Heat Meter Market by Type (Mechanical (Multi-Jet, Turbine), Static (Electromagnetic, Ultrasonic)), Connectivity (Wired, Wireless), End-User (Residential, Commercial & Public, Industrial) Region - Global Forecast to 2023

[119 Pages Report] The global heat meter market is estimated to be USD 797.2 million in 2017 and is projected to reach USD 1,218.9 million by 2023, at a CAGR of 7.50% during the forecast period.

The years considered for the study are as follows:

- Base Year: 2017

- Estimated Year: 2018

- Projected Year: 2023

- Forecast Period: 20182023

The base year considered for company profiles is 2017. Whenever information was unavailable for the base year, the prior year has been considered.

Objectives of the Study

- To define, describe, segment, and forecast the heat meter market by type, connectivity, end-user, and region

- To provide detailed information on the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the heat meter market with respect to individual growth trends, future expansions, and contribution of each segment to the market

- To analyze market opportunities for stakeholders and details of a competitive landscape for market leaders

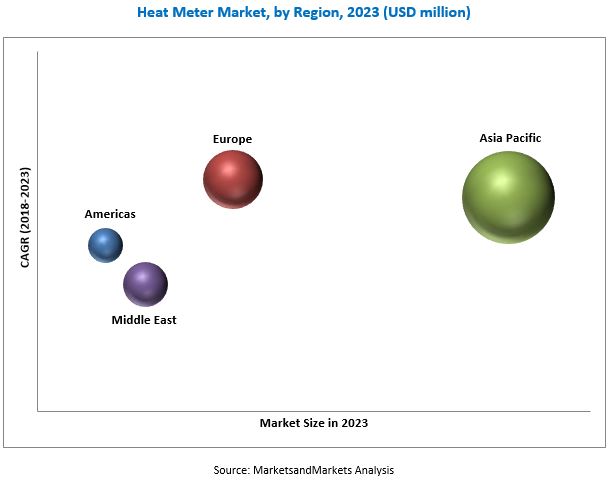

- To forecast the growth of the heat meter market with respect to four regions (Asia Pacific, Europe, Americas, and Middle East)

- To profile and rank key players and comprehensively analyze their market shares

- To track and analyze developments such as contracts & agreements, investments & expansions, new product developments, and mergers & acquisitions in the heat meter market

Research Methodology

This research study involved the use of extensive secondary sources such as press releases, investment reports, industry white papers, presentations, district heating associations, journals, database, and other publicly available sources to identify and collect information useful for a technical, market-oriented, and commercial study of the heat market. The primary sources include several industry experts from the core and related industries, preferred suppliers, manufacturers, distributors, service providers, technology developers, standards and certification organizations from companies, and organizations related to all the segments of this industrys value chain. The research methodology has been explained below.

- Study of annual revenues and market developments of major players providing heat meter

- Analysis of the major end-users of heat meter

- Assessment of future trends and growth of heat meter market based on investments in key end-user segments such as residential, commercial & public, and industrial

- Study of contracts & developments related to the heat meter market by key players across different regions

- Finalization of the overall market sizes by triangulating the supply-side data, which includes product developments, supply chains, and annual revenues of companies manufacturing heat meter across the globe

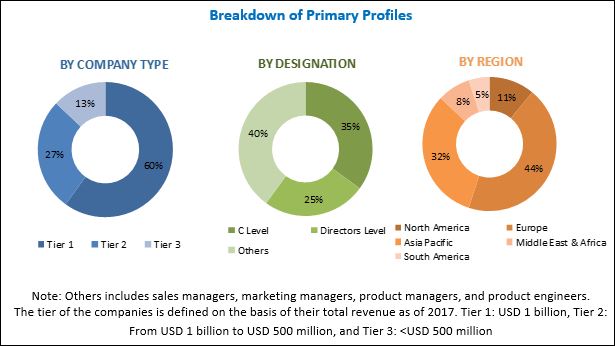

After arriving at the overall market size, the heat market was split into several segments and subsegments. The figure given below illustrates the breakdown of primary interviews conducted during the research study on the basis of company type, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

The leading players in the heat meter market include Danfoss (Denmark), Siemens (Germany), Diehl (Germany), Wasion Group (Hong Kong), Landis+Gyr (Switzerland), Itron (US), Zenner (Germany), Ista (Germany), Elster (Germany).

