High Performance Sensors Market by Type (Optical, Image, Radar, Pressure, Temperature, Proximity, Accelerometer, Humidity), Technology (MEMS, NEMS, CMOS), Industry (Military & Defense, Automotive, Consumer Electronics, Manufacturing, Telecommunication, Medical), Region- Global Forecast to 2030

High performance sensors are the device that detects and respond to specific inputs from the physical environments with high precision and accuracy. The specific inputs include position, pressure, level, motion, flow, humidity, and force among others. These sensors are also integral and essential part of artificial intelligence (AI) based systems, as it offers faster data processing more data continues to become available and requires processing for analysis and artificial intelligence applications. In an AI based system, nodes can number in thousands, each of which relates to one or more other sensors and sensor hubs, as well as individual actuators. High performance sensors help in seamless functioning of AI systems and enable the more accurate and automated environmental data collection with less erroneous noise amongst the accurately recorded information.

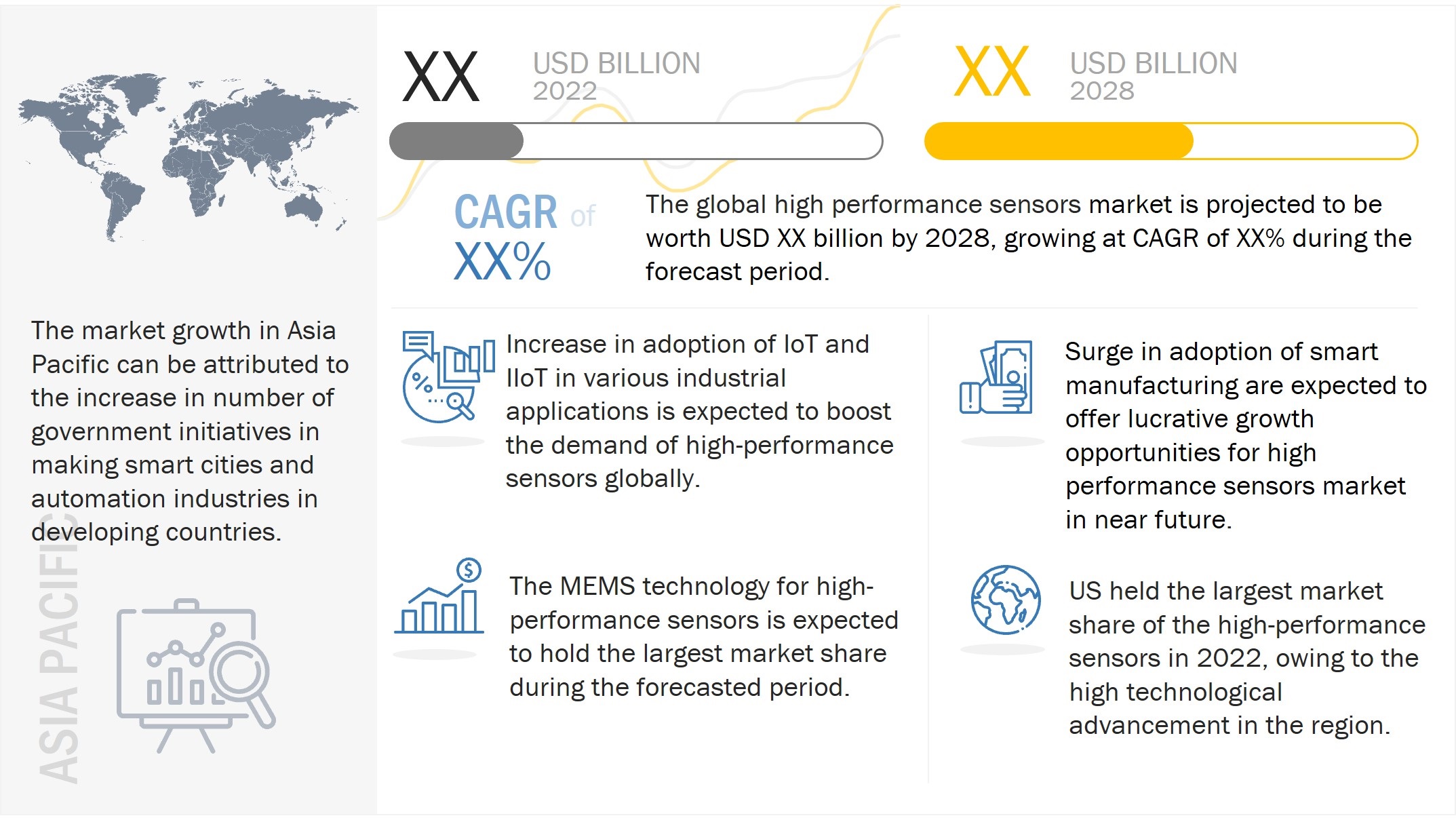

The global high-performance sensors market size is expected to grow from USD XX billion in 2024 to USD XX billion by 2030, at a CAGR of XX% during the forecasted period.

