Humic-based Biostimulants Market Size, Share, Industry Growth Analysis, Trends Report by Type (Humic Acid, Fulvic Acid, Potassium Humate), Application (Seed Treatment, Soil Treatment, Foliar Spray), Form, Crop Type, and Region (North America, Europe, APAC South America, Row) - Global Forecast to 2027

Humic-based Biostimulants Market Overview

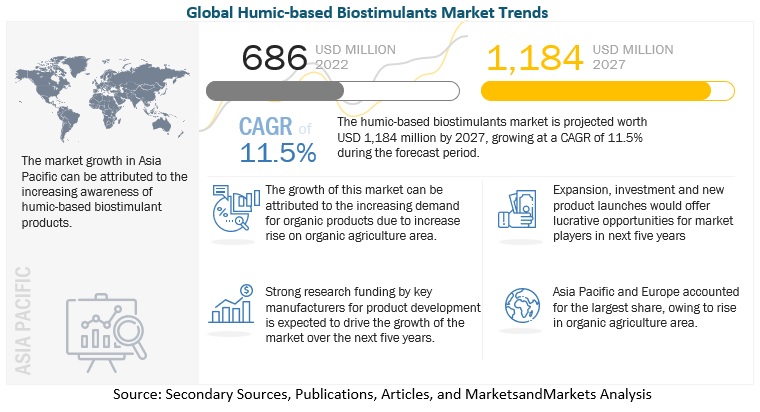

Humic based biostimulants market size was valued at USD 686 million in 2022. Humic-based biostimulants industry is projected to reach USD 1,184 million by 2027, growing at a CAGR of 11.5% during the forecast period 2022-2027. The humic based biostimulants market has grown rapidly worldwide, and to meet the population’s requirements, industries and research have effectively incorporated various innovative products and ingredients. The demand from farmers and consumers for organic products that provide alternatives to synthetic inputs is also boosting the market’s growth. Humic substances are a rich energy source beneficial soil microorganisms can readily utilize. The key function of humic substances is their water-holding capacity. Humic substances reduce soil pH and liberate carbon dioxide. They also help stabilize soil temperature and water evaporation and facilitate the uptake of nutrients. The application of dry or liquid humic substances to soil increases the efficiency of fertilizers. In addition, applying these substances may reduce the requirement for fertilizers and retain the fertilizers applied near the plant rooting zone for a longer time.

To know about the assumptions considered for the study, Request for Free Sample Report

Humic-based Biostimulants Market Dynamics

Driver: Rise in demand for humic-based biostimulants to combat pesticide toxicity

Pesticides are chemical substances intended for preventing or controlling pests. These are toxic substances that contaminate the soil. According to the report by a Kerala non-profit Pesticide Action Network, in India, four highly hazardous pesticides, i.e., Chlorpyrifos, Fipronil, and Atrazine, are used for crops more than officially approved. The approval of pesticides is given based on their residues on crops. Humic-based biostimulants are a sustainable approach to mitigating the toxicity of pesticides. Pesticide application is needed to increase crop production. One-third of the crop yields are produced by utilizing pesticides. The after-effects of pesticides on plants are dose-dependent, causing disruption and alteration of various physiological and biological processes, ultimately reducing growth and productivity.

Restraint: Commercialization of low-quality biostimulant products by local players

The crop protection industry has been growing rapidly over the past few decades. According to a report by Phillip McDougall on the Evolution of the Crop Protection Industry since 1960, published in 2018, more than 600 active ingredients were available to farmers across the globe. The market has more than 40 chemical groups, which have different modes of action and are the key to addressing problems related to resistance to insecticides, herbicides, and fungicides and increasing yields. The growing demand among farmers for conventional pesticides has led to the steady growth of humic-based biostimulants market, although there has been a decrease in the number of new chemical pesticide launches in the market. However, the preference for conventional pesticides has continued to increase as these products have a well-established market and are easily available compared to biologicals. Even though the awareness about biological crop protection has been encouraging enough in emerging economies to identify registered products and eliminate the notion among farmers that biostimulants products would be mostly counterfeit or spurious products, farmers are risk-averse to the adoption of biologicals as they are accustomed to the use of chemical pesticides due to the perception of higher yield and higher efficiency. In addition, most farmers perceive that biological crop protection products are costlier and take longer to take effect than conventional counterparts, which is a major challenge to the adoption of humic-based biostimulants.

