Hospital Lighting Market by Product (Troffers, Surface-mounted lights, Surgical lamps), Technology ( Fluorescent, LED, Renewable Energy) Application (Patient Wards & ICUs, Examination Rooms, Surgical Suites- Global Forecast to 2021

[122 Pages Report] The increasing adoption of led based lighting products to drive the hospital lighting market to reach USD 7.03 billion by 2021

The global hospital lighting market is segmented based on technology, products, applications and region. On the basis of technology, the market is segmented into fluorescent, LED, renewable energy and other technologies fluorescent technology segment is expected to account for the largest share of the market in 2016. Factors such as, cheaper cost and low operational cost are driving this market.

Based on product, market is segmented into troffers, surface-mounted lights, surgical lights and other products. Troffers segment is expected to account for the largest share of the market during the forecast period. Growth in this segment is driven by factor such as increasing adoption of LED based troffers in hospitals globally.

On the basis of applications, the hospital lighting market is classified into patient wards & ICUs, examination rooms, surgical suites and other applications. In 2016, the patient wards & ICUs segment is expected to account for the largest share of the market. This large share can be attributed to increasing number of hospitals in emerging countries such as India and China.

The hospital lighting market is projected to reach USD 7.03 billion by 2021 from USD 5.19 billion in 2016, at a CAGR of 6.2% from 2016 to 2021. The increasing adoption of LED based lighting products and increasing number of hospital in emerging economies are the key factor driving the market growth. Moreover, increasing government support to energy efficiency program for hospitals is contributing to the growth of market.

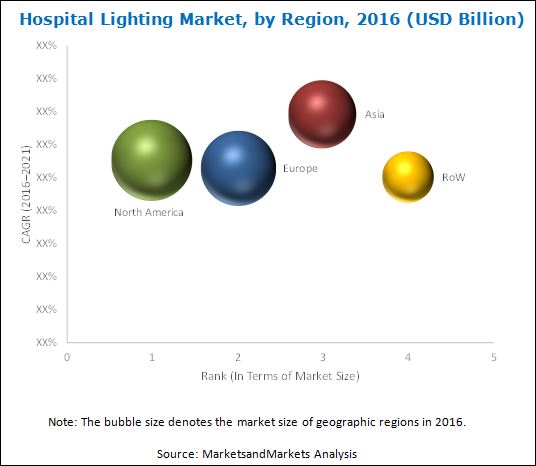

In 2016, North America is expected to account for the largest share of the market, followed by Europe. North America will continue to dominate the market in the forecast period due to ample government support and utility funding in order to promote energy efficiency projects and to support the modernization of hospital lighting industry. However, the market in Asia is expected to witness the highest CAGR, with the growth centered on China, Japan, and India.

Prominent players in this market are General Electric Company (U.S.), Acuity Brands Lighting Inc. (U.S.), Cree Inc. (U.S.), Eaton Corporation PLC (Ireland), Hubbell Incorporated (U.S.), Koninklijke Philips N.V. (Netherlands), and Zumtobel Group AG (Austria). Other players in this market include Herbert Waldmann GmbH & Co. KG (Germany), KLS Martin Group (Germany), and Trilux Lighting Ltd (U.K.).

Target Audience

- Healthcare service providers (hospitals and surgical centers)

- Manufacturers of lighting Products

- Vendors and Distributors of Hospital Lightings

- Hospitals and clinics

- Research Institutes

- Venture Capitalists and Investors

To know about the assumptions considered for the study, download the pdf brochure

Scope of the Report:

This research report categorizes the hospital lighting market into the following segments:

Hospital lighting Market, by Product

- Troffers

- Surface-mounted Lights

- Surgical Lamps

- Other Products

Hospital lighting Market, by Technology

- Fluorescent

- LED

- Renewable Energy

- Other Technologies

Hospital lighting Market, by Application

- Patient Wards & ICUs

- Examination Rooms

- Surgical Suites

- Other Applications

Hospital lighting Market, by Region

-

North America

- US

- Canada

-

Europe

- Germany

- U.K.

