Hygroscopic Building Material Market by Adsorption Process, End Use, Type (Inorganic Minerals, Inorganic Salts, Natural Materials, Molecular Sieve, Silica/Silicon Dioxide), Application (Building Material, Structural) and Region - Global Forecast to 2027

Updated on : August 07, 2024

Hygroscopic Building Material Market

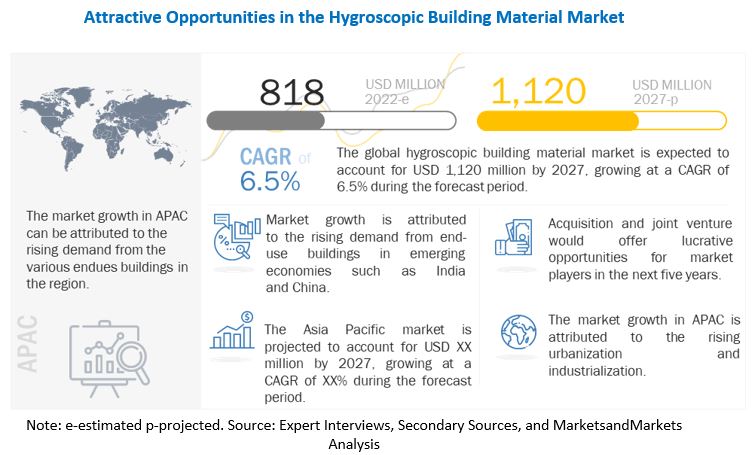

The hygroscopic building material market was valued at USD 818 million in 2022 and is projected to reach USD 1,120 million by 2027, growing at 6.5% cagr from 2022 to 2027. Increasing demand for hygroscopic building materials from emerging markets and growth in construction industry are driving the market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on global hygroscopic building material market

Since Western Europe has been one of the most heavily-impacted regions by the COVID-19 pandemic, it is no surprise that the lockdown and general containment measures imposed to delay its spread had a significant impact on the European construction sector. According to first estimates from Eurostat, the European Union's statistical office, seasonally-adjusted production in the EU construction industry fell by 11.7% MoM (Month on Month) in April 2020. At a global level, the supply chain has been disrupted in various ways in different parts of the world. The supply of construction material was halted due to the travel restriction and disruption in the supply chain.

Hygroscopic Building Material Market Dynamics

Driver: Rising demand from emerging markets

The Asia Pacific region witnessed high industrial growth in the past decade. This resulted in increased demand for hygroscopic materials in various applications. The region's developing countries, such as China and India, are expected to witness substantial growth in the hygroscopic building material market due to increased demand for the residential, commercial, and industrial construction. The changing lifestyle of people and the need for pleasant working and residential environments are also influencing the market. These factors are expected to boost the hygroscopic building material market in the Asia Pacific during the forecast period.

Restraint: Environmental and safety concerns

Hygroscopic materials sometimes, when mixed with concrete, cause a bleeding effect. This occurs when the concentration of hygroscopic material used as an additive is unstable, and thus, excess humidity is captured and stored in the structure. This can affect the stability of the building and can be hazardous to the people occupying the building. Furthermore, materials such as silica, when disposed of irresponsibly, can remain in the landfill or ocean for a long time without degrading. This can have a long-lasting effect on the environment. Overexposure to silica can also cause silicosis, a long-term lung disease. Silicosis caused by the inhalation of crystalline silica dust is the most common form of pneumoconiosis. Silicosis a diagnosed as a silent killer for workers in most parts of the world. Silica/Silicon Dioxide can also have a choking effect if consumed. Such factors can have an adverse effect on the environment and the safety of people.

Opportunity: Increasing population and rapid urbanization

According to the United Nations Department of Economic and Social Affairs/Population Division and World Population 2019, the global population is projected to reach 9.5 billion by 2050. The ever-increasing population and the industrial boom after the economic slowdown have escalated new construction in the commercial and residential sectors. The migration of the rural population to urban areas and the conversion of towns into cities have further fueled the growth of the hygroscopic building material market.

According to the Population Reference Bureau, China, India, and other Asian countries accounted for a combined population exceeding 4.6 billion in 2020. While in 2019, the APAC Human Development Report published by the United Nations Development Programme projected that the total population in the Asia Pacific is expected to reach 4.99 billion by 2050, of which 64% is projected to be urban. The rapidly rising household incomes and the increasing middle-class population is expected to propel the demand for new construction projects during the next two decades.

