Home Healthcare Software - Product & Service Market - Application (Clinical, Non - Clinical), Usage (Laptop, Smartphone), Product (Agency, Clinical Management System, Telehealth, Hospice), Delivery (Web - Based, On - Premises, Cloud), End User - Global Forecast to 2018

The global home healthcare software market is estimated to reach $6.4 billion by 2018, at a CAGR of 13.4% between 2013 and 2018. The market will be driven by skyrocketing healthcare cost, spiralling aging population that increases the incidences of chronic disorders, hospital readmission reduction program by U.S., shortage of nursing and doctors staff, OASIS documentation, and favorable government initiatives. However, rising incidences of data breach and loss of confidentiality, high maintenance and service expenses, and shortage of trained IT professionals are the factors that will hinder the market growth.

The technologies that changed the face of home healthcare software market are cloud computing, mobile health applications, telehealth, business analytical tools and integration of homecare software. The adoption of these technologies has resulted in the enhancement of quality care at home and lowered down the cost incurred in implementing homecare IT solutions.

Cloud computing mode of delivery of home healthcare software, robust adoption of smartphones, tablets, and PDA will elicit the demand of this software in coming years.

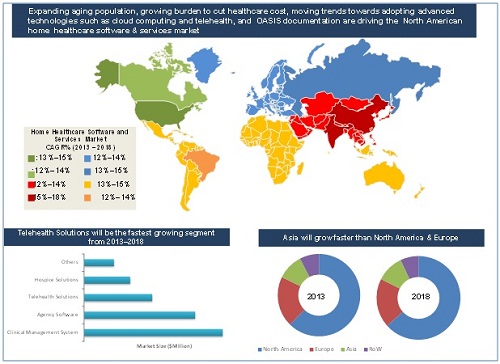

Geographic analysis reveals that North America is the largest contributor to the global home healthcare software market while Asia is expected to grow at the highest rate. Asia (China, India, and South Korea), Middle East (Saudi Arabia, Qatar), and Latin America (Brazil) are also poised to grow at double-digit CAGRs in the coming years.

The key players in the market are Agfa Healthcare (Belgium), Allscripts Healthcare Solutions, Inc. (U.S.), athenahealth, Inc. (U.S.), Cerner Corporation (U.S.), Carestream Health, Inc. (U.S.), Epic (U.S.)., GE Healthcare (U.K.), McKesson Corporation (U.S.), MEDITECH (U.S.), NextGen Healthcare Information System LLC (U.S.), Novarad Corporation (U.S.), and Siemens Healthcare (Germany).

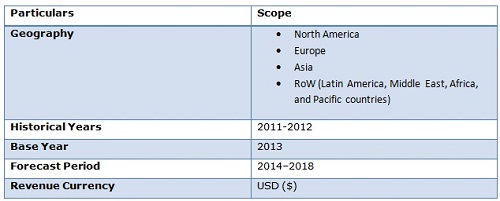

Scope of the Report

The study covers the revenue market of four major classes of global home healthcare software market - agency software, hospice solutions, clinical management systems, and telehealth solutions. Both clinical and non-clinical applications have been covered in the study.

The definition of the homecare software and services for the sake of this market study is as follows:

Home Healthcare software is IT solutions designed to provide care at home by homecare agency, hospice agency, private duty, and nursing centres among others. The key role of homecare software is to manage the vast patient clinical data and fasten the process of administrative task.

Home healthcare IT services definition includes the cost charged to the enterprises by the vendor for implementation, maintenance and post sales services, training and education, up gradation, integration, and interoperability services. Notable exclusions from IT services include consulting services, outsourcing services, and infrastructure management services.