Opportunity: Growth opportunities in developing countries

According to FAOSTAT, China, India, Brazil, and Argentina were some of the largest consumers of pesticides. The increasing rate of population, growing middle-class families, and an increase in disposable income, especially in these regions, have resulted in an increase in the demand for food, which would, in turn, lead to increased consumption of pesticides to obtain higher yields. However, the primary concerns in this region are pollution and contamination of the soil, as well as their harmful effects on the food chain. To combat the harmful effects of chemical pesticides, the governments in these regions are emphasizing the use of integrated pest management. In countries such as India and China, the average landholding of farmers is less, and the economic condition of farmers is poor. The absence of many producers in the industry and low entry barriers will give a first-mover advantage to entrants. The key players in the agricultural sector have started investing in the potential markets of emerging countries in the region. The rise in awareness among farmers about the advantages of biostimulants applications would drive its consumption in the Asia Pacific and South American regions.

Challenges in the Humic-based Biostimulants Market: Uncertainty about the regulatory framework of biostimulants

There is no overarching regulatory framework for the biostimulant industry. Humic-based biostimulants have not yet been governed under any standard global categorization. Biostimulants are not classified as a specific category with a consistent global definition. Plant biostimulants act as a border between plant protection products and fertilizers. According to EBIC, in Europe, there is uncertainty about whether biostimulants should be categorized under plant protection or plant nutrition, which resulted in a divided set of contradicting opinions on the products. They are considered additives in France, whereas, in Germany, they are marketed as plant strengtheners or growth enhancers. To consolidate the regulatory framework with respect to biostimulants in Europe, the European Biostimulants Industry Consortium (EBIC) drafted a directive based on the views and suggestions of manufacturers and research institutes and tabulated it for EU approval. However, biostimulant products are still required to undergo repetitive registration processes under each European country’s respective regulations. The data requirements and parameters range also vary according to each country in the EU.

Liquid form to witness the highest growth in humic based biostimulants market during the forecast period

Liquid is the most preferred form by farmers due to its ease of application. Owing to the high demand from farmers, even the manufacturers are providing humic-based biostimulant products in liquid form. Liquid formulations provide various options for crop growers to mix humic-based biostimulants with pesticides, fertilizers, or adjuvants. However, liquid formulations differ markedly in the nature of their characteristics that influence the selection, application rate, method of application, and environmental impact. The liquid formulation market is growing at a fast rate due to its higher effective duration and better performance as compared to the dry formulation.

Foliar spray to be the largest mode of application in 2022

The foliar spray application of humic-based biostimulants is one of the most widely used methods that help maximize plants’ productivity. This application of humic-based biostimulants directly on the leaves increases the effect of bioactive molecules on crop growth, resulting in increased absorption and improved uptake of micronutrients to every part of the plant. It is the most effective tool as compared to other modes of application. Many plant nutrients are needed in such great quantities that it is impractical to supply them through the foliage.

By crop type, fruits & vegetables to register highest CAGR in the humic-based biostimulants market during the forecast period

Fruits and vegetables are high-value crops that require high investment to achieve good-quality produce. Humic-based biostimulants play a vital role in enhancing crop size, quality, health, and stress tolerance and also reduce residue levels. The addition of humic acid in fruits results in fruit development; high crop yield; better quality with respect to size, color, and sugar content; prevention of fruit drops; and enhanced ripening. In vegetables, their use increases the size, improves the shelf-life, and develops pest resistance and antioxidant activity. In leafy vegetables, it has also resulted in improved quality, increased chlorophyll & carotenoid content, root growth & stimulation, and regulated nitrate levels within the EU-stipulated standard levels. These crops require a high dose of humic-based biostimulants compared to other crops, improving plant vigor, nutrition, and fertility.

To know about the assumptions considered for the study, download the pdf brochure

