Hyperscale Computing Market by Offering (Solutions and Services), Application (Cloud Computing, Big Data, IoT), Vertical (Manufacturing, Government & Defense, BFSI, IT & Telecom, Retail & Consumer Goods) and Region - Global Forecast to 2028

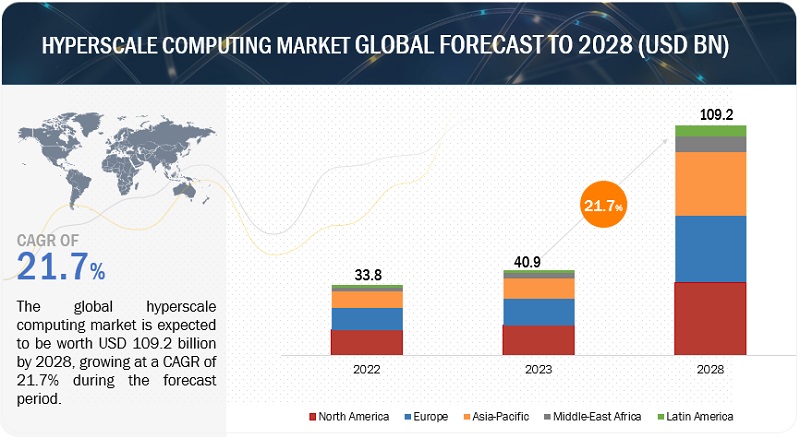

The Hyperscale Computing Market size is expected to grow from USD 40.9 billion in 2023 to USD 109.2 billion by 2028 at a compound annual growth rate (CAGR) of 21.7% during the forecast period. The future of hyperscale computing appears promising and transformative, as it continues to shape the technological landscape in the coming years. Companies that specialize in hyperscale computing use the latest hardware and software developments to guarantee a high level of dependability and responsiveness to consumer demand. As more idle hyperscale installations are enabled by the IoT and virtual monitoring systems, visibility will improve as CO2 emissions decline. Further, ongoing advancements in hardware, networking, and data management will enhance the efficiency and performance of hyperscale systems. Innovations in processors, storage technologies, and networking infrastructure will lead to even higher processing speeds, lower latencies, and improved energy efficiency. The rise of edge computing, which enables data processing closer to the source of data, will complement hyperscale computing. This integration will be crucial for applications requiring low-latency responses and reducing data transfer to centralized data centers, enhancing overall system performance.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Hyperscale Computing Market Dynamics

Driver: High adoption of hyperscale computing in different industries boosts the market growth

The growing demand for hyperscale computing is driven by various industries that require powerful and scalable computing resources. Hyperscale computing is used by technology companies, especially significant cloud service providers and internet service providers, to support their huge infrastructure requirements. To provide their services consistently and at scale, these businesses need a lot of computing power, storage, and network bandwidth. Further, the e-commerce sector significantly relies on hyperscale computing to manage inventories, analyze customer data, process massive volumes of online transactions, and offer individualized shopping experiences. The high availability, performance, and scalability needed by e-commerce systems are ensured by hyperscale infrastructure. Hyperscale computing is necessary for streaming services, gaming platforms, and digital media businesses to process and distribute high-quality content to millions of people worldwide. For the media and entertainment industry, it is essential to have the capacity to manage enormous volumes of data, carry out real-time encoding and decoding, and support high-resolution video streaming. Moreover, hyperscale computing is used by insurance companies, banking institutions, and other financial organizations to handle complicated financial calculations, risk modeling, fraud detection, algorithmic trading, and high-frequency transactions. The BFSI industry requirements include strong security measures, quick processing, and scalable infrastructure, all of which are met by hyperscale solutions and services.

Restraint: Higher capital expenditure costs and lack of data control

To support the needed scale and performance, organizations have to spend money on data centers, servers, networking tools, storage systems, and other hardware elements. For organizations with insufficient funding, these start-up expenses may be a barrier to entry. Organizations frequently need to enter into long-term agreements, including contracts with cloud service providers or colocation facilities, to invest in hyperscale infrastructure. These commitments could include minimum consumption limits or fixed-term contracts, which would increase the upfront expenses while limiting flexibility. Further, organizations may be concerned about the control and security of their data while employing hyperscale computing services. When data is stored on third-party infrastructure, concerns regarding data privacy, regulatory compliance, and the possibility of unauthorized access or data breaches arise. Moreover, organizations may be required by law or regulation to maintain data within particular jurisdictions in some sectors of the economy or certain locations. Utilizing hyperscale computing services may restrict the ability to choose where information is handled and kept, which could provide compliance problems.

Opportunity: Hyperscale data centers will become a new paradigm for delivering IT services

The delivery of IT services has undergone a paradigm shift with the rise of the hyperscale data center, a significant form factor. Hyperscale data centers stand out for their enormous size, high computer density, and effective infrastructure architecture. It serves as the foundation of cloud computing, enabling the provision of a vast array of IT services to businesses and end users. Massive workloads and enormous data volumes can be handled by hyperscale data centers. The capacity to service a huge number of users and applications is provided by the tens of thousands of servers, storage systems, and networking tools that are often housed in them. This scalability enables performance-uncompromising handling of peak demand and dynamic workloads, as well as effective resource allocation. Further, high availability and resilience are prioritized in hyperscale data centers. It is built with redundant network connectivity, power systems, and storage to guarantee minimal downtime and unbroken service delivery. Additionally, it frequently has several geographically dispersed data center locations, providing enhanced resilience and disaster recovery capabilities that will boost the hyperscale computing market.

Challenge: Carbon emissions by hyperscale data centers

Hyperscale data centers consume substantial amounts of energy to power and cool their large-scale infrastructure, resulting in considerable carbon emissions. Addressing this challenge is crucial to minimize the environmental impact and promote sustainability. Hyperscale data centers consume massive amounts of electricity to support their operations, including powering servers, networking equipment, storage systems, and cooling infrastructure. The energy demand of hyperscale computing continues to grow with increasing data volumes and computational requirements. This significant energy consumption contributes to carbon emissions, especially if the electricity is generated from non-renewable sources such as fossil fuels. Further, cooling is essential to maintain optimal operating temperatures in hyperscale data centers. However, cooling systems consume a significant portion of the energy used in data centers. Traditional cooling methods, such as mechanical chillers, can be energy intensive. Finding efficient cooling strategies, such as free cooling techniques, liquid cooling solutions, or advanced thermal management approaches, is essential to reduce energy consumption and associated carbon emissions. Transitioning to renewable energy sources is crucial for reducing the carbon footprint of hyperscale computing. By sourcing electricity from renewable sources such as solar, wind, hydro, or geothermal, data centers can significantly lower their carbon emissions.

