Hybrid Boats Market by Hull Design (Hydrofoil, Multihull, Rigid Inflatable), Propulsion (Electric, Hybrid), Platform (Recreational Boats, Commercial Boats, Military and Law Enforcement Boats), Material, Boat Size and Region - Global Forecast to 2028

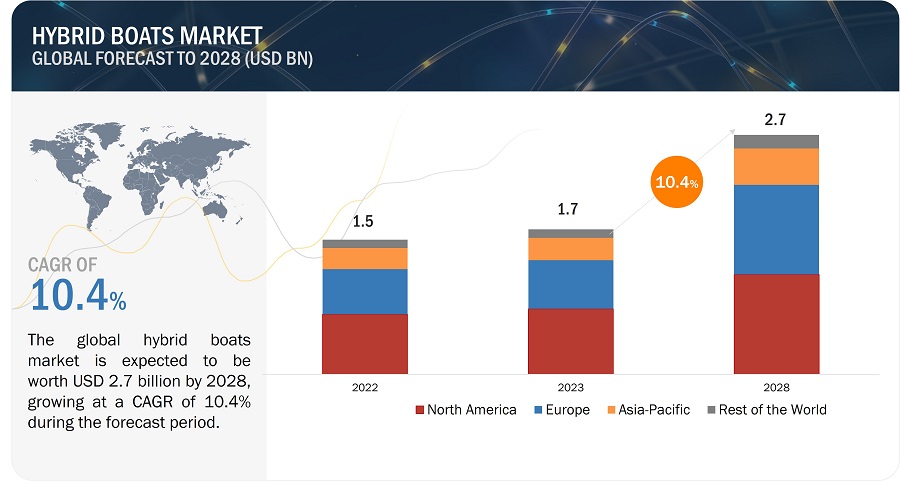

[235 Pages Report] The hybrid boats market is estimated to grow from USD 1.7 billion in 2023 to USD 2.7 billion by 2028, at a CAGR of 10.4% from 2023 to 2028. The hybrid boats market is driven by factors such as increasing demand for environmental sustainability and emission reduction, along with the increasing demand for the maritime transportation. Governments around the world are introducing stricter emissions standards for marine vessels, which is driving demand for cleaner propulsion technologies propelling the growth of hybrid boats market. Significant advancements in motors, batteries, and hull designs have made hybrid boats more efficient, reliable, and affordable. The development of powerful and lightweight electric hybrid propullsions has improved power, efficiency and range of hybrid boats.

Hybrid Boats Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Hybrid Boats Market Dynamics:

Driver: Increasing demand for green boating solutions propels the demand for hybrid boats

The growing environmental consciousness among boaters and policymakers is driving a shift towards sustainable boating practices, leading to a surge in demand for eco-friendly solutions like hybrid boats. Hybrid boats offer a compelling alternative to traditional powered boats, significantly reducing fuel consumption, greenhouse gas emissions, and air pollution, aligning with the pursuit of a more environmentally responsible marine industry. Traditional powered boats contribute substantially to environmental degradation. They consume large amounts of fossil fuels, releasing harmful pollutants like greenhouse gases (carbon dioxide, CO2), nitrogen oxides (NOx), and sulfur oxides (SOx). These emissions contribute to climate change, air pollution, and acid rain, harming marine ecosystems and human health. Hybrid boats address these environmental concerns by combining electric or hybrid propulsion systems with conventional engines. This combination optimizes fuel efficiency and minimizes emissions. Electric motors power boats at low speeds and for maneuvering, while the conventional engine takes over for higher speeds or longer distances. This leads as a driving factor for the hybrid boats market.

Restraint: Competition from other fuel-efficient technologies

Hybrid boats offer a promising solution for reducing emissions and fuel consumption in the marine industry. However they face restraint from other fuel-efficient technologies that also aim to decarbonize boating. These technologies pose a challenge to the widespread adoption of hybrid boats and may hinder their market growth. The performance and range of hybrid boats are heavily dependent on battery technology. Current battery technology has limitations in terms of energy density, meaning that batteries can only store a limited amount of energy for their weight and size. This limitation restricts the range of hybrid boats and makes them less suitable for longer voyages or high-speed applications. Hydrogen fuel cell technology is one of the emerging solutions for clean energy propulsion in boats. Hydrogen fuel cells generate electricity through a chemical reaction between hydrogen and oxygen, producing only water as a byproduct. This technology offers the potential for longer ranges and higher power output compared to hybrid boats, making it an attractive alternative for larger vessels and high-speed applications. This can be a barrier for companies that are developing hybrid boats.

Opportunity: Ongoing developments in charging infrastructure

The expansion and improvement of charging infrastructure for hybrid boats are crucial for their widespread adoption and market growth. While hybrid boats offer significant environmental and performance benefits, their adoption is hindered by the limited availability and accessibility of charging stations. Ongoing developments in charging infrastructure are addressing these challenges and creating new opportunities for the hybrid boats market. Governments and private companies are investing in the development of public charging stations for hybrid boats. These charging stations are being installed in marinas, boatyards, public docks, and other waterfront locations, making it easier for boaters to charge their hybrid boats. Fast charging technology is being developed for hybrid boats, enabling faster charging times and reducing the time it takes to recharge batteries. This is particularly important for larger boats or those that require frequent charging. Charging stations are being integrated with renewable energy sources, such as solar panels and wind turbines, to provide a sustainable and eco-friendly source of power for hybrid boats. This aligns with the overall goal of decarbonizing the marine industry. Smart charging systems are being implemented to manage the charging process efficiently and optimize energy usage. These systems can monitor battery levels, demand patterns, and grid conditions to ensure that charging occurs in a sustainable and cost-effective manner. Hence with many other benefits the ongoing developments in charging infrastructure is a huge opportunity for the hybrid boats market.

Challenges: High initial cost of hybrid boats

The reason for the higher initial cost of hybrid boats is the added expense of hybrid propulsion systems compared to traditional gasoline-powered engines. Hybrid propulsion systems typically include electric motors, batteries, inverters, and control systems. These components are more expensive than traditional gasoline engines and contribute significantly to the overall cost of hybrid boats. The higher upfront cost of hybrid boats can be a significant barrier to adoption for many consumers. The initial investment may be prohibitive for boaters who have limited budgets or who are not convinced of the long-term benefits of hybrid technology. This can hinder the widespread adoption of hybrid boats, particularly among recreational boaters who may not require the same level of fuel efficiency or range as commercial or professional boaters.

