Hybrid Seeds Market by Crop Type (Cereals & Grains, Oilseeds & Pulses, and Vegetables), Key Crop (Corn, Rice, Soybean, Cotton, Canola, Tomato, Hot pepper, Cucumber, Watermelon), Cultivation Type, and Region - Global Forecast to 2026

Hybrid Seeds Market Report Analysis & Industry Share, 2026

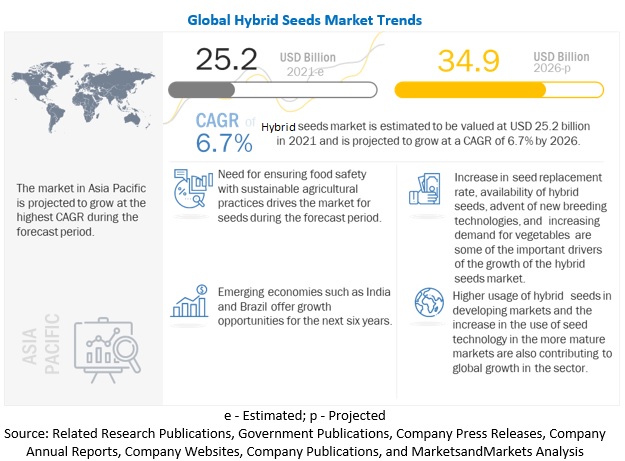

The hybrid seeds market size was valued at $25,191.5 million in 2021, and is predicted to reach $34,877.0 million by 2026, registering a CAGR of 6.7% from 2021 to 2026. The demand for hybrid seeds has increased due to their advantages over traditional seeds. These seeds are easier and faster to grow, and are more resilient to stress and disease. They also have longer lifespan, higher yields, and larger fruits. The growing awareness of these benefits has led to a rise in demand for hybrid seeds from various industries, including food processing, textile, pharmaceutical, and nuclear. As these industries rely heavily on agricultural crop seeds, the use of hybrid seeds plays a significant role in driving economic activities and market growth worldwide.

To know about the assumptions considered for the study, Request for Free Sample Report

Hybrid Seeds Market Dynamics

Driver: Rise in demand for fruits & vegetables across the globe

With the change in dietary practices globally, the demand for fresh and frozen vegetables has been growing. Consumers have become more conscious related to what to consume to better their health and overall wellness, due to which the production of fruits & vegetables has grown. Several farmers have gradually moved toward the cultivation of industrial crops, which would result in growth in market returns. According to the USDA, farmers are projected to seed approximately 91 million acres of land with soybean in 2018, an increase from 90.4 million acres sowed in 2017. The total acreage of the eight chief crops of the US is expected to rise from 252.3 million acres in 2017 to 253.7 million acres in 2018. This increase in acreage is estimated for crops such as sorghum, corn, barley, oats, cotton, rice, and fruit crops, while that of wheat is expected to decline.

In the US, the most commonly demanded fresh fruit was bananas. Some of the other commonly consumed fresh fruits include grapes, pears, and strawberries. There is also a strong demand for vegetables such as peppers, melons, and lettuce due to the growing focus on salad-based diets in North America. These factors could drive market growth.

Restraint of the Hybrid Seeds Market: Impact of climate change on crop production

Climate change plays an important role in the agricultural industry; it is useful in improving yield and reducing diseases and insect attacks. Uncertainty in the climatic conditions affects the crop yield, resulting in the loss of crops.

Climate has a vital effect on various agricultural crop production, and sometimes, climatic factors are the natural factors for the production of some crops. Weather forecast assumes considerable importance for agricultural activities to plan agricultural practices such as sowing, irrigation, management of crop diseases & pests, and harvest planning. For instance, common mustard crops grow naturally in mesic temperate regions; these mustard crops are expected to reduce due to global warming and increased aridity. The increased aridity is predicted to reduce the oil concertation and seed yield of rapeseed crops.

The increased emission of carbon dioxide and other greenhouse gases such as methane and nitrous oxide is responsible for the change in global temperature and warming. This change in the climate directly affects oilseed crops by decreasing the activity of pollinators. For instance, rapeseed is grown globally for cooking and use in animal feed and biofuels.

Challenges: Unorganized new entrants with a low profit-to-cost ratio

New technologies, such as breeding methods, are creating opportunities for the new entrants in the market, some of which disrupt the market for larger players. New entrants in the market do not have brand recognition, but the seed prices of these small players are very low as compared to those of the established players, which affects the market share of the big players. The easy availability of raw materials for seed products is the key aspect for domestic players; however, finding the distributor and adding a layer in the value chain either reduces the profit margin or increases the product cost. The competition with the domestic players and the new cheaper technologies available for breeding are challenging the larger players in the hybrid seeds market. Low brand loyalty is also one of the key factors challenging the market globally.

Opportunity: Demand for healthy and organic processed products

The increasing number of health-conscious consumers, coupled with the increasing awareness related to the negative effects of trans-fatty acids among consumers, is expected to increase the demand for food products that contain low trans-fat levels during the forecast period. Manufacturers are developing food products that use healthier oils instead of trans-fatty acids. They are also developing high-stability oils, such as high oleic sunflower, linolenic canola, and low linoleic soybean, to seek emerging opportunities. There is also a considerable potential to replace trans-fats due to the growing demand for food products containing functional ingredients. The growing agricultural land, globally, for all crop types, is also creating opportunities for seeds.

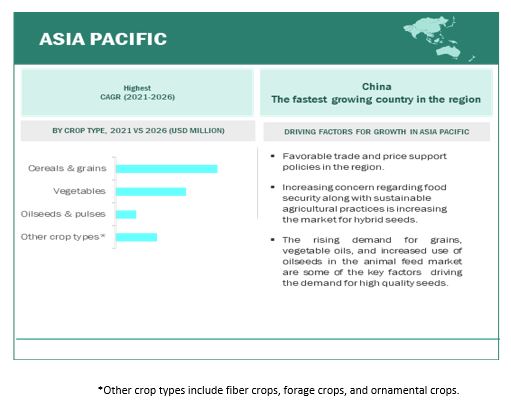

The cereal & grains category segment by crop type is projected to achieve the highest CAGR growth in the Hybrid seeds market.

Cereals & grains by crop type accounted for the largest market share in 2021, owing to factors, such as the widespread use of grains as a staple food in many Asian and Southeast Asian countries. Cereal crops provide essential nutrients and energy in the daily human diet through direct human consumption as well as through meat production as cereal & grain crops are major livestock feed. Hence, cereal & grains is accounted have highest market share and projected to grow at higher rates during the forecast period.

The soybean segment dominated the hybrid seed market with highest CAGR.

