Identity Governance and Administration Market by Component (Solution and Services), Deployment Type, Organization Size, Industry Vertical (BFSI, Government and Defense, and Telecom and IT), and Region - Global Forecast to 2023

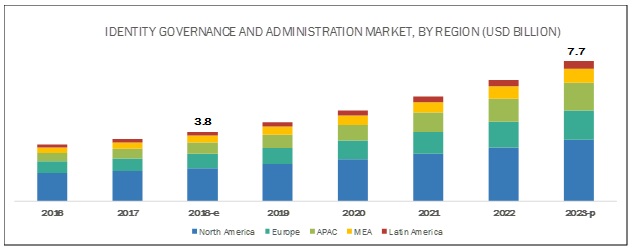

[129 Pages Report] MarketsandMarkets expects the identity governance and administration market expected to grow from $3.8 billion in 2018 to $7.7 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 15.2% during the forecast period. Major growth drivers for the market include such as globalization and rise in regulatory compliances.

By component, the services segment to be the largest contributor to the identity governance and administration market growth during the forecast period

Identity governance and administration services are the assistance offered by solution vendors to enable customers to efficiently use identity governance and administration solution and maintain them. Identity management involves diverse services to proactively identify the concerns and recommend the appropriate solution to resolve the identity-related issues. The identity management services market is dynamic; thus, vendors keep adding and offering different services, such as professional services and managed services, to expand their customer base. Identity governance and administration services optimize and automate identity management processes to enable access governance and control compliance.

Enhanced operational productivity to drive the adoption of identity governance and administration solutions among SMEs

The identity governance and administration solution enables enterprises to strengthen their security and reduce frauds while enhancing their customer experience. Hence, security is imperative for any organization irrespective of its size. The SMEs segment is the fastest-growing segment in the identity governance and administration market, as cloud-based solutions and services help them improve business performance, whereas the large enterprises segment is expected to hold a larger market size in the market, owing to the affordability and the early adoption of emerging technologies.

North America to account for the largest market size during the forecast period

North America is estimated to be the largest market share contributor in 2018, and the trend is expected to continue during the forecast period, due to the rapid adoption of identity governance and administration solution and services among enterprises in the region. The region has been an early adopter and a host to innovative initiatives for advanced security solutions and practices. Most identity governance and administration vendors, including the major players, have a direct or an indirect presence in this region via system integrators, distributors, and resellers. The major identity governance and administration vendors in North America have adopted several strategies to enhance their existing product portfolio and expand their presence in the identity governance and administration market. With the growing demand for identity governance and administration solution and services across industry verticals, the US is expected to be the major revenue contributor to the market in North America.

Key Players

Major global vendors in the market include Oracle (US), IBM (US), SailPoint (US), SAP (Germany), Microsoft (US), CA Technologies (US), Evidian (France), NetIQ (US), One Identity (US), RSA Security (US), Hitachi ID (Canada), Saviynt (US), AlertEnterprise (US), Omada (Denmark), and SecureAuth (US).

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2016–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast unit |

Value (USD) |

|

Segments covered |

Component, Organization Size, Deployment Type, Industry Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America |

|

Companies covered |

Oracle (US), IBM (US), SailPoint (US), SAP (Germany), Microsoft (US), CA Technologies (US), Evidian (France), NetIQ (US), One Identity (US), RSA Security (US), Hitachi ID (Canada), Saviynt (US), AlertEnterprise (US), Omada (Denmark), and SecureAuth (US). |

The research report categorizes the identity governance and administration market to forecast the revenues and analyze the trends in each of the following subsegments:

By Component

- Solution

-

Services

- Managed Services

-

Professional Services

- Integration and Implementation

- Training and Consulting

- Support and Maintenance

By Organization Size

- Large enterprises

- Small and Medium-sized Enterprises (SMEs)

Identity Governance and Administration Market By Deployment Type

- On-Premises

- Cloud

By Vertical

- BFSI

- Government and Defense

- Telecom and It

- Healthcare and Life Sciences

- Energy and Utilities

- Retail and Consumer Goods

- Manufacturing

- Others (Education, and Transportation and Logistics)

By Region

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- Rest of Europe

-

Asia Pacific (APAC)

- China

- India

- ANZ

- Rest of APAC

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

-

Middle East and Africa (MEA)

- Middle East

- Africa

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long-term?

- What are the upcoming verticals for the identity governance and administration market?

- Which segment provides the most opportunity for growth?

- Which are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

Frequently Asked Questions (FAQ):

What is Identity Governance and Administration (IGA)?

