Home Energy Management System Market by Hardware (Control Device, Display/ Communication Device), by Communication Technology (Z-Wave, ZigBee, Wi-Fi) and by Software & Service (Behavioral, Proactive) - Global Forecast to 2029

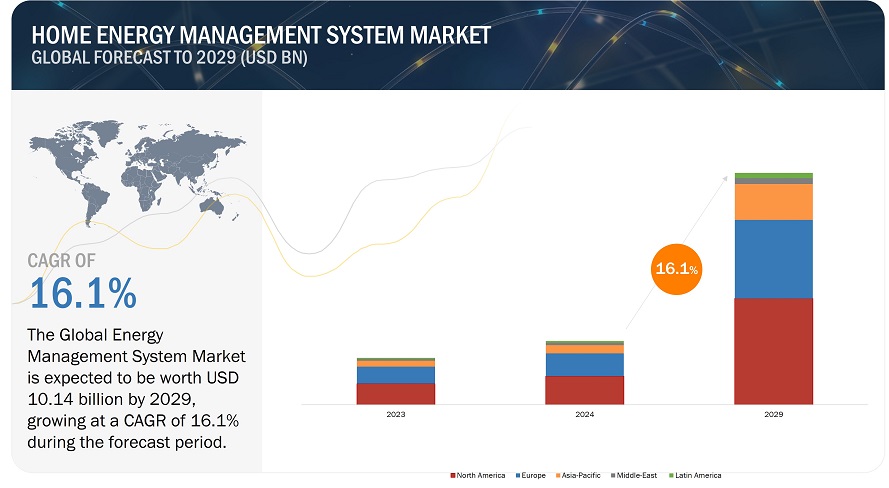

The global home energy management system market is projected to reach USD 10.14 billion by 2029 from USD 4.81 billion in 2024, growing at a CAGR of 16.1%. Demand for Home Energy Management Systems is growing. This is due to the rising energy costs, energy efficiency concerns, and increased environmental awareness. Modern homeowners are concerned with lowering their carbon footprint and minimizing utility bills, and HEMS offer the technology to monitor, control, and optimize energy use in real-time. With the integration of smart technologies like IoT-enabled devices and advanced analytics, it allows consumers to trace energy consumption patterns, recognize inefficiencies, and take appropriate corrective measures to save on costs and create a sustainable lifestyle.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Real time energy conservation approach to fuel the growth

Increased use of Home Energy Management Systems is driven by the adoption of real-time energy consumption. They provide consumers with the ability to view their usage and optimize in real time, thus making energy use efficient with resultant savings in power consumption. Using smart technologies such as IoT sensors, smart meters, and AI-based analytics, HEMS offers the end user an understanding of his consumption pattern, highlighting inefficiencies and suggesting on-the-spot improvement.

For example, instant data will help homeowners know their appliance draining energy and automatically operate them during off-peak hours, saving electricity. In return, HEMS can regulate home heating, cooling, lighting systems dynamically based on when there are people at the location and weather; ensure comfort and minimize waste. Users with capabilities of getting instant feedbacks are in a position to know exactly what to do so energy conservation can be affected now. Moreover, for homes with renewable energy systems such as solar panels, real-time energy management becomes essential to synchronize energy production with storage and consumption. This optimizes the use of clean energy and minimizes dependency on the grid. The more energy prices increase, the more concern there is about sustainability, and real-time energy conservation through HEMS is proving to be the practical and attractive solution for not only the environmentally conscious consumers but also for cost-sensitive households.

