Human Centric Lighting Market by Offering (Hardware (Lighting fixtures and Lighting Controllers), Software, and Services), Installation Type (New Installations and Retrofit Installations), Application, and Geography - Global Forecast to 2036

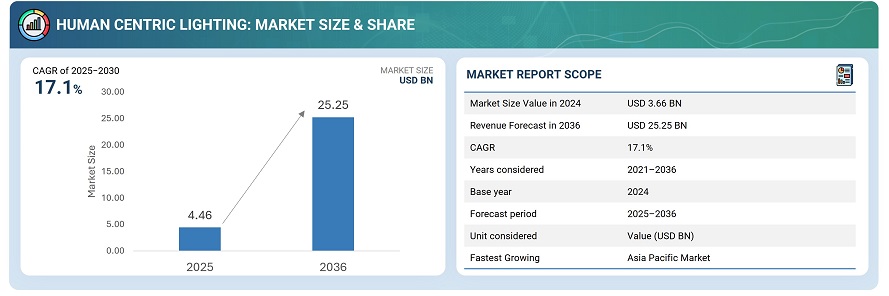

The human centric lighting market was valued at USD 3.66 billion in 2024 and is projected to reach USD 25.25 billion by 2036, growing at a CAGR of 17.1% from 2025 to 2036

The global human centric lighting market is driven by increasing awareness of wellness-oriented environments across workplaces, healthcare, and educational facilities. Integration of IoT-enabled tunable-white systems, sensor-based controls, and circadian algorithms enhances comfort and productivity. Moreover, the adoption of WELL v2 and LEED-certified designs, energy efficiency mandates, and smart building initiatives is expanding the market. Overall, the growing convergence of lighting, software analytics, and building automation is transforming the lighting industry toward adaptive, health-centric solutions.

Human Centric Lighting (HCL) refers to lighting systems designed to support human health, well-being, and performance by aligning artificial light with the body’s natural circadian rhythm. These systems use tunable white or spectrally adjustable LEDs to vary color temperature and intensity throughout the day, simulating natural daylight. By influencing biological, emotional, and cognitive responses, HCL improves alertness, mood, sleep quality, and overall visual comfort in indoor environments.

Market by Application

Wholesale & Retail

The wholesale and retail sector is witnessing growing adoption of human-centric lighting to enhance customer experience, visual comfort, and product appeal. Retailers are increasingly integrating tunable white and dynamic lighting systems to influence shopper behavior, extend dwell time, and improve employee alertness. The focus on energy-efficient, wellness-oriented environments is accelerating demand across supermarkets, showrooms, and large retail chains, aligning lighting quality with brand aesthetics and sustainability goals.

Residential

Residential adoption of human-centric lighting is increasing with the popularity of smart homes and connected lighting ecosystems. Consumers are opting for tunable LED systems that mimic natural daylight cycles, promoting relaxation and healthy sleep patterns. Integration with voice assistants and app-based controls is driving mainstream use, while declining LED costs and wellness awareness make HCL an attractive feature in premium housing, apartments, and renovation projects worldwide.

Healthcare

Healthcare remains one of the most prominent applications for human-centric lighting, given its proven benefits for patient recovery and staff well-being. Hospitals and clinics are adopting tunable lighting to regulate circadian rhythms, improve sleep quality, and enhance patient comfort. For caregivers, these systems reduce fatigue and errors during night shifts. Integration with building automation and IoT platforms is further driving adoption in modern healthcare facilities and eldercare centers.

Market by Offering

Hardware

Hardware dominates the human centric lighting market, accounting for the largest share owing to the widespread deployment of tunable-white luminaires, LED modules, and smart drivers. Increasing retrofitting of traditional systems with circadian-enabled fixtures across commercial, residential, and healthcare settings continues to drive demand. The shift toward connected, sensor-integrated luminaires and the adoption of DALI-2 and Bluetooth Mesh technologies further strengthen the hardware segment’s leading position in the market.