Humic-based Biostimulants Market Regional Insights

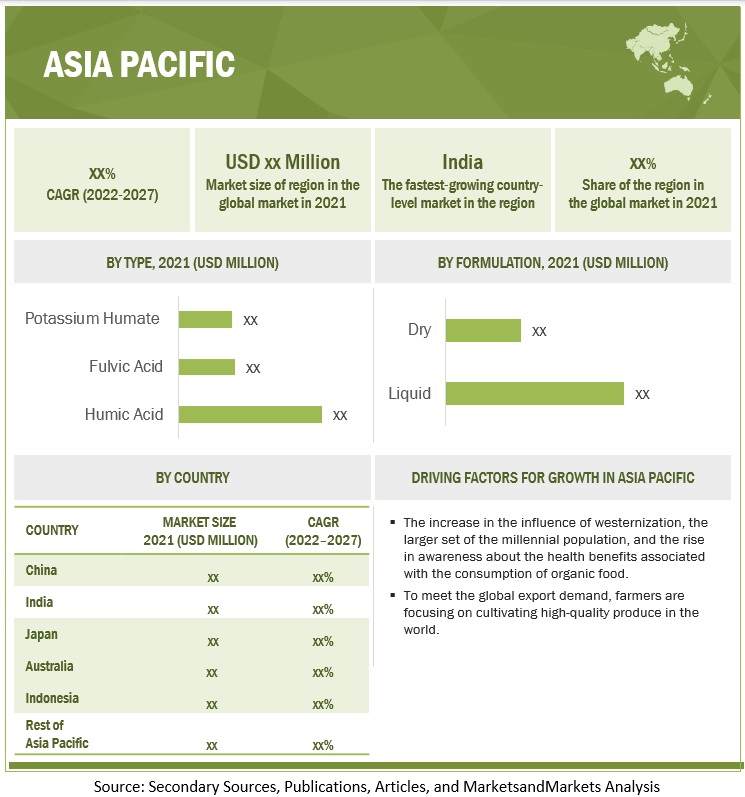

Asia Pacific region to grow at the highest rate of CAGR in the humic based biostimulants market during forecast period

The Asia-Pacific Plant Protection Commission (APPPC) plays an important role in promoting integrated pest management (IPM), an ecologically based, environmentally safe method for farmers to protect their crops against pest and disease incursions without the use of potentially hazardous chemicals. Through Farmer Field Schools; FAO regional IPM programs; collaborative research; and capacity-building programs for farmers, trainers, and plant protection workers, the Commission promotes the increasing use and effectiveness of IPM throughout the region. It facilitates regional information sharing and agreements, allowing member countries to implement IPM technologies that are appropriate for their circumstances. The increase in intensive agricultural practices and abusive use of chemicals has decreased nutrient levels in the soil. To revitalize the soil, agricultural inputs, such as bioinoculants, are recommended by agricultural authorities, such as the FAO and experts from leading organizations. The last two decades have witnessed considerable changes in the application of biostimulants and a decrease in the frequent usage of chemical-based fertilizers in this region.

Humic based Biostimulants Market Key Players

The key players in this market include Koppert (Netherlands), Valagro SpA (Italy), Biolchim S.p.A (Italy), FMC Corporation (US), Haifa Group (Israel), UPL Ltd. (India), Bayer AG (Germany), SIKKO industries ltd (India), NOVIHUM Technologies GmbH (Germany), HUMINTECH GMBH (Germany), and BORREGAARD (Norway).

Humic-based Biostimulants Market Report Scope

|

Report Metrics |

Details |

| Market size valuation in 2022 |

USD 686 million |

| Market size prediction by 2027 |

USD 1,184 million |

| Growth rate |

CAGR of 11.5% |

| Market size estimation |

2022–2027 |

| Base year considered |

2021 |

| Forecast period considered |

2022–2027 |

| Units considered |

Value (USD) and Volume (KT) |

| Segments covered |

By Type, Form, Mode of Application, Crop Type |

| Regions covered |

North America, Europe, Asia Pacific, South America and RoW |

| Companies studied |

|

Humic-based Biostimulants Market Target Audience:

- Humic-based biostimulant raw material suppliers

- Humic-based biostimulants manufacturers

- Intermediate suppliers, such as traders and distributors of humic-based biostimulants

- Manufacturers of biostimulants, crop nutrition, biofertilizers, and bipesticides

- Government and research organizations

-

Associations, regulatory bodies, and other industry-related bodies:

- World Health Organization (WHO)

- European Food Safety Authority (EFSA)

- US Food and Drug Administration

- Environmental Protection Agency

- Food and Agricultural Organisation

- Research Institute of Organic Agriculture (FiBL)

Humic-based Biostimulants Market Segmentation

This research report categorizes the market based on type, mode of application, form, crop type, and region.

|

Aspect |

Details |

| By Type |

|

| By Form |

|

| By Mode of Application |

|

| By Crop Type |

|

| By Region |

|

Humic-based Biostimulants Market Recent Developments & Industry News

- In May 2022, Koppert and UPL Ltd. partnered to promote sustainable agriculture in Spain and Portugal. Both companies start a collaboration at a technical and commercial level to facilitate the access of producers to biological solutions.

- In June 2021, UPL Australia launched a new range of biostimulant products based on GoActiv technology, designed to address specific crop physiological or abiotic stresses in fruits, vegetables, vines, and tree crops. GoActiv Technology is based on a 100% pure extract from the Ascophyllum nodosum seaweed species.

- In February 2021, UPL and Novozymes (Denmark) announced a partnership to provide a range of biological products to the Argentinian market. Biological products made by Novozymes and marketed under the ‘Nitragin’ brand will now become part of UPL’s portfolio, providing a complete range of bio-solutions and crop protection products.

- In February 2021, FMC Corporation entered a strategic collaboration with Novozymes to co-develop and commercialize biological enzyme-based crop protection solutions targeting fungal and insect pests. The companies would combine their respective R&D facilities with FMC and Novozymes, serving as commercial and manufacturing partners.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the humic-based biostimulants market?

