Industrial Energy Management System (IEMS) Market by Technology Solution (SCADA, PLC, DCS, Energy Platforms, Energy Analytics, Meter Data Management, EMIS, PLCS, & DRMS), by Hardware, by Services and by Industry Global Forecast to 2019

[188 Pages Report] The Industrial Energy Management System Market is expected be $12,560.0 million in 2014 and forecasted to be $24,385.0 million by 2019 with a compound annual growth rate (CAGR) of 14.2% for 2014 to 2019. Industrial Energy Management System Market are the prime energy consumer in any nations economy. The industries such as automotive, oil refineries, chemical, steel, aluminum, paper, and various others, energy accounts a biggest share of their operating cost expense. Moreover, as environmental regulations and the energy management standards are becoming more stringent, industries are continuously striving hard to make their manufacturing processes clean and efficient. All these factors make it imperative for industries to monitor their energy consumption and manage it for optimal consumption.

The Industrial Energy Management System Market systematically capture the energy fluctuation and serves as the monitoring system to strategically improvise the energy efficiency. It provides the industrial energy managers to visualize the energy consumed throughout the enterprise including the manufacturing process and building operation. IEMS being increasingly adopted by organizations and manufacturing facilities for energy efficiency, optimizing energy consumption, utilizing dynamic pricing tariffs and demand control thus reducing overall costs in operating a facility. The IEMS includes all the actions that are planned and implemented to confirm minimum energy consumption for the current activities. When the IEMS is integrated with the already existing management systems, energy-intensive industries profit from a reduction in personnel, as well as in temporal and financial expenditure.

ABB Ltd, CISCO System, Inc., Eaton Corporation PLC, Emerson Electric Company, EnerNOC, Inc., General Electric Company, Honeywell International, Inc., Rockwell Automation, Schneider Electric SE, and Siemens AG, are some of the leading vendors offering Industrial Energy Management System Market. Also some of the private players who cater the IEMS market with their innovative offering are categorised as the key innovator in the research report.

MarketsandMarkets has segmented the global Industrial Energy Management System Market by technology solutions, hardwares, services, industry and regions. The market research report analyzes global adoption trends, future growth potential, key drivers, restraints, opportunities, and best practices in this market.

On the basis of technology solution:

- supervisory control and data acquisition (SCADA)

- programmable logic controls (PLC)

- distributed control system (DCS)

- energy platform

- energy analytics

- meter data management (MDM)

- energy management information system (EMIS)

- peak load control system (PLCS)

- demand response management solution (DRMS)

On the basis of hardware:

The communication network includes

- Ethernet switches

- Gateways

- Routers

- Repeaters

- Bridges

Industrial hardwares include

- Smart meters

- Heating

- Ventilating

- Air-Conditioning (HVAC)

- Load control switches (LCS)

- Transmitters

- Human machine interface (HIM)/operator panels

- Others (breakers, and switch gears)

On the basis of service:

- system integrators

- consulting

- support and maintenance services.

On the basis of industry:

- Automotive

- Cement

- electronic

- food and beverages

- metal manufacturing

- mining and minerals

- oil and gas

- paper and pulp

- petrochemical

- utility

On the basis of geographical regions:

- North America (NA)

- Europe

- Latin America (LA)

- Asia-Pacific (APAC)

- Middle East and Africa (MEA).

The Industrial Energy Management System Market has been applied to the process and manufacturing sector since past few years. But its proper implementation was seen after the introduction of ISO 50001:2011 Energy Management System guideline in 2011. Many other standards were also introduced in past decade for the same purpose and many of the standards were implemented as the regional standards by the local governments. The standards lay down the requirements establishing, executing, upholding and enhancing an energy management system. The purpose of introducing the standard was to enable an industrial plant to adhere methodical way in accomplishing persistent enhancement of energy functioning, including energy efficiency, wastage reduction, energy usage and utilization. Today, industrial sector in the phase of dynamic rejuvenation and innovation has found many new ways to optimize the energy consumption and associated cost. The technology has been so advanced to allow greater insights regarding energy procurement, consumption, and strategies for management of energy as business inputs in the industrial process. Hence, there has been a drastic change in the view points of industrial organization to look at the energy cost, and strategies of efficient ways of energy consumption and management. This approach had a significant impact over the overall competitive landscape in the industrial sectors. The influence is said to have positive impacted over investors, shareholders, global supply chain, and customer associated.

