Hydrogen Fluoride Gas Detection Market Size, Share, Industry Growth, Trends & Analysis by Type (Fixed, Portable), End-user Industry (Chemicals, Mining & Metallurgical, Pharmaceuticals) and Geography (North America, APAC, Europe, RoW)

Updated on : July 19, 2023

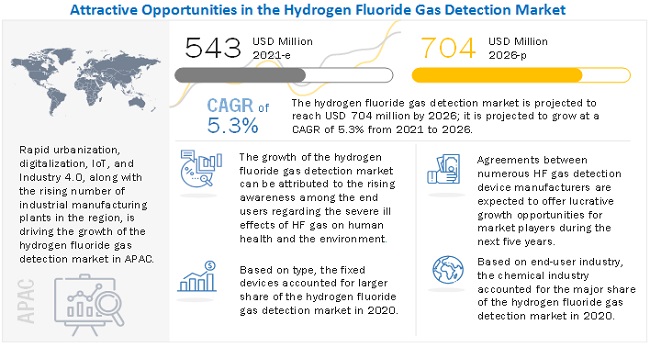

The global hydrogen fluoride gas detection market Size, Share, Industry Growth, Trends & Analysis is projected to reach USD 704 million by 2026 from an estimated USD 543 million in 2021, at a CAGR of 5.3% from 2021 to 2026.Major factors driving the growth of the market include increasing accidents due to hydrogen fluoride gas leakage in oil & gas refineries and chemical plants are driving demand for hydrogen fluoride gas detection industry and stringent regulation for human and environmental safety.

Hydrogen Fluoride Gas Detection Market: Segmentation and Growth Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Hydrogen Fluoride Gas Detection Market

The outbreak and the spread of the COVID-19 pandemic had a negative impact on the hydrogen fluoride gas detection market in 2020, resulting in decreased shipments of hydrogen fluoride gas detection devices. This resulted in declined revenues leading to low growth trends of the market during the first half of 2020. This trend continued to prevail till the first quarter of 2021.

Post COVID-19, the global hydrogen fluoride gas detection market is expected to witness steady growth due to the stringent government regulations and increase in demand for hydrogen fluoride gas detection devices in the chemical, semiconductor, and pharmaceutical industries.

Market Dynamics:

Driver: Stringent regulations for human and environmental safety

Government regulations play a significant role in the growth of the hydrogen fluoride gas detection market. As hydrogen fluoride is highly toxic and corrosive, it has adverse effects on human health and the environment. To safeguard human lives and the environment, different governing bodies, including the Occupational Safety and Health Administration (OSHA), the National Institute for Occupational Safety and Health (NIOSH), and the Environmental Protection Agency (EPA), have laid down certain guidelines that regulate the manufacturing and application of hydrogen fluoride and its detection devices. OSHA is responsible for the promulgation and enforcement activities. As per their directives, the permissible exposure limit (PEL) for hydrogen fluoride is 3.0 ppm as an 8-hour time-weighted average (TWA). NIOSH is responsible for recommending health and safety standards. As per their directives, the recommended exposure limit (REL) for hydrogen fluoride is 3.0 ppm as an 8-hour TWA and 6.0 ppm as a 15-minute short-term exposure limit (STEL). EPA is an independent executive agency of the US federal government tasked with environmental protection matters. The agency prepares guidelines pertaining to acute exposure guideline levels (AEGL) of workers to hydrogen fluoride. As per their guidelines, the AGEL-1 for hydrogen fluoride is 1.0 ppm as an 8-hour TWA, AGEL-2 for hydrogen fluoride is 12.0 ppm as an 8-hour TWA, and AGEL-3 for hydrogen fluoride is 22.0 ppm as an 8-hour TWA. All the manufacturers and end-user industries need to follow the regulations laid by these authorities. Also, several end-user industries such as chemical, refineries and pharmaceutical industries require to submit data related to safety practices adopted by them, measures to handle any hazardous conditions occurring due to hydrogen fluoride gas leakage, the amount of gas leaked in the plant, etc., to EPA. Thus, the imposition of these regulations increases the demand for hydrogen fluoride gas detection devices in different end-user industries.

Restraint: High price of hydrogen fluoride gas detection devices

Hydrogen fluoride gas is extremely hazardous for human health and the environment and therefore needs to be monitored constantly. However, hydrogen fluoride gas detection devices are extremely costly compared with other gas detection devices. For instance, an NDIR technology-based carbon dioxide gas sensor offered by Honeywell International, Inc. would cost USD 276.34 per unit, while an electrochemical technology-based hydrogen fluoride gas detection sensor offered by Honeywell International, Inc. costs USD 720 per unit. Moreover, the product development process is also time-consuming; hence, very limited product launches or developments by the manufacturers are observed between 2019–2021. Moreover, as hydrogen fluoride is corrosive, specific raw materials, such as high-grade corrosion resistant 316 stainless steel, are required to manufacture the detection devices that would not get affected when exposed to hydrogen fluoride gas. These raw materials are costly, which in turn increases the manufacturing cost of the devices. Thus, factors such as device development cost, R&D cost, and raw material cost contribute to the high price of hydrogen fluoride gas detection devices.

Opportunity: Increased adoption of IoT by end-user industries

Industry 4.0 fully automates manufacturing processes with very little to negligible human interference. It works on the Internet of Things (IoT), cyber-physical systems, Cloud robotics, Cloud computing, and Big Data. Thus, IoT has gained the attention of technology vendors, organizations, business decision-makers, and consumers in recent years. Industry players are focusing on adopting IoT due to continuous technological advancements, increased cellular connectivity and data transfer rates, and Cloud infrastructure development. IoT can be implemented using various smart and connected devices integrated into various smart appliances, smart homes, and connected cars. Additionally, the rising penetration of IoT in the industrial process has led to an upsurge in demand for portable and lightweight wireless and battery-powered hydrogen fluoride gas detection devices used for ubiquitous sensing as well as secured data storage and data transmission.

Various end-user industries such as chemicals, pharmaceuticals, semiconductor, mining and metallurgical, automotive, consumer electronics, and oil & gas have started implementing Industry 4.0 concepts in their manufacturing processes to harness their advantages, including increased productivity, flexibility, and safety, better quality, reduced need for consumables, and reduced production costs. This has led to the automation of different processes by manufacturing companies as well as the digitalization of their products and processes. The automation and digitalization of manufacturing companies are carried out using interconnected sensors and different detection and control devices and made available to human operators through IoT. These IoT devices are required to be robust, efficient, and cost-effective and are expected to increase the demand for wireless, portable, and IO-link compatible hydrogen fluoride gas detection devices during the forecast period.

