Industrial Crystallizers Market by Type (DTB, Forced Circulation, Fluidized Bed), Process (Continuous, Batch), End-Use Industry (Food & Beverage, Pharmaceutical, Chemical, Agrochemical, Wastewater Treatment) & Region - Global Forecast to 2027

Updated on : April 03, 2024

Industrial Crystallizers Market

The global industrial crystallizers market was valued at USD 3.8 billion in 2022 and is projected to reach USD 4.8 billion by 2027, growing at 5.1% cagr from 2022 to 2027. The industrial crystallizers market has grown considerably in recent years and is projected to grow at a significant rate in the coming years. The major reasons for rising demand of industrial crystallizers can be attributed to the adoption of ZLD in industries and growing end-use industries.

To know about the assumptions considered for the study, Request for Free Sample Report

Industrial Crystallizers Market Dynamics

Driver: Increase in wastewater treatment and growth in food & beverage industry

Crystallizers are used for recovering salts from wastewater, particularly in the treatment of chemical wastewater. With the challenges of wastewater treatment, researchers have begun to use crystallization techniques in wastewater treatment. Furthermore, in the food industry, crystallization can be used to recover crystalline goods (such as sugar, glucose, lactose, citric acid, and salt) to remove undesired components or to change the structure of some food products. Hence, the growth of these end-use industries will drive the growth of industrial crystallizers market.

Restraint: High manufacturing and operational cost

The manufacturing cost of industrial crystallizers is high owing to several factors such as changes in raw material requirement, design requirement according to end-use industry, significant technical & manufacturing expertise, and personnel training. The maintenance cost increases due to problems such as corrosion and scaling. Some liquids and chemicals can be corrosive to the crystallizer, which adds to the maintenance cost.

Opportunity: High demand from metal & mineral and agrochemical sectors in developing regions

There are numerous applications of crystallizers in the agrochemical industry, including production of fertilizers such as ammonium sulfate, mono-ammonium phosphate, di-ammonium phosphate, and potassium chloride, among others. The developing countries can utilize the opportunities made possible by foreign investment to grow their market share in agro-industrial sectors. This consequently creates an opportunity for the growth of the industrial crystallizers market.

Challenges: Supply chain disruption in the global industrial crystallizers market

There has been a shortage in global supply of raw materials, as well as semi-finished stainless steel and aluminum goods. Due to increased demand, decreased availability, and rising costs of raw materials, stainless steel prices are predicted to rise. One of the major raw materials used in the manufacturing of crystallizers is stainless steel. Thus, the shortage of stainless steel is a major challenge for the market players.

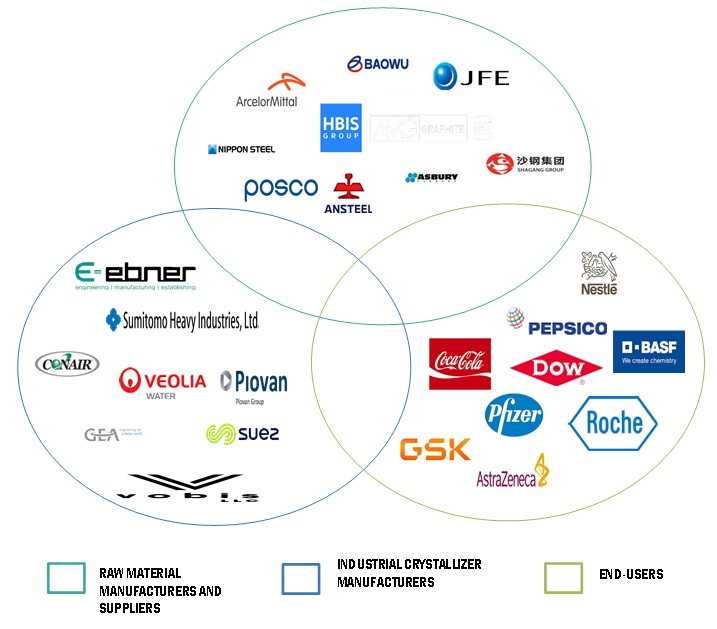

Industrial Crystallizers Market Ecosystem

Based on type, the forced circulation crystallizers segment is projected to grow at a significant CAGR during the forecast period

The type segment covers DTB crsytallizers, forced circulation crsytallizers, fluidized bed crystallizers, and others. The forced circulation crsytallizers are used to concentrate and evaporate aqueous or organic phase solutions in food, pharmaceutical, chemical, biotechnology, and other industries.

Based on process, the continuous segment is projected to grow at a significant CAGR during the forecast period

The process segment covers continuos and batch process. Continuous crystallizers offers consistent products and are usually smaller and energy efficient as compared to batch plants, for same production rate. Continuous crystallizers are suitable for high production rate systems.