Restraint: Additional costs for supplementary tools and services impacts the adoption

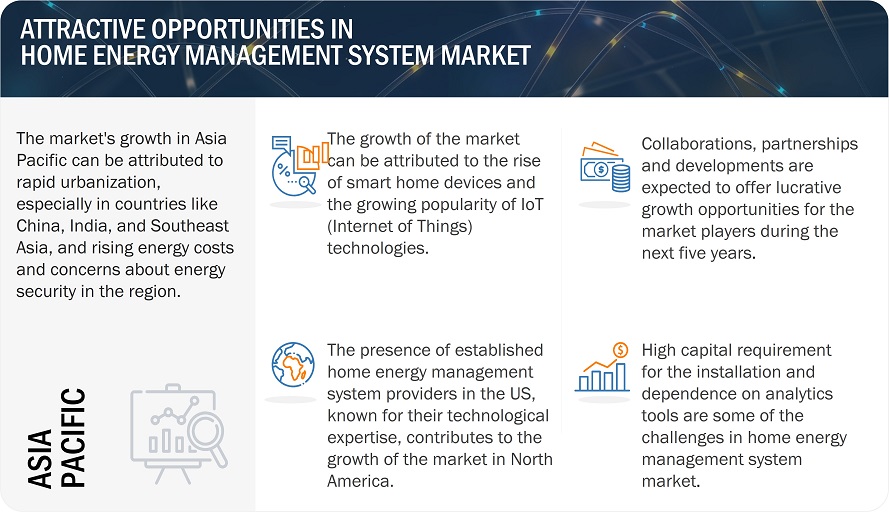

The adoption of HEMS is often restrained by the additional costs of supplementary tools and services that are usually required for the effective operation of such systems. Even though the core system itself might be affordable, the supplementary smart devices compatible with this system, advanced sensors, and sometimes even necessary upgrades can greatly increase the overall investment. For example, integrating HEMS with smart thermostats, lighting controls, or appliances enabled with IoT does require purchasing those devices and thus may not be economically possible for a cost-conscious homeowner.

Additionally, installation and setup charges are another source of cost burden. Many HEMS must be professionally installed, especially if the systems are combined with renewable sources such as solar panels or battery storage. Such services often come with expert know-how and, therefore, further inflate the front-end cost. Maintenance and software subscription costs for continuing updates, cloud storage, and data analytics contribute to ongoing costs and keep the application from spreading far.

Moreover, the advanced nature of some systems may require technical support or training, which can be troublesome or costly for users unacquainted with smart technologies. In regions having less developed infrastructure or having lower disposable income, supplementary costs are a major source of restraint. Overcoming such financial constraints through subsidies, bundle solutions, or simplified technology is essential to overcome such restraint and promote wider HEMS adoption.

Opportunity: Emerging growth of smart home industry to boost the demand

The emerging growth of the smart home industry provides an opportunity for adopting HEMS. Increasing popularity and integration of connected devices with automated technologies in the smart home environment create an opportunity and a need for a central management platform to handle the related energy consumption. HEMS form the backbone of this ecosystem, ensuring that energy usage is optimally controlled and optimized across multiple smart devices, such as lighting, heating, cooling, and appliances.

One of the important drivers is growing consumer desire for convenience and sustainability. Smart home technologies, which include IoT-enabled appliances and smart meters, produce an enormous amount of real-time data that HEMS can make use of in optimizing consumption patterns. For instance, integration of HEMS with smart thermostats may automatically adjust temperature levels according to occupancy and weather conditions to provide comfort along with efficient use of energy. Another factor is that the global shift towards renewable energy adoption and energy efficiency standards is compatible with the HEMS's features. Smart homes equipped with solar panels or battery storage have an energy management system to optimize production, storage, and usage, hence relying less on the grid. With this ever-growing smart home market, the HEMS service providers will be able to innovate and seize a larger market share of this dynamic consumer base.

Challenge: Large dependence on analytics software

One significant challenge for HEMS is its high dependence on advance analytics software, which is vital for processing energy consumption data and interpreting it. Even though analytics-driven insights drive the most optimal energy use levels, such dependence comes with several challenges that can limit the adoption of HEMS. Advanced analytics software does need high computation capabilities and usually operates in cloud, so high speed and stable internet is a needed in regions that have limited internet facilities or unreliable internet connection.