Hybrid Boats Market Ecosystem:

Based on Hull Design, the Multihull segment is projected to have the highest share in 2023

Based on Hull Design, the hybrid boats market has been segmented into hydrofoil, multihull, rigid inflatable and other hull design segments. Original equipment manufacturers (OEMs) have a strong understanding of the needs of their ship owners. Multihull vessels offer superior stability and seaworthiness compared to monohull boats, making them well-suited for hybrid propulsion systems. This stability allows hybrid multihull boats to operate efficiently at higher speeds and in rougher conditions. Multihull boats have a lower wetted surface area compared to monohull boats, which translates into lower drag and reduced power consumption. This makes them more energy-efficient and fuel-efficient, particularly when operating at slower speeds or under electric power. Multihull boats offer greater versatility and adaptability compared to monohull boats, making them suitable for a wider range of applications. This versatility is well-aligned with the growth of hybrid boat technology, which is expanding into various marine sectors beyond recreational boating. Hence, we can see that multihulls have the highest share in 2023 for the hybrid boats market.

Based on Propulsion, the Electric segment of the hybrid boats market is projected to have the highest market share for the year 2023.

Based on propulsion, Electric boats offer zero tailpipe emissions, significantly reducing pollution and environmental impact compared to traditional gasoline-powered boats. This aligns with the growing demand for sustainable boating solutions and aligns with stricter emission regulations. Electric propulsion systems are inherently more efficient than gasoline engines, converting a higher proportion of energy from the battery into propulsion. This leads to a longer range and better fuel economy, making electric boats more economical in the long run. Electric boats operate significantly quieter than gasoline engines, minimizing noise pollution and disturbance to marine life and nearby communities. This quiet operation enhances the boating experience and contributes to a more peaceful marine environment. Electric boats generally require less maintenance than traditional gasoline-powered boats due to the simpler design and fewer moving parts. This reduces maintenance costs and extends the lifespan of electric boats. These are the reasons that mainly contribute to the electric segment having the highest market share in the hybrid boats market.

Based on Platform, the commercial boat segment of the hybrid boats market is projected to have the second highest market share for 2023.

Based on platform, the hybrid boats market has been segmented into recreational boats, commercial boats and military and law enforcement boats. Commercial boat operators are subject to increasingly stringent emission regulations, particularly in port areas and sensitive marine environments. Hybrid boats offer a viable solution for commercial operators to comply with these regulations and reduce their environmental footprint. Commercial boats often operate long distances and consume significant amounts of fuel, making fuel efficiency a crucial factor. Hybrid boats offer improved fuel efficiency compared to traditional gasoline-powered boats, leading to substantial fuel savings and reduced operating costs. Commercial boats require reliable and durable propulsion systems to ensure consistent operation and minimize downtime. Hybrid boats are designed for demanding commercial applications and offer proven reliability and durability. Businesses and organizations are increasingly seeking sustainable solutions for their marine transportation needs. Hybrid boats align with this trend and provide a competitive advantage for commercial operators. Hence based on the platform the commercial boats segment of the hybrid boats market has the second highest share for 2023.

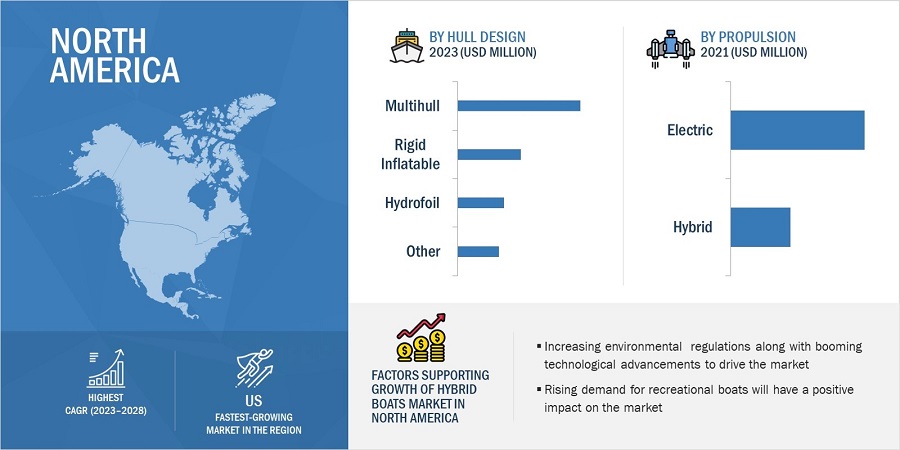

North America is accounted to have the highest market share during the forecasted period.

North America is estimated to account for the highest market share during the forecasted period. North America boasts a well-developed marine infrastructure, including marinas, boatyards, and repair facilities. This infrastructure is crucial for supporting the operation and maintenance of hybrid boats. North America is home to several leading hybrid boat manufacturers. These companies are driving innovation in hybrid boat technology and are offering a variety of hybrid boat models to cater to different needs and preferences. North American universities, research institutions, and private companies are actively engaged in the research and development of hybrid boat technologies. This ongoing innovation is helping to improve the efficiency, range, and performance of hybrid boats, making them more attractive to consumers and businesses. These are the major reasons that propel the highest market share of the North American region in the hybrid boats market.

Hybrid Boats Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Players such as Brunswick Corporation (US), Groupe Beneteau (France), Greenline Yachts (Slovenia), Candela Technology AB (Sweden), and Silent Yachts (Austria)among others cover various industry trends and new technological innovations in the hybrid boats companies for the period 2019-2028.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2019-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD) |

|

Segments Covered |

By hull design, by propulsion, by platform, by material, by boat size |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of the World |

|

Companies covered |

Brunswick Corporation (US), Groupe Beneteau (France), Greenline Yachts (Slovenia), Candela Technology AB (Sweden), and Silent Yachts (Austria) are some of the major players of marine sensors market. (25 Companies) |

Hybrid Boats Market Highlights

This research report categorizes the hybrid boat market based on hull design, propulsion, platform, material, boat size and region.

|

Segment |

Subsegment |

|

By Hull Design |

|

|

By Propulsion |

|

|

By Platform |

|

|

By Material |

|

|

By Boat Size |

|

|

By Region |

|

Recent Developments

- In May 2023, Mercury Marine, a subsidiary of Brunswick Corporation, and JJE, an electrified propulsion leader, partnered to expand the Avator electric product line to higher-power applications. This partnership will allow Mercury Marine to introduce higher-power electric motors and systems, up to 50 kW.

- In August 2022, Polestar and Candela Technology AB partnered to accelerate the adoption of electric boats on a mass scale. As per the collaboration, Polestar, the Swedish electric car manufacturer, would provide advanced battery and charging systems for the innovative hydro foiling speedboats of Candela Technology AB, marking a pivotal moment for electrification in the maritime industry.

- In June 2022, Silent Yachts acquired the full ownership of a newly constructed facility in Fano, situated along the picturesque Italian Adriatic Coast. This state-of-the-art site will be the manufacturing hub for the renowned Silent 60 and Silent 80 series of Silent Yachts. With over 250 skilled individuals, the company has ambitious plans for expansion and growth.