Challenge: Hydrogen fluoride gas sensor calibration is difficult

Hydrogen fluoride is a highly toxic, colorless gas, which is lighter than air and widely used in different end-user industries and industrial processes. It is highly soluble in water, where it forms hydrofluoric acid, which is extremely corrosive and causes irritation to the skin and mucous membranes, resulting in blindness by rapid destruction of the corneas and requiring immediate medical attention upon exposure. Thus, various gas detection devices such as sensors, transmitters, detectors, monitors, and analyzers are used to detect, measure, and monitor hydrogen fluoride gas concentrations. However, calibration of these devices is difficult due to the harmful effects of the gas, the time required for device calibration, and the response to different interfering gases while detecting hydrogen fluoride gas.

The hydrogen fluoride gas sensor takes a little longer to reach a final stable reading than other common electrochemical sensors such as carbon monoxide (CO) and hydrogen sulfide (H2S) gases. For instance, the hydrogen fluoride gas sensor response time at 20°C to 50% of its final stable reading (t50) is approximately 30 seconds, and 90% of its final stable reading (t90) is approximately 90 seconds. The hydrogen fluoride gas sensor is significantly affected by sudden shifts in humidity, causing a transient response, i.e., a momentary shift to zero response. The sensor response is positive when changing to drier air and negative when changing to more humid air. However, the sensor rapidly recovers as soon as conditions stabilize, and it requires time to stabilize if it is placed into an area with different relative humidity. Moreover, the hydrogen fluoride gas sensor responds to a number of acid gases with similar chemistry.

The portable devices segment is projected to grow at a higher CAGR during the forecast period

Portable devices, including detectors and handheld gas monitors, provide a relatively affordable option to end users compared with fixed monitors and offer ease in locating the hydrogen fluoride gas. For instance, in the case of large manufacturing plants, wireless gas detectors can be used to detect exact locations or the exact points of hydrogen fluoride gas leaks. These devices are user-friendly, reduce installation costs, are battery-operated, and offer accurate and fast hydrogen fluoride gas monitoring. Due to these benefits, portable devices are expected to grow at a higher CAGR during the forecast period.

The chemicals segment is projected to grow at the highest CAGR from 2021 to 2026

Hydrogen fluoride is a corrosive gas majorly found in chemical industries. It is used for manufacturing groups of chemicals especially refrigerants that can be used in refrigerators and air conditioners. Also, it can be used as a catalyst in the manufacture of alkanes from smaller alkenes. Highly accurate hydrogen fluoride gas monitoring and detecting devices are required in this industry to avoid any hazardous accident on the field. Therefore, the chemical industry generates a huge demand for highly accurate, sensitive, and reliable hydrogen fluoride gas detection devices. Thus, the hydrogen fluoride gas detection market for the chemical industry is projected to grow at the highest CAGR during the forecast period.

In 2026, the APAC is projected to hold the largest share of the overall hydrogen fluoride gas detection market

To know about the assumptions considered for the study, download the pdf brochure

In 2026, the APAC is projected to hold the largest share of the overall hydrogen fluoride gas detection market. The market in the APAC is expected to grow at the highest CAGR during the forecast period. The APAC is a manufacturing hub for automotive, consumer electronic devices and components. The growth of the hydrogen fluoride gas detection market in the APAC can be attributed to the large-scale production of electronic components in the region.

Countries such as China, Japan, India, and South Korea are major contributors to the growth of the hydrogen fluoride gas detection market in APAC. Factors such as the acceptance of innovative technologies and the increased popularity of advanced consumer electronics are driving the growth of the hydrogen fluoride gas detection market in this region.

Key Market Players

The hydrogen fluoride gas detection companies such as Honeywell International Inc. (US), Teledyne Technologies Incorporated (US), Drägerwerk AG & Co. KGaA (Germany), MSA Safety Incorporated (US), GfG Instrumentation, Inc. (US), Sensidyne, LP (US), Crowcon Detection Instruments Ltd. (UK), Analytical Technology, Inc. (ATI) (US), RKI Instruments, Inc. (US), and R.C. Systems, Inc. (US) are some of the key players in the hydrogen fluoride gas detection market.

Hydrogen Fluoride Gas Detection Market Report Scope :

|

Report Metric |

Detail |

| Estimated Market Size | USD 543 million in 2021 |

| Projected Market Size | USD 704 million by 2026 |

| Growth Rate | At CAGR of 5.3% |

|

Market Size Availability for Years |

2017–2026 |

|

Base Year |

2020 |

|

Forecast Period |

2021–2026 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

By type, end-user industry, and region |

|

Geographies Covered |

North America, Europe, APAC, and RoW |

|

Companies Covered |

Honeywell International Inc. (US), Teledyne Technologies Incorporated (US), Drägerwerk AG & Co. KGaA (Germany), MSA Safety Incorporated (US), GfG Instrumentation, Inc. (US), Sensidyne, LP (US), Crowcon Detection Instruments Ltd. (UK), Analytical Technology, Inc. (ATI) (US), RKI Instruments, Inc. (US), and R.C. Systems, Inc. (US) are some of the key players in the hydrogen fluoride gas detection market. |

This research report categorizes the hydrogen fluoride gas detection market based on type, end-user industry, and region

Hydrogen Fluoride Gas Detection Market:

Different Form of Hydrogen Fluoride:

- Gas Hydrogen Fluoride

- Liquid Hydrogen Fluoride

>Based on Type:

- Fixed Devices

- Portable Devices

Based on End-user Industry:

- Introduction

- Chemical

- Mining and Metallurgical

- Pharmaceutical

- Glass Etching

- Others (pulp & paper, wastewater treatment, and semiconductor)

Based on Region:

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- Italy

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- South Korea

- Rest of APAC

-

Rest of the world

- Middle East & Africa

- South America

Recent Developments

- In September 2021, MSA Safety Incorporated opened a new 20,000 square-foot manufacturing facility in Cranberry Township, US, to establish a global center of excellence for gas detection technology. The new facility will be used primarily for assembly work related to the recent relocation of multiple fixed gas and flame detection (FGFD) product lines from Lake Forest, US.

- In July 2021, MSA Safety Incorporated acquired Bacharach, Inc., a leader in gas detection technologies used in the heating, ventilation, air conditioning and refrigeration (HVAC-R) markets. Bacharach, Inc. has an annual revenue of approximately USD 70 million. The acquisition accelerated MSA’s access to attractive end markets globally.