The other challenge is that developing, maintaining, and up-gradation of such analytics software is expensive. Thus, all these costs reach the consumers in the form of subscription fees or high upfront prices for HEMS, that limits accessibility to more price-sensitive consumers. Additionally, users need at least a minimal amount of technical knowledge to effectively apply analytical software. Sophisticated, data-intense interfaces or interactive dashboards can easily be detrimental to consumers. In that case, analytics solutions should improve in access, user-friendliness, and privacy in order to enjoy wider use and confidence toward HEMS.

Based on hardware, control device segment is expected to dominate throughout forecast period

The control device segment accounts for the largest market share in the HEMS. Its critical role in enabling of real-time monitoring, automation, and energy use optimization makes the market grow. Control devices - that include smart thermostats, smart plugs, lighting controllers, and energy hubs-sustain as the central interface that serves between the user and the energy management system. These devices are able to provide energy consumption patterns that the homeowner is able to dynamically change on their own. They are able to integrate numerous connected appliances within one cohesive, automated ecosystem.

The major driving factor for this segment's dominance is the increasing demand for energy-efficient and user-friendly solutions. For example, smart thermostats can automatically optimize heating and cooling according to occupants and weather conditions, potentially reducing much energy wastage. The support of smart home technologies, IoT integration, further enhances the importance of control devices, which form the backbone of interconnected energy management systems. Further, AI and machine learning can now offer predictive energy usage insights from these devices, thereby further boosting their utility and adoption. As energy efficiency and automation gain priority, the control device segment is expected to dominate HEMS market.

Based on the communication technology, Wi-Fi segment to to dominate throughout forecast period

The Wi-Fi segment is expected to capture the HEMS market due to widespread availability, compatibility, and seamless connectivity with smart home devices. Technology that constitutes the backbone for most HEMS provides efficient communication among control devices, sensors, and the energy management platforms. Its dominance arises from the pervasiveness of Wi-Fi networks in households, which saves the cost and hassle of creating additional infrastructure, and it is thereby a more affordable and accessible option for homeowners.

Wi-Fi has several advantages such as high-speed data transfer and long range distance. This feature ensures the real-time monitoring and control of the energy consumption by multiple devices. This feature is greatly required in smart homes where varied IoT-enabled devices need to communicate with the central HEMS to optimize energy use. Wi-Fi is suitable to support advanced features such as predictive analytics and remote control through mobile apps because it can handle a large amount of data. Besides, the existence of dual-band and tri-band routers further increases Wi-Fi networks' reliability and scalability. That is the more number of devices could be joined without drastic performance loss. As consumers need convenience and real-time control, the robustness and flexibility of Wi-Fi connectivity ensure it as a dominant part of the HEMS market.

Based on region, Asia Pacific is expected to grow fastest during the forecasted period

The Asia-Pacific region is expected to be the growing fastest in HEMS market growth in several reasons. With increased urbanization and rising middle classes in countries like China, India, and many countries in Southeast Asia, people are demanding energy efficiency. As more customers take adopt smart home technology in those regions, energy management systems that can monitor and regulate energy usage become imperative.

Moreover, the policies and initiatives made by the government in the APAC region toward energy efficiency and sustainability have been accelerating the adoption of HEMS. Japan, South Korea, and China are investing heavily in green technology. They offer incentives and even set stringent energy efficiency standards that make it easier for renewable sources such as solar panels with battery storage to integrate HEMS.

The region is witnessing a rising focus on smart cities and IoT-enabled infrastructure. APAC countries will further enhance the prospects of HEMS, especially with the growing scalability of smart city projects and prospective smart grid systems. Further, high energy consumption and increasing electricity tariffs in emerging economies have become rising concerns among consumers to develop smart and cost-effective methods of managing energy consumption, making the APAC region a hub for high growth of HEMS in the next yearspractices has furthered its hold on industrial 3D printing. These factors are fueling the growth in the region.

Key Market Players

The home energy management systems market is dominated by a few globally established players, such as Honeywell International Inc. (US), Nest Labs Inc. (US), Vivint, Inc. (US), General Electric Company (US), Ecobee Inc (Canada), Alarm.com (US), Comcast Cable (US), Panasonic Corporation (Japan), Ecofactor Inc. (US), Energyhub Inc. (US).