This research report categorizes the global home healthcare software services market into the following segments:

Global Homecare Software and Services Market, by Product:

- Agency software

- Clinical Management System

- Hospice solutions

- Telehealth solutions

Global Homecare Software and Services Market, by Application:

- Clinical homecare solutions

- Non-clinical homecare solutions

Global Homecare Software and Services Market, by Usage Mode:

- Hand held mobile devices

- PC based/laptops

Global Homecare Software and Services Market, by Delivery Mode:

- Web-based

- On-premises

- Cloud-based

Global Homecare Software and Services Market, by Component:

- Software

- Service

Global Homecare Software and Services Market, by End-User:

- Homecare Agency

- Hospice Agency

- Private Duty

- Others

Homecare Software and Services Market, by Geography:

- North America

- Europe

- Asia

- Rest of the World (LATAM, Africa, Middle-East, Pacific countries)

The home healthcare software market is segmented based on products, applications, delivery modes, components, and end user. Based on products, the home healthcare market is further segmented into agency software, clinical management system, hospice solution, and telehealth solution. Of all, clinical management solutions and telehomecare will be the fastest growing markets in the given forecast period.

By application, home healthcare software market is divided into clinical and non-clinical. The clinical segment comprises of homecare-EMR, medication management, electronic point-of-care documentation, and others including physicians portal. On the other hand, the non-clinical homecare software is segmented into billing and scheduling, homecare-CRM, accounting, payroll, and others. Non-clinical applications accounted for the largest share of the global home healthcare software and services market in 2013 and clinical applications are estimated to grow at a higher CAGR from 2013 to 2018.

The three most important delivery modes considered for the study are web-based, on-premises, and cloud computing.

To understand the end-user perspective, the homecare software market is divided into homecare agency, hospice agency, private duty, and other including rehabilitation center. Homecare agency accounted for the largest share and private duty center is likely to grow at the fastest rate in the coming years.

Above all, the market study also covers the usage mode used as platforms for installing the software. The two usage modes are handheld devices, and laptop/desktop.

The global home healthcare software market is estimated to reach $6.4 billion by 2018 at a CAGR of 13.4% during the forecast period (20132018). A major factor that propels the growth of the market is the increasing demand for IT solutions that are capable of addressing numerous issues related to data storage, retrieval, and accessibility which in turn helps to reduce costs and improve the quality of care. Integrated homecare software products emerged as an effective tool to resolve the issue of medication errors, and to curtail the growing healthcare cost. Apart from this, factors such as government initiatives and various incentive plans for homecare providers, growing aging population, and high prevalence of chronic disorders across the globe will foster the adoption of homecare software. The adoption of new technologies such as mobile health, telehealth, and cloud-based model offers huge potential opportunity for growth in the homecare software market. Further, the introduction of ICD-10 conversion system will increase the demand for new software development and testing, thereby offering huge opportunities to homecare IT vendors.

The major bottlenecks for the growth of the market are growing concerns over security, interoperability issues, integration challenges, poor IT skills among staff, and weak financial support from governments in certain regions of Europe, and Asia,.

Emerging markets like China, India, Brazil, South Korea, and Saudi Arabia represent a lucrative growth opportunity for investors.

The key players in home healthcare software market are Agfa Healthcare (Belgium), Allscripts Healthcare Solutions, Inc. (U.S.), athenahealth, Inc. (U.S.), Cerner Corporation (U.S.), Carestream Health, Inc. (U.S.), Epic (U.S.)., GE Healthcare (U.K.),McKesson Corporation (U.S.), MEDITECH (U.S.), NextGen Healthcare Information System LLC (U.S.), Novarad Corporation (U.S.),and Siemens Healthcare (Germany).

