Hemp Protein Market - Global Forecast to 2030

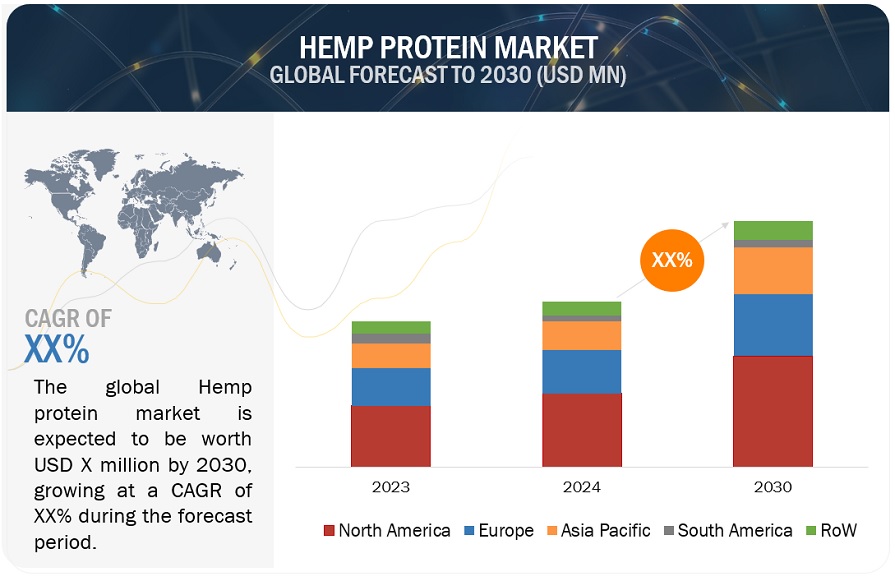

The market for Hemp Protein is estimated at USD xx Million in 2024; it is projected to grow at a CAGR of x% to reach USD xx Million by 2030. The hemp protein market is set to have a major impact globally owing to the shifts in consumer tastes and industry developments. Hemp protein is now applied in functional meals, supplements, and sports nutrition products due to its nutritional profile that contains all essential amino acids. Also, because of its subtle flavor and texture, it may be used in a variety of food categories, allowing producers to expand the range of plant-based products they offer in their portfolio. not just in the food & beverage sector, hemp protein is increasingly being applied in the animal feed sector for its immunity-building characteristics.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Hemp Protein Market Dynamics

Driver: Versatility of hemp proteins to be used with other plant proteins

While other plant proteins such as soy, pea, and rice proteins dominate the alternative proteins market, hemp protein is emerging as a popular alternative due to its allergen-friendly nature. as it is free from common allergens such as soy, gluten, and dairy, it highly appeals to consumers with dietary restrictions that hamper their health & wellbeing. Many companies are now blending hemp protein with other plant-based proteins such as pea, rice, or pumpkin seeds to enhance texture, flavor, and protein content in plant-based foods. This is usually due to the key flavor characteristic of hemp protein. This complementary use is helping the hemp protein market to carve a niche within the broader plant-based protein market.

Restraint: Market acceptance and perception barriers

Despite the growing awareness of hemp as a food source, in many regions, consumers still confuse hemp with marijuana. This hinders market growth due to issues with consumer acceptance owing to the stigma around cannabis-related products. Also, in certain regions where the cultural or legal acceptance of cannabis is low, the market barriers related to hemp even as a source of protein.

Opportunity: Innovation-driven Functional Foods and Nutraceutical applications

Hemp protein is being used in the development of functional food & beverage products as well as nutraceutical supplements. These products target specific health benefits such as heart health, digestion, and weight management. These factors help manufacturers expand their use of hemp proteins beyond traditional protein supplements. Major food companies and start-ups are now investing in research and development to improve the taste, texture, and functionality of hemp protein in various food applications. These investment opportunities are driving product innovation and helping hemp protein compete more effectively with established plant-based proteins.

Challenge: Regulatory Requirements

One of the biggest challenges for the hemp protein market is the inconsistent regulatory framework around hemp and its derivatives such as hemp proteins. While hemp cultivation is legal in countries such as the U.S., Canada, and also in some parts of Europe, it remains heavily regulated or illegal in many regions, mainly in Asia and Africa. This affects the global availability of hemp protein and withholds market expansion due to supply shortages and sales restrictions.<

HEMP PROTEIN MARKET ECOSYSTEM

Prominent companies in this market include well-established, financially stable companies providing Hemp Protein solutions. These companies have been operating in the market for several years and possess a diversified product portfolio, strong R&D capabilities, and strong sales and marketing networks. Prominent companies in this market include Axiom Foods, Inc. (USA), GFR Ingredients (Canada), Nutiva (USA), Manitoba Harvest (Canada), Hemp Oil Canada (Canada), North America Hemp & Grain Company (Canada), Hemp Food Australia (Australia), and Tilray Brands, Inc. (USA).

