HVDC Capacitor Market by Product Type (Ceramic Capacitors, Plastic Film Capacitors), Technology, Installation Type (Open Rack Capacitor Banks, Enclosed Rack Capacitor Banks), Application (Industrial, Commercial) and Region - Global Forecast to 2031

HVDC Capacitor Market Size & Growth

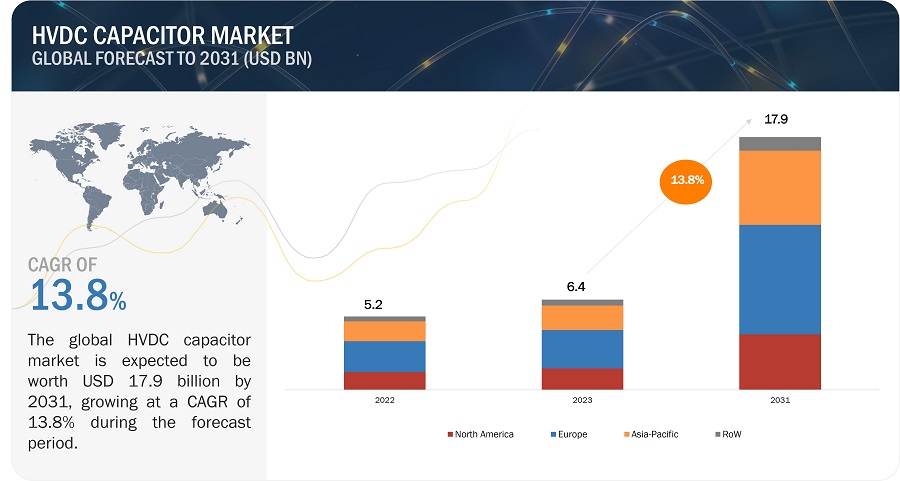

[244 Pages Report] The HVDC capacitor market is projected to grow from USD 6.4 billion in 2023 to USD 17.8 billion by 2031; it is expected to grow at a CAGR of 13.8% from 2023 to 2031. The factors driving the growth of the HVDC capacitor market include the increasing use of capacitors in commercial, industrial, aerospace and defense, and energy and power applications and ongoing government initiatives to improve energy infrastructure. Also, the cost effectiveness, high level of stability, and low loss levels of ceramic capacitors are amplifying their growth in future.

HVDC Capacitor Market Forecast to 2031

To know about the assumptions considered for the study, Request for Free Sample Report

HVDC Capacitor Market Dynamics

Driver: Rising demand for HVDC transmission systems

HVDC transmission systems are preferentially used as a better solution than HVAC systems for direct transmission of power over long distances. HVDC transmission systems involve the use of fewer transmission lines as compared to HVAC systems and thus has less effects on the environment. Also, they require less space for transmitting the same amount of energy. HVDC transmission systems help reduce transmission loss by 30-50% compared to AC overhead lines. Additionally. Compared to other forms of transmission HVDC has fewer conductors and/or insulators, thus lowering the total and installation costs. An HVDC capacitor industry is one of the fundamental subsystems of the HVDC transmission system and is vital in the conversion of the AC to DC as well as power transportation between HVDC converter stations followed by the inversion of DC to AC to feed electricity into the utility network.

Restraint: Hazardous effects of HV capacitors on humans and the environment

HV capacitors may catastrophically fail when subjected to voltages or currents beyond their rating or reaching their normal end of life. They may store hazardous energy even after the equipment has been de-energized and build a dangerous residual charge without an external source. The liquid dielectric in several capacitors, or its combustion products, may be toxic. An arc fault is generated when dielectric or metal interconnection failures occur in HV capacitors. The dielectric fluid vaporizes within oil-filled units and results in case bulging and rupture. In some instances, an explosion can occur, dispersing the flammable oil and causing fire and damage to the neighboring equipment. In such cases, rigid-cased cylindrical glass and plastic cases are more prone to explosive rupture than rectangular cases due to an inability to expand under pressure easily. In high-current applications, HV capacitors may face overheating, which may cause rapid interior heating and destruction. Capacitors used within high- energy capacitor banks can violently explode when a fault in one capacitor causes the sudden dumping of energy stored in the rest of the bank into the failing unit. Furthermore, HV vacuum capacitors can produce soft X-rays even while operating normally. These factors are hazardous for human beings and the environment.

Opportunity: Escalating demand for electric vehicles

Electric vehicles (EVs) are gaining traction globally as they are eco-friendly and an alternative to fuel- powered vehicles due to soaring oil prices. EVs comprise numerous electrical subsystems, including AC- DC conversion, DC-DC conversion, power management, and battery monitoring with a specific voltage, power, and size requirements, necessitating careful capacitor selection by designers. The electronic systems and components that have enabled the realization of various EVs have experienced a significant evolution, including the DC link power capacitor. Different HVDC capacitors, including aluminum electrolytic capacitors, film capacitors, tantalum capacitors, and ceramic capacitors, fulfill the high quality and reliability requirements of AEC-Q200 and VW AUDI 80808 standards are offered by various market players in the HVDC capacitor market. According to International Energy Agency (IEA), the global sales of EVs, including passenger vehicles, light trucks, and light commercial vehicles, was ~14 million in 2023. According to the International Energy Agency (IEA), electric car sales have more than tripled in three years, from roughly 4% in 2020 to 18% in 2023. EV sales are predicted to remain strong through 2024. In 2023, China accounted for approximately 37% of all new electric vehicle registrations worldwide.

Challenge: Catastrophic explosion of capacitor banks

An HVDC transmission system requires several capacitor banks connected in series and parallelly. These capacitor banks may explode catastrophically while functioning, and it is challenging to find out the exact cause of the failure of capacitor banks. Some major reasons for the explosion of the capacitor banks are mentioned below:

- The capacitor units are connected in series with inductors in the capacitor bank. When the voltage across the capacitor units exceeds the design values, the capacitor bank fails catastrophically due to inadequate voltage rating.

- A short-circuit in the capacitor unit due to over current and voltage may result in fuse blowing. the failure of the fuse is conditioned by improper protection of branches, application of improper capacitive units or fatigue.

- It transmits, stores, and interacts with the source or transformer inductance thus giving rise to ferro resonance. This can result in unconstrained oscillations in either the current or voltage pending on kind of resonance. Some of these challenges can be overcome by timely monitoring of capacitor banks. For instance, a short- circuited capacitor unit can be determined by inspecting the capacitor for bulging or case rupture. Thus, the catastrophic explosion of a capacitor bank may hinder the growth.