The process and manufacturing sector are accounted as the most important component of the gross domestic product (GDP) in any countrys economy. But the increasing energy procurement has declined the cost benefits of the process and manufacturing industries and hence an Industrial Energy Management System Market strategic plan is the priority focus of the industry. The industrial sector account to for almost one-third of the world total energy consumption it is now essential to understand and enhance the industrial energy consumption in an efficient manner. The implementation of energy management practices in the future is likely to depend more upon the government policies on the subject of energy efficiency and conservation as well as market education of end users about the importance of saving energy and improving bottom line profits.

The Industrial Energy Management System Market solutions are been deployed in various industries such as automotive, cement manufacturing, food and beverage processing, metal manufacturing, mining and mineral processing, oil and gas refineries, electronic manufacturing, paper and pulp processing, petrochemicals, and utility. The todays automotive manufacturing sector is highly advanced and comparatively efficient with noteworthy prospects of energy reduction through implementation of energy management and R&D automotive sector is the largest sector in terms of implementation of the IEMS solutions. While, the petrochemical sector is expected to show the highest growth rate during the five years forecast due to on-going crisis in the international market so as to reduce the consumption and expenses related to the energy. The main drivers for the market include increasing focus on energy saving and efficiency improvement and regulations and benefits. The services playing crucial role in system integration and contract consulting of manufacturing and engineering plants for energy star program.

The Industrial Energy Management System Market is expected be $12,560.0 million in 2014 and forecasted to be $24,385.0 million by 2019 with a compound annual growth rate (CAGR) of 14.2% for 2014 to 2019.

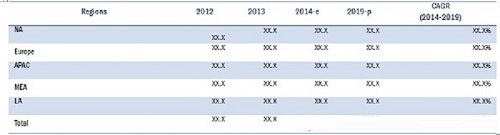

Global IEMS Market Size, by Regions, 2014-2019 ($ Million)

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of The Report

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered In the Report

1.3.3 Currency and Pricing

1.4 Limitations

1.5 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data from Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumption and Limitation

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 33)

4.1 Attractive Market Opportunities in Industrial Energy Management System Market

4.2 IEMS Overall Market 2014 Vs. 2019

4.3 IEMS Market Snapshot, By Type

4.4 APAC IEMS Market, By Industry, 2014

4.5 Lifecycle Analysis, By Region

4.6 Market Investment Scenario

4.7 Product Growth Matrix

4.8 Regional Adoption Scenario: Technology Solution

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Technology Solution

5.2.2 By Hardware

5.2.2.1 By Communication Network

5.2.2.2 By Industrial Hardware

5.2.3 By Service

5.2.4 By Industry

5.2.5 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Energy Consumption and Price Volatility