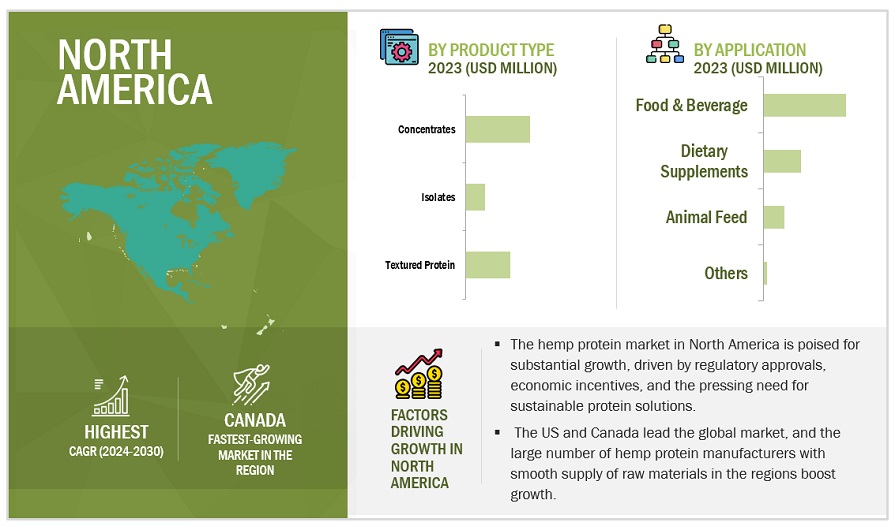

Based on product type, the concentrates sub segment is gaining traction in the Hemp Protein market.

Among the product types, hemp protein concentrates which are typically 50-70% protein by nature, are more versatile and can be used in a broader range of applications. They can be used in applications such as in baking, smoothies, snacks, and bars. They retain more of the natural fiber, fats, and nutrients found in hemp seeds, making them appealing to consumers seeking a wholesome, nutrient-dense product.

The animal feed application is forecasted to register the most significant CAGR over the projected period.

The growth of hemp protein in the animal feed sector is driven by its nutritional richness, sustainability, regulatory acceptance, and its ability to meet rising consumer demand for more natural, eco-friendly, and plant-based feed ingredients. Hemp protein can be easily incorporated into a wide range of animal feed formulations, such as for poultry, cattle, fish, and pets. Its amino acid profile complements other feed ingredients, such as soymeal or cornmeal and corn feed, providing a more balanced diet for farm animals and pets. As the focus on animal welfare, sustainability, and efficient farming continues to grow, hemp protein is becoming an increasingly valuable resource in animal nutrition.

The North American region is anticipated to experience the most rapid growth between 2024 and 2030.

The US and Canada are driving the North American hemp protein market due to a favorable regulatory landscape. Moreover, a growing consumer base seeking sustainable and plant-based nutrition and strong agricultural and technological infrastructure add up to the growth of this market in North America. Their innovation, established brands, and ability to capitalize on export opportunities position North America as the leader in the growing global hemp protein market. As demand for plant-based proteins continues to rise, the US and Canada are poised to play an increasingly dominant role in shaping the future of this market.

Key Market Players

Key Market Players in this market are Axiom Foods, Inc. (USA), GFR Ingredients (Canada), Nutiva (USA), Manitoba Harvest (Canada), Hemp Oil Canada (Canada), North America Hemp & Grain Company (Canada), Hemp Food Australia (Australia), and Tilray Brands, Inc. (USA).

Other market players include Bioway (Xi'An) Organic Ingredients Co., Ltd (China), Cooke Inc (Canada), ETChem (China), Green Source Organics (USA), and MB-Holding GmbH (Germany) among others.

These market players are focusing on increasing their presence through agreements and collaborations. These companies have strong presence in North America and Asia Pacific.

Recent Developments

- According to a new research study published by The American Journal of Clinical Nutrition-2024, hemp seed-based proteins and the bioactive peptide present in it were found to manage blood pressure in hypertensive individuals. Ashypertension is a chronic health condition, the demand for hemp protein-based supplements might be useful for health-conscious consumers. This new study could pave the way for the opportunistic market for this product in the supplements as well as the functional food & beverage sector.

- In April 2024, Canada-based feed company AltaGreen announced that it has collaborated with InnoTech Alberta and the University of Alberta, to create hemp-based feed formulations that, with minimal adjustments, may be fed to fish, swine as well as poultry to provide plant proteins to these animals in order to build their immunity without much use of preventive antibiotics. When the research is finished, they plan to apply for CFIA approval to enter the Canadian market with their three products for chicks, broilers, and hens.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Hemp Protein Market