- France

- Rest of Europe (RoE)

-

Asia

- China

- Japan

- India

- Rest of Asia (RoA)

- Rest of the World (RoW)

Customization Options:

- Company Information: Detailed company profiles of five or more market players

- Opportunities Assessment: A detailed report underlining the various growth opportunities presented in the market

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Market Dynamics

Advantages of LED lighting over conventional lighting to drive the global hospital lighting market to reach USD 7.03 billion by 2022

Modern lighting products, such as LED and OLED, are comparatively more expensive than most conventional lighting products; however, their total operational cost is lower than CFL and incandescent-based lighting. According to the Department of Energy (U.S.), the average operational cost of an LED bulb for 23 years is around USD 38 as compared to USD 48 for incandescent bulbs and USD 201 for CFL lighting. Owing to these operational cost advantages, the adoption rate of LED-based lighting fixtures in hospitals is on the rise. In 2014, LED Lighting had a higher adoption rate of 10.1% in hospitals.

LED and OLED are highly energy-efficient lighting products that have the potential to change the future of the global lighting industry.

Increasing number of hospitals in emerging economies to drive the hospital lighting industry across developing countries during the forecast period

Across the globe, the number of hospitals is on the rise, but this increase is particularly significant in emerging economies such as China and India. The sharp rise in the number of hospitals in this region can primarily be attributed to the rapidly growing population and increasing healthcare expenditure in these countries. This increasing number of hospitals in the emerging economies will subsequently lead to an increase in the number of hospital wards and operation theatres, which in turn will drive growth in the hospital lighting market.

Patient wards & ICUs to register the highest CAGR during the forecast period

Patient wards include general wards, emergency wards, and patient admission rooms, and intensive care (ICU) units include SICU (surgical ICU), CCU (cardiac ICU), and NICU (neonatal ICU). LED recessed troffers are used in patient wards & ICUs. Troffers can save up to 70% of power consumption (making them more cost effective) and have a longer life span (~25 years) as compared to other sources of light fixtures in hospitals. TRILUX Lighting Ltd. (U.K.), Eaton (Ireland), and Cree Inc. (U.S.) are the prominent players offering lighting solutions for patient wards and ICUs.

Key Questions

- What are the business growth strategies adopted by key market players to maintain their market position across key geographies?

- What is the existing developmental pipeline of major lighting technologies among manufacturers?

- Growing adoption of LED lights procedures is a key trend in clinical management. What impact this will have on hospital lighting market during the forecast period?

The hospital lighting market is projected to reach USD 7.03 Billion by 2021 from USD 5.19 Billion in 2016, at a CAGR of 6.2% from 2016 to 2021. The increasing adoption of LED based lighting products and increasing number of hospital in emerging economies are the key factor driving the market growth. Moreover, increasing government support to energy efficiency program for hospitals is contributing to the growth of market.

This market is segmented based on technology, products, applications and region. On the basis of technology, the market is segmented into fluorescent, LED, renewable energy and other technologies fluorescent technology segment is expected to account for the largest share of the market in 2016. Factors such as, cheaper cost and low operational cost are driving this market.

Based on product, market is segmented into troffers, surface-mounted lights, surgical lights and other products. Troffers segment is expected to account for the largest share of the market during the forecast period. Growth in this segment is driven by factor such as increasing adoption of LED based troffers in hospitals globally.

On the basis of applications, the hospital lighting market is classified into patient wards & ICUs, examination rooms, surgical suites and other applications. In 2016, the patient wards & ICUs segment is expected to account for the largest share of the market. This large share can be attributed to increasing number of hospitals in emerging countries such as India and China.

The global hospital lighting market is segmented into four major regions North America, Europe, Asia, and Rest of the World. In 2016, North America is expected to account for the largest share of the market, followed by Europe. North America will continue to dominate the market in the forecast period due to ample government support and utility funding in order to promote energy efficiency projects and to support the modernization of hospital lighting industry. However, the market in Asia is expected to witness the highest CAGR, with the growth centered on China, Japan, and India.