The European market accounted for the largest share in 2021. The concept of organic production has also gained popularity among farmers and consumers in the last decade. The need for organic products such as biostimulants has seen a rising trend in the EU. This has boosted many humic-based biostimulant companies in Europe.

How big is the humic-based biostimulants market?

The global market for humic-based biostimulants is estimated at USD 686 million in 2022; it is projected to grow at a CAGR of 11.5% to reach USD 1,184 million by 2027.

Which are the key players in the market, and how intense is the competition?

The global market for humic-based biostimulants is dominated by large-scale players. The key players in this market include Koppert (Netherlands), Valagro SpA (Italy), Biolchim S.p.A (Italy), FMC Corporation (US), Haifa Group (Israel), UPL Ltd. (India), Bayer AG (Germany), SIKKO INDUSTRIES LTD (India), NOVIHUM Technologies GmbH (Germany), HUMINTECH GMBH (Germany), and BORREGAARD (Norway). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

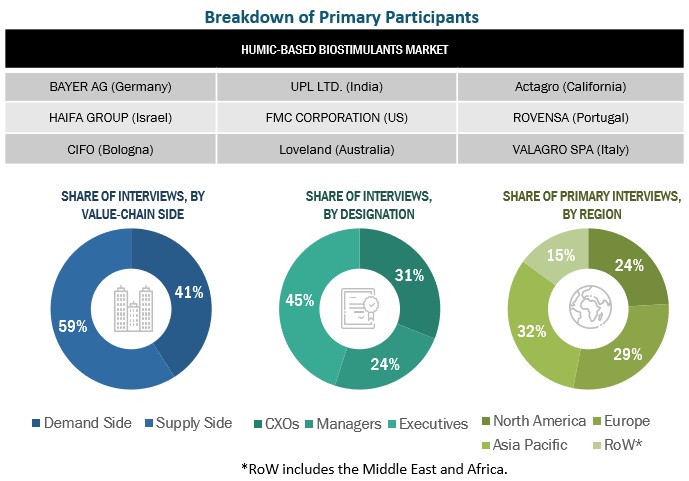

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the humic-based biostimulants market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects.

Secondary Research

In the secondary research process, various sources, such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the humic-based biostimulants market.

To know about the assumptions considered for the study, download the pdf brochure

Humic-based Biostimulants Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the humic based biostimulants market. These approaches were extensively used to determine the size of the subsegments in the market. The research methodology used to estimate the market size includes the following details:

-

Top-down approach:

- The key players in the industry and the market were identified through extensive secondary research.

- The industry’s supply chain and market size were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- The parent market—biostimulants—was considered to validate the details of the market further.

-

Bottom-up approach:

- The approach was employed to determine the overall size of the market in particular regions. Its share at the country and regional levels were validated through primary interviews with suppliers, dealers, and distributors.

- The global market for the types was estimated based on the demand from each type, offerings of key players, offerings, and the region-wise market share of major players.

- All macroeconomic and microeconomic factors affecting the growth of the humic-based biostimulants market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

The following sections (bottom-up & top-down) (supply-demand) depict the overall market size estimation process employed for this study.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall humic based biostimulants market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Additionally, the market size was validated using both the top-down and bottom-up approaches.

Humic-based Biostimulants Market Report Objectives

Market Intelligence

- Determining And Projecting The Size Of The Humic Based Biostimulants Market Based On Type, Form, Mode Of Application, Crop Type And Region Over A Period Ranging From 2022 To 2027

- Identifying Attractive Opportunities In The Market By Determining The Largest And Fastest-Growing Segments Across Regions

-

Analyzing The Demand-Side Factors Based On The Following:

- Impact Of Macroeconomic And Microeconomic Factors On The Market

- Shift In Demand Patterns Across Different Subsegments And Regions

Competitive Intelligence

- Identifying and profiling the key market players in the humic-based biostimulants market

- Determining the share of key players operating in the humic based biostimulants market

-

Providing a comparative analysis of the market leaders on the basis of the following:

- Product offerings

- Business strategies

- Strengths, weaknesses, opportunities, and threats

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by the key companies

- Analyzing the patents registered and regulatory frameworks across regions and their impact on prominent market players

- Analyzing the market dynamics and competitive situations & trends across regions and their impact on prominent market players

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis of the Humic-based Biostimulants Market

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe market for humic-based biostimulants into Greece

- Further breakdown of the Rest of South America market for humic-based biostimulants into Chile, Peru, and Ecuador

- Further breakdown of other countries in the RoW market for humic-based biostimulants into Egypt, Israel, and Turkey

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Humic-based Biostimulants Market