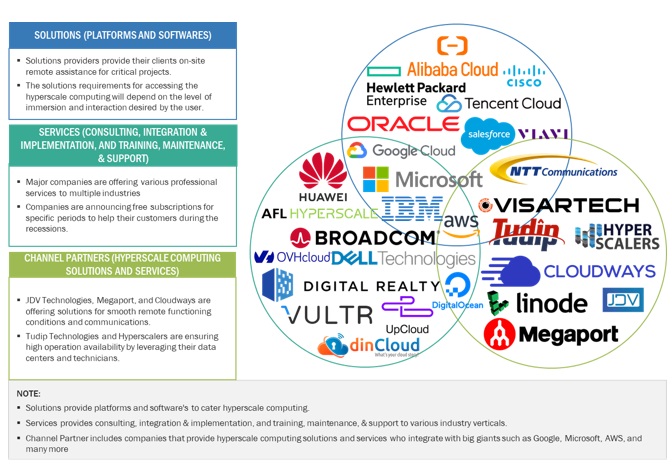

Hyperscale Computing Market Ecosystem

Prominent companies in this market are responsible for delivering hyperscale computing solutions and services to end users via various deployment models. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include AWS (US), Google (US), Microsoft Corporation (US), IBM Corporation (US), and Oracle Corporation (US). The section highlights the market's key players, including connectivity providers, OEMs, solutions providers, services providers and consultants, integrators, and MSPs. The chapter provides a description of the companies offering services and solutions in the hyperscale computing market, the latest company developments related to the recession, and MarketsandMarkets’ analysis of these vendors. It further highlights the unique differentiation points of each company and its expertise in the market.

Based on vertical, IT and telecom vertical is expected to hold the largest market share during the forecast period

Based on the vertical, the hyperscale computing market is segmented into BFSI, IT and telecom, government and defense, research and academics, healthcare and life sciences, manufacturing, retail and consumer goods, media and entertainment, and other verticals. Among the verticals, the IT and telecom segment is expected to hold the largest market share during the forecast period. Hyperscale computing enables the expansion of cloud services in the IT and telecom sectors. It allows service providers to deliver scalable, on-demand resources to customers, including virtual machines, storage, and networking. This scalability and flexibility are essential for accommodating the increasing data storage and processing needs of businesses. Secondly, hyperscale computing supports the development and deployment of advanced telecommunications services. It facilitates the processing of large volumes of real-time data in areas such as network optimization, traffic management, and predictive maintenance. This helps telecom companies enhance network performance, provide a better quality of service, and deliver innovative services such as 5G connectivity and IoT deployments.

Furthermore, hyperscale computing enables efficient data management and analytics in the IT and Telecom industry. It supports the processing and analysis of massive datasets to derive valuable insights for network optimization, customer behavior analysis, and target marketing campaigns. This, in turn, helps in improving service offerings, enhancing customer experiences, and driving business growth.

Based on application, the IoT segment holds the second-highest CAGR during the forecast period

Based on the application, the hyperscale computing market is segmented into cloud computing, big data, IoT, and other applications. As per the application segment IoT segment is expected to hold the second-highest CAGR during the forecast period. IoT applications encompass a wide range of use cases across industries, including smart cities, industrial automation, healthcare monitoring, logistics and supply chain management, and connected vehicles. Hyperscale computing provides the computational power, storage capacity, and scalability required to handle the massive influx of data from IoT devices. These applications rely on hyperscale infrastructure to process and analyze real-time streaming data, enable data integration and aggregation, and support the connectivity and interoperability of IoT devices at scale. IoT applications in the hyperscale computing market enable organizations to harness the potential of IoT data for actionable insights, predictive analytics, and automation. It also facilitates real-time monitoring and control, asset tracking, predictive maintenance, and optimization of operations based on IoT-generated data. Furthermore, hyperscale infrastructure supports the secure and reliable transmission of IoT data, as well as the integration with other systems and services.

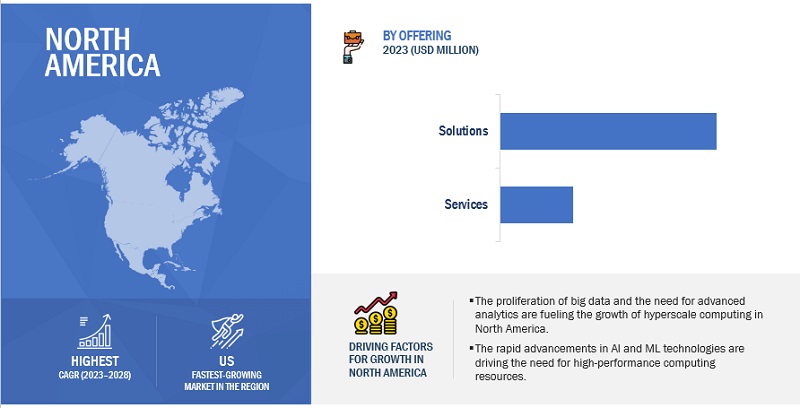

The US market is projected to contribute the largest share of the hyperscale computing market in North America.

North America is expected to lead the hyperscale computing market in 2023. The US is estimated to account for the largest market share in North America in 2023 in the hyperscale computing market, and the trend is expected to continue until 2028. In the US, the demand for hyperscale computing has grown significantly and is now a key enabler of numerous businesses and technological progress. Some of the biggest hyperscale data center operators and cloud service providers including such as AWS, Microsoft, IBM, Oracle, and Google are based in the US. These hyperscalers enable businesses to access on-demand computing resources, accelerating innovation, and fostering the growth of startups and technology-driven enterprises. The US government leverages hyperscale computing to enhance national security, conduct research, and manage large-scale public services. Federal agencies utilize cloud services to store and analyze vast amounts of data efficiently. Moreover, the hyperscale computing industry has created a substantial number of jobs, including data center management, cloud architecture, and software development roles, boosting employment opportunities nationwide, such factors have fuelled the growth of the market in the country.