- In September 2021, Groupe Beneteau announced a strategic partnership with Seanapps. Through this collaboration, a white-labeled solution, i.e., Connected Boat Solution, was introduced to seamlessly connect every Groupe Beneteau brand’s boat to its clients, dealers, and the Group. This groundbreaking initiative signified the marine industry’s commitment to embracing the digital era and addressing evolving customer demands.

Frequently Asked Questions (FAQs):

What is the current size of the hybrid boats Market?

The global hybrid boats Market size is estimated to grow from USD 1.7 billion in 2023 to USD 2.7 billion by 2028, at a CAGR of 10.4% in the forecasted period.

Who are the winners in the hybrid boats Market?

Brunswick Corporation (US), Groupe Beneteau (France), Greenline Yachts (Slovenia), Candela Technology AB (Sweden), and Silent Yachts (Austria).

What are some of the opportunities of the hybrid boats Market?

Ongoing developments in charging infrastructure for hybrid boats are an opportunity for the hybrid boats market.

What are some of the technological advancements in the market?

Automation, the Internet of Things, and advancements in the hull design manufacturing process are some of the technological advancements in the hybrid boats market.

What are the factors driving the growth of the market?

The increasing demand for green boating solutions, Development of innovative hybrid boat technologies Booming maritime tourism and the Increased need for maritime transportation fuels demand for hybrid boats.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Emergence of green boating solutions- Increasing development of innovative hybrid boat technologies- Booming maritime tourism and surface watersports industry- Growing demand for improved range and performanceRESTRAINTS- Rising competition from other fuel-efficient technologiesOPPORTUNITIES- Growth potential for marine electronics and controls- Ongoing developments in charging infrastructureCHALLENGES- High cost of hybrid hull boats- Limited availability of hybrid boats

- 5.3 RECESSION IMPACT ANALYSIS

-

5.4 VALUE CHAIN ANALYSISRAW MATERIALSRESEARCH & DEVELOPMENTCOMPONENT MANUFACTURINGOEMSEND USERSAFTERSALES SERVICES

-

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS FOR HYBRID BOATS MARKET

-

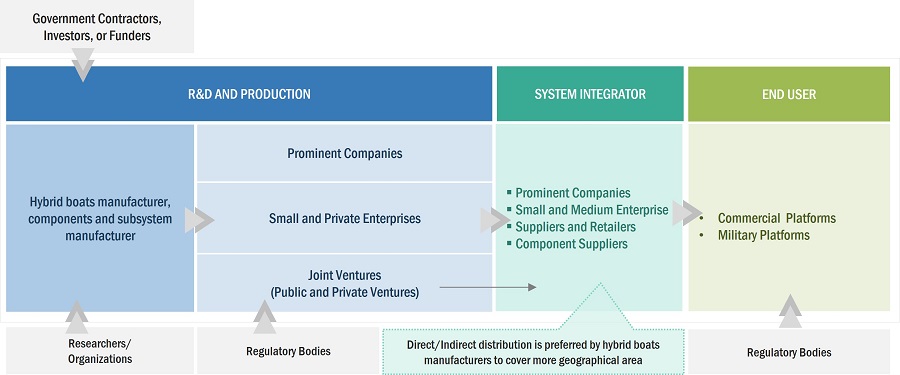

5.6 ECOSYSTEM ANALYSISPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

-

5.7 TECHNOLOGY ANALYSISHYDROFOIL HULL BOATSHYDROGEN FUEL CELLSHIGH ENERGY DENSITY ELECTROCHEMICAL STORAGE

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 AVERAGE SELLING PRICE ANALYSISINDICATIVE PRICING ANALYSIS

-

5.10 TARIFF AND REGULATORY LANDSCAPENORTH AMERICAEUROPEASIA PACIFICREST OF THE WORLD

- 5.11 TRADE ANALYSIS

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.14 USE CASE ANALYSISFUEL-EFFICIENT AND ENVIRONMENT-FRIENDLY BOATS FOR RECREATIONAL ACTIVITIESHYBRID PROPULSION SYSTEM FOR MILITARY APPLICATIONS

- 6.1 INTRODUCTION

-

6.2 TECHNOLOGY TRENDSHYBRID POWERTRAINBATTERY TECHNOLOGYELECTRIC PROPULSION SYSTEMSMART TECHNOLOGY AND CONNECTIVITYIMPROVED HULL DESIGN

-

6.3 IMPACT OF MEGATRENDS3D PRINTINGARTIFICIAL INTELLIGENCEPREDICTIVE MAINTENANCE

- 6.4 SUPPLY CHAIN ANALYSIS

-

6.5 PATENT ANALYSIS

- 6.6 TECHNOLOGY ROADMAP

- 7.1 INTRODUCTION

-

7.2 HYDROFOILENHANCED SPEED AND FUEL EFFICIENCY WITH REDUCED DRAG TO DRIVE MARKET

-

7.3 MULTIHULLIMPROVED STABILITY AND LOAD-CARRYING CAPACITY TO DRIVE MARKET

-

7.4 RIGID INFLATABLESFLEXIBLE NAVIGATION AND PORTABILITY IN SHALLOW WATERS TO DRIVE MARKET

-

7.5 OTHER HULL DESIGNSIMPROVED WAVE RESISTANCE PROPERTIES TO DRIVE MARKET

- 8.1 INTRODUCTION

-

8.2 ELECTRICGLOBAL SHIFT TOWARD REDUCING GREENHOUSE GAS EMISSIONS TO DRIVE MARKET

-

8.3 HYBRIDIMPROVED POWER MANAGEMENT SYSTEMS FOR OPTIMIZING ENERGY USAGE TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 RECREATIONAL BOATSCRUISING BOATS- Easy navigation in small ports and harbors to drive marketSPEED BOATS- Increasing demand for watersports and daily commuting to drive market

-

9.3 COMMERCIAL BOATSPASSENGER/CREW FERRY BOATS- Growing preference for safe and comfortable transportation to drive marketFISHING BOATS- Sustainable operations with minimized air, water, and noise pollution to drive marketTUGS AND WORKBOATS- Growing adoption in offshore wind farms and aquaculture to drive marketOTHER COMMERCIAL BOATS- Underwater exploration and research to drive market

-

9.4 MILITARY AND LAW ENFORCEMENT BOATSPATROL BOATS- Applications in stealth patrolling to drive marketCOMBAT BOATS- Agility and stealth capabilities to drive market