5.3.1.2 Corporate Responsibility and Brand Image

5.3.1.3 Energy Management Programs and Standards

5.3.2 Restraints

5.3.2.1 Long Period of Return on Investment (ROI)

5.3.2.2 Lack of Technical and Financial Resources

5.3.3 Opportunities

5.3.3.1 Exemption from Energy and Carbon Tax Policies

5.3.3.2 Competitiveness and Productivity Gains

5.3.4 Challenges

5.3.4.1 Difficulty in Initial Data Gathering

5.3.4.2 Loss of Data In Event Of Server Failure

6 Industry Trends (Page No. - 50)

6.1 Introduction

6.2 Value Chain Analysis

6.2.1 Technology Vendors

6.2.2 Original Device Manufacturer (ODM)

6.2.3 Energy Platform Vendors

6.2.4 System Integrators

6.3 Ecosystem

6.4 Porters Five Forces Analysis

6.4.1 Threat of New Entrants

6.4.2 Threat of Substitutes

6.4.3 Bargaining Power of Suppliers

6.4.4 Bargaining Power of Buyers

6.4.5 Intensity of Rivalry

6.5 Strategic Benchmarking

7 Industrial Energy Management System Market, By Technology Solution (Page No. - 56)

7.1 Introduction

7.2 Supervisory Control And Data Acquisition (SCADA)

7.3 Programmable Logic Control (PLC)

7.4 Distributed Control System (DCS)

7.5 Energy Platform

7.6 Energy Analytics

7.7 Meter Data Management (MDM)

7.8 Energy Management Information System (EMIS)

7.9 Peak Load Control System (PLCS)

7.10 Demand Response Management System (DRMS)

8 Industrial Energy Management System Market, By Hardware (Page No. - 73)

8.1 Introduction

8.2 Communication Network Hardware

8.2.1 Ethernet Switches

8.2.2 Gateways

8.2.3 Routers

8.2.4 Repeaters

8.2.5 Bridges

8.3 Industrial Hardware

8.3.1 Smart Meters

8.3.2 Heating, Ventilating, and Air Conditioning (HVAC)

8.3.3 Load Control Switch (LCS)

8.3.4 Transmitters

8.3.5 Human Machine Interface (HMI)/Operator Panels

8.3.6 Others

9 Industrial Energy Management System Market, By Service (Page No. - 93)

9.1 Introduction

9.2 System Integrator

9.3 Consulting Services

9.4 Support and Maintenance Services

10 Industrial Energy Management System Market, By Industry (Page No. - 99)

10.1 Introduction

10.2 Automotive Industry

10.3 Cement Industry

10.4 Electronics Industry

10.5 Food and Beverages Industry

10.6 Metal Manufacturing Industry

10.7 Mining and Minerals Industry

10.8 Oil and Gas Industry

10.9 Paper and Pulp Industry

10.10 Petrochemicals

10.11 Utilities

11 Industrial Energy Management System Market, By Region (Page No. - 118)

11.1 Introduction

11.2 North America (NA)

11.3 Europe

11.4 Asia-Pacific (APAC)

11.5 Middle East and Africa (MEA)

11.6 Latin America (LA)

12 Competitive Landscape (Page No. - 142)

12.1 Overview

12.2 Competitive Situation and Trends

12.3 Venture Funding

12.4 Mergers and Acquisitions

12.5 Partnerships, Agreements, Joint Ventures, and Collaborations

12.6 New Product Launch

12.7 Business Expansions

13 Company Profiles (Page No. - 152)

13.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MNM View)*

13.2 Cisco Systems, Inc.

13.3 Emerson Electric Company

13.4 General Electric Company

13.5 Schneider Electric Se

13.6 Siemens Ag

13.7 ASEA Brown Boveri (ABB) Ltd.

13.8 Eaton Corporation Plc

13.9 Enernoc, Inc.

13.10 Honeywell International, Inc.

13.11 Rockwell Automation

*Details On Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MNM View Might Not Be Captured In Case Of Unlisted Companies.

14 Appendix (Page No. - 183)

14.1 Excerpts from Industry Experts

14.2 Discussion Guide

14.3 Introducing RT: Real-Time Market Intelligence

14.4 Available Customizations

14.5 Related Reports

List of Tables (89 Tables)

Table 1 Industrial Energy Management System Market Size and Growth Rate, 20122019 ($Million, Y-O-Y %)

Table 2 Rising Energy Demand and Price Volatility Will Drive The Market

Table 3 Long Period Of ROI Is A Restraint To The Market Growth

Table 4 Competitiveness and Increase in Productivity Will Act As An Opportunity For The Market

Table 5 Data Redundancy Issues and Difficulty In Data Collection Will Be The Major Challenges For The Technology Vendors

Table 6 IEMS Market Size, By Technology Solution, 2012-2019 ($Million)

Table 7 SCADA Solution: IEMS Market Size, By Region, 20122019 ($Million)

Table 8 Plc Solution: Industrial Energy Management System MarketSize, By Region, 20122019 ($Million)

Table 9 DCS Solution: IEMS Market Size, By Region, 20122019 ($Million)

Table 10 Energy Platform: IEMS Market Size, By Region, 20122019 ($Million)

Table 11 Energy Analytics Solution: IEMS Market Size, By Region,20122019 ($Million)

Table 12 MDM Solution: IEMS Market Size, By Region, 20122019 ($Million)

Table 13 EMIS Solution: IEMS Market Size, By Region, 20122019 ($Million)

Table 14 PLCS Solution: Industrial Energy Management System Market Size, By Region, 20122019 ($Million)

Table 15 DRMS Solution: IEMS Market Size, By Region, 20122019 ($ Million)

Table 16 IEMS Hardware Market Size, By Type, 20122019 ($Million)

Table 17 Communication Network: IEMS Market Size, By Type, 20122019 ($Million)

Table 18 Communication Network Hardware: IEMS Market Size, By Region, 20122019 ($Million)