Key Market Players

The hyperscale computing market is dominated by a few globally established players such as AWS (US), Google (US), Microsoft Corporation (US), IBM Corporation (US), Oracle Corporation (US), HPE (US), Alibaba Cloud (China), Tencent Cloud (China), Salesforce (US), and Huawei (China) among others, are the key vendors that secured hyperscale computing contracts in last few years. These vendors can bring global processes and execution expertise; the local players only have local expertise. Driven by increased disposable incomes, easy access to knowledge, and fast adoption of technological products, buyers are more willing to experiment/test new things in the hyperscale computing market.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

Offering, Application, Vertical, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies Covered |

Some of the significant hyperscale computing market vendors are AWS (US), Google (US), Microsoft Corporation (US), IBM Corporation (US), Oracle Corporation (US), HPE (US), Alibaba Cloud (China), Tencent Cloud (China), Salesforce (US), Huawei (China), Viavi Solutions (US), Broadcom (US), AFL Hyperscale (US), OVHcloud (France), Iron Mountain (US), DigitalOcean (US), Rackspace (US), NTT Communications (Japan), and Digital Reality (US). |

Hyperscale Computing Market Highlights

This research report categorizes the Hyperscale Computing Market to forecast revenues and analyze trends in each of the following submarkets:

|

Segment |

Subsegment |

|

Based on the Component: |

|

|

Based on the Application: |

|

|

Based on the Vertical: |

|

|

Based on the Region: |

|

Recent Developments:

- In June 2023, Oracle Cloud Infrastructure (OCI) announced the availability of new compute instances based on the 4th Generation AMD EPYC processors. These instances leverage the advanced features and performance capabilities of the AMD EPYC processors to deliver enhanced computing power, efficiency, and security for workloads running on the Oracle Cloud.

- In March 2023, AWS and Nvidia collaborated to develop next-generation infrastructure to support the training of large machine learning (ML) models and the creation of generative AI applications. This collaboration combines AWS's expertise in cloud computing with Nvidia's industry-leading GPU technology. The collaboration aims to address the growing demand for computational power and specialized hardware required for training increasingly large and complex ML models.

- In July 2022, AWS to expand its portfolio included memory-optimized Amazon EC2 R6a instances featuring AMD EPYC (Milan) processors 10 percent less expensive than comparable x86 instances. High-performance computing and video processing workloads, which benefit from decreased network latency and highly scalable inter-node communication, are supported by Elastic Fabric Adapter (EFA) on R6a instances, which are built on the AWS Nitro System.

Frequently Asked Questions (FAQ):

What is hyperscale computing?

According to Dynatrace, The term hyperscale - describes an architecture's capacity to scale effectively as companies raise system demand. Hyperscalers are cloud service providers who provide seamless delivery and services to create a stable and scalable application environment. Hyperscale computing is significant as it allows IT teams to scale automatically and respond right away to increasing demand.

According to Viavi Solutions, A flexible data center architecture known as hyperscale computing uses huge horizontal server arrays and software-defined networking (SDN) to enable quick scaling on demand. The traffic between clients and servers is directed by specialized load-balancing software. Moreover, high levels of hardware efficiency and data throughput are made possible by hyperscale computing. By adapting computing, networking, and large data storage operations to changing service requirements, artificial intelligence (AI) is utilized to optimize these processes.

Which country is an early adopter of hyperscale computing?

The US is an early adopter of hyperscale computing.

Who are vital clients adopting hyperscale computing?

Key clients adopting the hyperscale computing market include: -

- Government Agencies

- Resellers and Distributors

- Research Organizations

- Corporates

- Administrators

Which are the key vendors exploring hyperscale computing?

Some of the significant hyperscale computing vendors are AWS (US), Google (US), Microsoft Corporation (US), IBM Corporation (US), Oracle Corporation (US), HPE (US), Alibaba Cloud (China), Tencent Cloud (China), Salesforce (US), Huawei (China), Viavi Solutions (US), Broadcom (US), AFL Hyperscale (US), OVHcloud (France), Iron Mountain (US), DigitalOcean (US), Rackspace (US), NTT Communications (Japan), and Digital Reality (US)

What is the total CAGR expected to be recorded for the hyperscale computing market during 2023-2028?

The market is expected to record a CAGR of 21.7% from 2023-2028

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising need for high-performance technology and cloud computing- Growing demand for hyperscale computing in different industries- Growing need to reduce CAPEX and OPEXRESTRAINTS- Higher capital expenditure and lack of data controlOPPORTUNITIES- Hyperscale data centers to be new paradigm for delivering IT services- Rising advancements in modular UPS systemsCHALLENGES- Managing and storing large amounts of data- Adherence to multiple standards and compliance requirements- Consumption of massive amounts of electricity resulting in carbon emissions- Fear of vendor lock-in and high costs

-

5.3 CASE STUDY ANALYSISREDDIT MIGRATED TO MANAGE AMAZON AURORA TO SCALE 30% YEAR-OVER-YEAR GROWTHSYNOPTEK STRATEGICALLY MIGRATED CUSTOMERS FROM MIAMI DATA CENTER TO MICROSOFT AZUREORACLE RED BULL RACING INCREASED SIMULATIONS AND SHARPENED DECISION-MAKING ON TRACK WITH ORACLE CLOUD INFRASTRUCTUREGOSH FORMED SUSTAINABLE INNOVATION USING OVHCLOUD- DEDICATED SERVERSSIMPLELOGIN SPEEDED UP ITS SERVICE WITH UPCLOUD-MANAGED DATABASES

-

5.4 ECOSYSTEM

- 5.5 VALUE CHAIN ANALYSIS

-

5.6 PRICING ANALYSISINTRODUCTIONAVERAGE SELLING PRICE TRENDSAVERAGE SELLING PRICE TRENDS OF KEY PLAYERS, BY OFFERING

-

5.7 PATENT ANALYSIS

-

5.8 TECHNOLOGY ANALYSISBIG DATA ANALYTICSEDGE COMPUTINGINTERNET OF THINGS (IOT)CLOUD COMPUTINGHIGH-PERFORMANCE COMPUTING5G TECHNOLOGY

-

5.9 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATIONS, BY REGION- North America- Europe- Asia Pacific- Middle East & South Africa- Latin AmericaREGULATORY IMPLICATIONS AND INDUSTRY STANDARDS- General Data Protection Regulation- SEC Rule 17a-4- ISO/IEC 27001- System and Organization controls 2 type II compliance- Financial Industry Regulatory Authority- Freedom of Information Act- Health Insurance Portability and Accountability Act

-

5.10 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.11 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.12 TRENDS/DISRUPTIONS IMPACTING BUYERS

-

5.13 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESS

- 5.14 BUYING CRITERIA

-

5.15 BUSINESS MODEL ANALYSISBUSINESS MODEL FOR SOFTWARE PROVIDERSBUSINESS MODEL FOR SERVICE PROVIDERS

-

6.1 INTRODUCTIONOFFERING: HYPERSCALE COMPUTING MARKET DRIVERS

-

6.2 SOLUTIONSSOLUTIONS TO HANDLE MASSIVE WORKLOADS, PROCESS & ANALYZE VAST DATA, AND DELIVER SCALABLE & RESILIENT SERVICES

