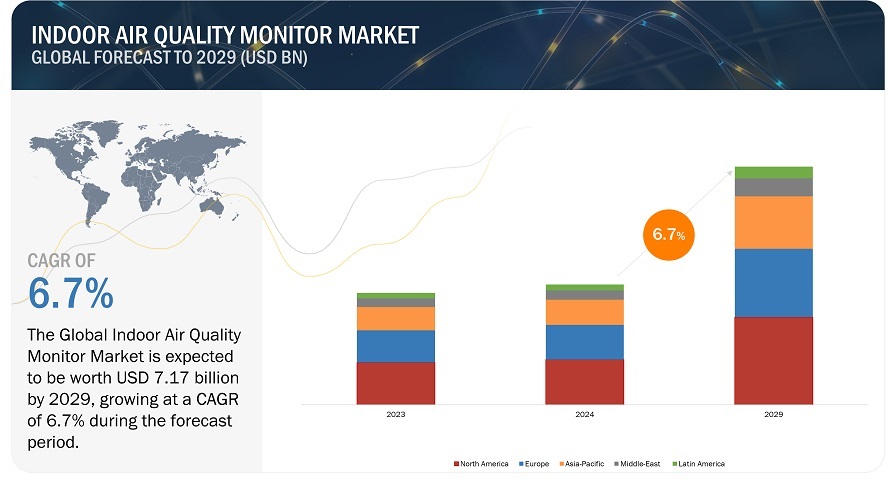

Indoor Air Quality Monitor Market by Product (Fixed, and Portable Indoor Monitor), Pollutant Type (Chemical, Physical, and Biological), EndľUser Application (Government Buildings, Industrial, Commercial, Residential) - Global Forecast to 2029

The global indoor air quality monitor market is projected to reach USD 7.17 billion by 2029 from USD 5.18 billion in 2024, growing at a CAGR of 6.7%. There is a growing demand for indoor air quality monitors because of a raised concern for health impacts from poor indoor air quality. Some of these factors affecting the respiratory health, particularly at homes, offices, and schools include pollution, allergens, and volatile organic compounds. The increase in health-conscious consumers has heightened the need for air quality monitoring to ensure safe living environments. In addition, the standards and regulations in indoor air quality are becoming stricter, which enables the residential and commercial sectors to install IAQ monitors for health, comfort, and compliance purposes.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Growing popularity of smart homes/ambient assisted living

The trend of smart homes and ambient assisted living becomes popular due to technological advancement, lifestyle, and demographic shifts. A major growth factor is the adoption of IoT technologies. Smart homes are constructed with a network of devices, including smart thermostats and devices for lighting, security, and appliances, which can now be controlled by smartphones or voice commands. With the newfound convenience, energy efficiency, and security it provides, smart homes are having higher demand. Another feature of smart home is the combined health and wellness technologies. Thus, smart homes can be a personal wellness monitor, coupled with health monitoring gadgets that include air quality sensors, sleep systems, and fitness monitors, where health can be tracked and improved upon in real time. This gives health technology the opportunity of blending into living rooms and working towards the achievement of healthy smart homes.

Sustainability plays a major role since smart homes increase the efficiency of energy usage through the automation of lighting, heating, and cooling that cut down waste. More and more health-conscious consumers want integrated systems monitoring air quality, wellness, and energy usage, which makes smart homes even more appealing as an all-in-one solution. All these factors together with the declining costs of smart devices make smart homes and ambient assisted living solutions more popular.

Restraint: Additional costs for supplementary tools and services impacts the adoption

One of the major barriers to the adoption of indoor air quality (IAQ) monitoring solutions is the high cost involved in both the initial investment and maintenance. Most advanced IAQ monitors, especially those with real-time data analytics, multiple sensor capabilities, and cloud-based features, are priced at a premium level. For residential consumers, this makes the systems cost-prohibitive, especially if the solution includes installation or professional calibration services. For business or industrial applications, costs can be multiplied, as more units may be needed to accommodate larger areas or an entire building. Maintenance costs such as calibration, sensor replacement, and software update or cloud storage subscriptions add significant long-term expenses.

High costs also can pose a limit to these solutions' accessibility in the area of low disposable income, or smaller businesses where this investment will not return at any point. The financial constraint is the most significant limitation in accessibility, particularly in the most cost-sensitive markets. While technology is becoming more affordable and consumer-friendly, its adoption may increase for IAQ monitoring solutions, but high costs are a major barrier to widespread use.

Opportunity: Growing industrial sector to drive the need for indoor air quality monitoring

Growing industrial sector presents significant opportunities for the IAQ monitoring market as the increased industrial activities spur the need for better environmental control. These include manufacturing plants, warehouses, and commercial buildings that contain more airborne pollutants such as dust, VOCs, and chemicals that could be dangerous to the health of employees and productivity. With the increasing demands of workplace safety and indoor air quality, more industries are being compelled to monitor and improve their indoor air quality in order to comply with regulations while protecting the health of their workers.

The indoor air quality monitoring system allows industries to monitor in real time the level of air pollution. It thus ensures that it reaches the required standards and provides insights into improvement action. The appearance of green building standards and smart factories encourages industries to introduce modern IAQ solutions into their environment. They keep companies informed about trends in air quality, contributing to optimizing ventilation systems, saving energy costs, and general environmental sustainability.

This increasing demand in the industrial sector is becoming a huge growth opportunity for IAQ monitoring companies through regulatory pressures and an increasing thrust in the occupational health and productivity of working places.