- In June 2021, Drägerwerk AG & Co. KGaA signed an agreement with AWC, Inc., a technology distributor of control and instrumentation equipment worldwide. AWC, Inc. represents and promotes Dräger’s fixed flame and gas detection systems portfolio sales in Louisiana, Tennessee, and Alabama.

- In May 2021, Drägerwerk AG & Co. KGaA launched the new Polytron 6100 EC WL, a wireless gas detection solution, for flexible and cost-efficient monitoring of industrial plants. The new transmitter is intrinsically safe and SIL2-rated and can continuously monitor toxic gases and oxygen.

- In July 2020, Teledyne Technologies Incorporated acquired the gas and flame detection business of 3M. 3M’s gas and flame detection business has annual global sales of approximately USD 120 million; with this acquisition, Teledyne Technologies Incorporated strengthened its position in the gas detection market.

Frequently Asked Questions (FAQ):

Which are the major companies in the hydrogen fluoride gas detection market? What are their major strategies to strengthen their market presence?

The major companies in the hydrogen fluoride gas detection market are – Honeywell International Inc. (US), Teledyne Technologies Incorporated (US), Drägerwerk AG & Co. KGaA (Germany), MSA Safety Incorporated (US), GfG Instrumentation, Inc. (US), Sensidyne, LP (US), Crowcon Detection Instruments Ltd. (UK), Analytical Technology, Inc. (ATI) (US), RKI Instruments, Inc. (US), and R.C. Systems, Inc. (US). The major strategies adopted by these players are agreements, acquisitions, partnerships, expansions, and product launches.

Which is the potential market for hydrogen fluoride gas detection in terms of the region?

The APAC region is expected to dominate the hydrogen fluoride gas detection market due to the presence of numerous consumers and hydrogen fluoride gas detection device manufacturing companies.

What are the opportunities for new market entrants?

There are significant opportunities in the hydrogen fluoride gas detection market for start-up companies. These companies can provide hydrogen fluoride gas detection devices to automotive industry. Also, they can develop hydrogen fluoride gas detection devices that are IO-link compatible and can be integrated Industry 4.0 environment.

What are the drivers and opportunities for the hydrogen fluoride gas detection market?

Factors such as increasing accidents due to hydrogen fluoride gas leakage in oil & gas refineries and chemical plants and stringent regulations for human and environmental safety are among the driving factors of the hydrogen fluoride gas detection market. Moreover, growth of the automotive industry and increased adoption of IoT by end use industries to create lucrative opportunities in the hydrogen fluoride gas detection market.

Who are the major consumers of hydrogen fluoride gas detection devices that are expected to drive the growth of the market in the next 5 years?

The major consumers for hydrogen fluoride gas detection devices are chemical, semiconductor, pulp & paper, wastewater treatment, mining & metallurgical, and pharmaceutical industries are expected to have a significant share in this market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 19)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 HYDROGEN FLUORIDE GAS DETECTION MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 23)

2.1 RESEARCH DATA

FIGURE 2 HYDROGEN FLUORIDE GAS DETECTION MARKET: RESEARCH DESIGN

FIGURE 3 HYDROGEN FLUORIDE GAS DETECTION MARKET: RESEARCH APPROACH

2.1.1 SECONDARY DATA

2.1.1.1 List of key secondary sources

2.1.1.2 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 Breakdown of primaries

2.1.2.3 Key data from primary sources

2.1.2.4 Key industry insights

2.2 FACTOR ANALYSIS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 – TOP-DOWN (SUPPLY SIDE): REVENUES GENERATED BY COMPANIES FROM SALES OF HYDROGEN FLUORIDE GAS DETECTION DEVICES

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 – TOP-DOWN (SUPPLY SIDE): ILLUSTRATION OF REVENUE ESTIMATIONS FOR ONE COMPANY IN HYDROGEN FLUORIDE GAS DETECTION MARKET

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 – BOTTOM-UP (DEMAND SIDE): DEMAND FOR HYDROGEN FLUORIDE GAS DETECTION DEVICES IN DIFFERENT END-USER INDUSTRIES

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Approach for obtaining market share using bottom-up analysis (demand side)

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

2.3.2.1 Approach for obtaining market share using top-down analysis (supply side)

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.5.1 ASSUMPTIONS

2.5.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 37)

3.1 IMPACT OF COVID-19 PANDEMIC ON HYDROGEN FLUORIDE GAS DETECTION MARKET

FIGURE 10 GLOBAL PROPAGATION OF COVID-19

TABLE 1 RECOVERY SCENARIOS FOR GLOBAL ECONOMY

3.2 REALISTIC SCENARIO

3.3 OPTIMISTIC SCENARIO

3.4 PESSIMISTIC SCENARIO

FIGURE 11 GROWTH PROJECTIONS OF HYDROGEN FLUORIDE GAS DETECTION MARKET IN REALISTIC, OPTIMISTIC, AND PESSIMISTIC SCENARIOS

TABLE 2 PRE- AND POST-COVID-19 SCENARIOS OF HYDROGEN FLUORIDE GAS DETECTION MARKET, 2017–2026 (USD MILLION)

TABLE 3 HYDROGEN FLUORIDE GAS DETECTION MARKET, 2017–2026, IN TERMS OF VALUE AND VOLUME

FIGURE 12 PRE- AND POST-COVID-19 SCENARIOS OF HYDROGEN FLUORIDE GAS DETECTION MARKET

FIGURE 13 PORTABLE DEVICES SEGMENT TO GROW AT HIGHER CAGR FROM 2021 TO 2026

FIGURE 14 CHEMICAL INDUSTRY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 15 APAC PROJECTED TO ACCOUNT FOR LARGEST SHARE OF HYDROGEN FLUORIDE GAS DETECTION MARKET IN 2026

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 HYDROGEN FLUORIDE GAS DETECTION MARKET OPPORTUNITIES

FIGURE 16 INCREASED GLOBAL ADOPTION OF HYDROGEN FLUORIDE GAS DETECTION DEVICES IN DIFFERENT INDUSTRIES PROJECTED TO FUEL MARKET GROWTH FROM 2021 TO 2026

