India Omni-channel and Warehouse Management Systems Market Type (Omni-Channel Solutions and Warehouse Management Systems), Component (Hardware, Software, and Service), Deployment Type (On-Premise and On-Cloud), and Vertical - Forecast to 2024

[89 Pages Report] The India omni-channel and warehouse management systems market size is expected to grow from USD 231 million in 2019 to USD 488 million by 2024, at a Compound Annual Growth Rate (CAGR) of 16.2% during the forecast period. Major growth drivers for the market include the rapid growth of eCommerce in India, easement of FDI policies in India, and launch of initiatives, such as “Make in India.”

The report provides detailed insights into the market by type (omni-channel solutions and WMS), component (hardware, software, and service), deployment type, and vertical.

By type, the warehouse management systems segment to be a larger contributor to the India omni-channel and warehouse management systems market growth during the forecast period

The Indian WMS market is comparatively less mature than several other countries mainly because of restraints, such as awareness levels, and acceptance and demand for quick Return on Investment (RoI). However, WMS adoption and penetration level are picking up the pace in the Indian market with logistics, industrial, and retail sectors having the highest adoption. Future growth of this market is expected to be driven mainly by eCommerce.

Increased agility and improved efficiency benefits to drive the adoption of India omni-channel and warehouse management systems

Key factors driving the omni-channel solutions market are increasing consumer adoption for online and other multiple channels, technology progress, and retailer push. In addition, government initiatives would come as complementing steps to the growth of omni-channel retailing. Retailers in India are understanding the importance of having omni-channel capabilities in the modern world. With omni-channel, retailers have reduced customer acquisition cost, improved order accuracy, and enhanced customer satisfaction.

Key India Omni-channel and Warehouse Management Systems Market Players

The major vendors in India omni-channel solutions market include SAP Hybris (Germany), IBM (US), JDA Software (US), Shopify (Canada), ETP International (Singapore), and Infor (US). While the major vendors in the India warehouse management market include SAP (Germany), JDA Software (US), Infor (US), and Technoforte Software (India).

SAP, a key player in the India Omni-channel and Warehouse Management Systems Market. The company differentiates itself by its light-weight microservices architecture, which provides the company with a competitive advantage. In India, SAP Hybris is adopting a partner-led go-to-market strategy for its major customers which are mostly SMEs. As a majority of business (approximately 70%) is facilitated by partners, the company is planning for a 100% channel partner-led strategy. Strengthening of partner network would also enable the company in further penetrating the market to non-metro cities.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast unit |

Value (USD) |

|

Segments covered |

Type, Component, Deployment Type, and Vertical |

|

Geographies covered |

India |

|

Companies covered |

SAP Hybris (Germany), IBM (US), JDA Software (US), Shopify (Canada), ETP International (Singapore), Infor (US), and Technoforte Software (India) |

The research report categorizes the India omni-channel and warehouse management systems market to forecast the revenues and analyze the trends in each of the following sub segments:

By Type

- WMS

- Omni-channel Solutions

By Component

- Hardware

- Software

- Services

By Deployment Type

- On-premises

- On-cloud

By Vertical

- Food and Beverages

- Consumer Electronics

- Apparel

- Logistics and Transportation

- Industrial

- Retail

- Government

- Food/Grocery

- Consumer Goods

- Pharmaceuticals

Recent Developments

- In Feb 2019, IBM announced its platform Watson portable across any cloud and empowered businesses to prevent vendor lock-in and start deploying AI wherever their data resides. This embarks a new chapter in the journey from AI experimentation to wide-scale deployment and industry transformation.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long-term?

- What are the upcoming verticals for the India Omni-Channel and Warehouse management systems market?

- Which segment provides the most opportunity for growth?

- Which are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

Frequently Asked Questions (FAQ):

What is the definition of omni-channel and warehouse management systems (WMS)?

Omni-channel refers to a business model that is based on unifying all the data and processes found within a retail organization. In an omni-channel business, each of its processes has total visibility to each of its processes. In other words, it relies on end-to-end solution. Omni-channel commerce enables interaction with customers seamlessly across multiple touchpoints by uniting physical and digital worlds for a single view of customers and merchandise.

