Peptide and Anticoagulant Drugs Market by Type (Hormonal (Insulin, Teriparatide, Calcitonin), Antibiotic (Colistin, Cycloserine), Low molecular weight heparin (Enoxaparin Sodium, Heparin Sodium), Application (Diabetes, Cancer) - Global Forecast to 2022

[85 Slides Report] The Indian peptide drugs market is expected to reach USD 883.0 Million in 2022 from USD 381.8 Million in 2016 and is expected to register a CAGR of 15.0%. Factors such as increasing prevalence of chronic diseases, rising aging population, and increasing healthcare expenditure are contributing to the growth of this market.

Indian Anticoagulant Drugs Market

The Indian anticoagulant drugs market is expected to reach USD 170.2 Million in 2022 from USD 127.8 Million in 2016 and is expected to register a CAGR of 4.9%. Factors such as incidence of coagulation disorders and government support for pharmaceutical companies are contributing to the growth of this market.

Years considered in this report

2016 – Base Year

2017 – Estimated Year

2022 – Projected Year

The objectives of this study are as follows:

- To define, describe, and forecast the Indian peptide and anticoagulant drugs market on the basis of type and application

- To provide detailed information regarding the major factors influencing growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders

- To profile key players and comprehensively analyze their market shares and core competencies in terms of market development and growth strategies

Research Methodology

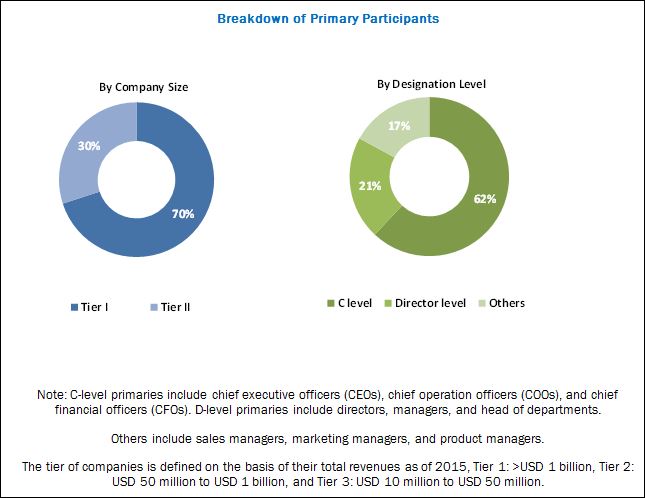

Top-down and bottom-up approaches were used to estimate and validate the size of the global Indian peptide and anticoagulant drugs industry and to estimate the size of various other dependent submarkets. The overall market size was used in the top-down approach to estimate the sizes of other individual markets (mentioned in the market segmentation by type and application) through percentage splits from secondary and primary research. The bottom-up approach was also implemented (wherever applicable) for data extracted from secondary research to validate the market segment revenues obtained. Various secondary sources referred to for this research study include publications from government sources such as the Indian Peptide Society (IPS), World Health Organization (WHO), GLOBOCAN, Canadian Institute for Health Information, and India Brand Equity Foundation (IBEF), Indian Council of Medical Research (ICMR), International Osteoporosis Foundation (IOF), Central Drugs Standard Control Organization, Indian Society for Study of Pain (ISSP), The Association of Physicians of India; corporate filings such as annual reports, investor presentations, and financial statements have been used to identify and collect information useful for this extensive commercial study of the Indian peptides and heparin market. Primary sources such as experts from related industries and suppliers have been interviewed to obtain and verify critical information as well as to assess prospects of the Indian peptides and heparin market. The breakdown of primaries is shown in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Key players in the Indian peptide drugs market

Key players operating in the Indian peptide drugs market include Abbott Laboratories (U.S.), Sanofi S.A. (France), Eli Lilly and Company (U.S.), Cipla Limited (India), and Biocon Limited (India), Intas Pharmaceuticals Ltd. (India), Sun Pharmaceutical Industries Ltd. (India), Cadila Pharmaceuticals (India), Lupin Limited (India), Emcure Pharmaceuticals Ltd. (India), Novartis International AG (Switzerland), Dr. Reddy’s Laboratories Limited (India), and Alkem Laboratories Limited (India)

Key players in the Indian anticoagulant drugs market

Key players operating in the Indian anticoagulant drugs market include Sanofi (France), Emcure Pharmaceutical Pvt. Ltd. (India), Cipla Ltd. (India), Bharat Serum (India), Pfizer Inc. (US), Abbott Laboratories (US), and Lupin Ltd. (India), Dr. Reddy’s Laboratories (India), Intas Pharmaceuticals Ltd. (India), Samarth Life Sciences (India), Claris Lifesciences Limited (India), Gland Pharma Limited (India), Mylan Pharmaceutical (India), Torrent Pharmaceuticals (India), and Micro Labs Ltd. (India).