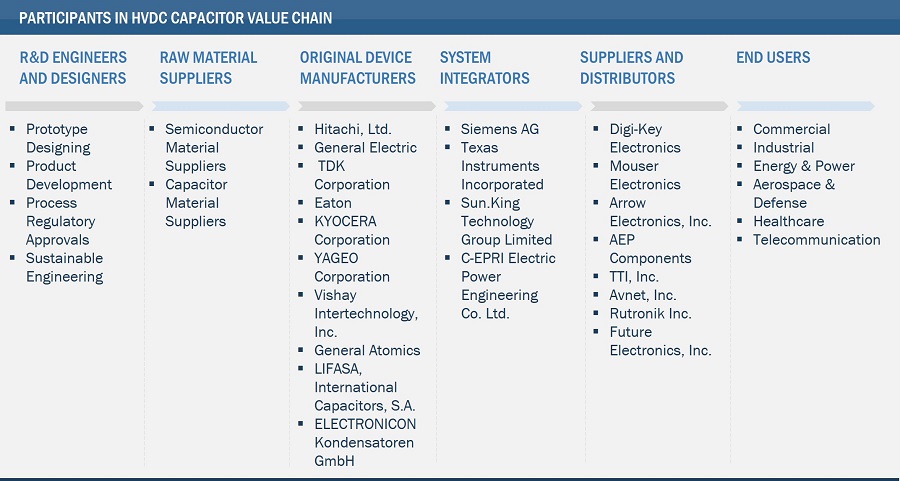

HVDC Capacitor Market Ecosystem

The prominent players in the HVDC capacitor market are Hitachi, Ltd. (Japan), General Electric (US), TDK Corporation (Japan), Eaton (US), KYOCERA Corporation (Japan), YAGEO Corporation (Taiwan), Vishay Intertechnology, Inc. (US). These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks.

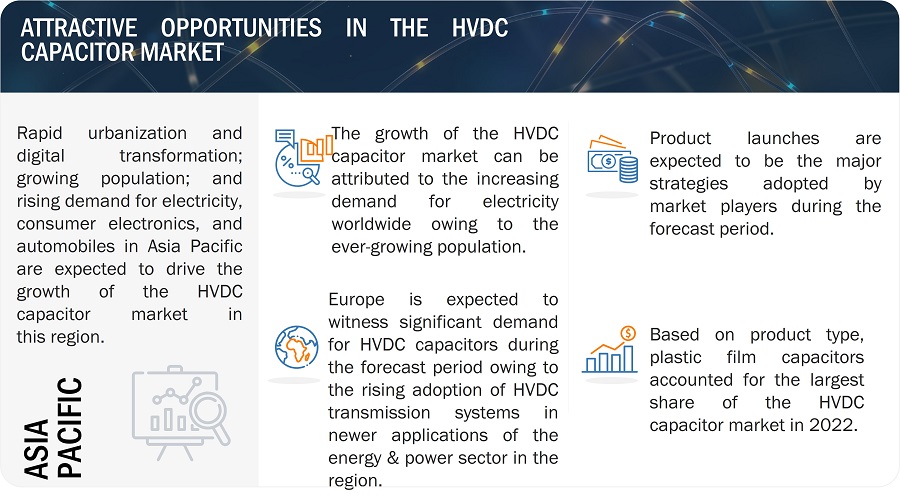

Plastic film capacitors accounted for the largest market share during the forecast period.

HVDC plastic film capacitors are expected to capture the largest market share during the forecast period owing to the increased adoption of these capacitors in commercial, industrial, aerospace & defense, and energy & power applications. They are highly reliable due to their self-healing capability and long service life and can continue operating effectively even in high temperatures. This comes with the benefits such as high reliability, low failure rate, longer life expectancy and enhanced efficiency under high temperatures. There are various types of the film capacitors used in the industries including SMD style capacitors, heavy duty snubber capacitors using screw terminals, axial style capacitors, radial style capacitors, and the hard duty solder terminal looks radial style capacitors. Plastic film capacitors with high power ratings are called film power capacitors. They are widely used in power generation and distribution facilities, as well as in high-power electronics, including pulsed lasers, phase shifters, and X-ray flashes, whereas decoupling capacitors find application in low-power electronics, such as A/D converters and filters, safety capacitors, snubber capacitors, and fluorescent light ballasts. They are also used to suppress electromagnetic interference.

Energy and Power applications accounted for the largest market share during the forecast period.

The HVDC capacitor market for energy and power applications is expected to hold the highest market share during the forecast period. The growth can be attributed to the increased demand for these capacitor banks owing to several benefits, including easy installation and maintenance, less assembly, simple design, and cost-effectiveness. They are widely used in energy and power applications for transmitting power over long distances. The ongoing projects undertaken by governments to enhance energy generation and distribution infrastructure will likely result in high demand for pole-mounted capacitor banks in the future. They are applied in energy and power sector for the transmission of power over long distances. Due to the constant investment by governments towards development of energy generation and distribution systems, it is expected that requirement of pole mounted capacitor banks will remain high in the future. Sustained government support and commitment towards the development of renewable energy sources to attain the net-zero emission pathway is also helping the growth. For instance, in July 2023, the US Department of Energy (DOE) announced that Puerto Rico Energy Resilience Fund (PR-ERF) would financially support with up to USD 453.5 million to extend rooftop solar PV and battery storage in residential in the area as well as support Puerto Rican households in need. A future with renewable energy means energy security and reliability for the Puerto Ricans as well as lower bills for the households.

The Asia Pacific region is projected to grow at the highest CAGR during the forecast period.

Asia Pacific holds tremendous potential for the HVDC capacitor market due to the rising demand for these capacitors from the automotive and transportation, consumer electronics, industrial, aerospace & defense, mining, healthcare, energy & power, and telecommunications sectors. Moreover, the governments of different Asia Pacific countries have taken various initiatives such as funding energy expansion projects, renovating existing aging energy infrastructures, and formulating regulations and standards for less carbon emissions, mainly emphasizing the use of sustainable energy, especially solar and offshore wind farms, are expected to fuel the demand for HVDC capacitors in the region in the coming years.

In July 2023, Hitachi Energy (Japan), a worldwide technology leader driving a sustainable energy future for all its customers, was selected by SSEN Transmission (Scotland), a subsidiary of the UK energy giant SSE plc, to provide several onshore high-voltage direct current (HVDC) converter stations to promote the UK power grid's transition to large-scale renewable energy sources.

