022 (USD MILLION)

- TABLE 13 INDUSTRIAL ETHERNET MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 14 INDUSTRIAL ETHERNET MARKET FOR AUTOMOTIVE & TRANSPORTATION IN NORTH AMERICA, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 15 INDUSTRIAL ETHERNET MARKET FOR AUTOMOTIVE & TRANSPORTATION IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 16 INDUSTRIAL ETHERNET MARKET FOR AUTOMOTIVE & TRANSPORTATION IN EUROPE, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 17 INDUSTRIAL ETHERNET MARKET FOR AUTOMOTIVE & TRANSPORTATION IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 18 INDUSTRIAL ETHERNET MARKET FOR AUTOMOTIVE & TRANSPORTATION IN ASIA PACIFIC, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 19 INDUSTRIAL ETHERNET MARKET FOR AUTOMOTIVE & TRANSPORTATION IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 20 INDUSTRIAL ETHERNET MARKET FOR AUTOMOTIVE & TRANSPORTATION IN ROW, BY REGION, 2018–2022 (USD MILLION)

- TABLE 21 INDUSTRIAL ETHERNET MARKET FOR AUTOMOTIVE & TRANSPORTATION IN ROW, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 INDUSTRIAL ETHERNET MARKET FOR ELECTRICAL & ELECTRONICS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 23 INDUSTRIAL ETHERNET MARKET FOR ELECTRICAL & ELECTRONICS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 INDUSTRIAL ETHERNET MARKET FOR ELECTRICAL & ELECTRONICS IN NORTH AMERICA, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 25 INDUSTRIAL ETHERNET MARKET FOR ELECTRICAL & ELECTRONICS IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 26 INDUSTRIAL ETHERNET MARKET FOR ELECTRICAL & ELECTRONICS IN EUROPE, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 27 INDUSTRIAL ETHERNET MARKET FOR ELECTRICAL & ELECTRONICS IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 28 INDUSTRIAL ETHERNET MARKET FOR ELECTRICAL & ELECTRONICS IN ASIA PACIFIC, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 29 INDUSTRIAL ETHERNET MARKET FOR ELECTRICAL & ELECTRONICS IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 30 INDUSTRIAL ETHERNET MARKET FOR ELECTRICAL & ELECTRONICS IN ROW, BY REGION, 2018–2022 (USD MILLION)

- TABLE 31 INDUSTRIAL ETHERNET MARKET FOR ELECTRICAL & ELECTRONICS IN ROW, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 INDUSTRIAL ETHERNET MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 33 INDUSTRIAL ETHERNET MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 INDUSTRIAL ETHERNET MARKET FOR OIL & GAS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 35 INDUSTRIAL ETHERNET MARKET FOR OIL & GAS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 INDUSTRIAL ETHERNET MARKET FOR CHEMICAL & FERTILIZER, BY REGION, 2018–2022 (USD MILLION)

- TABLE 37 INDUSTRIAL ETHERNET MARKET FOR CHEMICAL & FERTILIZER, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 INDUSTRIAL ETHERNET MARKET FOR FOOD & BEVERAGE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 39 INDUSTRIAL ETHERNET MARKET FOR FOOD & BEVERAGE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 INDUSTRIAL ETHERNET MARKET FOR PHARMACEUTICAL, BY REGION, 2018–2022 (USD MILLION)

- TABLE 41 INDUSTRIAL ETHERNET MARKET FOR PHARMACEUTICAL, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 INDUSTRIAL ETHERNET MARKET FOR ENERGY & POWER, BY REGION, 2018–2022 (USD MILLION)

- TABLE 43 INDUSTRIAL ETHERNET MARKET FOR ENERGY & POWER, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 INDUSTRIAL ETHERNET MARKET FOR MINING, BY REGION, 2018–2022 (USD MILLION)

- TABLE 45 INDUSTRIAL ETHERNET MARKET FOR MINING, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 INDUSTRIAL ETHERNET MARKET FOR ENGINEERING/FABRICATION, BY REGION, 2018–2022 (USD MILLION)

- TABLE 47 INDUSTRIAL ETHERNET MARKET FOR ENGINEERING/FABRICATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 INDUSTRIAL ETHERNET MARKET FOR WATER & WASTEWATER, BY REGION, 2018–2022 (USD MILLION)

- TABLE 49 INDUSTRIAL ETHERNET MARKET FOR WATER & WASTEWATER, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 INDUSTRIAL ETHERNET MARKET FOR OTHERS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 51 INDUSTRIAL ETHERNET MARKET FOR OTHERS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 INDUSTRIAL ETHERNET MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 53 INDUSTRIAL ETHERNET MARKET, BY REGION, 2023–2028(USD MILLION)

