Hydrogen Pipeline Market by Distance (Upto 300km, More than 300km), Pressure (<250 bar, >250 bar), Type (Mobile, Fixed), Hydrogen Form (Gas, Liquid), Pipeline Structure (Metal, Plastics & Composites), and Region - Global Forecast to 2030

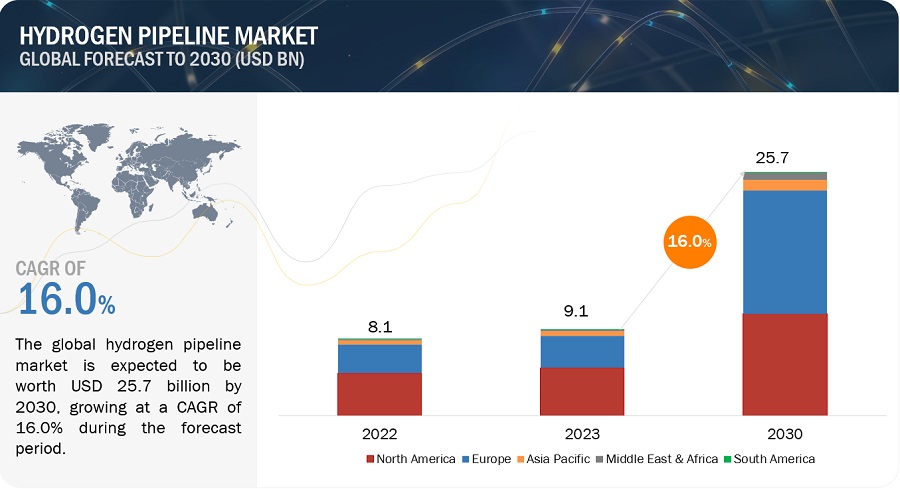

The Hydrogen pipeline market is projected to grow from USD 9.1 billion in 2023 to USD 25.7 billion by 2030, at a CAGR of 16.0% from 2023 to 2030. The growing demand for hydrogen as a clean energy carrier is a significant growth factor for the hydrogen pipeline market. Various sectors, including power generation, transportation, and industrial applications, are increasingly relying on hydrogen to meet their energy needs. This surge in demand necessitates the development of extensive pipeline networks to efficiently transport hydrogen from production facilities to end-users.

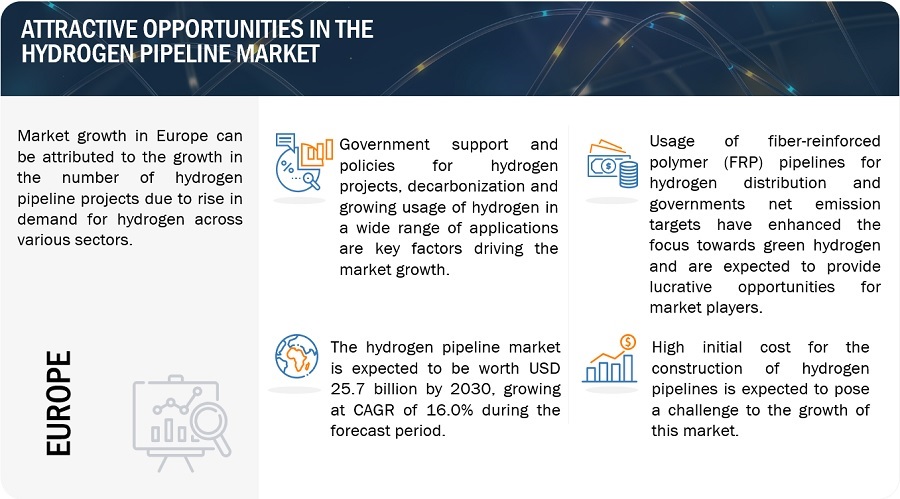

Attractive Opportunities in the Hydrogen Pipeline Market

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Global initiatives in decarbonization to reduce impact of climate change

Decarbonization has emerged as a critical global initiative to reduce the impact of climate change and transition toward more sustainable and environmentally friendly energy systems. As nations strive to reduce their carbon footprints, hydrogen has gained significant attention as a versatile and clean energy carrier. Hydrogen is considered a clean energy source for several reasons, and its adoption is being explored in various sectors to contribute to a more sustainable and low-carbon energy landscape. Therefore, such decarbonization initiatives worldwide underscore the growing importance of hydrogen pipelines in facilitating the widespread adoption of clean hydrogen as a sustainable energy solution enhancing growth for hydrogen pipeline market.

Restraint: Risk of accidents and explosions due to high flammability of hydrogen

The flammability of hydrogen poses a significant challenge to the development of the hydrogen pipeline market. Hydrogen is among the most flammable elements, with a wide explosive range, meaning it can ignite at relatively low concentrations and with minimal energy. This property raises concerns about potential accidents and explosions if hydrogen pipelines are not designed, constructed, operated, and maintained to the highest safety standards. Hydrogen molecules are very small and can easily leak through even the smallest cracks or imperfections in pipelines. These leaks can lead to the formation of explosive hydrogen-air mixtures. Hydrogen can ignite at very low concentrations and with minimal energy sources, such as sparks or static electricity. This means that even small incidents or equipment malfunctions can trigger explosions. These incidents contribute to the cautious approach toward hydrogen's flammability, influencing regulatory considerations, and safety protocols in the development and operation of hydrogen pipelines restraining the hydrogen pipeline market’s growth.

Opportunity: Governments net emission targets leading to enhanced focus on green hydrogen

Hydrogen production is going through an unprecedented revolution under the net zero emissions scenario. By 2050, most hydrogen production is expected to be through low-carbon technologies. According to the European Commission, Europe aims to be climate-neutral by 2050, an economy with net-zero greenhouse gas emissions. According to The Climate Action Tracker organization, The US government is committed to reaching net zero emissions by 2050. This has driven the focus on the usage and expansion of green hydrogen production. The majority of hydrogen that is produced is used by petroleum refineries and companies that manufacture fertilizers. Unfortunately, almost all this hydrogen is created through fossil fuel reforming, which is not environmentally friendly due to the production of CO2 emissions. To combat this issue, green hydrogen is produced through electrolysis, which splits water into hydrogen and oxygen using electricity and results in zero carbon emissions. This includes investments in green hydrogen production and the associated pipeline infrastructure which will eventually drive the growth in the hydrogen pipeline market.