What are the top companies providing Identity Governance and Administration Market?

What is the projected market value of Identity Governance and Administration Market?

What are major driving factor to boost the demand of IGA among SMEs in the market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primary Profiles

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Top-Down Approach

2.3.2 Bottom-Up Approach

2.4 Market Forecast

2.5 Assumptions for the Study

2.6 Limitations of the Study

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in the Identity Governance and Administration Market

4.2 Market in North America, By Component and Country

4.3 Market: Major Countries

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Focus of Organizations Toward Meeting Regulatory Compliances

5.2.1.2 Need to Enhance the Operational Efficiency of Identity Processes Among Organizations

5.2.2 Restraints

5.2.2.1 High Cost of Implementing Identity Governance and Administration Solutions

5.2.2.2 Lack of Knowledge About Identity Governance and Administration

5.2.3 Opportunities

5.2.3.1 Increasing Adoption of the Hybrid Deployment Type By Organizations

5.2.3.2 Growing Need to Manage Security Risks and Threats Among Organizations

5.2.4 Challenges

5.2.4.1 Managing Identities Across Multiple Operation Environments

5.3 Regulatory Implications

5.3.1 General Data Protection Regulation

5.3.2 Payment Card Industry Data Security Standard

5.3.3 Health Insurance Portability and Accountability Act

5.3.4 Federal Information Security Management Act

5.3.5 Gramm-Leach-Bliley Act

5.3.6 Sarbanes-Oxley Act

5.3.7 International Organization for Standardization 27001

5.4 Identity Governance and Administration: Use Cases

5.4.1 Use Case #1: Improve Compliance Tracking and Reporting

5.4.2 Use Case #2: Cost-Cutting By Streamlining Access Processes

6 Market By Component (Page No. - 40)

6.1 Introduction

6.2 Solution

6.2.1 Enables Businesses to Provide Automated Access to an Ever-Growing Number of Technology Assets and at the Same Time Manages Potential Security and Compliance Risks

6.3 Services

6.3.1 Identity Governance and Administration Services Optimize and Automate Identity Management Processes to Enable Access Governance and Control Compliance

7 Identity Governance and Administration Market, By Service (Page No. - 44)

7.1 Introduction

7.2 Professional Services

7.2.1 Integration and Implementation Services

7.2.1.1 Integration and Implementation Process Helps in Leveraging Existing Workflows and Organizations in Successfully Adopting Identity Governance and Administration Solution

7.2.2 Training and Consulting Services

7.2.2.1 Consulting Services Enable New and More Effective Ways of Working, Increase Employee Engagement and Agility, and Help Them in Understanding Consumer-Oriented Styles and Technologies in Market

7.2.3 Support and Maintenance Services

7.2.3.1 Support and Maintenance Services Help Companies in Understanding Market Trends, Changing Business Conditions, Client Insights, and Dealing With Service Inconveniences

7.3 Managed Services

7.3.1 Managed Services to Continue to Gain Popularity During the Forecast Period

8 Identity Governance and Administration Market By Deployment Type (Page No. - 51)

8.1 Introduction

8.2 0n-Premises

8.2.1 Need for Data Security Among Enterprises to Drive the Adoption of On-Premises Identity Governance and Administration Solutions

8.3 Cloud

8.3.1 Scalability and Cost-Effectiveness of Cloud-Based Identity Governance and Administration Solution to Boost Its Adoption

9 Market, By Organization Size (Page No. - 55)

9.1 Introduction

9.2 Small and Medium-Sized Enterprises

9.2.1 Demand for Cost-Effective Security Solutions to Drive the Growth of the Identity Governance and Administration Solution in Small and Medium-Sized Enterprises

9.3 Large Enterprises

9.3.1 Need for Data Security Among Large Enterprises to Drive the Adoption of the Identity Governance and Administration Solution

10 Identity Governance and Administration Market, By Industry Vertical (Page No. - 59)

10.1 Introduction

10.2 Banking, Financial Services, and Insurance

10.2.1 Growing Need to Meet Regulatory Compliances to Drive the Growth of the Market in the BFSI Industry Vertical

10.3 Government and Defense

10.3.1 Critical Need to Control Access to Sensitive Data and Information to Drive the Adoption of the Identity Governance and Administration Solution in the Government and Defense Industry Vertical

10.4 Telecom and It

10.4.1 Ever-Changing Regulatory and Compliance Landscape to Drive the Growth of the Market in the Telecom and It Industry Vertical