Challenge: Depletion of raw materials

The primary raw materials used in manufacturing hygroscopic materials are coal, bauxite, silicate, zeolite, and clay. All these mineral resources are naturally available; therefore, to preserve them, these raw materials' excess extraction and mining are not suitable. Since there are finite mineral resources, the exponential growth and expanding consumption are unmanageable. These depleting mineral resources can be a major challenge to the hygroscopic building material market.

In terms of value, the building material segment is projected to account for the largest share of the hygroscopic building material market, by application, during the forecast period.

The building material segment dominated the hygroscopic building material market, with a share of 60.4% in terms of value, of the overall market in 2021. Amorphous silica, activated alumina, and calcium oxides are mostly used among building materials due to their excellent moisture adsorbing ability and vast applications in concrete materials and dewatering additives. Concrete is a construction material composed of cement, fine aggregates (sand), and coarse aggregates mixed with water which hardens with time. The durability of concrete materials and structures is strongly affected by cracks that are mostly induced by poor volume stability and factors such as freeze-thawing, carbonization, alkali-aggregate reactions, chemical attacks, and rebar corrosion that affects durability.

In terms of value, the inorganic salts is projected to account for the fastest growth of the hygroscopic building material market, by type, during the forecast period.

Based on type, the inorganic salts segment accounted for the fastest growth at a CAGR of 6.8% during the forecast period. Calcium Chloride is one of the widely used inorganic salts. Calcium chloride has high efficiency compared to other types of hygroscopic materials, such as silica/silicon dioxide and clay, and finds a range of applications in the building & construction industry, such as dust control, gravel stabilization, concrete acceleration, and others. In these applications, calcium chloride attracts moisture from the air (and retains moisture applied during construction and maintenance operations) to bind fine and coarse gravel particles together, preventing road degradation.

APAC is expected to be the fastest-growing market during the forecast period.

Based on region, Asia Pacific is a key market for the production of hygroscopic building material and is projected to grow at a CAGR of 7.0% in terms of value during the forecasted period. The availability of low-cost raw materials and labor, coupled with increasing domestic demand, makes the region an attractive investment destination for hygroscopic building material manufacturers. The rising population, urbanization, industrialization, and growing concerns related to infrastructure development in China and India are some of the factors that will drive the hygroscopic building material market in this region.

To know about the assumptions considered for the study, download the pdf brochure

Hygroscopic Building Material Market Players

Major players operating in the global hygroscopic building material market include Porocel Corporation (US), W.R. Grace (US), Clariant (Switzerland), BASF SE (Germany), Arkema SA (France), Honeywell International (UK), Jalon Chemicals (China), Hengye Inc (US), Dessica Chemicals (India), and Fuji Silysia Chemical Ltd. (Japan).

Hygroscopic Building Material Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 818 million |

|

Revenue Forecast in 2027 |

USD 1,120 million |

|

CAGR |

6.5% |

|

Years considered for the study |

2020–2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD Million), Volume (Kiloton) |

|

Segments |

Type, Adsorption Process, Enduse, Application, and Region |

|

Regions |

North America, Europe, Asia Pacific, South America and Middle East & Africa |

|

Companies |

Porocel Corporation (US), W.R. Grace (US), Clariant (Switzerland), BASF SE (Germany), Arkema SA (France), Honeywell International (UK), Jalon Chemicals (China), Hengye Inc. (US), Dessica Chemicals (India), and Fuji Silysia Chemical Ltd. (Japan). |

This research report categorizes the hygroscopic building material market based on type, design, material, flow type, technology, application and region.

Based on Adsorption Process:

- Physical Adsorption

- Chemical Adsorption

Based on Enduse:

- Commercial

- Residential

- Industrial

Based on Type:

- Inorganic Minerals/Clays

- Inorganic Salts

- Natural Hygroscopic Materials

- Molecular Sieve

- Silica/Silicon Dioxide

- Others

Based on Application:

- Building Material

- Structural Application

Based on Region:

- Asia Pacific

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In June 2021, This acquisition is favorable for the materials technologies business segment of W.R. Grace. Fine Chemistry Business adds innovative and manufacturing capabilities to the company.

- In June 2018, The joint venture between Porocel Innovation and Zhejiang Rebirth leveraged Porocel Corporation with many years of experience and leadership in the Chinese market. This expanded their presence in the Asia region.

FAQs:

What are the factors influencing the growth of the hygroscopic building material market?

The growth of this market can be attributed to rising demand in the emerging countries undergoing industrialization and the growth of the construction industry.

