Healthy Energy Drinks Market

The global market for healthy energy drinks has been estimated to be USD XX billion in 2024 and is projected to grow at XX% between 2024 and 2029.

The healthy energy drinks market has shown significant growth in recent years, driven by an increasing consumer shift towards wellness and health-conscious choices. These beverages, often formulated with low sugar content, natural ingredients, and functional benefits like enhanced focus and energy, are gaining traction, especially among millennials and Gen Z consumers. Key segments driving the market include energy shots and natural or organic energy drinks, which resonate with consumers seeking cleaner, more natural alternatives. Packaging innovations, particularly in cans and other eco-friendly materials like tetra packs, also contribute to the market's expansion. Additionally, the rise of sugar-free or low-calorie variants aligns with global health trends, pushing the boundaries of product development. Market performance is further boosted by expanding distribution channels, especially off-trade sales in retail and supermarkets, which dominate the space. However, the on-trade segment, including restaurants and cafes, is gaining momentum as more consumers opt for healthier drink options in social settings.

Global Healthy Energy Drinks Market Trends

Market Dynamics

Drivers: Rising Demand for Functional Beverages

The demand for functional beverages has significantly contributed to the growth of the healthy energy drinks market. Consumers are increasingly seeking products that offer health benefits beyond just hydration or energy. Functional energy drinks, which are enriched with vitamins, antioxidants, and electrolytes, appeal to health-conscious individuals who prefer natural, clean-label options to support their overall well-being. These beverages often promise enhanced physical performance, improved cognitive function, and better recovery, making them popular among those focused on both mental and physical health. For example, JoulesHealth launched a new energy drink in October 2023 aimed at health-conscious youth who aspire to "achieve it all." This product caters to consumers looking for functional beverages that go beyond traditional energy drinks, reflecting the growing demand for products aligned with wellness trends. Additionally, Good Earth UK entered the functional beverage market with its launch of Good Earth Energy in May 2021. The brand targeted consumers skeptical of traditional energy drinks due to their high sugar, caffeine, and artificial ingredient content. Good Earth Energy features natural caffeine sourced from Guayusa, a leaf from Ecuador known for providing a steady energy boost, combined with natural fruit juices and vitamin C.

Companies are increasingly responding to the rising demand for functional beverages by focusing on health benefits, natural ingredients, and sustainability. This approach is driving growth in the healthy energy drinks market by offering innovative, functional products tailored to health-conscious and environmentally aware consumers.

Restraints: Health Concerns Around Caffeine

Health concerns about caffeine have posed a significant challenge for the growth of the healthy energy drinks market, despite the rising popularity of these products. High levels of caffeine in some energy drinks have raised alarms among consumers and health authorities due to potential adverse effects such as anxiety, insomnia, and cardiovascular issues. This has led to increased scrutiny from health regulators, with calls to limit the caffeine content in certain beverages, which could hinder market expansion.

Caffeine consumption is widespread, with 85% of Americans consuming at least one caffeinated beverage each day. The average daily intake of caffeine is 165 mg, with individuals aged 50 to 64 reporting the highest intake, averaging 226 mg per day. While coffee remains the primary source of caffeine across all age groups, younger consumers are more likely to obtain their caffeine from tea and carbonated soft drinks. These statistics indicate a strong ongoing demand for caffeinated beverages, but they also emphasize the need for balance in caffeine levels to mitigate potential health risks. As the market continues to expand, addressing consumer concerns about caffeine content will be essential for maintaining demand and minimizing regulatory challenges. Brands may need to focus on offering low-caffeine or caffeine-free alternatives to attract a broader audience that is concerned about the negative effects of excessive caffeine consumption.

Opportunities: Growing E-commerce Sales

The growth of e-commerce has created significant opportunities for companies in the healthy energy drinks market. As online retailing and direct-to-consumer sales channels have become more prevalent, businesses can effectively reach a wider audience, providing greater accessibility and convenience for consumers. This trend has opened new possibilities for exploring healthy energy drink options, allowing consumers to compare products, read reviews, and make informed choices without the constraints of physical store locations.