HVDC Capacitor Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major players in the HVDC capacitor companies include Hitachi, Ltd. (Japan), General Electric (US), TDK Corporation (Japan), Eaton (US), KYOCERA Corporation (Japan), YAGEO Corporation (Taiwan), Vishay Intertechnology, Inc. (US), General Atomics (US), LIFASA, International Capacitors, S.A. (Spain), ELECTRONICON Kondensatoren GmbH (Germany), API Capacitors (UK), Shanghai Yongming Electronic Co., Ltd (China), WUXI CRE NEW ENERGY TECHNOLOGY CO., LTD. (China), Isofarad Kft. (Hungary), HVP High Voltage Products GmbH. (Germany). These companies have used organic and inorganic growth strategies, such as product launches, acquisitions, and partnerships, to strengthen their position in the market.

Scope of the Report

|

Report Metric |

Details |

|

Market Size Availability for Years |

2019–2031 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2031 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

By Product Type, By Technology, By Installation Type, By Application |

|

Geographies Covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

Hitachi, Ltd. (Japan), General Electric (US), TDK Corporation (Japan), Eaton (US), KYOCERA Corporation (Japan), YAGEO Corporation (Taiwan), Vishay Intertechnology, Inc. (US), General Atomics (US), LIFASA, International Capacitors, S.A. (Spain), and ELECTRONICON Kondensatoren GmbH (Germany), Sieyuan Electric Co., Ltd. (China), Kunshan GuoLi Electronic Technology Co., Ltd.(China), Condis (Switzerland), samwha Capacitor Group (South Korea), API Capacitors (UK), Shanghai Yongming Electronic Co., Ltd (China), WUXI CRE NEW ENERGY TECHNOLOGY CO., LTD. (China), Isofarad Kft. (Hungary), HVP High Voltage Products GmbH. (Germany), ZEZ SILKO Czech Republic (Czech Republic) |

HVDC Capacitor Market Highlights

This research report categorizes the HVDC Capacitor Market based on product type, technology, installation type, application, and region.

|

Segment |

Subsegment |

|

By Product Type |

|

|

By Technology |

|

|

By Installation Type |

|

|

By Application |

|

|

By Region |

|

Recent Developments

- In June 2023, Hitachi Energy has received a contract by Inelfe, a joint venture between the operators of the French (RTE) and Spanish (Red Eléctrica) electricity transmission networks, to supply four high-voltage direct current (HVDC) converter stations for a subsea cable that will link France and Spain across the Biscay Gulf. Inelfe holds the responsibility for constructing and commissioning all cross-border connections among the two countries.

- In April 2023, Kyocera Corporation declared the development of a new capacitor (MLCC) with EIA 0201 dimensions (0.6 mm x 0.3 mm). As smartphones and wearable gadgets become more complex, electronic circuits require more MLCC devices with larger capacitance values.

- In March 2023, GE Renewable Energy’s Grid Solutions business announced that it had been awarded three High-Voltage Direct Current (HVDC) contracts totaling roughly 6 billion euros as part of a specially formed consortium with Sembcorp Marine for TenneT’s innovative 2GW Program in the Netherlands.

- In February 2023, Vishay Intertechnology, Inc. released a new series of low-impedance, Automotive Grade micro aluminum electrolytic capacitors that perform better in smaller case sizes than previous-generation alternatives.

- In February 2023, TDK Corporation introduced its new EPCOS B43652 series of snap-in aluminum electrolytic capacitors with particularly small dimensions and strong ripple current carrying capacity. The DC link circuitry of onboard chargers in xEVs is a common application for these capacitors with high CV products.

Frequently Asked Questions (FAQ):

What is the current size of the Global HVDC Capacitor Market?

The HVDC capacitor market is projected to grow from USD 6.4 billion in 2023 to USD 17.9 billion by 2031; it is expected to grow at a CAGR of 13.8% from 2023 to 2031.

Who are the winners in the Global HVDC Capacitor Market?

Companies such as Hitachi, Ltd. (Japan), General Electric (US), TDK Corporation (Japan), Eaton (US), KYOCERA Corporation (Japan), YAGEO Corporation (Taiwan), Vishay Intertechnology, Inc. (US).

Which region is expected to hold the highest market share?

Europe is expected to dominate the HVDC capacitor market during the forecast period. Growing demand for energy and power applications, and the region holds a strong base of end users from aerospace & defense, energy & power, mining, transportation, automotive, consumer electronics, and healthcare sectors.

What are the major drivers and opportunities related to the HVDC capacitor market?

The rising demand for HVDC transmission systems, Increasing adoption of renewable energy source with rising energy consumption, Ongoing government initiatives to improve energy infrastructure, Rising adoption of HVDC capacitors by industrial consumers in Asia Pacific, and Escalating demand for electric vehicles are some of the major drivers and opportunities related to the HVDC capacitor market.

What are the major strategies adopted by market players?

The key players have adopted product launches, acquisitions, and partnerships to strengthen their position in the HVDC capacitor market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising demand for HVDC transmission systems- Increasing adoption of renewable energy sources with rising energy consumption- Ongoing government initiatives to improve energy infrastructureRESTRAINTS- Hazardous effects of HV capacitors on humans and environmentOPPORTUNITIES- Rising adoption of HVDC capacitors by industrial consumers in Asia Pacific- Growing demand for electric vehiclesCHALLENGES- Catastrophic explosion of capacitor banks

- 5.3 SUPPLY CHAIN ANALYSIS

-

5.4 MARKET ECOSYSTEM

- 5.5 PRICING ANALYSIS

- 5.6 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.7 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- HVDC technology- Flat winding technology- HVDC power film technology

-

5.8 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTS

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.10 CASE STUDYGENERAL ELECTRIC SIGNS CONTRACT WITH TENNET FOR INNOVATIVE 2 GW PROGRAMEATON ENABLES SMART PREDICTIVE ELECTRICAL MAINTENANCE FOR COMMERCIAL AND INDUSTRIAL END USERSTDK CORPORATION EXPANDS MANUFACTURING FACILITY TO ENHANCE MULTILAYER CERAMIC CAPACITORS (MLCC)HITACHI ENERGY HELPS TRANSGRID IMPROVE POWER QUALITY OF QNIHITACHI ABB POWER GRIDS HELPS MINNESOTA POWER INCREASE AVAILABILITY OF CLEAN POWER TO ITS CUSTOMERS

-

5.11 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

5.12 PATENT ANALYSIS

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.14 TARIFF AND REGULATORY LANDSCAPESTANDARDS- International Electrotechnical Commission (IEC)- International Organization for Standardization (ISO)TARIFFSREGULATIONSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.1 INTRODUCTION

