Immersive VR Market Size, Share and Trends by Head-Mounted Displays (HMDs), Gesture Tracking Devices, Display Walls & Projectors, Sensors, Semiconductor Components, Position & Room Trackers, Displays and Cameras - Global Forecast to 2029

Updated on : October 22, 2024

Immersive VR Market Summary

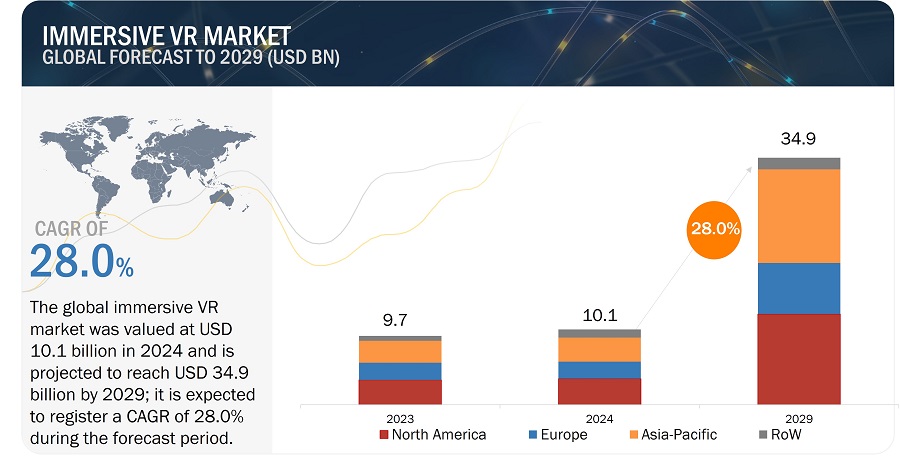

The global Immersive VR Market was valued at USD 10.1 billion in 2024 and is projected to grow from USD 18.79 billion in 2025 to USD 34.9 billion by 2029, at a CAGR of 28.0% during the forecast period. The market's expansive growth is driven by the increasing use of head-mounted displays (HMDs) in educational and enterprise applications, advancements in display technologies like OLEDOS, and the burgeoning availability of VR content creation tools. The software segment is anticipated to significantly influence the overall market growth. Key innovations in AI and machine learning are enhancing the immersive experience by improving content creation, object recognition, and user interaction.

Key Takeaways:

• The global Immersive VR Market was valued at USD 10.1 billion in 2024 and is projected to grow from USD 18.79 billion in 2025 to USD 34.9 billion by 2029, at a CAGR of 28.0% during the forecast period.

• By Product: Head-mounted displays are increasingly adopted in diverse applications, particularly in training and simulation, driving significant market growth.

• By Technology: Advancements in motion tracking and 3D graphics rendering engines are crucial, with AI and machine learning enhancing realism and interactivity.

• By Application: The gaming sector is a major driver, with innovations such as Meta's Quest 3 and Apple Vision Pro elevating user experiences through improved resolution and haptic feedback.

• By End User: The educational sector's adoption of immersive VR is rising, with applications in training and skill development gaining momentum.