- TABLE 54 INDUSTRIAL ETHERNET MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2022(USD MILLION)

- TABLE 55 INDUSTRIAL ETHERNET MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 56 INDUSTRIAL ETHERNET MARKET IN NORTH AMERICA, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 57 INDUSTRIAL ETHERNET MARKET IN NORTH AMERICA, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 58 INDUSTRIAL ETHERNET MARKET IN US, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 59 INDUSTRIAL ETHERNET MARKET IN US, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 60 INDUSTRIAL ETHERNET MARKET IN CANADA, BY END-USE INDUSTRY, 2018–2022(USD MILLION)

- TABLE 61 INDUSTRIAL ETHERNET MARKET IN CANADA, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 62 INDUSTRIAL ETHERNET MARKET IN MEXICO, BY END-USE INDUSTRY, 2018–2022(USD MILLION)

- TABLE 63 INDUSTRIAL ETHERNET MARKET IN MEXICO, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 64 INDUSTRIAL ETHERNET MARKET IN EUROPE, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 65 INDUSTRIAL ETHERNET MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 66 INDUSTRIAL ETHERNET MARKET IN EUROPE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 67 INDUSTRIAL ETHERNET MARKET IN EUROPE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 68 INDUSTRIAL ETHERNET MARKET IN UK, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 69 INDUSTRIAL ETHERNET MARKET IN UK, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 70 INDUSTRIAL ETHERNET MARKET IN GERMANY, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 71 INDUSTRIAL ETHERNET MARKET IN GERMANY, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 72 INDUSTRIAL ETHERNET MARKET IN FRANCE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 73 INDUSTRIAL ETHERNET MARKET IN FRANCE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 74 INDUSTRIAL ETHERNET MARKET IN ITALY, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 75 INDUSTRIAL ETHERNET MARKET IN ITALY, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 76 INDUSTRIAL ETHERNET MARKET IN SPAIN, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 77 INDUSTRIAL ETHERNET MARKET IN SPAIN, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 78 INDUSTRIAL ETHERNET MARKET IN REST OF EUROPE, BY END-USE INDUSTRY, 2018–2022(USD MILLION)

- TABLE 79 INDUSTRIAL ETHERNET MARKET IN REST OF EUROPE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 80 INDUSTRIAL ETHERNET MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 81 INDUSTRIAL ETHERNET MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 82 INDUSTRIAL ETHERNET MARKET IN ASIA PACIFIC, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 83 INDUSTRIAL ETHERNET MARKET IN ASIA PACIFIC, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 84 INDUSTRIAL ETHERNET MARKET IN CHINA, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 85 INDUSTRIAL ETHERNET MARKET IN CHINA, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 86 INDUSTRIAL ETHERNET MARKET IN JAPAN, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 87 INDUSTRIAL ETHERNET MARKET IN JAPAN, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 88 INDUSTRIAL ETHERNET MARKET IN INDIA, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 89 INDUSTRIAL ETHERNET MARKET IN INDIA, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 90 INDUSTRIAL ETHERNET MARKET IN SOUTH KOREA, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 91 INDUSTRIAL ETHERNET MARKET IN SOUTH KOREA, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 92 INDUSTRIAL ETHERNET MARKET IN REST OF ASIA PACIFIC, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 93 INDUSTRIAL ETHERNET MARKET IN REST OF ASIA PACIFIC, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 94 INDUSTRIAL ETHERNET MARKET IN ROW, BY REGION, 2018–2022 (USD MILLION)

- TABLE 95 INDUSTRIAL ETHERNET MARKET IN ROW, BY REGION, 2023–2028 (USD MILLION)

- TABLE 96 INDUSTRIAL ETHERNET MARKET IN ROW, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 97 INDUSTRIAL ETHERNET MARKET IN ROW, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 98 INDUSTRIAL ETHERNET MARKET IN SOUTH AMERICA, BY END-USE INDUSTRY, 2018–2022(USD MILLION)

- TABLE 99 INDUSTRIAL ETHERNET MARKET IN SOUTH AMERICA, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 100 INDUSTRIAL ETHERNET MARKET IN MIDDLE EAST, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 101 INDUSTRIAL ETHERNET MARKET IN MIDDLE EAST, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 102 INDUSTRIAL ETHERNET MARKET IN AFRICA, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 103 INDUSTRIAL ETHERNET MARKET IN AFRICA, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 104 COMPANIES ADOPTED PRODUCT LAUNCHES AND DEVELOPMENTS AS KEY GROWTH STRATEGIES FROM 2019 TO 2022