WMS is a software solution primarily used for the centralized management of various warehousing operations, including receiving and putaway, sorting, inventory control, picking, labor management, shipping, yard management, and dock management. A WMS can be implemented on-premises or can be accessed through cloud servers maintained by WMS vendors. The WMS can be used either as a stan-alone system or be integrated with the existing enterprise resource planning (ERP111110 system in the warehousing facility. Modern WMS is highly advanced and capable of handling and processing a significant amount of data efficiently.

What are the key factors driving the India omni-channel and warehouse management systems market?

What is India omni-channel and warehouse management systems’ market size?

Who are the key players in the India omni-channel and warehouse management systems market?

What are the benefits of omni-channel warehouse management systems?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 7)

1.1 Objectives of the Study

1.2 Market Scope

1.3 Market Definition (Omni-Channel)

1.4 Market Definition (Warehouse Management Systems)

1.5 Currency

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 12)

2.1 Research Data

2.1.1 Key Data From Secondary Sources

2.1.2 Key Data From Primary Sources

2.2 Market Size Estimation: Bottom-Up and Top-Down Approach

2.3 Research Assumptions

3 Premium Insights (Page No. - 20)

3.1 Premium Insights

4 Market Overview (Page No. - 24)

4.1 Market Drivers (Omnichannel Solutions)

4.2 Market Drivers (WMS)

4.3 Market Challenges (Omnichannel Solutions)

4.4 Market Challenges (WMS)

5 Market Sizing (Page No. - 33)

5.1 India Omni-Channel and Warehouse Management Solutions Market, By Type Opportunity

5.2 India Omni-Channel and Warehouse Management Solutions Market, By Component Opportunity

5.3 India Omni-Channel Management Solutions Market, By Component Opportunity

5.4 India Warehouse Management Solutions Market, By Component Opportunity

5.5 India Omni-Channel Management Solutions Market, By Deployment Type Opportunity

5.6 India Warehouse Management Solutions Market, By Deployment Type Opportunity

5.7 India Omni-Channel Management Solutions Market, By Vertical Opportunity

5.8 India Warehouse Management Solutions Market, By Vertical Opportunity

6 Competitive Landscape (Page No. - 50)

6.1 Growth Strategy in Omni-Channel and Warehouse Management Market

7 Company Profile for India Omni-Channel Management Market (Page No. - 58)

7.1 SAP Hybris

7.2 IBM

7.3 JDA Software

7.4 Shopify

7.5 ETP International

7.6 Infor

8 Company Profile for Warehouse Management Solutions Market (Page No. - 74)

8.1 SAP

8.2 JDA Software

8.3 Infor

8.4 Technoforte

9 Appendix (Page No. - 84)

9.1 Marketsandmarkets Knowledge Store: Snapshot

9.2 List of Abbreviations

9.3 Related Reports

9.4 Disclaimer

List of Tables (13 Tables)

Table 1 Key Data From Secondary Sources

Table 2 Key Data From Primary Sources

Table 3 Research Assumptions

Table 4 India Omni-Channel and Warehouse Management Market, By Type 2018–2024 (USD Million)

Table 5 India Omni-Channel and Warehouse Management Market, By Component, 2019–2024 (USD Million)

Table 6 India Omni-Channel Management Solutions Market, By Component, 2019–2024 (USD Million)

Table 7 India Warehouse Management Solutions Market, By Component, 2019–2024 (USD Million)

Table 8 India Omni-Channel Management Solutions Market, By Deployment Type, 2019–2024 (USD Million)

Table 9 India Warehouse Management Solutions Market, By Deployment Type, 2019–2024 (USD Million)

Table 10 India Omni-Channel Management Solutions Market, By Vertical, 2019–2024 (USD Million)

Table 11 India Warehouse Management Solutions Market, By Vertical, 2019–2024 (USD Million)

Table 12 Partnerships, Agreements, Collaborations and Acquistions

Table 13 New Product Launch and Product Enhancement

List of Figures (23 Figures)