To know about the assumptions considered for the study, Request for Free Sample Report

High Performance Sensors Market Dynamics

DRIVERS: Growing trends towards intelligent sensing in various industrial applications

The industrial processing relies on common attributes such as precision reliability, security and intelligent processing and analytics. For this purpose, intelligent sensing plays a vital role to offer high quality performance and robustness of the sensors across widely varying conditions. High performance sensors are being deployed to gather relevant contextual information in various industrial processes. Moreover, with the emergence of Industry 4.0, manufacturers need to adopt digital processes to survive in the increasingly competitive market. The essential components and framework of Industry 4.0 comprise Big Data, model simulation, cloud technology, augmented reality, Industrial Internet of Things (IIOT), artificial intelligence, autonomous robots, and cybersecurity. Industry 4.0 has also led to an increase in the adoption of high-performance sensors. Companies are also experiencing major benefits in terms of lower costs, improved efficiencies, increased yield, mass customization, and most significantly new revenue and business models.

Surge in demand for high performance sensors for automotive applications

The evolution of motor vehicles has accelerated over the last decade – from manual transmission automobiles to uber-sophisticated semi and fully autonomous smart cars guided by onboard sensors and autopilot systems. This has been fueled primarily by rapid innovation in, and adoption of, the intelligent sensor technology. A single automobile has a wide range of sensors, such as humidity and temperature, flow, environmental, position, and gas sensors, for the smooth operation of different parts of the vehicle. The implementation of contactless position sensors in an anti-collision system helps avoid collision of the vehicle with a pedestrian, standby vehicle, the vehicle in motion, or any other obstacle. Owing to the adoption of linear and tilt sensors, modern cars provide the facility to adjust the seat position electronically and align it exactly according to the position desired by travelers based on their preference/comfort. Thus, high-performance sensors with data gathering and self-diagnostics features are necessary to deploy in various automotive systems, from airbags and safety belts through braking systems to blind spot detection systems and lane-departure alert systems for enhanced reliability, interoperability, and control.

CHALLENGES: Rising cybersecurity challenges in connected sensors

Interconnectivity is expected to become increasingly common in a few years, raising concerns over safety and cybersecurity, which will be a critical component in the operation of smart sensors. As IoT based sensors can be connected to cloud servers via a web interface in unprotected computers or handheld systems, the communication within the interconnected sensors may be compromised. Although cybersecurity standards, such as the ISA/IEC 62443, have been developed recently by the International Electrotechnical Commission (IEC) and the International Society of Automation (ISA), implementation is still limited currently.

Key Market Players:

The high-performance sensors market is dominated by a few globally established players such as Analog Devices Inc. (US), Baker Hughes (US), Infineon Technologies (Germany), NXP Semiconductor (Netherlands), Panasonic Corporation (Japan), STMicroelectronics N.V. (Switzerland), TE Connectivity (US), Texas Instruments (US), Northrop Grumman (US), Thales Group (US), and Telco Sensors Inc. (US) among others.

Recent Developments

- In February 2022, Nortek launched Doppler Velocity Log (DVL), which is used to provide vehicles a control system with speed over ground measurements. DVL is a compact, high-performance sensor used in subsea vehicles.

- In August 2021, Analog Devices Inc. acquired Maxim Integrated Products Inc., an independent manufacturer of innovative analog and mixed-signal products and technologies. This acquisition helps to strengthen ADI’s position as a high-performance analog semiconductor company.