Challenge: High initial cost of construction of hydrogen pipelines

The construction and installation of hydrogen pipeline infrastructure involves significant upfront costs. This factor can be a deterrent, especially in regions where financial commitment is a challenge. The high initial cost associated with developing hydrogen pipelines poses a significant barrier to entry for both, public and private entities interested in embracing hydrogen as a key component of their energy infrastructure. The substantial capital required for planning, engineering, and constructing these pipelines can strain budgets and financial resources, preventing potential investors and stakeholders from pursuing hydrogen projects.

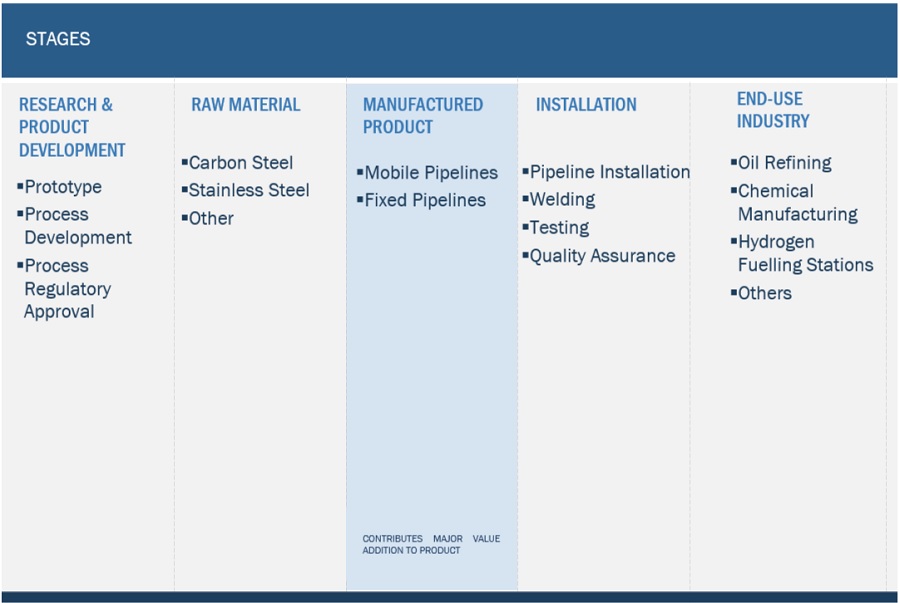

Hydrogen pipeline market: ecosystem

Prominent companies in this market include well-established, and financially stable manufacturers of hydrogen pipeline market. These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. Prominent companies in this market include Hexagon Purus (Norway), ArcelorMittal (Luxembourg), Salzgitter AG (Germany), Tenaris (Luxembourg), GF Piping Systems (Switzerland), and others.

Based on type, the fixed pipelines segment is projected to register the highest CAGR during the forecast period.

The fixed pipeline segment is estimated to be the fastest-growing segment of the global hydrogen pipeline market in the forecast period by type. Constructed from durable materials such as steel or plastic. With a key role in transporting hydrogen from production sites to diverse end-users, including industrial plants and refineries, fixed pipelines emerge as a practical and viable choice, especially in regions expecting significant growth in hydrogen demand.

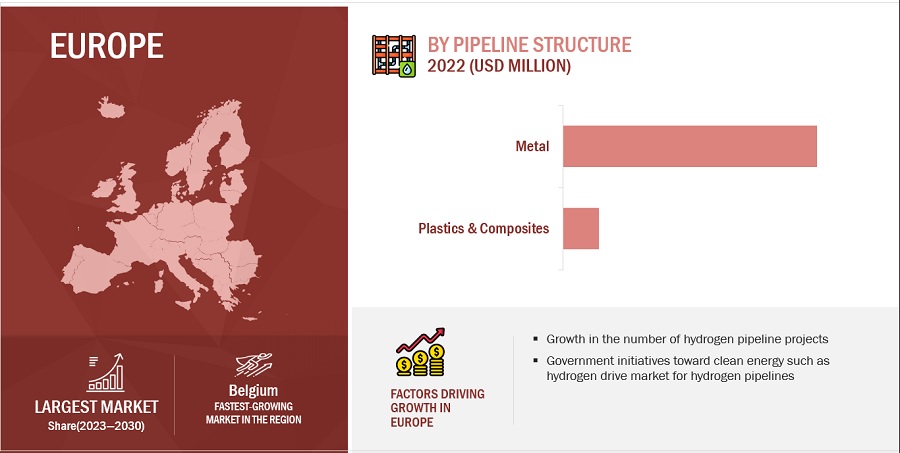

Based on pipeline structure, the plastics & composites segment is expected to grow at the fastest rate during the forecast period.

Plastics & composites accounted for the fastest growing segment of the global hydrogen pipeline market in the forecast period by pipeline structure. Fiber-reinforced Polymer (FRP), is a composite material gaining attention for constructing hydrogen pipelines. As an alternative to traditional metal, FRPs also offer advantages in hydrogen transport due to their corrosion resistance, lightweight nature, and high strength-to-weight ratio. For preventing hydrogen embrittlement, FRPs provide a durable solution, and their flexibility ensures cost-effectiveness and adaptability in various lands and grounds. Ongoing research focuses on optimizing the design and material composition of FRP pipelines to meet stringent safety standards for hydrogen transportation.

Based on region, Europe region is projected to be the largest market for hydrogen pipeline market during the forecast period .