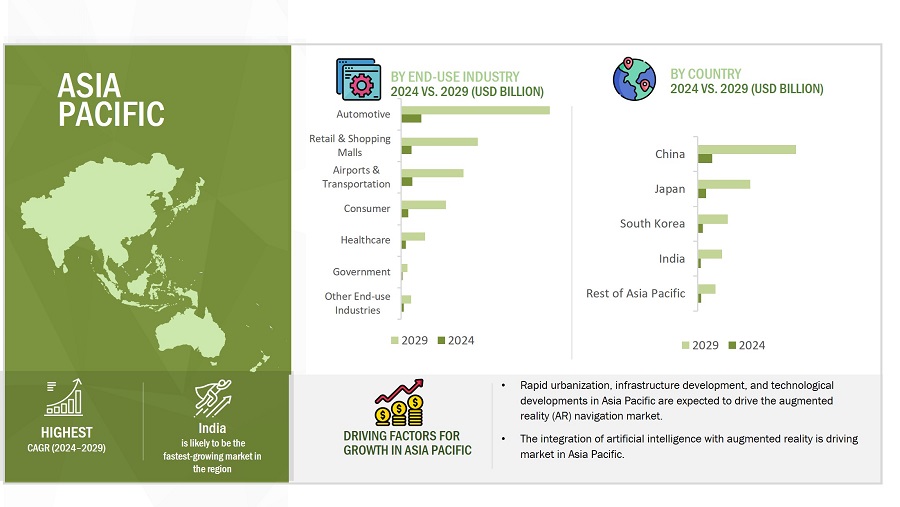

• By Region: ASIA PACIFIC is expected to grow fastest at 31.1% CAGR, driven by technological advancements and increasing investments in VR infrastructure.

• Market Dynamics: Key drivers include the rising popularity of the metaverse, technological advancements in display, and increasing investments, while challenges such as technological limitations and health concerns remain.

The immersive VR market is poised for significant transformation as ongoing developments in 5G technology and the expansion of the travel and tourism industry offer substantial growth opportunities. The integration of AI/Gen AI technologies will continue to enhance user interaction and content creation, propelling the market forward. Long-term projections suggest that as these innovations address current challenges and improve user experiences, the market will see accelerated adoption across various sectors.

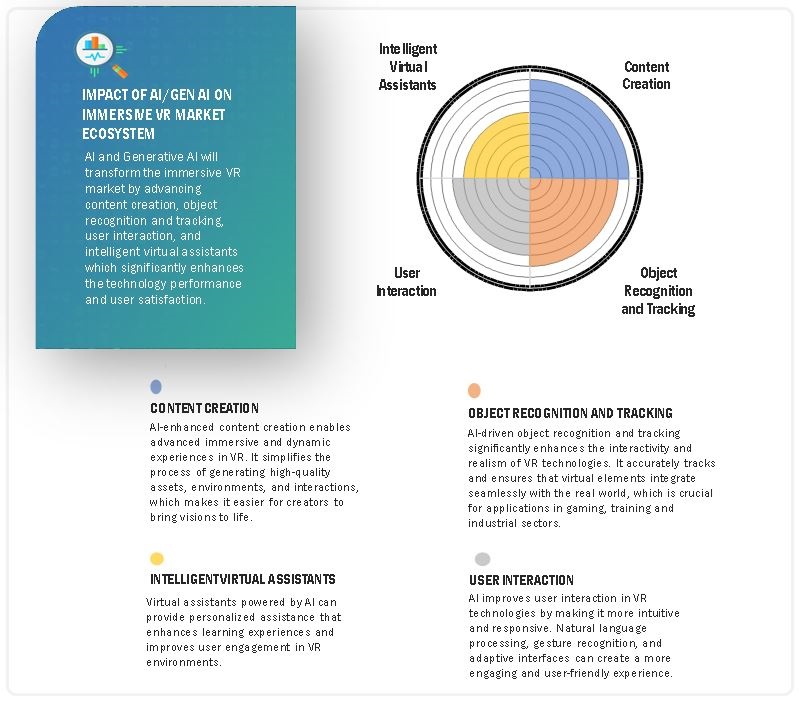

Impact of AI/Gen AI on Immersive VR Ecosystem

The major use cases of Al/Gen Al in the immersive VR market are content creation, object recognition and tracking, user interaction, and intelligent virtual assistants. Al-enhanced content creation empowers the fast and easy generation of quality assets, environments, and interactions that provide more immersive and dynamic VR experiences. Al-driven object recognition and tracking boost interactivity and realism several-fold by ensuring that virtual elements fit well into the real world, which is crucial in gaming, training, and industrial applications. Besides, Al enhances user interaction with intuitive and responsive interaction through natural language processing, gesture recognition, and adaptive interfaces that enhance user engagement. Other benefits are Al-powered virtual assistants that can provide personalized aid and learn; however, their full potential is again limited because of technological and integrational challenges. Finally, spatial mapping enhanced by Al is required to develop the most immersive VR experiences since it accurately perceives and reconstructs physical environments. In this regard, spatial awareness drives applications like navigation, gaming, and training.