-

6.3 SERVICESSERVICE PROVIDERS TO IDENTIFY AREAS OF IMPROVEMENT AND OPTIMIZATION OPPORTUNITIESCONSULTINGINTEGRATION & IMPLEMENTATIONTRAINING, SUPPORT, AND MAINTENANCE

-

7.1 INTRODUCTIONAPPLICATION: HYPERSCALE COMPUTING MARKET DRIVERS

-

7.2 CLOUD COMPUTINGNEED FOR PROVISIONING RESOURCES IN FLEXIBLE AND GRANULAR MANNER TO DRIVE DEMAND

-

7.3 BIG DATANEED FOR EFFICIENT INGESTING AND PROCESS STREAMING BIG DATA IN REAL TIME TO SUPPORT GROWTH FOR HYPERSCALE COMPUTING

-

7.4 IOTSEAMLESS INTEGRATION OF DIVERSE IOT DEVICES AND PROTOCOLS TO FACILITATE DATA EXCHANGE AND CROSS-DOMAIN IOT SOLUTIONS

- 7.5 OTHER APPLICATIONS

-

8.1 INTRODUCTIONVERTICAL: HYPERSCALE COMPUTING MARKET DRIVERS

-

8.2 BFSIHYPERSCALE COMPUTING IN BFSI TO PROVIDE ROBUST DATA PROCESSING CAPABILITIES, ENHANCE SECURITY, AND ENABLE ADVANCED ANALYTICS

-

8.3 IT & TELECOMHYPERSCALE COMPUTING TO ENABLE EFFICIENT DATA MANAGEMENT AND ANALYTICS IN IT & TELECOM

-

8.4 RESEARCH & ACADEMICSHYPERSCALE COMPUTING TO STORE AND ANALYZE VAST AMOUNTS OF DATA IN RESEARCH & ACADEMICS

-

8.5 GOVERNMENT & DEFENSEIMPROVING GOVERNMENT SERVICES AND CITIZEN ENGAGEMENT TO ENABLE DELIVERY OF DIGITAL SERVICES AND DATA-DRIVEN POLICY-MAKING

-

8.6 RETAIL & CONSUMER GOODSHYPERSCALE COMPUTING IN RETAIL & CONSUMER GOODS TO ENABLE INVENTORY TRACKING AND SUPPLY CHAIN OPTIMIZATION

-

8.7 MANUFACTURINGHYPERSCALE COMPUTING IN MANUFACTURING TO ENABLE ROBOTICS, AUTOMATION, AND 3D PRINTING

-

8.8 HEALTHCARE & LIFE SCIENCESHYPERSCALE COMPUTING TO PROVIDE COMPUTATIONAL POWER, SECURE INFRASTRUCTURE, AND REMOTE DIAGNOSTICS

-

8.9 MEDIA & ENTERTAINMENTHYPERSCALE COMPUTING TO ENABLE HIGH-PERFORMANCE RENDERING AND VISUAL EFFECTS IN MEDIA & ENTERTAINMENT INDUSTRY

- 8.10 OTHER VERTICALS

-

9.1 INTRODUCTIONNORTH AMERICANORTH AMERICA: HYPERSCALE COMPUTING MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- High adoption of advanced technologies such as IoT and edge computing to fuel US marketCANADA- Combining advanced servers with storage to drive demand for hyperscale computing

-

9.2 EUROPEEUROPE: HYPERSCALE COMPUTING MARKET DRIVERSEUROPE: RECESSION IMPACTUK- Increasing use of high-performance technologies to drive demand for hyperscale computingGERMANY- Rising digitalization and effective management of hyperscale computing lifecycle processes to fuel marketFRANCE- Strong government support for adoption of hyperscale computing to propel marketREST OF EUROPE

-

9.3 ASIA PACIFICASIA PACIFIC: HYPERSCALE COMPUTING MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTCHINA- Presence of innovative technologies in China to drive marketJAPAN- Increasing R&D investments and skilled professionals to boost marketINDIA- Continuous upgrades in hyperscale infrastructure and applications to drive demand for hyperscale computingREST OF ASIA PACIFIC

-

9.4 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: HYPERSCALE COMPUTING MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTKINGDOM OF SAUDI ARABIA- Low IT costs and scalability to fuel adoption of cloud-based applications and storageUAE- Rising government investments and economic developments in UAE to drive demand for hyperscale computingREST OF MIDDLE EAST & AFRICA

-

9.5 LATIN AMERICALATIN AMERICA: HYPERSCALE COMPUTING MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTBRAZIL- Growing complexity of cloud environment and expanding services to propel marketMEXICO- High adoption of major digital transformation in data center technology to drive demand for hyperscale computingREST OF LATIN AMERICA

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/KEY STRENGTHS/RIGHT TO WIN

- 10.3 MARKET SHARE ANALYSIS

- 10.4 HISTORICAL REVENUE ANALYSIS OF TOP VENDORS

-

10.5 COMPANY EVALUATION MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.6 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2022RESPONSIVE COMPANIESPROGRESSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING OF STARTUPS/SMES

- 10.7 COMPANY FINANCIAL METRICS

- 10.8 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- 10.9 KEY MARKET DEVELOPMENTS

- 11.1 INTRODUCTION

-

11.2 MAJOR PLAYERSAWS- Business overview- Products/Services offered- Recent developments- MnM viewGOOGLE- Business overview- Products/Services offered- Recent developments- MnM viewMICROSOFT CORPORATION- Business overview- Products/Services offered- Recent developments- MnM viewIBM CORPORATION- Business overview- Products/Services offered- Recent developments- MnM viewALIBABA CLOUD- Business overview- Products/Services offered- Recent developments- MnM viewORACLE CORPORATION- Business overview- Products/Services offered- Recent developments- MnM viewHPE- Business overview- Products/Services offered- Recent developmentsTENCENT CLOUD- Business overview- Products/Services offered- Recent developmentsSALESFORCE- Business overview- Products/Services offered- Recent developmentsHUAWEI- Business overview- Products/Services offered- Recent developments

-

11.3 OTHER PLAYERSVIAVI SOLUTIONSBROADCOMAFL HYPERSCALEOVHCLOUDIRON MOUNTAINDIGITALOCEANRACKSPACENTT COMMUNICATIONSDIGITAL REALITYAKAMAI TECHNOLOGIES

-

11.4 STARTUPS/SMESUPCLOUDDINCLOUDVULTRVISARTECHTUDIP TECHNOLOGIESHYPERSCALERSCLOUDWAYSJDV TECHNOLOGIESMEGAPORT

-

12.1 INTRODUCTIONRELATED MARKETLIMITATIONS

- 12.2 CLOUD COMPUTING MARKET

- 12.3 HYPERSCALE DATA CENTER MARKET

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATE, 2015–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 RESEARCH ASSUMPTIONS