Soybeans are regarded as an important crop because they are one of the richest and cheapest sources of protein, and they are a staple food for both human and animal diets. The importance of this crop have impacted as highly demanded segement in hybrid seed market.

Regional Insights:

APAC is projected to account for the highest CAGR in the Hybrid seeds market during the forecast period.

Being the world’s largest as well as most populous continent, the Asia Pacific region is one of the key markets for hybrid seeds. The worlds highest populated countries are in asia pacific region. Which could increase food demand in this region. Other factors, such as climatic conditions and fertile land, have contributed to high agricultural activity in this region. China and india are the largest produers of major crops such as cereals & grains. Such factors have impacted on hybrid seed market, and have been the dominating region in hybrid dees market during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players in the Hybrid Seeds Market

The key players in this market include BASF SE (Germany), Bayer AG (Germany), Syngenta Group (Switzerland), Corteva Agriscience (US), DLF (Denmark), Groupe Limagrain (France), FMC Corporation (US), KWS SAAT SE (Germany), UPL (India), Enza Zaden (UK), Sakata Seed Corporation (Japan), Longping Hi-Tech (China), Land O’Lakes, Inc. (US), Rijk Zwaan Zaadteelt en Zaadhandel B.V. (Netherlands), Euralis (France) and Invivo Group (France). These players are focusing on expanding their production facilities as well as by launching new products to grow their businesses and their market shares. New product launches as a result of extensive R&D initiatives, geographical expansion to tap the potential of emerging economies, and strategic acquisitions to gain a foothold over the large extent of the supply chain are the key strategies adopted by companies in the Hybrid seed market.

Hybrid Seeds Market Report Scope

|

Report Metric |

Details |

|

Market size valuation in 2020 |

USD 23,683.9 million |

|

Market size valuation in 2021 |

USD 25,191.5 million |

|

Market size prediction in 2026 |

USD 34,877.0 million |

|

Progress rate |

CAGR of 6.7% |

|

Segments covered |

Crop Type, Key Crop, Cultivation Type and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, South America, RoW |

|

Market Growth Drivers |

Rising demand for fruits & vegetables across the globe to drive the hybrid seeds market |

|

Market Opportunities |

Growing demand for healthy and organic processed products to create business opportunities |

|

Largest Growing Region |

APAC |

|

Companies covered |

|

Hybrid Seeds Market Segmentation

This research report categorizes the market based on crop type, key crop, cultivation type and region.

|

Segment |

Subsegment |

|

By Crop Type |

|

|

By Key Crop |

|

|

By Cultivation Type |

|

|

By Region |

|

Recent Developments in the Hybrid Seeds Market

- In June 2020, BASF SE has introduced its new brand for hybrid wheat seeds, Ideltis. BASF’s hybrid wheat aims to provide farmers with higher and more stable performance in yield and quality.

- In May 2020, Corteva Agriscience announced the launch of Brevant seeds, a bold, high-performance corn and soybean brand available exclusively at retail locations in the Midwest and Eastern Corn Belt, US.

- In august 2020, Syngenta Group acquired Sensako (South Africa), a seed company specialized in cereals. The acquisition would enhance the presence of Syngenta seeds in the South African market.

- In October 2020, KWS SAAT SE invested USD 55.9 million for its new production facility in Einbeck site, Germany. The production facility would increase the production capacity of sugar beet seeds by 30%. The expansion would help the company to cater to a growing demand for sugar beet seeds.

Frequently Asked Questions (FAQ):

How big is the hybrid seeds market?

The Hybrid seed market is estimated at USD 25,191.5 million in 2021; it is projected to grow at a CAGR of 6.7 % to reach USD 34,877 million by 2026.

Why do farmers prefer hybrid seeds? What are the problems with hybrid seeds?

Growing hybrid seeds is easier and faster. Hybrid seeds are used to improve plants quality, such as better yield, greater uniformity, improved colour, disease resistance. They can handle stress better, have more yield, larger fruits, and are disease resistant. Their lifespan is greater than that of the other seeds.

Problems with hybrid plants are Hybrid seeds needs to be produced every year, as the characters are segregated and not maintained in the next generation. And the cost of production of hybrid seeds is high.

Which players are involved in manufacturing of Hybrid seeds?

The key players in this market include BASF SE (Germany), Bayer AG (Germany), Syngenta Group (Switzerland), Corteva Agriscience (US), DLF (Denmark), Groupe Limagrain (France), FMC Corporation (US), KWS SAAT SE (Germany), UPL (India), Enza Zaden (UK), Sakata Seed Corporation (Japan), Longping Hi-Tech (China), Land O’Lakes, Inc. (US), Rijk Zwaan Zaadteelt en Zaadhandel B.V. (Netherlands), Euralis (France) and Invivo Group (France).

What are the potential challenges to the hybrid seeds market?

Challenges like Unorganized new entrants with a low profit-to-cost ratio, Commercialization of fake hybrid seeds and counterfeit products, Initial breeding of hybrid seeds is expensive are some of the challegens faced by the hybrid seed market.

What are the key development strategies undertaken by companies in the Hybrid seed market?

Strategies such as new product launches, investments into expansion and development, research initiatives are the key strategies being used by large players in order to achieve differential positioning in the global market. . . .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 HYBRID SEEDS MARKET SEGMENTATION

1.3.1 REGIONAL SEGMENTATION

1.3.2 INCLUSIONS & EXCLUSIONS

1.3.3 PERIODIZATION CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 US DOLLAR EXCHANGE RATE CONSIDERED, 2015–2020

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 27)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN: MARKET

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key industry insights

2.1.2.2 Breakdown of primary interviews

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET: TOP-DOWN APPROACH

FIGURE 5 MARKET: BOTTOM-UP APPROACH

2.3 GROWTH RATE FORECAST ASSUMPTION

2.4 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS & LIMITATIONS: HYBRID SEEDS MARKET

2.5.1 ASSUMPTIONS

2.5.2 RESEARCH LIMITATIONS AND ASSOCIATED RISKS

FIGURE 7 LIMITATIONS OF THE STUDY

2.6 SCENARIO-BASED MODELLING

2.7 COVID-19 HEALTH ASSESSMENT

FIGURE 8 COVID-19: GLOBAL PROPAGATION

FIGURE 9 COVID-19 PROPAGATION: SELECT COUNTRIES

2.8 COVID-19 ECONOMIC ASSESSMENT

FIGURE 10 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.8.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 11 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 12 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 13 IMPACT OF COVID-19 ON THE HYBRID SEED MARKET SIZE, BY SCENARIO, 2020 VS. 2021 (USD MILLION)