Based on end-use industry, the food & beverage segment is projected to grow at a significant CAGR during the forecast period

In food & beverage industry, crystallizers are used for the production of several products including sugar, edible oil, and juices. Food crystallization can be influenced by a variety of circumstances, which requires understanding of crystal quality and property in various foods.

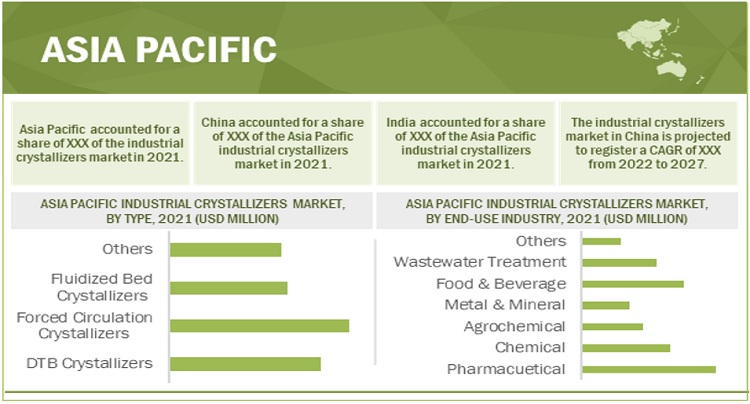

Asia Pacific region is projected to grow at a significant CAGR during the forecast period

By region, Asia Pacific is one of the fastest-growing markets of industrial crystallizers. The high growth can be attributed to the presence of major manufacturing countries including China, which is expected to register the highest CAGR during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Industrial Crystallizers Market Players

Veolia Water Technologies (France), Sumitomo Heavy Industries, Ltd. (Japan), Sulzer Ltd. (Switzerland), SUEZ Water Technologies & Solutions (France), GEA Group AG (Germany), Tsukishima Kikai Co., Ltd. (Japan), Condorchem Envitech (Spain), Piovan S.p.A. (Italy), Alaqua Inc. (US), Fives Group (France), Vobis LLC (US), Anssen Metallurgy Group Co., Ltd. (China), Ebner GmbH & Co. Kg (Germany), Moretto SPA (Italy) and Motan Colortronic (Germany)are among the key players leading the market through their innovative offerings, enhanced production capacities, and efficient distribution channels.

industrial Crystallizers Market Report Scope

|

Report Metric |

Details |

|

Market Size Available for Years |

2019,2020,2021,2022,2023,2024,2025,2026 and 2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

By type, by process, by end-use industry and Region. |

|

Geographies Covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies Covered |

The major market players include Veolia Water Technologies (France), Sumitomo Heavy Industries, Ltd. (Japan), Sulzer Ltd. (Switzerland), SUEZ Water Technologies & Solutions (France), GEA Group AG (Germany), Tsukishima Kikai Co., Ltd. (Japan), Condorchem Envitech (Spain), Piovan S.p.A. (Italy), Alaqua Inc. (US), Fives Group (France), Vobis LLC (US), Anssen Metallurgy Group Co., Ltd. (China), Ebner GmbH & Co. Kg (Germany), Moretto SPA (Italy) and Motan Colortronic (Germany) |

This research report categorizes the industrial crystallizers market based on type, process, end-use industry and region.

Based on type, the industrial crystallizers market has been segmented as follows:

- DTB Crystallizers

- Forced Circulation Crystallizers

- Fluidized Bed Crystallizers

- Others

Based on process, the industrial crystallizers market has been segmented as follows:

- Continuous

- Batch

Based on end-use industry, the industrial crystallizers market has been segmented as follows:

- Pharmaceutical

- Agrochemical

- Metal & Mineral

- Food & Beverage

- Chemical

- Wastewater Treatment

- Others

Based on regions, the industrial crystallizers market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In May 2019, Veolia Water Technologies was awarded a contract by Smurfit Kappa to supply state-of-the-art HPD systems at the Sangüesa mill in Northern Spain.

- In May 2018, SUEZ Water Technologies & Solutions (SUEZ) and Rosneft signed a strategic cooperation agreement to improve water and waste programs across Rosneft sites.

Frequently Asked Questions (FAQ):

Which are the key companies operating in the industrial crystallizers market?

Veolia Water Technologies (France), Sumitomo Heavy Industries, Ltd. (Japan), Sulzer Ltd. (Switzerland), SUEZ Water Technologies & Solutions (France), GEA Group AG (Germany), Tsukishima Kikai Co., Ltd. (Japan), Condorchem Envitech (Spain), Piovan S.p.A. (Italy), Alaqua Inc. (US), Fives Group (France), Vobis LLC (US), Anssen Metallurgy Group Co., Ltd. (China), Ebner GmbH & Co. Kg (Germany), Moretto SPA (Italy) and Motan Colortronic (Germany) are some of the companies operating in the industrial crystallizers market.