Europe is projected to be the largest market from 2023 to 2030. The key driving factor in this region is the diverse stages of development in new energy policies among European countries. With the Europe region committed to a binding target of at least a 40% reduction in greenhouse gas emissions by 2030, it positions itself as a significant player. Furthermore, as one of the oldest oil-producing regions globally, Europe is witnessing rapid adoption of fuel cells driven by increasing projects and government initiatives in residential and commercial sectors. This surge in fuel cell growth is expected to fuel the demand for hydrogen, consequently propelling the hydrogen pipeline market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Cenergy Holdings (Belgium), SoluForce B.V. (The Netherlands), Salzgitter AG (Germany), Gruppo Sarplast S.r.l (Italy), Tenaris (Luxembourg), Hexagon Purus (Norway), Pipelife International GmbH (Austria), Europe Technologies (France), H2 Clipper, Inc. (US), NPROXX (The Netherlands), GF Piping Systems (Switzerland), ArcelorMittal (Luxembourg), and Jindal Saw Limited (India), and others are among the major players leading the market through their innovative offerings, enhanced production capacities, and efficient distribution channels.

Scope of the Report:

|

Report Metric |

Details |

|

Market Size Available for Years |

2019 to 2030 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2030 |

|

Forecast Units |

Value (USD Million/Billion) & Volume (Kilometer) |

|

Segments Covered |

Type, Pipeline Structure, Distance, Pressure, Hydrogen Form, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, South America, and the Middle East & Africa |

|

Companies Covered |

Cenergy Holdings (Belgium), SoluForce B.V. (The Netherlands), Salzgitter AG (Germany), Gruppo Sarplast S.r.l (Italy), Tenaris (Luxembourg), Hexagon Purus (Norway), Pipelife International GmbH (Austria), Europe Technologies (France), H2 Clipper, Inc. (US), NPROXX (The Netherlands), GF Piping Systems (Switzerland), ArcelorMittal (Luxembourg), and Jindal Saw Limited (India), and others. |

This research report categorizes the hydrogen pipeline market based on type, textile type, application, and region.

Based on type, the hydrogen pipeline market has been segmented as follows:

- Mobile Pipelines

- Fixed Pipelines

Based on distance, the hydrogen pipeline market has been segmented as follows:

- Upto 300 Km

- More than 300 Km

Based on hydrogen form, the hydrogen pipeline market has been segmented as follows:

- Gas

- Liquid

Based on pipeline structure, the hydrogen pipeline market has been segmented as follows:

- Metal

- Plastics & Composites

Based on the region, the hydrogen pipeline market has been segmented as follows:

-

Asia Pacific

- China

- India

- Australia

- Japan

- South Korea

- Rest of Asia Pacific

-

Europe

- Belgium

- Denmark

- Greece

- Spain

- Germany

- France

- Rest of Europe

-

North America

- US

- Canada

- Mexico

-

South America

- Brazil

- Rest of South America

-

Middle East & Africa

- GCC Countries (UAE & Saudi Arabia)

- Rest of GCC

- South Africa

- Rest of the Middle East & Africa

Recent Developments

- In October 2022, Hexagon Purus and Lhyfe entered into a collaborated on the production of green and renewable hydrogen for transportation and industrial applications.

- In June 2022, SoluForce BV entered into an agreement with ADNOC to set up a local manufacturing facility for reinforced thermoplastic pipes and non-metallic solutions. This will help SoluForce B.V. expand the manufacture of H2T pipes in Abu Dabi.

- In March 2021, Salzgitter AG and seven companies namely, BP, Evonik, Nowega, OGE, RWE, and Thyssengas, entered a partnership to build a cross-border infrastructure for hydrogen, from the production of green hydrogen to transport and industrial use. This partnership aims to create the basis of a European infrastructure for green hydrogen.

Frequently Asked Questions (FAQ):

What is the key driver for the hydrogen pipeline market?

Decarbonization as a driving force for the hydrogen pipeline market

Which region is expected to register the highest CAGR in the hydrogen pipeline market during the forecast period?

The hydrogen pipeline market in the Middle East & Africa is estimated to register the highest CAGR during the forecast period.

What is the major type of Hydrogen Pipeline?

The fixed pipelines segment is the major type of hydrogen pipeline. They are permanently installed in the ground, providing a reliable and long-term solution for transporting hydrogen.

Who are the major players in the hydrogen pipeline market?

The key players operating in the market include Hexagon Purus (Norway), ArcelorMittal (Luxembourg), Salzgitter AG (Germany), Tenaris (Luxembourg), and GF Piping Systems (Switzerland).

What is the total CAGR expected to record for the hydrogen pipeline market during 2023-2030?

The market is expected to record a CAGR of 16.0 % from 2023-2030. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Government support and policies for hydrogen projects- Growing usage of hydrogen in wide range of applications- Global initiatives in decarbonization to reduce impact of climate change- Increasing use of hydrogen fuel cells to generate electricity in automotive sector and power plantsRESTRAINTS- Issues in hydrogen transport due to low volumetric density- Risk of accidents and explosions due to high flammability of hydrogenOPPORTUNITIES- Advantages offered by fiber-reinforced polymer pipelines for hydrogen distribution- Governments net emission targets leading to enhanced focus on green hydrogenCHALLENGES- Slow pace of infrastructure development- High construction cost of hydrogen pipelines

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 ECOSYSTEM

-

5.5 VALUE CHAIN ANALYSISRAW MATERIALS

- 5.6 TECHNOLOGY ANALYSIS

-

5.7 GLOBAL REGULATORY FRAMEWORK AND ITS IMPACT ON HYDROGEN PIPELINE MARKETREGULATIONS RELATED TO HYDROGEN PIPELINESREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.8 CASE STUDYVITAL ROLE OF HYDROGEN PIPELINES IN HYDROGEN CELL BATTERIES

- 5.9 KEY CONFERENCES AND EVENTS, 2023 & 2024

-

5.10 PATENT ANALYSISMETHODOLOGYMAJOR PATENTS

-

5.11 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.12 TRADE ANALYSISIMPORT–EXPORT SCENARIOEXPORT SCENARIOIMPORT SCENARIO