Which are the key applications driving the hygroscopic building material market?

The sectors driving the demand for hygroscopic building material market are building materials and structural applications.

Who are the major manufacturers?

Major manufacturers include Porocel Corporation (US), W.R. Grace (US), Clariant (Switzerland), BASF SE (Germany), Arkema SA (France), Honeywell International (UK), Jalon Chemicals (China), Hengye Inc (US), Dessica Chemicals (India), and Fuji Silysia Chemical Ltd. (Japan), among others.

What is the biggest restraint for hygroscopic building material?

The biggest restraint can be environmental and safety concerns.

How is COVID-19 affecting the overall hygroscopic building material market?

The hygroscopic building material market saw a disruption in supply chain in its many industries.

What will be the growth prospects of the hygroscopic building material market?

Growth in developing countries and increasing population & rapid urbanization are driving the market..

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 HYGROSCOPIC BUILDING MATERIAL MARKET: INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.4 REGIONS COVERED

1.4.1 YEARS CONSIDERED

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 1 HYGROSCOPIC BUILDING MATERIAL MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Primary interviews – demand and supply-side

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 2 HYGROSCOPIC BUILDING MATERIAL MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 3 HYGROSCOPIC BUILDING MATERIAL MARKET: TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: HYGROSCOPIC BUILDING MATERIAL MARKET BOTTOM-UP APPROACH

2.3 FORECAST NUMBER CALCULATION

FIGURE 5 DEMAND-SIDE FORECAST PROJECTIONS

2.4 DATA TRIANGULATION

FIGURE 6 HYGROSCOPIC BUILDING MATERIAL MARKET: DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.6 ASSUMPTIONS

2.7 LIMITATIONS & RISKS ASSOCIATED WITH HYGROSCOPIC BUILDING MATERIAL MARKET

3 EXECUTIVE SUMMARY (Page No. - 38)

FIGURE 7 COMMERCIAL END-USE TO LEAD HYGROSCOPIC BUILDING MATERIAL MARKET DURING FORECAST PERIOD

FIGURE 8 BUILDING MATERIAL APPLICATION OF HYGROSCOPIC MATERIAL TO LEAD MARKET

FIGURE 9 INORGANIC MINERALS/CLAYS TO DOMINATE HYGROSCOPIC BUILDING MATERIAL MARKET BETWEEN 2022 AND 2027

FIGURE 10 ASIA PACIFIC LED HYGROSCOPIC BUILDING MATERIAL MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 41)

4.1 SIGNIFICANT OPPORTUNITIES IN HYGROSCOPIC BUILDING MATERIAL MARKET

FIGURE 11 HIGH GROWTH POTENTIAL IN ASIA PACIFIC REGION TO DRIVE MARKET

4.2 ASIA PACIFIC: HYGROSCOPIC BUILDING MATERIAL MARKET, BY APPLICATION AND COUNTRY, 2021

FIGURE 12 BUILDING MATERIAL APPLICATION DOMINATED MARKET IN ASIA PACIFIC

4.3 HYGROSCOPIC BUILDING MATERIAL MARKET, BY TYPE

FIGURE 13 INORGANIC MINERALS/CLAYS TO LEAD HYGROSCOPIC BUILDING MATERIAL MARKET IN TERMS OF VOLUME

4.4 HYGROSCOPIC BUILDING MATERIAL MARKET, BY END-USE

FIGURE 14 COMMERICAL USE OF HYGROSCOPIC BUILDING MATERIAL TO LEAD MARKET IN TERMS OF VOLUME

4.5 HYGROSCOPIC BUILDING MATERIALS MARKET, BY COUNTRY

FIGURE 15 INDIA TO BE FASTEST-GROWING HYGROSCOPIC BUILDING MATERIAL MARKET

5 MARKET OVERVIEW (Page No. - 44)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, CHALLENGES, AND OPPORTUNITIES IN HYGROSCOPIC BUILDING MATERIAL MARKET

5.2.1 DRIVERS

5.2.1.1 Rising demand from emerging markets

5.2.1.2 Growth of construction industry globally

5.2.2 RESTRAINTS

5.2.2.1 Environmental and safety concerns

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing population and rapid urbanization

5.2.3.2 Increase in residential, industrial, and commercial construction

5.2.4 CHALLENGES

5.2.4.1 Depletion of raw materials

5.3 PORTER'S FIVE FORCES ANALYSIS

FIGURE 17 HYGROSCOPIC BUILDING MATERIAL MARKET: PORTER'S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 THREAT OF NEW ENTRANTS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 1 HYGROSCOPIC BUILDING MATERIAL MARKET: PORTER'S FIVE FORCES ANALYSIS