What are the key strategies adopted by the market players?

The companies involved in the industrial crystallizers market have focused on agreement, contract, and partnership as their key strategies to increase their geographical reach and business revenue.

How industrial crystallizers are classified?

Industrial crystallizers are classified based on type, process, end-use industry, and region.

What are the major drivers of industrial crystallizers market?

Increase in wastewater treatment and growth in food & beverage industry is one of the drivers of industrial crystallizers market.

What are the major raw material used for manufacturing industrial crystallizers?

Generally stainless steel, mild steel and graphite is used for manufacturing of industrial crystallizers. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

TABLE 1 INDUSTRIAL CRYSTALLIZERS MARKET: INCLUSIONS & EXCLUSIONS

1.3 STUDY SCOPE

FIGURE 1 INDUSTRIAL CRYSTALLIZERS MARKET SEGMENTATION

1.3.1 REGIONAL SCOPE

1.3.2 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 RESEARCH LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 2 INDUSTRIAL CRYSTALLIZERS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Participating companies for primary research

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 BASE NUMBER CALCULATION

FIGURE 5 MARKET SIZE ESTIMATION (SUPPLY SIDE): INDUSTRIAL CRYSTALLIZERS MARKET

2.4 DATA TRIANGULATION

FIGURE 6 INDUSTRIAL CRYSTALLIZERS MARKET: DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 37)

TABLE 2 INDUSTRIAL CRYSTALLIZERS MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 7 CONTINUOUS PROCESS ACCOUNTED FOR LARGER SHARE OF INDUSTRIAL CRYSTALLIZERS MARKET IN 2021

FIGURE 8 FORCED CIRCULATION CRYSTALLIZERS ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

FIGURE 9 PHARMACEUTICAL SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

FIGURE 10 ASIA PACIFIC MARKET TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 41)

4.1 SIGNIFICANT OPPORTUNITIES IN INDUSTRIAL CRYSTALLIZERS MARKET

FIGURE 11 INDUSTRIAL CRYSTALLIZERS MARKET TO WITNESS MODERATE GROWTH BETWEEN 2022 AND 2027

4.2 INDUSTRIAL CRYSTALLIZERS MARKET, BY REGION

FIGURE 12 ASIA PACIFIC TO GROW AT HIGHEST RATE BETWEEN 2022 AND 2027

4.3 ASIA PACIFIC INDUSTRIAL CRYSTALLIZERS MARKET, BY PROCESS AND COUNTRY

FIGURE 13 CHINA TO LEAD ASIA PACIFIC INDUSTRIAL CRYSTALLIZERS MARKET

4.4 INDUSTRIAL CRYSTALLIZERS MARKET: MAJOR COUNTRIES

FIGURE 14 CHINA TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 43)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN INDUSTRIAL CRYSTALLIZERS MARKET

5.2.1 DRIVERS

5.2.1.1 Increase in wastewater treatment and growth of food & beverage industry

FIGURE 16 REVENUE GROWTH IN FOOD & BEVERAGE INDUSTRY, BY COUNTRY (2022)

5.2.1.2 Increasing adoption of ZLD in industries

5.2.2 RESTRAINTS

5.2.2.1 High manufacturing and operational cost

5.2.3 OPPORTUNITIES

5.2.3.1 High demand from metal & mineral and agrochemical sectors in developing regions

5.2.4 CHALLENGES

5.2.4.1 Highly fragmented market

5.2.4.2 Supply chain disruption in global industrial crystallizers market

5.3 PORTER'S FIVE FORCES ANALYSIS

TABLE 3 INDUSTRIAL CRYSTALLIZERS MARKET: PORTER'S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 THREAT OF NEW ENTRANTS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 VALUE CHAIN ANALYSIS

FIGURE 17 VALUE CHAIN ANALYSIS: HIGHEST VALUE ADDED DURING MANUFACTURING PHASE

5.5 ECOSYSTEM

FIGURE 18 ECOSYSTEM MAP OF INDUSTRIAL CRYSTALLIZERS MARKET

TABLE 4 INDUSTRIAL CRYSTALLIZERS MARKET: ECOSYSTEM

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

FIGURE 19 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR INDUSTRIAL CRYSTALLIZERS MARKET

5.7 PATENT ANALYSIS

5.7.1 INTRODUCTION

5.7.2 METHODOLOGY

5.7.3 DOCUMENT TYPE

FIGURE 20 NUMBER OF GRANTED PATENTS, PATENT APPLICATIONS, AND LIMITED PATENTS

FIGURE 21 PUBLICATION TRENDS - LAST 10 YEARS

5.7.4 INSIGHTS

FIGURE 22 LEGAL STATUS OF PATENTS

5.7.5 JURISDICTION ANALYSIS

FIGURE 23 TOP JURISDICTION, BY DOCUMENT

5.7.6 TOP COMPANIES/APPLICANTS

FIGURE 24 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

TABLE 5 LIST OF PATENTS BY CHINA PETROLEUM & CHEMICAL CORP.