Attractive opportunities in the immersive VR market size

Immersive VR Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Immersive VR Market Trends and Dynamics:

Driver: Increasing use of VR HMDs in gaming sector

VR technology is evolving rapidly in the field of gaming. Gaming technologies based on immersive VR have recently made significant strides due to the introduction of various products, including Meta's Quest 3 and Apple Vision Pro. These devices are lightweight, durable, and fun at the same time. An immersive experience in gaming has become much easier owing to various improvements, such as higher resolution, more defined graphics, and superior displays. Moreover, devices such as sophisticated haptic feedback devices, including suits and gloves, make the VR experience even better. For example, Ubisoft's haptic suit designed for Assassin's Creed Nexus - an exclusive game on a VR platform, intends to take players deeper into the virtual world by providing them with real touch sensations.

Restraint: Technological limitations

The field of vision (FOV) that users of immersive VR equipment can see is approximately 90 degrees, which is substantially less than the FOV of a human, which is approximately 120 degrees vertically and 190 degrees horizontally. Virtual reality experiences lose some immersive quality when consumers perceive a restriction in their peripheral vision compared to their real-world perception. These limitations may impact user involvement, in general, owing to the lesser feeling of immersion and realism in virtual environments. Furthermore, prolonged usage of existing VR headsets typically results in discomfort and heaviness. User discomfort is caused by various factors, including poor material selection, improper weight distribution, and ergonomic design errors.

Opportunity: Continuous developments in 5G technology

Immersive VR market is becoming increasingly popular for both personal and business use. It is anticipated that the introduction of 5G technology will solve certain issues by enabling the most efficient deployment of processing power. 5 G's improved performance enhances the VR application user experience through reliable and faster connections. Virtual reality experiences can become more responsive with reduced latency and increased data transmission rates, while graphics can also allow for real-time streaming of complex 3D images and better-quality data. The capabilities of 5G have opened up new applications for virtual reality (VR), including edge computing and real-time cloud rendering. This makes complex and data-intensive applications possible, such as simulations of smart cities and virtual travel.

In May 2023, the Spanish professional football team Atlético de Madrid and Telefónica S.A. (Spain) agreed to develop a new immersive way to watch matches in VR and over 5G. The 5G Multicam concept allows football fans to view games in a whole new way. The action can be seen in real-time from a variety of locations, including behind the goal, the tunnel exit, the press area, and the stadium control center.

Challenge: High energy consumption and latency issues

The effectiveness of VR devices is influenced by a number of technological factors that need to be carefully considered. The two most significant factors are energy consumption and display latency. Latency, or the interval of time between a user's action in a virtual reality environment and its visual display, influences the user's sense of immersion with these technologies. The slightest delays could result in uneasiness, perplexity, or a sense of being cut off from the virtual world. Moreover, there is a strong correlation between usefulness, feasibility, and energy consumption in virtual environments. As a result, lower battery life leads to shorter immersed sessions and more frequent recharges.

Immersive VR Market Ecosystem

Prominent companies in this market include well-established, financially stable providers of immersive VR systems. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Meta (US), Sony Group Corporation (Japan), Apple Inc. (US), Samsung Electronics Co., Ltd. (South Korea), Microsoft (US), Unity Technologies (US), Barco (Belgium), Penumbra, Inc. (US), HTC Corporation (Taiwan), ByteDance (China), and DPVR (China).

