High Speed Serial Bus Market by Type (Ethernet, Fiber channel, Fireware, SerialRapid I/O, Serial Front panel data port), & A&D Application (EO/IR, EW/Radar, CNS, cockpit displays), Application (mission computers, weapon systems, sensor systems, navigation systems, communication, and displays), Platform (Commercial and Military)and Region - Global Forecast to 2025

A high speed serial (HSS) is a type of advanced databus that helps systems including avionics and flight control systems LRU’s such as primary flight computers, aircraft control data, Autopilot director computer , flight data recorder, among others in transferring digital data between or within devices over the network. The HSS technology is used in various sectors, of which the major are the automotive and the military & civil aviation industries.

The study considered major activities to estimate the current market size for high speed serial. Exhaustive secondary research was undertaken to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments. Need for data integrity and reliability, need to reduce SwaP specification, and rise in intensive electrification commercial aviation application are driving the market

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg, BusinessWeek, as Statista, OICA, World trade, Atlas trade, Gunter’s Space Page, Boeing Outlook, Airbus Outlook, Factiva, were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognised authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

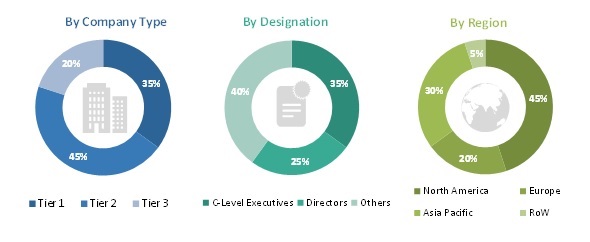

The high speed serial bus market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and integratory and regulatory organizations in its supply chain. The demand side of this market is characterized by various end-users, such as commercial organizations and military forces of different countries. The supply side is characterized by adoption of advanced high speed 1553 technology boost performance. The following is the breakdown of primary respondents that were interviewed to obtain qualitative and quantitative information about the high speed serial bus market. Following is the breakdown of primary respondents.

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the high speed serial bus Market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market were identified through secondary research and their market ranking determined through primary and secondary research. This included a study of annual and financial reports of the top market players and extensive interviews with industry experts.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

The high speed serial market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and integratory and regulatory organizations in its supply chain. The demand side of this market is characterized by various end-users, such as commercial organizations and military forces of different countries.

The supply side is characterized by technological integration & product enhancement , developing fiber channels for real time avionics applciation. The following is the breakdown of primary respondents that were interviewed to obtain qualitative and quantitative information about the high speed serial bus market.

Report Objectives

- To define, describe, segment, and forecast the size of the high speed serial bus market based on type, application , platform, A&D test application, and region

- To understand the structure of the market by identifying its various segments and subsegments

- To forecast the size of various segments of the market with respect to four major regions, namely, North America, Europe, Asia Pacific, and Rest of the World along with the major countries in each of these regions

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the high speed serial bus market

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders by identifying key market trends

- To analyze competitive developments such as contracts, acquisitions, expansions, new product launches, partnerships & agreements, and R&D activities in the market

- To provide a detailed competitive landscape of the high speed serial bus market, along with an analysis of the business and corporate strategies adopted by leading players

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2025 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2025 |

|

Forecast monetary unit |

Value (USD) |

|

Segments covered |

Type, Platform, Application, A&D test application |

|

Regions covered |

North America, Europe, Asia Pacific, Rest of the world |

|

Companies covered |

Teredyne, Inc(US), , STAR-Dundee (UK), Critical I/O, LLC (US), Abaco(US), TE connectivity(Switzerland), Pentek (US), Amphenol Corporation (US), Optical Cable Corporation (US), Data Device Corporation (US) among others. |

This research report categorizes the high speed serial bus market based type, platform, application, A&D test application, and region.

Based on Type, the high speed serial bus market has been segmented as follows:

- Ethernet

- Fiber Channel

- Firewire

- Serial Rapid I/O (SRIO)

- Serial Front Panel data port

Based on the A&D test Application, the high speed serial bus market has been segmented as follows:

- EO/IR

- EW/Radar

- Cockpit Display

- CNS (Communication, Navigation and Surveillance)

Based on the platform, the high speed serial bus market has been segmented as follows:

- Commercial

- Narrow Body Aircraft

- Wide Body Aircraft

- Very Large Aircraft

- Regional Transport Aircraft

- Military

- Fighter Aircraft

- Transport Aircraft

- Military Helicopters

Based on the region, high speed serial bus market has been segmented as follows:

- Mission Computers

- Weapon Systems

- Sensors systems

- Navigation Systems

- Communication

- Display

Based on the region, high speed serial bus market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)

RoW includes Latin America, Middle East, and Africa

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies.