Software

The software segment is growing at the fastest rate, driven by the rising adoption of intelligent lighting control platforms and cloud-based management systems. These solutions enable scheduling, circadian tuning, daylight integration, and data analytics to optimize occupant comfort and energy efficiency. The growing emphasis on user-centric lighting experience, interoperability with BMS platforms, and WELL v2 certification requirements are accelerating the adoption of advanced lighting software solutions worldwide.

Services

Services play a crucial role in supporting system integration, design optimization, and maintenance for human-centric lighting installations. Growing demand for customized lighting design, commissioning, and performance monitoring is boosting this segment’s importance. The rising preference for long-term maintenance contracts and turnkey projects among enterprises and healthcare facilities supports consistent growth, though at a slightly lower pace than software, as mature regions shift toward service-based lighting models.

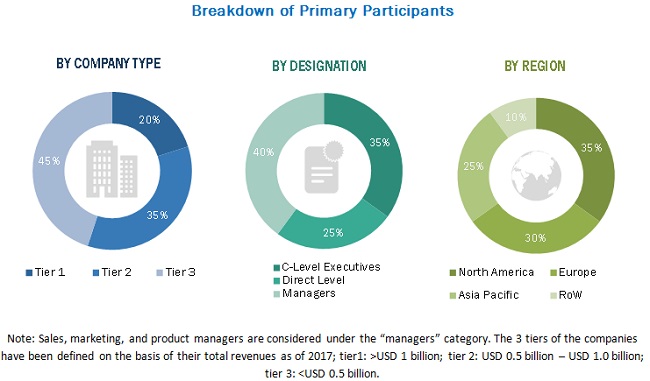

Market by Geography

Geographically, the human centric lighting market demonstrates robust growth across Europe, North America, Asia Pacific, South America, and the Middle East & Africa. Europe continues to dominate due to its mature lighting standards, early WELL and LEED integration, and strong regulatory backing for energy-efficient and circadian-supportive lighting. North America remains a key contributor, propelled by rising wellness design trends and rapid adoption of IoT-enabled lighting systems in commercial and healthcare environments. Asia Pacific is emerging as the most dynamic region, supported by large-scale smart city initiatives, urban infrastructure investments, and growing awareness of the impact of light on human health. South America and the Middle East & Africa are witnessing gradual adoption, driven by increasing commercial construction, hospitality growth, and rising focus on occupant well-being in new urban developments.

Market Dynamics

Driver: Growing emphasis on health, productivity, and well-being

The growing awareness of the impact of light on human health and productivity is driving demand for human-centric lighting systems. Modern workplaces, hospitals, and educational facilities are adopting tunable lighting that aligns with the body’s circadian rhythm to improve concentration, alertness, and sleep quality. With wellness design becoming central to architecture, human-centric lighting is increasingly integrated into smart building ecosystems to promote comfort and long-term well-being.

Restraint: High initial investment and integration complexity

Despite the benefits, high upfront installation costs and the complexity of integrating lighting with IoT, sensors, and control platforms limit adoption. Human-centric lighting systems often require advanced drivers, control software, and programming expertise, increasing both material and labor costs. Small-scale and cost-sensitive projects, especially in developing markets, face challenges justifying these investments without clear short-term returns.

Opportunity: Expansion of smart buildings and WELL-certified infrastructure

The rise of smart buildings and wellness certifications such as WELL v2 and LEED is opening new opportunities for human centric lighting. Corporations and healthcare facilities are prioritizing lighting systems that enhance occupant health and energy performance. Integration of HCL with AI-driven building management systems, cloud analytics, and mobile controls provides scalable opportunities for manufacturers to deliver personalized, data-backed lighting experiences.