FIGURE 14 CEREALS & GRAINS SEGMENT TO HAVE THE MAJORITY SHARE THROUGHOUT THE FORECAST PERIOD

FIGURE 15 CORN SEGMENT TO ACCOUNT FOR THE LARGEST MARKET SHARE IN 2021

FIGURE 16 ASIA-PACIFIC REGION TO SHOWCASE THE HIGHEST GROWTH RATE BY 2026

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 OPPORTUNITIES IN THE GLOBAL MARKET

FIGURE 17 INCREASING NEED FOR FOOD & FEED TO ACCELERATE THE GROWTH OF THE MARKET

4.2 MARKET, BY KEY CROP

FIGURE 18 CORN SEGMENT TO HOLD THE LARGEST SHARE IN THE MARKET IN 2020

4.3 MARKET, BY CROP TYPE & REGION

FIGURE 19 ASIA PACIFIC TO WITNESS THE LARGEST MARKET SHARE IN OTHER CROP TYPES IN 2021

4.4 ASIA PACIFIC: MARKET, BY CROP TYPE & COUNTRY

4.5 KEY GEOGRAPHICAL MARKETS

FIGURE 20 CHINA ACCOUNTED FOR THE LARGEST SHARE IN THE MARKET IN 2020

4.6 COVID-19 IMPACT ON THE MARKET

FIGURE 21 PRE AND POST-COVID-19 IMPACT ON THE HYBRID SEEDS MARKET

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

5.2 MACROECONOMIC INDICATORS

5.2.1 INTRODUCTION

5.2.1.1 Growth in the usage of commercial seeds

FIGURE 22 ASIA PACIFIC: MAJOR SEED EXPORTING COUNTRIES, 2018

FIGURE 23 ASIA PACIFIC: MAJOR SEED IMPORTING COUNTRIES, 2018

FIGURE 24 EUROPE: CULTIVATION AREA FOR COMMERCIAL SEED PRODUCTION: TOP FIVE SEED-PRODUCING COUNTRIES, 2016–2019 (‘000 HA)

5.2.1.2 Population growth and demand for diverse food products

FIGURE 25 POPULATION GROWTH TREND, BY REGION, 1950–2050 (MILLION)

5.2.1.3 Increase in pesticide usage at the global level

FIGURE 26 GLOBAL PESTICIDE TRADE, BY KEY REGION, 2014–2018 (USD MILLION)

5.2.1.4 Growth in market demand for high-value and industrial crops

FIGURE 27 AREA HARVESTED UNDER HIGH-VALUE CROPS, 2015–2019 (MILLION HA)

5.3 MARKET DYNAMICS

FIGURE 28 HYBRID SEEDS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.3.1 DRIVERS

5.3.1.1 Rise in demand for fruits & vegetables across the globe

FIGURE 29 INCREASE IN HARVESTED AREA FOR FRUITS & VEGETABLES, 2015–2019 (MILLION HA)

5.3.1.2 Increase in seed replacement ratio

5.3.1.3 Increasing use of hybrid seeds with several technological components

5.3.1.4 Rise in mechanization of farms

FIGURE 30 GLOBAL EXPORTS OF FARM EQUIPMENT, 2019

FIGURE 31 GLOBAL EXPORTS OF FARMING EQUIPMENT, 2019

5.3.2 RESTRAINTS

5.3.2.1 Impact of climate change on crop production

TABLE 2 WEATHER CONDITIONS VS. DISEASE IN GROUNDNUT IN SPECIFIC COUNTRIES

5.3.2.2 Once used hybrid seeds cannot be reproduced

5.3.3 OPPORTUNITIES

5.3.3.1 Demand for healthy and organic processed products

FIGURE 32 ORGANIC FARM AREA GROWTH TREND, BY KEY COUNTRY, 2016–2019 ('000 HA)

FIGURE 33 ORGANIC RETAIL SALES, 2017 VS 2018 (USD MILLION)