- TABLE 105 INDUSTRIAL ETHERNET MARKET: DEGREE OF COMPETITION

- TABLE 106 INDUSTRIAL ETHERNET MARKET: PRODUCT LAUNCHES, JANUARY 2019–NOVEMBER 2022

- TABLE 107 INDUSTRIAL ETHERNET MARKET: DEALS, JANUARY 2019–NOVEMBER 2022

- TABLE 108 SIEMENS: BUSINESS OVERVIEW

- TABLE 109 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 110 SIEMENS: PRODUCT LAUNCHES

- TABLE 111 SIEMENS: DEALS

- TABLE 112 ROCKWELL AUTOMATION: BUSINESS OVERVIEW

- TABLE 113 ROCKWELL AUTOMATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 114 ROCKWELL AUTOMATION: PRODUCT LAUNCHES

- TABLE 115 ROCKWELL AUTOMATION: DEALS

- TABLE 116 CISCO SYSTEMS: BUSINESS OVERVIEW

- TABLE 117 CISCO SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 118 CISCO SYSTEMS: PRODUCT LAUNCHES

- TABLE 119 CISCO SYSTEMS: DEALS

- TABLE 120 OMRON: BUSINESS OVERVIEW

- TABLE 121 OMRON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 122 OMRON: PRODUCT LAUNCHES

- TABLE 123 OMRON: DEALS

- TABLE 124 MOXA: BUSINESS OVERVIEW

- TABLE 125 MOXA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 126 MOXA: PRODUCT LAUNCHES

- TABLE 127 BELDEN: BUSINESS OVERVIEW

- TABLE 128 BELDEN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 129 BELDEN: PRODUCT LAUNCHES

- TABLE 130 BELDEN: DEALS

- TABLE 131 HUAWEI TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 132 HUAWEI TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 133 HUAWEI TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 134 HUAWEI TECHNOLOGIES: DEALS

- TABLE 135 HUAWEI TECHNOLOGIES: OTHERS

- TABLE 136 SICK: BUSINESS OVERVIEW

- TABLE 137 SICK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 138 SICK: PRODUCT LAUNCHES

- TABLE 139 SICK: DEALS

- TABLE 140 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

- TABLE 141 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 142 SCHNEIDER ELECTRIC: DEALS

- TABLE 143 ABB: BUSINESS OVERVIEW

- TABLE 144 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 145 ABB: DEALS

- TABLE 146 HITACHI: COMPANY OVERVIEW

- TABLE 147 ERICSSON: COMPANY OVERVIEW

- TABLE 148 MITSUBISHI ELECTRIC GROUP: COMPANY OVERVIEW

- TABLE 149 CHAOS PRIME: COMPANY OVERVIEW

- FIGURE 1 INDUSTRIAL ETHERNET MARKET SEGMENTATION

- FIGURE 2 PROCESS FLOW: INDUSTRIAL ETHERNET MARKET SIZE ESTIMATION

- FIGURE 3 INDUSTRIAL ETHERNET MARKET: RESEARCH DESIGN

- FIGURE 4 INDUSTRIAL ETHERNET MARKET: BOTTOM-UP APPROACH

- FIGURE 5 INDUSTRIAL ETHERNET MARKET: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 RECESSION IMPACT: GDP GROWTH PROJECTION TILL 2023 FOR MAJOR ECONOMIES

- FIGURE 8 RECESSION IMPACT ON INDUSTRIAL ETHERNET MARKET, 2018–2028 (USD MILLION)

- FIGURE 9 BY OFFERING, HARDWARE SEGMENT TO HOLD SECOND-LARGEST MARKET SHARE FROM 2023 TO 2028

- FIGURE 10 BY PROTOCOL, ETHERNET/IP SEGMENT TO LEAD MARKET FROM 2023 TO 2028

- FIGURE 11 BY END-USE INDUSTRY, WATER & WASTEWATER SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 13 GROWING NEED FOR SCALABLE, FAST, RELIABLE, AND INTEROPERABLE COMMUNICATION PROTOCOLS TO BOOST MARKET GROWTH

- FIGURE 14 SERVICES SEGMENT TO REGISTER HIGHEST CAGE FROM 2023 TO 2028

- FIGURE 15 ETHERNET/IP PROTOCOL SEGMENT TO LEAD MARKET FROM 2023 TO 2028

- FIGURE 16 ELECTRICAL & ELECTRONICS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2028

- FIGURE 17 INDUSTRIAL ETHERNET MARKET IN CHINA TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR INDUSTRIAL ETHERNET MARKET

- FIGURE 19 ANNUAL INSTALLATION OF INDUSTRIAL ROBOTS, BY CONTINENTS, 2021 (THOUSAND UNITS)