Target Audience for this Report:

- Peptide and anticoagulant drugs manufacturers

- Peptide and anticoagulant drugs marketing players

- Peptide and anticoagulant drugs distributors

- Various research and consulting companies

Value Addition for the Buyer:

This report aims to provide insights into the Indian peptide and anticoagulant market. It provides valuable information on peptides, by type and application and Indian anticoagulant drugs, by type. Detailed information of peptides and anticoagulant drugs manufacturers and marketing players are also available in this report. In addition, leading players in the market are profiled to understand the strategies undertaken by them to be competitive in this market.

Scope of the Indian Peptide and Indian Anticoagulant Drugs Market Report:

This report categorizes the Indian peptide and anticoagulant drugs market into the following segments:

-

Indian Peptide Drugs Market, By Type

-

Hormonal

- Insulin

- Teriparatide

- Leuprolide Acetate

- Liraglutide

- Octreotide Acetate

- Calcitonin-Salmon

- Triptorelin

- Glucagon

- Exenatide

- Others

-

Antibiotic

- Eptifibatide

-

ACE Inhibitor

- Glatiramer Acetate

- Other

- Antifungal

-

Others

- Bivalirudin

-

Hormonal

-

Indian Peptide Drugs Market, By Application

- Diabetes

- Infectious Diseases

- Cancer

- Osteoporosis

- Cardiology

- Gynecology

- Other Applications

-

Indian Anticoagulant Drugs Market, By Low Molecular Weight Heparin Type

- Enoxaparin Sodium

- Heparin Sodium

- Fondaparinux

- Dalteparin Sodium

Customization Options:

Detailed analysis and profiling of additional market players (up to 5)

The Indian peptide drugs market is expected to reach USD 883.0 Million by 2022 from USD 381.8 Million in 2016, at a CAGR of 15.0%. Increasing prevalence of chronic diseases such as diabetes, cancer, and osteoporosis and favorable government policies for the pharmaceutical sector are expected to drive the growth of this market.

The Indian peptide drugs market is segmented by type and application. By type, the Indian peptide drugs market is segmented into hormonal, antifungal, antibiotic, ACE inhibitor and others. Hormonal segment dominated the Indian peptide drugs market in 2016. The growing incidence of diabetes, cancer diseases in India are the key factors driving the growth of this segment.

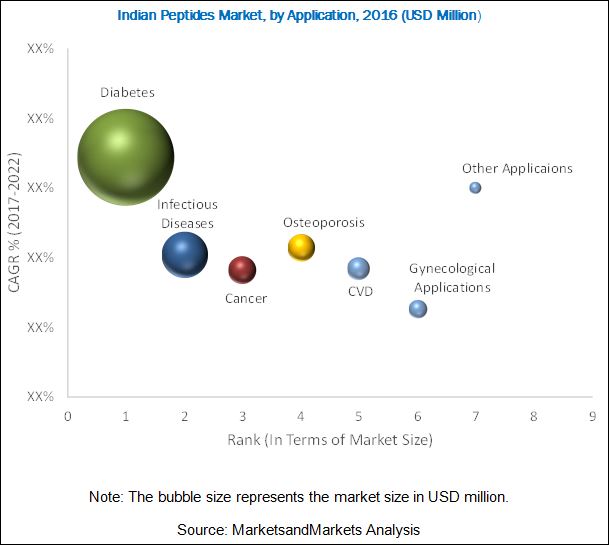

On the basis of application, the Indian peptide drugs market segmented into diabetes, cancer, cardiovascular disease (CVD), gynecological application, infectious diseases, osteoporosis, and other applications (acromegaly, multiple sclerosis, and hepatitis). Diabetes segment accounts for the largest segment and is also the fastest growing application segment in the market. The increasing prevalence and incidence of diabetes and rising awareness about the benefits of early diagnosis are the major factors driving the growth of this market.

Biocon Limited, Sun Pharmaceutical Industries Limited, Wokhardt Limited, Intas Pharmaceutical Limited, Cipla Limited, Emcure Pharmaceutical Limited, and Zydus Cadila have been identified as the top players in this market. These companies have a broad product portfolio with comprehensive features. These companies have products for all end users in this segment, a strong geographical presence, and more importantly, focus on continuous product innovations.

The Indian anticoagulant drugs market is expected to reach USD 170.2 Million by 2022 from USD 127.8 Million in 2016, at a CAGR of 4.9%. The growing incidence of coagulation disorders and government support for pharmaceutical companies are expected to drive the growth of this market.