-

6.2 PLASTIC FILM CAPACITORSSUITABLE FOR ENERGY AND POWER APPLICATIONS DUE TO LONG SERVICE LIFE AND HIGH RELIABILITY

-

6.3 ALUMINUM ELECTROLYTIC CAPACITORSIDEAL FOR APPLICATIONS REQUIRING LARGER CAPACITANCE VALUES

-

6.4 CERAMIC CAPACITORSWIDELY USED FOR ELECTROSTATIC DISCHARGE PROTECTION IN AUTOMOTIVE APPLICATIONS

-

6.5 TANTALUM WET CAPACITORSPREFERRED IN INDUSTRIAL AND MILITARY APPLICATIONS DUE TO HIGH RELIABILITY AND STABILITY

- 6.6 OTHERS

- 7.1 INTRODUCTION

-

7.2 LINE-COMMUTATED CONVERTER (LCC)USED FOR LARGE-CAPACITY POWER TRANSMISSION WITH LOW LOSS

-

7.3 VOLTAGE-SOURCE CONVERTER (VSC)PROVIDES QUICKER POWER FLOW REGULATION WITH FLEXIBLE AND PROLONGED REACTIVE POWER

- 8.1 INTRODUCTION

-

8.2 OPEN RACK CAPACITOR BANKSHELP REDUCE POWER LOSS AND IMPROVE VOLTAGE STABILITY IN TRANSMISSION AND DISTRIBUTION NETWORKSINTERNALLY FUSED CAPACITOR BANKSEXTERNALLY FUSED CAPACITOR BANKSFUSELESS CAPACITOR BANKS

-

8.3 ENCLOSED RACK CAPACITOR BANKSREDUCES FAULT DAMAGE AND ALLOWS GREATER SYNCHRONIZATION WITH UPSTREAM PROTECTIVE DEVICESFIXED CAPACITOR BANKSAUTOMATIC CAPACITOR BANKS

-

8.4 POLE-MOUNTED CAPACITOR BANKSOFFERS VOLTAGE REGULATION AND POWER FACTOR DUE TO SIMPLE DESIGN AND LOW EQUIPMENT COST

- 9.1 INTRODUCTION

-

9.2 COMMERCIALREQUIREMENT TO MEET QUALITY AND RELIABILITY STANDARDS IN AUTOMOTIVE APPLICATIONS TO BOOST MARKET

-

9.3 INDUSTRIALHEAVY MANUFACTURING- Need for consistent power supply with low voltage swings and power loss to drive marketMINING- Increasing utilization in mining power inverters to create demand for HVDC capacitorsSTEEL MANUFACTURING- Requirement for power factor correction and high-quality electricity to promote use of HVDC capacitorsPETROCHEMICALS- Need to reduce CO2 emissions and energy consumption to boost adoption of HVDC capacitorsOTHERS

-

9.4 ENERGY AND POWERPOWER TRANSMISSION- Rising demand for integrated networks and bulk power transmission to promote use of HVDC capacitorsPOWER DISTRIBUTION- Surging use of HVDC capacitors to convert DC power to AC power to propel marketRENEWABLE POWER GENERATION- Wind power plants- Solar power plants

-

9.5 AEROSPACE AND DEFENSEDEPLOYMENT OF HVDC CAPACITORS IN RADAR SYSTEMS, POWER SUPPLIES, AND GUIDANCE SYSTEMS TO FUEL DEMAND

- 9.6 OTHERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAUS- Focus on innovation and advancement in technical fields to drive marketCANADA- Growing renewable energy sector, swift urbanization, and expanding rural electrification to propel marketMEXICO- High demand for electric and hybrid vehicles to boost marketIMPACT OF RECESSION ON HVDC MARKET IN NORTH AMERICA

-

10.3 EUROPESWEDEN- Cross-country transmission projects to create requirement for HVDC capacitorsUK- Ongoing offshore wind projects to create opportunities for HVDC technology providersGERMANY- Technological innovations in automotive sector to boost marketNORWAY- Ongoing HVDC projects to accelerate market growthREST OF EUROPEIMPACT OF RECESSION ON HVDC MARKET IN EUROPE

-

10.4 ASIA PACIFICCHINA- Strong need for smooth power distribution at transportation hubs to propel marketJAPAN- Thriving transportation and consumer electronics sectors to spur market growthINDIA- Huge investments in renewable energy projects to generate demand for HVDC capacitorsREST OF ASIA PACIFICIMPACT OF RECESSION ON HVDC MARKET IN ASIA PACIFIC

-

10.5 ROWMIDDLE EAST & AFRICA- Increase in HVDC projects to drive demand for HVDC capacitorsSOUTH AMERICA- High level of industrial activities to fuel HVDC capacitor market growthIMPACT OF RECESSION ON HVDC MARKET IN ROW

- 11.1 OVERVIEW

-

11.2 MARKET EVALUATION FRAMEWORKPRODUCT PORTFOLIOREGIONAL FOCUSMANUFACTURING FOOTPRINTORGANIC/INORGANIC STRATEGIES

- 11.3 MARKET SHARE ANALYSIS, 2022

- 11.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

-

11.5 KEY COMPANY EVALUATION MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.6 COMPANY FOOTPRINT

-

11.7 START-UPS/SMES EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

11.8 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALSOTHERS

-

12.1 KEY PLAYERSHITACHI, LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGENERAL ELECTRIC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTDK CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewEATON- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKYOCERA CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewYAGEO GROUP- Business overview- Products/Solutions/Services offered- Recent developmentsVISHAY INTERTECHNOLOGY, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsGENERAL ATOMICS- Business overview- Products/Solutions/Services offered- Recent developmentsLIFASA, INTERNATIONAL CAPACITORS, S.A.U- Business overview- Products/Solutions/Services offered- Recent developmentsELECTRONICON KONDENSATOREN GMBH- Business overview- Products/Solutions/Services offered

-

12.2 OTHER PLAYERSSIEYUAN ELECTRIC CO., LTD.KUNSHAN GUOLI ELECTRONIC TECHNOLOGY CO., LTD.CONDISSAMWHA CAPACITOR GROUPAPI CAPACITORSSHANGHAI YONGMING ELECTRONIC CO., LTD.WUXI CRE NEW ENERGY TECHNOLOGY CO., LTD.ISOFARAD KFT.HVP HIGH VOLTAGE PRODUCTS GMBHZEZ SILKO

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 LIST OF HVDC CAPACITOR AND CAPACITOR BANK MANUFACTURERS

- TABLE 2 AVERAGE SELLING PRICE OF HVDC CAPACITORS, BY PRODUCT TYPE

- TABLE 3 AVERAGE SELLING PRICE OF HVDC CAPACITORS OFFERED BY KEY PLAYERS, BY PRODUCT TYPE

- TABLE 4 HVDC CAPACITOR MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MAJOR APPLICATIONS (%)

- TABLE 6 KEY BUYING CRITERIA FOR MAJOR APPLICATIONS

- TABLE 7 IMPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 8 EXPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 9 TOP 20 PATENT OWNERS, 2013–2022