Global Home Healthcare Software & Services Market Scenario

Source: Press Releases, HIMSS Analytics, HealthcareITnews , Healthcare-informatics, Electronic Journal of Health Informatics, NAHC, AHCA, HCAOA, EAA, Expert Interviews, and MarketsandMarkets Analysis

Table Of Contents

1 Introduction (Page No. - 18)

1.1 Objectives Of The Study

1.2 Report Description

1.3 Markets Covered

1.4 Stakeholders

1.5 Market Scope

1.6 Research Methodology

1.6.1 Market Size Estimation & Data Triangulation

1.6.2 Key Data From Secondary Sources

1.6.3 Key Data Points From Primary Sources

1.6.4 Assumptions

2 Executive Summary (Page No. - 30)

3 Premium Insights (Page No. - 35)

3.1 As A Sub-Segment Of Home Healthcare Market & Hcit Market

3.2 Market Snapshot

3.3 Geographic Analysis

3.4 Market Dynamics

3.5 Market, By Product

3.6 Market, By Application

3.7 Market, By Delivery Mode

4 Market Overview (Page No. - 42)

4.1 Introduction

4.2 Market Segmentation

4.3 Market Dynamics

4.3.1 Drivers

4.3.1.1 Homecare Software Adoption, A Viable Solution That Curtails Healthcare Cost

4.3.1.2 Hospital Readmission Reduction Program By The U.S. Affordable Care Act Will Increase The Need For Homecare It Solutions

4.3.1.3 Cost-Effective Outcomes While Adopting Homecare Software Will Drive The Market

4.3.1.4 Growth In Aging Population Triggers The Incidences Of Chronic Disorders That Accelerates The Demand For Homecare Solutions

4.3.1.5 Shortage Of Nursing Staff And Doctors Will Increase The Need Of Homecare Services

4.3.1.6 Government Support And Healthcare Reforms Foster The Adoption Of Homecare Software And Services

4.3.1.7 Oasis Documentation Will Drive The Demand For Electronic Point-Of-Care Documentation Among Homecare Providers

4.3.2 Restraints

4.3.2.1 Security Concerns And Rising Incidences Of Data Breach & Loss Of Confidentiality Will Restrain The Market Growth

4.3.2.2 High Maintenance And Service Expenses Will Hinder The Market

4.3.3 Opportunities

4.3.3.1 Apac Countries Offer Huge Potential For The Homecare Systems Market

4.3.3.2 Cloud Computing Mode Of Delivery, An Opportunity For Homecare Market

4.3.3.3 The Shifting Trend Towards Telehealth Technology Will Be An Opportunity For The Homecare Market

4.3.3.4 Growing Adoption Of Smart Phones, Tablets & Pda Will Increase The Adoption Of Homecare Software

4.3.3.5 Icd-10 Conversion System Will Increase The Demand For Software Development And Testing

4.3.4 Challenges

4.3.4.1 Fragmented Nature Of The Home Healthcare Software Market

4.3.4.2 Inadequate Technical & On-Site Support

4.4 Winning Imperative

4.4.1 Investment In Technology Will Enable Vendors & Homecare Agencies To Gain Competitive Advantage

4.5 Burning Issue

4.5.1 Obama 2015 Budget Proposal That Cuts Reimbursement Value Of Medicare And Medicaid

4.6 Porters Five Force Analysis

4.6.1 Threat From New Entrants

4.6.2 Threat From Substitutes

4.6.3 Degree Of Competition

4.6.4 Bargaining Power Of Suppliers

4.6.5 Bargaining Power Of Buyers

4.7 Major Player Analysis

4.7.1 Mckesson: Extensive Product Portfolio

4.7.2 Thornberry: Pioneer Player That Received Cchit Certification For Ndoc V.12.11 (Homecare Ehr)

4.7.3 Kinnser Software: Web-Based Homecare & Hospice Solutions

4.7.4 Hearst Corporation: Entered Homecare Market By Acquiring Homecare Homebase

4.7.5 Cerner Corporation: Strategic Alliance With Beyondnow Technology & Resource System

5 By Product Type (Page No. - 64)

5.1 Introduction

5.2 Agency Homecare Software

5.3 Hospice Solutions

5.4 Telehealth Solutions

5.5 Clinical Management Systems

5.6 Others (Medical Equipment, Infusion & Supply Chain Software)

6 By Application (Page No. - 79)

6.1 Introduction

6.2 Non-Clinical Home Healthcare Software & Services

6.2.1 Billing, Invoicing & Scheduling

6.2.2 Homecare Accounting System

6.2.3 Personnel Management System & Payroll

6.2.4 Homecare Crm

6.2.5 Other Non-Clinical Applications (Ledger Solutions, Financial Reporting, Timetrak, Employee Portal, Workflow Audit & Resource Center)

