Heat Shield Market by End-Use Industry (Automotive, Aircraft & Defense (Firearm)) and Material Type (Aluminum, Metallic, Non-Metallic) - Global Trends & Forecasts to 2021

The heat shield market is projected to reach USD 4.19 Billion by 2021, at a CAGR of 5.06%. In this report, 2015 is considered as the base year and the forecast period is between 2016 and 2021.

The objectives of Heat Shield Market Study are:

- To analyze and forecast the market size of heat shield, in terms of value

- To define, describe, and segment the global heat shield market by material type and by end-use industry

- To forecast the sizes of the market segments based on regions such as Asia-Pacific, North America, Western Europe, Central & Eastern Europe, South America and the Middle East & Africa

- To provide detailed information regarding the important factors influencing the growth of the market (drivers, restraints, and opportunities)

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To analyze competitive developments such as expansions, alliances, joint ventures, mergers & acquisitions, and new product developments in the global heat shield market

- To strategically profile key players and comprehensively analyze their core competencies

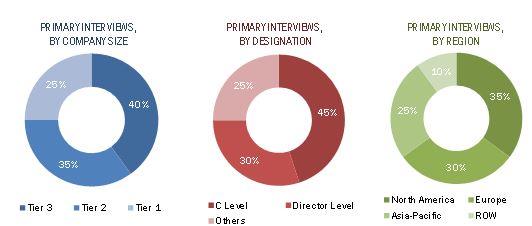

This technical, market-oriented, and commercial study of the heat shield market involves the extensive use of secondary sources, directories, and databases (such as Hoovers, Bloomberg BusinessWeek, and Factiva) to identify and collect information. The primary sources mainly include several experts from core and related industries and preferred suppliers, manufacturers, distributors, service providers, and organizations related to all segments of the industry’s supply chain. After arriving at the overall market size, the total market has been split into several segments and subsegments. The figure below illustrates the breakdown of the primary interviews based on company type, designation, and region conducted during the research study.

To know about the assumptions considered for the study, Request for Free Sample Report

Key Players in Heat Shield Market

The heat shield value chain includes raw material manufacturers such as Alcoa Inc. (U.S.) and ArcelorMittal S.A. (Luxembourg), and heat shield manufacturers such as Morgan Advanced Materials (U.K.), Dana Holding Corporation (U.S), and Federal Mogul Holding Corporation (U.S.). Furthermore, the products manufactured by these companies are used by companies related to automotive, aircraft, and defense (firearms) such as Toyota (Japan), General Motors (U.S.), BMW (Germany), Daimler (Germany), Airbus (France), and Boeing (U.S.).

Target Audience in Heat Shield Market

- Heat shield manufacturers

- Heat shield dealers

- Heat shield suppliers

- End users

- Raw material suppliers and others.

Heat Shield Market Report Scope

This report categorizes the global heat shield market based on type, application, and region.

Market Segmentation, by Material Type:

The heat shield market has been segmented based on material type:

-

Metallic heat shield

- Aluminum heat shield

- Non-metallic heat shield

Market Segmentation, by End-Use Industry:

The heat shield market has been segmented based on application:

-

Automotive

- Passenger cars

- Light commercial vehicles

- Heavy trucks

- Buses & coaches

-

Aircraft

- Piston engine aircraft

- Turbine engine aircrafts

- Defense (firearms)

Market Segmentation, by Region:

The regional analysis covers:

- Asia-Pacific

- North America

- Western Europe

- Central & Eastern Europe

- South America

- Middle East & Africa

Heat Shield Market Report Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Heat Shield Market Product Analysis

- Product Matrix that gives a detailed comparison of product portfolio of each company

Heat Shield Market Regional Analysis

- Further breakdown of a region with respect to a particular country

Heat Shield Market Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The global market size of heat shield was USD 3.14 Billion in 2015 and is estimated to reach USD 4.19 Billion by 2021, at a CAGR of 5.06% between 2016 and 2021. Rise in automotive and aircraft production and rising concern towards safety in their exhaust system are expected to drive the demand of heat shield, globally.