Prominent players in this Hospital Lighting Market are General Electric Company (U.S.), Acuity Brands Lighting Inc. (U.S.), Cree Inc. (U.S.), Eaton Corporation PLC (Ireland), Hubbell Incorporated (U.S.), Koninklijke Philips N.V. (Netherlands), and Zumtobel Group AG (Austria). Other players in this market include Herbert Waldmann GmbH & Co. KG (Germany), KLS Martin Group (Germany), and Trilux Lighting Ltd (U.K.).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Hospital Lighting Market Definition

1.3 Market Scope

1.3.1 Hospital Lighting Market Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Secondary Data

2.1.1 Key Data From Secondary Sources

2.2 Primary Data

2.2.1 Key Data From Primary Sources

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Assumptions for the Study

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 27)

4.1 Hospital Lighting Market to Offer Opportunities

4.2 Geographic Analysis: Market, By Technology (2016)

4.3 Hospital Lighting Market Size, By Application, 2016 vs 2021

4.4 Geographical Snapshot of the Global Market

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Hospital Lighting Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Number of Hospitals in Emerging Economies

5.2.1.2 Increasing Adoption of LED-Based Lighting Fixtures

5.2.1.2.1 Advantages of LED Lighting Over Conventional Lighting

5.2.1.2.2 Government Initiatives to Improve Energy Efficiency in Hospitals

5.2.2 Opportunity

5.2.2.1 Advancements in Lighting Technologies

6 Hospital Lighting Market, By Product (Page No. - 34)

6.1 Introduction

6.2 Troffers

6.3 Surface-Mounted Lights

6.4 Surgical Lamps

6.5 Other Products

7 Hospital Lighting Market, By Technology (Page No. - 40)

7.1 Introduction

7.2 Fluorescent Technology

7.3 LED Technology

7.4 Renewable Energy

7.5 Other Technologies

8 Hospital Lighting Market, By Application (Page No. - 46)

8.1 Introduction

8.2 Patient Wards & ICUs

8.3 Surgical Suites

8.4 Examination Rooms

8.5 Other Applications

9 Hospital Lighting Market, By Region (Page No. - 52)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.3 Europe

9.3.1 Germany

9.3.2 U.K.

9.3.3 France

9.3.4 Rest of Europe (RoE)

9.4 Asia

9.4.1 China

9.4.2 Japan

9.4.3 India

9.4.4 Rest of Asia

9.5 Rest of the World

10 Competitive Landscape (Page No. - 84)

10.1 Introduction

10.2 Strategic Overview

10.3 Hospital Lighting Market Share Analysis

10.4 Competitive Situation and Trends

10.4.1 Product Launches

10.4.2 Agreements & Partnerships

10.4.3 Acquisitions

10.4.4 Expansions

10.4.5 Other Developments

11 Company Profiles (Page No. - 90)

(Introduction, Products & Services, Strategy, & Analyst Insights, Developments, MnM View)*

11.1 Introduction

11.2 Acuity Brands Lighting Inc.

11.3 Cree Inc.

11.4 Eaton Corporation PLC

11.5 GE Lighting (A Fully Owned Subsidiary of General Electric Company)

11.6 Hubbell Incorporation

11.7 Koninklijke Philips N.V.

11.8 Zumtobel Group AG

11.9 Herbert Waldmann GmbH & Co. Kg

11.10 KLS Martin Group

11.11 Trilux Lighting Ltd.

*Details on Marketsandmarkets View, Introduction, Product & Services, Strategy, & Analyst Insights, New Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 114)

12.1 Industry Insights

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (69 Tables)

Table 1 Comparative Analysis of Different Lighting Fixtures, By Type

Table 2 Hospital Lighting Market Size, By Product, 2014–2021 (USD Million)

Table 3 Hospital Lighting Market Size for Troffers, By Region, 2014–2021 (USD Million)

Table 4 Market Size for Surface-Mounted Lights, By Region, 2014–2021 (USD Million)

Table 5 Hospital Lighting Market Size for Surgical Lamps, By Region, 2014–2021 (USD Million)

Table 6 Application of Emergency Lights in Hospitals

Table 7 Market Size for Other Products, By Region, 2014–2021 (USD Million)

Table 8 Hospital Lighting Market Size, By Technology, 2014–2021 (USD Million)

Table 9 Market Size for Fluorescent Technology, By Region, 2014–2021 (USD Million)

Table 10 Hospital Lighting Market Size for LED Technology, By Region, 2014–2021 (USD Million)

Table 11 Market Size for Renewable Energy, By Region, 2014–2021 (USD Million)

Table 12 Hospital Lighting Market Size for Other Technologies By Region, 2014–2021 (USD Million)

Table 13 Market Size, By Application, 2014–2021 (USD Million)

Table 14 Hospital Lighting Market Size for Hospital Wards & Intensive Care Units, By Region, 2014–2021 (USD Million)