6.3 Clinical Home Healthcare Software & Services Market

6.3.1 Introduction

6.3.2 Electronic Point-Of-Care Documentation

6.3.3 Homecare Ehr

6.3.4 Medication Management

6.3.5 Other Clinical Applications (Alert Management Modules, Physician Portal & Electronic Digital Signature)

7 By Mode Of Usage (Page No. - 101)

7.1 Introduction

7.2 Pc/Laptop

7.3 Handheld Device/Smartphone

8 By Delivery Mode (Page No. - 109)

8.1 Introduction

8.2 Web-Based Home Healthcare Software & Services

8.3 On-Premise Home Healthcare Software & Services

8.4 Cloud-Based Home Healthcare Software & Services

9 By Component (Page No. - 121)

9.1 Introduction

9.2 Software

9.3 Services

10 By End User (Page No. - 129)

10.1 Introduction

10.2 Homecare Agencies

10.3 Hospice Care

10.4 Private Duty Agencies

10.5 Rehabilation Centers/Therapy Centers

11 Geographic Analysis (Page No. - 140)

11.1 Introduction

11.2 North America

11.3 Europe

11.4 Asia

11.5 Rest Of The World (Row)

12 Competitive Landscape (Page No. - 183)

12.1 Introduction

12.2 New Product Launches & Product Modifications

12.3 Agreements, Partnerships & Collaborations

12.4 Mergers & Acquisitions

12.5 Divestiture

13 Company Profiles (Page No. - 192)

13.1 Allscripts Healthcare Solutions, Inc.

13.2 Cerner Corporation

13.3 Continulink Llc

13.4 Delta Health Technologies

13.5 Hearst Corporation

13.6 Healthmedx

13.7 Kinnser Software, Inc.

13.8 Mckesson Corporation

13.9 Medical Information Technology, Inc. (Meditech)

13.10 Thornberry Limited

*Details On Business Overview, Products & Services, Financials, Strategy, & Recent Developments Might Not Be Captured In Case Of Unlisted Companies.

List Of Tables (81 Tables)

Table 1 Home Healthcare Software Market, By Geography, 20112018 ($Million)

Table 2 Global Market, By Product, 20112018 ($Million)

Table 3 Market, By Geography, 20112018 ($Million)

Table 4 Agency Homecare Software Market, By Geography, 20112018 ($Million)

Table 5 Hospice Solutions Market, By Geography, 20112018 ($Million)

Table 6 Telehealth Solutions Market, By Geography, 20112018 ($Million)

Table 7 Clinical Management Systems Market, By Geography, 20112018 ($Million)

Table 8 Other Products Market, By Geography, 20112018 ($Million)

Table 9 Global Homecare Software Services Market, By Application, 20112018 ($Million)

Table 10 Global Non-Clinical Home Healthcare Software Services Market, By Application, 20112018 ($Million)

Table 11 Non-Clinical Home Healthcare Software Market, By Geography, 20112018 ($Million)

Table 12 Billing, Invoicing & Scheduling Homecare Software Market, By Geography, 20112018 ($Million)

Table 13 Accounting System: Home Healthcare Software & Services Market, By Geography, 20112018 ($Million)

Table 14 Human Resource/Payroll: Homecare Software & Services Market, By Geography, 20112018 ($Million)

Table 15 Homecare Crm Homecare Software & Services Market, By Geography, 20112018 ($Million)

Table 16 Other Non-Clinical Applications Homecare Software & Services Market, By Geography, 20112018 ($Million)

Table 17 Global Clinical Home Healthcare Software & Services Market, By Application, 20112018 ($Million)

