Handheld Chemical and Metal Detector Market by Technology (Raman Spectroscopy, Ion Mobility Spectrometry), Application (Chemical Detection, Explosive Detection), End User, and Geography (2022-2027)

Updated on : October 23, 2024

The handheld chemical and metal detector market is witnessing increasing demand due to rising concerns over safety and security in sectors such as defense, law enforcement, transportation, and industrial manufacturing. These portable devices are crucial for detecting hazardous chemicals, explosives, and metals in real-time, making them essential tools for military operations, airport security, and border control. Key trends driving the market include advancements in sensor technology, the growing need for rapid detection solutions, and increased government investments in security infrastructure. Additionally, the rising threat of terrorism and the demand for non-invasive, easy-to-use detection systems are further boosting market growth. As safety regulations tighten and the focus on public security intensifies, the market for handheld chemical and metal detectors is expected to expand significantly.

Handheld Chemical and Metal Detector Market Size & Growth

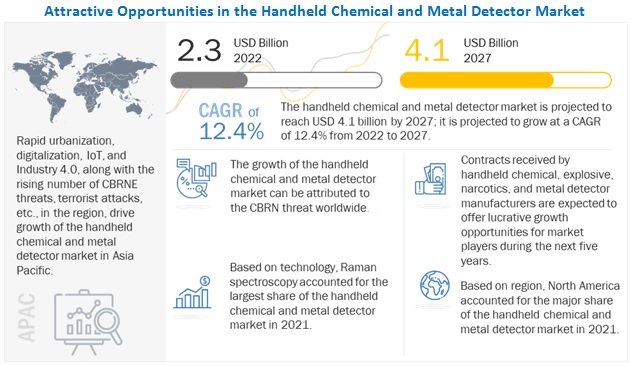

The global handheld chemical and metal detector market is projected to reach USD 4.1 billion by 2027 from an estimated USD 2.3 billion in 2022, growing at a CAGR of 12.4% during the forecast period from 2022 to 2027.

Major factors driving the growth of the market include increasing threat of chemical and explosives terrorism and rising focus of governments worldwide on imposing stringent regulations to ensure human and environmental safety.

To know about the assumptions considered for the study, Request for Free Sample Report

Handheld Chemical and Metal Detector Market Segment Overview:

Raman spectroscopy is projected to grow at the highest CAGR during the forecast period

Raman spectroscopy is among the widely used detection technologies. According to the Scientific Working Group for the Analysis of Seized Drugs (SWGDRUG), an instrument or a device based on Raman spectroscopy is an analytical technique that has the highest potential discriminating ability for the detection and identification of narcotics (Class A analytical technique).

In addition, handheld detectors based on Raman spectroscopy offer rapid response time, ease of operation, and effective identification of chemicals, explosives, and narcotics by scanning packaging materials, without disturbing the sample, which minimizes the exposure to the operator—keeping the first responder and community safer. Due to these benefits, Raman spectroscopy technology is expected to dominate the market during the forecast period.

Narcotics detection application is projected to grow at the highest CAGR during the forecast period

According to the World Drug Report 2021 by the United Nations Office on Drugs and Crime (UNODC), cannabis potency has quadrupled in some parts of the world over the last two decades.

The number of people using drugs increased by 22%, and the number of cannabis users has increased by nearly 18% from 2010 to 2019. Also, most countries have reported a rise in the use of cannabis, specifically during the pandemic. This increase in the use of drugs or narcotics is expected to increase the demand for handheld detectors for narcotics detection during the forecast period.

Law enforcement agencies & forensic departments is projected to grow at the highest CAGR from 2022 to 2027

Law enforcement agencies & forensic departments require versatile and practical equipment that can meet various needs without slowing down their operations.

Handheld detectors enable law enforcement agencies and forensic departments to add an unexpected layer of security at a checkpoint or extend actionable intelligence capability beyond the fixed-site checkpoint. Owing to this, the handheld chemical and metal detector industry for the law enforcement agencies & forensic departments is projected to grow at the highest CAGR during the forecast period.

In 2027, the North America is projected to hold the largest share of the overall market

North America held the largest share of the handheld chemical and metal detector market in 2021 and is expected to dominate the market during the forecast period.

The dominance is due to its strong base of end users, including law enforcement agencies & forensic departments, customs & border security staff, military & defense forces, airports, and the pharmaceuticals industry. These end users demand handheld chemical, explosive, narcotics, and metal detectors for the safe detection of chemicals, explosives, and priority drugs. According to NBC News, California’s national forests are home to 80–85% of the country’s illegal marijuana growth. Drug traffickers reroute millions of gallons of water to grow and have caused several large wildfires. Also, the significant use of pesticides on crops is endangering wildlife, water supplies, and people. Handheld detectors help forest officers to detect these hazardous chemicals and drugs and protect forests from wildfires. Moreover, the region also houses numerous chemical, explosive, narcotics, and metal detector manufacturers, including OSI Systems, Inc.; Teledyne Technologies Incorporated; Thermo Fisher Scientific Inc.; Agilent Technologies, Inc.; and 908 Devices Inc.