Table 15 Market Size for Surgical Suites, By Region, 2014–2021 (USD Million)

Table 16 Hospital Lighting Market Size for Examination Rooms, By Region, 2014–2021 (USD Million)

Table 17 Hospital Lighting Market Size for Other Applications, By Region, 2014–2021 (USD Million)

Table 18 Hospital Lighting Market Size, By Region, 2014–2021 (USD Million)

Table 19 North America: Hospital Lighting Market Size, By Country, 2014–2021 (USD Million)

Table 20 North America: Market Size, By Product, 2014–2021 (USD Million)

Table 21 North America: Hospital Lighting Market Size, By Technology, 2014–2021 (USD Million)

Table 22 North America: Market Size, By Application, 2014–2021 (USD Million)

Table 23 U.S.: Hospital Lighting Market Size, By Product, 2014–2021 (USD Million)

Table 24 U.S.: Market Size, By Technology, 2014–2021 (USD Million)

Table 25 U.S.: Hospital Lighting Market Size, By Application, 2014–2021 (USD Million)

Table 26 Canada: Hospital Lighting Market Size, By Product, 2014–2021 (USD Million)

Table 27 Canada: Hospital Lighting Market Size, By Technology, 2014–2021 (USD Million)

Table 28 Canada: Market Size, By Application, 2014–2021 (USD Million)

Table 29 Europe: Hospital Lighting Market Size, By Country, 2014–2021 (USD Million)

Table 30 Europe: Market Size, By Product, 2014–2021 (USD Million)

Table 31 Europe: Hospital Lighting Market Size, By Technology, 2014–2021 (USD Million)

Table 32 Europe: Lighting Market Size, By Application, 2014–2021 (USD Million)

Table 33 Germany: Hospital Lighting Market Size, By Product, 2014–2021 (USD Million)

Table 34 Germany: Hospital Lighting Market Size, By Technology, 2014–2021 (USD Million)

Table 35 Germany: Hospital Lighting Market Size, By Application, 2014–2021 (USD Million)

Table 36 U.K.: Hospital Lighting Market Size, By Product, 2014–2021 (USD Million)

Table 37 U.K.: Hospital Lighting Market Size, By Technology, 2014–2021 (USD Million)

Table 38 U.K.: Market Size, By Application, 2014–2021 (USD Million)

Table 39 France: Hospital Lighting Market Size, By Product, 2014–2021 (USD Million)

Table 40 France: Hospital Lighting Market Size, By Technology, 2014–2021 (USD Million)

Table 41 France: Hospital Lighting Market Size, By Application, 2014–2021 (USD Million)

Table 42 RoE: Market Size, By Product, 2014–2021 (USD Million)

Table 43 RoE: Hospital Lighting Market Size, By Technology, 2014–2021 (USD Million)

Table 44 RoE: Market Size, By Application, 2014–2021 (USD Million)

Table 45 Asia: Hospital Lighting Market Size, By Country, 2014–2021 (USD Million)

Table 46 Asia: Hospital Lighting Market Size, By Product, 2014–2021 (USD Million)

Table 47 Asia: Hospital Lighting Market Size, By Technology, 2014–2021 (USD Million)

Table 48 Asia: Hospital Lighting Market Size, By Application, 2014–2021 (USD Million)

Table 49 China: Hospital Lighting Market Size, By Product, 2014–2021 (USD Million)

Table 50 China: Market Size, By Technology, 2014–2021 (USD Million)

Table 51 China: Market Size, By Application, 2014–2021 (USD Million)

Table 52 Japan: Market Size, By Product, 2014–2021 (USD Million)

Table 53 Japan: Hospital Lighting Market Size, By Technology, 2014–2021 (USD Million)

Table 54 Japan: Market Size, By Application, 2014–2021 (USD Million)

Table 55 India: Hospital Lighting Market Size, By Product, 2014–2021 (USD Million)

Table 56 India: Market Size, By Technology, 2014–2021 (USD Million)

Table 57 India: Hospital LightingMarket Size, By Application, 2014–2021 (USD Million)

Table 58 RoA: Market Size, By Product, 2014–2021 (USD Million)

Table 59 RoA: Hospital Lighting Market Size, By Technology, 2014–2021 (USD Million)

Table 60 RoA: Market Size, By Application, 2014–2021 (USD Million)

Table 61 RoW: Hospital Lighting Market Size, By Product, 2014–2021 (USD Million)