- 10.1 INTRODUCTION

-

10.2 COMPOSITEHIGH STRENGTH-TO-WEIGHT RATIO TO DRIVE MARKET

-

10.3 ALUMINUMLONGEVITY, DURABILITY, AND ECO-FRIENDLY NATURE TO DRIVE MARKET

-

10.4 STEELHIGHER IMPACT RESISTANCE AGAINST CORROSION AND HARSH ENVIRONMENT TO DRIVE MARKET

-

10.5 OTHER MATERIALSINCREASING DEMAND FOR CUSTOMIZABLE AND RENEWABLE MATERIALS TO DRIVE MARKET

- 11.1 INTRODUCTION

-

11.2 <20 FEETAFFORDABILITY, EASE OF STORAGE, AND PORTABILITY TO DRIVE MARKET

-

11.3 20 TO 50 FEETNEED FOR EXTENDED RANGE AND POWER FOR LONGER VOYAGES TO DRIVE MARKET

-

11.4 >50 FEETSUSTAINABLE LUXURY YACHTING TO DRIVE MARKET

- 12.1 INTRODUCTION

- 12.2 REGIONAL RECESSION IMPACT ANALYSIS

-

12.3 NORTH AMERICANORTH AMERICA: PESTLE ANALYSISNORTH AMERICA: RECESSION IMPACT ANALYSISUS- Recreational sea transport to drive marketCANADA- National Shipbuilding Strategy to drive market

-

12.4 EUROPEEUROPE: PESTLE ANALYSISEUROPE: RECESSION IMPACT ANALYSISUK- Rising demand for multi-purpose boating experiences to drive marketFRANCE- Increased investments in hybrid propulsion R&D to drive marketITALY- Climate Change Adaptation Strategy and Sustainable Mobility Plan to drive marketGERMANY- Increased naval expenditure and growth of maritime industry to drive marketDENMARK- Stringent environmental regulations and rising eco-consciousness among consumers to drive marketGREECE- Eco-tourism and watersports to drive marketNORWAY- Implementation of International Maritime Organization rule to drive marketREST OF EUROPE

-

12.5 ASIA PACIFICASIA PACIFIC: PESTLE ANALYSISASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- Strategic development guidelines and long-term targets for inland waterway transportation to drive marketSOUTH KOREA- Emission Control Area regulation to drive marketAUSTRALIA- Transition toward environmentally conscious alternatives and clean energy to drive marketJAPAN- Technological advancements in batteries, electric motors, and hybrid boat designs to drive marketREST OF ASIA PACIFIC

-

12.6 REST OF THE WORLDREST OF THE WORLD: PESTLE ANALYSISREST OF THE WORLD: RECESSION IMPACT ANALYSISLATIN AMERICA- Higher economic growth and development of marinas to drive marketMIDDLE EAST & AFRICA- Increasing affordability and ease of operation of hybrid boats to drive market

- 13.1 INTRODUCTION

- 13.2 RANKING ANALYSIS

- 13.3 REVENUE ANALYSIS

-

13.4 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

13.5 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

13.6 COMPETITIVE SCENARIODEALS

-

14.1 KEY PLAYERSBRUNSWICK CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGROUPE BENETEAU- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGREENLINE YACHTS- Business overview- Products/Solutions/Services offered- MnM viewCANDELA TECHNOLOGY AB- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSILENT YACHTS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewX SHORE- Business overview- Products/Solutions/Services offered- Recent developmentsQUADROFOIL D.O.O.- Business overview- Products/Solutions/Services offeredNAVALT- Business overview- Products/Solutions/Services offeredNAVIER- Business overview- Products/Solutions/Services offeredRUBAN BLEU- Business overview- Products/Solutions/Services offered- Recent developmentsARTEMIS TECHNOLOGIES LTD.- Business overview- Products/Solutions/Services offeredLEOPARD CATAMARAN- Business overview- Products/Solutions/Services offeredFOUNTAINE PAJOT- Business overview- Products/Solutions/Services offeredRAPIDO TRIMARAN- Business overview- Products/Solutions/Services offeredNEEL TRIMARAN- Business overview- Products/Solutions/Services offered

-

14.2 OTHER PLAYERSFOUR WINNSCOSMOPOLITAN YACHTSMIDSHIP MARINEWIDER YACHTSHH CATAMARANTORNADO BOATSRIBCRAFT LTD.DNA PERFORMANCE SAILING BVMULTIHULL CENTRETHE MULTIHULL COMPANY

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 PRIMARY INTERVIEWEE DETAILS

- TABLE 4 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 5 IMPACT OF PORTER’S FIVE FORCES

- TABLE 6 AVERAGE SELLING PRICE, BY PLATFORM (USD MILLION)

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 9 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 10 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 11 COUNTRY-WISE IMPORTS, 2019–2022 (USD THOUSAND)

- TABLE 12 COUNTRY-WISE EXPORTS, 2019–2022 (USD THOUSAND)

- TABLE 13 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, BY TOP 3 MATERIALS (%)

- TABLE 14 KEY BUYING CRITERIA FOR HYBRID BOATS MARKET, BY PLATFORM

- TABLE 15 DETAILED LIST OF CONFERENCES AND EVENTS, 2023–2024

- TABLE 16 INNOVATIONS AND PATENT REGISTRATIONS, 2020–2023

- TABLE 17 HYBRID BOATS MARKET, BY HULL DESIGN, 2019–2022 (USD MILLION)

- TABLE 18 HYBRID BOATS MARKET, BY HULL DESIGN, 2023–2028 (USD MILLION)

- TABLE 19 HYBRID BOATS MARKET, BY PROPULSION, 2019–2022 (USD MILLION)

- TABLE 20 HYBRID BOATS MARKET, BY PROPULSION, 2023–2028 (USD MILLION)

- TABLE 21 HYBRID BOATS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 22 HYBRID BOATS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 23 HYBRID BOATS MARKET, BY RECREATIONAL BOATS, 2019–2022 (USD MILLION)

- TABLE 24 HYBRID BOATS MARKET, BY RECREATIONAL BOATS, 2023–2028 (USD MILLION)

- TABLE 25 HYBRID BOATS MARKET, BY COMMERCIAL BOATS, 2019–2022 (USD MILLION)

- TABLE 26 HYBRID BOATS MARKET, BY COMMERCIAL BOATS, 2023–2028 (USD MILLION)

- TABLE 27 HYBRID BOATS MARKET, BY MILITARY AND LAW ENFORCEMENT BOATS, 2019–2022 (USD MILLION)

- TABLE 28 HYBRID BOATS MARKET, BY MILITARY AND LAW ENFORCEMENT BOATS, 2023–2028 (USD MILLION)

- TABLE 29 HYBRID BOATS MARKET, BY MATERIAL, 2019–2022 (USD MILLION)

- TABLE 30 HYBRID BOATS MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 31 HYBRID BOATS MARKET, BY BOAT SIZE, 2019–2022 (USD MILLION)