5.4 VALUE CHAIN ANALYSIS

5.4.1 RAW MATERIAL SUPPLIERS

5.4.2 MANUFACTURERS

5.4.3 FORMULATORS

5.4.4 END CONSUMERS

FIGURE 18 HYGROSCOPIC BUILDING MATERIAL MARKET: VALUE CHAIN

5.5 RAW MATERIAL ANALYSIS

5.5.1 CONCRETE

5.5.2 SILICON DI-OXIDE

5.5.3 ZEOLITE

5.6 TRADE ANALYSIS

TABLE 2 IMPORT TRADE DATA FOR ACTIVATED CARBON FOR TOP TEN COUNTRIES, 2016–2020 (USD THOUSAND)

TABLE 3 EXPORT TRADE DATA FOR ACTIVATED CARBON FOR TOP TEN COUNTRIES, 2016–2020 (USD THOUSAND)

TABLE 4 IMPORT TRADE DATA FOR BENTONITE FOR TOP TEN COUNTRIES, 2016–2020 (USD THOUSAND)

TABLE 5 EXPORT TRADE DATA FOR BENTONITE FOR TOP TEN COUNTRIES, 2016–2020 (USD THOUSAND)

TABLE 6 IMPORT TRADE DATA FOR CALCIUM CHLORIDE FOR TOP TEN COUNTRIES, 2016–2020 (USD THOUSAND)

TABLE 7 EXPORT TRADE DATA FOR CALCIUM CHLORIDE FOR TOP TEN COUNTRIES, 2016–2020 (USD THOUSAND)

5.7 ECOSYSTEM MAPPING

FIGURE 19 ECOSYSTEM OF HYGROSCOPIC BUILDING MATERIAL MARKET

TABLE 8 HYGROSCOPIC BUILDING MATERIAL: ECOSYSTEM

5.8 MACROECONOMIC ANALYSIS

TABLE 9 PROJECTED REAL GDP GROWTH (ANNUAL PERCENT CHANGE) OF KEY COUNTRIES, 2018–2025

5.9 COVID-19 IMPACT ANALYSIS

5.9.1 COVID-19 ECONOMIC ASSESSMENT

5.9.2 EFFECTS ON GDPS OF COUNTRIES

5.9.3 CONFIRMED CASES AND DEATHS, BY GEOGRAPHY

FIGURE 20 IMPACT OF COVID-19, BASED ON COUNTRY

5.9.4 IMPACT ON END-USE INDUSTRIES

5.10 CASE STUDY ANALYSIS

5.10.1 BASF SE

5.11 TECHNOLOGY ANALYSIS

5.11.1 SUPERABSORBENT POLYMERS (SAP)

5.11.2 EARTH BRICKS

5.12 TARIFFS & REGULATIONS

5.12.1 ASIA PACIFIC

5.12.2 EUROPE

5.12.3 NORTH AMERICA

5.12.3.1 US

5.12.3.2 Canada

5.13 OPERATIONAL DATA

TABLE 10 CEMENT PRODUCTION, BY COUNTRY (THOUSAND METRIC TONS)

5.14 AVERAGE SELLING PRICE ANALYSIS

FIGURE 21 HYGROSCOPIC BUILDING MATERIAL AVERAGE REGIONAL PRICE

FIGURE 22 AVERAGE YEARLY PRICING, BY TYPE

5.15 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

FIGURE 23 REVENUE SHIFT FOR HYGROSCOPIC MATERIAL MANUFACTURERS

5.16 PATENT ANALYSIS

5.16.1 METHODOLOGY

5.16.2 DOCUMENT TYPE

TABLE 11 TOTAL NUMBER OF PATENTS

FIGURE 24 TOTAL NUMBER OF PATENTS

5.16.3 PUBLICATION TRENDS, LAST 10 YEARS

FIGURE 25 NUMBER OF PATENTS YEAR-WISE FROM 2011 TO 2021

5.16.4 INSIGHTS

5.16.5 LEGAL STATUS OF PATENTS

FIGURE 26 PATENT ANALYSIS, BY LEGAL STATUS

5.16.6 JURISDICTION ANALYSIS

FIGURE 27 TOP JURISDICTION – BY DOCUMENT

5.16.7 TOP COMPANIES/APPLICANTS

FIGURE 28 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

5.16.7.1 Patents

TABLE 12 LIST OF PATENTS

6 HYGROSCOPIC BUILDING MATERIAL MARKET, BY ADSORPTION PROCESS (Page No. - 67)

6.1 INTRODUCTION

6.2 PHYSICAL ADSORPTION

6.3 CHEMICAL ADSORPTION

7 HYGROSCOPIC BUILDING MATERIAL MARKET, BY END-USE (Page No. - 68)

7.1 INTRODUCTION

FIGURE 29 COMMERCIAL END-USE TO ACCOUNT FOR LARGEST MARKET SHARE TILL 2027

TABLE 13 HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY END-USE, 2020–2027 (USD MILLION)