The automotive industry dominated the heat shield market during the forecast period, followed by aircraft and defense (firearms) in 2015. Defense (firearms) is expected to be the fastest growing industry of the heat shield market during the forecast period. The rising military expenses of the country, has resulted in the increase in the consumption of firearms and the use of heat shields in them, globally. The firearm consumption is also increasing due to its rising use for personal safety among the civilians.

The heat shield market is classified based on material type metallic and non-metallic. The market is dominated by non-metallic heat shields which are made up of ceramics, silica fibers, carbon-fiber reinforced plastics, silicon carbide and others, which have good thermal capabilities. The metallic heat shield are also growing at a decent rate due to rising use of metals such as aluminum and stainless steel, which have high tensile strength and high thermal conductivity.

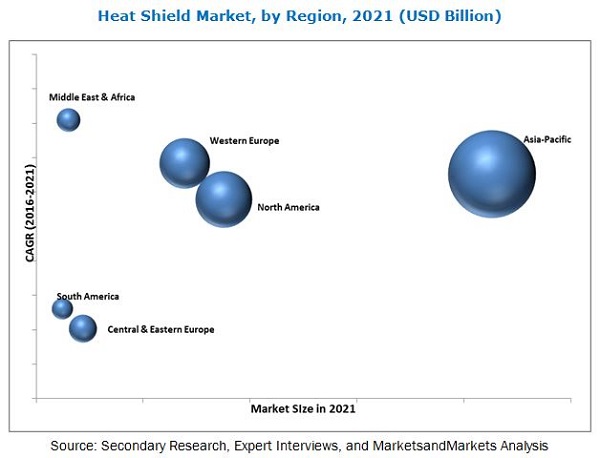

Currently, Asia-Pacific is the largest heat shield market, in terms of value, followed by North America and Western Europe. Some of the factors driving the growth of the market in Asia-Pacific are rise in the automotive production, rise in disposable income, and increased number of heat shield manufacturers in the region.

Middle-East is expected to be the fastest-growing heat shield market due to rising middle-class population and automotive production in the countries such as Iran, Egypt, and Turkey

To know about the assumptions considered for the study, download the pdf brochure

Key Heat Shield Market Industry Players

The major restraint of the market is the emerging battery-driven vehicle market, which will eliminate the use of exhaust system in the vehicles, where the heat shields are majorly used. Expansion and new product launch are the most preferred strategies adopted by the key market players to sustain in this highly competitive market. The major opportunity for heat shield is the innovations and the technological advancements in the manufacturing of heat shields. Some of the important manufacturers are Morgan Advanced Materials (U.K.), Dana Holding Corporation (U.S.), Federal Mogul Holding Corporation (U.S.), Autoneum Holdings AG (Switzerland), Lydall Inc. (U.S.), Elringklinger AG (Germany), Progress-Werk Oberkirch AG (Germany), UGN Inc. (U.S.), ThermoTec Automotive (U.S.), Zircotec (U.K.), and others. Companies in this market compete with each other with respect to prices and product offerings to meet the market requirements.

Frequently Asked Questions (FAQ):

What is the Heat Shield Market growth?

Growth of Heat Shield Market - At a CAGR of 5.06% between 2016 and 2021.

Who leading market players in Heat Shield industry?

Currently, various market players such as are Morgan Advanced Materials (U.K.), Dana Holding Corporation (U.S.), Federal Mogul Holding Corporation (U.S.), Autoneum Holdings AG (Switzerland), Lydall Inc. (U.S.), Elringklinger AG (Germany), Progress-Werk Oberkirch AG (Germany), UGN Inc. (U.S.), ThermoTec Automotive (U.S.), and Zircotec (U.K.) dominate the global heat shield market.

How big is the Heat Shield Market?

The global heat shield market is projected to reach USD 4.19 Billion by 2021.

Which segments are covered in Heat Shield Market report?