TABLE 6 LIST OF PATENTS BY INSTITUTE OF PROCESS ENGINEERING, CAS

TABLE 7 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

5.8 TECHNOLOGY ANALYSIS

5.8.1 DTB CRYSTALLIZER

5.8.2 VACUUM CRYSTALLIZER

5.8.3 FLUIDIZED BED CRYSTALLIZER

5.8.4 FORCED CIRCULATION CRYSTALLIZER

5.9 KEY CONFERENCES & EVENTS

TABLE 8 INDUSTRIAL CRYSTALLIZERS MARKET: DETAILED LIST OF CONFERENCES & EVENTS (2022-2023)

5.10 REGULATORY LANDSCAPE

5.10.1 STANDARDS FOR INDUSTRIAL CRYSTALLIZERS

5.10.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.11 CASE STUDY ANALYSIS

5.11.1 OPTIMIZATION OF INDUSTRIAL CRYSTALLIZATION THROUGH SEMI-AUTOMATED CRYSTALLIZER

5.11.2 SUCCESSFUL COMMISSIONING OF CRYSTALLIZATION PLANT

6 INDUSTRIAL CRYSTALLIZERS MARKET, BY TYPE (Page No. - 64)

6.1 INTRODUCTION

FIGURE 25 INDUSTRIAL CRYSTALLIZERS MARKET, BY TYPE, 2022–2027(USD MILLION)

TABLE 12 INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

6.2 DTB CRYSTALLIZERS

6.2.1 DTB CRYSTALLIZERS USED TO PRODUCE LARGE SIZE CRYSTALS

TABLE 13 DTB CRYSTALLIZERS MARKET SIZE, BY REGION, 2019–2027 (USD MILLION)

6.3 FORCED CIRCULATION CRYSTALLIZERS

6.3.1 FORCED CIRCULATION CRYSTALLIZERS IDEAL FOR CONTINUOUS PROCESS

TABLE 14 FORCED CIRCULATION CRYSTALLIZERS MARKET SIZE, BY REGION, 2019–2027 (USD MILLION)

6.4 FLUIDIZED BED CRYSTALLIZERS

6.4.1 FLUIDIZED BED CRYSTALLIZERS USED FOR WASTEWATER TREATMENT

TABLE 15 FLUIDIZED BED CRYSTALLIZERS MARKET SIZE, BY REGION, 2019–2027 (USD MILLION)

6.5 OTHERS

TABLE 16 OTHER CRYSTALLIZERS MARKET SIZE, BY REGION, 2019–2027 (USD MILLION)

7 INDUSTRIAL CRYSTALLIZERS MARKET, BY PROCESS (Page No. - 70)

7.1 INTRODUCTION

FIGURE 26 INDUSTRIAL CRYSTALLIZERS MARKET, BY PROCESS, 2022–2027(USD MILLION)

TABLE 17 INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY PROCESS, 2019–2027 (USD MILLION)

7.2 CONTINUOUS

7.2.1 CONTINUOUS PROCESS MORE ECONOMICAL THAN BATCH PROCESS

TABLE 18 INDUSTRIAL CRYSTALLIZERS MARKET SIZE FOR CONTINUOUS PROCESS, BY REGION, 2019–2027 (USD MILLION)

7.3 BATCH

7.3.1 BATCH PROCESS IDEAL FOR PROCESSING ENCRUSTATION SOLUTIONS

TABLE 19 INDUSTRIAL CRYSTALLIZERS MARKET SIZE FOR BATCH PROCESS, BY REGION, 2019–2027 (USD MILLION)

8 INDUSTRIAL CRYSTALLIZERS MARKET, BY END-USE INDUSTRY (Page No. - 74)

8.1 INTRODUCTION

FIGURE 27 INDUSTRIAL CRYSTALLIZERS MARKET, BY END-USE INDUSTRY, 2022–2027(USD MILLION)

TABLE 20 INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2027 (USD MILLION)

8.2 PHARMACEUTICAL

8.2.1 CRYSTALLIZERS WIDELY USED FOR MANUFACTURING API IN PHARMACEUTICAL SECTOR

TABLE 21 INDUSTRIAL CRYSTALLIZERS MARKET SIZE IN PHARMACEUTICAL, BY REGION, 2019–2027 (USD MILLION)

8.3 AGROCHEMICAL

8.3.1 CRYSTALLIZERS USED IN FERTILIZER MANUFACTURING IN AGROCHEMICAL INDUSTRY

TABLE 22 INDUSTRIAL CRYSTALLIZERS MARKET SIZE IN AGROCHEMICAL, BY REGION, 2019–2027 (USD MILLION)