4.2 HYDROGEN FLUORIDE GAS DETECTION MARKET, BY TYPE

FIGURE 17 FIXED DEVICES TO ACCOUNT FOR LARGER SHARE OF GLOBAL HYDROGEN FLUORIDE GAS DETECTION MARKET IN 2026

4.3 HYDROGEN FLUORIDE GAS DETECTION MARKET, BY END-USER INDUSTRY

FIGURE 18 CHEMICAL INDUSTRY TO ACCOUNT FOR LARGEST SHARE OF HYDROGEN FLUORIDE GAS DETECTION MARKET IN 2026

4.4 HYDROGEN FLUORIDE GAS DETECTION MARKET, BY REGION

FIGURE 19 APAC TO ACCOUNT FOR LARGEST SHARE OF GLOBAL HYDROGEN FLUORIDE GAS DETECTION MARKET IN 2026

4.5 HYDROGEN FLUORIDE GAS DETECTION MARKET, BY COUNTRY

FIGURE 20 MARKET IN CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 HYDROGEN FLUORIDE GAS DETECTION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing accidents due to hydrogen fluoride gas leakage in oil & gas refineries and chemical plants are driving demand for hydrogen fluoride gas detection devices

5.2.1.2 Stringent regulations for human and environmental safety

FIGURE 22 HYDROGEN FLUORIDE GAS DETECTION MARKET DRIVERS AND THEIR IMPACT

5.2.2 RESTRAINTS

5.2.2.1 High price of hydrogen fluoride gas detection devices

FIGURE 23 HYDROGEN FLUORIDE GAS DETECTION MARKET RESTRAINT AND ITS IMPACT

5.2.3 OPPORTUNITIES

5.2.3.1 Growth of automotive industry

FIGURE 24 NUMBER OF AUTOMOTIVE PRODUCED FROM 2019–2021 WORLDWIDE (BILLION UNITS)

5.2.3.2 Increased adoption of IoT by end-user industries

FIGURE 25 HYDROGEN FLUORIDE GAS DETECTION MARKET OPPORTUNITIES AND THEIR IMPACT

5.2.4 CHALLENGES

5.2.4.1 Hydrogen fluoride gas sensor calibration is difficult

FIGURE 26 HYDROGEN FLUORIDE GAS DETECTION MARKET CHALLENGE AND ITS IMPACT

5.3 SUPPLY CHAIN ANALYSIS

FIGURE 27 SUPPLY CHAIN OF HYDROGEN FLUORIDE GAS DETECTION MARKET

5.4 TRENDS/DISRUPTIONS IMPACTING BUSINESSES OF MARKET PLAYERS AND RAW MATERIAL SUPPLIERS

5.4.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR HYDROGEN FLUORIDE GAS DETECTION MARKET PLAYERS

FIGURE 28 REVENUE SHIFT IN HYDROGEN FLUORIDE GAS DETECTION MARKET

5.5 HYDROGEN FLUORIDE GAS DETECTION ECOSYSTEM

FIGURE 29 HYDROGEN FLUORIDE GAS DETECTION ECOSYSTEM

TABLE 4 LIST OF HYDROGEN FLUORIDE GAS DETECTION DEVICE MANUFACTURERS, SUPPLIERS, AND DISTRIBUTORS

5.6 PORTER’S FIVE FORCES MODEL

TABLE 5 HYDROGEN FLUORIDE GAS DETECTION MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 30 PORTER’S FIVE FORCES ANALYSIS

5.6.1 INTENSITY OF COMPETITIVE RIVALRY

5.6.2 BARGAINING POWER OF SUPPLIERS

5.6.3 BARGAINING POWER OF BUYERS

5.6.4 THREAT OF SUBSTITUTES

5.6.5 THREAT OF NEW ENTRANTS

5.7 CASE STUDY

5.7.1 INTERNATIONAL GAS DETECTORS HELP MANCHESTER ENGINEERING CAMPUS DEVELOPMENT IN PROTECTING STAFF AND STUDENTS 24/7

5.7.2 MSA SAFETY INCORPORATED HELP PETROLUEM REFINERY TO ACHIEVE HIGHEST AMOUNT OF PROTECTION WITH HIGHEST UPTIME AVAILABLE AND NO MAINTENANCE

5.8 TECHNOLOGY ANALYSIS

5.8.1 KEY TECHNOLOGIES

5.8.1.1 Electrochemical technology

5.8.2 COMPLEMENTARY TECHNOLOGIES

5.8.2.1 Bluetooth Low Energy (BLE)

5.8.3 ADJACENT TECHNOLOGIES

5.8.3.1 Tunable Diode Laser Absorption Spectroscopy (TDLAS)

5.9 AVERAGE SELLING PRICE ANALYSIS

TABLE 6 AVERAGE SELLING PRICES OF HYDROGEN FLUORIDE GAS DETECTION DEVICE TYPES

5.10 TRADE ANALYSIS

5.10.1 IMPORT SCENARIO

TABLE 7 IMPORT DATA, BY COUNTRY, 2016–2020 (USD MILLION)

5.10.2 EXPORT SCENARIO

TABLE 8 EXPORT DATA, BY COUNTRY, 2016–2020 (USD MILLION)

5.11 PATENT ANALYSIS, 2015–2021

FIGURE 31 PATENTS GRANTED WORLDWIDE FROM 2011 TO 2021

TABLE 9 TOP 20 PATENT OWNERS FROM 2011 TO 2021

FIGURE 32 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2011–2021

5.12 TARIFFS AND REGULATIONS

5.12.1 TARIFFS

5.12.2 REGULATORY COMPLIANCE

6 DIFFERENT FORMS OF HYDROGEN FLUORIDE (Page No. - 76)

6.1 INTRODUCTION

FIGURE 33 DIFFERENT FORMS OF HYDROGEN FLUORIDE

6.2 HYDROGEN FLUORIDE GAS

6.3 LIQUID HYDROGEN FLUORIDE

7 HYDROGEN FLUORIDE GAS DETECTION MARKET, BY TYPE (Page No. - 78)

7.1 INTRODUCTION

FIGURE 34 HYDROGEN FLUORIDE GAS DETECTION MARKET, BY TYPE

FIGURE 35 FIXED DEVICES SEGMENT TO ACCOUNT FOR LARGER SHARE OF HYDROGEN FLUORIDE GAS DETECTION MARKET IN 2021

TABLE 10 HYDROGEN FLUORIDE GAS DETECTION MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 11 HYDROGEN FLUORIDE GAS DETECTION MARKET, BY TYPE, 2021–2026 (USD MILLION)

7.2 FIXED DEVICES

7.2.1 FIXED DEVICES ENABLE CONTINUOUS MONITORING OF HYDROGEN FLUORIDE GAS

7.3 PORTABLE DEVICES

7.3.1 PORTABLE DEVICES ARE EFFECTIVE AND PRACTICAL MEASUREMENT TOOLS

8 HYDROGEN FLUORIDE GAS DETECTION MARKET, BY END-USER INDUSTRY (Page No. - 82)

8.1 INTRODUCTION

FIGURE 36 HYDROGEN FLUORIDE GAS DETECTION MARKET, BY END-USER INDUSTRY

FIGURE 37 CHEMICAL INDUSTRY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 12 HYDROGEN FLUORIDE GAS DETECTION MARKET, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 13 HYDROGEN FLUORIDE GAS DETECTION MARKET, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