Target Audience:

- Government and Research Organizations

- Heat Meters Manufacturers

- Maintenance and Service Providers

- Technology Standard Organizations, Forums, Alliances, and Associations

Scope of the Report:

By Type

- Mechanical

- Static

By Connectivity

- Wired Connection

- Wireless Connection

By End-User

- Residential

- Commercial & Public

- Industrial

By Region

- Americas

- Asia Pacific

- Europe

- Middle East

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the clients specific needs. The following customization options are available for this report:

Company Information

- Detailed analyses and profiling of additional market players (up to five)

The global heat meters market is projected to reach USD 1,218.9 million by 2023 from an estimated USD 849.1 million in 2018, at a CAGR of 7.50%. This growth can be attributed to factors such as the requirement for the accurate measurement of heat consumption, legislative mandate to install heat meters, and increased savings through heat conservation.

The heat meters, by type, is segmented into mechanical and static. The static heat meter segment held the largest market share in 2017 and is projected to grow at the highest CAGR during the forecast period. Static meters are available in a wide range of flow rates, which are used in building technology and automation and in district heating. Furthermore, static meters use a fluidic oscillator principle for providing reliable flow and energy readings.

The report segments the heat meters market, by connectivity, into wired connection and wireless connection. The wired heat meter segment is expected hold the largest market share during the forecast period. The trend is expected to change soon with the growing awareness about wireless connection.

The report segments the heat meters market, by end-user, into residential, commercial & public, and industrial. Residential heat meters segment held the largest market share in 2017 and is projected to grow at the highest CAGR during the forecast period. Increasing consumer awareness and growing installation of heat meter have empowered residents to have control over their energy consumption. Residential heat meters have witnessed a large-scale adoption in the residential sector, which includes large multifamily buildings, luxury apartments, and single-family homes.

In this report, the heat meter industry has been analyzed with respect to four regions, namely, Americas, Europe, Asia Pacific, and Middle East. Asia Pacific is estimated to be the largest heat meter market from 2018 to 2023. The increase in construction activities and change in climatic conditions offer high growth opportunities for the heat meter market in this region. Furthermore, rapid urbanization in China has raised the demand for thermal comfort, which is likely to drive the heat meter market. These factors have made China one of the most lucrative markets for heat meter manufacturers.

Capital cost associated with heat meters and the increasing competition from alternative heat sources could act as restraints for the heat meter industry. Consumers with centralized heating systems are increasingly in favor of heat meters but often cannot afford them. It is also observed that in some cases, district heating service providers are reluctant to bear the cost of heat meters as it further adds to their operational expenses. The growth in other alternatives such as renewable heat technologies, which have several policy support and legislative incentives, is expected to weaken the need for heat meter installation.

The global heat meter market is dominated by a few major players that have a wide regional presence. The leading players in heat meters market are Siemens (Germany), Diehl (Germany), Danfoss (Denmark), Kamstrup (Denmark), and Wasion Group (China). New product development was the most commonly adopted strategy by the top players. This was followed by investments & expansions and contracts & agreements.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regional Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Limitation

1.7 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Attractive Opportunities in the Heat Meter Market

4.2 Market, By Country

4.3 Asia Pacific Heat Meter Market, By End-User & Country

4.4 Market, By Type

4.5 Market, By Connectivity

4.6 Market, By End-User

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Mandatory Legislative Requirement to Install Heat Meters