Challenge: Limited standardization and awareness in emerging markets

The absence of universal standards and limited awareness among architects, engineers, and facility managers hinders large-scale deployment. In many developing regions, HCL is still perceived as a premium feature rather than an essential building requirement. Lack of clear regulatory frameworks, standardized metrics for circadian effectiveness, and trained professionals in lighting design remain key challenges that must be addressed to accelerate global market adoption.

Future Outlook

Between 2025 and 2036, the human centric lighting market is expected to expand rapidly as wellness, sustainability, and smart building trends converge. Advancements in IoT-enabled controls, spectral tuning, and AI-based circadian algorithms will transform lighting from a static utility into an adaptive health-supporting system. Growing emphasis on WELL-certified buildings, energy efficiency, and occupant well-being will fuel adoption across offices, healthcare, and hospitality spaces. As costs decline and awareness rises, human centric lighting will evolve into a mainstream feature of intelligent, occupant-focused environments, shaping the next generation of sustainable architecture and connected living.

Key Market Players

The top human centric lighting companies are Signify Holding B.V. (Netherlands), Acuity Brands, Inc. (US), ams-OSRAM AG (Austria), Zumtobel Group AG (Austria), and LEDVANCE GmbH (Germany).

Key Questions addressed in this report:

- What is the current size of the human-centric lighting market?

- Who are the winners in the human-centric lighting market?

- What are the factors driving the growth of the market?

- What are the factors impeding the growth of the market?

- What are the strategies adopted by market players to strengthen their position in the market?

- What are the major application industries that are expected to provide opportunities for the adoption of human-centric lighting?

- Which installation type is expected to dominate the human-centric lighting market?

- What are the major factors driving the human-centric lighting market growth in the Asia Pacific?

- Which country is expected to dominate the human-centric lighting market in the Asia Pacific?

- What are the major restraining factors in the human-centric lighting market?

Table of Contents

1 Introduction (Page No. - 15)

1.1 Study Objectives

1.2 Definition

1.3 Market Segmentation

1.3.1 Geographic Scope

1.3.2 Years Considered

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Major Secondary Sources

2.1.1.2 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews With Experts

2.1.2.2 Key Data From Primary Sources

2.1.2.3 Key Industry Insights

2.1.2.4 Breakdown of Primaries

2.1.3 Secondary and Primary Research

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing Market Share By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing Market Share By Top-Down Analysis (Supply Side)

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in Human Centric Lighting Market

4.2 Market, By Component and Service

4.3 Market in Europe for Application and Country

4.4 Market, By Country

5 Market Overview (Page No. - 35)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 High Adoption of Led Lighting Solutions

5.1.1.2 Initiatives Toward Establishing Smart Cities Driving Demand for Human Centric Solutions

5.1.1.3 Growing Demand for Energy-Efficient Lighting Solutions

5.1.2 Restraints

5.1.2.1 Compatibility Issues and High Installation Cost

5.1.3 Opportunities

5.1.3.1 Implementation of Wireless Technology for Led Lighting

5.1.4 Challenges

5.1.4.1 Lack of Common Standards

5.2 Value Chain Analysis

6 Human Centric Lighting Market, By Installation Type (Page No. - 41)

6.1 Introduction

6.2 New Installations

6.2.1 New Installations Held Larger Share of Market in 2018

6.3 Retrofit Installations

6.3.1 Retrofit Installations Held Smaller Market Share Owing to Their Less Compatibility With Fixtures and Controllers in 2018

