Healthcare Display Market by Device Type (Mobile, Desktop, AIO), Technology (LCD, OLED, Micro-LED, Direct-view LED), Panel Size, Resolution, Application (Digital Pathology, Multi-modality, Surgical, Radiology, Mammography) and Region – Global Forecast to 2030

The term healthcare display refers displays that are deployed in healthcare devices, and these devices used for multiple applications such as digital pathology, multi-modality, surgical, radiology, and mammography applications. The market is likely to witness significant growth owing to the rising demand for innovative and advanced, but cost-effective, healthcare display devices. However, most of the currently available healthcare display devices are expensive due to the deployment of advanced technologies such as IoT enabled devices and AR/VR devices. Hence, the availability of these devices on lease is likely to surge their demand in healthcare facilities, thereby positively influencing market growth.

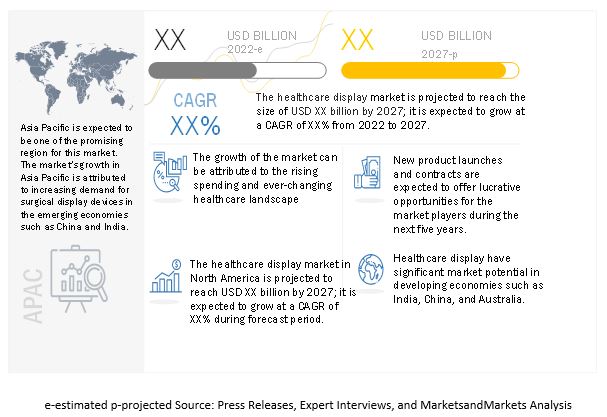

The global healthcare display market size is expected to grow from USD XX billion in 2022 to USD XX billion by 2027, at a CAGR of XX%. The market is likely to witness significant growth owing to the rising healthcare spending and ever-changing healthcare landscape, increasing adoption of IoT-based smart medical devices, growing use of radiation therapy in diagnosis and treatment of diseases.

To know about the assumptions considered for the study, Request for Free Sample Report

Drivers: Rising healthcare spending and ever-changing healthcare landscape

Healthcare expenditure has a direct relationship with an increasingly aging population, rising per capita disposable income, and improving lifestyle. The medical expenditure per person for the age group 60 years and above is much higher than that of the people within the age group of 15–30 years.

The world’s older population is continuously increasing at an unprecedented rate, which means increased life expectancy but with multiple comorbidities. Although healthcare infrastructure across the world is growing and improving, affordability and accessibility barriers cause hindrance to the penetration of medical devices within the vast majority of the population. Healthcare spending needs to be increased to overcome the challenge of poor accessibility and affordability. Growth in overall healthcare expenditure is likely to result in better access to healthcare display and encourage manufacturers of healthcare display toward spending on R&D and innovations. Healthcare spending in developed countries is expected to grow substantially in the coming decades.

Thus, the rising healthcare spending and ever-changing healthcare landscape propelled the growth of the healthcare display market.

Challenges: Minimizing latency for healthcare display

Latency is a delay that increases the real or perceived response time of healthcare displays than their required response time. Certain factors such as an imbalance in the data processing speed of microprocessors and input or output devices can cause latency in healthcare display. Displays contribute to more than 50% of the total response delay in the healthcare devices. There will be a deviation in the location from the exact position if there is an issue in the measurement of the viewpoint. Thus, minimizing latency is one of the key challenges for companies developing healthcare displays.

Key players in the market

Samsung Electronics (South Korea), Barco (Belgium), BenQ (Taiwan), EIZO Corporation (Japan), and LG Display (South Korea) are few key players in the healthcare display market globally.

Recent Developments

- In April 2022, Samsung partnered with ShareSafe, a HealthTech and Media company. Moreover, ShareSafe announces the launch of its ShareView mobile multi-content casting technology in partnership with Samsung's Healthcare Display division for integration on Samsung Smart TVs manufactured for healthcare.

- In July 2022, EIZO announced four new monitors ranging from 32 to 55 inches with 4K UHD resolution (3840 x 2160 pixels) for use in endoscopy, microsurgery, and other high-precision procedures in the operating room.

- In June 2022, EIZO announced the release of the RadiForce MS236WT-A – a 23-inch 2 megapixel (1920 x 1080 pixels) multitouch monitor ideal for displaying and marking electronic medical records and images in hospitals and clinics.