8.2 CHEMICALS

8.2.1 HYDROGEN FLUORIDE GAS DETECTION DEVICES HELP MAINTAIN PERSONNEL AND ENVIRONMENTAL SAFETY IN CHEMICAL INDUSTRY

FIGURE 38 APAC TO DOMINATE HYDROGEN FLUORIDE GAS DETECTION MARKET FOR CHEMICAL INDUSTRY DURING FORECAST PERIOD

TABLE 14 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR CHEMICALS, BY REGION, 2017–2020 (USD MILLION)

TABLE 15 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR CHEMICALS, BY REGION, 2021–2026 (USD MILLION)

TABLE 16 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR CHEMICALS IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 17 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR CHEMICALS IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 18 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR CHEMICALS IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 19 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR CHEMICALS IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 20 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR CHEMICALS IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 21 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR CHEMICALS IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 22 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR CHEMICALS IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 23 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR CHEMICALS IN ROW, BY REGION, 2021–2026 (USD MILLION)

8.3 MINING & METALLURGICAL

8.3.1 HYDROGEN FLUORIDE FINDS NUMEROUS APPLICATIONS IN MINING & METALLURGICAL INDUSTRY

FIGURE 39 APAC IS ESTIMATED TO DOMINATE HYDROGEN FLUORIDE GAS DETECTION MARKET FOR MINING & METALLURGICAL SEGMENT IN 2021

TABLE 24 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR MINING & METALLURGICAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 25 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR MINING & METALLURGICAL, BY REGION, 2021–2026 (USD MILLION)

TABLE 26 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR MINING & METALLURGICAL IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD THOUSAND)

TABLE 27 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR MINING & METALLURGICAL IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD THOUSAND)

TABLE 28 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR MINING & METALLURGICAL IN EUROPE, BY COUNTRY, 2017–2020 (USD THOUSAND)

TABLE 29 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR MINING & METALLURGICAL IN EUROPE, BY COUNTRY, 2021–2026 (USD THOUSAND)

TABLE 30 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR MINING & METALLURGICAL IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 31 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR MINING & METALLURGICAL IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 32 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR MINING & METALLURGICAL IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 33 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR MINING & METALLURGICAL IN ROW, BY REGION, 2021–2026 (USD MILLION)

8.4 PHARMACEUTICALS

8.4.1 HYDROGEN FLUORIDE GAS DETECTION DEVICES DETECT ACCURATE LEVELS OF HYDROGEN FLUORIDE IN PHARMACEUTICALS

TABLE 34 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR PHARMACEUTICALS, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 35 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR PHARMACEUTICALS, BY REGION, 2021–2026 (USD THOUSAND)

TABLE 36 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR PHARMACEUTICALS IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD THOUSAND)

TABLE 37 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR PHARMACEUTICALS IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD THOUSAND)

TABLE 38 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR PHARMACEUTICALS IN EUROPE, BY COUNTRY, 2017–2020 (USD THOUSAND)

TABLE 39 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR PHARMACEUTICALS IN EUROPE, BY COUNTRY, 2021–2026 (USD THOUSAND)

TABLE 40 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR PHARMACEUTICALS IN APAC, BY COUNTRY, 2017–2020 (USD THOUSAND)

TABLE 41 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR PHARMACEUTICALS IN APAC, BY COUNTRY, 2021–2026 (USD THOUSAND)

TABLE 42 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR PHARMACEUTICALS IN ROW, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 43 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR PHARMACEUTICALS IN ROW, BY REGION, 2021–2026 (USD THOUSAND)

8.5 GLASS ETCHING

8.5.1 FIXED AND PORTABLE HYDROGEN FLUORIDE GAS DETECTION DEVICES ARE ESSENTIAL TO ACTIVELY MONITOR LEVELS OF HYDROGEN FLUORIDE

TABLE 44 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR GLASS ETCHING, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 45 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR GLASS ETCHING, BY REGION, 2021–2026 (USD THOUSAND)

TABLE 46 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR GLASS ETCHING IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD THOUSAND)

TABLE 47 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR GLASS ETCHING IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD THOUSAND)

TABLE 48 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR GLASS ETCHING IN EUROPE, BY COUNTRY, 2017–2020 (USD THOUSAND)

TABLE 49 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR GLASS ETCHING IN EUROPE, BY COUNTRY, 2021–2026 (USD THOUSAND)

TABLE 50 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR GLASS ETCHING IN APAC, BY COUNTRY, 2017–2020 (USD THOUSAND)

TABLE 51 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR GLASS ETCHING IN APAC, BY COUNTRY, 2021–2026 (USD THOUSAND)

TABLE 52 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR GLASS ETCHING IN ROW, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 53 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR GLASS ETCHING IN ROW, BY REGION, 2021–2026 (USD THOUSAND)

8.6 OTHERS

TABLE 54 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR OTHERS, BY REGION, 2017–2020 (USD MILLION)

TABLE 55 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR OTHERS, BY REGION, 2021–2026 (USD MILLION)

FIGURE 40 US IS ESTIMATED TO LEAD HYDROGEN FLUORIDE GAS DETECTION MARKET FOR OTHERS SEGMENT IN 2021

TABLE 56 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR OTHERS IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 57 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR OTHERS IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 58 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR OTHERS IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 59 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR OTHERS IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 60 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR OTHERS IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 61 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR OTHERS IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 62 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR OTHERS IN ROW, 2017–2020 (USD MILLION)

TABLE 63 HYDROGEN FLUORIDE GAS DETECTION MARKET FOR OTHERS IN ROW, BY REGION, 2021–2026 (USD MILLION)

9 REGIONAL ANALYSIS (Page No. - 106)

9.1 INTRODUCTION

FIGURE 41 REGIONAL SPLIT OF HYDROGEN FLUORIDE GAS DETECTION MARKET

FIGURE 42 APAC TO DOMINATE HYDROGEN FLUORIDE GAS DETECTION MARKET DURING FORECAST PERIOD

TABLE 64 HYDROGEN FLUORIDE GAS DETECTION MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 65 HYDROGEN FLUORIDE GAS DETECTION MARKET, BY REGION, 2021–2026 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 43 NORTH AMERICA: HYDROGEN FLUORIDE GAS DETECTION MARKET SNAPSHOT