10.5 Energy and Utilities

10.5.1 Growing Need to Enhance Operational Efficiency and Mitigate Potential Identity-Based Threats to Drive the Adoption of the Identity Governance and Administration Solution in the Energy and Utilities Industry Vertical

10.6 Manufacturing

10.6.1 Emphasis on Controlling Access to Operation-Critical Data to Drive the Adoption of Identity Governance and Administration Solution in the Manufacturing Industry Vertical

10.7 Retail and Consumer Goods

10.7.1 Need to Protect Customer Data to Drive the Market in the Retail Industry Vertical

10.8 Healthcare and Life Sciences

10.8.1 Growing Regulatory Compliances in the Healthcare and Life Sciences Industry Vertical to Drive the Adoption of Identity Governance and Administration Solution and Services

10.9 Others

11 Identity Governance and Administration Market, By Region (Page No. - 69)

11.1 Introduction

11.2 North America

11.2.1 United States

11.2.1.1 Favorable Economic Conditions and Increasing Focus Toward Innovative Security Solutions to Drive the Growth of the Market in the Us

11.2.2 Canada

11.2.2.1 Early Adoption of Advanced Technologies to Boost the Market Growth

11.3 Europe

11.3.1 United Kingdom

11.3.1.1 Stringent Regulations and Compliances Related to Identity Security to Drive the Growth of the Market

11.3.2 Germany

11.3.2.1 Increasing Need to Secure Users Identity and Provide Delightful Customer Experience to Boost the Adoption of the Market

11.3.3 Rest of Europe

11.4 Asia Pacific

11.4.1 China

11.4.1.1 Growing Identity-Related Fraudulent Activities to Increase the Demand for the Identity Governance and Administrations Market

11.4.2 India

11.4.2.1 Indirect Presence and Growth in the Number of Start-Ups of Identity Governance and Administration Vendors to Drive the Growth of the Market in India

11.4.3 Australia and New Zealand

11.4.3.1 Rise in the Adoption of Identity Governance and Administration Solutions and Associated Services Across Industry Verticals in Australia and New Zealand

11.4.4 Rest of Asia Pacific

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Growing Need to Meet Industry Compliance and Regulations to Drive the Growth of the Market

11.5.2 Africa

11.5.2.1 Increasing Focus on Digital Transformation to Boost the Market in Africa

11.6 Latin America

11.6.1 Brazil

11.6.1.1 Increase in It Spending to Drive the Growth of the Market in Brazil

11.6.2 Mexico

11.6.2.1 Growing Need for Enhanced Security Solutions to Boost the Market in Mexico During the Forecast Period

11.6.3 Rest of Latin America

12 Competitive Landscape (Page No. - 91)

12.1 Competitive Leadership Mapping

12.1.1 Visionary Leaders

12.1.2 Innovators

12.1.3 Dynamic Differentiators

12.1.4 Emerging Companies

12.2 Competitive Scenario

12.2.1 Product/Solution Launches and Enhancements

12.2.2 Business Expansions

12.2.3 Partnerships

13 Company Profiles (Page No. - 96)

13.1 Introduction

(Business Overview, Solutions and Services Offered, Recent Developments, MnM View, SWOT Analysis)*

13.2 Oracle

13.3 IBM

13.4 Sailpoint

13.5 SAP

13.6 CA Technologies

13.7 Microsoft

13.8 Evidian

13.9 RSA Security

13.10 Netiq

13.11 One Identity

13.12 Saviynt

13.13 Hitachi Id

13.14 Omada

13.15 Alertenterprise

13.16 Secureauth

*Business Overview, Solutions and Services Offered, Recent Developments, MnM View, SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 122)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Available Customizations

14.4 Related Reports

14.5 Author Details

List of Tables (65 Tables)

Table 1 United States Dollar Exchange Rate, 2015–2017

Table 2 Identity Governance and Administration Market Size, By Component, 2016–2023 (USD Million)

Table 3 Solution: Market Size By Region 2016–2023 (USD Million)

Table 4 Services: Market Size By Region 2016–2023 (USD Million)

Table 5 Market Size, By Service, 2016–2023 (USD Million)

Table 6 Professional Services: Market Size By Type, 2016–2023 (USD Million)

Table 7 Professional Services: Market Size By Region, 2016–2023 (USD Million)

Table 8 Integration and Implementation Services: Market Size By Region, 2016–2023 (USD Million)

Table 9 Training and Consulting Services: Market Size By Region, 2016–2023 (USD Million)

Table 10 Support and Maintenance Services: Market Size By Region, 2016–2023 (USD Million)