Table 19 Ethernet Switches: IEMS Market Size, By Region, 20122019 ($Million)

Table 20 Gateways: Industrial Energy Management System Market Size, By Region, 20122019 ($Million)

Table 21 Routers: IEMS Market Size, By Region, 20122019 ($Million)

Table 22 Repeaters: IEMS Market Size, By Region, 20122019 ($Million)

Table 23 Bridges: IEMS Market Size, By Region, 20122019 ($Million)

Table 24 Industrial Hardware: IEMS Market Size, By Type, 20122019 ($Million)

Table 25 IEMS Industrial Hardware Market Size, By Region, 20122019 ($Million)

Table 26 Smart Meters: Industrial Energy Management System Market Size, By Region, 20122019 ($Million)

Table 27 HVAC: IEMS Market Size, By Region, 20122019 ($Million)

Table 28 LCS: IEMS Market Size, By Region, 20122019 ($Million)

Table 29 Transmitters: IEMS Market Size, By Region, 20122019 ($Million)

Table 30 HMI/Operator Panels: Market Size, By Region, 20122019 ($Million)

Table 31 Others: IEMS Market Size, By Region, 20122019 ($Million)

Table 32 IEMS: Market Size, By Service, 20122019 ($Million)

Table 33 System Integrator Service: IEMS Market Size, By Region,20122019 ($Million)

Table 34 Consulting Services: Industrial Energy Management System Market Size, By Region, 20122019 ($Million)

Table 35 Support and Maintenance Services: IEMS Market Size, By Region,20122019 ($Million)

Table 36 IEMS Market Size, By Industry, 20122019 ($Million)

Table 37 Automotive Industry: IEMS Market Size, By Region, 20122019 ($Million)

Table 38 Cement Industry: IEMS Market Size, By Region, 20122019 ($Million)

Table 39 Electronics Industry: IEMS Market Size, By Region, 20122019 ($Million)

Table 40 Food and Beverages Industry: Industrial Energy Management System Market Size, By Region, 20122019 ($Million)

Table 41 Metal Manufacturing Industry: IEMS Market Size, By Region, 20122019 ($Million)

Table 42 Mining and Minerals Industry: IEMS Market Size, By Region, 20122019 ($Million)

Table 43 Oil and Gas Industry: IEMS Market Size, By Region, 20122019 ($Million)

Table 44 Paper and Pulp Industry: IEMS Market Size, By Region, 20122019 ($Million)

Table 45 Petrochemicals Industry: IEMS Market Size, By Region,20122019 ($Million)

Table 46 Utilities Industry: IEMS Size, By Region, 20122019 ($Million)

Table 47 IEMS Market Size, By Region, 20122019 ($Million)

Table 48 APAC Has the Highest Market Growth Rate From 2014 To 2019

Table 49 Regional Snapshot: APAC Market As A Hotspot

Table 50 NA: Industrial Energy Management System Market Size, By Type, 20122019 ($Million)

Table 51 NA: IEMS Market Size, By Technology Solution, 20122019 ($Million)

Table 52 NA: IEMS Market Size, By Hardware Type, 20122019 ($Million)

Table 53 NA: IEMS Market Size, By Communication Network, 20122019 ($Million)

Table 54 NA: IEMS Market Size, By Industrial Hardware, 20122019 ($Million)

Table 55 NA: IEMS Market Size, By Service, 20122019 ($Million)

Table 56 NA: IEMS Market Size, By Industry, 20122019 ($Million)

Table 57 Europe: Industrial Energy Management System Market Size, By Types, 20122019 ($Million)

Table 58 Europe: IEMS Market Size, By Technology Solution, 20122019 ($Million)

Table 59 Europe: IEMS Market Size, By Hardware Type, 20122019 ($Million)

Table 60 Europe: IEMS Market Size, By Communication Network,20122019 ($Million)

Table 61 Europe: IEMS Market Size, By Industrial Hardware, 20122019 ($Million)

Table 62 Europe: IEMS Market Size, By Service, 20122019 ($Million)

Table 63 Europe: IEMS Market Size, By Industry, 20122019 ($Million)

Table 64 APAC: Industrial Energy Management System Market Size, By Type, 20122019 ($Million)

Table 65 APAC: IEMS Market Size, By Technology Solution, 20122019 ($Million)

Table 66 APAC: IEMS Market Size, By Hardware Type, 20122019 ($Million)