TABLE 14 HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY END-USE, 2020–2027 (KILOTON)

7.2 COMMERCIAL

7.2.1 INCREASE IN RETAIL, OFFICE SPACES, AND HOTELS IS CONTRIBUTING TO GROWTH OF COMMERCIAL BUILDINGS

7.3 RESIDENTIAL

7.3.1 URBANIZATION AND MIGRATION OF PEOPLE COUPLED WITH INCREASING POPULATION ARE DRIVING DEMAND

7.4 INDUSTRIAL

7.4.1 INCREASE IN INDUSTRIALIZATION TO DRIVE INDUSTRIAL BUILDINGS SEGMENT

8 HYGROSCOPIC BUILDING MATERIAL MARKET, BY TYPE (Page No. - 72)

8.1 INTRODUCTION

FIGURE 30 INORGANIC MINERALS/CLAYS ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

TABLE 15 HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 16 HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY TYPE, 2020–2027 (KILOTON)

8.2 INORGANIC MINERALS AND CLAYS

8.2.1 INCREASING DEMAND FOR ACTIVATED ALUMINA AND BENTONITE CLAY IS DRIVING MARKET

8.2.2 BENTONITE CLAY

8.2.3 ACTIVATED ALUMINA

8.2.4 KAOLIN

8.2.5 KIESELGUHR

8.2.6 SEPIOLITE

8.3 INORGANIC SALTS

8.3.1 GROWING USE OF CALCIUM CHLORIDE AND CALCIUM OXIDE IN BUILDING CONCRETE MATERIALS IS DRIVING DEMAND

8.3.2 CALCIUM OXIDE

8.3.3 CALCIUM CHLORIDE

8.4 NATURAL HYGROSCOPIC MATERIALS

8.4.1 RENEWED INTEREST IN NATURAL HYGROSCOPIC MATERIALS DUE TO RECENT DEMAND FOR SUSTAINABLE MATERIALS IN CONSTRUCTION PROCESSES

8.4.2 ACTIVATED CARBONS

8.4.3 WOOD

8.5 MOLECULAR SIEVE

8.5.1 ZEOLITE-BASED MOLECULAR SIEVES ARE MOST COMMONLY USED HYGROSCOPIC BUILDING MATERIALS

8.6 SILICA/SILICON DIOXIDE

8.6.1 USE OF SILICA IN ASPHALT, BRICK, CEMENT, CONCRETE, DRYWALL, GROUT, MORTAR, AND TILE IS PROPELLING DEMAND

8.7 OTHERS

8.7.1 POLYMER

8.7.2 STRAW

9 HYGROSCOPIC BUILDING MATERIAL MARKET, BY APPLICATION (Page No. - 79)

9.1 INTRODUCTION

FIGURE 31 BUILDING MATERIAL SEGMENT ACCOUNTS FOR LARGER MARKET SHARE IN 2022

TABLE 17 HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 18 HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

9.2 BUILDING MATERIAL

9.2.1 AMORPHOUS SILICA, ACTIVATED ALUMINA, AND CALCIUM OXIDES ARE MOSTLY USED FOR THEIR SUPERIOR MOISTURE ADSORBING ABILITY

9.2.2 CONCRETE MATERIAL

9.2.3 DEWATERING ADDITIVES

9.2.4 WATER RETENTION SHEETS

9.2.5 WATER RETENTION TAPES

9.2.6 OTHERS

9.3 STRUCTURAL APPLICATION

9.3.1 ROOFING APPLICATION ACCOUNTS FOR SIGNIFICANT SHARE OF HYGROSCOPIC BUILDING MATERIAL

9.3.2 ROOF

9.3.3 WALL

9.3.4 OTHERS

10 HYGROSCOPIC BUILDING MATERIAL MARKET, BY REGION (Page No. - 84)

10.1 INTRODUCTION

FIGURE 32 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

TABLE 19 HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 20 HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