Recent Developments

- In August 2024, Huawei Digital Power has unveiled its innovative Smart Home Energy solution, marking a key milestone in the company’s dedication to supporting the country’s transition to a sustainable and energy-efficient future.

- In January 2023, General Electric Company and Ecobee, Inc. have announced that their full range of Wi-Fi and cellular-enabled home standby generators is set to seamlessly integrate with the latest ecobee smart thermostats. This integration is designed to create a unified energy management hub within homes

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.4 Currency

1.5 Limitation

1.6 Stakeholders

2 Research Design (Page No. - 15)

2.1 Market Size Estimation

2.1.1 Bottom-Up Approach

2.1.2 Top-Down Approach

2.2 Market Breakdown and Data Trangulation

2.3 Market Share Estimation

2.3.1 Key Data From Secondary Sources

2.3.2 Key Data From Primary Sources

2.4 Assumptions

3 Executive Summary (Page No. - 22)

4 Premium Insights (Page No. - 26)

4.1 Opportunities in the HEMS Market

4.2 Home Energy Management System Market—Top Control Devices

4.3 The Market Based on Communication Technology and Geography

4.4 North America Dominated the HEMS Market in 2015

4.5 Global HEMS Market Size Based on Software & Services (2015, 2016, and 2022)

5 Market Overview (Page No. - 29)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Home Energy Management System Market, By Hardware

5.2.2 Market, By Communication Technology

5.2.3 HEMS Market, By Software/ Service

5.2.4 Home Energy Management System Market, By Geography

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Real-Time Energy Conservation Approach

5.3.1.2 Convenience of Cloud Computing and Data Analytics

5.3.1.3 Increased Device Interconnectivity

5.3.2 Restraints

5.3.2.1 Additional Costs for Supplementary Tools and Services

5.3.2.2 Supply-Side of HEMS Ecosystem Affected Due to Low Implementation Rate in APAC

5.3.3 Opportunities

5.3.3.1 Emerging Growth of Smart Home Industry

5.3.4 Challenges

5.3.4.1 Large Dependance on Analytics Software

5.3.4.2 Need for Constant Monitoring

6 Industry Trends (Page No. - 37)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 Market, By Hardware (Page No. - 44)

7.1 Introduction

7.2 Control Device

7.2.1 Lighting Controller

7.2.2 Sensor

7.2.3 Smart Meter

7.2.4 Smart Plug/ Strip

7.2.5 Thermostat

7.3 Display/ Communication Device

8 Market, By Communication Technology (Page No. - 57)

8.1 Introduction

8.2 Z-Wave

8.3 Zigbee

8.4 Wi-Fi

8.5 Other Communication Technologies

9 Market, By Software & Service (Page No. - 64)

9.1 Introduction

9.2 Behavioral

9.3 Proactive

10 Market, By Geography (Page No. - 70)

10.1 Introduction

10.2 North America

10.3 Europe

10.4 APAC

10.5 Rest of the World (RoW)

11 Competitive Landscape (Page No. - 93)

11.1 Overview

11.2 Market Share Analysis, HEMS System Market

11.3 Competitive Situation and Trends

11.3.1 New Product Launches

11.3.2 Contracts, Collaborations, and Agreements

11.3.3 Mergers and Acquisitions

12 Company Profiles (Page No. - 99)

(Overview, Products & Services, Strategies & Insights, Developments and Mnm View )*

12.1 Honeywell International, Inc.

12.2 Nest Labs, Inc.

12.3 Vivint, Inc.

12.4 General Electric Company

12.5 Ecobee, Inc.

12.6 Alarm.Com

12.7 Comcast Cable (Xfinity)

12.8 Panasonic Corporation

12.9 Ecofactor, Inc.

12.10 Energyhub, Inc.

*Details on Marketsandmarkets View, Overview, Products & Services, Financials and Strategy & Analyst Insights Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 124)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Introducing RT: Real Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

List of Tables (73 Tables)

Table 1 Global Home Energy Management System Market Size, By Hardware, 2014–2022 (USD Million)