- FIGURE 20 IMPACT ANALYSIS OF DRIVERS ON INDUSTRIAL ETHERNET MARKET

- FIGURE 21 IMPACT ANALYSIS OF RESTRAINTS ON INDUSTRIAL ETHERNET MARKET

- FIGURE 22 IMPACT ANALYSIS OF OPPORTUNITIES ON INDUSTRIAL ETHERNET MARKET

- FIGURE 23 IMPACT ANALYSIS OF CHALLENGES ON INDUSTRIAL ETHERNET MARKET

- FIGURE 24 VALUE CHAIN ANALYSIS OF INDUSTRIAL ETHERNET MARKET

- FIGURE 25 INDUSTRIAL ETHERNET MARKET, BY OFFERING

- FIGURE 26 SERVICES SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 27 INDUSTRIAL ETHERNET MARKET, BY PROTOCOL

- FIGURE 28 ETHERCAT SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 29 INDUSTRIAL ETHERNET MARKET, BY END-USE INDUSTRY

- FIGURE 30 WATER & WASTEWATER SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 31 INDUSTRIAL ETHERNET MARKET IN CHINA TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 32 NORTH AMERICA: INDUSTRIAL ETHERNET MARKET SNAPSHOT

- FIGURE 33 EUROPE: INDUSTRIAL ETHERNET MARKET SNAPSHOT

- FIGURE 34 ASIA PACIFIC: INDUSTRIAL ETHERNET MARKET SNAPSHOT

- FIGURE 35 MARKET SHARE OF KEY COMPANIES IN INDUSTRIAL ETHERNET MARKET, 2022

- FIGURE 36 INDUSTRIAL ETHERNET MARKET: COMPANY EVALUATION QUADRANT, 2022

- FIGURE 37 SIEMENS: COMPANY SNAPSHOT

- FIGURE 38 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

- FIGURE 39 CISCO SYSTEMS: COMPANY SNAPSHOT

- FIGURE 40 OMRON: COMPANY SNAPSHOT

- FIGURE 41 BELDEN: COMPANY SNAPSHOT

- FIGURE 42 HUAWEI TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 43 SICK: COMPANY SNAPSHOT

- FIGURE 44 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 45 ABB: COMPANY SNAPSHOT

The study has involved four major activities in estimating the size of the industrial ethernet market. Exhaustive secondary research has been done to collect information on the market, the peer market, and the parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the total market size. After that, market breakdown and data triangulation methods have been used to estimate the market for segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases and investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard and silver-standard websites, regulatory bodies, trade directories, and databases.

Primary Research

Extensive primary research has been conducted after understanding and analyzing the industrial ethernet market through secondary research. Several primary interviews have been conducted with key opinion leaders from both the demand-side and supply-side vendors across four major regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW). Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is as follows-

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the industrial ethernet market. These methods have also been used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size is as follows:

- Key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- Revenue of various industrial ethernet hardware, software, and services providers is considered to arrive at global numbers.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained earlier, the global market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the industrial ethernet market has been validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the industrial ethernet market, by offering, protocol, and end-use industry, in terms of value

- To describe and forecast the market size, by region, for North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW), in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze Micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To describe the value chain of the industrial ethernet market

- To analyze opportunities in the market for stakeholders and describe the competitive landscape of the market

- To strategically profile key players and comprehensively analyze their market ranking and core competencies

- To analyze competitive developments such as product developments/launches, expansion, and acquisitions in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Industrial Ethernet Market

I have interest in Li-Fi technology, Industrial Automation, Industrial Ethernet, and Industrie 4.0 in India and China. Does the report include information about these parameters?

What all information the report provides specific to major industrial protocols (ProfiNet, EtherCat, PowerLink, Ethernet/IP, etc)? Please response at the earliest. Thank you.

I am looking for information on industrial network connectivity products, such as industrial Ethernet, cellular routers & gateways, other industrial wireless. Network edge devices such as industrial wireless sensors and platforms.

Could you please send me a sample and brochure of this report? What is the best price you can offer? Thanks!

Looking for the market information on Industrial Ethernet Market by Offering (Hardware, Software, and Services) and Protocol (EtherNet/IP, PROFINET, Modbus TCP, POWERLINK, CC-Link IE, EtherCAT, and Sercos III) in North America and Europe regions.

I am writing a short article for online Media about industrial automation trends worldwide, so need a bit more detailed information about the markets and forecast. Thank you.

We are industrial ethernet switch providers. We are intrested in market volume an market share information of these switches. When will be an updated version of this study with updated forecast period available?