By End-Use Industry (Automotive, Aircraft & Defense (Firearm)) & Material Type (Aluminum, Metallic, Non-Metallic).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Market

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.3.3 Currency

1.4 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 22)

4 Premium Insights (Page No. - 26)

4.1 Attractive Market Opportunities for Heat Shield Manufacturers

4.2 Rapid Growth of the Heat Shield Market

4.3 Automotive Dominates the Heat Shield Market

4.4 Heat Shield Market Attractiveness

4.5 Life Cycle Analysis

5 Market Overview (Page No. - 29)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Material Type

5.2.2 By End-Use Industry

5.2.3 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increase in Vehicle Production

5.3.1.2 Increase in Aircraft Production

5.3.1.3 Rising Concern Towards Safety in Aircraft, Automotive, and Firearms

5.3.1.4 Increasing Demand for Luxury Vehicles

5.3.2 Restraints

5.3.2.1 Emerging Battery-Driven Vehicle Market

5.3.3 Opportunities

5.3.3.1 Technological Advancements

5.4 Value-Chain Analysis

5.4.1 Raw Materials

5.4.2 Manufacturing

5.4.3 Distribution

5.4.4 Marketing and Sales

5.5 Porter’s Five Forces Analysis

5.5.1 Threat of New Entrants

5.5.2 Bargaining Power of Suppliers

5.5.3 Threat of Substitutes

5.5.4 Bargaining Power of Buyers

5.5.5 Intensity of Rivalry

5.6 Economic Indicators

5.6.1 Industry Outlook

5.6.1.1 Automotive

5.6.1.2 Impact of GDP on Commercial Vehicle Sales

5.6.1.3 Increasing Vehicle Production in Developing Countries

5.6.1.4 Defense

6 Heat Shield Market, By Material Type (Page No. - 45)

6.1 Introduction

6.2 Metallic Heat Shield

6.2.1 Aluminum-Based Heat Shields

6.3 Non-Metallic Heat Shield

7 Heat Shield Market, By End-Use Industry (Page No. - 52)

7.1 Introduction

7.2 Automotive

7.2.1 Passenger Cars

7.2.2 Light Commercial Vehicles

7.2.3 Heavy Trucks

7.2.4 Buses & Coaches

7.3 Aircraft

7.3.1 Piston Engine Aircraft

7.3.2 Turbine Engine Aircraft

7.4 Defense (Firearm)

8 Regional Analysis (Page No. - 66)

8.1 Introduction

8.2 Asia-Pacific

8.2.1 Introduction

8.2.2 Market Analysis, By End-Use Industry

8.2.3 Market Analysis, By Country

8.3 North America

8.3.1 Introduction

8.3.2 Market Analysis, By End-Use Industry

8.3.3 Market Analysis, By Country

8.4 Western Europe

8.4.1 Introduction

8.4.2 Market Analysis, By End-Use Industry

8.4.3 Market Analysis, By Country

8.5 Central & Eastern Europe

8.5.1 Introduction

8.5.2 Market Analysis, By End-Use Industry

8.5.3 Market Analysis, By Country

8.6 South America

8.6.1 Introduction

8.6.2 Market Analysis, By End-Use Industry

8.6.3 Market Analysis, By Country

8.7 Middle East & Africa

8.7.1 Introduction

8.7.2 Market Analysis, By End-Use Industry

8.7.3 Market Analysis, By Country

9 Competitive Landscape (Page No. - 87)

9.1 Market Share Analysis

9.2 Overview

9.3 Expansion: the Most Popular Growth Strategies

9.4 Maximum Developments in 2013 and 2014

9.5 Competitive Situation & Trends

9.5.1 Expansion

9.5.2 New Product Launch

9.5.3 Joint Venture/Agreement/Collaboration

9.5.4 Mergers & Acquisitions

9.5.5 Supply Contracts

10 Company Profiles (Page No. - 94)

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, Ratio Analysis, MnM View)*

10.1 Morgan Advanced Materials

10.2 Dana Holding Corporation

10.3 Federal Mogul Holding Corporation

10.4 Autoneum Holdings AG

10.5 Lydall Inc.

10.6 Elringklinger AG

10.7 Progress-Werk Oberkirch AG

10.8 Ugn Inc.

10.9 Thermotec Automotive Products

10.10 Zircotec Ltd

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

10.11 List of Other Heat Shield Manufacturers

11 Appendix (Page No. - 117)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.3 Introducing RT: Real Time Market Intelligence