Table 2 HEMS Market Size, By Software and Service, 2014–2022 (USD Million)

Table 3 North America: HEMS Market Size, By Hardware, 2014–2022 (USD Million)

Table 4 Driver Analysis

Table 5 Restraint Analysis

Table 6 Home Energy Management System Market Size, By Hardware, 2014–2022 (USD Million)

Table 7 Home Energy Management System Market Size for Hardware, By Region, 2014–2022 (USD Million)

Table 8 Market Size for Hardware, By Control Device, 2014–2022 (USD Million)

Table 9 Home Energy Management System Market Size for Control Devices, By Region, 2014–2022 (USD Million)

Table 10 HEMS Market Size for Hardware, By Control Device, 2014–2022 (Thousand Units)

Table 11 Home Energy Management System Market Size for Lighting Controllers, By Region, 2014–2022 (USD Million)

Table 12 HEMS Market Size for Sensors, By Region, 2014–2022 (USD Million)

Table 13 Market Size for Smart Meters, By Region, 2014–2022 (USD Million)

Table 14 Home Energy Management System Market for Smart Plugs/ Strips, By Region, 2014–2022 (USD Million)

Table 15 Home Energy Management System Market Size for Thermostats, By Region, 2014–2022 (USD Million)

Table 16 HEMS Market for Hardware , By Display/ Communication Device, 2014–2022 (USD Million)

Table 17 Market Size for Display/ Communication Devices, By Region, 2014–2022 (USD Million)

Table 18 Home Energy Management System Market Size for Monitoring/ Display Systems, By Region, 2014–2022 (USD Million)

Table 19 HEMS Market Size for Communication Devices, By Region, 2014–2022 (USD Million)

Table 20 Market Size, By Communication Technology, 2014–2022 (USD Million)

Table 21 Home Energy Management System Market Size for Communication Technology, By Region, 2014-2022 (USD Million)

Table 22 HEMS Market Size for Z-Wave, By Region, 2014–2022 (USD Million)

Table 23 Market Size for Zigbee, By Region, 2014–2022 (USD Million)

Table 24 HEMS Market for Wi-Fi, By Region, 2014–2022 (USD Million)

Table 25 HEMS Market for Other Communication Technologies, By Region, 2014–2022 (USD Million)

Table 26 Home Energy Management System Market Size, By Software & Service, 2014–2022 (USD Million)

Table 27 Home Energy Management System Market for Software & Services, By Region, 2014–2022 (USD Million)

Table 28 HEMS Market Size for Behavioral, By Region, 2014–2022 (USD Million)

Table 29 Market Size for Proactive, By Region, 2014–2022 (USD Million)

Table 30 Home Energy Management System Market Size, By Region, 2014–2022 (USD Million)

Table 31 North America: Home Energy Management System Market Size, By Country, 2014–2022 (USD Million)

Table 32 North America : HEMS Market Size, By Segment, 2014–2022 (USD Million)

Table 33 North America: Market Size, By Hardware, 2014–2022 (USD Million)

Table 34 North America: HEMS Market Size, By Control Device, 2014–2022 (USD Million)

Table 35 North America: Home Energy Management System Market Size, By Display/ Communication Device, 2014–2022 (USD Million)

Table 36 North America: HEMS Market Size for Hardware, By Country, 2014–2022 (USD Million)

Table 37 North America: Home Energy Management System Market Size, By Communication Technology, 2014–2022 (USD Million)

Table 38 North America: Market Size for Communication Technology, By Country, 2014–2022 (USD Million)

Table 39 North America: HEMS Market Size, By Software & Service, 2014–2022 (USD Million)

Table 40 North America: HEMS Market Size for Software & Service, By Country, 2014–2022 (USD Million)

Table 41 Europe: HEMS Market Size, By Geography, 2014–2022 (USD Million)

Table 42 Europe: Home Energy Management System Market Size, By Segment, 2014–2022 (USD Million)

Table 43 Europe: Home Energy Management System Market Size, By Hardware, 2014–2022 (USD Million)