The Indian anticoagulant drugs market is segmented by type. By low molecular weight heparin type, the Indian anticoagulant drugs market is segmented into heparin sodium, enoxaparin sodium, fondaparinux, and dalteparin sodium. The enoxaparin sodium segment dominated the Indian anticoagulant drugs market in 2016. The growing incidence of coagulation disorder in India are the key factors driving the growth of this segment.

Availability of alternative drugs and the high degree of market consolidation are restraining the growth of the Indian peptide and anticoagulant drugs market. For example, the top players in this market are large & well established and enjoy a high degree of brand loyalty.

Emcure Pharmaceutical Pvt. Ltd. (India), Cipla Ltd. (India), Gland Pharma Limited (India), Troikaa Pharmaceuticals Ltd. (India), and Biological E Limited (India) have been identified as the top players in this market. These companies have a broad product portfolio with comprehensive features. These companies have products for all end users in this segment, a strong geographical presence, and more importantly, focus on continuous product innovations.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Indian Peptide Drugs Market Overview (Page No. - 11)

1.1 Introduction

1.2 Indian Peptide Drugs Market Dynamics

1.2.1 Drivers

1.2.1.1 Rising Incidence of Diseases

1.2.1.2 Favorable Government Initiatives for the Pharmaceutical Sector

1.2.2 Restraint

1.2.2.1 Availability of Alternative Drugs

1.2.3 Opportunity

1.2.3.1 Patent Expiry of Blockbuster Peptides

1.2.4 Challenge

1.2.4.1 Regulatory and Pricing Issues

2 Indian Peptide Drugs Market, By Type (Page No. - 16)

2.1 Introduction

2.2 Hormonal

2.2.1 Insulin Market

2.2.2 Teriparatide Acetate Market

2.2.3 Leuprolide Acetate Market

2.2.4 Octreotide Acetate Market

2.2.5 Calcitonin Salmon Market

2.2.6 Triptorelin Market

2.2.7 Glucagon Market

2.2.8 Exenatide Market

2.2.9 Others

2.3 Antibiotic

2.3.1 Eptifiabtide

2.4 Ace Inhibitors

2.4.1 Glatimer Acetate Market

2.4.2 Others

2.5 Antifungal

2.5.1 Caspofungin Market

2.5.2 Cetrorelix Market

2.6 Other Peptide Drugs

3 Indian Peptide Drugs Market, By Application (Page No. - 32)

3.1 Introduction

3.2 Diabetes

3.3 Infectious Diseases

3.4 Cancer

3.5 Osteoporosis

3.6 Cardiology

3.7 Gynecology

3.8 Other Applications

4 Indian Peptide Drugs Market Share Analysis (Page No. - 36)

5 Indian Peptide Drugs Market Company Profiles (Page No. - 37)

(Business Overview, Products Offered)*

5.1 Biocon Limited

5.2 Sun Pharmaceutical Industries Ltd.

5.3 Wockhardt Ltd.

5.4 Intas Pharmaceuticals Ltd.

5.5 Cipla Limited

5.6 Emcure Pharmaceuticals Pvt. Ltd.

5.7 Zydus Cadila

5.8 Bharat Serum and Vaccines Limited

5.9 Natco Pharma Limited

5.10 Dr. Reddy's Laboratories

*Details on Marketsandmarkets View, Business Overview, Products Offered Might Not Be Captured in Case of Unlisted Companies.

6 Indian Heparin Market Overview (Page No. - 53)

6.1 Introduction

6.2 Indian Heparin Market Dynamics

6.2.1 Drivers

6.2.1.1 Growing Incidence of Coagulation Disorders

6.2.1.2 Government Support for the Pharmaceutical Industry

6.2.2 Restraint

6.2.2.1 High Degree of Consolidation to Hinder Small Players From Entering the Market

6.2.3 Challenge

6.2.3.1 Regulatory and Pricing Issues

7 Indian Anticoagulant Drugs Market, By Type (Page No. - 57)

7.1 Introduction

7.2 Enoxaparin Sodium

7.3 Heparin Sodium

7.4 Fondaparinux

7.5 Dalteparin Sodium

8 Indian Anticoagulant Drugs Market Share Analysis (Page No. - 63)

9 Indian Anticoagulant Drugs Market Company Profiles (Page No. - 64)

(Business Overview, Products Offered)*

9.1 Cipla Ltd.

9.2 Emcure Pharmaceuticals Pvt. Ltd.

9.3 Gland Pharma Limited

9.4 Troikaa Pharmaceuticals Ltd.

9.5 Biological E Limited

9.6 Bharat Biotech

9.7 Samarth Life Sciences Pvt. Ltd.

9.8 VHB Life Sciences Limited

9.9 Celon Laboratories Pvt. Ltd.

9.10 United Biotech (P) Limited

*Details on Marketsandmarkets View, Business Overview, Products Offered Might Not Be Captured in Case of Unlisted Companies.