- In September 2020, Analog Devices, Inc. strategically collaborated with Microsoft Corporation to leverage Microsoft’s 3D Time-of-Flight (ToF) sensor technology, allowing customers to easily create high-performance 3D applications that bring higher degrees of depth accuracy and work regardless of the environmental conditions in the scene.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 Introduction

1.1. Study Objectives

1.2. Definition

1.3. Study Scope

1.3.1. Markets Covered

1.3.2. Geographic Scope

1.3.3. Years Considered

1.4. Currency

1.5. Key Stakeholders

1.6. Summary of Changes

2 Research Methodology

2.1. Research Data

2.2. Secondary Data

2.2.1. Major Secondary Sources

2.2.2. Key Data from Secondary Sources

2.3. Primary Data

2.3.1. Key Data from Primary Sources

2.3.2. Key Participants in Primary Processes across Market Value Chain

2.3.3. Breakdown of Primary Interviews

2.3.4. Key Industry Insights

2.4. Market Size Estimation

2.5. Market Breakdown and Data Triangulation

2.6. Risk Analysis

2.7. Research Assumptions and Limitations

3 Executive Summary

4 Premium Insights

5 Industry Trends and Market Overview

5.1. Introduction

5.2. Value Chain Analysis

5.3. Market Dynamics

5.3.1. Drivers

5.3.2. Restraints

5.3.3. Opportunities

5.3.4. Challenges

5.4. Value Chain Analysis

5.5. Market Ecosystem

5.6. Pricing Analysis

5.6.1. Average Selling Price (ASP) of Key Players

5.6.2. Average Selling Price (ASP) Trends

5.7. Trends/Disruptions Impacting Customers

5.8. Technology Analysis

5.9. Key Stakeholders and Buying Criteria

5.9.1. Key Stakeholders and Buying Process

5.9.2. Buying Criteria

5.10. Porter’s Five Forces Analysis

5.11. Case Study Analysis

5.12. Patent Analysis

5.13. Trade Analysis

5.14. Tariffs and Regulatory Landscape

5.14.1. Regulatory Bodies, Government Agencies, and Other Organization

5.14.2. Regulations & Standards

6 High Performance Sensor Market, By Type

6.1. Introduction

6.2. Optical Sensor

6.3. Image Sensor

6.4. Radar Sensor

6.5. Pressure Sensor

6.6. Temperature & Thermocouple Sensor

6.7. Proximity & Displacement Sensor

6.8. Accelerometer & Gyroscope Sensor

6.9. Humidity Sensor

6.10. Others

7 High Performance Sensor Market, By Technology

7.1. Introduction

7.2. MEMS

7.3. NEMS

7.4. CMOS

7.5. Other

8 High Performance Sensor Market, By Industry

8.1. Introduction

8.2. Military & Defense

8.3. Automotive

8.4. Aviation

8.5. Consumer Electronics

8.6. Manufacturing

8.7. Telecommunication

8.8. Medical & Healthcare

8.9. Others

9 High Performance Sensor Market, By Region

9.1. Introduction

9.2. North America

9.2.1. US

9.2.2. Canada

9.2.3. Mexico

9.3. Europe

9.3.1. UK

9.3.2. Germany

9.3.3. France

9.3.4. Italy

9.3.5. Rest of Europe

9.4. APAC

9.4.1. China

9.4.2. Japan

9.4.3. India

9.4.4. Rest of APAC

9.5. RoW

9.5.1. South America

9.5.2. Middle East

9.5.3. Africa

10 Competitive Landscape

10.1. Overview

10.2. 5-Year Revenue Analysis- Top 5 Companies

10.3. Market Share Analysis: Seamless Biometric Market (Top 5)

10.4. Company Evaluation Quadrant, 2021

10.4.1. Star

10.4.2. Pervasive

10.4.3. Participant

10.4.4. Emerging Leader

10.5. Startup/SME Evaluation Quadrant, 2021

10.5.1. Progressive Companies

10.5.2. Responsive Companies

10.5.3. Dynamic Companies

10.5.4. Starting Blocks

10.5.5. Startup/ SME Data Table

10.6. Company Footprint

10.7. Competitive Benchmarking

10.8. Competitive Situations and Trends

11 Company Profiles

11.1. Introduction

11.2. Key Players

11.2.1. Analog Devices Inc.

11.2.2. Baker Hughes

11.2.3. Infineon Technologies

11.2.4. NXP Semiconductor

11.2.5. Panasonic Corporation

11.2.6. STMicroelectronics

11.2.7. TE Connectivity

11.2.8. Texas Instruments

11.2.9. Northrop Grumman

11.2.10. Thales

11.2.11. Telco Sensors

11.2.12. Leuze Electronics

11.2.13. Omron

11.3. Other Key Player

12 Adjacent & Related Market

13 Appendix

Note: The above-mentioned Table of Content is tentative and might change during course of research study.

Growth opportunities and latent adjacency in High Performance Sensors Market