7 Human Centric Lighting Market, By Offering (Page No. - 45)

7.1 Introduction

7.2 Hardware

7.2.1 Lighting Fixtures

7.2.1.1 Lighting Fixtures Held Largest Share of Market in 2018

7.2.2 Lighting Controllers

7.2.2.1 Sensors

7.2.2.2 Drivers

7.2.2.3 Microprocessors and Microcontrollers

7.2.2.4 Switches and Dimmers

7.2.2.5 Transmitters and Receivers

7.3 Software Components

7.3.1 Software Components Expected to Register Highest CAGR in Overall Market During Forecast Period

7.4 Services

7.4.1 Design and Engineering

7.4.1.1 Design and Engineering Services Play Important Role in Market

7.4.2 Installation Services

7.4.2.1 Market for Installation Services to Grow at Highest CAGR During Forecast Period

7.4.3 Post Installation Services

7.4.3.1 Post-Installation Services Held Largest Market Share in 2018

8 Human Centric Lighting Market , By Application (Page No. - 57)

8.1 Introduction

8.2 Wholesale and Retail

8.2.1 Retail Stores are Likely to Employ Human Centric Lighting Solutions to Enhance Shopping Experience

8.3 Enterprises and Data Centres

8.3.1 Human Centric Lighting Solutions are Used to Increase Energy and Motivation Levels as Well as Productivity of Employees in Enterprises

8.4 Residential

8.4.1 Residential Applications Expected to Witness Highest Growth Rate During Forecast Period

8.5 Educational Institutions

8.5.1 Educational Institutions Accounted for Significant Share of Market in 2018

8.6 Healthcare

8.6.1 Healthcare Considered as Prominent Application Area for Human Centric Lighting Solutions

8.7 Industrial

8.7.1 Strict Government Regulations and Introduction of Advanced Lighting Technologies Will Surge Demand for Human Centric Lighting Solutions in Industrial Applications in Near Future

8.8 Hospitality

8.8.1 Hospitality Applications Accounted for Third-Largest Share of Market in 2018

9 Geographic Analysis (Page No. - 66)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 US to Remain Largest Market for Human Centric Lighting Systems in North America