FIGURE 44 US TO DOMINATE HYDROGEN FLUORIDE GAS DETECTION MARKET IN 2021

TABLE 66 HYDROGEN FLUORIDE GAS DETECTION MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 67 HYDROGEN FLUORIDE GAS DETECTION MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 68 HYDROGEN FLUORIDE GAS DETECTION MARKET IN NORTH AMERICA, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 69 HYDROGEN FLUORIDE GAS DETECTION MARKET IN NORTH AMERICA, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

9.2.1 US

9.2.1.1 Prominent presence of hydrogen fluoride manufacturers and consumers to boost market in US

TABLE 70 HYDROGEN FLUORIDE GAS DETECTION MARKET IN US, BY END-USER INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 71 HYDROGEN FLUORIDE GAS DETECTION MARKET IN US, BY END-USER INDUSTRY, 2021–2026 (USD THOUSAND)

9.2.2 CANADA

9.2.2.1 Mining & metallurgical industry to offer promising opportunities for hydrogen fluoride gas detection market growth in Canada

TABLE 72 HYDROGEN FLUORIDE GAS DETECTION MARKET IN CANADA, BY END-USER INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 73 HYDROGEN FLUORIDE GAS DETECTION MARKET IN CANADA, BY END-USER INDUSTRY, 2021–2026 (USD THOUSAND)

9.2.3 MEXICO

9.2.3.1 Automotive industry to create lucrative opportunities for hydrogen fluoride gas detection devices in Mexico

TABLE 74 HYDROGEN FLUORIDE GAS DETECTION MARKET IN MEXICO, BY END-USER INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 75 HYDROGEN FLUORIDE GAS DETECTION MARKET IN MEXICO, BY END-USER INDUSTRY, 2021–2026 (USD THOUSAND)

9.3 EUROPE

FIGURE 45 EUROPE: HYDROGEN FLUORIDE GAS DETECTION MARKET SNAPSHOT

TABLE 76 HYDROGEN FLUORIDE GAS DETECTION MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 77 HYDROGEN FLUORIDE GAS DETECTION MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 78 HYDROGEN FLUORIDE GAS DETECTION MARKET IN EUROPE, BY END-USER INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 79 HYDROGEN FLUORIDE GAS DETECTION MARKET IN EUROPE, BY END-USER INDUSTRY, 2021–2026 (USD THOUSAND)

9.3.1 GERMANY

9.3.1.1 Germany to dominate hydrogen fluoride gas detection market in Europe during forecast period

TABLE 80 HYDROGEN FLUORIDE GAS DETECTION MARKET IN GERMANY, BY END-USER INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 81 HYDROGEN FLUORIDE GAS DETECTION MARKET IN GERMANY, BY END-USER INDUSTRY, 2021–2026 (USD THOUSAND)

9.3.2 UK

9.3.2.1 Presence of key end-user industry in UK to support hydrogen fluoride gas detection market growth during forecast period

TABLE 82 HYDROGEN FLUORIDE GAS DETECTION MARKET IN UK, BY END-USER INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 83 HYDROGEN FLUORIDE GAS DETECTION MARKET IN UK, BY END-USER INDUSTRY, 2021–2026 (USD THOUSAND)

9.3.3 FRANCE

9.3.3.1 Growth in chemical industry to increase demand for hydrogen fluoride gas detection devices in France

TABLE 84 HYDROGEN FLUORIDE GAS DETECTION MARKET IN FRANCE, BY END-USER INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 85 HYDROGEN FLUORIDE GAS DETECTION MARKET IN FRANCE, BY END-USER INDUSTRY, 2021–2026 (USD THOUSAND)

9.3.4 ITALY

9.3.4.1 Flourishing end-user industries to fuel market growth in Italy

TABLE 86 HYDROGEN FLUORIDE GAS DETECTION MARKET IN ITALY, BY END-USER INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 87 HYDROGEN FLUORIDE GAS DETECTION MARKET IN ITALY, BY END-USER INDUSTRY, 2021–2026 (USD THOUSAND)

9.3.5 REST OF EUROPE

TABLE 88 HYDROGEN FLUORIDE GAS DETECTION MARKET IN REST OF EUROPE, BY END-USER INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 89 HYDROGEN FLUORIDE GAS DETECTION MARKET IN REST OF EUROPE, BY END-USER INDUSTRY, 2021–2026 (USD THOUSAND)

9.4 APAC

FIGURE 46 APAC: HYDROGEN FLUORIDE GAS DETECTION MARKET SNAPSHOT

FIGURE 47 CHINA TO DOMINATE HYDROGEN FLUORIDE GAS DETECTION MARKET IN APAC FROM 2021–2026

TABLE 90 HYDROGEN FLUORIDE GAS DETECTION MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 91 HYDROGEN FLUORIDE GAS DETECTION MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 92 HYDROGEN FLUORIDE GAS DETECTION MARKET IN APAC, BY END-USER INDUSTRY, 2017–2020 (USD MILLION)

TABLE 93 HYDROGEN FLUORIDE GAS DETECTION MARKET IN APAC, BY END-USER INDUSTRY, 2021–2026 (USD MILLION)

9.4.1 CHINA

9.4.1.1 China is fastest-growing market for hydrogen fluoride gas detection devices

TABLE 94 HYDROGEN FLUORIDE GAS DETECTION MARKET IN CHINA, BY END-USER INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 95 HYDROGEN FLUORIDE GAS DETECTION MARKET IN CHINA, BY END-USER INDUSTRY, 2021–2026 (USD THOUSAND)

9.4.2 JAPAN

9.4.2.1 Presence of numerous hydrogen fluoride gas consumers in Japan supports hydrogen fluoride gas detection market growth

TABLE 96 HYDROGEN FLUORIDE GAS DETECTION MARKET IN JAPAN, BY END-USER INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 97 HYDROGEN FLUORIDE GAS DETECTION MARKET IN JAPAN, BY END-USER INDUSTRY, 2021–2026 (USD THOUSAND)

9.4.3 INDIA

9.4.3.1 Indian government’s initiatives to encourage growth of domestic chemical production to boost hydrogen fluoride gas detection devices market growth

TABLE 98 HYDROGEN FLUORIDE GAS DETECTION MARKET IN INDIA, BY END-USER INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 99 HYDROGEN FLUORIDE GAS DETECTION MARKET IN INDIA, BY END-USER INDUSTRY, 2021–2026 (USD THOUSAND)

9.4.4 SOUTH KOREA

9.4.4.1 Consumer electronics and semiconductor industries to bolster hydrogen fluoride gas detection market in South Korea