- TABLE 10 HVDC CAPACITOR MARKET: LIST OF CONFERENCES AND EVENTS

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 HVDC CAPACITOR MARKET, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

- TABLE 14 HVDC CAPACITOR MARKET, BY PRODUCT TYPE, 2023–2031 (USD MILLION)

- TABLE 15 HVDC CAPACITOR MARKET, BY PRODUCT TYPE, 2019–2022 (MILLION UNITS)

- TABLE 16 HVDC CAPACITOR MARKET, BY PRODUCT TYPE, 2023–2031 (MILLION UNITS)

- TABLE 17 DIFFERENT CHARACTERISTICS OF DIELECTRICS IN PLASTIC FILM CAPACITORS

- TABLE 18 PLASTIC FILM CAPACITORS: HVDC CAPACITOR MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 19 PLASTIC FILM CAPACITORS: HVDC CAPACITOR MARKET, BY APPLICATION, 2023–2031 (USD MILLION)

- TABLE 20 ALUMINUM ELECTROLYTIC CAPACITORS: HVDC CAPACITOR MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 21 ALUMINUM ELECTROLYTIC CAPACITORS: HVDC CAPACITOR MARKET, BY APPLICATION, 2023–2031 (USD MILLION)

- TABLE 22 CERAMIC CAPACITORS: HVDC CAPACITOR MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 23 CERAMIC CAPACITORS: HVDC CAPACITOR MARKET, BY APPLICATION, 2023–2031 (USD MILLION)

- TABLE 24 TANTALUM WET CAPACITORS: HVDC CAPACITOR MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 25 TANTALUM WET CAPACITORS: HVDC CAPACITOR MARKET, BY APPLICATION, 2023–2031 (USD MILLION)

- TABLE 26 OTHERS: HVDC CAPACITOR MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 27 OTHERS: HVDC CAPACITOR MARKET, BY APPLICATION, 2023–2031 (USD MILLION)

- TABLE 28 HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 29 HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2023–2031 (USD MILLION)

- TABLE 30 LCC: HVDC CAPACITOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 31 LCC: HVDC CAPACITOR MARKET, BY REGION, 2023–2031 (USD MILLION)

- TABLE 32 VSC: HVDC CAPACITOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 33 VSC: HVDC CAPACITOR MARKET, BY REGION, 2023–2031 (USD MILLION)

- TABLE 34 HVDC CAPACITOR MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 35 HVDC CAPACITOR MARKET, BY INSTALLATION TYPE, 2023–2031 (USD MILLION)

- TABLE 36 OPEN RACK CAPACITOR BANKS: HVDC CAPACITOR MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 37 OPEN RACK CAPACITOR BANKS: HVDC CAPACITOR MARKET, BY APPLICATION, 2023–2031 (USD MILLION)

- TABLE 38 ENCLOSED RACK CAPACITOR BANKS: HVDC CAPACITOR MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 39 ENCLOSED RACK CAPACITOR BANKS: HVDC CAPACITOR MARKET, BY APPLICATION, 2023–2031 (USD MILLION)

- TABLE 40 POLE-MOUNTED CAPACITOR BANKS: HVDC CAPACITOR MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 41 POLE-MOUNTED CAPACITOR BANKS: HVDC CAPACITOR MARKET, BY APPLICATION, 2023–2031 (USD MILLION)

- TABLE 42 HVDC CAPACITOR MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 43 HVDC CAPACITOR MARKET, BY APPLICATION, 2023–2031 (USD MILLION)

- TABLE 44 COMMERCIAL: HVDC CAPACITOR MARKET, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

- TABLE 45 COMMERCIAL: HVDC CAPACITOR MARKET, BY PRODUCT TYPE, 2023–2031 (USD MILLION)

- TABLE 46 COMMERCIAL: HVDC CAPACITOR MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 47 COMMERCIAL: HVDC CAPACITOR MARKET, BY INSTALLATION TYPE, 2023–2031 (USD MILLION)

- TABLE 48 COMMERCIAL: HVDC CAPACITOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 49 COMMERCIAL: HVDC CAPACITOR MARKET, BY REGION, 2023–2031 (USD MILLION)

- TABLE 50 INDUSTRIAL: HVDC CAPACITOR MARKET, BY SUB-TYPE, 2019–2022 (USD MILLION)

- TABLE 51 INDUSTRIAL: HVDC CAPACITOR MARKET, BY SUB-TYPE, 2023–2031 (USD MILLION)

- TABLE 52 INDUSTRIAL: HVDC CAPACITOR MARKET, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

- TABLE 53 INDUSTRIAL: HVDC CAPACITOR MARKET, BY PRODUCT TYPE, 2023–2031 (USD MILLION)

- TABLE 54 INDUSTRIAL: HVDC CAPACITOR MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 55 INDUSTRIAL: HVDC CAPACITOR MARKET, BY INSTALLATION TYPE, 2023–2031 (USD MILLION)

- TABLE 56 INDUSTRIAL: HVDC CAPACITOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 57 INDUSTRIAL: HVDC CAPACITOR MARKET, BY REGION, 2023–2031 (USD MILLION)

- TABLE 58 ENERGY AND POWER: HVDC CAPACITOR MARKET, BY SUB-TYPE, 2019–2022 (USD MILLION)

- TABLE 59 ENERGY AND POWER: HVDC CAPACITOR MARKET, BY SUB-TYPE, 2023–2031 (USD MILLION)

- TABLE 60 ENERGY AND POWER: HVDC CAPACITOR MARKET, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

- TABLE 61 ENERGY AND POWER: HVDC CAPACITOR MARKET, BY PRODUCT TYPE, 2023–2031 (USD MILLION)

- TABLE 62 ENERGY AND POWER: HVDC CAPACITOR MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 63 ENERGY AND POWER: HVDC CAPACITOR MARKET, BY INSTALLATION TYPE, 2023–2031 (USD MILLION)

- TABLE 64 ENERGY AND POWER: HVDC CAPACITOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 65 ENERGY AND POWER: HVDC CAPACITOR MARKET, BY REGION, 2023–2031 (USD MILLION)

- TABLE 66 RENEWABLE POWER GENERATION: HVDC CAPACITOR MARKET, BY SUB-TYPE, 2019–2022 (USD MILLION)

- TABLE 67 RENEWABLE POWER GENERATION: HVDC CAPACITOR MARKET, BY SUB-TYPE, 2023–2031 (USD MILLION)

- TABLE 68 AEROSPACE AND DEFENSE: HVDC CAPACITOR MARKET, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

- TABLE 69 AEROSPACE AND DEFENSE: HVDC CAPACITOR MARKET, BY PRODUCT TYPE, 2023–2031 (USD MILLION)