- TABLE 32 HYBRID BOATS MARKET, BY BOAT SIZE, 2023–2028 (USD MILLION)

- TABLE 33 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 34 HYBRID BOATS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 35 HYBRID BOATS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 NORTH AMERICA: HYBRID BOATS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 37 NORTH AMERICA: HYBRID BOATS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 38 NORTH AMERICA: HYBRID BOATS MARKET, BY HULL DESIGN, 2019–2022 (USD MILLION)

- TABLE 39 NORTH AMERICA: HYBRID BOATS MARKET, BY HULL DESIGN, 2023–2028 (USD MILLION)

- TABLE 40 NORTH AMERICA: HYBRID BOATS MARKET, BY PROPULSION, 2019–2022 (USD MILLION)

- TABLE 41 NORTH AMERICA: HYBRID BOATS MARKET, BY PROPULSION, 2023–2028 (USD MILLION)

- TABLE 42 NORTH AMERICA: HYBRID BOATS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 43 NORTH AMERICA: HYBRID BOATS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 44 NORTH AMERICA: HYBRID BOATS MARKET, BY MATERIAL, 2019–2022 (USD MILLION)

- TABLE 45 NORTH AMERICA: HYBRID BOATS MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 46 NORTH AMERICA: HYBRID BOATS MARKET, BY BOAT SIZE, 2019–2022 (USD MILLION)

- TABLE 47 NORTH AMERICA: HYBRID BOATS MARKET, BY BOAT SIZE, 2023–2028 (USD MILLION)

- TABLE 48 US: HYBRID BOATS MARKET, BY HULL DESIGN, 2019–2022 (USD MILLION)

- TABLE 49 US: HYBRID BOATS MARKET, BY HULL DESIGN, 2023–2028 (USD MILLION)

- TABLE 50 US: HYBRID BOATS MARKET, BY PROPULSION, 2019–2022 (USD MILLION)

- TABLE 51 US: HYBRID BOATS MARKET, BY PROPULSION, 2023–2028 (USD MILLION)

- TABLE 52 US: HYBRID BOATS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 53 US: HYBRID BOATS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 54 CANADA: HYBRID BOATS MARKET, BY HULL DESIGN, 2019–2022 (USD MILLION)

- TABLE 55 CANADA: HYBRID BOATS MARKET, BY HULL DESIGN, 2023–2028 (USD MILLION)

- TABLE 56 CANADA: HYBRID BOATS MARKET, BY PROPULSION, 2019–2022 (USD MILLION)

- TABLE 57 CANADA: HYBRID BOATS MARKET, BY PROPULSION, 2023–2028 (USD MILLION)

- TABLE 58 CANADA: HYBRID BOATS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 59 CANADA: HYBRID BOATS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 60 EUROPE: HYBRID BOATS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 61 EUROPE: HYBRID BOATS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 62 EUROPE: HYBRID BOATS MARKET, BY HULL DESIGN, 2019–2022 (USD MILLION)

- TABLE 63 EUROPE: HYBRID BOATS MARKET, BY HULL DESIGN, 2023–2028 (USD MILLION)

- TABLE 64 EUROPE: HYBRID BOATS MARKET, BY PROPULSION, 2019–2022 (USD MILLION)

- TABLE 65 EUROPE: HYBRID BOATS MARKET, BY PROPULSION, 2023–2028 (USD MILLION)

- TABLE 66 EUROPE: HYBRID BOATS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 67 EUROPE: HYBRID BOATS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 68 EUROPE: HYBRID BOATS MARKET, BY MATERIAL, 2019–2022 (USD MILLION)

- TABLE 69 EUROPE: HYBRID BOATS MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 70 EUROPE: HYBRID BOATS MARKET, BY BOAT SIZE, 2019–2022 (USD MILLION)

- TABLE 71 EUROPE: HYBRID BOATS MARKET, BY BOAT SIZE, 2023–2028 (USD MILLION)

- TABLE 72 UK: HYBRID BOATS MARKET, BY HULL DESIGN, 2019–2022 (USD MILLION)

- TABLE 73 UK: HYBRID BOATS MARKET, BY HULL DESIGN, 2023–2028 (USD MILLION)

- TABLE 74 UK: HYBRID BOATS MARKET, BY PROPULSION, 2019–2022 (USD MILLION)

- TABLE 75 UK: HYBRID BOATS MARKET, BY PROPULSION, 2023–2028 (USD MILLION)

- TABLE 76 UK: HYBRID BOATS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 77 UK: HYBRID BOATS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 78 FRANCE: HYBRID BOATS MARKET, BY HULL DESIGN, 2019–2022 (USD MILLION)

- TABLE 79 FRANCE: HYBRID BOATS MARKET, BY HULL DESIGN, 2023–2028 (USD MILLION)

- TABLE 80 FRANCE: HYBRID BOATS MARKET, BY PROPULSION, 2019–2022 (USD MILLION)

- TABLE 81 FRANCE: HYBRID BOATS MARKET, BY PROPULSION, 2023–2028 (USD MILLION)

- TABLE 82 FRANCE: HYBRID BOATS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 83 FRANCE: HYBRID BOATS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 84 ITALY: HYBRID BOATS MARKET, BY HULL DESIGN, 2019–2022 (USD MILLION)

- TABLE 85 ITALY: HYBRID BOATS MARKET, BY HULL DESIGN, 2023–2028 (USD MILLION)

- TABLE 86 ITALY: HYBRID BOATS MARKET, BY PROPULSION, 2019–2022 (USD MILLION)

- TABLE 87 ITALY: HYBRID BOATS MARKET, BY PROPULSION, 2023–2028 (USD MILLION)

- TABLE 88 ITALY: HYBRID BOATS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 89 ITALY: HYBRID BOATS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 90 GERMANY: HYBRID BOATS MARKET, BY HULL DESIGN, 2019–2022 (USD MILLION)

- TABLE 91 GERMANY: HYBRID BOATS MARKET, BY HULL DESIGN, 2023–2028 (USD MILLION)

- TABLE 92 GERMANY: HYBRID BOATS MARKET, BY PROPULSION, 2019–2022 (USD MILLION)

- TABLE 93 GERMANY: HYBRID BOATS MARKET, BY PROPULSION, 2023–2028 (USD MILLION)

- TABLE 94 GERMANY: HYBRID BOATS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 95 GERMANY: HYBRID BOATS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 96 DENMARK: HYBRID BOATS MARKET, BY HULL DESIGN, 2019–2022 (USD MILLION)

- TABLE 97 DENMARK: HYBRID BOATS MARKET, BY HULL DESIGN, 2023–2028 (USD MILLION)

- TABLE 98 DENMARK: HYBRID BOATS MARKET, BY PROPULSION, 2019–2022 (USD MILLION)