-

5.13 PRICING ANALYSISAVERAGE SELLING PRICE OF HYDROGEN PIPELINES, BY REGIONAVERAGE SELLING PRICE OF HYDROGEN PIPELINES, BY MARKET PLAYER

- 6.1 INTRODUCTION

-

6.2 UP TO 300 KMREQUIRES CAREFUL CONSIDERATION OF FACTORS SUCH AS SAFETY, MATERIAL COMPATIBILITY, AND ENVIRONMENTAL IMPACT

-

6.3 MORE THAN 300 KMONGOING INSPECTIONS, MAINTENANCE, AND PERIODIC INTEGRITY ASSESSMENTS PARAMOUNT FOR SUSTAINED RELIABILITY OF PIPELINES

- 7.1 INTRODUCTION

-

7.2 METALSCRITICAL COMPONENT OF HYDROGEN DISTRIBUTION INFRASTRUCTURE

-

7.3 PLASTICS & COMPOSITESCORROSION RESISTANCE, LIGHTWEIGHT, AND HIGH STRENGTH-TO-WEIGHT RATIO PROPERTIES TO DRIVE MARKET

- 8.1 INTRODUCTION

-

8.2 <250 BARDEMAND FOR TRANSPORT OF HYDROGEN OVER SHORT DISTANCES TO DRIVE MARKET

-

8.3 >250 BARREQUIREMENT OF ELEVATED PRESSURE LEVELS FOR EFFICIENT TRANSPORT OF HYDROGEN OVER LONG DISTANCES TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 MOBILE PIPELINESDEMAND FROM AREAS NOT SERVED BY TRADITIONAL PIPELINES TO DRIVE MARKET

-

9.3 FIXED PIPELINESEFFICIENCY AND COST-EFFECTIVENESS IN TRANSPORTING LARGE VOLUMES OF GASES AND LIQUIDS OVER LONG DISTANCES TO DRIVE MARKET

- 10.1 INTRODUCTION

-

10.2 GASTRANSPORTATION SECTOR AND INDUSTRIAL PROCESS APPLICATIONS TO DRIVE MARKET

-

10.3 LIQUIDEASE OF TRANSPORT OVER LONG DISTANCES TO DRIVE MARKET

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICAIMPACT OF RECESSION ON NORTH AMERICAUS- Demand for hydrogen and decarbonizing economy to drive marketREST OF NORTH AMERICA

-

11.3 ASIA PACIFICIMPACT OF RECESSION ON ASIA PACIFICCHINA- Growth in hydrogen production to drive marketSOUTH KOREA- Strategic initiatives by government for hydrogen production and transport to propel marketJAPAN- Rise in production and storage of hydrogen to drive marketAUSTRALIA- Significant investments and abundant renewable energy resources to drive marketNEW ZEALAND- Commitment to achieving net-zero emissions by 2050 to drive marketREST OF ASIA PACIFIC

-

11.4 EUROPEIMPACT OF RECESSION ON EUROPEGERMANY- Growing infrastructure for hydrogen production and transportation to drive marketBELGIUM- Infrastructure growth in hydrogen production and transportation to drive marketNETHERLANDS- Focus on hydrogen infrastructure and transmission to drive marketUK- Upcoming developments related to production and transportation of hydrogen to drive marketREST OF EUROPE

-

11.5 MIDDLE EAST & AFRICAGCC COUNTRIES- Saudi Arabia- Oman- Rest of GCCREST OF MIDDLE EAST & AFRICA

-

11.6 SOUTH AMERICABRAZIL- Infrastructure developments for production, storage, and distribution of hydrogen to drive marketREST OF SOUTH AMERICA

- 12.1 INTRODUCTION

-

12.2 STRATEGIES ADOPTED BY KEY PLAYERSOVERVIEW OF STRATEGIES ADOPTED BY KEY MANUFACTURERS

- 12.3 REVENUE ANALYSIS

-

12.4 MARKET SHARE ANALYSISRANKING OF KEY MARKET PLAYERS, 2022MARKET SHARE OF KEY PLAYERS- Hexagon Purus (Norway)- ArcelorMittal (Luxembourg)- Salzgitter AG (Germany)- Tenaris (Luxembourg)- GF Piping Systems (Switzerland)

-

12.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

12.6 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

12.7 COMPETITIVE SCENARIO AND TRENDSDEALSOTHER DEVELOPMENTS

-

13.1 KEY PLAYERSCENERGY HOLDINGS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSOLUFORCE B.V.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSALZGITTER AG- Business overview- Products/Solutions/Services offered- Recent developmentsGRUPPO SARPLAST S.R.L.- Business overview- Products/Solutions/Services offeredTENARIS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHEXAGON PURUS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPIPELIFE INTERNATIONAL GMBH- Business overview- Products/Solutions/Services offeredEUROPE TECHNOLOGIES- Business overview- Products/Solutions/Services offeredH2 CLIPPER INC.- Business overview- Products/Solutions/Services offeredNPROXX- Business overview- Products/Solutions/Services offered- MnM viewGF PIPING SYSTEMS- Business overview- Products/Solutions/Services offeredARCELORMITTAL- Business overview- Products/Solutions/Services offeredJINDAL SAW LTD.- Business overview- Products/Solutions/Services offered

-

13.2 OTHER PLAYERSMETLINE INDUSTRIES- Products/Solutions/Services offeredTEREGA- Products/Solutions/Services offeredOCTALSTEEL- Products/Solutions/Services offered

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

-

14.3 HYDROGEN PIPELINE INTERCONNECTED MARKETSGREEN HYDROGEN MARKET- Market definition- Market overview- Green hydrogen market, by technologyHYDROGEN GENERATION MARKET- Market definition- Market overview- Hydrogen generation market, by source