FIGURE 34 SHARE OF ORGANIC FRESH PRODUCE SALES AND VOLUME

5.3.3.2 Growth in adoption of hybrid seed technology for vegetables

5.3.4 CHALLENGES: HYBRID SEEDS MARKET

5.3.4.1 Unorganized new entrants with a low profit-to-cost ratio

5.3.4.2 Commercialization of fake hybrid seeds and counterfeit products

5.3.4.3 Initial breeding of hybrid seeds is expensive

5.3.5 COVID-19 PANDEMIC IMPACT ON SEED INDUSTRY

6 INDUSTRY TRENDS (Page No. - 62)

6.1 REGULATIONS

6.1.1 NORTH AMERICA

6.1.1.1 United States

6.1.1.2 Canada

6.1.2 EUROPEAN UNION

6.1.3 ASIA PACIFIC

6.1.3.1 India

6.1.3.2 China

6.1.3.3 Bangladesh

6.1.4 BRAZIL

6.1.5 SOUTH AFRICA

6.2 PATENT ANALYSIS

FIGURE 35 NUMBER OF PATENTS APPROVED FOR HYBRID SEEDS IN THE GLOBAL MARKET, 2010–2020

FIGURE 36 REGIONAL ANALYSIS OF PATENTS APPROVED IN THE HYBRID SEEDS MARKET, 2015–2020

TABLE 3 LIST OF KEY PATENTS FOR SEEDS, 2017–2020

6.3 VALUE CHAIN ANALYSIS

6.3.1 RESEARCH & PRODUCT DEVELOPMENT

6.3.2 SEED MANUFACTURERS

6.3.3 DISTRIBUTORS

6.3.4 RETAILERS

FIGURE 37 VALUE CHAIN ANALYSIS OF HYBRID SEEDS (2015): A MAJOR CONTRIBUTION FROM THE R&D PHASE

6.4 SUPPLY CHAIN ANALYSIS

FIGURE 38 SUPPLY CHAIN ANALYSIS FOR THE MARKET

6.5 MARKET ECOSYSTEM

TABLE 4 HYBRID SEEDS MARKET: ROLE IN ECOSYSTEM

FIGURE 39 SUPPLY CHAIN ECOSYSTEM

6.5.1 UPSTREAM

6.5.1.1 Major fruit & vegetable seed providers

6.5.1.2 Raw material providers

6.5.2 DOWNSTREAM

6.5.2.1 Regulatory bodies & certification providers

6.6 YC-YCC SHIFTS IN THE SEEDS MARKET

FIGURE 40 DEMAND FOR HIGH-QUALITY FRUIT & VEGETABLE SEEDS FOR IMPROVING FOOD QUALITY IS THE NEW HOT BET IN THE MARKET

6.7 TECHNOLOGY ANALYSIS

6.7.1 CRISPR-MEDIATED GENOME EDITING

6.7.2 USE OF DATA ANALYTICS IN SEED SELECTION

6.8 CASE STUDIES

6.8.1 KWS SAAT SE STARTED INCREASING PRODUCTION FACILITIES FOR ITS CUSTOMERS

6.8.1.1 Problem statement

6.8.1.2 Solution offered

6.8.1.3 Outcome

6.8.2 BASF SE INTRODUCED NEW WHEAT HYBRIDS FOR THE NORTH AMERICA MARKET

6.8.2.1 Problem statement

6.8.2.2 Solution offered

6.8.2.3 Outcome

6.8.3 NEW VARIETY OF SEED DEMAND BY INDUSTRY PLAYERS TO ENSURE LONG PRODUCTION CYCLES OF SEEDS

6.8.3.1 Problem statement

6.8.3.2 Solution offered

6.8.3.3 Outcome

6.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 HYBRID SEEDS MARKET: PORTER’S FIVE FORCES ANALYSIS

6.9.1 THREAT OF NEW ENTRANTS

6.9.2 THREAT OF SUBSTITUTES

6.9.3 BARGAINING POWER OF SUPPLIERS

6.9.4 BARGAINING POWER OF BUYERS

6.9.5 INTENSITY OF COMPETITIVE RIVALRY

6.1 TRADE ANALYSIS

6.10.1 EXPORT SCENARIO: SEEDS FOR SOWING

FIGURE 41 SOYBEAN SEED EXPORTS, BY KEY COUNTRY, 2012–2019 (USD MILLION)

FIGURE 42 WHEAT SEED EXPORTS, BY KEY COUNTRY, 2012–2019 (USD MILLION)

FIGURE 43 CORN SEED EXPORTS, BY KEY COUNTRY, 2012–2019 (USD MILLION)

FIGURE 44 VEGETABLE SEED EXPORTS, BY KEY COUNTRY, 2012–2019 (USD MILLION)

6.10.2 IMPORT SCENARIO: SEEDS FOR SOWING

FIGURE 45 SOYBEAN SEED IMPORTS, BY KEY COUNTRY, 2012–2019 (USD MILLION)

FIGURE 46 WHEAT SEED IMPORTS, BY KEY COUNTRY, 2012–2019 (USD MILLION)

FIGURE 47 CORN SEED IMPORTS, BY KEY COUNTRY, 2012–2019 (USD MILLION)

FIGURE 48 VEGETABLE SEED IMPORTS, BY KEY COUNTRY, 2012–2019 (USD MILLION)

7 HYBRID SEEDS MARKET, BY CROP TYPE (Page No. - 89)

7.1 INTRODUCTION

FIGURE 49 THE CEREALS & GRAINS SEGMENT IS PROJECTED TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

TABLE 6 MARKET SIZE, BY CROP TYPE, 2014–2020 (USD MILLION)

TABLE 7 HBRID SEEDS MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

7.2 COVID-19 IMPACT ON THE MARKET, BY CROP TYPE

7.2.1 REALISTIC SCENARIO

TABLE 8 REALISTIC SCENARIO: MARKET SIZE, BY CROP TYPE, 2018–2021 (USD MILLION)

7.2.2 OPTIMISTIC SCENARIO

TABLE 9 OPTIMISTIC SCENARIO: MARKET SIZE, BY CROP TYPE, 2018–2021 (USD MILLION)

7.2.3 PESSIMISTIC SCENARIO

TABLE 10 PESSIMISTIC SCENARIO: MARKET SIZE, BY CROP TYPE, 2018–2021 (USD MILLION)

7.3 CEREALS & GRAINS

7.3.1 COMPANIES ARE FOCUSED ON MAKING USE OF HYBRID VARIETIES OF CEREALS FOR IMPROVING FEED QUALITY

TABLE 11 CEREALS & GRAINS MARKET SIZE, BY REGION, 2014–2020 (USD MILLION)

TABLE 12 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 13 MARKET SIZE, BY CROP, 2014–2020 (USD MILLION)

TABLE 14 MARKET SIZE, BY CROP, 2021–2026 (USD MILLION)

7.4 OILSEEDS & PULSES

7.4.1 DEMAND FOR OILSEEDS AS STAPLE DIET IS INCREASING IN DEVELOPING COUNTRIES

TABLE 15 OILSEEDS & PULSES HYBRID SEEDS MARKET SIZE, BY REGION, 2014–2020 (USD MILLION)

TABLE 16 OILSEEDS & PULSES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 17 MARKET SIZE, BY CROP, 2014–2020 (USD MILLION)

TABLE 18 MARKET SIZE, BY CROP, 2021–2026 (USD MILLION)

7.5 VEGETABLES

7.5.1 VEGETABLES HAVE BEEN GAINING IMPORTANCE IN THE PROCESSED FOOD INDUSTRY FOR THEIR NUTRITIONAL PROPERTIES

TABLE 19 VEGETABLES HYBRID SEEDS: MARKET SIZE, BY REGION, 2014–2020 (USD MILLION)

TABLE 20 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 21 MARKET SIZE, BY CROP, 2014–2020 (USD MILLION)

TABLE 22 MARKET SIZE, BY CROP, 2021–2026 (USD MILLION)

7.6 OTHER CROP TYPES

7.6.1 DEMAND FOR HYBRID TURFGRASS TO MEET THE REQUIREMENTS OF SPORTS TOURNAMENTS

TABLE 23 OTHER CROP TYPES HYBRID SEEDS: MARKET SIZE, BY REGION, 2014–2020 (USD MILLION)

TABLE 24 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8 HYBRID SEEDS MARKET, BY KEY CROP (Page No. - 102)

8.1 INTRODUCTION

FIGURE 50 CORN SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

TABLE 25 MARKET SIZE, BY KEY CROP, 2014–2020 (USD MILLION)

TABLE 26 MARKET SIZE, BY KEY CROP, 2021–2026 (USD MILLION)

8.2 CORN

8.2.1 COMPANIES ARE FOCUSED ON MAKING USE OF HYBRID VARIETIES OF CORN FOR IMPROVING FEED QUALITY

FIGURE 51 ANNUAL PRODUCTION OF CORN, 2018–2020 (MILLION TONNE)

TABLE 27 CORN HYBRID SEEDS: MARKET SIZE, BY REGION, 2014–2020 (USD MILLION)

TABLE 28 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.3 RICE

8.3.1 RISING RICE CONSUMPTION IN DEVELOPING COUNTRIES TO BOOST THE DEMAND FOR HYBRID VARIETIES

TABLE 29 RICE HYBRID SEEDS: MARKET SIZE, BY REGION, 2014–2020 (USD MILLION)

TABLE 30 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.4 SOYBEAN

8.4.1 FAVORABLE TRADE AND PRICE-RELATED POLICY TO DRIVE THE GROWTH OF SOYBEAN

FIGURE 52 ANNUAL SOYBEAN PRODUCTION, BY KEY COUNTRY, 2016–2020 (MILLION TONNE)