Challenge: Complex nature of indoor pollutants

The complexity of indoor pollutants indeed makes the implementation and utilization of indoor air quality (IAQ) monitoring solutions very difficult. Variety of pollutants can be present indoors, namely particulate matter (PM), volatile organic compounds (VOCs), carbon dioxide (CO2), carbon monoxide (CO), mold spores, allergens, and radon. These pollutants each have their specific sources and behaviors, thus their various health impacts, and require different types of sensors and detection technologies for good monitoring.

The diversity of these pollutants makes it quite difficult to design cost-effective IAQ monitors that could measure several pollutants at the same time. Environmental conditions-the temperature, humidity, and air circulation-will affect how pollutants behave and can be detected. Hence, more complexities are expected in monitoring system design for reliability. Even the analytics required for the data interpretation present a significant hurdle for mass consumers. The need for sustained innovation in IAQ technology is needed due to the diversified and dynamic nature of indoor pollutants and to facilitate effective access for bettering the indoor air quality.

Based on product, portable indoor monitor segment is expected to grow fastest during the forecasted period

Portable indoor air quality monitoring devices are growing at a faster rate than fixed installations, mainly because of convenience and cost-effectiveness while allowing for flexibility. Increasing demand for real-time air quality monitoring at various sites can be met with these compact monitors. Unlike fixed monitors that do not move, IAQ portable monitors can be shifted from one room to the next or even between buildings in order to closely monitor indoor air quality.

Health-conscious consumers having understanding of air quality impact on wellness is a major factor for portable monitors. Affordable and easy-to-use devices are ever in increasing demand for making the home or office environments safe to inhabit and safe while on the road. Portable monitors satisfy the needs for these compact, yet often cheaper devices that are equally accurate for monitoring PM, VOCs, and CO2 compared to the fixed systems. In addition, recent developments in sensors as well as wireless communication facilitate advanced feature within low cost for portable monitors, this places portable IAQ monitors as fastest growing segment..

Based on the pollutant type, chemical segment to to dominate throughout forecast period

Based on the type of pollutant, indoor air quality monitoring market is dominated by the chemical segment, led by the ubiquity and health risks arising from chemical indoor air pollution. Some examples of chemical pollutants include volatile organic compounds, carbon monoxide, nitrogen dioxide emitted by products used inside homes, furniture, building materials, and combustion. These pollutants are of great concern because they can cause serious health problems, from mild irritation to severe respiratory and neurological conditions, even at low concentrations. Increased usage of synthetic materials and chemicals in construction, furnishing, and cleaning products has increased the vulnerability of chemical pollutants in indoor and outdoor environments. A growing awareness of the effects of these pollutants on their health has led consumers and organizations to monitor and mitigate these substances, thereby increasing demand for advanced IAQ monitoring systems that can detect chemical pollutants.

Moreover, indoor air quality regulations and guidelines of various governments emphasize chemical pollutant control, mainly in the workplaces, schools, and healthcare sectors. The monitors that contain sensitive chemical sensors are serving these demands and have intensified the dominance of the chemical segment. Along with these trends, as public concern and enforcement continue to build up, the chemical pollutant segment continues to take the center stage of the IAQ monitoring market..

Based on region, North America is expected to dominate indoor air quality monitor market

North America is dominating the market of indoor air quality monitors because of the combination of regulatory frameworks, heightened awareness, and technological advancements. The governments of the region, particularly the United States and Canada, have implemented strict regulations and guidelines regarding indoor air quality in commercial, industrial, and residential settings. Agencies such as the EPA and OSHA have provided standards that encourage the adoption of IAQ monitoring systems to abide by their regulations and prevent public health problems. In addition, the high rate of urbanization and industrial activities in the region increase indoor air pollution. This makes it critical to monitor the indoor air. High usage of synthetic building materials, household chemicals, and HVAC systems in North America increases risks associated with indoor pollutants such as VOCs, CO2, and PM.

Increased awareness among consumers and businesses in North America concerning poor indoor air quality's health consequences. Advancements in technology and high disposable incomes, has made IAQ monitoring systems more accessible and therefore increasingly adopted within homes, offices, schools, and healthcare facilities. This is enabling North America to lead position in the market.

Key Market Players

The indoor air quality monitor market is dominated by a few globally established players, such as Thermo Fischer Scientific Inc. (US), Siemens AG (Germany), Emerson Electric Co. (US), 3M (US), TSI Inc. (US), Ingersoll Rand PLC (Ireland), Horiba Ltd (Japan), Testo AG (Germany), Aeroqual Ltd. (New Zealand).

Recent Developments

- In January 2024, Ductmate Industries and Linx Industries, divisions of DMI Companies Inc., have teamed up with Airthings to provide a comprehensive and adaptable indoor air quality monitoring solution for buildings of all types.

- In February 2022, Honeywell has announced the launch of its Indoor Air Quality (IAQ) monitor, designed to notify building owners and operators of potential issues, allowing them to take proactive measures to enhance indoor air quality and reduce the risk of airborne contaminant transmission.

Growth opportunities and latent adjacency in Indoor Air Quality Monitor Market

My research is focused on new algorithms for Indoor Air Quality Monitoring. I would like to see the details of this report in order to include some of its information in my publications to increase the impact of my work. I would also like to know the newer opportunities in the market.

We are providing indoor air quality monitoring in real time. We want to support our customer the best possible way. Therefore we would like to know about the market trends. Also would like to know the scope of the report.

Blue air AB is a producer of air purifiers and air monitors. Looking for data to plan our product portfolio of air management products going forward. Special interest: Stand alone air monitors and sensors integrated in air purifiers measuring particles (PM2.5, PM10) and gases (VOCs, etc.). We design and develop connected products to digital sensors in IoT content is of high interest.

I would like to have an idea of the potential market of indoor air monitoring device (sales, number of device scaled, market share,...). Also have you included IoT or smart sensors in the scope of the report?