- TABLE 70 AEROSPACE AND DEFENSE: HVDC CAPACITOR MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 71 AEROSPACE AND DEFENSE: HVDC CAPACITOR MARKET, BY INSTALLATION TYPE, 2023–2031 (USD MILLION)

- TABLE 72 AEROSPACE AND DEFENSE: HVDC CAPACITOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 73 AEROSPACE AND DEFENSE: HVDC CAPACITOR MARKET, BY REGION, 2023–2031 (USD MILLION)

- TABLE 74 OTHERS: HVDC CAPACITOR MARKET, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

- TABLE 75 OTHERS: HVDC CAPACITOR MARKET, BY PRODUCT TYPE, 2023–2031 (USD MILLION)

- TABLE 76 OTHERS: HVDC CAPACITOR MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 77 OTHERS: HVDC CAPACITOR MARKET, BY INSTALLATION TYPE, 2023–2031 (USD MILLION)

- TABLE 78 OTHERS: HVDC CAPACITOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 79 OTHERS: HVDC CAPACITOR MARKET, BY REGION, 2023–2031 (USD MILLION)

- TABLE 80 HVDC CAPACITOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 81 HVDC CAPACITOR MARKET, BY REGION, 2023–2031 (USD MILLION)

- TABLE 82 NORTH AMERICA: HVDC CAPACITOR MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 83 NORTH AMERICA: HVDC CAPACITOR MARKET, BY COUNTRY, 2023–2031 (USD MILLION)

- TABLE 84 NORTH AMERICA: HVDC CAPACITOR MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 85 NORTH AMERICA: HVDC CAPACITOR MARKET, BY APPLICATION, 2023–2031 (USD MILLION)

- TABLE 86 US: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 87 US: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2023–2031 (USD MILLION)

- TABLE 88 CANADA: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 89 CANADA: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2023–2031 (USD MILLION)

- TABLE 90 MEXICO: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 91 MEXICO: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2023–2031 (USD MILLION)

- TABLE 92 EUROPE: HVDC CAPACITOR MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 93 EUROPE: HVDC CAPACITOR MARKET, BY COUNTRY, 2023–2031 (USD MILLION)

- TABLE 94 EUROPE: HVDC CAPACITOR MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 95 EUROPE: HVDC CAPACITOR MARKET, BY APPLICATION, 2023–2031 (USD MILLION)

- TABLE 96 SWEDEN: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 97 SWEDEN: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2023–2031 (USD MILLION)

- TABLE 98 UK: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 99 UK: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2023–2031 (USD MILLION)

- TABLE 100 GERMANY: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 101 GERMANY: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2023–2031 (USD MILLION)

- TABLE 102 NORWAY: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 103 NORWAY: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2023–2031 (USD MILLION)

- TABLE 104 REST OF EUROPE: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 105 REST OF EUROPE: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2023–2031 (USD MILLION)

- TABLE 106 ASIA PACIFIC: HVDC CAPACITOR MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 107 ASIA PACIFIC: HVDC CAPACITOR MARKET, BY COUNTRY, 2023–2031 (USD MILLION)

- TABLE 108 ASIA PACIFIC: HVDC CAPACITOR MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 109 ASIA PACIFIC: HVDC CAPACITOR MARKET, BY APPLICATION, 2023–2031 (USD MILLION)

- TABLE 110 CHINA: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 111 CHINA: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2023–2031 (USD MILLION)

- TABLE 112 JAPAN: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 113 JAPAN: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2023–2031 (USD MILLION)

- TABLE 114 INDIA: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 115 INDIA: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2023–2031 (USD MILLION)

- TABLE 116 REST OF ASIA PACIFIC: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 117 REST OF ASIA PACIFIC: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2023–2031 (USD MILLION)

- TABLE 118 ROW: HVDC CAPACITOR MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 119 ROW: HVDC CAPACITOR MARKET, BY REGION, 2023–2031 (USD MILLION)

- TABLE 120 ROW: HVDC CAPACITOR MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 121 ROW: HVDC CAPACITOR MARKET, BY APPLICATION, 2023–2031 (USD MILLION)

- TABLE 122 MIDDLE EAST & AFRICA: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 123 MIDDLE EAST & AFRICA: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2023–2031 (USD MILLION)

- TABLE 124 SOUTH AMERICA: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 125 SOUTH AMERICA: HVDC CAPACITOR MARKET, BY TECHNOLOGY, 2023–2031 (USD MILLION)

- TABLE 126 OVERVIEW OF STRATEGIES ADOPTED BY KEY HVDC CAPACITOR MANUFACTURERS

- TABLE 127 DEGREE OF COMPETITION (2022)

- TABLE 128 OVERALL COMPANY FOOTPRINT

- TABLE 129 COMPANY FOOTPRINT: PRODUCT TYPE

- TABLE 130 COMPANY FOOTPRINT: APPLICATION

- TABLE 131 COMPANY FOOTPRINT: REGION

- TABLE 132 HVDC CAPACITOR MARKET: LIST OF KEY START-UPS/SMES

- TABLE 133 HVDC CAPACITOR MARKET: COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 134 PRODUCT LAUNCHES, JANUARY 2020 - JUNE 2023

- TABLE 135 DEALS, JANUARY 2020 - JUNE 2023

- TABLE 136 OTHERS, JANUARY 2020- JUNE 2023

- TABLE 137 HITACHI, LTD.: BUSINESS OVERVIEW

- TABLE 138 HITACHI, LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 139 HITACHI, LTD.: PRODUCT LAUNCHES

- TABLE 140 HITACHI, LTD.: DEALS

- TABLE 141 HITACHI, LTD.: OTHERS

- TABLE 142 GENERAL ELECTRIC: BUSINESS OVERVIEW

- TABLE 143 GENERAL ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 144 GENERAL ELECTRIC: DEALS

- TABLE 145 TDK CORPORATION: BUSINESS OVERVIEW

- TABLE 146 TDK CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 147 TDK CORPORATION: PRODUCT LAUNCHES

- TABLE 148 TDK CORPORATION: OTHERS

- TABLE 149 EATON: BUSINESS OVERVIEW

- TABLE 150 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 151 EATON: DEALS

- TABLE 152 KYOCERA CORPORATION: BUSINESS OVERVIEW

- TABLE 153 KYOCERA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 154 KYOCERA CORPORATION: PRODUCT LAUNCHES

- TABLE 155 KYOCERA CORPORATION: DEALS

- TABLE 156 KYOCERA CORPORATION: OTHERS

- TABLE 157 YAGEO GROUP: BUSINESS OVERVIEW

- TABLE 158 YAGEO GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 159 VISHAY INTERTECHNOLOGY, INC.: BUSINESS OVERVIEW