11.4 Available Customizations

11.5 Related Reports

List of Tables (85 Tables)

Table 1 Thermal Conductivity of Materials

Table 2 Vehicles in Use, By Region and Country, 2010-2014

Table 3 Military Expenditure By Country, 2016

Table 4 Heat Shield Market Size, By Type, 2014–2021 (USD Million)

Table 5 Metallic Heat Shield Market Size, By End-Use Industry,2014–2021 (USD Million)

Table 6 Metallic Heat Shield Market Size, By Region, 2014–2021 (USD Million)

Table 7 Aluminum Heat Shield Market Size, By End-Use Industry,2014–2021 (USD Million)

Table 8 Aluminum Heat Shield Market Size, By Region, 2014–2021 (USD Million)

Table 9 Aluminum Heat Shield Market Size, By Application,2014–2021 (USD Million)

Table 10 Non-Metallic Heat Shield Market Size, By End-Use Industry,2014–2021 (USD Million)

Table 11 Non-Metallic Heat Shield Market Size, By Region,2014–2021 (USD Million)

Table 12 Heat Shield Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 13 Automotive Heat Shield Market Size, By Vehicle Type,2014–2021 (USD Million)

Table 14 Automotive Heat Shield Market Size, By Material Type,2014–2021 (USD Million)

Table 15 Automotive Heat Shield Market Size, By Region, 2014–2021 (USD Million)

Table 16 Aluminum-Based Automotive Heat Shield Market Size, By Vehicle Type, 2014–2021 (USD Million)

Table 17 Aluminum-Based Automotive Heat Shield Market Size, By Region,2014–2021 (USD Million)

Table 18 Market Size for Automotive Heat Shield in Passenger Cars, By Region, 2014–2021 (USD Million)

Table 19 Market Size for Aluminum-Based Automotive Heat Shield in Passenger Cars, By Region, 2014–2021 (USD Million)

Table 20 Market Size for Automotive Heat Shield in Light Commercial Vehicles, By Region, 2014–2021 (USD Million)

Table 21 Market Size for Aluminum-Based Automotive Heat Shield in Light Commercial Vehicles, By Region, 2014–2021 (USD Million)

Table 22 Automotive Heat Shield Market in Heavy Trucks, By Region,2014–2021 (USD Million)

Table 23 Aluminum-Based Automotive Heat Shield Market in Heavy Trucks,By Region, 2014–2021 (USD Million)

Table 24 Automotive Heat Shield Market in Buses & Coaches, By Region,2014–2021 (USD Million)

Table 25 Aluminum-Based Automotive Heat Shield Market in Buses & Coaches,By Region, 2014–2021 (USD Million)

Table 26 Aircraft Manufacturing Data (2010–2015)

Table 27 Aircraft Heat Shield Market, By Type, 2014–2021 (USD Million)

Table 28 Aircraft Heat Shield Market, By Material Type, 2014–2021 (USD Million)

Table 29 Aircraft Heat Shield Market, By Region, 2014–2021 (USD Million)

Table 30 Piston Aircraft Heat Shield Market, By Type, 2014–2021 (USD Million)

Table 31 Piston Aircraft Heat Shield Market, By Material Type,2014–2021 (USD Million)

Table 32 Turbine Aircraft Heat Shield Market, By Type, 2014–2021 (USD Million)

Table 33 Turbine Aircraft Heat Shield Market, By Material Type,2014–2021 (USD Million)

Table 34 Defense (Firearm) Heat Shield Market, By Material Type,2014–2021 (USD Million)

Table 35 Defense (Firearm) Heat Shield Market, By Region,2014–2021 (USD Million)

Table 36 Heat Shield Market Size, By Region, 2014–2021 (USD Million)

Table 37 Aluminum Heat Shield Market Size, By Region, 2014–2021 (USD Million)

Table 38 Asia-Pacific: Heat Shield Market Size, By End-Use Industry,2014–2021 (USD Million)