TABLE 31 SOYBEAN HYBRID SEEDS: MARKET SIZE, BY REGION, 2014–2020 (USD MILLION)

TABLE 32 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.5 COTTON

8.5.1 RISING DEMAND FOR FEED IS INCREASING THE ADOPTION OF HYBRID SEEDS

TABLE 33 COTTON HYBRID SEEDS MARKET SIZE, BY REGION, 2014–2020 (USD MILLION)

TABLE 34 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.6 CANOLA

8.6.1 CANOLA IS BEING PREFERRED AS AN ECONOMICALLY CHEAPER OPTION TO SOYBEAN

TABLE 35 CANOLA HYBRID SEEDS: MARKET SIZE, BY REGION, 2014–2020 (USD MILLION)

TABLE 36 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.7 TOMATO

8.7.1 TOMATO SEEDS HOLDS STRONG DEMAND IN GLOBAL MARKET

TABLE 37 TOMATO HYBRID SEED: MARKET SIZE, BY REGION, 2014–2020 (USD MILLION)

TABLE 38 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.8 WATERMELON

8.8.1 RISE IN PER CAPITA CONSUMPTION OF WATERMELONS TO DRIVE THE DEMAND FOR HYBRID SEEDS

TABLE 39 WATERMELON HYBRID SEEDS: MARKET SIZE, BY REGION, 2014–2020 (USD MILLION)

TABLE 40 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.9 CUCUMBER

8.9.1 INCREASE IN CONSUMPTION OF SALAD-BASED DIETS HAS BEEN DRIVING THE DEMAND FOR CUCUMBER

TABLE 41 CUCUMBER HYBRID SEEDS: MARKET SIZE, BY REGION, 2014–2020 (USD MILLION)

TABLE 42 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.10 HOT PEPPER

8.10.1 CONSUMER PREFERENCE FOR SPICY FOODS IS LEADING TO GROWING DEMAND FOR PEPPER, THEREBY DRIVING THE MARKET FOR ITS SEEDS

TABLE 43 HOT PEPPER HYBRID SEEDS: MARKET SIZE, BY REGION, 2014–2020 (USD MILLION)

TABLE 44 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.11 OTHER KEY CROPS

8.11.1 WIDE ADAPTABILITY AND DISEASE RESISTANCE OFFERED BY HYBRID SEEDS IS INCREASING ITS ADOPTION

9 HYBRID SEEDS MARKET, BY CULTIVATION TYPE (Page No. - 118)

9.1 INTRODUCTION

9.2 PROTECTED CULTIVATION

9.2.1 INCREASING DEMAND FOR HIGH-QUALITY ORGANIC FRUITS

9.3 OPEN FIELD CULTIVATION

9.3.1 HYBRID SEEDS PROVIDE HIGHER YIELD AND EFFECTIVE DISEASE RESISTANCE

10 MARKET, BY REGION (Page No. - 121)

10.1 INTRODUCTION

FIGURE 53 ASIA PACIFIC COUNTRIES ARE PROJECTED TO WITNESS HIGH GROWTH DURING THE FORECAST PERIOD

TABLE 45 MARKET SIZE, BY REGION, 2014–2020 (USD MILLION)

TABLE 46 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.1.1 COVID-19 IMPACT ON THE MARKET, BY REGION

10.1.1.1 Realistic scenario

TABLE 47 REALISTIC SCENARIO: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

10.1.1.2 Optimistic scenario

TABLE 48 OPTIMISTIC SCENARIO: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

10.1.1.3 Pessimistic scenario

TABLE 49 PESSIMISTIC SCENARIO: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 54 NORTH AMERICA: REGIONAL SNAPSHOT

TABLE 50 NORTH AMERICA: HYBRID SEEDS MARKET SIZE, BY COUNTRY, 2014–2020 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET SIZE, BY CROP TYPE, 2014–2020 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

10.2.1 US

10.2.1.1 Rising consumption of fresh vegetables in the US aiding the growth of the market

TABLE 54 US: MARKET SIZE, BY CROP TYPE, 2014–2020 (USD MILLION)

TABLE 55 US: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Adoption of cutting-edge technologies in plant breeding to drive the Canadian market

TABLE 56 CANADA: MARKET, BY CROP TYPE, 2014–2020 (USD MILLION)

TABLE 57 CANADA: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

10.2.3 MEXICO

10.2.3.1 Increase in demand for healthy food is driving the market for hybrid seeds

TABLE 58 MEXICO: MARKET SIZE, BY CROP TYPE, 2014–2020 (USD MILLION)

TABLE 59 MEXICO: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

10.3 EUROPE

TABLE 60 EUROPE: MARKET SIZE, BY COUNTRY, 2014–2020 (USD MILLION)

TABLE 61 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 62 EUROPE: MARKET SIZE, BY CROP TYPE, 2014–2020 (USD MILLION)

TABLE 63 EUROPE: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

10.3.1 SPAIN

10.3.1.1 Growth in the export of fruits and vegetables is driving the demand for high-quality seeds

TABLE 64 SPAIN: MARKET SIZE FOR HYBRID SEEDS, BY CROP TYPE, 2014–2020 (USD MILLION)

TABLE 65 SPAIN: HYBRID SEEDS MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

10.3.2 ITALY

10.3.2.1 Italian farmers adopt 220,000 ha for seed production annually

TABLE 66 ITALY: MARKET, BY CROP TYPE, 2014–2020 (USD MILLION)

TABLE 67 ITALY: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 High production of vegetables has promoted the growth of the market

TABLE 68 FRANCE: MARKET, BY CROP TYPE, 2014–2020 (USD MILLION)

TABLE 69 FRANCE: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

10.3.4 GERMANY

10.3.4.1 Germany is one of the principal exporters of high-quality fruits & vegetables

TABLE 70 GERMANY: MARKET SIZE, BY CROP TYPE, 2014–2020 (USD MILLION)

TABLE 71 GERMANY: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

10.3.5 NETHERLANDS

10.3.5.1 The Netherlands is largely focusing on the production of vegetable seeds

TABLE 72 NETHERLANDS: MARKET, BY CROP TYPE, 2014–2020 (USD MILLION)

TABLE 73 NETHERLANDS: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

10.3.6 RUSSIA

10.3.6.1 High domestic demand for vegetable oil is driving the growth of sunflower seeds in the country

TABLE 74 RUSSIA: MARKET SIZE, BY CROP TYPE, 2014–2020 (USD MILLION)

TABLE 75 RUSSIA: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

10.3.7 REST OF EUROPE

10.3.7.1 Increased demand for biofuel production from rapeseed has been a turning point in the commercial sector of countries in this region