Table 67 APAC: IEMS Market Size, By Communication Network,20122019 ($Million)

Table 68 APAC: IEMS Market Size, By Industrial Hardware, 20122019 ($Million)

Table 69 APAC: IEMS Market Size, By Service, 20122019 ($Million)

Table 70 APAC: IEMS Market Size, By Industry, 20122019 ($Million)

Table 71 MEA: Industrial Energy Management System Market Size, By Type, 20122019 ($Million)

Table 72 MEA: IEMS Market Size, By Technology Solution, 20122019 ($Million)

Table 73 MEA: IEMS Market Size, By Hardware Type, 20122019 ($Million)

Table 74 MEA: IEMS Market Size, By Communication Network, 20122019 ($Million)

Table 75 MEA: IEMS Market Size, By Industrial Hardware, 20122019 ($Million)

Table 76 MEA: IEMS Market Size, By Service, 20122019 ($Million)

Table 77 MEA: IEMS Market Size, By Industry, 20122019 ($Million)

Table 78 LA: Industrial Energy Management System Market Size, By Type, 20122019 ($Million)

Table 79 LA: IEMS Market Size, By Technology Solution, 20122019 ($Million)

Table 80 LA: IEMS Market Size, By Hardware Type, 20122019 ($Million)

Table 81 LA: IEMS Market Size, By Communication Network, 20122019 ($Million)

Table 82 LA: IEMS Market Size, By Industrial Hardware, 20122019 ($Million)

Table 83 LA: IEMS Market Size, By Service, 20122019 ($Million)

Table 84 LA: IEMS Market Size, By Industry, 20122019 ($Million)

Table 85 Venture Funding, 20092014

Table 86 Mergers and Acquisitions, 20102014

Table 87 Partnerships, Agreements, Joint Ventures, and Collaborations,20092014

Table 88 Expansions, 20102014

Table 89 New Product Developments, 20122014

List of Figures (94 Figures)

Figure 1 Global IEMS Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Market Breakdowns and Data Triangulation

Figure 5 Na Held the Largest Market Share In 2014

Figure 6 Top Three Segments for Industrial Energy Management System Market in 20142019

Figure 7 IEMS Market Size And Growth Rate, 20122019 ($Million, Y-O-Y %)

Figure 8 Stringent Energy Management Standards Drive IEMS Market toward Growth

Figure 9 Global IEMS Market, By Region, 2014 vs. 2019 ($Million)

Figure 10 Hardware Market to Grow At the Highest Rate among The Top Three IEMS Segments

Figure 11 Automotive and Cement Industries Are the Leading Segments In Terms Of Market Share In APAC Region For 2014

Figure 16 Workflow Model: Industrial Energy Management System Market

Figure 17 Market Segmentation: By Technology Solution

Figure 18 Market Segmentation: By Hardware

Figure 19 Market Segmentation: By Communication Network

Figure 20 Market Segmentation: By Industrial Hardware

Figure 21 Market Segmentation: By Service

Figure 22 Market Segmentation: By Industry

Figure 23 Market Segmentation: By Region

Figure 24 Increasing Energy Consumption and Price Volatility Will Spur the Demand Of IEMS Solutions

Figure 25 IEMS: Value Chain Analysis

Figure 26 Industrial Energy Management System Market Ecosystem

Figure 27 IEMS: Porters Five Forces Analysis

Figure 28 Majority Of The Market Dominated By Energy Analytics Solutions

Figure 29 SCADA Solution: IEMS Market Size, By Region, 20142019 ($Million)

Figure 30 Plc Solution: IEMS Market Size, By Region, 20142019 ($Million)

Figure 31 Distributed Control System

Figure 32 DCS Solution: IEMS Market Size, By Region, 20142019 ($Million)

Figure 33 Energy Platform: IEMS Market Size, By Region, 20122019 ($Million)

Figure 34 Energy Analytics Technologies & Solutions

Figure 35 Energy Analytics Solution : IEMS Market Size, By Region,

20142019 ($Million)

Figure 36 Mdm Solution: IEMS Market Size, By Region, 20142019 ($Million)

Figure 37 Emis Block Diagram

Figure 38 Emis Solution: IEMS Market Size, By Region, 20142019 ($Million)

Figure 39 Plcs Solution: Industrial Energy Management System Market Size, By Region, 20142019 ($Million)