According to an article released by Digital Commerce 360, the Food & Beverage e-commerce sector experienced substantial growth in 2023, with online sales reaching approximately USD 30.95 billion, up from USD 27.80 billion in 2022. Meanwhile, the total retail sales in the United States climbed to USD 979.16 billion, an increase from USD 957.19 billion the previous year. E-commerce continues to gain importance, with top retailers in the Food & Beverage category increasing both their sales and market share, reflecting the ongoing shift towards digital platforms.

The pandemic has significantly changed how consumers purchase food and beverages, making online grocery shopping a norm for people of all ages. Millennials, aged 25-34, comprise the largest share of online Food & Beverage consumers at 24.3%, followed by those aged 35-44 at 21.1%. Even older age groups have embraced online grocery shopping, with 9% of shoppers aged 65 and older now purchasing their groceries online. This growing base of online shoppers across various age groups creates a favorable environment for healthy energy drink brands to thrive in the digital space, as consumers increasingly appreciate the convenience of e-commerce for their beverage purchases.

Challenges: Intense Competition

The healthy energy drinks market is highly competitive, with many established and emerging brands fighting for consumer attention. Major beverage companies like Coca-Cola, PepsiCo, and Monster are expanding their portfolios to include healthier energy drink options. These companies have strong brand recognition, extensive distribution networks, and large marketing budgets, allowing them to dominate the market and reach a wide audience. Their entry into the health-conscious segment has intensified competition, forcing smaller brands to find ways to differentiate themselves through product innovation and niche marketing.

As larger companies increasingly offer healthier options, they often utilize their existing resources and customer loyalty, making it challenging for newer and smaller entrants to compete. These new players may face difficulties securing shelf space, building their brand presence, and achieving the necessary scale to match the marketing power of industry giants. Additionally, large companies can negotiate favorable agreements with suppliers and distributors, giving them a competitive advantage in terms of cost efficiency. This dynamic can lead to price wars that squeeze profit margins for smaller brands.

Smaller brands often rely on unique value propositions—such as organic ingredients, low-calorie options, or sustainability credentials—to attract specific segments of health-conscious consumers. However, these brands must continuously innovate and effectively communicate their unique selling points to stand out in an increasingly crowded market.

Market Ecosystem

The healthy energy drinks market ecosystem is a dynamic and rapidly evolving landscape, influenced by a variety of stakeholders across both the supply and demand sides. On the supply side, it consists of major beverage companies, health-focused brands, ingredient suppliers, and packaging companies, each playing a role in developing innovative, functional products. On the demand side, diverse consumer segments, retail channels, and e-commerce platforms shape purchasing behavior, with health-conscious consumers increasingly seeking products that offer both energy boosts and health benefits. Government bodies, research organizations, and industry associations further influence this ecosystem by regulating standards, conducting studies, and driving consumer education, which collectively guide the market's growth and development.

The can packaging type segment accounted the largest during the forecast period.

For the Healthy Energy Drinks Market, by Packaging Type, the Cans segment typically holds the majority of the market share. Cans are the most popular packaging choice for energy drinks due to their convenience, portability, and cost-effectiveness. Cans also offer a longer shelf life and are widely preferred for on-the-go consumption, which aligns with the active lifestyle of energy drink consumers.

The traditional energy drinks accounted the largest during the forecast period

In the Healthy Energy Drinks Market, Traditional Energy Drinks currently hold the largest market share. This category includes energy drinks formulated with caffeine, sugars, and other stimulants such as taurine and guarana. The demand for these drinks is primarily driven by consumers seeking quick energy boosts and increased focus, particularly among young adults and individuals with active or demanding lifestyles.