Table 44 Europe: HEMS Market Size for Hardware, By Control Device, 2014–2022 (USD Million)

Table 45 Europe: Home Energy Management System Market Size, By Display/ Communication Device, 2014–2022 (USD Million)

Table 46 Europe: Home Energy Management System Market Size for Hardware, By Geography, 2014–2022 (USD Million)

Table 47 Europe: HEMS Market Size, By Communication Technology, 2014–2022 (USD Million)

Table 48 Europe: Home Energy Management System Market Size for Communication Technology, Bygeography, 2014–2022 (USD Million)

Table 49 Europe: HEMS Market Size, By Software & Service, 2014–2022 (USD Million)

Table 50 Europe: HEMS Market Size for Software & Service, By Geography, 2014–2022 (USD Million)

Table 51 APAC: Home Energy Management System Market Size, By Geography, 2014–2022 (USD Million)

Table 52 APAC: HEMS Market Size, By Segment, 2014–2022 (USD Million)

Table 53 APAC: Home Energy Management System Market Size, By Hardware, 2014–2022 (USD Million)

Table 54 APAC: Home Energy Management System Market Size, By Control Device, 2014–2022 (USD Million)

Table 55 APAC: HEMS Market Size, By Display/ Communication Device, 2014–2022 (USD Million)

Table 56 APAC: Home Energy Management System Market Size for Hardware, By Geography, 2014–2022 (USD Million)

Table 57 APAC: Home Energy Management System Market Size, By Communication Technology, 2014–2022 (USD Million)

Table 58 APAC: HEMS Market Size for Communication Technology, By Geography, 2014–2022 (USD Million)

Table 59 APAC: Home Energy Management System Market Size, By Software & Service, 2014–2022 (USD Million)

Table 60 APAC: Home Energy Management System Market for Software & Services, By Geography, 2014–2022 (USD Million)

Table 61 RoW: HEMS Market Size, By Region, 2014–2022 (USD Million)

Table 62 RoW: HEMS Market Size, By Segment, 2014–2022 (USD Million)

Table 63 RoW: HEMS Market Size, By Hardware, 2014–2022 (USD Million)

Table 64 RoW: Home Energy Management System MarketSize, By Control Device, 2014–2022 (USD Million)

Table 65 RoW: Home Energy Management System Market Size, By Display/ Communication Device, 2014–2022 (USD Million)

Table 66 RoW: HEMS Market Size for Hardware, By Region, 2014–2022 (USD Million)

Table 67 RoW: Market Size, By Communication Technology, 2014–2022 (USD Million)

Table 68 RoW: Home Energy Management System Market Size for Communication Technology Market Size, By Region, 2014–2022 (USD Million)

Table 69 RoW: Home Energy Management System Market Size, By Software & Service, 2014–2022 (USD Million)

Table 70 RoW: HEMS Market Size for Software & Services, By Region, 2014–2022 (USD Million)

Table 71 New Product Launches, 2013-2015

Table 72 Contracts, Collaborations and Agreements, 2013-2015

Table 73 Mergers and Acquisitions, 2013-2015

List of Figures (46 Figures)

Figure 1 Market Segments

Figure 2 Years Considered for the Study

Figure 3 Home Energy Management System Market: Research Design

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Home Energy Management System Market: Data Triangulation Model

Figure 7 HEMS Market,By Communication Technology Snapshot: the Zigbee Protocol Expected to Witness A High Growth Between 2016–2022

Figure 8 Home Energy Management System Market, By Geography, Snapshot (2015 vs 2022): APAC to Witness the Highest Growth During the Forecast Period

Figure 9 Attractive Market Opportunities for the HEMS Market (2016–2022)

Figure 10 Thermostats Expected to Hold the Largest Market Share During the Forecast Period

Figure 11 Wi-Fi Held the Largest Share in the HEMS Market

Figure 12 China and Australia Expected to Grow at the Highest Rate By 2022

Figure 13 Proactive Solutions to Hold the Largest Share in the Global HEMS Market on the Basis of Software & Services