5.2.1.2 Accurate Measurement of Heat Consumption

5.2.1.3 Increased Savings Through Heat Conservation

5.2.2 Restraints

5.2.2.1 Increasing Competition From Alternative Heat Sources

5.2.2.2 Capital Cost Associated With Heat Meters

5.2.3 Opportunities

5.2.3.1 Rise in Development of District Heating Infrastructure

5.2.3.2 Mandatory Heat Meter Installment in Old Building Renovation Projects

5.2.4 Challenges

5.2.4.1 Technical Challenge of Installation in Old Dwellings

5.2.4.2 Rise of Energy-Efficient Infrastructure and Zero Energy Buildings

6 Heat Meter Market, By Type (Page No. - 39)

6.1 Introduction

6.2 Mechanical Heat Meter

6.2.1 Multi-Jet Meter

6.2.2 Turbine Meter

6.3 Static Heat Meter

6.3.1 Electromagnetic Meter

6.3.2 Ultrasonic Meter

7 Heat Meter Market, By Connectivity (Page No. - 45)

7.1 Introduction

7.2 Wired Connection

7.3 Wireless Connection

8 Heat Meter Market, By End-User (Page No. - 49)

8.1 Introduction

8.2 Residential

8.3 Commercial & Public

8.4 Industrial

9 Heat Meter Market, By Region (Page No. - 56)

9.1 Introduction

9.2 Asia Pacific

9.2.1 By Type

9.2.2 By Connectivity

9.2.3 By End-User

9.2.4 By Country

9.2.4.1 China

9.2.4.2 Japan

9.2.4.3 Rest of Asia Pacific

9.3 Americas

9.3.1 By Type

9.3.2 By Connectivity

9.3.3 By End-User

9.3.4 By Country

9.3.4.1 US

9.3.4.2 Canada

9.3.4.3 Rest of Americas

9.4 Europe

9.4.1 By Type

9.4.2 By Connectivity

9.4.3 By End-User

9.4.4 By Country

9.4.4.1 UK

9.4.4.2 Germany

9.4.4.3 Denmark

9.4.4.4 Sweden

9.4.4.5 Rest of Europe

9.5 Middle East

9.5.1 By Type

9.5.2 By Connectivity

9.5.3 By End-User

9.5.4 By Country

9.5.4.1 Saudi Arabia

9.5.4.2 UAE

9.5.4.3 Rest of Middle East

10 Competitive Landscape (Page No. - 82)

10.1 Overview

10.2 Ranking of Players and Industry Concentration, 2017

10.3 Competitive Scenario

10.3.1 Contracts & Agreements, 20152018

10.3.2 New Product Developments, 20152018

10.3.3 Investments & Expansions, 20152018

10.3.4 Mergers & Acquisitions, 20152018

10.3.5 Partnerships, 20152018

10.3.6 Collaborations, 20152018

11 Company Profiles (Page No. - 86)

11.1 Benchmarking

(Business Overview, Products Offered, Recent Developments)*

11.2 Danfoss

11.3 Diehl

11.4 Itron

11.5 Landis+Gyr

11.6 Siemens

11.7 Wasion Group

11.8 Elster

11.9 Engelmann

11.10 Ista

11.11 Kamstrup

11.12 Qundis

11.13 Sensus (Xylem)

11.14 Sontex

11.15 Zenner

*Details on Business overview, Products offered, Recent Developments might not be captured in case of unlisted companies.