TABLE 76 REST OF EUROPE: HYBRID SEEDS MARKET, BY CROP TYPE, 2014–2020 (USD MILLION)

TABLE 77 REST OF EUROPE: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 55 ASIA PACIFIC: REGIONAL SNAPSHOT

TABLE 78 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2014–2020 (USD MILLION)

TABLE 79 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 80 ASIA PACIFIC: MARKET SIZE, BY CROP TYPE, 2014–2020 (USD MILLION)

TABLE 81 ASIA PACIFIC: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Initiatives by the government to increase productivity & meet export quality standards

TABLE 82 CHINA: MARKET SIZE, BY CROP TYPE, 2014–2020 (USD MILLION)

TABLE 83 CHINA: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

10.4.2 JAPAN

10.4.2.1 Presence of seed companies would propel the growth of the Japanese market

TABLE 84 JAPAN: MARKET SIZE, BY CROP TYPE, 2014–2020 (USD MILLION)

TABLE 85 JAPAN: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Rise in demand for Indian vegetable seeds in other international markets

TABLE 86 INDIA: HYBRID SEEDS MARKET, BY CROP TYPE, 2014–2020 (USD MILLION)

TABLE 87 INDIA: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

10.4.4 AUSTRALIA

10.4.4.1 Growth in the export market for canola to drive the growth of the market

TABLE 88 AUSTRALIA: MARKET, BY CROP TYPE, 2014–2020 (USD MILLION)

TABLE 89 AUSTRALIA: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

10.4.5 THAILAND

10.4.5.1 Export of corn drives the seeds market in Thailand

TABLE 90 THAILAND: MARKET SIZE, BY CROP TYPE, 2014–2020 (USD MILLION)

TABLE 91 THAILAND: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

10.4.6 REST OF ASIA PACIFIC

TABLE 92 REST OF ASIA PACIFIC: MARKET SIZE, BY CROP TYPE, 2014–2020 (USD MILLION)

TABLE 93 REST OF ASIA PACIFIC: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

10.5 SOUTH AMERICA

TABLE 94 SOUTH AMERICA: MARKET SIZE FOR HYBRID SEEDS, BY COUNTRY, 2014–2020 (USD MILLION)

TABLE 95 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 96 SOUTH AMERICA: MARKET SIZE, BY CROP TYPE, 2014–2020 (USD MILLION)

TABLE 97 SOUTH AMERICA: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

10.5.1 BRAZIL

10.5.1.1 High demand for soybean from European and Asian countries

TABLE 98 BRAZIL: MARKET SIZE, BY CROP TYPE, 2014–2020 (USD MILLION)

TABLE 99 BRAZIL: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

10.5.2 ARGENTINA

10.5.2.1 Argentinian companies are promoting the adoption of hybrid crops

TABLE 100 ARGENTINA: HYBRID SEEDS MARKET SIZE, BY CROP TYPE, 2014–2020 (USD MILLION)

TABLE 101 ARGENTINA: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

10.5.3 REST OF SOUTH AMERICA

TABLE 102 REST OF SOUTH AMERICA: MARKET SIZE, BY CROP TYPE, 2014–2020 (USD MILLION)

TABLE 103 REST OF SOUTH AMERICA: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

10.6 REST OF THE WORLD

TABLE 104 ROW: MARKET SIZE FOR HYBRID SEEDS, BY REGION, 2014–2020 (USD MILLION)

TABLE 105 ROW: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 106 ROW: MARKET SIZE, BY CROP TYPE, 2014–2020 (USD MILLION)

TABLE 107 ROW: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

10.6.1 SOUTH AFRICA

10.6.1.1 Presence of subsidies and other government initiatives to drive the growth of the market

TABLE 108 SOUTH AFRICA: MARKET SIZE, BY CROP TYPE, 2014–2020 (USD MILLION)

TABLE 109 SOUTH AFRICA: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

10.6.2 MIDDLE EAST

10.6.2.1 High demand for corn in food and feed would drive the cereals & grains market

TABLE 110 MIDDLE EAST: MARKET SIZE, BY CROP TYPE, 2014–2020 (USD MILLION)

TABLE 111 MIDDLE EAST: MARKET SIZE, BY CROP TYPE, 2021–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 163)

11.1 OVERVIEW

11.2 MARKET RANKING ANALYSIS

TABLE 112 MARKET FOR HYBRID SEEDS: TOP 5 COMPANY RANKING ANALYSIS, 2020

11.3 COMPANY REVENUE ANALYSIS

FIGURE 56 REVENUE ANALYSIS OF THE KEY PLAYERS IN THE HYBRID SEEDS MARKET, 2015–2019 (USD BILLION)

11.4 COVID-19-SPECIFIC COMPANY RESPONSE

11.4.1 BASF SE

11.4.2 BAYER AG

11.4.3 SYNGENTA GROUP

11.4.4 CORTEVA AGRISCIENCE

11.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 EMERGING COMPANIES

FIGURE 57 MARKET, COMPANY EVALUATION QUADRANT, 2019 (KEY PLAYERS)

11.6 COMPANY PRODUCT FOOTPRINT

TABLE 113 CROP TYPE FOOTPRINT (KEY PLAYERS)

TABLE 114 COMPANY REGION FOOTPRINT (KEY PLAYERS)

TABLE 115 COMPANY PRODUCT FOOTPRINT (KEY PLAYERS)

11.7 COMPANY EVALUATION QUADRANT (SME/STARTUPS)

11.7.1 PROGRESSIVE COMPANIES

11.7.2 STARTING BLOCKS

11.7.3 RESPONSIVE COMPANIES

11.7.4 DYNAMIC COMPANIES

FIGURE 58 HYBRID SEEDS MARKET, COMPANY EVALUATION QUADRANT, 2019 (SME/STARTUPS)