10.2 ASIA PACIFIC

FIGURE 33 ASIA PACIFIC: HYGROSCOPIC BUILDING MATERIAL MARKET SNAPSHOT

TABLE 21 ASIA PACIFIC: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 22 ASIA PACIFIC: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 23 ASIA PACIFIC: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 24 ASIA PACIFIC: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.2.1 CHINA

10.2.1.1 Rising urbanization and industrialization to drive market

TABLE 25 CHINA: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 26 CHINA: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.2.2 INDIA

10.2.2.1 Government policies and projects likely to impact market growth

TABLE 27 INDIA: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 28 INDIA: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.2.3 JAPAN

10.2.3.1 Commercial construction to drive market growth

TABLE 29 JAPAN: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 30 JAPAN: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.2.4 SOUTH KOREA

10.2.4.1 Green initiatives and affordable housing to drive construction industry

TABLE 31 SOUTH KOREA: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 32 SOUTH KOREA: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.2.5 AUSTRALIA

10.2.5.1 Government investments to drive construction industry

TABLE 33 AUSTRALIA: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 34 AUSTRALIA: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.2.6 MALAYSIA

10.2.6.1 Development in transport infrastructure and commercial buildings to drive market

TABLE 35 MALAYSIA: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 36 MALAYSIA: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.2.7 REST OF ASIA PACIFIC

TABLE 37 REST OF ASIA PACIFIC: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 38 REST OF ASIA PACIFIC: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (VOLUME)

10.3 EUROPE

FIGURE 34 EUROPE: HYGROSCOPIC BUILDING MATERIAL MARKET SNAPSHOT

TABLE 39 EUROPE: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 40 EUROPE: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 41 EUROPE: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 42 EUROPE: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.3.1 GERMANY

10.3.1.1 New construction concepts to drive hygroscopic building material market

TABLE 43 GERMANY: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 44 GERMANY: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.3.2 ITALY

10.3.2.1 Upcoming construction projects to drive demand

TABLE 45 ITALY: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 46 ITALY: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.3.3 FRANCE

10.3.3.1 Budget assigned for construction industry to drive market

TABLE 47 FRANCE: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027(USD MILLION)

TABLE 48 FRANCE: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.3.4 SPAIN

10.3.4.1 Growth in infrastructure and real estate sectors to propel demand

TABLE 49 SPAIN: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 50 SPAIN: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.3.5 UK

10.3.5.1 Government policy to help in construction industry growth

TABLE 51 UK: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 52 UK: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.3.6 RUSSIA

10.3.6.1 Residential and commercial construction to boost demand for hygroscopic materials

TABLE 53 RUSSIA: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 54 RUSSIA: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.3.7 REST OF EUROPE

TABLE 55 REST OF EUROPE: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 56 REST OF EUROPE: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.4 NORTH AMERICA

FIGURE 35 NORTH AMERICA: HYGROSCOPIC BUILDING MATERIAL MARKET SNAPSHOT

TABLE 57 NORTH AMERICA: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 58 NORTH AMERICA: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 59 NORTH AMERICA: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 60 NORTH AMERICA HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.4.1 US

10.4.1.1 Construction of new complexes and buildings is propelling demand

TABLE 61 US: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 62 US: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.4.2 CANADA

10.4.2.1 Growing population to increase demand for new residential buildings

TABLE 63 CANADA: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 64 CANADA: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.4.3 MEXICO

10.4.3.1 Rising middle-class population to drive demand for new homes, factories, and offices

TABLE 65 MEXICO: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 66 MEXICO: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.5 MIDDLE EAST & AFRICA

TABLE 67 MIDDLE EAST & AFRICA: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 68 MIDDLE EAST & AFRICA: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 69 MIDDLE EAST & AFRICA: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 70 MIDDLE EAST & AFRICA HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.5.1 SAUDI ARABIA

10.5.1.1 Transition from oil-based economy to influence market for hygroscopic building materials

TABLE 71 SAUDI ARABIA HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 72 SAUDI ARABIA: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.5.2 UAE

10.5.2.1 Upcoming construction projects to drive market

TABLE 73 UAE: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 74 UAE HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.5.3 SOUTH AFRICA

10.5.3.1 Increasing foreign investments to create market opportunities

TABLE 75 SOUTH AFRICA: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 76 SOUTH AFRICA: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.5.4 QATAR