12 Appendix (Page No. - 109)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Questionnaire

12.4 Knowledge Store: Marketsandmarkets Subscription Portal

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (63 Tables)

Table 1 Heat Meter Market Snapshot

Table 2 Heat Metering Regulations in Eu Countries

Table 3 Global Heat Meter Market, By Type, 20162023 (USD Million)

Table 4 Mechanical Market Size, By Region, 20162023 (USD Million)

Table 5 Mechanical Market Value, By Top Countries, 20182023 (USD Million)

Table 6 Static Heat Meter: Market Size, By Region, 20162023 (USD Million)

Table 7 Static Market Value, By Top Countries, 20182023 (USD Million)

Table 8 Global Market, By Connectivity, 20162023 (USD Million)

Table 9 Wired Connection: Heat Meter Market Size, By Region, 20162023 (USD Million)

Table 10 Wireless Connection: Market Size, By Region, 20162023 (USD Million)

Table 11 Global Heat Meter Market, By End-User, 20162023 (USD Million)

Table 12 Residential: Market Size, By Region, 20162023 (USD Million)

Table 13 Residential Segment Market Value, By Top Countries, 20182023 (USD Million)

Table 14 Commercial & Public: Market Size, By Region, 20162023 (USD Million)

Table 15 Commercial & Public Segmnet Market Value, By Top Countries, 20182023 (USD Million)

Table 16 Industrial: Market Size, By Region, 20162023 (USD Million)

Table 17 Commercial & Public Segmnet Market Value, By Top Countries, 20182023 (USD Million)

Table 18 Heat Meter Market, By Region, 20162023 (USD Million)

Table 19 Asia Pacific: Market Size, By Type, 20162023 (USD Million)

Table 20 Asia Pacific: Market Size, By Connectivity, 20162023 (USD Million)

Table 21 Asia Pacifc: Market Size, By End-User, 20162023 (USD Million)

Table 22 Asia Pacific: Market Size, By Country, 20162023 (USD Million)

Table 23 China: Heat Meter Market Size, By End-User, 20162023 (USD Million)

Table 24 China: Market Size, By Type, 20162023 (USD Million)

Table 25 Japan: Market Size, By End-User, 20162023 (USD Million)

Table 26 Japan: Market Size, By Type, 20162023 (USD Million)

Table 27 Rest of Asia Pacifc: Market Size, By End-User, 20162023 (USD Million)

Table 28 Rest of Asia Pacifc: Market Size, By Type, 20162023 (USD Million)

Table 29 Americas: Heat Meter Market Size, By Type, 20162023 (USD Million)

Table 30 Americas: Size, By Connectivity, 20162023 (USD Million)

Table 31 Americas: Market Size, By End-User, 20162023 (USD Million)

Table 32 Americas: Market Size, By Country, 20162023 (USD Million)

Table 33 US: Market Size, By End-User, 20162023 (USD Million)

Table 34 US: Heat Meter Market Size, By Type, 20162023 (USD Million)

Table 35 Canada: Market Size, By End-User, 20162023 (USD Million)

Table 36 Canada: Market Size, By Type, 20162023 (USD Million)

Table 37 Rest of Americas: Market Size, By End-User, 20162023 (USD Million)

Table 38 Rest of Americas: Market Size, By Type, 20162023 (USD Million)

Table 39 Europe: Market Size, By Type, 20162023 (USD Million)

Table 40 Europe: Market, By Connectivity, 20162023 (USD Million)

Table 41 Europe: Market Size, By End-User, 20162023 (USD Million)

Table 42 Europe: Market Size, By Country, 20162023 (USD Million)

Table 43 UK: Market Size, By End-User, 20162023 (USD Million)

Table 44 UK: Market Size, By Type, 20162023 (USD Million)

Table 45 Germany: Market Size, By End-User, 20162023 (USD Million)

Table 46 Germany: Market Size, By Type, 20162023 (USD Million)

Table 47 Denmark: Market Size, By End-User, 20162023 (USD Million)

Table 48 Denmark: Market Size, By Type, 20162023 (USD Million)

Table 49 Sweden: Market Size, By End-User, 20162023 (USD Million)

Table 50 Sweden: Market Size, By Type, 20162023 (USD Million)

Table 51 Rest of Europe: Heat Meter Market Size, By End-User, 20162023 (USD Million)

Table 52 Rest of Europe: Market Size, By Type, 20162023 (USD Million)