Figure 14 By Geography

Figure 15 Drivers, Restraints, Opportunities, and Challenges for the HEMS Market

Figure 16 Value Chain Analysis: Software and Service Providers to Generate Maximum Revenue in the HEMS Industry

Figure 17 Porter’s Analysis

Figure 18 Porter’s Analysis: HEMS Market

Figure 19 Threat of New Entrants

Figure 20 Threat of Substitutes

Figure 21 Bargaining Power of Suppliers

Figure 22 Bargaining Power of Buyers

Figure 23 Intensity of Competitive Rivalry

Figure 24 Home Energy Management System Market Size for Hardware, By Control Device (USD Million)

Figure 25 Home Energy Management System Market, By Communication Technology, 2015 and 2022

Figure 26 HEMS Market, By Software & Service, 2015-2022 (USD Million)

Figure 27 Geographic Snapshot of the HEMS Market (2016–2022)

Figure 28 North America: HEMS Market Snapshot

Figure 29 The U.K. Held the Largest Share of the HEMS Market in Europe, in 2015

Figure 30 APAC: Home Energy Management System Market Snapshot—China to Be the Most Lucrative Market During the Forecast Period

Figure 31 Companies Adopted New Product Launches and Mergers and Acquisitions as the Key Growth Strategies Between 2013 and 2015

Figure 32 Global Home Energy Management System Market Share, By Key Player, 2015

Figure 33 Market Evolution Framework—New Product Launches Fueled the Market Growth in 2015

Figure 34 Battle for Market Share: New Product Launches Was the Key Strategy

Figure 35 Geography Revenue Mix

Figure 36 Honeywell International, Inc.: Company Snapshot

Figure 37 Honeywell International, Inc: SWOT Analysis

Figure 38 Nest Labs, Inc.: SWOT Analysis

Figure 39 Vivint, Inc.: Company Snapshot

Figure 40 Vivint, Inc.: SWOT Analysis

Figure 41 General Electric Company: Company Snapshot

Figure 42 General Electric Company: SWOT Analysis

Figure 43 Ecobee, Inc.: SWOT Analysis

Figure 44 Alarm.Com: Company Snapshot

Figure 45 Comcast Corporation: Company Snapshot

Figure 46 Panasonic Corporation: Company Snapshot

The research methodology adopted for analyzing the Home Energy Management Systems (HEMS) market is a combination of primary and secondary research techniques, structured to provide a comprehensive and objective understanding of the market landscape. The study aims to assess the current market size, growth potential, key drivers, challenges, and trends shaping the future of the HEMS industry.

Primary research involved direct interaction with industry stakeholders through interviews, surveys, and questionnaires. These respondents included HEMS manufacturers, technology providers, energy consultants, and regulatory bodies. Their insights provided firsthand knowledge about market trends, user behavior, technological advancements, and competitive dynamics. This information was cross-verified with data gathered through secondary sources to ensure consistency and reliability.

Secondary research comprised the analysis of publicly available data from credible sources such as industry reports, whitepapers, government publications, trade journals, and company financial statements. Market data was also collected from energy agencies, smart grid initiatives, and IoT innovation reports to support the evaluation of market opportunities and threats.

To estimate and forecast the market size, a top-down and bottom-up approach was used. Segment-wise analysis was conducted by breaking down the market into hardware, software, and services, as well as communication technologies and end-user applications. Forecasting models incorporated current trends, historical data, and predictive analytics using statistical tools and software.

Lastly, a rigorous data validation and triangulation process was applied to enhance the credibility of findings. This involved comparing data from multiple sources and conducting internal reviews by market analysts. The methodology ensures that the final report delivers a data-driven and strategic perspective on the global HEMS market, providing stakeholders with actionable insights for decision-making.

Growth opportunities and latent adjacency in Home Energy Management System Market

I would like to see some examples from the document to make a purchase decision. Also interested in "Home Automation and Control Market".

I am interest to understand the HEMS market. Also, want to understand the company profiles of leading players with focus on their annual turnover?

Is there a way to get a version that is US only at a lower rate? Also want to understand what quantitate data is included?