Table 62 RoW: Hospital Lighting Market Size, By Technology, 2014–2021 (USD Million)

Table 63 RoW: Market Size, By Application, 2014–2021 (USD Million)

Table 64 Growth Strategy Matrix, 2013–2017

Table 65 Product Launches, 2013–2017

Table 66 Agreements & Partnerships, 2013–2017

Table 67 Acquisitions, 2013–2017

Table 68 Expansions, 2013–2017

Table 69 Other Developments, 2013–2017

List of Figures (48 Figures)

Figure 1 Global Market Segmentation

Figure 2 Research Methodology

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Global Hospital Lighting Market: Bottom-Up Approach

Figure 5 Global Market: Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 Hospital Lighting Market Size, By Product, 2016 vs 2021 (USD Billion)

Figure 8 Market Size, By Technology, 2016 vs 2021 (USD Billion)

Figure 9 Hospital Lighting Market Size, By Application, 2016 vs 2021 (USD Billion)

Figure 10 Geographic Snapshot of the Global Market

Figure 11 Global Hospital Lighting Market to Witness Moderate Growth During the Forecast Period

Figure 12 Fluorescent Technology Accounted for the Largest Share of the Global Market in 2016

Figure 13 Patient Wards & ICU Segment Will Continue to Dominate the Market in 2021

Figure 14 Asia to Register the Highest Growth Rate During the Forecast Period

Figure 15 Hospital Lighting Market: Drivers and Opportunities

Figure 16 Troffers Commanded the Largest Market Share in 2016

Figure 17 The Fluorescent Technology Segment Dominated the Hospital Lighting Market in 2016

Figure 18 Patient Wards & ICUs Segment Accounted for the Largest Market Share in 2016

Figure 19 Regional Snapshot: Emerging Asian Markets Offer Significant Growth Opportunities

Figure 20 North America: Market Snapshot

Figure 21 Fluorescent Technology Segment to Dominate the North American Hospital Lighting Technology Market During the Forecast Period

Figure 22 Fluorescent Technology Segment to Dominate the Hospital Lighting Technology Market in U.S. During the Forecast Period

Figure 23 Fluorescent Technology Segment to Dominate the Canadian Hospital Lighting Technology Market During the Forecast Period

Figure 24 Europe: Market Snapshot

Figure 25 Emerging Markets of Germany Offer Significant Growth Opportunities

Figure 26 Fluorescent Technology Segment to Dominate the European Hospital Lighting Market, By Technology, During the Forecast Period

Figure 27 LED Technology to Grow at the Fastest Rate in Germany During the Forecast Period

Figure 28 LED Segment to Grow at the Highest Rate in the U.K. Market, By Technology

Figure 29 Fluorescent Technology Segment Holds Largest Share of the French Market

Figure 30 LED Technology to Grow at the Fastest Rate in Germany During the Forecast Period

Figure 31 Asia: Hospital Lighting Market Snapshot

Figure 32 China Dominates the Asian Market

Figure 33 Asia: Fluorescent Technology Segment Expected to Dominate the Hospital Lighting Technology Market

Figure 34 Fluorescent Technology Segment to Hold Largest Share in the Chinese Hospital Lighting Market, By Technology

Figure 35 LED Segment to Register Highest Growth in the Japanese Market

Figure 36 Indian Market, By Technology: Fluorescent Technology Segment Holds Largest Share

Figure 37 Fluorescent Technology Segment to Dominate the RoA Market During the Forecast Period

Figure 38 LED, the Fastest-Growing Technology Segment of the RoW Market

Figure 39 Product Launches Were the Key Strategies Adopted By Players in the Global Market

Figure 40 Market Share Analysis, By Key Player, 2015

Figure 41 Geographic Revenue Mix of Top Market Players

Figure 42 Acuity Brands Lighting Inc.: Company Snapshot (2015)

Figure 43 Cree Inc.: Company Snapshot (2015)

Figure 44 Eaton Corporation PLC: Company Snapshot (2015)

Figure 45 General Electric Company: Company Snapshot (2015)

Figure 46 Hubbell Incorporated: Company Snapshot (2015)

Figure 47 Koninklijke Philips N.V.: Company Snapshot (2015)

Figure 48 Zumtobel Group AG: Company Snapshot (2015)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Hospital Lighting Market