8.4 METAL & MINERAL

8.4.1 CRYSTALLIZERS USED FOR METAL SEPARATION

TABLE 23 INDUSTRIAL CRYSTALLIZERS MARKET SIZE IN METAL & MINERAL, BY REGION, 2019–2027 (USD MILLION)

8.5 FOOD & BEVERAGE

8.5.1 ONE OF LEADING CONSUMERS OF INDUSTRIAL CRYSTALLIZERS

TABLE 24 INDUSTRIAL CRYSTALLIZERS MARKET SIZE IN FOOD & BEVERAGE, BY REGION, 2019–2027 (USD MILLION)

8.6 CHEMICAL

8.6.1 CRYSTALLIZERS USED TO PRODUCE SPECIALTY COMPOUNDS

TABLE 25 INDUSTRIAL CRYSTALLIZERS MARKET SIZE IN CHEMICAL, BY REGION, 2019–2027 (USD MILLION)

8.7 WASTEWATER TREATMENT

8.7.1 CRYSTALLIZATION IS PROMISING TECHNIQUE FOR WASTEWATER TREATMENT

TABLE 26 INDUSTRIAL CRYSTALLIZERS MARKET SIZE IN WASTEWATER TREATMENT, BY REGION, 2019–2027 (USD MILLION)

8.8 OTHERS

TABLE 27 INDUSTRIAL CRYSTALLIZERS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2019–2027 (USD MILLION)

9 INDUSTRIAL CRYSTALLIZERS MARKET, BY REGION (Page No. - 82)

9.1 INTRODUCTION

FIGURE 28 REGIONAL SNAPSHOT: ASIA PACIFIC TO WITNESS HIGHEST GROWTH

TABLE 28 INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY REGION, 2019–2027 (USD MILLION)

9.2 ASIA PACIFIC

FIGURE 29 ASIA PACIFIC: INDUSTRIAL CRYSTALLIZERS MARKET SNAPSHOT

TABLE 29 ASIA PACIFIC: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY COUNTRY, 2019–2027 (USD MILLION)

TABLE 30 ASIA PACIFIC: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 31 ASIA PACIFIC: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY PROCESS, 2019–2027 (USD MILLION)

TABLE 32 ASIA PACIFIC: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2027 (USD MILLION)

9.2.1 CHINA

9.2.1.1 Leading industrial crystallizers market in Asia Pacific

TABLE 33 CHINA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 34 CHINA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2027 (USD MILLION)

9.2.2 SOUTH KOREA

9.2.2.1 Growing industrial crystallizers demand in metal industry

TABLE 35 SOUTH KOREA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 36 SOUTH KOREA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2027 (USD MILLION)

9.2.3 JAPAN

9.2.3.1 Industrial crystallizers market to grow due to expansion of pharmaceutical sector

TABLE 37 JAPAN: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 38 JAPAN: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2027 (USD MILLION)

9.2.4 INDIA

9.2.4.1 Diverse manufacturing industries to create demand for industrial crystallizers

TABLE 39 INDIA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 40 INDIA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2027 (USD MILLION)

9.2.5 AUSTRALIA

9.2.5.1 Metal and food industries to create demand for industrial crystallizers

TABLE 41 AUSTRALIA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 42 AUSTRALIA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2027 (USD MILLION)

9.2.6 MALAYSIA

9.2.6.1 Innovation in specialty chemical industry to create growth opportunities

TABLE 43 MALAYSIA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 44 MALAYSIA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2027 (USD MILLION)

9.2.7 REST OF ASIA PACIFIC

TABLE 45 REST OF ASIA PACIFIC: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 46 REST OF ASIA PACIFIC: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2027 (USD MILLION)

9.3 NORTH AMERICA

FIGURE 30 NORTH AMERICA: INDUSTRIAL CRYSTALLIZERS MARKET SNAPSHOT

TABLE 47 NORTH AMERICA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY COUNTRY, 2019–2027 (USD MILLION)

TABLE 48 NORTH AMERICA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 49 NORTH AMERICA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY PROCESS, 2019–2027 (USD MILLION)

TABLE 50 NORTH AMERICA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2027 (USD MILLION)

9.3.1 US

9.3.1.1 Industrial crystallizers' demand to increase in pharmaceutical sector in US

TABLE 51 US: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 52 US: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2027 (USD MILLION)

9.3.2 CANADA

9.3.2.1 Food & beverage industry to fuel demand for industrial crystallizers

TABLE 53 CANADA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 54 CANADA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2027 (USD MILLION)

9.3.3 MEXICO

9.3.3.1 Industrial crystallizers market growth driven by metal industry

TABLE 55 MEXICO: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 56 MEXICO: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2027 (USD MILLION)