- TABLE 4 HYPERSCALE COMPUTING MARKET: PRICING ANALYSIS, BY VENDORS

- TABLE 5 TOP PATENT OWNERS

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 HYPERSCALE COMPUTING MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 11 HYPERSCALE COMPUTING MARKET: KEY CONFERENCES AND EVENTS IN 2023–2024

- TABLE 12 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS OF TOP SOLUTIONS

- TABLE 13 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 14 HYPERSCALE COMPUTING MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 15 HYPERSCALE COMPUTING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 16 SOLUTIONS: HYPERSCALE COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 17 SOLUTIONS: HYPERSCALE COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 18 SERVICES: HYPERSCALE COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 19 SERVICES: HYPERSCALE COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 20 HYPERSCALE COMPUTING MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 21 HYPERSCALE COMPUTING MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 22 CONSULTING: HYPERSCALE COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 23 CONSULTING: HYPERSCALE COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 INTEGRATION & IMPLEMENTATION: HYPERSCALE COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 25 INTEGRATION & IMPLEMENTATION: HYPERSCALE COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 TRAINING, SUPPORT, AND MAINTENANCE: HYPERSCALE COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 27 TRAINING, SUPPORT, AND MAINTENANCE: HYPERSCALE COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 HYPERSCALE COMPUTING MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 29 HYPERSCALE COMPUTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 30 HYPERSCALE COMPUTING MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 31 HYPERSCALE COMPUTING MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 32 BFSI: HYPERSCALE COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 33 BFSI: HYPERSCALE COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 IT & TELECOM: HYPERSCALE COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 35 IT & TELECOM: HYPERSCALE COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 RESEARCH & ACADEMICS: HYPERSCALE COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 37 RESEARCH & ACADEMICS: HYPERSCALE COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 GOVERNMENT & DEFENSE: HYPERSCALE COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 39 GOVERNMENT & DEFENSE: HYPERSCALE COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 RETAIL & CONSUMER GOODS: HYPERSCALE COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 41 RETAIL & CONSUMER GOODS: HYPERSCALE COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 MANUFACTURING: HYPERSCALE COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 43 MANUFACTURING: HYPERSCALE COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 HEALTHCARE & LIFE SCIENCES: HYPERSCALE COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 45 HEALTHCARE & LIFE SCIENCES: HYPERSCALE COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 MEDIA & ENTERTAINMENT: HYPERSCALE COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 47 MEDIA & ENTERTAINMENT: HYPERSCALE COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 OTHER VERTICALS: HYPERSCALE COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 49 OTHER VERTICALS: HYPERSCALE COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 HYPERSCALE COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 51 HYPERSCALE COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 NORTH AMERICA: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 53 NORTH AMERICA: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 54 NORTH AMERICA: HYPERSCALE COMPUTING SOLUTIONS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 55 NORTH AMERICA: HYPERSCALE COMPUTING SOLUTIONS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 56 NORTH AMERICA: HYPERSCALE COMPUTING SERVICES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 57 NORTH AMERICA: HYPERSCALE COMPUTING SERVICES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 59 NORTH AMERICA: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: HYPERSCALE COMPUTING CONSULTING MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 61 NORTH AMERICA: HYPERSCALE COMPUTING CONSULTING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: HYPERSCALE COMPUTING INTEGRATION & IMPLEMENTATION MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 63 NORTH AMERICA: HYPERSCALE COMPUTING INTEGRATION & IMPLEMENTATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: HYPERSCALE COMPUTING TRAINING, SUPPORT, AND MAINTENANCE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 65 NORTH AMERICA: HYPERSCALE COMPUTING TRAINING, SUPPORT, AND MAINTENANCE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: HYPERSCALE COMPUTING MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 67 NORTH AMERICA: HYPERSCALE COMPUTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: HYPERSCALE COMPUTING MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 69 NORTH AMERICA: HYPERSCALE COMPUTING MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: HYPERSCALE COMPUTING MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 71 NORTH AMERICA: HYPERSCALE COMPUTING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 72 US: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 73 US: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 74 US: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 75 US: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 76 CANADA: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 77 CANADA: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 78 CANADA: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 79 CANADA: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 80 EUROPE: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 81 EUROPE: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 82 EUROPE: HYPERSCALE COMPUTING SOLUTIONS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 83 EUROPE: HYPERSCALE COMPUTING SOLUTIONS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 84 EUROPE: HYPERSCALE COMPUTING SERVICES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 85 EUROPE: HYPERSCALE COMPUTING SERVICES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 86 EUROPE: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 87 EUROPE: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 88 EUROPE: HYPERSCALE COMPUTING CONSULTING MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 89 EUROPE: HYPERSCALE COMPUTING CONSULTING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 90 EUROPE: HYPERSCALE COMPUTING INTEGRATION & IMPLEMENTATION MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 91 EUROPE: HYPERSCALE COMPUTING INTEGRATION & IMPLEMENTATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 92 EUROPE: HYPERSCALE COMPUTING TRAINING, SUPPORT, AND MAINTENANCE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 93 EUROPE: HYPERSCALE COMPUTING TRAINING, SUPPORT, AND MAINTENANCE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 94 EUROPE: HYPERSCALE COMPUTING MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 95 EUROPE: HYPERSCALE COMPUTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 96 EUROPE: HYPERSCALE COMPUTING MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 97 EUROPE: HYPERSCALE COMPUTING MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 98 EUROPE: HYPERSCALE COMPUTING MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 99 EUROPE: HYPERSCALE COMPUTING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 100 UK: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 101 UK: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 102 UK: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 103 UK: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 104 GERMANY: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 105 GERMANY: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 106 GERMANY: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 107 GERMANY: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 108 FRANCE: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 109 FRANCE: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 110 FRANCE: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 111 FRANCE: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 112 REST OF EUROPE: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 113 REST OF EUROPE: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 114 REST OF EUROPE: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 115 REST OF EUROPE: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 116 ASIA PACIFIC: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 117 ASIA PACIFIC: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 118 ASIA PACIFIC: HYPERSCALE COMPUTING SOLUTIONS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 119 ASIA PACIFIC: HYPERSCALE COMPUTING SOLUTIONS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 120 ASIA PACIFIC: HYPERSCALE COMPUTING SERVICES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 121 ASIA PACIFIC: HYPERSCALE COMPUTING SERVICES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 122 ASIA PACIFIC: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 123 ASIA PACIFIC: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 124 ASIA PACIFIC: HYPERSCALE COMPUTING CONSULTING MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 125 ASIA PACIFIC: HYPERSCALE COMPUTING CONSULTING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 126 ASIA PACIFIC: HYPERSCALE COMPUTING INTEGRATION & IMPLEMENTATION MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 127 ASIA PACIFIC: HYPERSCALE COMPUTING INTEGRATION & IMPLEMENTATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 128 ASIA PACIFIC: HYPERSCALE COMPUTING TRAINING, SUPPORT, AND MAINTENANCE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 129 ASIA PACIFIC: HYPERSCALE COMPUTING TRAINING, SUPPORT, AND MAINTENANCE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 130 ASIA PACIFIC: HYPERSCALE COMPUTING MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 131 ASIA PACIFIC: HYPERSCALE COMPUTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 132 ASIA PACIFIC: HYPERSCALE COMPUTING MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 133 ASIA PACIFIC: HYPERSCALE COMPUTING MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 134 ASIA PACIFIC: HYPERSCALE COMPUTING MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 135 ASIA PACIFIC: HYPERSCALE COMPUTING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 136 CHINA: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 137 CHINA: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 138 CHINA: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 139 CHINA: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 140 JAPAN: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 141 JAPAN: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 142 JAPAN: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 143 JAPAN: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 144 INDIA: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 145 INDIA: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 146 INDIA: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 147 INDIA: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 148 REST OF ASIA PACIFIC: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 149 REST OF ASIA PACIFIC: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 150 REST OF ASIA PACIFIC: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 151 REST OF ASIA PACIFIC: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: HYPERSCALE COMPUTING SOLUTIONS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: HYPERSCALE COMPUTING SOLUTIONS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: HYPERSCALE COMPUTING SERVICES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: HYPERSCALE COMPUTING SERVICES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: HYPERSCALE COMPUTING CONSULTING MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: HYPERSCALE COMPUTING CONSULTING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: HYPERSCALE COMPUTING INTEGRATION & IMPLEMENTATION MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: HYPERSCALE COMPUTING INTEGRATION & IMPLEMENTATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: HYPERSCALE COMPUTING TRAINING, SUPPORT, AND MAINTENANCE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: HYPERSCALE COMPUTING TRAINING, SUPPORT, AND MAINTENANCE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: HYPERSCALE COMPUTING MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: HYPERSCALE COMPUTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: HYPERSCALE COMPUTING MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: HYPERSCALE COMPUTING MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: HYPERSCALE COMPUTING MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: HYPERSCALE COMPUTING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 172 KSA: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 173 KSA: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 174 KSA: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 175 KSA: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 176 UAE: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 177 UAE: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 178 UAE: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 179 UAE: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 180 REST OF MIDDLE EAST & AFRICA: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 181 REST OF MIDDLE EAST & AFRICA: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 182 REST OF MIDDLE EAST & AFRICA: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 183 REST OF MIDDLE EAST & AFRICA: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 184 LATIN AMERICA: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 185 LATIN AMERICA: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 186 LATIN AMERICA: HYPERSCALE COMPUTING SOLUTIONS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 187 LATIN AMERICA: HYPERSCALE COMPUTING SOLUTIONS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 188 LATIN AMERICA: HYPERSCALE COMPUTING SERVICES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 189 LATIN AMERICA: HYPERSCALE COMPUTING SERVICES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 190 LATIN AMERICA: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 191 LATIN AMERICA: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 192 LATIN AMERICA: HYPERSCALE COMPUTING CONSULTING MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 193 LATIN AMERICA: HYPERSCALE COMPUTING CONSULTING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 194 LATIN AMERICA: HYPERSCALE COMPUTING INTEGRATION & IMPLEMENTATION MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 195 LATIN AMERICA: HYPERSCALE COMPUTING INTEGRATION & IMPLEMENTATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 196 LATIN AMERICA: HYPERSCALE COMPUTING TRAINING, SUPPORT, AND MAINTENANCE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 197 LATIN AMERICA: HYPERSCALE COMPUTING TRAINING, SUPPORT, AND MAINTENANCE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 198 LATIN AMERICA: HYPERSCALE COMPUTING MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 199 LATIN AMERICA: HYPERSCALE COMPUTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 200 LATIN AMERICA: HYPERSCALE COMPUTING MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 201 LATIN AMERICA: HYPERSCALE COMPUTING MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 202 LATIN AMERICA: HYPERSCALE COMPUTING MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 203 LATIN AMERICA: HYPERSCALE COMPUTING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 204 BRAZIL: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 205 BRAZIL: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 206 BRAZIL: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 207 BRAZIL: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 208 MEXICO: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 209 MEXICO: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 210 MEXICO: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 211 MEXICO: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 212 REST OF LATIN AMERICA: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 213 REST OF LATIN AMERICA: HYPERSCALE COMPUTING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 214 REST OF LATIN AMERICA: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 215 REST OF LATIN AMERICA: HYPERSCALE COMPUTING MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 216 MARKET SHARE OF KEY VENDORS IN 2022