Immersive VR Market Segmentation

By offering, software segment to exhibit the highest CAGR from 2024 to 2029

The software segment is projected to register the highest CAGR during the period from 2024 to 2029. The need for innovative and flexible virtual reality (VR) experiences in numerous sectors drives up the demand for software. The rapid increase in demand for dependable software solutions that are capable of producing engaging and seamless VR content is fueling the rise of the immersive VR software segment. Additionally, as more companies show an interest in offering their clients exciting and captivating experiences, there is an increasing need for custom VR software that can integrate with current systems and deliver real-time analytics.

By device type, head-mounted displays segment to witness highest growth during forecast period

The immersive VR market for the head-mounted displays (HMDs) segment is expected to register the highest CAGR during the forecast period. This high growth is attributed to the rising use in the business, gaming, and entertainment sectors. One of the main drivers of the immersive VR market expansion is its potential to offer completely immersive experiences, which are becoming increasingly prevalent as a result of affordable and advanced technology. Advancements in display technology have made head-mounted displays (HMDs) more appealing to both consumers and companies. Their larger field of view and higher resolution enhance the virtual reality (VR) experience. Moreover, the decreasing cost of devices with eye-tracking capabilities and wireless connectivity facilitates the adoption of HMDs in a variety of applications.

Immersive VR Industry Regional Analysis

Asia Pacific projected to register highest CAGR in immersive VR market

In 2029, the immersive VR market in Asia Pacific is predicted to expand at the highest CAGR. The Asia Pacific immersive VR industry is experiencing significant growth due to the rise of eSports. Immersive VR offers a new level of engagement for gamers, and the growing popularity of eSports fuels the demand for VR. Also, users in the region are increasingly using 5G networks to enhance virtual reality experiences and make them universally accessible as they provide lower latency and faster bandwidth. Additionally, companies are being prompted to use immersive VR technology in an attempt to improve customer engagement and offer unique purchasing experiences due to the region's e-commerce and digital marketplaces expanding quickly.

Immersive VR Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Immersive VR Companies - Key Market Players

- Meta (US),

- Sony Group Corporation (Japan),

- Samsung Electronics Co., Ltd. (South Korea),

- Microsoft (US),

- Unity Technologies (US),

- Barco (Belgium),

- Penumbra, Inc. (US),

- HTC Corporation (Taiwan),

- Apple Inc. (US)

- DPVR (China) are some of the key players in the immersive VR companies.

Immersive VR Market Report Scope

|

Report Metric |

Details |

|

Estimated Market Size |

USD 10.1 billion in 2024 |

|

Expected Market Size |

USD 34.9 billion by 2029 |

|

Growth Rate |

CAGR of 28.0% |

|

Market Size Availability for Years |

2020–2029 |

|

Base Year |

2023 |

|

Forecast Period |

2024–2029 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

By offering, device type, application, and region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

Meta (US), Sony Group Corporation (Japan), Samsung Electronics Co., Ltd. (South Korea), Microsoft (US), Apple Inc. (US), Barco (Belgium), HTC Corporation (Taiwan), ByteDance (China), DPVR (China), Penumbra, Inc. (US), and Unity Technologies (US), are some of the key players in the immersive VR market. |

Immersive VR Market Highlights

This research report categorizes the immersive VR market share based on offering, device type, application, and region.

|

Segment |

Subsegment |

|

By Offering |

|

|

By Device Type |

|

|

By Application |

|

|

By Region |

|

Recent Developments in Immersive VR Industry

- In June 2024, Google formed a collaboration with the artist Grand Palais Immersif's recent exhibition, "Loading: Urban Art in the Digital Age Exhibition," which is an immersive exhibition that portrays the history of urban art and sheds light on the impact of digital technologies.

- In May 2024, Alo Moves and Meta formed a partnership that will feature 3D classes for a new level of immersion. Under this partnership, Alo Moves will utilize Meta Quest 3 in the same rooms as the instructors for classes spanning yoga, Pilates, and meditation.