- TABLE 160 VISHAY INTERTECHNOLOGY, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 VISHAY INTERTECHNOLOGY, INC.: PRODUCT LAUNCHES

- TABLE 162 VISHAY INTERTECHNOLOGY, INC.: DEALS

- TABLE 163 GENERAL ATOMICS: BUSINESS OVERVIEW

- TABLE 164 GENERAL ATOMICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 165 GENERAL ATOMICS: DEALS

- TABLE 166 GENERAL ATOMICS: OTHERS

- TABLE 167 LIFASA, INTERNATIONAL CAPACITORS, S.A.U: BUSINESS OVERVIEW

- TABLE 168 LIFASA, INTERNATIONAL CAPACITORS, S.A.U: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 169 LIFASA, INTERNATIONAL CAPACITORS, S.A.U: DEALS

- TABLE 170 ELECTRONICON KONDENSATOREN GMBH: BUSINESS OVERVIEW

- TABLE 171 ELECTRONICON KONDENSATOREN GMBH: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- FIGURE 1 HVDC CAPACITOR MARKET: SEGMENTATION

- FIGURE 2 HVDC CAPACITOR MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1—TOP-DOWN (SUPPLY SIDE): REVENUE GENERATED BY COMPANIES FROM SALES OF HVDC CAPACITORS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1—TOP-DOWN (SUPPLY SIDE): ILLUSTRATION OF REVENUE ESTIMATION FOR ONE COMPANY IN HVDC CAPACITOR MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2—BOTTOM-UP (DEMAND SIDE): DEMAND FOR HVDC CAPACITORS, BY PRODUCT TYPE

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 HVDC CAPACITOR MARKET

- FIGURE 11 ENERGY AND POWER APPLICATION TO ACCOUNT FOR LARGEST SHARE OF HVDC CAPACITOR MARKET IN 2031

- FIGURE 12 LCC TECHNOLOGY TO HOLD LARGER MARKET SHARE IN 2031

- FIGURE 13 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR HVDC CAPACITORS DURING FORECAST PERIOD

- FIGURE 14 RISING ELECTRICITY DEMAND OWING TO GROWING POPULATION WORLDWIDE TO FUEL MARKET GROWTH FROM 2023 TO 2031

- FIGURE 15 PLASTIC FILM CAPACITORS TO HOLD MAJORITY SHARE OF GLOBAL HVDC CAPACITOR MARKET IN 2031

- FIGURE 16 ENCLOSED RACK CAPACITOR BANKS TO ACCOUNT FOR LARGER MARKET SHARE IN 2031

- FIGURE 17 LCC TECHNOLOGY AND ENERGY AND POWER APPLICATION TO CAPTURE LARGEST MARKET SHARES IN 2023

- FIGURE 18 HVDC CAPACITOR MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 HVDC CAPACITOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 HVDC CAPACITOR MARKET DRIVERS AND THEIR IMPACT

- FIGURE 21 HVDC CAPACITOR MARKET RESTRAINTS AND THEIR IMPACT

- FIGURE 22 HVDC CAPACITOR MARKET OPPORTUNITIES AND THEIR IMPACT

- FIGURE 23 HVDC CAPACITOR MARKET CHALLENGES AND THEIR IMPACT

- FIGURE 24 HVDC CAPACITOR MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 25 HVDC CAPACITOR MARKET: ECOSYSTEM

- FIGURE 26 AVERAGE SELLING PRICE OF HVDC CAPACITORS OFFERED BY KEY PLAYERS, BY PRODUCT TYPE

- FIGURE 27 AVERAGE SELLING PRICE TREND FOR HVDC CAPACITORS, 2019–2031 (USD)

- FIGURE 28 REVENUE SHIFT AND NEW REVENUE POCKETS FOR HVDC CAPACITOR MARKET PLAYERS

- FIGURE 29 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MAJOR APPLICATIONS

- FIGURE 31 KEY BUYING CRITERIA FOR MAJOR APPLICATIONS

- FIGURE 32 PATENTS GRANTED WORLDWIDE, 2013–2022

- FIGURE 33 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2013–2022

- FIGURE 34 HVDC CAPACITOR MARKET, BY PRODUCT TYPE

- FIGURE 35 PLASTIC FILM CAPACITORS TO HOLD LARGEST MARKET SHARE IN 2031

- FIGURE 36 CONSTRUCTION OF PLASTIC FILM CAPACITORS

- FIGURE 37 CONSTRUCTION OF ALUMINUM ELECTROLYTIC CAPACITORS

- FIGURE 38 CONSTRUCTION OF MULTILAYER CERAMIC CAPACITORS (MLCC)

- FIGURE 39 CONSTRUCTION OF TANTALUM WET CAPACITORS

- FIGURE 40 CONSTRUCTION OF GLASS CAPACITORS

- FIGURE 41 HVDC CAPACITOR MARKET, BY TECHNOLOGY

- FIGURE 42 LCC SEGMENT TO HOLD LARGER SHARE OF HVDC CAPACITOR MARKET IN 2031

- FIGURE 43 HVDC CAPACITOR MARKET, BY INSTALLATION TYPE

- FIGURE 44 ENCLOSED RACK CAPACITOR BANKS TO CAPTURE LARGEST SHARE OF HVDC CAPACITOR MARKET IN 2023

- FIGURE 45 INTERNALLY FUSED CAPACITOR BANK DESIGN

- FIGURE 46 EXTERNALLY FUSED CAPACITOR BANK DESIGN

- FIGURE 47 FUSELESS CAPACITOR BANK DESIGN

- FIGURE 48 HVDC CAPACITOR MARKET, BY APPLICATION

- FIGURE 49 ENERGY AND POWER APPLICATION TO LEAD HVDC CAPACITOR MARKET IN 2031

- FIGURE 50 REGIONAL SPLIT OF HVDC CAPACITOR MARKET

- FIGURE 51 EUROPE TO LEAD GLOBAL HVDC CAPACITOR MARKET IN 2031

- FIGURE 52 NORTH AMERICA: HVDC CAPACITOR MARKET SNAPSHOT

- FIGURE 53 EUROPE: HVDC CAPACITOR MARKET SNAPSHOT

- FIGURE 54 ASIA PACIFIC: HVDC CAPACITOR MARKET SNAPSHOT

- FIGURE 55 FIVE-YEAR REVENUE ANALYSIS OF TOP FIVE PLAYERS IN HVDC CAPACITOR MARKET, 2018–2022

- FIGURE 56 HVDC CAPACITOR MARKET: KEY COMPANY EVALUATION MATRIX, 2022

- FIGURE 57 START-UPS/SMES EVALUATION MATRIX, 2022

- FIGURE 58 HITACHI, LTD.: COMPANY SNAPSHOT

- FIGURE 59 GENERAL ELECTRIC: COMPANY SNAPSHOT

- FIGURE 60 TDK CORPORATION: COMPANY SNAPSHOT

- FIGURE 61 EATON: COMPANY SNAPSHOT

- FIGURE 62 KYOCERA CORPORATION: COMPANY SNAPSHOT

- FIGURE 63 YAGEO GROUP: COMPANY SNAPSHOT

- FIGURE 64 VISHAY INTERTECHNOLOGY, INC.: COMPANY SNAPSHOT

The study involved four major activities in estimating the size of the HVDC capacitor market. Exhaustive secondary research has been conducted to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

Revenues of companies offering HVDC capacitors have been obtained from the secondary data available through paid and unpaid sources. The revenues have also been derived by analyzing the product portfolio of key companies, and these companies have been rated according to the performance and quality of their products.