9.11 Author Details

List of Tables (45 Tables)

Table 1 Incidence of Cancer Cases in India, 2015 vs 2025

Table 2 Peptide Drugs and Their Alternatives

Table 3 Indian Peptide Drugs Market, By Type, 2016–2022 (USD Million)

Table 4 Insulin Market: Manufacturers and Brands

Table 5 Insulin Market: Key Players and Brands

Table 6 Teriparatide Acetate Market: Manufacturers and Brands

Table 7 Teriparatide Acetate Market: Key Players and Brands

Table 8 Liraglutide Market: Key Players and Brands

Table 9 Leuprolide Acetate Market: Manufacturers and Brands

Table 10 Leuprolide Acetate Market: Key Players and Brands

Table 11 Octreotide Acetate Market: Manufacturers and Brands

Table 12 Octreotide Acetate Market: Key Players and Brands

Table 13 Calcitonin-Salmon Market: Manufacturers and Brands

Table 14 Calcitonin-Salmon Market: Key Players and Brands

Table 15 Triptorelin Market: Manufacturers and Brands

Table 16 Triptorelin Market: Key Players and Brands

Table 17 Eptifibatide Market: Manufacturers and Brands

Table 18 Eptifibatide Market: Key Players and Brands

Table 19 Glatiramer Acetate Market: Manufacturers and Brands

Table 20 Glatiramer Acetate Market: Key Players and Brands

Table 21 Bivalirudin Market: Manufacturers and Brands

Table 22 Bivalirudin Market: Key Players and Brands

Table 23 Glucagon Market: Key Players and Brands

Table 24 Exenatide Market: Key Players and Brands

Table 25 Colistin Molecule: Manufactureres and Brands

Table 26 Colistin Market: Key Players and Brands

Table 27 Enalapril Molecule: Manufactureres and Brands

Table 28 Enalapril Market: Key Players and Brands

Table 29 Caspofungin: Manufactureres and Brands

Table 30 Caspofungin Market: Key Players and Brands

Table 31 Bortezomib: Manufactureres and Brands

Table 32 Bortezomib Market: Key Players and Brands

Table 33 Oxytocin: Manufacturers and Brands

Table 34 Oxytocin Market: Key Players and Brands

Table 35 Indian Peptides Market Size, By Application, 2016–2022 (USD Million)

Table 36 Incidence of Cancer Cases in India, 2015 vs 2025

Table 37 Indian Anticoagulant Market, By Type, 2016–2022 (USD Million)

Table 38 Enoxaparin Sodium Market: Manufacturers and Brands

Table 39 Enoxaparin Sodium Market: Key Players and Brands

Table 40 Heparin Sodium Market: Manufacturers and Brands

Table 41 Heparin Sodium Market: Key Players and Brands

Table 42 Fondaparinux Market: Manufacturers and Brands

Table 43 Fondaparinux Market: Key Players and Brands

Table 44 Dalteparin Sodium Market: Manufacturers and Brands

Table 45 Dalteparin Sodium Market: Key Players and Brands

List of Figures (15 Figures)

Figure 1 Indian Peptides Market: Drivers, Restraints, Opportunities, and Challenges

Figure 2 Drug Approvals in India

Figure 3 Other Molecules: Market Share, 2016

Figure 4 Indian Peptides Market Share, By Key Player, 2016

Figure 5 Company Snapshot: Biocon Limited (2016)

Figure 6 Company Snapshot: Sun Pharmaceutical Industries Ltd (2016)

Figure 7 Company Snapshot: Wockhardt Ltd. (2016)

Figure 8 Company Snapshot: Intas Pharmaceuticals Ltd (2016)

Figure 9 Company Snapshot: Cipla Limited(2016)

Figure 10 Company Snapshot: Zydus Cadila (2016)

Figure 11 Company Snapshot: Natco Pharma Limited (2016)

Figure 12 Company Snapshot: Dr. Reddy’s Laboratories (2016)

Figure 13 Indian Heparin Market: Drivers, Restraints, and Challenges

Figure 14 Indian Heparin Market Share, By Key Player, 2016

Figure 15 Company Sanpshot: Cipla Ltd.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Peptide and Anticoagulant Drugs Market