Table 11 Managed Services: Market Size By Region, 2016–2023 (USD Million)

Table 12 Identity Governance and Administration Market Size, By Deployment Type, 2016–2023 (USD Million)

Table 13 On-Premises: Market Size By Region, 2016–2023 (USD Million)

Table 14 Cloud: Market Size By Region, 2016–2023 (USD Million)

Table 15 Market Size, By Organization Size, 2016–2023 (USD Million)

Table 16 Small and Medium-Sized Enterprises: Market Size By Region 2016–2023 (USD Million)

Table 17 Large Enterprises: Market Size By Region 2016–2023 (USD Million)

Table 18 Market Size, By Region, 2016–2023 (USD Million)

Table 19 Banking, Financial Services, and Insurance: Market Size By Region, 2016–2023 (USD Million)

Table 20 Government and Defense: Market Size By Region, 2016–2023 (USD Million)

Table 21 Telecom and It: Market Size By Region, 2016–2023 (USD Million)

Table 22 Energy and Utilities: Market Size By Region, 2016–2023 (USD Million)

Table 23 Manufacturing: Market Size By Region, 2016–2023 (USD Million)

Table 24 Retail and Consumer Goods: Market Size By Region, 2016–2023 (USD Million)

Table 25 Healthcare and Life Sciences: Market Size By Region, 2016–2023 (USD Million)

Table 26 Others: Market Size By Region, 2016–2023 (USD Million)

Table 27 Identity Governance and Administration Market Size, By Region, 2016–2023 (USD Million)

Table 28 North America: Market Size By Component, 2016–2023 (USD Million)

Table 29 North America: Market Size By Service, 2016–2023 (USD Million)

Table 30 North America: Market Size By Professional Service, 2016–2023 (USD Million)

Table 31 North America: Market Size By Deployment Type, 2016–2023 (USD Million)

Table 32 North America: Market Size By Organization Size, 2016–2023 (USD Million)

Table 33 North America: Market Size By Industry Vertical, 2016–2023 (USD Million)

Table 34 North America: Market Size By Country, 2016–2023 (USD Million)

Table 35 Europe: Market Size, By Component, 2016–2023 (USD Million)

Table 36 Europe: Market Size By Service, 2016–2023 (USD Million)

Table 37 Europe: Market Size By Professional Service, 2016–2023 (USD Million)

Table 38 Europe: Market Size By Deployment Type, 2016–2023 (USD Million)

Table 39 Europe: Market Size By Organization Size, 2016–2023 (USD Million)

Table 40 Europe: Market Size By Industry Vertical, 2016–2023 (USD Million)

Table 41 Europe: Market Size By Country, 2016–2023 (USD Million)

Table 42 Asia Pacific: Identity Governance and Administration Market Size, By Component, 2016–2023 (USD Million)

Table 43 Asia Pacific: Market Size By Service, 2016–2023 (USD Million)

Table 44 Asia Pacific: Market Size By Professional Service, 2016–2023 (USD Million)

Table 45 Asia Pacific: Market Size By Deployment Type, 2016–2023 (USD Million)

Table 46 Asia Pacific: Market Size By Organization Size, 2016–2023 (USD Million)

Table 47 Asia Pacific: Market Size By Industry Vertical, 2016–2023 (USD Million)

Table 48 Asia Pacific: Market Size By Country, 2016–2023 (USD Million)

Table 49 Middle East and Africa: Market Size, By Component, 2016–2023 (USD Million)

Table 50 Middle East and Africa: Market Size By Service, 2016–2023 (USD Million)

Table 51 Middle East and Africa: Market Size By Professional Services, 2016–2023 (USD Million)

Table 52 Middle East and Africa: Market Size By Deployment Type, 2016–2023 (USD Million)

Table 53 Middle East and Africa: Market Size By Organization Size, 2016–2023 (USD Million)

Table 54 Middle East and Africa: Market Size By Industry Vertical, 2016–2023 (USD Million)

Table 55 Middle East and Africa: Market Size By Sub-Region, 2016–2023 (USD Million)

Table 56 Latin America: Identity Governance and Administration Market Size, By Component 2016–2023 (USD Million)

Table 57 Latin America: Market Size By Service, 2016–2023 (USD Million)

Table 58 Latin America: Market Size By Professional Services, 2016–2023 (USD Million)

Table 59 Latin America: Market Size By Deployment Type, 2016–2023 (USD Million)

Table 60 Latin America: Market Size By Organization Size, 2016–2023 (USD Million)