9.2.2 Canada

9.2.2.1 Government of Canada to Promote Energy-Conserving Lighting Solutions

9.2.3 Mexico

9.2.3.1 Mexico to Witness Growing Demand for Leds

9.3 Europe

9.3.1 UK

9.3.1.1 Growing Demand for Energy-Saving and Long-Lasting Lighting Systems to Drive Human Centric Lighting Market in Uk

9.3.2 Germany

9.3.2.1 Rising Demand for Smart Homes to Drive Market in Germany

9.3.3 France

9.3.3.1 Growing Awareness About Energy Conservation to Drive Market in France

9.3.4 Rest of Europe

9.4 APAC

9.4.1 China

9.4.1.1 Growing Awareness About Environmental Protection and Energy Efficient Solutions to Drive Market in China

9.4.2 Japan

9.4.2.1 Fastest-Growing Economy to Augment Market Growth of Human Centric Lighting in Japan

9.4.3 South Korea

9.4.3.1 Developing Energy-Efficient Labels and Standards Programs to Boost Growth of Market in South Korea

9.4.4 India

9.4.4.1 Establishing National Program for Led-Based Home Lighting to Boost Market in India

9.4.5 Rest of APAC

9.5 RoW

9.5.1 Middle East and Africa

9.5.1.1 Growing Government Initiatives for Energy-Efficient Systems to Boost Market

9.5.2 South America

10 Competitive Landscape (Page No. - 97)

10.1 Introduction

10.2 Market Player Ranking Analysis

10.3 Competitive Leadership Mapping

10.3.1 Visionary Leaders

10.3.2 Dynamic Differentiators

10.3.3 Innovators

10.3.4 Emerging Companies

10.4 Competitive Benchmarking

10.4.1 Strength of Product Portfolio (25 Companies)

10.4.2 Business Strategy Excellence (25) Companies

10.5 Competitive Scenario

10.6 Competitive Situations & Trends

10.6.1 Product Launches/Developments

10.6.2 Mergers/Acquisitions/Alliances/Joint Ventures

10.6.3 Collaborations/Contracts/Agreements/Partnerships

10.6.4 Expansions

11 Company Profiles (Page No. - 116)

11.1 Introduction

11.2 Key Players

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.2.1 Signify Lighting NV

11.2.2 OSRAM Licht AG

11.2.3 Acuity Brands, Inc.

11.2.4 Cree, Inc.

11.2.5 Legrand SA

11.2.6 Hubbell Incorporated

11.2.7 Zumtobel Group AG

11.2.8 Wipro Enterprises (P) Limited

11.2.9 Glamox AS

11.2.10 Lutron Electronics

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

11.3 Other Companies

11.3.1 LUMITECH Produktion Und Entwicklung GmbH

11.3.2 SDA Lighting

11.3.3 TRILUX GmbH & Co. Kg

11.3.4 ESYLUX GmbH

11.3.5 Helvar OY AB

11.3.6 LEDRAbrands, Inc.

11.3.7 B.E.G. Brück Electronic GmbH

11.3.8 AB Fagerhult

11.3.9 Gerard Lighting

11.3.10 Halla, A.S.

12 Appendix (Page No. - 156)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (67 Tables)

Table 1 Human Centric Lighting Market , By Installation Type, 2016–2024 (USD Million)

Table 2 Market for New Installations, By Region, 2016–2024 (USD Million)

Table 3 Market for Retrofit Installations, By Region, 2016–2024 (USD Million)

Table 4 Market, By Offering, 2016–2024 (USD Million)

Table 5 Human Centric Lighting Market for Hardware, By Component, 2016–2024 (USD Million)

Table 6 Market for Hardware, By Region, 2016–2024 (USD Million)

Table 7 Market for Lighting Fixtures, By Region, 2016–2024 (USD Million)

Table 8 Human Centric Lighting Market for Lighting Controllers, By Type, 2016–2024 (USD Million)

Table 9 Market for Lighting Controllers, By Type, 2016–2024 (Thousand Units)

Table 10 Market for Lighting Controllers, By Region, 2016–2024 (USD Million)

Table 11 Market for Software Components, By Region, 2016–2024 (USD Million)

Table 12 Market, By Service, 2016–2024 (USD Million)

Table 13 Human Centric Lighting Market for Services, By Region, 2016–2024 (USD Million)

Table 14 Market for Design and Engineering Services, By Region, 2016–2024 (USD Million)

Table 15 Market for Installation Services, By Region, 2016–2024 (USD Million)

Table 16 Market for Post Installation Services, By Region, 2016–2024 (USD Million)

Table 17 Market, By Application, 2016–2024 (USD Million)

Table 18 Market for Wholesale and Retail, By Region, 2016–2024 (USD Million)

Table 19 Market for Enterprises and Data Centres, By Region, 2016–2024 (USD Million)

Table 20 Human Centric Lighting Market for Residential Application, By Region, 2016–2024 (USD Million)

Table 21 Market for Educational Institutions, By Region, 2016–2024 (USD Million)

Table 22 Human Centric Lighting Market for Healthcare, By Region, 2016–2024 (USD Million)

Table 23 Market for Industrial Application, By Region, 2016–2024 (USD Million)

Table 24 Market for Hospitality, By Region, 2016–2024 (USD Million)

Table 25 Human Centric Lighting Market, By Region, 2016–2024 (USD Million)

Table 26 Market in North America, By Offerings, 2016–2024 (USD Million)

Table 27 Market in North America, By Hardware Type, 2016–2024 (USD Million)

Table 28 Market in North America for Services, By Type, 2016–2024 (USD Million)

Table 29 Market in North America, By Installation Type, 2016–2024 (USD Million)

Table 30 Market in North America, By Application, 2016–2024 (USD Million)

Table 31 Human Centric Lighting Market in North America, By Country, 2016–2024 (USD Million)

Table 32 Market in US, By Application, 2016–2024 (USD Million)

Table 33 Human Centric Lighting Market in Canada, By Application, 2016–2024 (USD Million)

Table 34 Market in Mexico, By Application, 2016–2024 (USD Million)