- TABLE 217 OVERALL COMPANY FOOTPRINT FOR KEY PLAYERS

- TABLE 218 OVERALL COMPANY FOOTPRINT FOR STARTUPS/SMES

- TABLE 219 KEY STARTUPS/SMES

- TABLE 220 HYPERSCALE COMPUTING MARKET: PRODUCT LAUNCHES/ENHANCEMENTS, 2020-2023

- TABLE 221 HYPERSCALE COMPUTING MARKET: DEALS, 2020–2023

- TABLE 222 AWS: BUSINESS OVERVIEW

- TABLE 223 AWS: PRODUCTS/SERVICES OFFERED

- TABLE 224 AWS: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 225 AWS: DEALS

- TABLE 226 GOOGLE: BUSINESS OVERVIEW

- TABLE 227 GOOGLE: PRODUCTS/SERVICES OFFERED

- TABLE 228 GOOGLE: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 229 GOOGLE: DEALS

- TABLE 230 MICROSOFT CORPORATION: BUSINESS OVERVIEW

- TABLE 231 MICROSOFT CORPORATION: PRODUCTS/SERVICES OFFERED

- TABLE 232 MICROSOFT CORPORATION: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 233 MICROSOFT CORPORATION: DEALS

- TABLE 234 IBM CORPORATION: BUSINESS OVERVIEW

- TABLE 235 IBM CORPORATION: PRODUCTS/SERVICES OFFERED

- TABLE 236 IBM CORPORATION: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 237 IBM CORPORATION: DEALS

- TABLE 238 ALIBABA CLOUD: BUSINESS OVERVIEW

- TABLE 239 ALIBABA CLOUD: PRODUCTS/SERVICES OFFERED

- TABLE 240 ALIBABA CLOUD: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 241 ALIBABA CLOUD: DEALS