Figure 1 Markets Covered (Omni-Channel)

Figure 2 Markets Covered (WMS)

Figure 3 Years Considered in the Report

Figure 4 Indian Omni-Channel Market: Research Design

Figure 5 Indian WMS Market: Research Design

Figure 6 Indian Omni-Channel Warehouse Market: Vertical Split

Figure 7 Market Size Estimation Methodology: Bottom-Up Approach

Figure 8 Market Size Estimation Methodology: Top-Down Approach

Figure 9 India Omni-Channel and Warehouse Management Market, By Type 2019–2024 (USD Million)

Figure 10 India Omni-Channel and Warehouse Management Market, By Component, 2019–2024 (USD Million)

Figure 11 India Omni-Channel Management Solutions Market, By Component, 2019–2024 (USD Million)

Figure 12 India Warehouse Management Solutions Market, By Component, 2019–2024 (USD Million)

Figure 13 India Omni-Channel Management Solutions Market, By Deployment Type, 2019–2024 (USD Million)

Figure 14 India Warehouse Management Solutions Market, By Deployment Type , 2019–2024 (USD Million)

Figure 15 India Omni-Channel Management Solutions Market, By Vertical , 2019–2024 (USD Million)

Figure 16 India Warehouse Management Solutions Market, By Vertical, 2019–2024 (USD Million)

Figure 17 Companies Adopted the Strategy of New Product Launches and Upgradations as the Key Growth Strategy During the Period 2017–2019

Figure 18 Market Evaluation Framework

Figure 19 Battle for Market Share: Key Players in India Omnichanneland Warehouse Management Market Adopting New Product Launch as the Key Growth Strategy

Figure 20 SAP:Company Snapshot

Figure 21 IBM:Company Snapshot

Figure 22 Shopify:Company Snapshot

Figure 23 SAP:Company Snapshot

The study involved 4 major activities to estimate the current market size of the India omni-channel and warehouse management systems market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments.

Secondary Research

In the secondary research process, various secondary sources were referred to, for identifying and collecting information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; and whitepapers, such as certified publications, and articles from recognized associations, including data center knowledge and government publishing sources. Secondary sources considered for the study included Factiva and D&B Hoovers. Secondary research was mainly used to obtain key information about the industry’s value chain, the total pool of key players, market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

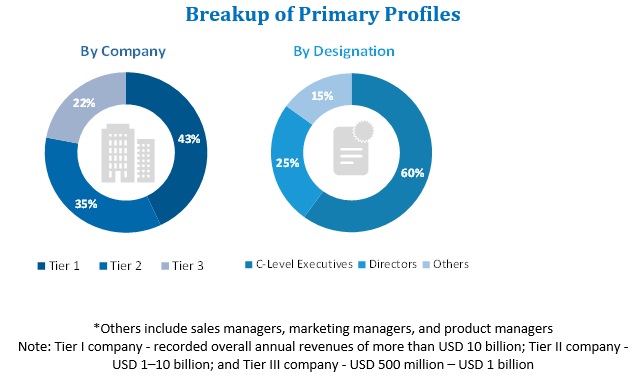

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations providing WMS and omni-channel solutions. The primary sources from the demand side included end users of WMS and omni-channel solutions, including Chief Information Officers (CIOs), IT technicians and technologists, and IT managers at public and investor-owned utilities.

The following figure depicts the breakup of the primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the India omni-channel and warehouse management systems market. They were also used extensively to estimate the size of various sub segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment, the data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both, the demand and supply sides, in the India omni-channel and warehouse management systems.

Report Objectives

- To define, segment, and project the market size of the India omni-channel and warehouse management systems market

- To understand the structure of the market by identifying its various sub segments

- To provide detailed information about the key factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify major growth strategies adopted by players across key regions

- To analyze the competitive developments, such as expansions and investments, new product launches, mergers and acquisitions, joint ventures, and agreements, in the India omni-channel and warehouse management systems market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs and on best effort basis for profiling of additional market players.

Growth opportunities and latent adjacency in India Omni-channel and Warehouse Management Systems Market