Well-established brands like Red Bull, Monster, and Rockstar have significantly contributed to the dominance of traditional energy drinks in the market. These brands maintain a large consumer base due to strong brand recognition, extensive distribution networks, and consistent marketing efforts. However, there is a noticeable shift in the market, with growing interest in Natural/Organic Energy Drinks and Sugar-Free or Low-Calorie Energy Drinks. While these categories are expanding rapidly, Traditional Energy Drinks still lead in overall consumption, remaining the preferred choice for many consumers looking for a quick, high-intensity energy boost.

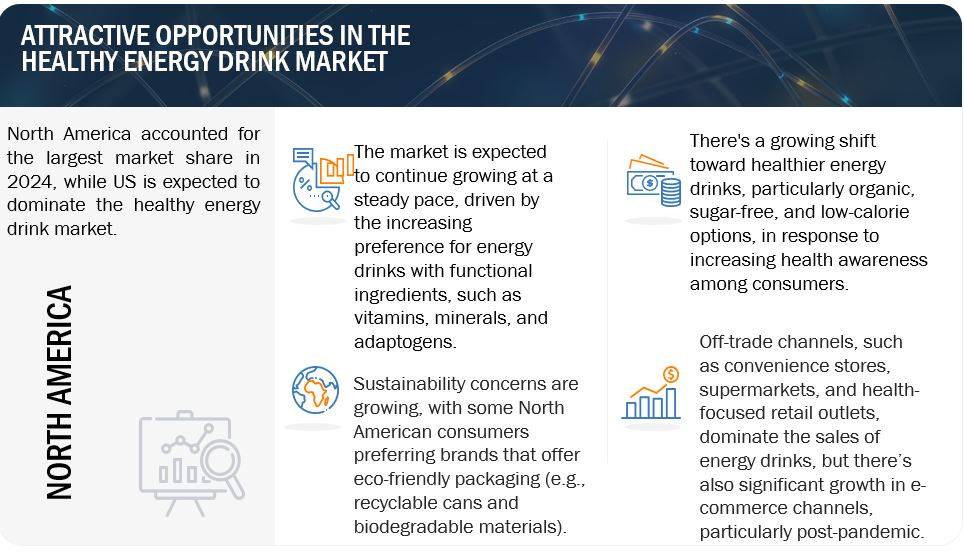

North America dominated the healthy energy drinks market during the forecast period.

In the Healthy Energy Drinks Market, North America dominates in terms of market share, particularly driven by the United States, which is one of the largest consumers of energy drinks globally. The region has been a key growth driver for the market, accounting for a significant portion of global consumption. This is primarily due to the high demand for energy-boosting beverages, fueled by a large, health-conscious, and active population. According to recent industry reports, North America holds approximately 35-40% of the global market share for energy drinks. The U.S. alone represents the largest portion, with a consumption rate significantly higher than other regions. In 2023, the average American consumed about 165 mg of caffeine per day, and energy drinks, particularly traditional ones, remain a popular source of caffeine alongside coffee. The demographic segments, especially young adults aged 18-34, are the largest consumers of energy drinks, utilizing these products for enhanced physical and mental performance during work, study, and recreational activities.

The market in North America continues to thrive due to strong brand recognition of leading players such as Red Bull, Monster, and PepsiCo’s Rockstar. The introduction of healthier alternatives, such as natural/organic and low-calorie energy drinks, has further boosted consumption among health-conscious individuals.

Key Market Players

The key players in this market include Aje Group, Carabao Group Public Company Limited, Congo Brands, Hell Energy Magyarország Korlátolt Felelosségu Társaság, Living Essentials, Llc, Monster Beverage Corporation, Osotspa Public Company Limited, Pepsico, Inc., Red Bull Gmbh And Suntory Holdings Limited.

Recent Developments

- October 2024, Boost Drinks has expanded its Energy range with a new 500ml format, available in Original, Sugar-Free Original, and Red Berry flavors, all priced at £1. The new size was selected based on sales data showing these flavors as the best-sellers in the brand's 250ml range. The 500ml category is valued at £745 million and growing annually by 13%, with Boost holding a significant position as the third-largest energy drink brand. This move responds to consumer demand for larger, on-the-go formats and offers retailers increased profit potential. Boost is committed to continuing innovation within the soft drinks sector.