9.4 EUROPE

FIGURE 31 EUROPE: INDUSTRIAL CRYSTALLIZERS MARKET SNAPSHOT

TABLE 57 EUROPE: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY COUNTRY, 2019–2027 (USD MILLION)

TABLE 58 EUROPE: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 59 EUROPE: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY PROCESS, 2019–2027 (USD MILLION)

TABLE 60 EUROPE: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2027 (USD MILLION)

9.4.1 GERMANY

9.4.1.1 Growing end-use industries to support market growth

TABLE 61 GERMANY: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 62 GERMANY: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2027 (USD MILLION)

9.4.2 UK

9.4.2.1 Rising demand for industrial crystallizers in UK's pharmaceutical sector

TABLE 63 UK: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 64 UK: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2027 (USD MILLION)

9.4.3 FRANCE

9.4.3.1 Metal industry to create demand for industrial crystallizers

TABLE 65 FRANCE: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 66 FRANCE: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2027 (USD MILLION)

9.4.4 ITALY

9.4.4.1 Food & beverage industry to drive market

TABLE 67 ITALY: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 68 ITALY: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2027 (USD MILLION)

9.4.5 RUSSIA

9.4.5.1 Demand for industrial crystallizers to increase in chemical industry

TABLE 69 RUSSIA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 70 RUSSIA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2027 (USD MILLION)

9.4.6 SPAIN

9.4.6.1 Growth in food & beverage sector to create opportunities

TABLE 71 SPAIN: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 72 SPAIN: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2027 (USD MILLION)

9.4.7 REST OF EUROPE

TABLE 73 REST OF EUROPE: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 74 REST OF EUROPE: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2027 (USD MILLION)

9.5 MIDDLE EAST & AFRICA

TABLE 75 MIDDLE EAST & AFRICA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY COUNTRY, 2019–2027 (USD MILLION)

TABLE 76 MIDDLE EAST & AFRICA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 77 MIDDLE EAST & AFRICA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY PROCESS, 2019–2027 (USD MILLION)

TABLE 78 MIDDLE EAST & AFRICA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2027 (USD MILLION)

9.5.1 SAUDI ARABIA

9.5.1.1 Growth in industrial sector to boost demand for industrial crystallizers

TABLE 79 SAUDI ARABIA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 80 SAUDI ARABIA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2027 (USD MILLION)

9.5.2 UAE

9.5.2.1 Metal and other end-use industries to drive market in UAE

TABLE 81 UAE: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 82 UAE: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2027 (USD MILLION)

9.5.3 SOUTH AFRICA

9.5.3.1 Growing industrial sectors to fuel industrial crystallizers market

TABLE 83 SOUTH AFRICA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 84 SOUTH AFRICA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2027 (USD MILLION)

9.5.4 REST OF MIDDLE EAST & AFRICA

TABLE 85 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 86 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2027 (USD MILLION)

9.6 SOUTH AMERICA

TABLE 87 SOUTH AMERICA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY COUNTRY, 2019–2027 (USD MILLION)

TABLE 88 SOUTH AMERICA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 89 SOUTH AMERICA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY PROCESS, 2019–2027 (USD MILLION)

TABLE 90 SOUTH AMERICA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2027 (USD MILLION)

9.6.1 ARGENTINA

9.6.1.1 Growing end-use industries to create demand in Argentina

TABLE 91 ARGENTINA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 92 ARGENTINA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2027 (USD MILLION)

9.6.2 BRAZIL

9.6.2.1 Industrial crystallizers market to increase in manufacturing sector

TABLE 93 BRAZIL: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 94 BRAZIL: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2027 (USD MILLION)

9.6.3 REST OF SOUTH AMERICA

TABLE 95 REST OF SOUTH AMERICA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY TYPE, 2019–2027 (USD MILLION)

TABLE 96 REST OF SOUTH AMERICA: INDUSTRIAL CRYSTALLIZERS MARKET SIZE, BY END-USE INDUSTRY, 2019–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 120)

10.1 OVERVIEW

10.2 KEY PLAYER STRATEGIES

TABLE 97 OVERVIEW OF STRATEGIES ADOPTED BY INDUSTRIAL CRYSTALLIZER MANUFACTURERS

10.3 MARKET SHARE AND REVENUE ANALYSIS

FIGURE 32 INDUSTRIAL CRYSTALLIZERS MARKET SHARE ANALYSIS

10.3.1 REVENUE ANALYSIS OF TOP PLAYERS IN INDUSTRIAL CRYSTALLIZERS MARKET

FIGURE 33 TOP PLAYERS – REVENUE ANALYSIS (2016–2020)

10.4 COMPETITIVE BENCHMARKING

10.4.1 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 34 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN INDUSTRIAL CRYSTALLIZERS MARKET