Various secondary sources have been referred to in the secondary research process for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; IoT technologies journals and certified publications; articles by recognized authors; gold-standard and silver-standard websites; directories; and databases.

Secondary research has been conducted mainly to obtain critical information about the market’s value chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both demand- and technology-oriented perspectives. Secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

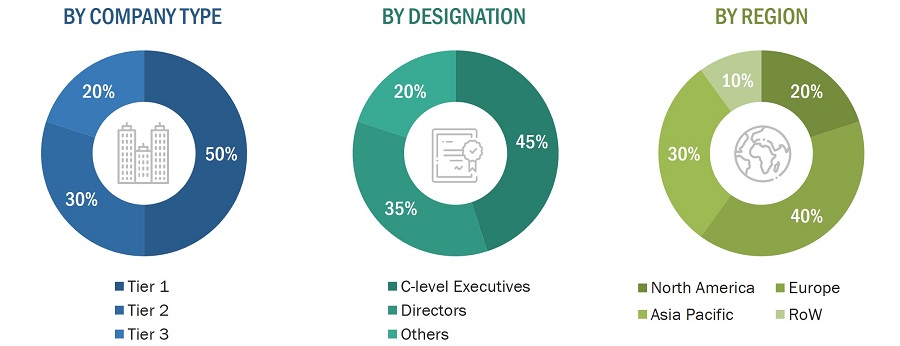

Extensive primary research has been conducted after understanding and analyzing the current scenario of the HVDC capacitor market through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand and supply sides across 4 major regions: North America, Europe, Asia Pacific, and RoW. Approximately 25% of the primary interviews have been conducted with the demand side, while 75% have been conducted with the supply side. Primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews. Questionnaires and e-mails have also been used to collect data.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the HVDC Capacitor Market.

- Identifying approximate revenues of companies involved in the HVDC capacitors market ecosystem

- Identifying various key players offering different types of HVDC capacitors

- Analyzing the global penetration of each offering through primary and secondary research

- Estimating the market for HVDC capacitors by product type

- Tracking the ongoing developments and identifying the upcoming ones in the market that include investments, research and development activities, product launches, collaborations, and partnerships undertaken, as well as forecasting the market based on these developments and other critical parameters.

- Carrying out multiple discussions with the key opinion leaders to understand the HVDC capacitors technologies and related raw materials, as well as products designed and developed to analyze the break-up of the scope of work carried out by the key companies manufacturing panels.

- Verifying and cross-checking the estimate at every level through discussions with key opinion leaders such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts in MarketsandMarkets.

- Studying various paid and unpaid sources of information such as annual reports, press releases, white papers, and databases for the company- and region-specific developments undertaken in the HVDC capacitor market

The top-down approach has been used to estimate and validate the total size of the HVDC Capacitor Market.

- Focusing initially on the high investments and expenditures undertaken in the ecosystem of HVDC capacitors, further splitting into product type, technology, installation type, application, and region and listing key developments in major market areas

- Identifying all major players in the HVDC capacitor market and the deployment of their products for various applications and verifying the findings through secondary research and brief discussions with industry experts

- Analyzing revenues, product mix, geographic presence, and key end-use applications of HVDC capacitors to estimate and arrive at the percentage splits

- Discussing these splits with industry experts to validate the information and identify key growth pockets across all major segments

- Breaking down the total market based on verified splits and key growth pockets across all segments

Data Triangulation

After arriving at the overall size of the HVDC capacitor market through the process explained, the total market has been split into several segments and subsegments. Market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from the demand and supply sides. The market has also been validated using the top-down and bottom-up approaches.

Market Definition

A high-voltage direct current (HVDC) capacitor creates a smooth voltage from irregular or pulsating voltage sources. HVDC capacitors offer high efficiency and reduce electric losses. Therefore, they are commonly used in HVDC transmission systems for long-distance, point-to-point power transfers. They are also used in DC supplies or electronic equipment and applications wherein high current pulses are produced. The scope of the study includes product types, technologies, installation types, and application of HVDC capacitors as well as regions wherein they are used.

Key Stakeholders

- Suppliers of raw materials

- Technology investors

- Manufacturers and suppliers of a wide variety of HVDC capacitors

- Integrators and service providers of HVDC capacitors

- Government bodies such as regulatory authorities and policymakers for the electronics industry

- Venture capitalists, startup companies, and private equity firms

- Technology developers

- Distributors, resellers, and traders

- Hardware component suppliers and distributors

- Original equipment manufacturers (OEMs) and system integrators

- Standardization and testing firms

- Associations, forums, and alliances related to the HVDC applications and energy generation sector

- Research institutions and organizations

- Market research and consulting firms

- End users

Report Objectives

- To describe, segment, and forecast the HVDC capacitor market based on technology, installation type, and application in terms of value

- To describe and forecast the market size for different product types of HVDC capacitors in terms of value and volume

- To describe and forecast the market for four key regions: North America, Europe, Asia Pacific, and the Rest of the World (RoW), in terms of value and volume

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the HVDC capacitor market

- To provide a detailed overview of the value chain pertaining to the HVDC capacitor ecosystem, along with the average selling prices of different types of HVDC capacitors

- To strategically analyze the ecosystem, Porter’s five forces, technology analysis, tariffs and regulations, patent landscape, trade landscape, key conferences and events, and case studies pertaining to the market under study

- To strategically analyze micromarkets with regard to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market

- To analyze competitive developments such as product launches, collaborations, partnerships, contracts, expansions, and mergers and acquisitions in the HVDC capacitor market

- To strategically profile the key players in the HVDC capacitor market and comprehensively analyze their market ranking and core competencies

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in HVDC Capacitor Market

I would like to know what the future of Tantalum capacitors looks like, upcoming trends and its share of the market.