Table 35 Market in Europe, By Offerings, 2016–2024 (USD Million)

Table 36 Market in Europe, By Hardware Type, 2016–2024 (USD Million)

Table 37 Human Centric Lighting Market in Europe for Services, By Type, 2016–2024 (USD Million)

Table 38 Market in Europe, By Installation Type, 2016–2024 (USD Million)

Table 39 Market in Europe, By Application, 2016–2024 (USD Million)

Table 40 Market in Europe, By Country, 2016–2024 (USD Million)

Table 41 Human Centric Lighting Market in UK, By Application, 2016–2024 (USD Million)

Table 42 Market in Germany, By Application, 2016–2024 (USD Million)

Table 43 Market in France, By Application, 2016–2024 (USD Million)

Table 44 Market in Rest of Europe, By Application, 2016–2024 (USD Million)

Table 45 Market in APAC, By Offerings, 2016–2024 (USD Million)

Table 46 Market in APAC, By Hardware Type, 2016–2024 (USD Million)

Table 47 Market in APAC for Services, By Type, 2016–2024 (USD Million)

Table 48 Human Centric Lighting Market in APAC, By Installation Type, 2016–2024 (USD Million)

Table 49 Market in APAC, By Application, 2016–2024 (USD Million)

Table 50 Market in APAC, By Country, 2016–2024 (USD Million)

Table 51 Human Centric Lighting Market in China, By Application, 2016–2024 (USD Million)

Table 52 Market in Japan, By Application, 2016–2024 (USD Million)

Table 53 Market in South Korea, By Application, 2016–2024 (USD Thousand)

Table 54 Market in India, By Application, 2016–2024 (USD Thousand)

Table 55 Market in Rest of APAC, By Application, 2016–2024 (USD Million)

Table 56 Human Centric Lighting Market in RoW, By Offerings, 2016–2024 (USD Million)

Table 57 Market in RoW, By Hardware Type, 2016–2024 (USD Million)

Table 58 Human Centric Lighting Market in RoW for Services, By Type, 2016–2024 (USD Million)

Table 59 Market in RoW, By Installation Ype, 2016–2024 (USD Million)

Table 60 Market in RoW, By Application, 2016–2024 (USD Million)

Table 61 Market in RoW, By Region, 2016–2024 (USD Million)

Table 62 Human Centric Lighting Market in Middle East & Africa, By Application , 2016–2024 (USD Thousand)

Table 63 Market in South America, By Application, 2016–2024 (USD Thousand)

Table 64 Product Launches/Developments (2016–2018)

Table 65 Mergers/Acquisitions/Alliances/Joint Ventures (2016–2018)

Table 66 Collaborations/Contracts/Agreements/Partnerships (2016–2018)

Table 67 Expansions (2016–2018)

List of Figures (44 Figures)

Figure 1 Human Centric Lighting Market Segmentation

Figure 2 Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Market Breakdown and Data Triangulation

Figure 6 Assumptions for Research Study

Figure 7 Market, 2016–2024 (USD Million)

Figure 8 Market, By Offering (2019 vs 2024)

Figure 9 New Installation Held Major Share of Market in 2018

Figure 10 Market for Residential Application to Grow at Highest CAGR From 2019 to 2024

Figure 11 Europe to Hold Largest Share of Market in 2019

Figure 12 Growing Demand for Energy-Efficient Lighting Solutions to Boost Human-Centric Lighting Market During Forecast Period

Figure 13 Market for Software Component to Grow at Highest CAGR From 2019 to 2024

Figure 14 Lighting Fixtures to Hold Larger Share of Market By 2024

Figure 15 Healthcare Application and Germany Accounted for Largest Share of European Market in 2018

Figure 16 Market in China to Grow at Highest CAGR From 2019 to 2024

Figure 17 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 18 Major Value Added By Original Equipment Manufacturers and Software Providers

