Hydrogel Wound Care Market by Product (Amorphous Hydrogel Dressings, Impregnated Gauze, Hydrogel Sheets), Wound Type (Surgical & Traumatic Wounds, Burns, Diabetic Foot, Venous, Pressure Ulcers), End User (Hospitals, Home Care) - Global Forecast to 2027

“Rising prevalence of chronic & acute wounds and growing number of surgical procedures are driving the overall growth of the hydrogel wound care market”

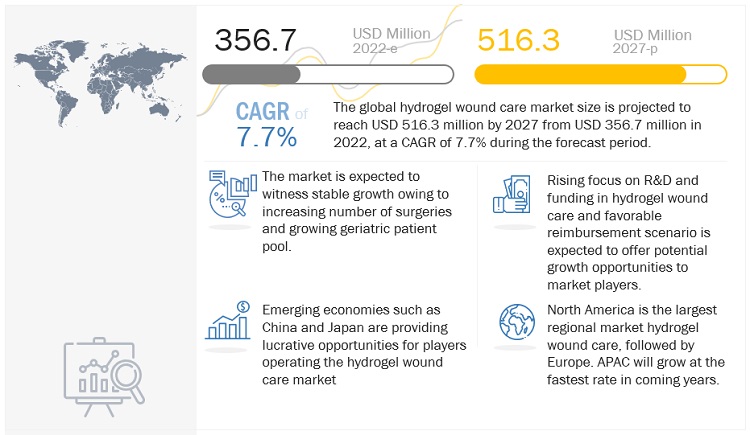

The global hydrogel wound care market is projected to reach USD 516.3 million by 2027 from USD 356.7 million in 2022, at a CAGR of 7.7% during the forecast period. Market is driven by factors such as the growing number of surgical procedures, rising prevalence of chronic and acute wounds, and growing geriatric patient pool. Emerging economies such as China and Japan are providing lucrative opportunities for the players operating in the hydrogel wound care market.

To know about the assumptions considered for the study, Request for Free Sample Report

“The amorphous hydrogel dressings segment accounted for the largest market share in the hydrogel wound care market during the forecast period, by product”

The hydrogel wound care market is segmented into amorphous hydrogel dressings, impregnated gauze, hydrogel sheets, and other products. The amorphous hydrogel dressings segment dominated the hydrogel wound care market in 2021. This can be attributed to the excessive use of amorphous hydrogel dressings over impregnated gauze and hydrogel sheets to treat ulcers and wounds, as amorphous dressings have an advantage over other dressings in promoting efficient wound healing.

“In 2021, surgical & traumatic wounds segment accounted for the largest market share”

Based on wound type, the hydrogel wound care market is segmented into surgical & traumatic wounds, diabetic foot ulcers, pressure ulcers, venous leg ulcers, burns, and other wounds. The surgical & traumatic wounds segment accounted for the largest market share in 2021. The rising number of surgical site infections (SSIs) is the major driver for this segment. Surgical wounds majorly occur due to SSIs. Thus, the rising incidence of surgical site infections is predicted to boost the segment growth. Diabetic foot ulcers segment accounted for the second largest share in 2021. DFUs have a more significant healing duration and require frequent dressing changes, which is responsible for higher demand for wound care products such as hydrogel dressings. Thus, the rise in the number of visits for the DFUs treatment is anticipated to drive the segments growth during the forecast period.

“The Asia Pacific market is expected to grow at the highest CAGR during the forecast period”

The global hydrogel wound care market is segmented into five regions - North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. The Asia Pacific region is expected to witness the highest growth in the hydrogel wound care market during the forecast period. The high growth in this region can primarily be attributed to the increasing prevalence of chronic wounds, increasing incidence of DFUs, rising healthcare spending, growing per capita income, the expansion of private-sector hospitals to rural areas in various APAC countries, increasing medical tourism, and the presence of high-growth markets. The low labor costs and favorable regulatory environment in the region are also expected to propel market growth. Additionally, the rising geriatric population in this region is expected to raise the demand for hydrogel wound care products.