FIGURE 48 OTHERS SEGMENT DOMINATED HYDROGEN FLUORIDE GAS DETECTION MARKET IN SOUTH KOREA IN 2021

TABLE 100 HYDROGEN FLUORIDE GAS DETECTION MARKET IN SOUTH KOREA, BY END-USER INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 101 HYDROGEN FLUORIDE GAS DETECTION MARKET IN SOUTH KOREA, BY END-USER INDUSTRY, 2021–2026 (USD THOUSAND)

9.4.5 REST OF APAC

TABLE 102 HYDROGEN FLUORIDE GAS DETECTION MARKET IN REST OF APAC, BY END-USER INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 103 HYDROGEN FLUORIDE GAS DETECTION MARKET IN REST OF APAC, BY END-USER INDUSTRY, 2021–2026 (USD THOUSAND)

9.5 REST OF THE WORLD (ROW)

FIGURE 49 MIDDLE EAST & AFRICA TO DOMINATE HYDROGEN FLUORIDE GAS DETECTION MARKET DURING FORECAST PERIOD

TABLE 104 HYDROGEN FLUORIDE GAS DETECTION MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 105 HYDROGEN FLUORIDE GAS DETECTION MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 106 HYDROGEN FLUORIDE GAS DETECTION MARKET IN ROW, BY END-USER INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 107 HYDROGEN FLUORIDE GAS DETECTION MARKET IN ROW, BY END-USER INDUSTRY, 2021–2026 (USD THOUSAND)

9.5.1 MIDDLE EAST & AFRICA

9.5.1.1 Presence of various industries to drive hydrogen fluoride gas detection market in Middle East & Africa

TABLE 108 HYDROGEN FLUORIDE GAS DETECTION MARKET IN MIDDLE EAST & AFRICA, BY END-USER INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 109 HYDROGEN FLUORIDE GAS DETECTION MARKET IN MIDDLE EAST & AFRICA, BY END-USER INDUSTRY, 2021–2026 (USD THOUSAND)

9.5.2 SOUTH AMERICA

9.5.2.1 Dominance of mining & metallurgical industry expected to bolster hydrogen fluoride gas detection market in South America

TABLE 110 HYDROGEN FLUORIDE GAS DETECTION MARKET IN SOUTH AMERICA, BY END-USER INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 111 HYDROGEN FLUORIDE GAS DETECTION MARKET IN SOUTH AMERICA, BY END-USER INDUSTRY, 2021–2026 (USD THOUSAND)

10 COMPETITIVE LANDSCAPE (Page No. - 139)

10.1 OVERVIEW

10.2 MARKET EVALUATION FRAMEWORK

TABLE 112 OVERVIEW OF STRATEGIES DEPLOYED BY KEY HYDROGEN FLUORIDE GAS DETECTION MANUFACTURERS

10.2.1 PRODUCT PORTFOLIO

10.2.2 REGIONAL FOCUS

10.2.3 MANUFACTURING FOOTPRINT

10.2.4 ORGANIC/INORGANIC STRATEGIES

10.3 MARKET SHARE ANALYSIS, 2020

TABLE 113 HYDROGEN FLUORIDE GAS DETECTION MARKET: MARKET SHARE ANALYSIS (2020)

10.4 5-YEAR COMPANY REVENUE ANALYSIS

FIGURE 50 5-YEAR REVENUE ANALYSIS OF TOP 5 PLAYERS IN HYDROGEN FLUORIDE GAS DETECTION MARKET, 2016–2020

10.5 COMPANY EVALUATION QUADRANT

10.5.1 STAR

10.5.2 EMERGING LEADER

10.5.3 PERVASIVE

10.5.4 PARTICIPANT

FIGURE 51 HYDROGEN FLUORIDE GAS DETECTION MARKET: COMPANY EVALUATION QUADRANT, 2020

10.6 COMPANY FOOTPRINT

TABLE 114 COMPANY FOOTPRINT

TABLE 115 COMPANY TYPE FOOTPRINT

TABLE 116 COMPANY END-USER INDUSTRY FOOTPRINT

TABLE 117 COMPANY REGION FOOTPRINT

10.7 COMPETITIVE SITUATIONS AND TRENDS

10.7.1 PRODUCT LAUNCHES

TABLE 118 PRODUCT LAUNCHES, JANUARY 2019–DECEMBER 2021

10.7.2 DEALS

TABLE 119 DEALS, JANUARY 2019–DECEMBER 2021

10.7.3 OTHERS

TABLE 120 EXPANSION, JANUARY 2019–DECEMBER 2021

11 COMPANY PROFILE (Page No. - 154)

11.1 KEY PLAYERS

(Business overview, Products/solutions offered, Recent Developments, MNM view)*

11.1.1 HONEYWELL INTERNATIONAL INC.

TABLE 121 HONEYWELL INTERNATIONAL INC.: BUSINESS OVERVIEW

FIGURE 52 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

11.1.2 TELEDYNE TECHNOLOGIES INCORPORATED

TABLE 122 TELEDYNE TECHNOLOGIES INCORPORATED: BUSINESS OVERVIEW

FIGURE 53 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT

11.1.3 DRÄGERWERK AG & CO. KGAA

TABLE 123 DRÄGERWERK AG & CO. KGAA: BUSINESS OVERVIEW

FIGURE 54 DRÄGERWERK AG & CO. KGAA: COMPANY SNAPSHOT

11.1.4 MSA SAFETY INCORPORATED

TABLE 124 MSA SAFETY INCORPORATED: BUSINESS OVERVIEW

FIGURE 55 MSA SAFETY INCORPORATED: COMPANY SNAPSHOT

11.1.5 GFG INSTRUMENTATION, INC.

TABLE 125 GFG INSTRUMENTATION, INC.: BUSINESS OVERVIEW

11.1.6 CROWCON DETECTION INSTRUMENTS LTD.

TABLE 126 CROWCON DETECTION INSTRUMENTS LTD.: BUSINESS OVERVIEW

11.1.7 RKI INSTRUMENTS, INC.

TABLE 127 RKI INSTRUMENTS, INC.: BUSINESS OVERVIEW

11.1.8 ANALYTICAL TECHNOLOGY, INC. (ATI)

TABLE 128 ANALYTICAL TECHNOLOGY, INC. (ATI): BUSINESS OVERVIEW

11.1.9 R.C. SYSTEMS, INC.

TABLE 129 R.C. SYSTEMS, INC.: BUSINESS OVERVIEW

11.1.10 SENSIDYNE, LP

TABLE 130 SENSIDYNE, LP: BUSINESS OVERVIEW

*Details on Business overview, Products/solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