Figure 19 New Installations to Lead Market From 2019 to 2024

Figure 20 Market for Software Components to Grow at Highest CAGR From 2019 to 2024

Figure 21 Drivers to Hold Largest Size of Market for Lighting Control From 2019 to 2024

Figure 22 Market for Installation Services to Grow at the Highest CAGR From 2019 to 2024

Figure 23 Market for Residential Applications Expected to Grow at Highest CAGR From 2019 to 2024

Figure 24 Market for Residential Application in Europe to Grow at Highest CAGR From 2019 to 2024

Figure 25 Geographic Snapshot: Market in APAC to Witness Highest CAGR From 2019 to 2024

Figure 26 Europe to Account for Largest Market Size By 2024, While APAC Will Witness Highest CAGR During 2019–2024

Figure 27 North America: Market Snapshot

Figure 28 Europe: Market Snapshot

Figure 29 APAC: Human Centric Lighting Market Snapshot

Figure 30 Companies Adopted Product Launches/Developments as Key Growth Strategies During 2016–2018

Figure 31 OSRAM Litch AG (Germany) Led Market in 2018

Figure 32 Market (Global) Competitive Leadership Mapping, 2018

Figure 33 Evaluation Framework: Market

Figure 34 Signify Lighting NV: Company Snapshot

Figure 35 OSRAM Licht AG: Company Snapshot

Figure 36 Acuity Brands, Inc.: Company Snapshot

Figure 37 Cree, Inc.: Company Snapshot

Figure 38 Cree, Inc.: SWOT Analysis

Figure 39 Legrand SA: Company Snapshot

Figure 40 Legrand SA: SWOT Analysis

Figure 41 Hubbell Incorporated: Company Snapshot

Figure 42 Zumtobel Group AG: Company Snapshot

Figure 43 Wipro Enterprises (P) Limited: Company Snapshot

Figure 44 Glamox AS: Company Snapshot

The study involved 4 major activities in estimating the current size of the human centric lighting market. Exhaustive secondary research has been done to collect information on the market, the peer market, and the parent market. To validate these findings,assumptions, and sizing with industry experts from across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market sizes of segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the human centric lighting market begins with capturing data on revenues of critical vendors in the market through secondary research. This study incorporates using extensive secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information useful for the technical, market-oriented, and commercial study of the human centric lighting market. Vendor offerings have also been taken into consideration to determine the market segmentation. This entire research methodology includes studying annual and financial reports of top players, presentations, press releases, journals, paid databases, trade directories, regulatory bodies, and safety standard organizations.

Primary Research

The human centric lighting market’s supply chain comprises several stakeholders, such as suppliers of standard components, original equipment manufacturers (OEMs), software providers, solutions providers, and system integrators. The supply side is characterized by advancements in human centric lighting solutions and their diverse applications. Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the human centric lighting market and various market subsegments. The research methodology used to estimate the market sizes includes the following:

- Key companies in major applications and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size in terms of value have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the estimation processes as explained above—the market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides of lighting fixtures and lighting controllers.

Research Objective

- To describe and forecast the overall human centric lighting market, by offering, installation type, application, and geography, in terms of value

- To describe and forecast the overall human centric lighting market, by offering, in terms of volume, for lighting controllers

- To forecast the market size for various segments with regard to 4 regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW), in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the human centric lighting market

- To provide a detailed overview of the value chain of the human centric lighting market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the overall human centric lighting market

- To analyze opportunities in the human centric lighting market for stakeholders by identifying the high-growth segments

- To strategically profile key players, comprehensively analyze their market rankings and core competencies2, and detail the competitive landscape for market leaders

- To analyze competitive developments such as contracts, mergers and acquisitions, product launches and developments, and R&D in the overall human centric lighting market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Critical Questions

- What new applications are explored by human centric lighting solution providers?

- Who are the key players in the market, and how intense is the competition?

Growth opportunities and latent adjacency in Human Centric Lighting Market