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 HYDROGEN PIPELINE MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 HYDROGEN PIPELINE MARKET SNAPSHOT: 2023 VS. 2030

- TABLE 3 HYDROGEN PIPELINE PROJECTS

- TABLE 4 HYDROGEN PIPELINE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 HYDROGEN PIPELINE MARKET: ECOSYSTEM

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 HYDROGEN PIPELINE MARKET: CONFERENCES & EVENTS, 2023–2024

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR HYDROGEN PIPELINE TYPE (%)

- TABLE 11 KEY BUYING CRITERIA FOR TOP TWO END USES

- TABLE 12 HYDROGEN EXPORT TRADE DATA

- TABLE 13 HYDROGEN IMPORT TRADE DATA

- TABLE 14 HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (USD MILLION)

- TABLE 15 HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (USD MILLION)

- TABLE 16 HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (KILOMETER)

- TABLE 17 HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (KILOMETER)

- TABLE 18 METALS: HYDROGEN PIPELINE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 19 METALS: HYDROGEN PIPELINE MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 20 METALS: HYDROGEN PIPELINE MARKET, BY REGION, 2019–2022 (KILOMETER)

- TABLE 21 METALS: HYDROGEN PIPELINE MARKET, BY REGION, 2023–2030 (KILOMETER)

- TABLE 22 PLASTICS & COMPOSITES: HYDROGEN PIPELINE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 23 PLASTICS & COMPOSITES: HYDROGEN PIPELINE MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 24 PLASTICS & COMPOSITES: HYDROGEN PIPELINE MARKET, BY REGION, 2019–2022 (KILOMETER)

- TABLE 25 PLASTICS & COMPOSITES: HYDROGEN PIPELINE MARKET, BY REGION, 2023–2030 (KILOMETER)

- TABLE 26 HYDROGEN PIPELINE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 27 HYDROGEN PIPELINE MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 28 HYDROGEN PIPELINE MARKET, BY TYPE, 2019–2022 (KILOMETER)

- TABLE 29 HYDROGEN PIPELINE MARKET, BY TYPE, 2023–2030 (KILOMETER)

- TABLE 30 HYDROGEN PIPELINE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 31 HYDROGEN PIPELINE MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 32 HYDROGEN PIPELINE MARKET, BY REGION, 2019–2022 (KILOMETER)

- TABLE 33 HYDROGEN PIPELINE MARKET, BY REGION, 2023–2030 (KILOMETER)

- TABLE 34 NORTH AMERICA: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (USD MILLION)

- TABLE 35 NORTH AMERICA: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (USD MILLION)

- TABLE 36 NORTH AMERICA: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (KILOMETER)

- TABLE 37 NORTH AMERICA: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (KILOMETER)

- TABLE 38 NORTH AMERICA: HYDROGEN PIPELINE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 39 NORTH AMERICA: HYDROGEN PIPELINE MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 40 NORTH AMERICA: HYDROGEN PIPELINE MARKET, BY COUNTRY, 2019–2022 (KILOMETER)

- TABLE 41 NORTH AMERICA: HYDROGEN PIPELINE MARKET, BY COUNTRY, 2023–2030 (KILOMETER)

- TABLE 42 US: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (USD MILLION)

- TABLE 43 US: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (USD MILLION)

- TABLE 44 US: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (KILOMETER)

- TABLE 45 US: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (KILOMETER)

- TABLE 46 REST OF NORTH AMERICA: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (USD MILLION)

- TABLE 47 REST OF NORTH AMERICA: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (USD MILLION)

- TABLE 48 REST OF NORTH AMERICA: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (KILOMETER)

- TABLE 49 REST OF NORTH AMERICA: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (KILOMETER)

- TABLE 50 ASIA PACIFIC: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (USD MILLION)

- TABLE 51 ASIA PACIFIC: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (USD MILLION)

- TABLE 52 ASIA PACIFIC: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (KILOMETER)

- TABLE 53 ASIA PACIFIC: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (KILOMETER)

- TABLE 54 ASIA PACIFIC: HYDROGEN PIPELINE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 55 ASIA PACIFIC: HYDROGEN PIPELINE MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 56 ASIA PACIFIC: HYDROGEN PIPELINE MARKET, BY COUNTRY, 2019–2022 (KILOMETER)

- TABLE 57 ASIA PACIFIC: HYDROGEN PIPELINE MARKET, BY COUNTRY, 2023–2030 (KILOMETER)

- TABLE 58 CHINA: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (USD MILLION)

- TABLE 59 CHINA: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (USD MILLION)

- TABLE 60 CHINA: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (KILOMETER)

- TABLE 61 CHINA: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (KILOMETER)

- TABLE 62 SOUTH KOREA: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (USD MILLION)

- TABLE 63 SOUTH KOREA: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (USD MILLION)

- TABLE 64 SOUTH KOREA: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (KILOMETER)

- TABLE 65 SOUTH KOREA: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (KILOMETER)

- TABLE 66 JAPAN: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (USD MILLION)

- TABLE 67 JAPAN: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (USD MILLION)

- TABLE 68 JAPAN: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (KILOMETER)

- TABLE 69 JAPAN: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (KILOMETER)

- TABLE 70 AUSTRALIA AND NEW ZEALAND: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (USD MILLION)

- TABLE 71 AUSTRALIA AND NEW ZEALAND: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (USD MILLION)

- TABLE 72 AUSTRALIA AND NEW ZEALAND: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (KILOMETER)

- TABLE 73 AUSTRALIA AND NEW ZEALAND: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (KILOMETER)

- TABLE 74 REST OF ASIA PACIFIC: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (USD MILLION)

- TABLE 75 REST OF ASIA PACIFIC: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (USD MILLION)

- TABLE 76 REST OF ASIA PACIFIC: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (KILOMETER)

- TABLE 77 REST OF ASIA PACIFIC: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (KILOMETER)

- TABLE 78 EUROPE: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (USD MILLION)

- TABLE 79 EUROPE: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (USD MILLION)