11.2 OTHER KEY PLAYERS

11.2.1 NEW COSMOS ELECTRIC CO., LTD.

11.2.2 SHENZHEN YUANTE TECHNOLOGY CO., LTD. (SAFEGAS)

11.2.3 ATB ANALYTICS LLC

11.2.4 GASERA LTD.

11.2.5 INTERNATIONAL GAS DETECTORS (IGD)

11.2.6 GAO TEK INC.

11.2.7 MACURCO GAS DETECTION

11.2.8 MEMBRAPOR AG

11.2.9 SENSOR ELECTRONICS CORPORATION

11.2.10 SHENZHEN KORNO IMPORT & EXPORT CO., LTD.

11.2.11 NEO MONITORS AS

11.2.12 APPLIED TECHNO ENGINEERS PVT LTD.

11.2.13 EC SENSE GMBH

11.2.14 HENAN OTYWELL ELECTRONIC TECHNOLOGY CO., LTD.

11.2.15 SICK AG

12 APPENDIX (Page No. - 203)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

The study involved four major activities in estimating the size of the hydrogen fluoride gas detection market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the hydrogen fluoride gas detection market. Secondary sources considered for this research study include government sources; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and professional associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Secondary research has been mainly used to obtain key information about the supply chain of the hydrogen fluoride gas detection industry to identify the key players based on their products, as well as to identify the prevailing industry trends in the hydrogen fluoride gas detection market based on type, end- user industry, and region. It also includes information about the key developments undertaken from both market- and technology-oriented perspectives.

Primary Research

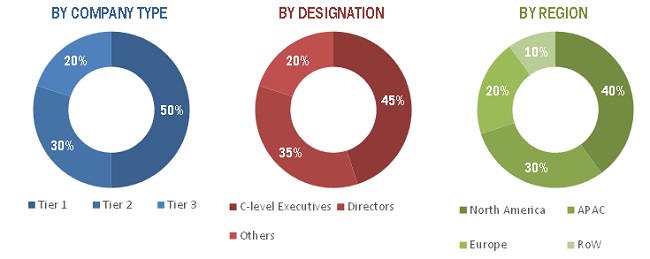

Extensive primary research has been conducted after understanding and analyzing the current scenario of the hydrogen fluoride gas detection market through secondary research. Several primary interviews have been conducted with key opinion leaders from both the demand and supply sides across four major regions: North America, Europe, APAC, and RoW. Approximately 25% of the primary interviews have been conducted with the demand side, while 75% have been conducted with the supply side. This primary data has been collected mainly through telephonic interviews, which account for 80% of the total primary interviews. Questionnaires and e-mails have also been used to collect data.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

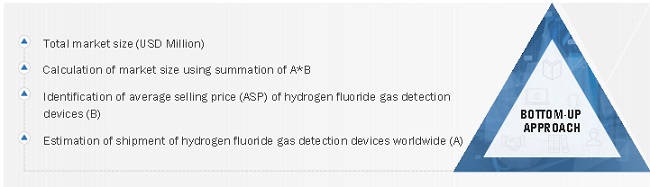

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the hydrogen fluoride gas detection market.

- Identifying various end-user industries where hydrogen fluoride gas detection devices are used or likely to be used

- Analyzing each end-user industry along with major related companies and hydrogen fluoride gas detection devices providers

- Estimating the market for the end-user industry in which hydrogen fluoride gas detection devices are used

- Tracking the ongoing and upcoming installation of hydrogen fluoride gas detection devices by end-user industry and forecasting the market based on these developments and other critical parameters

- Undertaking multiple discussions with key opinion leaders to understand the type of hydrogen fluoride gas detection devices and services and different technologies designed and developed for end-user industries, which helped in analyzing the impact of the developments undertaken by each major company on the hydrogen fluoride gas detection market

- Arriving at the market estimates by analyzing the end-user industries at the country-level; thereafter, combining this data to arrive at the market estimates based on region

- Verifying and crosschecking estimates at every level with key opinion leaders, including chief executive officers (CEO), directors, and operation managers, and then finally with the domain experts of MarketsandMarkets

- Studying various paid and unpaid sources of information such as annual reports, press releases, white papers, and databases for the company- and region-specific developments undertaken in the hydrogen fluoride gas detection market

To know about the assumptions considered for the study, Request for Free Sample Report

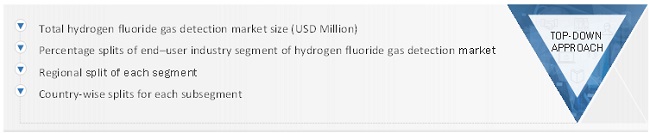

The top-down approach has been used to estimate and validate the total size of the hydrogen fluoride gas detection market.

- Focusing initially on the high investments and expenditures undertaken in the ecosystem of hydrogen fluoride gas detection; further splitting into type and end-user industry and listing key developments in key market areas

- Identifying all major players in the hydrogen fluoride gas detection market and their penetration in various end-user industries through secondary research and verifying with brief discussions with industry experts

- Analyzing revenues, product mix, geographic presence, and key end-user industries for which hydrogen fluoride gas detection devices are offered by all identified players to estimate and arrive at the percentage splits for all key segments

- Discussing these splits with industry experts to validate the information and identifying key growth pockets across all key segments

- Breaking down the total market based on verified splits and key growth pockets across all segments

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides in the hydrogen fluoride gas detection market.

Report Objectives

- To describe and forecast the global size of the hydrogen fluoride gas detection market in terms of value and volume

- To describe, segment, and forecast, the hydrogen fluoride gas detection market based on type and end-user industry in terms of value

- To describe and forecast the market for four key regions, namely, North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW), in terms of value

- To describe the different forms of hydrogen fluoride

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the hydrogen fluoride gas detection market

- To provide a detailed overview of the supply chain pertaining to the hydrogen fluoride gas detection ecosystem along with the average selling prices of hydrogen fluoride gas detection devices

- To strategically analyze the ecosystem, tariffs and regulations, patent landscape, trade landscape, and case studies pertaining to the market understudy

- To describe the detailed impact of the COVID-19 pandemic on the market

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market

- To analyze competitive developments such as product launches, expansions, agreements, partnerships, and acquisitions in the hydrogen fluoride gas detection market

- To strategically profile the key players in the hydrogen fluoride gas detection market and comprehensively analyze their market rankings and core competencies2

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Hydrogen Fluoride Gas Detection Market