- In December 2023, DPVR and SchooVR, a company that offers immersive educational content, entered into a partnership. This partnership between DPVR and SchooVR was aimed at improving instructional strategies for educators and learners by incorporating virtual reality (VR) into the classroom setting.

- In September 2023, DPVR launched P2, a PC-based immersive virtual reality headset. It is ideal for traffic use and helps FEC owners with revenue growth and business transformation due to its stereo speakers, longer detachable cord, and leather faceliner.

- In February 2023, Sony Group Corporation introduced the PlayStation VR2. It features high-fidelity visuals, new sensory features, and enhanced tracking, providing gamers with extraordinary experiences. The headset includes an OLED display with a resolution of 2000 x 2040 pixels per eye, a 110-degree field of view, and foveated rendering. It also incorporates innovative technology like the PlayStation VR2 Sense controller, 3D Audio, and eye tracking to enhance sensory features during gameplay.

Frequently Asked Questions (FAQs):

Which are the major companies in the immersive VR market share? What are their major strategies to strengthen their market presence?

The major companies in the immersive VR market are Meta (US), Sony Group Corporation (Japan), Samsung Electronics Co., Ltd. (South Korea), Microsoft (US), Unity Technologies (US), Barco (Belgium), Penumbra, Inc. (US), HTC Corporation (Taiwan), ByteDance (China), and DPVR (China). The major strategies adopted by these players are product launches and developments.

Which region is expected to witness the highest CAGR?

Asia Pacific is expected to witness the highest CAGR during the forecast period. This high growth is attributed to the presence of numerous key players in the region, such as Sony Group Corporation, ByteDance, and DPVR, as well as the availability of cost-effective VR products from local manufacturers, especially in China.

Who are the winners in the global immersive VR market share?

Companies such as Meta (US), Sony Group Corporation (Japan), DPVR (China), ByteDance (China), Microsoft (US), and HTC Corporation (Taiwan) fall under the winner's category. These companies cater to the requirements of their customers by providing immersive VR systems. Moreover, these companies are highly adopting inorganic growth strategies to strengthen their global market position and customer base.

What are the drivers and opportunities for the immersive VR market share?

The growing penetration of the Metaverse is a driver, and Continuous developments in 5G technology are an opportunity in the immersive VR market.

What is the current size of the global immersive VR market?

The global immersive VR market is expected to reach USD 34.9 billion by 2029 from USD 10.1 billion in 2024, at a CAGR of 28.0%.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

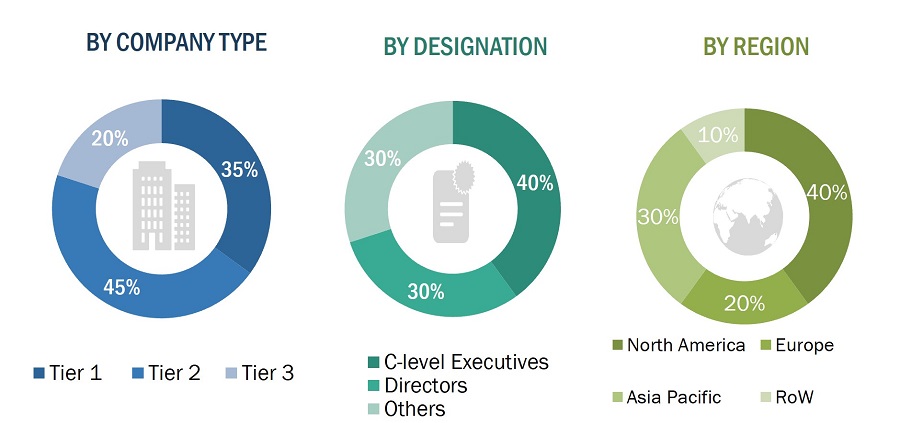

The research study involved 4 major activities in estimating the size of the immersive VR market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the supply chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information required for this study. The secondary sources include annual reports, press releases, and investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, regional outlook and developments from both market and technology perspectives.