- October 2024, KEY, the all-natural, sugar-free energy drink powered by ketones, announced its nationwide launch at Sprouts Farmers Market, expanding to over 420 stores. This rapid growth marks a major milestone for KEY, more than doubling its retail presence to 700+ stores across the U.S. With its innovative formula of low caffeine and zero sugar, KEY is setting a new standard in the healthy energy drink market, appealing to health-conscious consumers seeking sustained energy without the usual sugar spikes or caffeine jitters. This expansion reflects a rising demand for clean, functional energy alternatives.

- November 2024, Oasis Energy Drink has entered the healthy energy drink market with a focus on natural ingredients like green coffee and Guayusa leaf, offering a balanced 160 mg caffeine boost without sugar or calories. The launch introduces a competitive alternative, appealing to health-conscious consumers seeking clean energy without artificial additives. With plans to expand its flavor range in Q1 2025, Oasis aims to strengthen its market position and potentially drive demand for healthier, sustainable energy drink options.

- On July, 2024 Tenzing, a UK-based functional energy drinks maker, has launched the world’s strongest natural energy drink, Super Natural Energy. The new Fiery Mango flavor contains 200mg of natural caffeine, derived from green coffee and green tea, and is packed with 1000mg of cordyceps mushrooms, magnesium, vitamin C, and electrolytes. This drink offers 60mg of caffeine per 100ml, significantly higher than Tenzing Original's 32mg per 100ml. Compared to competitors, Prime Energy has 42mg per 100ml and Red Bull 30mg per 100ml. Tenzing's CEO, Huib van Bockel, emphasized the product’s unique combination of energy-boosting ingredients and functional benefits. The drink is available in the UK via Tenzing’s website, Amazon, and Holland & Barrett stores.

- In October 2022, ZOA Energy, the fastest-growing energy drink in the U.S., has officially launched in Canada, marking its first international expansion. Powered by natural caffeine from green coffee beans and green tea, ZOA Energy’s popular flavors—Tropical Punch, White Peach, and Wild Orange—are now available across all ten Canadian provinces, including through Amazon, ZOA’s website, and Costco stores. This milestone highlights ZOA’s growing influence in the clean energy drink market, driven by consumer demand for healthier energy alternatives. With its zero-sugar formula and commitment to authenticity, ZOA is poised to capture new markets and expand its global footprint.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the healthy energy drinks market?

North America dominated the healthy energy drinks market, worth USD XX billion in 2024, and is projected to reach USD XX billion by 2029, at a CAGR of XX% during the forecast period.

What is the current size of the global healthy energy drinks market?

The global healthy energy drinks market was valued at USD XX billion in 2024. It is projected to reach USD XX billion by 2029, recording a CAGR of XX% during the forecast period.

Who are the key players in the market?

The key players in this market include Aje Group, Carabao Group Public Company Limited, Congo Brands, Hell Energy Magyarország Korlátolt Felelosségu Társaság, Living Essentials, Llc, Monster Beverage Corporation, Osotspa Public Company Limited, Pepsico, Inc., Red Bull Gmbh And Suntory Holdings Limited.

What are the factors driving the healthy energy drinks market?

- Consumer Health Consciousness: Growing demand for healthier, functional beverages with natural ingredients.

- Convenience: Increased preference for on-the-go, ready-to-drink formats.

- Innovation in Flavors: Introduction of unique and bold flavors to attract diverse consumer preferences.

- E-commerce Growth: Expansion of online retail channels driving accessibility and convenience.

- Sustainability: Rising demand for eco-friendly packaging and sustainable sourcing of ingredients.

- Premiumization: Consumers willing to pay more for high-quality, natural, or organic products.

Which segment accounted for the largest healthy energy drinks market share?

Can packaging type accounted for the largest market share in the packaging type in forecast period.

TABLE OF CONTENTS

1. INTRODUCTION

Growth opportunities and latent adjacency in Healthy Energy Drinks Market