- In June 2022, EIZO announced the release of the RadiForce MX243W – a 24.1-inch 2.3 megapixel (1920 x 1200 pixels) monitor for displaying patient charts and reviewing diagnostic imaging in hospital and clinic environments.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 Introduction

1.1. Study Objectives

1.2. Market Definition

1.3. Study Scope

1.3.1. Markets Covered

1.3.2. Geographic Scope

1.3.3. Years Considered

1.4. Currency

1.5. Limitations

1.6. Stakeholders

2 Research Methodology

2.1. Introduction

2.2. Research Data

2.2.1. Secondary Data

2.2.2. Primary Data

2.2.2.1. Breakdown Of Primary Interviews

2.2.2.2. Primary Interviews With Experts

2.2.2.3. Key Data From Primary Source

2.2.2.4. Key Industry Insights

2.3. Market Size Estimation

2.3.1. Bottom-UP Approach

2.3.2. Top-Down Approach

2.4. Market Breakdown and Data Triangulation

2.5. Research Assumptions

2.6. Risk Assessment

3 Executive Summary

4 Premium Insights

5 Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.2.4. Challenges

5.3. Trends/Disruption Impacting Customer’s Business

5.4. Ecosystem/Market Map

5.5. Value Chain Analysis

5.6. Key Stakeholders & Buying Criteria

5.7. Technology Analysis

5.8. Patent Analysis

5.9. Tariff & Regulatory Framework

5.9.1. Regulatory Bodies, Government Agencies, and Other Organizations

5.9.2. Tariffs

5.9.3. Regulations

5.9.4. Standards

5.10. Trade Data Analysis

5.11. Case Study

5.12. Key Conferences & Events in 2023-2024

5.13. Porter’s Five Force Analysis

5.14. Average Selling Price (ASP) Analysis

6 Healthcare Display Market, By Technology

6.1. Introduction

6.2. LCD

6.3. OLED

6.4. Direct-View LED

6.5. Micro-LED

6.6. Others

7 Healthcare Display Market, By Panel Size

7.1. Introduction

7.2. Upto 27 Inches

7.3. 27- 42 Inches

7.4. Above 42 Inches

8 Healthcare Display Market, By Device Type

8.1. Introduction

8.2. Mobile

8.3. Desktop

8.4. All-in-One

8.5. Others

9 Healthcare Display Market, By Device Type

9.1. Introduction

9.2. Upto 2.0 MP

9.3. 2.1-4.0 MP

9.4. 4.1-8.0 MP

9.5. Above 8.1 MP

10 Healthcare Display Market, By Application

10.1. Introduction

10.2. Digital Pathology

10.3. Multi-Modality Applications

10.4. Surgical/Interventional Applications

10.5. Radiology

10.6. Mammography

10.7. Other Applications

11 Healthcare Display Market, By Region

11.1. Introduction

11.2. North America

11.2.1. US

11.2.2. Canada

11.2.3. Mexico

11.3. Europe

11.3.1. Germany

11.3.2. UK

11.3.3. France

11.3.4. Rest of Europe

11.4. Asia Pacific

11.4.1. China

11.4.2. Japan

11.4.3. South Korea

11.4.4. Rest of Asia Pacific

11.5. Rest of World (RoW)

11.5.1. Middle East & Africa

11.5.2. South America

12 Competitive Landscape

12.1. Overview

12.2. Market Evaluation Framework

12.2.1. Product Portfolio

12.2.2. Regional Focus

12.2.3. Manufacturing Footprint

12.2.4. Organic/Inorganic Strategies

12.3. Market Share Analysis (Top 5 Players)

12.4. 5-Year Company Revenue Analysis

12.5. Company Evaluation Quadrant

12.5.1. Stars

12.5.2. Emerging Leaders

12.5.3. Pervasive

12.5.4. Participants

12.5.5. Competitive Benchmarking

12.6. Company Footprint

12.6.1. Company Technology Footprint

12.6.2. Company Application Footprint

12.6.3. Company Region Footprint

12.7. Competitive Situation and Trends

12.7.1. Product Launches

12.7.2. Deals

13 Company Profiles

13.1. Introduction

13.2. Key Players

13.2.1. Samsung Electronics

13.2.2. Barco

13.2.3. BenQ

13.2.4. EIZO Corporation

13.2.5. LG Display

13.2.6. Sharp (Foxconn)

13.2.7. Japan Display

13.2.8. Innolux

13.2.9. NEC Corporation

13.2.10. Leyard Optoelectronic (Planar)

13.2.11. BOE Technology

13.2.12. Axiomtek Co., Ltd.

13.2.13. Advantech

14 Appendix

14.1. Discussion Guide

14.2. Knowledge Store: MarketsandMarkets’ Subscription Portal

14.3. Available Customization

14.4. Related Reports

14.5. Author Details

Growth opportunities and latent adjacency in Healthcare Display Market