Table 39 Asia Pacific: Automotive Heat Shield Market Size, By Vehicle Type,2014–2021 (USD Million)

Table 40 Asia-Pacific: Heat Shield Market Size, By Country,2014–2021 (USD Million)

Table 41 Asia-Pacific: Aluminum Heat Shield Market Size, By Country,2014–2021 (USD Million)

Table 42 China: Heat Shield Market Size, By Material Type,2014–2021 (USD Million)

Table 43 Japan : Heat Shield Market Size, By Material Type,2014–2021 (USD Million)

Table 44 India: Heat Shield Market Size, By Material Type,2014–2021 (USD Million)

Table 45 Australia: Heat Shield Market Size, By Material Type,2014–2021 (USD Million)

Table 46 South Korea: Heat Shield Market Size, By Material Type,2014–2021 (USD Million)

Table 47 North America: Heat Shield Market Size, By End-Use Industry,2014–2021 (USD Million)

Table 48 North America: Automotive Heat Shield Market Size, By Vehicle Type, 2014–2021 (USD Million)

Table 49 North America: Heat Shield Market Size, By Country,2014–2021 (USD Million)

Table 50 North America: Aluminum Heat Shield Market Size, By Country,2014–2021 (USD Million)

Table 51 U.S.: Heat Shield Market Size, By Material Type, 201–2021 (USD Million)

Table 52 Canada: Heat Shield Market Size, By Material Type,2014–2021 (USD Million)

Table 53 Mexico: Heat Shield Market Size, By Material Type,2014–2021 (USD Million)

Table 54 Western Europe: Heat Shield Market Size, By End-Use Industry,2014–2021 (USD Million)

Table 55 Western Europe: Automotive Heat Shield Market Size, By Vehicle Type, 2014–2021 (USD Million)

Table 56 Western Europe: Heat Shield Market Size, By Country,2014–2021 (USD Million)

Table 57 Western Europe: Aluminum Heat Shield Market Size, By Country,2014–2021 (USD Million)

Table 58 Germany: Heat Shield Market Size, By Material Type,2014–2021 (USD Million)

Table 59 France: Heat Shield Market Size, By Material Type,2014–2021 (USD Million)

Table 60 U.K.: Heat Shield Market Size, By Material Type, 2014–2021 (USD Million)

Table 61 Italy: Heat Shield Market Size, By Material Type,2014–2021 (USD Million)

Table 62 Spain: Heat Shield Market Size, By Material Type,2014–2021 (USD Million)

Table 63 Central & Eastern Europe: Heat Shield Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 64 Central & Eastern Europe: Automotive Heat Shield Market Size,By Vehicle Type, 2014–2021 (USD Million)

Table 65 Central & Eastern Europe: Heat Shield Market Size, By Country,2014–2021 (USD Million)

Table 66 Central & Eastern Europe: Aluminum Heat Shield Market Size,By Country, 2014–2021 (USD Million)

Table 67 Russia: Heat Shield Market Size, By Material Type,2014–2021 (USD Million)

Table 68 Poland: Heat Shield Market Size, By Material Type,2014–2021 (USD Million)

Table 69 South America: Heat Shield Market Size, By End-Use Industry,2014–2021 (USD Million)

Table 70 South America: Automotive Heat Shield Market Size, By Vehicle Type, 2014–2021 (USD Million)

Table 71 South America: Heat Shield Market Size, By Country,2014–2021 (USD Million)

Table 72 South America: Aluminum Heat Shield Market Size, By Country,2014–2021 (USD Million)

Table 73 Brazil: Heat Shield Market Size, By Material Type,2014–2021 (USD Million)

Table 74 Argentina: Heat Shield Market Size, By Material Type,2014–2021 (USD Million)

Table 75 Middle East & Africa: Heat Shield Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 76 Middle East & Africa: Automotive Heat Shield Market Size, By Vehicle Type, 2014–2021 (USD Million)

Table 77 Middle East & Africa: Heat Shield Market Size, By Country,2014–2021 (USD Million)