The primary interviews conducted for this report can be categorized as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C-level - 27%, D-level - 18%, and Others - 55%

- By Region: North America - 51%, Europe - 21%, Asia Pacific - 18%, Latin America – 6% , and the Middle East & Africa – 4%

To know about the assumptions considered for the study, download the pdf brochure

Lits of Companies Profiled in the Report:

- Smith & Nephew (UK)

- 3M (US)

- Convatec Group Plc (UK)

- Coloplast A/S (Denmark)

- Molnlycke Health Care Ab (Sweden)

- Paul Hartmann AG (Germany)

- DeRoyal Industries (US)

- Advanced Medical Solutions Group plc (UK)

- Cardinal Health, Inc. (US)

- Derma Sciences (US)M

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

5.3 ECOSYSTEM ANALYSIS

5.4 SUPPLY CHAIN ANALYSIS

5.5 PRICING ANALYSIS

6 HYDROGEL WOUND CARE MARKET, BY PRODUCT

6.1 INTRODUCTION

6.2 AMORPHOUS HYDROGEL DRESSING

6.3 IMPREGNATED GAUZE

6.4 HYDROGEL SHEETS

6.5 OTHER PRODUCTS (IF ANY)

7 HYDROGEL WOUND CARE MARKET, BY WOUND TYPE

7.1 INTRODUCTION

7.2 SURGICAL & TRAUMATIC WOUNDS

7.3 DIABETIC FOOT ULCERS

7.4 PRESSURE ULCERS

7.5 VENOUS LEG ULCERS

7.6 BURNS

7.7 OTHER WOUNDS

8 HYDROGEL WOUND CARE MARKET, BY END USER

8.1 INTRODUCTION

8.2 HOSPITALS & CLINICS

8.2.1 INPATIENT SETTINGS

8.2.2 OUTPATIENT SETTINGS

8.3 HOME CARE SETTINGS

8.4 OTHER END USERS

9 HYDROGEL WOUND CARE MARKET, BY REGION

9.1 INTRODUCTION

9.2 NORTH AMERICA

9.2.1 U.S.

9.2.2 CANADA

9.3 EUROPE

9.3.1 GERMANY

9.3.2 FRANCE

9.3.3 U.K.

9.3.4 ITALY

9.3.5 SPAIN

9.3.6 REST OF EUROPE

9.4 ASIA

9.4.1 JAPAN

9.4.2 CHINA

9.4.3 INDIA

9.4.4 REST OF ASIA

9.5 REST OF THE WORLD

10 COMPETITIVE LANDSCAPE

12.1 COMPANY EVALUATION MATRIX DEFINITION & METHODOLOGY

12.2 MARKET SHARE/RANKING ANALYSIS (2021, % OF USD MILLION)

12.3 COMPETITIVE SCENARIO

12.3.1 PRODUCT LAUNCHES AND APPROVALS

12.3.2 COLLABORATIONS

12.3.3 EXPANSIONS

12.3.4 ACQUISITIONS

12.3.5 OTHER DEVELOPMENTS

12.4 COMPETITIVE LEADERSHIP MAPPING

12.4.1 VENDOR INCLUSION CRITERIA

12.4.2 STARS

12.4.3 EMERGING LEADERS

12.4.4 PERVASIVE

12.4.5 EMERGING COMPANIES

11 COMPANY PROFILES (INTRODUCTION, PRODUCTS & SERVICES, STRATEGY, & ANALYST INSIGHTS, DEVELOPMENTS, MNM VIEW)*

11.1 SMITH & NEPHEW PLC

11.2 3M GROUP

11.3 CONVATEC GROUP PLC

11.4 COLOPLAST A/S

11.5 MÖLNLYCKE HEALTH CARE AB

11.6 DEROYAL INDUSTRIES INC.

11.7 PAUL HARTMANN AG

11.8 ADVANCED MEDICAL SOLUTIONS GROUP PLC

11.9 CARDINAL HEALTH

11.10 DERMA SCIENCES

12 APPENDIX

Growth opportunities and latent adjacency in Hydrogel Wound Care Market