- TABLE 242 ORACLE CORPORATION: BUSINESS OVERVIEW

- TABLE 243 ORACLE CORPORATION: PRODUCT/SERVICES OFFERED

- TABLE 244 ORACLE CORPORATION: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 245 ORACLE CORPORATION: DEALS

- TABLE 246 HPE: BUSINESS OVERVIEW

- TABLE 247 HPE: PRODUCTS/SERVICES OFFERED

- TABLE 248 HPE: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 249 HPE: DEALS

- TABLE 250 TENCENT CLOUD: BUSINESS OVERVIEW

- TABLE 251 TENCENT CLOUD: PRODUCTS/SERVICES OFFERED

- TABLE 252 TENCENT CLOUD: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 253 TENCENT CLOUD: DEALS

- TABLE 254 SALESFORCE: BUSINESS OVERVIEW

- TABLE 255 SALESFORCE: PRODUCTS/SERVICES OFFERED

- TABLE 256 SALESFORCE: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 257 SALESFORCE: DEALS

- TABLE 258 HUAWEI: BUSINESS OVERVIEW

- TABLE 259 HUAWEI: PRODUCTS/SERVICES OFFERED

- TABLE 260 HUAWEI: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 261 HUAWEI: DEALS

- TABLE 262 CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2017–2021 (USD BILLION)

- TABLE 263 CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2022–2027 (USD BILLION)

- TABLE 264 IAAS: CLOUD COMPUTING MARKET, BY REGION, 2017–2021 (USD BILLION)

- TABLE 265 IAAS: CLOUD COMPUTING MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 266 PAAS: CLOUD COMPUTING MARKET, BY REGION, 2017–2021 (USD BILLION)

- TABLE 267 PAAS: CLOUD COMPUTING MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 268 SAAS: CLOUD COMPUTING MARKET, BY REGION, 2017–2021 (USD BILLION)

- TABLE 269 SAAS: CLOUD COMPUTING MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 270 HYPERSCALE DATA CENTER MARKET, BY COMPONENT, 2015–2022 (USD BILLION)

- TABLE 271 SOLUTIONS: HYPERSCALE DATA CENTER MARKET, BY TYPE, 2015–2022 (USD BILLION)

- TABLE 272 SERVER MARKET, BY REGION, 2015–2022 (USD BILLION)

- TABLE 273 STORAGE MARKET, BY REGION, 2015–2022 (USD BILLION)

- TABLE 274 NETWORKING MARKET, BY REGION, 2015–2022 (USD BILLION)

- TABLE 275 SOFTWARE MARKET, BY REGION, 2015–2022 (USD BILLION)

- TABLE 276 SERVICES: HYPERSCALE DATA CENTER MARKET, BY TYPE, 2015–2022 (USD BILLION)

- TABLE 277 CONSULTING MARKET, BY REGION, 2015–2022 (USD BILLION)

- TABLE 278 INSTALLATION & DEPLOYMENT MARKET, BY REGION, 2015–2022 (USD BILLION)

- TABLE 279 MAINTENANCE & SUPPORT MARKET, BY REGION, 2015–2022 (USD BILLION)

- FIGURE 1 HYPERSCALE COMPUTING MARKET: RESEARCH DESIGN

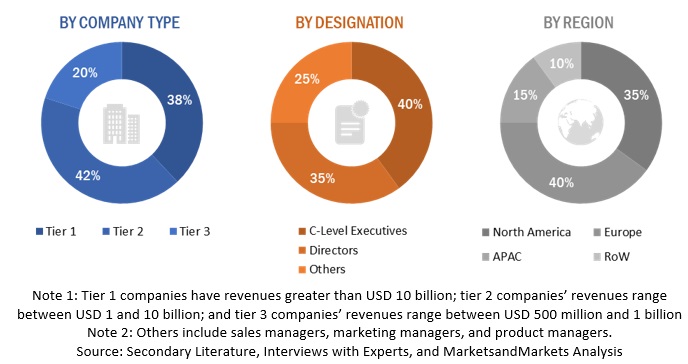

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 DATA TRIANGULATION

- FIGURE 4 HYPERSCALE COMPUTING MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY-SIDE): REVENUE OF HYPERSCALE COMPUTING FROM VENDORS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH 2 (SUPPLY-SIDE): COLLECTIVE REVENUE OF HYPERSCALE COMPUTING FROM VENDORS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY – (DEMAND-SIDE): ILLUSTRATION OF VENDOR REVENUE ESTIMATION

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY – (SUPPLY-SIDE): CAGR PROJECTIONS FROM SUPPLY SIDE

- FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2 (DEMAND-SIDE): REVENUE GENERATED FROM HYPERSCALE COMPUTING COMPONENT

- FIGURE 10 HYPERSCALE COMPUTING MARKET, MARKET SNAPSHOT, 2020–2028

- FIGURE 11 TOP MARKET SEGMENTS IN TERMS OF GROWTH RATE

- FIGURE 12 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2028

- FIGURE 13 TRAINING, SUPPORT, AND MAINTENANCE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2028

- FIGURE 14 CLOUD COMPUTING SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2028

- FIGURE 15 IT & TELECOM SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2028

- FIGURE 16 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 17 DRASTIC GEOGRAPHIC CHANGES AND TECHNOLOGICAL EVOLUTION TO DRIVE HYPERSCALE COMPUTING’S ARCHIVING GROWTH

- FIGURE 18 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 19 TRAINING, SUPPORT, AND MAINTENANCE SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 20 CLOUD COMPUTING SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 21 IT & TELECOM TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 22 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

- FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: HYPERSCALE COMPUTING MARKET

- FIGURE 24 HYPERSCALE COMPUTING MARKET: ECOSYSTEM

- FIGURE 25 HYPERSCALE COMPUTING MARKET: VALUE CHAIN

- FIGURE 26 NUMBER OF PATENTS PUBLISHED, 2012-2022

- FIGURE 27 TOP TEN PATENT APPLICANTS IN 2022

- FIGURE 28 HYPERSCALE COMPUTING MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 29 HYPERSCALE COMPUTING MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP APPLICATIONS

- FIGURE 31 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 32 HYPERSCALE COMPUTING MARKET: BUSINESS MODELS

- FIGURE 33 SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 TRAINING, SUPPORT, AND MAINTENANCE SEGMENT TO REGISTER HIGHER GROWTH TILL 2028

- FIGURE 35 CLOUD COMPUTING SEGMENT TO SHOW FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 36 RETAIL & CONSUMER GOODS SEGMENT TO GROW HIGHEST DURING FORECAST PERIOD