Table 61 Latin America: Market Size By Industry Vertical, 2016–2023 (USD Million)

Table 62 Latin America: Market Size By Country, 2016–2023 (USD Million)

Table 63 Product/Solution Launches and Enhancements, 2017–2019

Table 64 Business Expansions, 2018

Table 65 Partnerships, 2018

List of Figures (31 Figures)

Figure 1 Identity Governance and Administration Market: Research Design

Figure 2 Factor Analysis

Figure 3 Services Segment to Hold A Higher Market Share in the Market in 2017

Figure 4 Banking, Financial Services, and Insurance Industry Vertical Dominated the Market in 2018

Figure 5 North America Accounted for the Highest Share of the Market in 2018

Figure 6 Growing Focus of Organizations Toward Meeting Regulatory Compliances to Drive the Market Growth

Figure 7 Services Segment and the United States Accounted for Higher Shares in North America for the Market in 2018

Figure 8 India to Grow at the Fastest Rate During the Forecast Period

Figure 9 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 10 Services Segment to Grow at A Higher CAGR During the Forecast Period

Figure 11 Managed Services Segment to Grow at A Higher CAGR During the Forecast Period

Figure 12 Cloud Segment to Grow at A Higher CAGR During the Forecast Period

Figure 13 Small and Medium-Sized Enterprises to Grow at A Higher CAGR During the Forecast Period

Figure 14 Healthcare and Lifesciences Segment to Grow at the Highest CAGR During the Forecast Period

Figure 15 Asia Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 16 North America: Market Snapshot

Figure 17 Asia Pacific: Market Snapshot

Figure 18 Identity Governance and Administration Market (Global), Competitive Leadership Mapping, 2018

Figure 19 Key Developments By the Leading Players in the Market 2017–2018

Figure 20 Geographic Revenue Mix of the Top Market Players

Figure 21 Oracle: Company Snapshot

Figure 22 SWOT Analysis: Oracle

Figure 23 IBM: Company Snapshot

Figure 24 SWOT Analysis: IBM

Figure 25 Sailpoint: Company Snapshot

Figure 26 SWOT Analysis: Sailpoint

Figure 27 SAP: Company Snapshot

Figure 28 SWOT Analysis: SAP

Figure 29 CA Technologies: Company Snapshot

Figure 30 SWOT Analysis: CA Technologies

Figure 31 Microsoft: Company Snapshot

The study involved 4 major activities to estimate the current market size of the identity governance and administration market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

The market size for companies offering identity governance and administration solutions and services was arrived at on the basis of the secondary data available through paid and unpaid sources, and by analyzing the product portfolios of the major companies in the ecosystem and rating them according to their performance and quality. In the secondary research process, various sources were referred to, for identifying and collecting information for this study. The secondary sources included annual reports, press releases and investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both the market and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for making this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the identity governance and administration market.

After the complete market engineering (including calculations for market statistics, market breakup, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information, and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types; competitive landscape of identity governance and administration solution and service providers; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key players’ strategies.

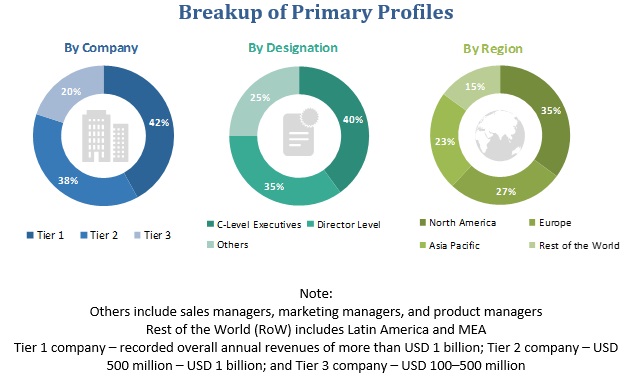

The following figure depicts the breakup of the primary respondents’ profiles:

To know about the assumptions considered for the study, download the pdf brochure

Identity Governance and Administration Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the market. They were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both, the demand and supply sides, in the market.

Report Objectives

- To define, segment, and project the global market size of the identity governance and administration market

- To understand the structure of the market by identifying its various subsegments

- To provide detailed information about the key factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to the 5 major regions (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify major growth strategies adopted by players across key regions

- To analyze the competitive developments, such as product/solution launches and enhancements, business expansions, partnerships, and mergers and acquisitions, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs and on best effort basis for profiling of additional market players.

Growth opportunities and latent adjacency in Identity Governance and Administration Market