11.8 PRODUCT FOOTPRINT (SME/STARTUPS)

TABLE 116 COMPANY CROP FOOTPRINT

TABLE 117 COMPANY CROP TYPE FOOTPRINT

TABLE 118 COMPANY REGION FOOTPRINT

TABLE 119 COMPANY PRODUCT FOOTPRINT

11.9 COMPETITIVE SCENARIO & TRENDS

11.9.1 NEW PRODUCT LAUNCHES

TABLE 120 MARKET: NEW PRODUCT LAUNCHES, JANUARY 2018–JUNE 2020

11.9.2 DEALS

TABLE 121 MARKET: DEALS, FEBRUARY 2018–OCTOBER 2020

11.9.3 OTHERS

TABLE 122 MARKET: OTHERS, JANUARY 2018–OCTOBER 2020

12 COMPANY PROFILES (Page No. - 187)

(Business overview, Products offered, Recent developments & MnM View)*

12.1 KEY PLAYERS

12.1.1 BASF SE

TABLE 123 BASF SE: BUSINESS OVERVIEW

FIGURE 59 BASF SE: COMPANY SNAPSHOT

TABLE 124 BASF SE: NEW PRODUCT LAUNCHES

TABLE 125 BASF SE: DEALS

TABLE 126 BASF SE: OTHERS

12.1.2 BAYER AG

TABLE 127 BAYER AG: HYBRID SEEDS MARKET BUSINESS OVERVIEW

FIGURE 60 BAYER AG: COMPANY SNAPSHOT

TABLE 128 BAYER AG: NEW PRODUCT LAUNCHES

TABLE 129 BAYER AG: DEALS

TABLE 130 BAYER AG: OTHERS

12.1.3 SYNGENTA GROUP

TABLE 131 SYNGENTA GROUP: BUSINESS OVERVIEW

FIGURE 61 SYNGENTA GROUP: COMPANY SNAPSHOT

TABLE 132 SYNGENTA GROUP: DEALS

12.1.4 KWS SAAT SE

TABLE 133 KWS SAAT SE: BUSINESS OVERVIEW

FIGURE 62 KWS SAAT SE: COMPANY SNAPSHOT

TABLE 134 KWS SAAT SE: NEW PRODUCT LAUNCHES

TABLE 135 KWS SAAT SE: DEALS

TABLE 136 KWS SAAT SE: OTHERS

12.1.5 CORTEVA AGRISCIENCE

TABLE 137 CORTEVA AGRISCIENCE: BUSINESS OVERVIEW

FIGURE 63 CORTEVA AGRISCIENCE: COMPANY SNAPSHOT

TABLE 138 CORTEVA AGRISCIENCE: NEW PRODUCT LAUNCHES

TABLE 139 CORTEVA AGRISCIENCE: DEALS

TABLE 140 CORTEVA AGRISCIENCE: OTHERS

12.1.6 GROUPE LIMAGRAIN

TABLE 141 GROUPE LIMAGRAIN: HYBRID SEED MARKET BUSINESS OVERVIEW

FIGURE 64 GROUPE LIMAGRAIN: COMPANY SNAPSHOT

TABLE 142 GROUPE LIMAGRAIN: DEALS

12.1.7 ADVANTA SEEDS (UPL)

TABLE 143 ADVANTA SEEDS: HYBRID SEEDS MARKET

BUSINESS OVERVIEW

FIGURE 65 ADVANTA SEEDS: COMPANY SNAPSHOT

TABLE 144 UPL: DEALS

TABLE 145 UPL: OTHERS

12.1.8 SAKATA SEED CORPORATION

TABLE 146 SAKATA SEED CORPORATION: BUSINESS OVERVIEW

FIGURE 66 SAKATA SEED CORPORATION: COMPANY SNAPSHOT

TABLE 147 SAKATA SEED CORPORATION: DEALS

TABLE 148 SAKATA SEED CORPORATION: OTHERS

12.1.9 DLF

TABLE 149 DLF: BUSINESS OVERVIEW

FIGURE 67 DLF: COMPANY SNAPSHOT

TABLE 150 DLF: DEALS

TABLE 151 DLF: OTHERS

12.1.10 ENZA ZADEN

TABLE 152 ENZA ZADEN: BUSINESS OVERVIEW

TABLE 153 ENZA ZADEN: DEALS

TABLE 154 ENZA ZADEN: OTHERS

12.1.11 RALLIS INDIA LIMITED

TABLE 155 RALLIS INDIA LIMITED: BUSINESS OVERVIEW

FIGURE 68 RALLIS INDIA LIMITED: COMPANY SNAPSHOT

12.2 OTHER PLAYERS

12.2.1 FMC CORPORATION

TABLE 156 FMC CORPORATION: HYBRID SEEDS MARKET BUSINESS OVERVIEW

FIGURE 69 FMC CORPORATION: COMPANY SNAPSHOT

TABLE 157 FMC CORPORATION: OTHERS

12.2.2 TAKII & CO., LTD

TABLE 158 TAKII & CO., LTD: BUSINESS OVERVIEW

12.2.3 BARENBRUG

TABLE 159 BARENBRUG: BUSINESS OVERVIEW

TABLE 160 BARENBRUG: DEALS

12.2.4 LONGPING HI-TECH

TABLE 161 LONGPING HI-TECH: BUSINESS OVERVIEW

TABLE 162 LONGPING HI-TECH: DEALS

12.2.5 LAND O'LAKES, INC.

TABLE 163 LAND O’LAKES: BUSINESS OVERVIEW

12.2.6 VIKIMA SEEDS A/S

TABLE 164 VIKIMA SEEDS A/S: BUSINESS OVERVIEW

12.2.7 ALLIED SEED LLC

TABLE 165 ALLIED SEED LLC: BUSINESS OVERVIEW

12.2.8 AMPAC SEED COMPANY

TABLE 166 AMPAC SEED COMPANY: BUSINESS OVERVIEW

12.2.9 IMPERIAL SEED LTD.

TABLE 167 IMPERIAL SEED LTD.: HYBRID SEEDS MARKET BUSINESS OVERVIEW

12.2.10 MAHYCO

TABLE 168 MAHYCO.: BUSINESS OVERVIEW

TABLE 169 MAHYCO: DEALS

12.2.11 SL AGRITECH

TABLE 170 SL AGRITECH: BUSINESS OVERVIEW

12.2.12 BRETTYOUNG

TABLE 171 BRETTYOUNG: BUSINESS OVERVIEW

12.2.13 RASI SEEDS

TABLE 172 RASI SEEDS: BUSINESS OVERVIEW

12.2.14 CN SEEDS

TABLE 173 CN SEEDS: BUSINESS OVERVIEW

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

13 ADJACENT & RELATED MARKETS TO HYBRID SEEDS MARKET(Page No. - 258)

13.1 INTRODUCTION

13.2 LIMITATIONS

13.3 SEED TREATMENT MARKET

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

13.3.3 SEED TREATMENT SIZE, BY TYPE

TABLE 174 SEED TREATMENT MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

13.3.4 SEED TREATMENT MARKET, BY APPLICATION TECHNIQUE

TABLE 175 SEED TREATMENT MARKET SIZE, BY APPLICATION TECHNIQUE, 2018–2025 (USD MILLION)

13.3.5 SEED TREATMENT MARKET, BY CROP TYPE

TABLE 176 SEED TREATMENT MARKET SIZE, BY CROP TYPE, 2018–2025 (USD MILLION)

13.3.6 SEED TREATMENT MARKET, BY FUNCTION

TABLE 177 SEED TREATMENT MARKET SIZE, BY FUNCTION, 2018–2025 (USD MILLION)