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

TABLE OF CONTENTS

1 Introduction (Page No. 19)

1.1 study Objectives

1.2 Market definition and scope

1.3 Market scope

1.3.1 regional scope

1.3.2 years considered

1.4 Currency

1.5 limitations

1.6 market STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. 24)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.3 Market Definition & Scope

2.1.4 Segment Definitions

2.1.4.1 High speed serial bus market, by platform

2.1.4.2 High speed serial bus market, by aircraft component

2.1.4.3 High speed serial bus market, by type

2.1.4.4 High speed serial bus market, by application

2.2 Research approach & Methodology

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Impact of COVID-19 on the high speed serial market

2.2.1.2 Regional high speed serial bus market

2.2.1.3 High speed serial bus market for aircraft component segment

2.2.1.4 High speed serial bus market for type

2.2.1.5 High speed serial bus market for platform

2.2.2 TOP-DOWN APPROACH

2.2.3 Pricing Analysis

2.3 triangulation & validation

2.3.1 TRIANGULATION through secondary

2.3.2 TRIANGULATION THROUGH primaries

2.4 RESEARCH ASSUMPTIONS

2.4.1 Market Sizing

2.4.2 MARKET Forecasting

2.5 Risks

2.5.1 Limitations/Grey areas

2.5.1.1 Pricing

2.5.1.2 Market size & CAGR

3 executive summary (Page No. 35)

4 market overview (Page No. 38)

4.1 INTRODUCTION

4.2 MARKET DYNAMICS

4.2.1 DRIVERS

4.2.1.1 Need to reduce SWaP specifications

4.2.1.2 Rise in passenger movement leading to increase in orders for commercial aircraft

4.2.1.3 Need for data integrity and reliability

4.2.1.4 Rise in usage of high speed serial bus for next-generation military aircraft

4.2.1.5 Increasing adoption of Controller Area Network (CAN) dat bus in commercial aircraft

4.2.1.6 Intensive electrification commercial aviation, and marine industries

4.2.2 restraints

4.2.2.1 Defense budget reductions in advanced economies

4.2.2.2 Product life-cycle

4.2.3 challenges

4.2.3.1 Delay in the protocol certification process

4.2.3.2 Design challenges in high speed serial bus

4.2.3.3 Significant R&D investments for technological advancements in defense operations

4.2.4 Opportunities

4.2.4.1 Replacement of high speed parallel bus with high speed serial bus

4.2.4.2 Rise in the adoption of glass cockpits in next-generation aircraft

5 Industry trends (Page No. 49)

5.1 Introduction

5.2 SUPPLY CHAIN ANALYSIS

5.3 VALUE CHAIN ANALYSIS

5.4 STRATEGIC BENCHMARKING

5.4.1 TECHNOLOGICAL INTEGRATION & PRODUCT ENHANCEMENT

5.4.2 developing Fiber Channels for real-time avionics applications

5.4.3 Peripheral Component Interconnect express (PCI-e)

5.4.4 The fiber-optic high speed HSS bus for a new generation of military aircraft

5.4.5 adoption of advanced High Speed 1553 Technology Advances Boost Performance

5.4.6 advancements in high speed converter technology enables next-generation wireless communication system dfor eesign

5.4.7 Adoption of SpaceWire standard in spacecraft

5.4.8 The fiber-optic high speed HSS bus for next-generation military aircraft

5.4.9 ethernet

5.4.10 flexray as an emerging automotive protocol

5.4.10.1 Safety critical AFDX

5.4.10.2 Adoption of high-performance MIL-STD

6 high speed serial communication buses, by type (Page No. 58)

6.1 INTRODUCTION

6.2 impact of covid19 in high speed serial bus

6.2.1 ethernet

6.2.2 fIBeR CHANNEL

6.2.3 FIreWIRE (1394)

6.2.4 Serial rapid i/o (sRio)

6.2.5 Serial FRONT PANEL DATA PORT (sfpdp)

7 high speed serial bus , by a&d applications (For TEST) (Page No. 63)

7.1 INTRODUCTION

7.1.1 eo/ir

7.1.2 ew/radar

7.1.3 COCKPIT DISPLAY

7.1.4 cns (COMMUNICATION, NAVIGATION, and surveillance)

8 high speed databus market, by platform (Page No. 67)

8.1 Introduction

8.2 impact of covid-19 on platforms of high speed serial bus

8.2.1 most impacted platform segment

8.2.1.1 Commercial aviation

8.2.1.2 Business and general aviation

8.2.2 least impacted platform segment

8.2.2.1 Military aviation

8.2.2.2 .commercial aviation

8.2.3 narrow body aircraft (nba)