- TABLE 80 EUROPE: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (KILOMETER)

- TABLE 81 EUROPE: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (KILOMETER)

- TABLE 82 EUROPE: HYDROGEN PIPELINE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 83 EUROPE: HYDROGEN PIPELINE MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 84 EUROPE: HYDROGEN PIPELINE MARKET, BY COUNTRY, 2019–2022 (KILOMETER)

- TABLE 85 EUROPE: HYDROGEN PIPELINE MARKET, BY COUNTRY, 2023–2030 (KILOMETER)

- TABLE 86 GERMANY: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (USD MILLION)

- TABLE 87 GERMANY: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (USD MILLION)

- TABLE 88 GERMANY: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (KILOMETER)

- TABLE 89 GERMANY: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (KILOMETER)

- TABLE 90 BELGIUM: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (USD MILLION)

- TABLE 91 BELGIUM: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (USD MILLION)

- TABLE 92 BELGIUM: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (KILOMETER)

- TABLE 93 BELGIUM: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (KILOMETER)

- TABLE 94 NETHERLANDS: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (USD MILLION)

- TABLE 95 NETHERLANDS: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (USD MILLION)

- TABLE 96 NETHERLANDS: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (KILOMETER)

- TABLE 97 NETHERLANDS: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (KILOMETER)

- TABLE 98 UK: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (USD MILLION)

- TABLE 99 UK: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (USD MILLION)

- TABLE 100 UK: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (KILOMETER)

- TABLE 101 UK: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (KILOMETER)

- TABLE 102 REST OF EUROPE: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (USD MILLION)

- TABLE 103 REST OF EUROPE: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (USD MILLION)

- TABLE 104 REST OF EUROPE: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (KILOMETER)

- TABLE 105 REST OF EUROPE: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (KILOMETER)

- TABLE 106 MIDDLE EAST & AFRICA: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (USD MILLION)

- TABLE 107 MIDDLE EAST & AFRICA: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (USD MILLION)

- TABLE 108 MIDDLE EAST & AFRICA: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (KILOMETER)

- TABLE 109 MIDDLE EAST & AFRICA: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (KILOMETER)

- TABLE 110 MIDDLE EAST & AFRICA: HYDROGEN PIPELINE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 111 MIDDLE EAST & AFRICA: HYDROGEN PIPELINE MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 112 MIDDLE EAST & AFRICA: HYDROGEN PIPELINE MARKET, BY COUNTRY, 2019–2022 (KILOMETER)

- TABLE 113 MIDDLE EAST & AFRICA: HYDROGEN PIPELINE MARKET, BY COUNTRY, 2023–2030 (KILOMETER)

- TABLE 114 SAUDI ARABIA: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (USD MILLION)

- TABLE 115 SAUDI ARABIA: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (USD MILLION)

- TABLE 116 SAUDI ARABIA: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (KILOMETER)

- TABLE 117 SAUDI ARABIA: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (KILOMETER)

- TABLE 118 OMAN: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (USD MILLION)

- TABLE 119 OMAN: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (USD MILLION)

- TABLE 120 OMAN: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (KILOMETER)

- TABLE 121 OMAN: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (KILOMETER)

- TABLE 122 REST OF MIDDLE EAST & AFRICA: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (USD MILLION)

- TABLE 123 REST OF MIDDLE EAST & AFRICA: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (USD MILLION)

- TABLE 124 REST OF MIDDLE EAST & AFRICA: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (KILOMETER)

- TABLE 125 REST OF MIDDLE EAST & AFRICA: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (KILOMETER)

- TABLE 126 SOUTH AMERICA: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (USD MILLION)

- TABLE 127 SOUTH AMERICA: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (USD MILLION)

- TABLE 128 SOUTH AMERICA: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (KILOMETER)

- TABLE 129 SOUTH AMERICA: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (KILOMETER)

- TABLE 130 SOUTH AMERICA: HYDROGEN PIPELINE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 131 SOUTH AMERICA: HYDROGEN PIPELINE MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 132 SOUTH AMERICA: HYDROGEN PIPELINE MARKET, BY COUNTRY, 2019–2022 (KILOMETER)

- TABLE 133 SOUTH AMERICA: HYDROGEN PIPELINE MARKET, BY COUNTRY, 2023–2030 (KILOMETER)

- TABLE 134 BRAZIL: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (USD MILLION)

- TABLE 135 BRAZIL: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (USD MILLION)

- TABLE 136 BRAZIL: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (KILOMETER)

- TABLE 137 BRAZIL: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (KILOMETER)

- TABLE 138 REST OF SOUTH AMERICA: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (USD MILLION)

- TABLE 139 REST OF SOUTH AMERICA: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (USD MILLION)

- TABLE 140 REST OF SOUTH AMERICA: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2019–2022 (KILOMETER)

- TABLE 141 REST OF SOUTH AMERICA: HYDROGEN PIPELINE MARKET, BY PIPELINE STRUCTURE, 2023–2030 (KILOMETER)

- TABLE 142 HYDROGEN PIPELINE MARKET: DEGREE OF COMPETITION

- TABLE 143 BY TYPE (13 COMPANIES)

- TABLE 144 BY PIPELINE STRUCTURE (13 COMPANIES)

- TABLE 145 COMPANY REGION FOOTPRINT (13 COMPANIES)

- TABLE 146 HYDROGEN PIPELINE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 147 HYDROGEN PIPELINE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 148 HYDROGEN PIPELINE MARKET: DEALS (2019–2023)

- TABLE 149 HYDROGEN PIPELINE MARKET: EXPANSIONS, INVESTMENTS, AND INNOVATIONS (2019–2023)

- TABLE 150 CENERGY HOLDINGS: COMPANY OVERVIEW

- TABLE 151 CENERGY HOLDINGS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 152 CENERGY HOLDINGS: DEALS

- TABLE 153 SOLUFORCE B.V.: COMPANY OVERVIEW

- TABLE 154 SOLUFORCE B.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 155 SOLUFORCE B.V.: DEALS