10.5.4.1 Upcoming projects to create opportunities for construction industry growth

TABLE 77 QATAR: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 78 QATAR: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.5.5 REST OF MIDDLE EAST & AFRICA

TABLE 79 REST OF MIDDLE EAST & AFRICA: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 80 REST OF MIDDLE EAST & AFRICA: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.6 SOUTH AMERICA

TABLE 81 SOUTH AMERICA: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 82 SOUTH AMERICA: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 83 SOUTH AMERICA: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 84 SOUTH AMERICA: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.6.1 BRAZIL

10.6.1.1 Government program to directly impact construction industry

TABLE 85 BRAZIL: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 86 BRAZIL: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.6.2 ARGENTINA

10.6.2.1 Growing urban population is resulting in significant increase in residential and commercial buildings

TABLE 87 ARGENTINA: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 88 ARGENTINA: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

10.6.3 REST OF SOUTH AMERICA

TABLE 89 REST OF SOUTH AMERICA: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 90 REST OF SOUTH AMERICA: HYGROSCOPIC BUILDING MATERIAL MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

11 COMPETITIVE LANDSCAPE (Page No. - 117)

11.1 OVERVIEW

FIGURE 36 COMPANIES ADOPTED ACQUISITION AS KEY GROWTH STRATEGY BETWEEN 2017 AND 2021

11.2 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2021

FIGURE 37 RANKING OF TOP FIVE PLAYERS IN HYGROSCOPIC BUILDING MATERIAL MARKET, 2021

11.3 MARKET SHARE ANALYSIS

FIGURE 38 HYGROSCOPIC BUILDING MATERIAL MARKET SHARE, BY COMPANY (2021)