8.2.3.1 Advancements in hydraulic and pneumatic aircraft systems are driving the demand for narrow body aircraft

8.2.4 wide body aircraft (wba)

8.2.4.1 Post COVID-19 increase in passenger travel is expected to raise the demand for wide body aircraft

8.2.5 very large aircraft (VLA)

8.2.5.1 Demand for fuel-efficient aircraft drives the very large aircraft market

8.2.6 regional transport aircraft (rta)

8.2.6.1 Increase in the use of fly-by-wire technology fueling the demand for regional transport aircraft worldwide

8.3 military aircraft

8.3.1 fighter jets

8.3.1.1 Increasing Procurement of Fighter Jets Due to Rising Military Budgets

8.3.2 TRANSPORT AIRCRAFT

8.3.2.1 Increasing use of Transport Aircraft in Military Operations

8.3.3 Military helicopters

8.3.3.1 Combat helicopters comprise specialized attack and multi-purpose attack helicopters

9 high speed serial market, BY application (Page No. 76)

9.1 INTRODUCTION

9.1.1 mission computers

9.1.2 weapon systems

9.1.3 sensor systems

9.1.4 navigation systems

9.1.5 COMMS (ICS, RADIO, IFF)

9.1.6 display

10 Regional analysis (Page No. 82)

10.1 introduction

10.2 North America

10.2.1 US

10.2.2 canada

10.3 Europe

10.3.1 UK

10.3.2 russia

10.3.3 GERMANY

10.3.4 norway

10.3.5 sWEDEN

10.3.6 france

10.3.7 italy

10.3.8 rEST OF EUROPE

10.4 asia pacific

10.4.1 china

10.4.2 india

10.4.3 japan

10.4.4 singapore

10.4.5 south korea

10.4.6 rest of asia pacific

10.5 rest of the world (Row)

10.5.1 middle east

10.5.2 africa

10.5.3 latin america

11 company profiles (Page No. 125)

11.1 Introduction

11.2 market shARE of key players, 2020

11.3 TERADYNE, INC

11.3.1 business Overview

11.3.2 products/solutions offered

11.3.3 Unique VALUE PROPOSITION AND Right TO WIN

11.3.3.1 SWOT Analysis

11.3.4 RECENT DEVELOPMENTS

11.3.5 mnm view

11.4 PENTEK, INC

11.4.1 business Overview

11.4.2 products/solutions offered

11.4.3 Unique VALUE PROPOSITION AND Right TO WIN

11.4.4 RECENT DEVELOPMENTS

11.4.5 MNM View

11.5 star-dundee

11.5.1 business Overview

11.5.2 products/solutions offered

11.5.3 Unique VALUE PROPOSITION AND Right TO WIN

11.5.4 RECENT DEVELOPMENTS

11.5.5 mnm vIEW

11.6 critical i/o, LLC

11.6.1 business Overview

11.6.2 products/solutions offered

11.6.3 Unique VALUE PROPOSITION AND Right TO WIN

11.6.4 RECENT DEVELOPMENTS

11.7 ABACO sYstems

11.7.1 business Overview

11.7.2 products/solutions offered

11.7.3 Unique VALUE PROPOSITION AND Right TO WIN

11.7.4 RECENT DEVELOPMENTS

11.8 te connectivity

11.8.1 business Overview

11.8.2 products/solutions offered

11.8.3 Unique VALUE PROPOSITION AND Right TO WIN

11.8.4 SWOT Analysis

11.8.5 RECENT DEVELOPMENTS

11.9 AMPHENOL CORPORATION

11.9.1 business Overview

11.9.2 products/solutions offered

11.9.3 Unique VALUE PROPOSITION AND Right TO WIN

11.9.4 SWOT Analysis

11.9.5 RECENT DEVELOPMENTS

11.1 optical cable corporation

11.10.1 business Overview

11.10.2 products/solutions/services offered

11.10.3 Unique VALUE PROPOSITION AND Right TO WIN

11.10.4 SWOT Analysis

11.10.5 RECENT DEVELOPMENTS

11.11 data device corporation

11.11.1 business Overview

11.11.2 products/solutions/services offered

11.11.3 Unique VALUE PROPOSITION AND Right TO WIN

11.11.4 SWOT Analysis

11.11.5 RECENT DEVELOPMENTS

11.12 astronics corporation

11.12.1 business Overview

11.12.2 products/solutions/services offered

11.12.3 Unique VALUE PROPOSITION AND Right TO WIN

11.12.4 SWOT Analysis

11.12.5 RECENT DEVELOPMENTS

11.13 collins AEROSPACE, A RAYTHEON TECHNOLOGIES COMPANY

11.13.1 business Overview

11.13.2 products/solutions/services offered

11.13.3 Unique VALUE PROPOSITION AND Right TO WIN

11.13.4 RECENT DEVELOPMENTS

11.14 NEXANS

11.14.1 business Overview

11.14.2 products/solutions/services offered

11.14.3 RECENT DEVELOPMENTS

11.15 corning, inc

11.15.1 business Overview

11.15.2 products/solutions/services offered

11.15.3 RECENT DEVELOPMENTS

11.16 huber+Sunher

11.16.1 business Overview

11.16.2 products/solutions/services offered

11.16.3 RECENT DEVELOPMENTS

12 company profiles -Original Equipment manufacture (Page No. 163)