- TABLE 156 SALZGITTER AG: COMPANY OVERVIEW

- TABLE 157 SALZGITTER AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 158 SALZGITTER AG: DEALS

- TABLE 159 SALZGITTER AG: OTHERS

- TABLE 160 GRUPPO SARPLAST S.R.L.: COMPANY OVERVIEW

- TABLE 161 GRUPPO SARPLAST S.R.L.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 162 TENARIS: COMPANY OVERVIEW

- TABLE 163 TENARIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 164 TENARIS: DEALS

- TABLE 165 HEXAGON PURUS: COMPANY OVERVIEW

- TABLE 166 HEXAGON PURUS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 167 HEXAGON PURUS: DEALS

- TABLE 168 PIPELIFE INTERNATIONAL GMBH: COMPANY OVERVIEW

- TABLE 169 PIPELIFE INTERNATIONAL GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 170 EUROPE TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 171 EUROPE TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 172 H2 CLIPPER INC.: COMPANY OVERVIEW

- TABLE 173 H2 CLIPPER INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 174 NPROXX: COMPANY OVERVIEW

- TABLE 175 NPROXX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 176 GF PIPING SYSTEMS: COMPANY OVERVIEW

- TABLE 177 GF PIPING SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 ARCELORMITTAL: COMPANY OVERVIEW

- TABLE 179 ARCELORMITTAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 180 JINDAL SAW LTD.: COMPANY OVERVIEW

- TABLE 181 JINDAL SAW LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 182 METLINE INDUSTRIES: COMPANY OVERVIEW

- TABLE 183 METLINE INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 TEREGA: COMPANY OVERVIEW

- TABLE 185 TEREGA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 OCTALSTEEL: COMPANY OVERVIEW

- TABLE 187 OCTALSTEEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 GREEN HYDROGEN MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

- TABLE 189 GREEN HYDROGEN MARKET, BY TECHNOLOGY, 2019–2026 (KILOTON)

- TABLE 190 HYDROGEN GENERATION MARKET, BY SOURCE, 2018–2022 (THOUSAND METRIC TONS)

- TABLE 191 HYDROGEN GENERATION MARKET, BY SOURCE, 2023–2028 (THOUSAND METRIC TONS)

- TABLE 192 HYDROGEN GENERATION MARKET, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 193 HYDROGEN GENERATION MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- FIGURE 1 HYDROGEN PIPELINE MARKET SEGMENTATION

- FIGURE 2 HYDROGEN PIPELINE MARKET: RESEARCH DESIGN

- FIGURE 3 MATRIX TO CONSTRUCT AND ASSESS DEMAND FOR HYDROGEN PIPELINES

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 HYDROGEN PIPELINE MARKET: DATA TRIANGULATION

- FIGURE 7 FIXED PIPELINES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 8 PLASTICS & COMPOSITES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 9 MARKET IN MIDDLE EAST & AFRICA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 CLEAN ENERGY INITIATIVES TO DRIVE MARKET

- FIGURE 11 EUROPE TO REGISTER HIGHEST CAGR, IN TERMS OF VOLUME, FROM 2023 TO 2030

- FIGURE 12 FIXED PIPELINES SEGMENT TO DOMINATE MARKET, IN TERMS OF VOLUME, FROM 2023 TO 2030

- FIGURE 13 METALS SEGMENT TO HOLD LARGER SHARE, IN TERMS OF VOLUME, BETWEEN 2023 AND 2030

- FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN HYDROGEN PIPELINE MARKET

- FIGURE 15 PORTER’S FIVE FORCES ANALYSIS OF HYDROGEN PIPELINE MARKET

- FIGURE 16 ECOSYSTEM MAP OF HYDROGEN PIPELINE MARKET

- FIGURE 17 VALUE CHAIN ANALYSIS OF HYDROGEN PIPELINE MARKET

- FIGURE 18 LIST OF MAJOR PATENTS FOR HYDROGEN PIPELINES

- FIGURE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR HYDROGEN PIPELINE TYPE

- FIGURE 20 KEY BUYING CRITERIA FOR TOP TWO PIPELINE TYPES

- FIGURE 21 AVERAGE SELLING PRICE OF HYDROGEN PIPELINES, BY REGION

- FIGURE 22 AVERAGE SELLING PRICE OF HYDROGEN PIPELINES, BY MARKET PLAYER,

- FIGURE 23 METALS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 24 FIXED PIPELINES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 25 MARKET IN MIDDLE EAST & AFRICA TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 26 NORTH AMERICA: HYDROGEN PIPELINE MARKET SNAPSHOT

- FIGURE 27 ASIA PACIFIC: HYDROGEN PIPELINE MARKET SNAPSHOT

- FIGURE 28 EUROPE: HYDROGEN PIPELINE MARKET SNAPSHOT

- FIGURE 29 REVENUE ANALYSIS OF KEY COMPANIES (2018–2022)

- FIGURE 30 RANKING OF TOP FIVE PLAYERS IN HYDROGEN PIPELINE MARKET, 2022

- FIGURE 31 HYDROGEN PIPELINE MARKET SHARE ANALYSIS

- FIGURE 32 COMPANY EVALUATION MATRIX: HYDROGEN PIPELINE MARKET (TIER 1 COMPANIES)

- FIGURE 33 COMPANY FOOTPRINT (13 COMPANIES)