Figure 40 Drms Solutions: Evolution

Figure 41 Drms Solution: IEMS Market Size, By Region, 20142019 ($Million)

Figure 42 IEMS Hardware Market Size, By Region, 20142019 ($Million)

Figure 43 Communication Network Hardware: IEMS Market Size, By Type,

20142019 ($Million)

Figure 44 Ethernet Switches Market Size, By Region, 20142019 ($Million)

Figure 45 Gateways: IEMS Market Size, By Region, 20142019 ($Million)

Figure 46 Routers: IEMS Market Size, By Region, 20142019 ($Million)

Figure 47 Repeaters: IEMS Market Size, By Region, 20142019 ($Million)

Figure 48 Bridges: IEMS Market Size, By Region, 20142019 ($Million)

Figure 49 Industrial Hardware: IEMS Market Size, By Type, 20142019 ($Million)

Figure 50 Smart Meters: IEMS Market Size, By Region, 20142019 ($Million)

Figure 51 HVAC: Industrial Energy Management System Market Size, By Region, 20142019 ($Million)

Figure 52 LCS Market Size, By Region, 20142019 ($Million)

Figure 53 Transmitters: IEMS Market Size, By Region, 20142019 ($Million)

Figure 54 HMI/Operator Panels: IEMS Market Size, By Region,

20142019 ($Million)

Figure 55 Others: IEMS Market Size, By Region, 20142019 ($Million)

Figure 56 IEMS Market Size, By Service, 20142019 ($Million)

Figure 57 System Integrator Service: IEMS Market Size, By Region,

20142019 ($Million)

Figure 58 Consulting Services: IEMS Market Size, By Region, 20142019 ($Million)

Figure 59 Support and Maintenance Services: IEMS Market Size, By Region,

20142019 ($Million)

Figure 60 IEMS Market Size, By Industry, 20142019 ($Million)

Figure 61 Automotive Energy Consumption in Various Processes

Figure 62 Automotive Industry: Industrial Energy Management System Market Size, By Region, 20142019 ($Million)

Figure 63 Cement Industry: IEMS Market Size, By Region, 20142019 ($Million)

Figure 64 Electronics Industry: IEMS Market Size, By Region,

20142019 ($Million)

Figure 65 Food and Beverages Industry: IEMS Market Size, By Region,

20142019 ($Million)

Figure 66 Metal Manufacturing Industry: IEMS Market Size, By Region,

20142019 ($Million)

Figure 67 Mining and Minerals Industry: IEMS Market Size, By Region,

20142019 ($Million)

Figure 68 Oil and Gas Industry: Industrial Energy Management System Market Size, By Region, 20142019 ($Million)

Figure 69 Paper and Pulp Industry: IEMS Market Size, By Region,

20142019 ($Million)

Figure 70 Petrochemicals Industry: IEMS Market Size, By Region,

20142019 ($Million)

Figure 71 Utility Industry: IEMS Market Size, By Region, 20142019 ($Million)

Figure 72 APAC: An Attractive Destination for IEMS Market, 20142019

Figure 73 Companies Adopted Inorganic Growth Strategies Such As Mergers & Acquisitions and Partnerships & Agreements over The Last Three Years

Figure 74 Schneider Electric Grew At the Highest Rate between 2009 And 2013

Figure 75 Market Evaluation Frameworks

Figure 76 Battle for Market Share: Venture Funding Is the Key Strategy

Figure 77 Competitive Analysis: Regional Market Share Analysis

Figure 78 Cisco: Company Snapshot

Figure 79 Cisco: SWOT Analysis

Figure 80 Emerson: Company Snapshot

Figure 81 Emerson: SWOT Analysis

Figure 82 GE: Company Snapshot

Figure 83 GE: SWOT Analysis

Figure 84 Schneider Electric: Company Snapshot

Figure 85 Schneider Electric: SWOT Analysis

Figure 86 Siemens: Company Snapshot

Figure 87 Siemens: SWOT Analysis

Figure 88 Abb: Company Snapshot

Figure 89 Eaton: Company Snapshot

Figure 90 Enernoc: Company Snapshot

Figure 91 Enernoc: SWOT Analysis

Figure 92 Honeywell: Company Snapshot

Figure 93 Honeywell: SWOT Analysis

Figure 94 Rockwell Automation: Company Snapshot

Growth opportunities and latent adjacency in Industrial Energy Management System (IEMS) Market