12.1 raytheon TECHNOLOGIES, CORPORATION

12.1.1 business Overview

12.1.2 products/solutions/services offered

12.1.3 Unique VALUE PROPOSITION AND Right TO WIN

12.1.3.1 SWOT Analysis

12.1.4 RECENT DEVELOPMENTS

12.2 bae systems

12.2.1 business Overview

12.2.2 products/solutions/services offered

12.2.3 Unique VALUE PROPOSITION AND Right TO WIN

12.2.3.1 SWOT Analysis

12.2.4 RECENT DEVELOPMENTS

12.3 mbda

12.3.1 business Overview

12.3.2 products/solutions offered

12.3.3 Unique VALUE PROPOSITION AND Right TO WIN

12.3.4 RECENT DEVELOPMENTS

12.4 leonardo drs

12.4.1 business Overview

12.4.2 products/solutions/services offered

12.4.3 Unique VALUE PROPOSITION AND Right TO WIN

12.4.4 RECENT DEVELOPMENTS

12.5 garmin ltd

12.5.1 business Overview

12.5.2 products/solutions/services offered

12.5.3 Unique VALUE PROPOSITION AND Right TO WIN

12.5.3.1 SWOT Analysis

12.5.4 RECENT DEVELOPMENTS

12.6 avic

12.6.1 business Overview

12.6.2 products/solutions/services offered

12.6.3 Unique VALUE PROPOSITION AND Right TO WIN

12.6.4 RECENT DEVELOPMENTS

12.7 Thales

12.7.1 business Overview

12.7.2 products/solutions/services offered

12.7.3 Unique VALUE PROPOSITION AND Right TO WIN

12.7.3.1 SWOT Analysis

12.7.4 RECENT DEVELOPMENTS

12.8 Boeing

12.8.1 business Overview

12.8.2 products/solutions/services offered

12.8.3 Unique VALUE PROPOSITION AND Right TO WIN

12.8.3.1 SWOT Analysis

12.8.4 RECENT DEVELOPMENTS

12.9 Lockheed martin corporation

12.9.1 business Overview

12.9.2 products/solutions/services offered

12.9.3 Unique VALUE PROPOSITION AND Right TO WIN

12.9.4 RECENT DEVELOPMENTS

12.1 northrop grumman

12.10.1 business Overview

12.10.2 products/solutions/services offered

12.10.3 Unique VALUE PROPOSITION AND Right TO WIN

12.10.3.1 SWOT Analysis

12.10.4 RECENT DEVELOPMENTS

12.11 honeywell INTERNATIONAL, INC

12.11.1 business Overview

12.11.2 products/solutions/services offered

12.11.3 Unique VALUE PROPOSITION AND Right TO WIN

12.11.3.1 SWOT Analysis

12.11.4 RECENT DEVELOPMENTS

13 Aircraft MANUFACTURers company profiles (Page No. 197)

13.1 Introduction

13.1.1 Who to whom analysis

13.2 Gulfstream Aerospace

13.2.1 BUSINESS OVERVIEW

13.2.1.1 PRODUCTS OFFERED

13.2.1.2 RECENT DEVELOPMENTS

13.3 Airbus Group

13.3.1 Business Overview

13.3.2 Products offered

2.1.1 Unique VALUE PROPOSITION AND Right TO WIN

2.1.2 AIRBUS’s Right to Win

13.3.3 growth STRATEGy

13.3.3.1 Organic Strategy

13.3.3.2 SWOT ANALYSIS

13.3.4 recent developments

13.4 saab AB

13.4.1 Business Overview

13.4.2 PRODUCTS offered

13.4.3 MNM view

13.5 BAE systems

13.5.1 Business Overview

13.5.2 Products offered

13.5.2.1 RECENT DEVELOPMENTS

13.5.2.2 MNM VIEW

13.6 Comac

13.6.1 Business Overview

13.6.2 Products offered

13.6.2.1 RECENT DEVELOPMENTS

13.6.2.2 MnM View

Growth opportunities and latent adjacency in High Speed Serial Bus Market