10.4.2 BUSINESS STRATEGY EXCELLENCE

FIGURE 35 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN INDUSTRIAL CRYSTALLIZERS MARKET

TABLE 98 COMPANY END-USE INDUSTRY FOOTPRINT, 2021

TABLE 99 COMPANY PRODUCT TYPE FOOTPRINT, 2021

TABLE 100 COMPANY PROCESS FOOTPRINT, 2021

TABLE 101 COMPANY REGION FOOTPRINT, 2021

TABLE 102 COMPANY OVERALL FOOTPRINT, 2021

10.5 COMPANY EVALUATION QUADRANT, 2021

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE PLAYERS

10.5.4 PARTICIPANTS

FIGURE 36 INDUSTRIAL CRYSTALLIZERS MARKET: COMPETITIVE LANDSCAPE MAPPING

10.6 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION QUADRANT, 2021

10.6.1 PROGRESSIVE COMPANIES

10.6.2 RESPONSIVE COMPANIES

10.6.3 DYNAMIC COMPANIES

10.6.4 STARTING BLOCKS

FIGURE 37 INDUSTRIAL CRYSTALLIZERS MARKET (GLOBAL): SMES EVALUATION QUADRANT, 2021

TABLE 103 INDUSTRIAL CRYSTALLIZERS: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 104 INDUSTRIAL CRYSTALLIZERS: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

TABLE 105 INDUSTRIAL CRYSTALLIZERS: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

10.7 KEY MARKET DEVELOPMENTS

TABLE 106 INDUSTRIAL CRYSTALLIZERS MARKET: DEALS, 2016–2022

11 COMPANY PROFILES (Page No. - 133)

11.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, MnM view, Right to win, Strategic choices, Weaknesses and competitive threats) *