Table 18 Clinical Home Healthcare Software & Services Market, By Geography, 20112018 ($Million)

Table 19 Electronic Poc Documentation Homecare Software & Services Market, By Geography, 20112018 ($Million)

Table 20 Homecare Ehr Home Healthcare Software & Services Market, By Geography, 20112018 ($Million)

Table 21 Medication Management Homecare Software & Services Market, By Geography, 20112018 ($Million)

Table 22 Other Clinical Applications Homecare Software & Services Market, By Geography, 20112018 ($Million)

Table 23 Global Homecare Software & Services Market, By Mode Of Usage, 20112018 ($Million)

Table 24 Pc/Laptop Homecare Software & Services Market, By Geography, 20112018 ($Million)

Table 25 Hand Held Devices Homecare Software & Services Market, By Geography, 20112018 ($Million)

Table 26 Global Homecare Software & Services Market, By Delivery Mode, 20112018 ($Million)

Table 27 Home Healthcare Software Market, By Geography, 20112018 ($Million)

Table 28 Web-Based Home Healthcare Software & Services Market,By Geography, 20112018($Million)

Table 29 On-Premise Homecare Software & Services Market, By Geography, 20112018 ($Million)

Table 30 Cloud-Based Home Healthcare Software & Services Market, By Geography, 20112018 ($Million)

Table 31 Global Homecare Software & Services Market, By Component, 20112018 ($Million)

Table 32 Homecare Software Market, By Geography, 20112018 ($Million)

Table 33 Home Healthcare Services Market, By Geography, 20112018 ($Million)

Table 34 Global Home Healthcare Software Market, By End User, 20112018 ($Million)

Table 35 Market For Homecare Agencies, By Geography, 20112018 ($Million)

Table 36 Market For Hospice Care, By Geography, 20112018 ($Million)

Table 37 Market For Private Duty Agencies, By Geography, 20112018 ($Million)

Table 38 Market For Rehabilatation Centers, By Geography, 20112018 ($Million)

Table 39 Homecare Software & Services Market, By Geography, 20112018 ($Million)

Table 40 North America: Market, By Product, 20112018 ($Million)

Table 41 North America: Market, By Application, 20112018 ($Million)

Table 42 North America: Non-Clinical Home Healthcare Software & Services Market, By Application, 20112018 ($Million)

Table 43 North America: Clinical Home Healthcare Software & Services Market, By Application, 20112018 ($Million)

Table 44 North America : Market, By Mode Of Usage , 20112018 ($Million)

Table 45 North America: Market, By Delivery Mode, 20112018 ($Million)

Table 46 North America: Market, By Component, 20112018 ($Million)

Table 47 North America: Market, By End User, 20112018 ($Million)

Table 48 Europe: Market, By Product, 20112018 ($Million)

Table 49 Europe: Market, By Application, 20112018 ($Million)

Table 50 Europe: Non-Clinical Home Healthcare Software & Services Market, By Application, 20112018 ($Million)

Table 51 Europe: Clinical Home Healthcare Software & Services Market, By Application, 20112018 ($Million)

Table 52 Europe: Market, By Usage Mode, 20112018 ($Million)

Table 53 Europe: Market, By Delivery Mode, 20112018 ($Million)

Table 54 Europe:Market, By Component, 20112018 ($Million)

Table 55 Europe: Market, By End User, 20112018 ($Million)

Table 56 Asia: Market, By Product, 20112018 ($Million)

Table 57 Asia: Market, By Application, 20112018 ($Million)

Table 58 Asia: Non-Clinical Home Healthcare Software & Services Market, By Application, 2011-2018 ($Million)

Table 59 Asia: Clinical Home Healthcare Software & Services Market, By Application, 20112018($Million)

Table 60 Asia: Market, By Usage Mode, 20112018 ($Million)

Table 61 Asia: Market, By Delivery Mode, 20112018 ($Million)

Table 62 Asia: Market, By Component, 20112018 ($Million)