- TABLE 99 DENMARK: HYBRID BOATS MARKET, BY PROPULSION, 2023–2028 (USD MILLION)

- TABLE 100 DENMARK: HYBRID BOATS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 101 DENMARK: HYBRID BOATS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 102 GREECE: HYBRID BOATS MARKET, BY HULL DESIGN, 2019–2022 (USD MILLION)

- TABLE 103 GREECE: HYBRID BOATS MARKET, BY HULL DESIGN, 2023–2028 (USD MILLION)

- TABLE 104 GREECE: HYBRID BOATS MARKET, BY PROPULSION, 2019–2022 (USD MILLION)

- TABLE 105 GREECE: HYBRID BOATS MARKET, BY PROPULSION, 2023–2028 (USD MILLION)

- TABLE 106 GREECE: HYBRID BOATS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 107 GREECE: HYBRID BOATS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 108 NORWAY: HYBRID BOATS MARKET, BY HULL DESIGN, 2019–2022 (USD MILLION)

- TABLE 109 NORWAY: HYBRID BOATS MARKET, BY HULL DESIGN, 2023–2028 (USD MILLION)

- TABLE 110 NORWAY: HYBRID BOATS MARKET, BY PROPULSION, 2019–2022 (USD MILLION)

- TABLE 111 NORWAY: HYBRID BOATS MARKET, BY PROPULSION, 2023–2028 (USD MILLION)

- TABLE 112 NORWAY: HYBRID BOATS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 113 NORWAY: HYBRID BOATS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 114 REST OF EUROPE: HYBRID BOATS MARKET, BY HULL DESIGN, 2019–2022 (USD MILLION)

- TABLE 115 REST OF EUROPE: HYBRID BOATS MARKET, BY HULL DESIGN, 2023–2028 (USD MILLION)

- TABLE 116 REST OF EUROPE: HYBRID BOATS MARKET, BY PROPULSION, 2019–2022 (USD MILLION)

- TABLE 117 REST OF EUROPE: HYBRID BOATS MARKET, BY PROPULSION, 2023–2028 (USD MILLION)

- TABLE 118 REST OF EUROPE: HYBRID BOATS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 119 REST OF EUROPE: HYBRID BOATS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 120 ASIA PACIFIC: HYBRID BOATS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 121 ASIA PACIFIC: HYBRID BOATS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 122 ASIA PACIFIC: HYBRID BOATS MARKET, BY HULL DESIGN, 2019–2022 (USD MILLION)

- TABLE 123 ASIA PACIFIC: HYBRID BOATS MARKET, BY HULL DESIGN, 2023–2028 (USD MILLION)

- TABLE 124 ASIA PACIFIC: HYBRID BOATS MARKET, BY PROPULSION, 2019–2022 (USD MILLION)

- TABLE 125 ASIA PACIFIC: HYBRID BOATS MARKET, BY PROPULSION, 2023–2028 (USD MILLION)

- TABLE 126 ASIA PACIFIC: HYBRID BOATS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 127 ASIA PACIFIC: HYBRID BOATS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 128 ASIA PACIFIC: HYBRID BOATS MARKET, BY MATERIAL, 2019–2022 (USD MILLION)

- TABLE 129 ASIA PACIFIC: HYBRID BOATS MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 130 ASIA PACIFIC: HYBRID BOATS MARKET, BY BOAT SIZE, 2019–2022 (USD MILLION)

- TABLE 131 ASIA PACIFIC: HYBRID BOATS MARKET, BY BOAT SIZE, 2023–2028 (USD MILLION)

- TABLE 132 CHINA: HYBRID BOATS MARKET, BY HULL DESIGN, 2019–2022 (USD MILLION)

- TABLE 133 CHINA: HYBRID BOATS MARKET, BY HULL DESIGN, 2023–2028 (USD MILLION)

- TABLE 134 CHINA: HYBRID BOATS MARKET, BY PROPULSION, 2019–2022 (USD MILLION)

- TABLE 135 CHINA: HYBRID BOATS MARKET, BY PROPULSION, 2023–2028 (USD MILLION)

- TABLE 136 CHINA: HYBRID BOATS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 137 CHINA: HYBRID BOATS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 138 SOUTH KOREA: HYBRID BOATS MARKET, BY HULL DESIGN, 2019–2022 (USD MILLION)

- TABLE 139 SOUTH KOREA: HYBRID BOATS MARKET, BY HULL DESIGN, 2023–2028 (USD MILLION)

- TABLE 140 SOUTH KOREA: HYBRID BOATS MARKET, BY PROPULSION, 2019–2022 (USD MILLION)

- TABLE 141 SOUTH KOREA: HYBRID BOATS MARKET, BY PROPULSION, 2023–2028 (USD MILLION)

- TABLE 142 SOUTH KOREA: HYBRID BOATS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 143 SOUTH KOREA: HYBRID BOATS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 144 AUSTRALIA: HYBRID BOATS MARKET, BY HULL DESIGN, 2019–2022 (USD MILLION)

- TABLE 145 AUSTRALIA: HYBRID BOATS MARKET, BY HULL DESIGN, 2023–2028 (USD MILLION)

- TABLE 146 AUSTRALIA: HYBRID BOATS MARKET, BY PROPULSION, 2019–2022 (USD MILLION)

- TABLE 147 AUSTRALIA: HYBRID BOATS MARKET, BY PROPULSION, 2023–2028 (USD MILLION)

- TABLE 148 AUSTRALIA: HYBRID BOATS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 149 AUSTRALIA: HYBRID BOATS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 150 JAPAN: HYBRID BOATS MARKET, BY HULL DESIGN, 2019–2022 (USD MILLION)

- TABLE 151 JAPAN: HYBRID BOATS MARKET, BY HULL DESIGN, 2023–2028 (USD MILLION)

- TABLE 152 JAPAN: HYBRID BOATS MARKET, BY PROPULSION, 2019–2022 (USD MILLION)

- TABLE 153 JAPAN: HYBRID BOATS MARKET, BY PROPULSION, 2023–2028 (USD MILLION)

- TABLE 154 JAPAN: HYBRID BOATS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 155 JAPAN: HYBRID BOATS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 156 REST OF ASIA PACIFIC: HYBRID BOATS MARKET, BY HULL DESIGN, 2019–2022 (USD MILLION)

- TABLE 157 REST OF ASIA PACIFIC: HYBRID BOATS MARKET, BY HULL DESIGN, 2023–2028 (USD MILLION)

- TABLE 158 REST OF ASIA PACIFIC: HYBRID BOATS MARKET, BY PROPULSION, 2019–2022 (USD MILLION)

- TABLE 159 REST OF ASIA PACIFIC: HYBRID BOATS MARKET, BY PROPULSION, 2023–2028 (USD MILLION)