11.1.1 VEOLIA WATER TECHNOLOGIES

TABLE 107 VEOLIA WATER TECHNOLOGIES: COMPANY OVERVIEW

FIGURE 38 VEOLIA WATER TECHNOLOGIES: COMPANY SNAPSHOT

11.1.2 SUMITOMO HEAVY INDUSTRIES, LTD.

TABLE 108 SUMITOMO HEAVY INDUSTRIES, LTD.: COMPANY OVERVIEW

FIGURE 39 SUMITOMO HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT

11.1.3 SUEZ WATER TECHNOLOGIES & SOLUTIONS

TABLE 109 SUEZ WATER TECHNOLOGIES & SOLUTIONS: COMPANY OVERVIEW

FIGURE 40 SUEZ WATER TECHNOLOGIES & SOLUTIONS: COMPANY SNAPSHOT

11.1.4 GEA GROUP AG

TABLE 110 GEA GROUP AG: COMPANY OVERVIEW

FIGURE 41 GEA GROUP AG: COMPANY SNAPSHOT

11.1.5 SULZER LTD.

TABLE 111 SULZER LTD.: COMPANY OVERVIEW

FIGURE 42 SULZER LTD.: COMPANY SNAPSHOT

11.1.6 TSUKISHIMA KIKAI CO., LTD.

TABLE 112 TSUKISHIMA KIKAI CO., LTD.: COMPANY OVERVIEW

FIGURE 43 TSUKISHIMA KIKAI CO., LTD.: COMPANY SNAPSHOT

11.1.7 FIVES GROUP

TABLE 113 FIVES GROUP: COMPANY OVERVIEW

FIGURE 44 FIVES GROUP: COMPANY SNAPSHOT

11.1.8 CONDORCHEM ENVITECH

TABLE 114 CONDORCHEM ENVITECH: COMPANY OVERVIEW

11.1.9 PIOVAN S.P.A

TABLE 115 PIOVAN S.P.A.: COMPANY OVERVIEW

11.1.10 ALAQUA INC.

TABLE 116 ALAQUA INC.: COMPANY OVERVIEW

11.1.11 VOBIS LLC

TABLE 117 VOBIS LLC: COMPANY OVERVIEW

11.1.12 ANSSEN METALLURGY GROUP C0., LTD.

TABLE 118 ANSSEN METALLURGY GROUP CO., LTD.: COMPANY OVERVIEW

11.1.13 EBNER GMBH & CO. KG

TABLE 119 EBNER GMBH & CO. KG: COMPANY OVERVIEW

11.1.14 MORETTO SPA

TABLE 120 MORETTO SPA: COMPANY OVERVIEW

11.1.15 MOTAN COLORTRONIC

TABLE 121 MOTAN COLORTRONIC: COMPANY OVERVIEW

11.2 OTHER PLAYERS

11.2.1 TECHNOFORCE LLC

TABLE 122 TECHNOFORCE LLC: COMPANY OVERVIEW

11.2.2 FASA AB

TABLE 123 FASA AB: COMPANY OVERVIEW

11.2.3 BOARDMAN LLC

TABLE 124 BOARDMAN LLC: COMPANY OVERVIEW

11.2.4 OMVE

TABLE 125 OMVE: COMPANY OVERVIEW

11.2.5 NU-VU CONAIR

TABLE 126 NU-VU CONAIR: COMPANY OVERVIEW

11.2.6 DEGA PLASTICS

TABLE 127 DEGA PLASTICS: COMPANY OVERVIEW

11.2.7 SHAANXI AEROSPACE POWER HI-TECH CO., LTD.

TABLE 128 SHAANXI AEROSPACE POWER HI-TECH CO., LTD.: COMPANY OVERVIEW

11.2.8 DIAMAT MASCHINENBAU GMBH

TABLE 129 DIAMAT MASCHINENBAU GMBH: COMPANY OVERVIEW

11.2.9 ZHANGJIAGANG YUREFON MACHINERY CO., LTD.

TABLE 130 ZHANGJIAGANG YUREFON MACHINERY CO., LTD.: COMPANY OVERVIEW

11.2.10 WHITING EQUIPMENT CANADA, INC.

TABLE 131 WHITING EQUIPMENT CANADA, INC.: COMPANY OVERVIEW

11.2.11 ROSENBLAD DESIGN GROUP, INC.

TABLE 132 ROSENBLAD DESIGN GROUP, INC.: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, MnM view, Right to win, Strategic choices, Weaknesses and competitive threats might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 172)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

12.3 CUSTOMIZATION OPTIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

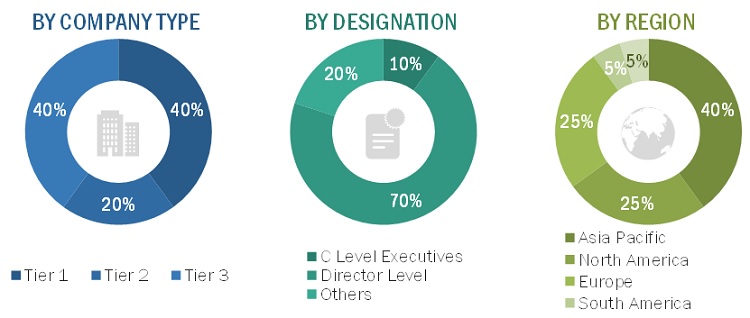

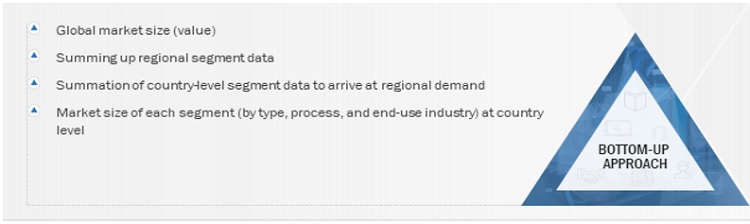

The study involved four major activities in estimating the current size of the industrial crystallizers market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the industrial crystallizers value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this study include Hoovers, Bloomberg, BusinessWeek, and Dun & Bradstreet, were referred for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles by recognized authors, authenticated directories, and databases. Secondary data has been collected and analysed to arrive at the overall market size, which is further validated by primary research.

Primary Research

The industrial crystallizers market comprises several stakeholders, such as raw material suppliers, manufacturers, raw material manufacturers, end-use industries, distributors, traders, suppliers, institutions, contract manufacturing organizations, and regulatory organizations in the supply chain.

As part of the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report on the industrial crystallizers market. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, and related key executives from various key companies and organizations operating in the industrial crystallizers market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various end-use industries.

Breakdown of the Primary Interviews

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the industrial crystallizers market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data was then consolidated and added with detailed inputs and analysis and presented in this report.

- For the calculation of each specific market segment, the most appropriate and immediate parent market size was used to implement the top-down approach. The bottom-up approach was used for data extracted from secondary research to validate the market size of the segments in terms of value.

- The market for 2021 was calculated by considering the growth rates suggested by primary experts and macroeconomic factors influencing the growth of end-use industries.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition to this, the market size was validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the global market size of industrial crystallizers in terms of value

- To define, describe, and forecast the global market size of industrial crystallizers based on construction type, functionality, end-use industry, and region

- To provide detailed information about significant drivers, restraints, opportunities, and challenges influencing market growth

- To forecast the size of the various segments of the global industrial crystallizers market based on five regions—North America, Asia Pacific, Europe, South America, and the Middle East & Africa—along with key countries in each of these regions

- To analyze region-specific trends in North America, Europe, Asia Pacific, Middle East & Africa, and South America

- To analyze recent developments, such as agreements, contracts, partnerships, and acquisitions in the global industrial crystallizers market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- A further breakdown of product portfolio of each company in the industrial crystallizers market

- A further breakdown of a region of the industrial crystallizers market with respect to a particular country

- Details and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Industrial Crystallizers Market