Primary Research

In primary research, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative insights required for this report. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, manufacturers, technology and innovation directors, end users, and related executives from multiple key companies and organizations operating in the augmented and immersive VR market ecosystem. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the immersive VR market.

- Identifying applications wherein immersive VR systems are deployed or are expected to use

- Analyzing major providers of immersive VR equipment and original equipment manufacturers (OEMs), as well as studying their portfolios and understanding different technologies used

- Analyzing the average selling price of immersive VR systems

- Arriving at the market estimates by analyzing the revenue of companies and then combining these figures to arrive at the market size

- Studying various paid and unpaid sources, such as annual reports, press releases, white papers, and databases, to gather the required information

- Tracking the ongoing developments and identifying the upcoming developments in the market that include investments, research and development activities, product launches, contracts, collaborations, and partnerships undertaken, and forecasting the market size based on these developments

- Carrying out multiple discussions with key opinion leaders to understand the types of immersive VR hardware and software designed and developed, thereby analyzing the break-up of the scope of work carried out by the major companies in the immersive VR market

- Arriving at the market estimates by analyzing the revenue generated by key companies providing immersive VR products on the basis of their locations (countries) and then combining the market size for each country to get the market estimate by region

- Verifying and crosschecking the estimates at every level by discussing with key opinion leaders, including CXOs, directors, and operation managers, and then finally with the domain experts at MarketsandMarkets

The top-down approach has been used to estimate and validate the total size of the immersive VR market.

- Focusing on top-line investments and expenditures being made in the ecosystems of various applications

- Calculating the market size, considering revenues from major players through the cost of immersive VR systems

- Segmenting each application of the immersive VR system in each region and deriving the global market size based on the region

- Acquiring and analyzing information related to revenues generated by players through their crucial product offerings

- Conducting multiple on-field discussions with key opinion leaders involved in developing various immersive VR solutions

- Estimating geographical splits by using secondary sources on the basis of various factors, such as the number of players in a specific country and region, types of immersive VR products/solutions offered across various applications.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides of the immersive VR market.

Market Definition

Immersive VR is the simulated experience using 3D near-eye displays and pose tracking that makes the user feel as if they are actually present in the virtual world. It creates similar or entirely different simulated environments for applications in entertainment, education, and healthcare. These environments are meant to be interactive and immersive such that users believe they are actually within these virtual settings. VR usually employs headsets with near-eye displays and tracking mechanisms for creating movement and position within the visualization. Additionally, other senses including sound as well as haptics might be included to make the whole experience better.

Key Stakeholders

- Raw material and manufacturing equipment suppliers

- Semiconductor foundries

- Original equipment manufacturers (OEMs)

- Immersive VR device manufacturers

- Original design manufacturers (ODMs) and OEM technology solution providers

- Research organizations

- Technology standard organizations, forums, alliances, and associations

- Technology investors

- Governments, financial institutions, and investment communities

- Analysts and strategic business planners

Report Objectives

- To describe and forecast the size of the immersive VR market by offering, device type, application, and region in terms of value

- To describe and forecast the market size of various segments across four key regions—North America, Europe, Asia Pacific, and Rest of the World (RoW), in terms of value

- To forecast the size of the immersive VR market by device type in terms of volume

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the immersive VR market

- To analyze the immersive VR value chain and ecosystem, along with the average selling price of immersive VR systems

- To strategically analyze the regulatory landscape, tariff, standards, patents, Porter’s five forces, import and export scenarios, trade values, and case studies pertaining to the market under study

- To strategically analyze micromarkets with regard to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments

- To provide details of the competitive landscape for market leaders

- To analyze strategies such as product launches, expansion, collaborations, acquisitions, partnerships, and expansions adopted by players in the immersive VR market

- To profile key players in the immersive VR market and comprehensively analyze their market ranking based on their revenue, market share, and core competencies.

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Growth opportunities and latent adjacency in Immersive VR Market