- TABLE 160 REST OF ASIA PACIFIC: HYBRID BOATS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 161 REST OF ASIA PACIFIC: HYBRID BOATS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 162 REST OF THE WORLD: HYBRID BOATS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 163 REST OF THE WORLD: HYBRID BOATS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 164 REST OF THE WORLD: HYBRID BOATS MARKET, BY HULL DESIGN, 2019–2022 (USD MILLION)

- TABLE 165 REST OF THE WORLD: HYBRID BOATS MARKET, BY HULL DESIGN, 2019–2022 (USD MILLION)

- TABLE 166 REST OF THE WORLD: HYBRID BOATS MARKET, BY PROPULSION, 2019–2022 (USD MILLION)

- TABLE 167 REST OF THE WORLD: HYBRID BOATS MARKET, BY PROPULSION, 2023–2028 (USD MILLION)

- TABLE 168 REST OF THE WORLD: HYBRID BOATS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 169 REST OF THE WORLD: HYBRID BOATS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 170 REST OF THE WORLD: HYBRID BOATS MARKET, BY MATERIAL, 2019–2022 (USD MILLION)

- TABLE 171 REST OF THE WORLD: HYBRID BOATS MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 172 REST OF THE WORLD: HYBRID BOATS MARKET, BY BOAT SIZE, 2019–2022 (USD MILLION)

- TABLE 173 REST OF THE WORLD: HYBRID BOATS MARKET, BY BOAT SIZE, 2023–2028 (USD MILLION)

- TABLE 174 LATIN AMERICA: HYBRID BOATS MARKET, BY HULL DESIGN, 2019–2022 (USD MILLION)

- TABLE 175 LATIN AMERICA: HYBRID BOATS MARKET, BY HULL DESIGN, 2023–2028 (USD MILLION)

- TABLE 176 LATIN AMERICA: HYBRID BOATS MARKET, BY PROPULSION, 2019–2022 (USD MILLION)

- TABLE 177 LATIN AMERICA: HYBRID BOATS MARKET, BY PROPULSION, 2023–2028 (USD MILLION)

- TABLE 178 LATIN AMERICA: HYBRID BOATS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 179 LATIN AMERICA: HYBRID BOATS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: HYBRID BOATS MARKET, BY HULL DESIGN, 2019–2022 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: HYBRID BOATS MARKET, BY HULL DESIGN, 2022–2023 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: HYBRID BOATS MARKET, BY PROPULSION, 2019–2022 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: HYBRID BOATS MARKET, BY PROPULSION, 2023–2028 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: HYBRID BOATS MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: HYBRID BOATS MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 186 KEY PLAYERS’ STRATEGIES IN HYBRID BOATS MARKET

- TABLE 187 COMPANY FOOTPRINT

- TABLE 188 COMPANY FOOTPRINT, BY PLATFORM

- TABLE 189 COMPANY FOOTPRINT, BY REGION

- TABLE 190 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 191 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 192 HYBRID BOATS MARKET: DEALS, SEPTEMBER 2021–JUNE 2023

- TABLE 193 BRUNSWICK CORPORATION: COMPANY OVERVIEW

- TABLE 194 BRUNSWICK CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 195 BRUNSWICK CORPORATION: DEALS

- TABLE 196 GROUPE BENETEAU: COMPANY OVERVIEW

- TABLE 197 GROUPE BENETEAU: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 198 GROUPE BENETEAU: DEALS

- TABLE 199 GREENLINE YACHTS: COMPANY OVERVIEW

- TABLE 200 GREENLINE YACHTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 201 CANDELA TECHNOLOGY AB: COMPANY OVERVIEW

- TABLE 202 CANDELA TECHNOLOGY AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 203 CANDELA TECHNOLOGY AB: DEALS

- TABLE 204 SILENT YACHTS: COMPANY OVERVIEW

- TABLE 205 SILENT YACHTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 206 SILENT YACHTS: OTHERS

- TABLE 207 X SHORE: COMPANY OVERVIEW

- TABLE 208 X SHORE: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 209 X SHORE: DEALS

- TABLE 210 QUADROFOIL D.O.O.: COMPANY OVERVIEW

- TABLE 211 QUADROFOIL D.O.O.: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 212 NAVALT: COMPANY OVERVIEW

- TABLE 213 NAVALT: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 214 NAVIER: COMPANY OVERVIEW

- TABLE 215 NAVIER: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 216 RUBAN BLEU: COMPANY OVERVIEW

- TABLE 217 RUBAN BLEU: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 218 RUBAN BLEU: DEALS

- TABLE 219 ARTEMIS TECHNOLOGIES LTD.: COMPANY OVERVIEW

- TABLE 220 ARTEMIS TECHNOLOGIES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 221 LEOPARD CATAMARAN: COMPANY OVERVIEW

- TABLE 222 LEOPARD CATAMARAN: PRODUCTS/ SOLUTIONS/SERVICES OFFERED?

- TABLE 223 FOUNTAINE PAJOT: COMPANY OVERVIEW

- TABLE 224 FOUNTAINE PAJOT: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- TABLE 225 RAPIDO TRIMARAN: COMPANY OVERVIEW

- TABLE 226 RAPIDO TRIMARAN: PRODUCTS/ SOLUTIONS/SERVICES OFFERED?

- TABLE 227 NEEL TRIMARAN: COMPANY OVERVIEW

- TABLE 228 NEEL TRIMARAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED?

- FIGURE 1 HYBRID BOATS MARKET SEGMENTATION

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

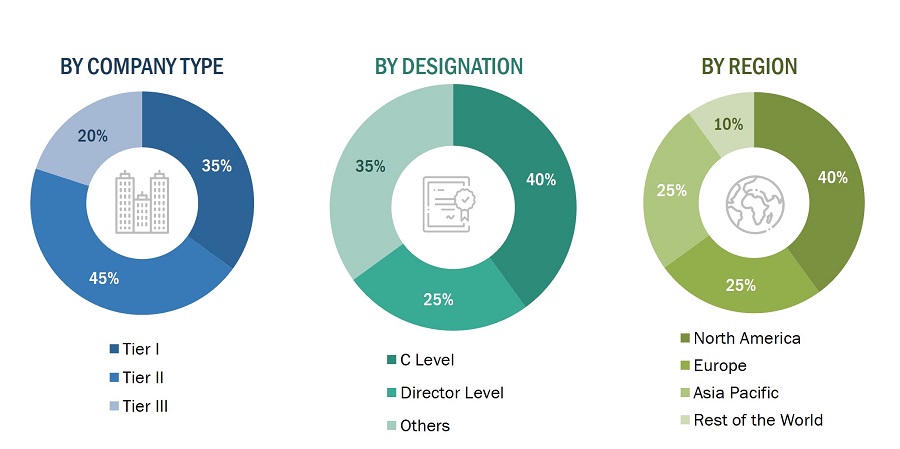

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 MULTIHULL SEGMENT TO HOLD HIGHEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 9 ALUMINUM TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 10 >50 SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 NORTH AMERICAN MARKET TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 12 INCREASING GLOBAL TRADE AND DEVELOPMENT OF INNOVATIVE HYBRID BOAT TECHNOLOGIES TO DRIVE MARKET