- FIGURE 37 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2028

- FIGURE 38 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 39 ASIA PACIFIC: REGIONAL SNAPSHOT

- FIGURE 40 OVERVIEW OF STRATEGIES ADOPTED BY KEY VENDORS

- FIGURE 41 HYPERSCALE COMPUTING MARKET: MARKET SHARE ANALYSIS

- FIGURE 42 HISTORICAL REVENUE ANALYSIS, 2018–2022 (USD MILLION)

- FIGURE 43 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 44 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- FIGURE 45 EVALUATION MATRIX FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- FIGURE 46 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2022

- FIGURE 47 COMPANY FINANCIAL METRICS, 2022

- FIGURE 48 HYPERSCALE COMPUTING MARKET: GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS, 2022

- FIGURE 49 AWS: COMPANY SNAPSHOT

- FIGURE 50 GOOGLE: COMPANY SNAPSHOT

- FIGURE 51 MICROSOFT CORPORATION: COMPANY SNAPSHOT

- FIGURE 52 IBM CORPORATION: COMPANY SNAPSHOT

- FIGURE 53 ALIBABA CLOUD: COMPANY SNAPSHOT

- FIGURE 54 ORACLE CORPORATION: COMPANY SNAPSHOT

- FIGURE 55 HPE: COMPANY SNAPSHOT

- FIGURE 56 TENCENT CLOUD: COMPANY SNAPSHOT

- FIGURE 57 SALESFORCE: COMPANY SNAPSHOT

- FIGURE 58 HUAWEI: COMPANY SNAPSHOT

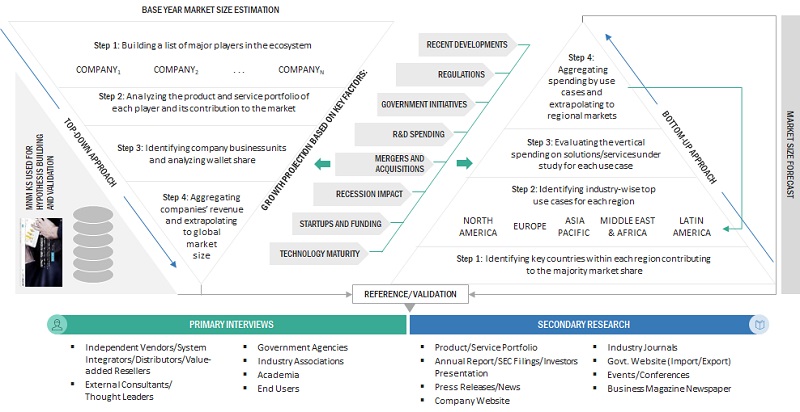

This research study involved extensive secondary sources, directories, and paid databases, to identify and collect information useful for this technical, market-oriented, and commercial study of the hyperscale computing market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the market prospects. The following figure highlights the market research methodology in developing this report on the hyperscale computing market.

Secondary Research

The market size of companies offering hyperscale computing solutions was derived based on the secondary data available through paid and unpaid sources and by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their solution capabilities and business strategies. In the secondary research process, various sources were referred to for identifying and collecting information for the study. Secondary sources included annual reports, press releases, investor presentations of companies and product data sheets; white papers; journals; certified publications; and articles from recognized authors, government websites, directories, and databases.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives; all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from hyperscale computing vendors, industry associations, and independent consultants; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technology and region. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), the installation teams of end users using hyperscale computing solutions, and digital initiatives project teams, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current use of hyperscale computing solution, which would affect the overall hyperscale computing market.

The Breakup of Primary Profiles:

To know about the assumptions considered for the study, download the pdf brochure

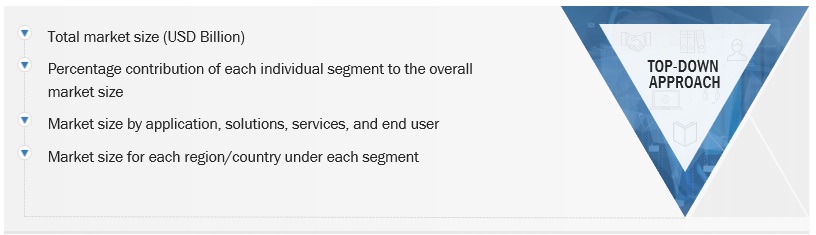

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and forecast the hyperscale computing market and other dependent submarkets. The bottom-up procedure was deployed to arrive at the overall market size using the revenues and offerings of the key companies in the market. With data triangulation methods and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

Top Down and Bottom Up Approach of Hyperscale Computing Market

To know about the assumptions considered for the study, Request for Free Sample Report

The top-down and bottom-up approaches were used to estimate and validate the size of the hyperscale computing market and various other dependent subsegments. The research methodology used to estimate the market size included the following:

Key players in the market were identified through secondary research, and their revenue contributions in respective countries were determined through primary and secondary research.

This entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives.

All percentage splits, and breakups were determined using secondary sources and verified through primary sources.

Top Down Approach of Hyperscale Computing Market

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size—using the market size estimation processes as explained above. Where applicable, data triangulation and market breakdown procedures were employed to complete the overall market engineering process and determine the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from government agencies’ demand and supply sides.

Market Definition

Hyperscale Computing refers to the ability to scale computing resources, such as processing power, storage, and networking, to a massive scale. It is not limited to the cloud but can be applied in various computing environments, including both cloud and on-premises setups. Hyperscale computing involves designing and deploying distributed computing architectures that can handle large workloads and data sets. It often requires the use of technologies like distributed file systems, parallel processing, load balancing, and fault-tolerant designs. The aim is to achieve high-performance computing capabilities by distributing the workload across a large number of interconnected servers or data centers. Inclusions and exclusions

Key Stakeholders

- Information Technology (IT) service providers

- IT infrastructure equipment providers

- System integrators

- Consulting service providers

- Cloud service providers

- Data center vendors

- Colocation providers

- Government and standardization bodies

Report Objectives

- To define, describe, and forecast the hyperscale computing market by offerings (solution and services), application, vertical, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the market with respect to individual growth trends, prospects, and contributions to the overall market

- To forecast the market size of five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To profile the key players in the market and comprehensively analyze their core competencies in each subsegment

- To analyze the competitive developments, such as partnerships, acquisitions, and product/solution launches and enhancements, in the hyperscale computing market

- To analyze the impact of the recession on the global hyperscale computing market

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakup of the hyperscale computing market

Company Information

- Detailed analysis and profiling of five additional market players

Growth opportunities and latent adjacency in Hyperscale Computing Market