Table 78 Middle East & Africa: Aluminum Heat Shield Market Size, By Country, 2014–2021 (USD Million)

Table 79 Middle East: Heat Shield Market Size, By Material Type,2014–2021 (USD Million)

Table 80 Africa: Heat Shield Market Size, By Material Type,2014–2021 (USD Million)

Table 81 Expansion, 2013–2015

Table 82 New Product Launch, 2011-2015

Table 83 Joint Venture/Agreement/Collaboration, 2011-2013

Table 84 Mergers & Acquisitions, 2013

Table 85 Supply Contracts, 2015

List of Figures (46 Pages)

Figure 1 Heat Shield Market: Research Design

Figure 2 Market Size Estimation: Bottom-Up Approach

Figure 3 Market Size Estimation: Top-Down Approach

Figure 4 Data Triangulation

Figure 5 Automotive Industry Dominates the Heat Shield Market

Figure 6 Defense (Firearm) to Be the Fastest Growing End-Use Industry for Heat Shield During the Forecast Period

Figure 7 Asia-Pacific Estimated to Be the Largest Market,2016–2021 (USD Million)

Figure 8 Attractive Opportunities in the Heat Shield Market

Figure 9 Asia-Pacific Expected to Witness Rapid Growth Between 2016 and 2021

Figure 10 Heat Shield Market Share, By Type, 2016 (USD Million)

Figure 11 Asia-Pacific to Increase the Demand for Heat Shields Between2016 and 2021

Figure 12 North America is the Largest Heat Shield Market

Figure 13 Heat Shield Market, By Region

Figure 14 Vehicle Production Forecast: Key Countries

Figure 15 Aircraft Production Forecast: By Aircraft Type

Figure 16 Major Value Addition Observed in Manufacturing Phase

Figure 17 Porter’s Five Forces Analysis: Heat Shield Market, 2016

Figure 18 Vehicles in Use, By Region, 2014

Figure 19 Gross Domestic Product (GDP) vs. Commercial Vehicle Production

Figure 20 Significant Growth in Vehicle Production Across the Globe

Figure 21 Heat Shield Market Segmentation, By Material Type

Figure 22 Non-Metallic Heat Shields to Dominate the Heat Shield Market Between 2016 and 2021

Figure 23 Heat Shield Market, By End-Use Industry

Figure 24 Automotive is the Largest End-Use Industry for Heat Shield

Figure 25 Passenger Cars Estimated to Be the Largest Segment for Heat Shield in Automotive Industry

Figure 26 Turbine Engine Aircraft to Be the Largest Market for Aircraft Heat Shield Market

Figure 27 Asia-Pacific to Be the Largest Market for Heat Shield Market

Figure 28 Asia-Pacific: China to Be the Fastest-Growing Market for Heat Shield (2016–2021)

Figure 29 North America: U.S. to Account for the Largest Market Share(2016–2021)

Figure 30 Heat Shield Market Share, By Key Players, 2015

Figure 31 Companies Adopted Product Innovation as the Key Growth Strategy, 2011-2015

Figure 32 Major Growth Strategies in the Aluminum Heat Shield Market,2011–2015

Figure 33 Developments in the Global Aluminum Heat Shields Market, 2011–2015

Figure 34 Morgan Advanced Materials: Company Snapshot

Figure 35 Morgan Advanced Materials: SWOT Analysis

Figure 36 Dana Holding Corporation: Company Snapshot

Figure 37 Dana Holding Corporation: SWOT Analysis

Figure 38 Federal Mogul Holding Corporation: Company Snapshot

Figure 39 Federal Mogul Holding Corporation: SWOT Analysis

Figure 40 Autoneum Holding AG: Company Snapshot

Figure 41 Autoneum Holdings AG: SWOT Analysis

Figure 42 Lydall Inc.: Company Snapshot

Figure 43 Lydall Inc.: SWOT Analysis

Figure 44 Elringklinger AG: Company Snapshot

Figure 45 Elringklinger AG: SWOT Analysis

Figure 46 Progress-Werk Oberkirch AG: Company Snapshot

Growth opportunities and latent adjacency in Heat Shield Market