- FIGURE 34 STARTUP/SME EVALUATION QUADRANT: HYDROGEN PIPELINE MARKET

- FIGURE 35 CENERGY HOLDINGS: COMPANY SNAPSHOT

- FIGURE 36 SALZGITTER AG: COMPANY SNAPSHOT

- FIGURE 37 TENARIS: COMPANY SNAPSHOT

- FIGURE 38 HEXAGON PURUS: COMPANY SNAPSHOT

- FIGURE 39 GF PIPING SYSTEMS: COMPANY SNAPSHOT

- FIGURE 40 ARCELORMITTAL: COMPANY SNAPSHOT

- FIGURE 41 JINDAL SAW LTD.: COMPANY SNAPSHOT

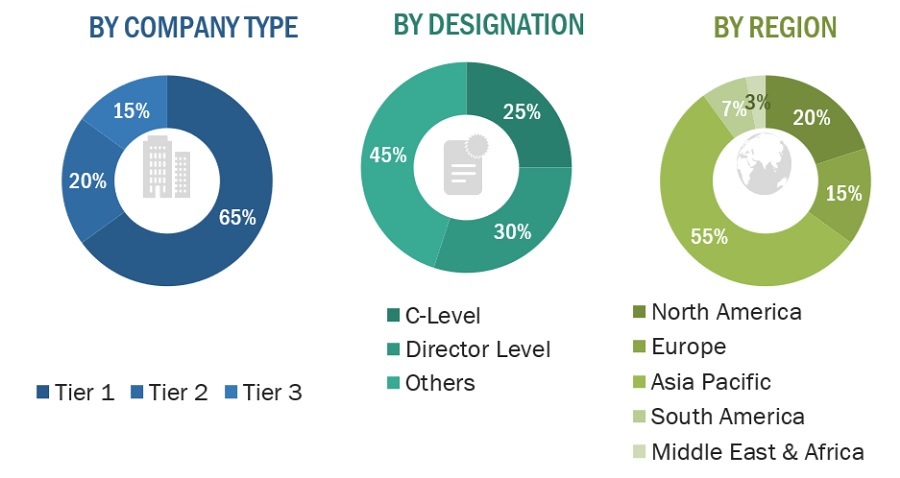

The study involved four major activities in estimating the current market size of hydrogen pipelines. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with industry experts across the value chain of the hydrogen pipeline through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the size of the segments and sub-segments of the market.

Secondary Research

The research methodology used to estimate and forecast the access control market begins with capturing data on the revenues of key vendors in the market through secondary research. BusinessWeek, Factiva, World Bank, and Industry Journals, such as Hoovers, Bloomberg BusinessWeek, Factiva, World Bank, and Industry Journals, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; notifications by regulatory bodies; trade directories; and databases. Vendor offerings have also been taken into consideration to determine market segmentation.

Primary Research

The hydrogen pipeline market comprises several stakeholders, such as such as raw material suppliers, technology support providers, hydrogen pipeline manufacturers, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the hydrogen pipeline market . Primary sources from the demand side included directors, marketing heads, and purchase managers from various sourcing industries. Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

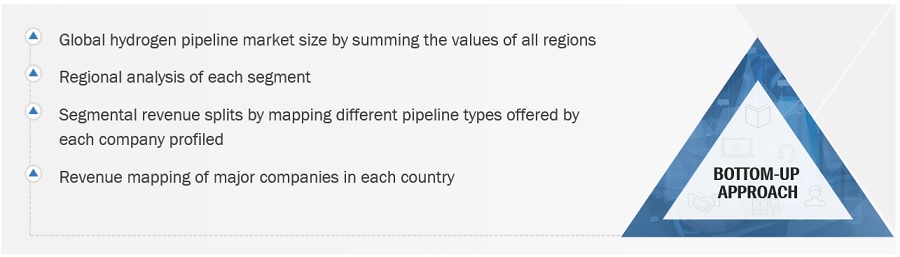

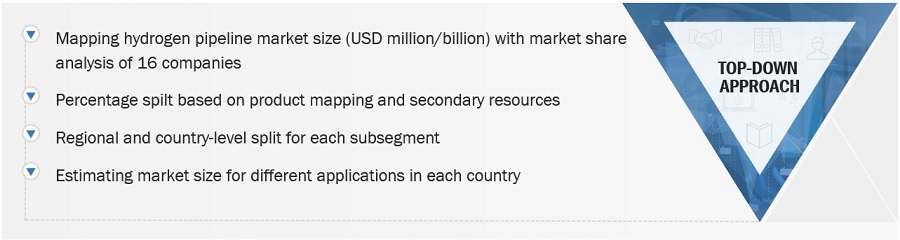

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the hydrogen pipeline market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the hydrogen pipeline market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Global Hydrogen Pipeline Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Hydrogen Pipeline Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the oil & gas sector.

Market Definition

Hydrogen pipelines are specialized structures designed to transport hydrogen gas from production sites to various destinations. These pipelines in the hydrogen supply chain ensure the efficient distribution of hydrogen for uses like industrial processes, power generation, and transportation. Constructed to withstand hydrogen's unique characteristics, including its flammability and ability to permeate certain materials, these pipelines are typically made of materials resistant to hydrogen embrittlement and corrosion, with steel being a common choice. Hydrogen can be transported in both gaseous and liquid form through these pipelines, depending on application requirements and pipeline design.

Key Stakeholders

- Raw material manufacturers

- Technology support providers

- Manufacturers of hydrogen pipeline

- Traders, distributors, and suppliers

- Regulatory Bodies and Government Agencies

- Research & Development (R&D) Institutions

- End-use Industries

- Consulting Firms, Trade Associations, and Industry Bodies

- Investment Banks and Private Equity Firms

Report Objectives:

- To analyze and forecast the market size of the hydrogen pipeline market in terms of value

- To provide detailed information regarding the major factors (drivers, restraints, challenges, and opportunities) influencing the regional market

- To analyze and forecast the global hydrogen pipeline market on the basis of type, pipeline structure, distance, pressure, hydrogen form, and region

- To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders

- To forecast the size of various market segments based on four major regions: North America, Europe, Asia Pacific, South America, and the Middle East & Africa, along with their respective key countries

- To track and analyze the competitive developments, such as acquisitions, partnerships, collaborations, agreements, and expansions in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the report:

- Additional country-level analysis of the hydrogen pipeline market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Growth opportunities and latent adjacency in Hydrogen Pipeline Market