TABLE 91 HYGROSCOPIC BUILDING MATERIAL MARKET: DEGREE OF COMPETITION

11.4 MARKET EVALUATION MATRIX

TABLE 92 MARKET EVALUATION MATRIX

11.5 COMPANY EVALUATION MATRIX, 2022 (TIER 1)

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PARTICIPANTS

FIGURE 39 HYGROSCOPIC BUILDING MATERIAL MARKET: COMPANY EVALUATION MATRIX, 2022

11.6 COMPANY INDUSTRY FOOTPRINT

11.7 COMPANY REGION FOOTPRINT

11.8 STRENGTH OF STRATEGY EXCELLENCE

11.9 BUSINESS PRODUCT FOOTPRINT

11.10 START-UPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX

11.10.1 PROGRESSIVE COMPANIES

11.10.2 RESPONSIVE COMPANIES

11.10.3 STARTING BLOCKS

FIGURE 40 HYGROSCOPIC BUILDING MATERIAL MARKET: STARTUPS AND SMES MATRIX, 2022

11.11 COMPETITIVE SCENARIO

11.11.1 ACQUISITION

TABLE 93 HYGROSCOPIC BUILDING MATERIAL: DEALS, 2017—2021

11.11.2 OTHER DEVELOPMENTS

TABLE 94 OTHER DEVELOPMENTS, 2017–2021

12 COMPANY PROFILES (Page No. - 130)

12.1 MAJOR PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

12.1.1 POROCEL CORPORATION (EVONIK)

TABLE 95 POROCEL CORPORATION: COMPANY OVERVIEW

TABLE 96 POROCEL CORPORATION: PRODUCT OFFERINGS

TABLE 97 POROCEL CORPORATION: DEALS

12.1.2 W.R. GRACE

TABLE 98 W.R. GRACE: COMPANY OVERVIEW

FIGURE 41 WR GRACE: COMPANY SNAPSHOT

TABLE 99 W.R. GRACE: PRODUCT OFFERINGS

TABLE 100 W.R. GRACE: DEALS

12.1.3 CLARIANT

TABLE 101 CLARIANT: COMPANY OVERVIEW

FIGURE 42 CLARIANT: COMPANY SNAPSHOT

TABLE 102 CLARIANT: PRODUCT OFFERINGS

TABLE 103 CLARIANT: DEALS

12.1.4 BASF SE

TABLE 104 BASF SE: COMPANY OVERVIEW

FIGURE 43 BASF SE: COMPANY SNAPSHOT

TABLE 105 BASF SE: PRODUCT OFFERINGS

12.1.5 ARKEMA SA

TABLE 106 ARKEMA SA.: COMPANY OVERVIEW

FIGURE 44 ARKEMA SA: COMPANY SNAPSHOT

TABLE 107 ARKEMA SA: PRODUCT OFFERINGS

12.1.6 HONEYWELL INTERNATIONAL INC.

TABLE 108 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

FIGURE 45 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

TABLE 109 HONEYWELL INTERNATIONAL INC.: PRODUCT OFFERINGS

12.1.7 JALON

TABLE 110 JALON: COMPANY OVERVIEW

TABLE 111 JALON: PRODUCT OFFERINGS

12.1.8 HENGYE INC.

TABLE 112 HENGYE INC.: COMPANY OVERVIEW

TABLE 113 HENGYE INC.: PRODUCT OFFERINGS

12.1.9 DESICCA CHEMICALS PVT. LTD.

TABLE 114 DESSICA CHEMICALS PVT. LTD.: COMPANY OVERVIEW

TABLE 115 DESSICA CHEMICALS PVT. LTD.: PRODUCT OFFERINGS

12.1.10 FUJI SILYSIA CHEMICAL LTD.

TABLE 116 FUJI SILYSIA CHEMICAL LTD.: COMPANY OVERVIEW

TABLE 117 FUJI SILYSIA CHEMICAL LTD.: PRODUCT OFFERINGS

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

12.2 OTHER KEY COMPANIES

12.2.1 GRAVER TECHNOLOGIES

12.2.2 ABSORTECH

12.2.3 SERCALIA

12.2.4 MOLSIVCN ADSORBENT CO., LTD

12.2.5 ZEOLYST INTERNATIONAL

12.2.6 SORBEAD INDIA

12.2.7 ZEOCHEM

12.2.8 SILICYCLE INC.

12.2.9 HAYCARB PLC

12.2.10 KUREHA CORPORATION

12.2.11 NEDEX

12.2.12 ALFA AESAR

12.2.13 MOLECULAR PRODUCTS INC.

12.2.14 MULTISORB TECHNOLOGIES

12.2.15 EP MINERALS

13 APPENDIX (Page No. - 157)

13.1 INSIGHTS FROM INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

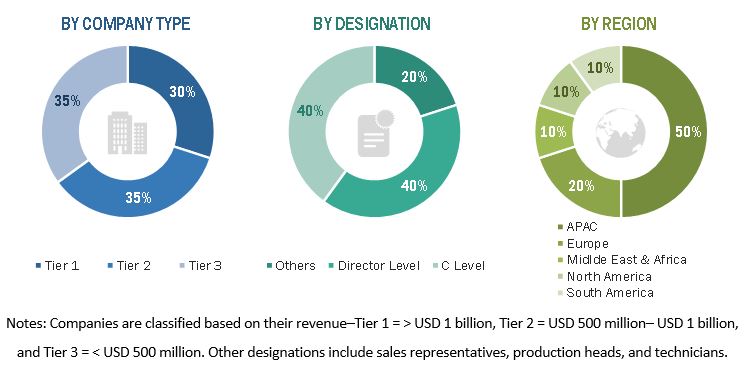

The study involved four major activities in estimating the current size of the hygroscopic building material market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and subsegments of the overall market.

Secondary Research

This research report involves extensive secondary sources, directories, and databases, such as Bloomberg, BusinessWeek, Factiva, ICIS, and OneSource, to identify and collect information useful for the technical, market-oriented, and commercial study of the hygroscopic building material market. The secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications.

Primary Research

The hygroscopic building material market comprises several stakeholders, such as raw material suppliers, formulators, end-product manufacturers, buyers, and regulatory organizations. The demand side of this market is characterized by developing applications, such as building material and structural application. The supply side included industry experts, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the size of the various submarkets for hygroscopic building materials for each region. The research methodology used to estimate the market size included the following steps:

- Global hygroscopic building material market was identified, and the share of hygroscopic building material was determined through primary and secondary research.

- The global market was then segmented into five major regions and validated through industry experts.

- All percentage shares, splits, and breakdowns based on type, enduse, application, and country were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed inputs and analysis and presented in this report.

Data Triangulation

After arriving at the overall market size-using the estimation processes explained above-the hygroscopic building material market was split into several segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the size of the hygroscopic building material market in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing market growth

- To estimate and forecast the market size based on type, enduse, application, and region

- To forecast the size of the market in the major regions, namely, Europe, North America, Asia Pacific (APAC), Middle East & Africa, and South America along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To identify the impact of the COVID-19 pandemic on the market

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the hygroscopic building material market report:

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company

Regional Analysis

- A further breakdown of the hygroscopic building material market, by segments

Company Information

- Detailed analysis and profiling of additional market players (up to ten)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Hygroscopic Building Material Market