Table 53 Middle East: Market Size, By Type, 20162023 (USD Million)

Table 54 Middle East: Heat Meter Size, By Connectivity, 20162023 (USD Million)

Table 55 Middle East: Heat Meter Market Size, By End-User, 20162023 (USD Million)

Table 56 Middle East: Market Size, By Country, 20162023 (USD Million)

Table 57 Saudi Arabia: Heat Meter Market Size, By End-User, 20162023 (USD Million)

Table 58 Saudi Arabia: Market Size, By Type, 20162023 (USD Million)

Table 59 UAE: Heat Meter Market Size, By End-User, 20162023 (USD Million)

Table 60 UAE: Market Size, By Type, 20162023 (USD Million)

Table 61 Rest of Middle East: Market Size, By End-User, 20162023 (USD Million)

Table 62 Rest of Middle East: Market Size, By Type, 20162023 (USD Million)

Table 63 Kamstrup Was the Most Active Player in the Market Between 2015 and 2018

List of Figures (40 Figures)

Figure 1 Research Design

Figure 2 Breakdown of Primaries: By Company Type, Designation, & Region

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Assumptions of the Research Study

Figure 7 Static Segment, By Type, is Expected to Grow at the Highest CAGR During the Forecast Period, 20182023

Figure 8 Wired Connection Segment is Estimated to Lead the Heat Meter Market, By Connectivity, 20182023

Figure 9 Residential Segment is Estimated to Lead the Market, By End-User, 20182023

Figure 10 Asia Pacific to Lead the Market

Figure 11 Mandatory Legislative Requirement to Install Heat Meters is Expected to Drive the Market From 2018 to 2023

Figure 12 The Market in the UK is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 13 Residential Segment Dominates the Heat Meter Market in Asia Pacific

Figure 14 Static Segment is Expected to Dominate the Market During the Forecast Period.

Figure 15 Wired Connection Segment is Expected to Dominate the Heat Meter Market, By Connectivity, During the Forecast Period

Figure 16 Residential Segment is Expected to Dominate the Market, By End-User, During the Forecast Period

Figure 17 Heat Meter Market: Drivers, Restraints, Opportunities, & Challenges

Figure 18 Share of Renewable Energy Sources in Heat Consumption (In %), 20132017

Figure 19 Current Share of the Total Annual Heating and Cooling Demand Met By Dhc in (%)

Figure 20 Global District Heating and Cooling Potential, By Countries, 2015 vs 2030 (In Gw)

Figure 21 Static Segment is Expected to Hold the Largest Market Share By 2023

Figure 22 Mechanical Market Share, By Top Countries, 2017 (USD Million)

Figure 23 Static Heat Meter Market Share, By Top Countries, 2017 (USD Million)

Figure 24 Wired Connection Segment is Expected to Hold the Largest Market Share By 2023

Figure 25 Residential Segment is Expected to Hold the Largest Market Share By 2023

Figure 26 Residential Segment Market Share, By Top Countries, 2017 (USD Million)

Figure 27 Commercial & Public Segment Market Share, By Top Countries, 2017 (USD Million)

Figure 28 Industrial Segment Market Share, By Top Countries, 2017 (USD Million)

Figure 29 Regional Snapshot: the Market in Europe is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 30 Heat Meter Market Share (Value), By Region, 2023

Figure 31 Asia Pacific: Market Snapshot

Figure 32 Europe: Market Snapshot

Figure 33 Key Developments in the Heat Meter Market, 20152018

Figure 34 Top 5 Market Leaders in the Market in 2017

Figure 35 Danfoss: Company Snapshot

Figure 36 Diehl: Company Snapshot

Figure 37 Itron: Company Snapshot

Figure 38 Landis+Gyr: Company Snapshot

Figure 39 Siemens: Company Snapshot

Figure 40 Wasion Group: Company Snapshot

Growth opportunities and latent adjacency in Heat Meter Market