Table 63 Asia: Market, By End User, 20112018 ($Million)

Table 64 Row: Market, By Product, 20112018 ($Million)

Table 65 Row: Market, By Usage Mode, 20112018 ($Million)

Table 66 Row: Market, By Delivery Mode, 20112018 ($Million)

Table 67 Row: Market, By Application, 20112018 ($Million)

Table 68 Row: Non-Clinical Home Healthcare Software & Services Market, By Application, 2011-2018 ($Million)

Table 69 Row: Clinical Home Healthcare Software & Services Market, By Application, 20112018($Million)

Table 70 Row: Market, By Component, 20112018 ($Million)

Table 71 Row: Market, By End User, 20112018 ($Million)

Table 72 New Product Launches & Product Modifications, 20112014

Table 73 Agreements, Partnerships & Collaborations, 20112014

Table 74 Mergers & Acquisitions, 20112014

Table 75 Divestiture, 20112014

Table 76 Allscripts: Total Revenue And R&D Expenses, 20102012 ($Million)

Table 77 Allscripts: Total Revenue, By Segment, 20102012 ($Million)

Table 78 Cerner Corporation: Total Revenue And R&D Expenses 20112013 ($Million)

Table 79 Cerner Corporation: Total Revenue, By Segment, 20112013 ($Million)

Table 80 Mckesson Corporation: Total Revenue And R&D Expenses 20102012 ($Million)

Table 81 Mckesson: Total Revenue, By Segment, 20102012 ($Billion)

List Of Figures (33 Figures)

Figure 1 Market Crackdown & Data Triangulation For

Figure 2 Market Forecasting Model

Figure 3 Global Market, By Product, 2013 ($Million)

Figure 4 Global Market, Clinical Vs. Non-Clinical Application, 2013 ($Million)

Figure 5 Market As A Sub-Segment Of Home Healthcare Market & Hcit Market, 2013 (%)

Figure 6 Global Market Snapshot, 2013 ($Million)

Figure 7 Market, Geographic Analysis, By Product, 2013 ($Million)

Figure 8 Market Dynamics

Figure 9 Global Market, By Product, 2013 Vs. 2018 ($Million)

Figure 10 Opportunity Matrix: By Application, 2013

Figure 11 Global Market, By Delivery Mode, 2013 Vs. 2018 ($Million)

Figure 12 Market Ecosystem

Figure 13 Global Homecare Software Market Segmentation

Figure 14 Market: Porters Five Force Analysis

Figure 15 Geographic Reach Vs Product Portfolio, By Key Player (2013)

Figure 16 Market, By Product, 2013 Vs. 2018 ($Million)

Figure 17 Global Market, By Application, 20112018 ($Million)

Figure 18 Global Non-Clinical Home Healthcare Software & Services Market, By Application, 20112018 ($Million)

Figure 19 Global Clinical Home Healthcare Software & Services Market, By Application, 20112018 ($Million)

Figure 20 Global Market, By Mode Of Usage, 2013 Vs 2018

Figure 21 Global Market, By Delivery Mode, 2013 Vs. 2018

Figure 22 Global Market, By Component, 2013 Vs. 2018

Figure 23 Global Market, By End User, 2013 Vs. 2018

Figure 24 Opportunity Matrix: Homecare Software & Services Market, By Geography

Figure 25 Opportunity Matrix: North America Homecare Software Market, By Application, 2013

Figure 26 Opportunity Matrix: Europe Homecare Software Market, By Application, 2013

Figure 27 Opportunity Matrix: Europe Homecare Software Market, By Application, 2013

Figure 28 Opportunity Matrix: Europe Homecare Software Market, By Application , 2013

Figure 29 Key Growth Strategies, 20112014

Figure 30 Allscripts Overview

Figure 31 Cerner Corporation Overview

Figure 32 Mckesson Corporation Overview

Figure 33 Meditech Overview

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Home Healthcare Software - Product & Service Market