13.3.7 SEED TREATMENT MARKET, BY REGION

TABLE 178 SEED TREATMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

13.4 SEED TREATMENT MARKET, NORTH AMERICA

TABLE 179 NORTH AMERICA: SEED TREATMENT MARKET SIZE, BY CROP TYPE, 2018–2025 (USD MILLION)

13.5 SEED TREATMENT MARKET, ASIA PACIFIC

TABLE 180 ASIA PACIFIC: SEED TREATMENT MARKET SIZE, BY CROP TYPE, 2018–2025 (USD MILLION)

13.6 SEED TREATMENT MARKET, EUROPE

TABLE 181 EUROPE: SEED TREATMENT MARKET SIZE, BY CROP TYPE, 2018–2025 (USD MILLION)

13.7 SEED TREATMENT MARKET, SOUTH AMERICA

TABLE 182 SOUTH AMERICA: SEED TREATMENT MARKET SIZE, BY CROP TYPE, 2018–2025 (USD MILLION)

13.8 SEED TREATMENT MARKET, REST OF THE WORLD

TABLE 183 ROW: SEED TREATMENT MARKET SIZE, BY CROP TYPE, 2018–2025 (USD MILLION)

13.9 BIOLOGICAL SEED TREATMENT MARKET (ADJACENT MARKETS TO HYBRID SEEDS MARKET)

13.9.1 MARKET DEFINITION

13.9.2 MARKET OVERVIEW

13.9.3 BIOLOGICAL SEED TREATMENT SIZE, BY TYPE

TABLE 184 BIOLOGICAL SEED TREATMENT MARKET, BY TYPE, 2018–2025 (USD MILLION)

13.9.4 BIOLOGICAL SEED TREATMENT SIZE, BY CROP TYPE

TABLE 185 BIOLOGICAL SEED TREATMENT MARKET SIZE, BY CROP TYPE, 2018–2025 (USD MILLION)

13.9.5 BIOLOGICAL SEED TREATMENT SIZE, BY FUNCTION

TABLE 186 BIOLOGICAL SEED TREATMENT MARKET SIZE, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 187 BIOLOGICAL SEED TREATMENT MARKET SIZE, BY FUNCTION, 2018–2025 (KT)

13.9.6 BIOLOGICAL SEED TREATMENT MARKET, BY REGION

TABLE 188 BIOLOGICAL SEED TREATMENT MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 189 BIOLOGICAL SEED TREATMENT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 190 BIOLOGICAL SEED TREATMENT MARKET SIZE, BY REGION, 2018–2025 (KT)

13.10 BIOLOGICAL SEED TREATMENT, NORTH AMERICA

TABLE 191 NORTH AMERICA: BIOLOGICAL SEED TREATMENT MARKET SIZE, BY CROP, 2018–2025 (USD MILLION)

13.11 BIOLOGICAL SEED TREATMENT, EUROPE

TABLE 192 EUROPE: BIOLOGICAL SEED TREATMENT MARKET SIZE, BY CROP, 2018–2025 (USD MILLION)

13.12 BIOLOGICAL SEED TREATMENT, ASIA PACIFIC

TABLE 193 ASIA PACIFIC: BIOLOGICAL SEED TREATMENT MARKET SIZE, BY CROP, 2018–2025 (USD MILLION)

13.13 BIOLOGICAL SEED TREATMENT, SOUTH AMERICA

TABLE 194 SOUTH AMERICA: BIOLOGICAL SEED TREATMENT MARKET SIZE, BY CROP, 2018–2025 (USD MILLION)

13.14 BIOLOGICAL SEED TREATMENT, REST OF THE WORLD

TABLE 195 ROW: BIOLOGICAL SEED TREATMENT MARKET SIZE, BY CROP, 2018–2025 (USD MILLION)

14 APPENDIX (Page No. - 284)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

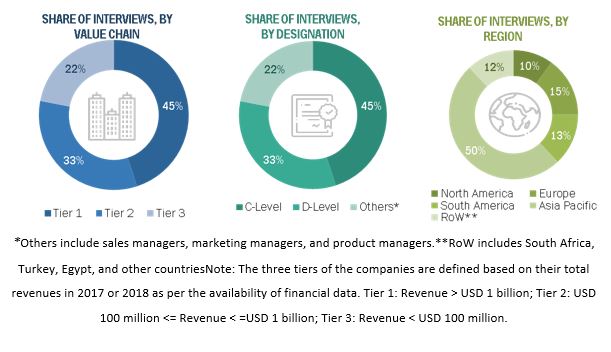

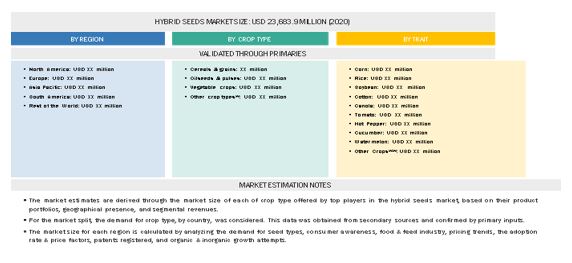

The study involves four major activities to estimate the current size of the hybrid seeds market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. These findings, assumptions, and market sizes were validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation approaches were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

The hybrid seeds market comprises several stakeholders such as manufacturers, importers and exporters, traders, distributors, and suppliers of seeds, feed processors & manufacturers, government & research organizations. Some of the major stakeholders in the market include plant biotechnological companies genetic solution providers, plant & livestock breeders, public and private research institutions, agencies, and laboratories, commercial seed manufacturers (including both GM and conventional seed manufacturers), concerned government authorities, and seed and plant breeding societies and associations

The demand-side of this market is characterized by the rising demand for hybrid seeds in the feed and biofuel industries. The supply-side is characterized by the supply of conventional seeds from various suppliers in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Hybrid Seeds Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, was determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary respondents

- All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analysed to obtain the final quantitative and qualitative data.

Global Hybrid Seeds Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed. The data was triangulated by studying various factors and trends from both the demand and supply sides in the seed market.

Objectives of Hybrid Seeds Market Report

- To define, segment, and project the global market size of the seed market.

- To understand the seed market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to the regions (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify major growth strategies adopted by players across key regions

- To analyze the competitive developments such as expansions & investments, mergers & acquisitions, new product launches, partnerships, joint ventures, and agreements

1 Core competencies of companies include their key developments and strategies adopted by them to sustain their position in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis of Hybrid Seeds Market

- Further breakdown of the Rest of Europe seed market into Ireland, Ukraine, Austria, Sweden, and Belgium.

- Further breakdown of the Rest of Asia-Pacific seed market into Vietnam, and South Korea

- Further breakdown of the Rest of South America seed market into Uruguay, and Paraguay

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Hybrid Seeds Market