- FIGURE 13 ELECTRIC SEGMENT TO HAVE LARGEST MARKET SHARE IN 2023

- FIGURE 14 COMMERCIAL BOATS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 NORWAY TO BE FASTEST-GROWING MARKET BETWEEN 2023 AND 2028

- FIGURE 16 HYBRID BOATS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 COMMON LITHIUM-ION BATTERIES WITH KEY FEATURES

- FIGURE 18 VALUE CHAIN ANALYSIS

- FIGURE 19 ECOSYSTEM MAPPING

- FIGURE 20 AVERAGE SELLING PRICE, BY PLATFORM

- FIGURE 21 IMPORT DATA OF TOP 10 COUNTRIES

- FIGURE 22 EXPORT DATA OF TOP 10 COUNTRIES

- FIGURE 23 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS

- FIGURE 24 KEY BUYING CRITERIA FOR HYBRID BOATS MARKET, BY PLATFORM

- FIGURE 25 SUPPLY CHAIN ANALYSIS

- FIGURE 26 LIST OF MAJOR PATENTS RELATED TO HYBRID BOATS MARKET

- FIGURE 27 EVOLUTION OF HYBRID BOATS MARKET

- FIGURE 28 HYBRID BOATS MARKET, BY HULL DESIGN, 2023–2028 (USD MILLION)

- FIGURE 29 HYBRID BOATS MARKET, BY PROPULSION, 2023–2028 (USD MILLION)

- FIGURE 30 RECREATIONAL BOATS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 31 HYBRID BOATS MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- FIGURE 32 HYBRID BOATS MARKET, BY BOAT SIZE, 2023–2028 (USD MILLION)

- FIGURE 33 HYBRID BOATS MARKET, BY REGION, 2023–2028

- FIGURE 34 NORTH AMERICA: HYBRID BOATS MARKET SNAPSHOT

- FIGURE 35 EUROPE: HYBRID BOATS MARKET SNAPSHOT

- FIGURE 36 CO2 EMISSIONS FROM DOMESTIC SHIPPING IN NORWAY

- FIGURE 37 ASIA PACIFIC: HYBRID BOATS MARKET SNAPSHOT

- FIGURE 38 REST OF THE WORLD: HYBRID BOATS MARKET SNAPSHOT

- FIGURE 39 MARKET RANKING ANALYSIS OF TOP 5 PLAYERS, 2022

- FIGURE 40 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2022

- FIGURE 41 COMPANY EVALUATION MATRIX, 2022

- FIGURE 42 STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 43 BRUNSWICK CORPORATION: COMPANY SNAPSHOT

- FIGURE 44 GROUPE BENETEAU: COMPANY SNAPSHOT

- FIGURE 45 FOUNTAINE PAJOT: COMPANY SNAPSHOT

This research study used secondary sources, directories, and databases like D&B Hoovers, Bloomberg Businessweek, and Factiva to identify and collect information relevant to the hybrid boats market. Primary sources included industry experts from the core and related industries, preferred suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all the segments of this industry’s value chain. All primary sources were interviewed to obtain and verify critical qualitative and quantitative information and assess prospects for the market's growth during the forecast period.

Secondary Research:

The share of companies in the hybrid boats market was determined using secondary data made available through paid and unpaid sources and by analyzing their product portfolios. The companies were rated based on the performance and quality of their products. These data points were further validated by primary sources. Secondary sources that were referred to for this research study on the hybrid boats market included financial statements of companies offering and developing hybrid boats products and solutions and information from various trade, business, and professional associations, among others. Secondary data was collected and analyzed to arrive at the overall size of the hybrid boats market, which was further validated by primary respondents.

Primary Research:

Extensive primary research was conducted after obtaining information about the current scenario of the hybrid boats market through secondary research. Several primary interviews were conducted with market experts from the demand and supply sides across North America, Europe, Asia Pacific, and Rest of the World. This primary data was collected through questionnaires, emails, and telephonic interviews.

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as vice presidents, directors, regional managers, technology providers, product development teams, distributors, and end users.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products & services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the trends related to hull design, propulsion, platform, material and boat size. Stakeholders from the demand side, such as CXOs, production managers, engineers, and installation teams of end users of hybrid boats, were interviewed to understand the buyer’s perspective on the suppliers, products, service providers, and their current usage and outlook of their business, which could affect the hybrid boats market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the hybrid boats market. The research methodology used to estimate the size of the market includes the following details.

The key players in the hybrid boats market were identified through secondary research, and their market shares were determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews with leaders such as directors, engineers, marketing executives, and other stakeholders of leading companies operating in the hybrid boats market.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the hybrid boats market. This data was consolidated, enhanced with detailed inputs, analysed by MarketsandMarkets, and presented in this report.

Market size estimation methodology: Bottom-up Approach

Market size estimation methodology: Top-Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both top-down and bottom-up approaches.

Market Definition

The hybrid boats market refers to boats with hybrid hulls equipped with electric and hybrid propulsion systems. These boats combine traditional combustion engines with electric propulsion systems to achieve enhanced fuel efficiency, reduced emissions, and improved performance. Hybrid hulls incorporate innovative design elements and materials to optimize water flow, reduce drag, and enhance stability.

Key Stakeholders

- Hybrid Boat Manufacturers

- Subcomponent Manufacturers

- Technology Support Providers

- Research Bodies

- System Integrators

- Commercial Vessel Operators

- Defense Organizations

Objectives of the Study

- To define, describe, segment, and forecast the size of the hybrid boats market based on hull design, material, boat size, propulsion, platform, and region

- To analyze the degree of competition in the market by mapping the recent developments, products, and services of key market players

- To understand the structure of the hybrid boats market by identifying its various segments and subsegments

- To identify and analyze key drivers, restraints, opportunities, and challenges that influence the market growth

- To provide an overview of the tariff and regulatory landscape for the adoption of hybrid boats across regions

- To forecast the size of market segments across North America, Europe, Asia Pacific, and Rest of the World, along with major countries in each region

- To identify transportation industry trends, market trends, and technology trends currently prevailing in the market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To provide a detailed competitive landscape of the market, along with an analysis of business and strategies such as mergers and acquisitions, partnerships, agreements, and product developments in the hybrid boats market

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the hybrid boats market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the hybrid boats market.

Growth opportunities and latent adjacency in Hybrid Boats Market