To know about the assumptions considered for the study, download the pdf brochure

Top 10 Key Market Players in Handheld Chemical and Metal Detector Companies

- OSI Systems, Inc. (US),

- Teledyne Technologies Incorporated (US),

- Smiths Group plc (UK),

- Thermo Fisher Scientific Inc. (US),

- Agilent Technologies, Inc. (US),

- Bruker Corporation (US),

- Leidos (US),

- Garrett Metal Detectors (US),

- 908 Devices Inc. (US), and

- Nuctech Company Limited (China)

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Handheld Chemical and Metal Detector Market Scope

|

Report Metric |

Detail |

|

Market Size Availability for Years |

2018–2027 |

|

Base Year |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

By technology, application, end user, and region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

OSI Systems, Inc. (US), Teledyne Technologies Incorporated (US), Smiths Group plc (UK), Thermo Fisher Scientific Inc. (US), Agilent Technologies, Inc. (US), Bruker Corporation (US), Leidos (US), Garrett Metal Detectors (US), 908 Devices Inc. (US), and Nuctech Company Limited (China) are some of the key players in the handheld chemical and metal detector market. |

Handheld Chemical and Metal Detector Market Dynamics:

Driver: Rising focus of governments worldwide on imposing stringent regulations to ensure human and environmental safety

Government regulations play a significant role in the growth of the market. Several chemicals such as nitroglycerin, octogen, azidoazide are highly toxic and explosive.

Exposures to hazardous chemicals can cause a wide range of short- and long-term health effects, depending on the nature of the chemicals used and a person's susceptibility, as well as whether these chemicals are inhaled or absorbed by the skin. To safeguard human lives and the environment, different governing bodies, including the Occupational Safety and Health Administration (OSHA), the National Institute for Occupational Safety and Health (NIOSH), and the Environmental Protection Agency (EPA), have laid down certain guidelines that regulate the manufacturing and application of these chemicals. OSHA is responsible for the promulgation and enforcement activities.

As per its directives, the permissible exposure limit (PEL) for octogen is an 8-hour time-weighted average (TWA). NIOSH is responsible for recommending health and safety standards. As per its directives, the recommended exposure limit (REL) for octogen is a 10-hour TWA. All manufacturers and end-user industries need to follow the regulations laid by these authorities. The GxP guidelines and regulations are imposed by the Food and Drug Administration (FDA) to ensure that bio/pharmaceutical products are safe, meet their intended use, and adhere to quality processes during manufacturing, control, storage, and distribution.

Hence, pharmaceutical manufacturing companies require handheld chemical and drug detectors for the identification, testing, and rejection or approval of raw materials or components before proceeding with the drug manufacturing process. Also, several end-user industries, such as chemicals and pharmaceuticals, are required to submit data related to safety practices followed by them, measures taken by them to handle any hazardous conditions occurring due to production, leakage, spillage, and any casualties that occurred at workplaces due to toxic or hazardous chemicals to EPA. Thus, the rising focus of governments across the world on the imposition of stringent regulations to ensure worker safety leads to high demand for handheld chemical detectors by chemicals and pharmaceuticals industries.

Restraint: Extremely high cost of handheld chemical, explosive, and narcotics detectors, along with longer time to market

Handheld chemical, explosive, and narcotics detectors can be carried from one place to another by security personnel including firefighters and emergency responders, who may need to enter dangerous environments where toxic chemicals or hazardous materials (HAZMATs) are present.

These devices are essential to safeguard first responders, who come in contact with drugs, explosives, or hazardous chemicals, from long-term consequences of these chemicals on their health.

However, these devices are extremely costly compared to other portable detection devices. For instance, the GID-3 portable chemical detector offered by Smiths Detection, Inc. costs USD 18,255 per unit, while ACE-ID, a handheld Raman detector capable of detecting explosives, precursors, narcotics, and toxic chemicals, offered by Smiths Detection, Inc. costs USD 25,995 per unit. Also, MX908, a handheld mass spectroscopy detector capable of detecting explosives, precursors, narcotics, and toxic chemicals, offered by 908 Devices, Inc. costs USD 65,000 per unit. Moreover, the product development process is also time-consuming; hence, limited products are launched or developed by the manufacturers. Thus, factors such as device development cost and R&D cost contribute to the high price of handheld chemical, explosive, and narcotics detectors.

Opportunity: Surging need to improve airport security

Airports are often the transit points for drug trafficking, transnational organized crimes, and acts of terrorism. Such illicit flows have a direct impact on city safety.

Therefore, all individuals at airports are bound to be screened every day for the presence of trace explosives, liquids, metals, radiological materials, biological agents, nuclear weapons, and drugs to avoid airside crimes. The use of effective technologies is essential to address a variety of threats posed by precursor chemicals and explosives, as well as by terrorism. Governments worldwide have become increasingly concerned about the smuggling of explosives, weapons, and radiological materials.

Hence, they have started enforcing several security measures, such as screening passengers and their luggage to ensure public safety, identifying suspicious air cargo, and restricting illegal activities. Screening devices used at airports across the world need to comply with the European Civil Aviation Conference's (ECAC) Standard 3. Thus, various screening devices, such as handheld detectors, desktop or portable detection devices, screening systems, are used at airports to improve the efficiency and effectiveness of the security process.

In addition, the projected air freight growth, owing to the improved standard of living, high disposable income, and affordable cost of travel, is likely to increase the number of air passengers and air freight volumes, which will elevate the demand for security screening devices, including handheld chemical, explosive, narcotics, and metal detectors. However, due to the outbreak of the pandemic, there was a decrease in the air passenger volume, but it is expected to increase in the future. According to the International Civil Aviation Organization (ICAO), there were 4.5 billion air passengers in 2019, whereas the number decreased to 1.8 billion in 2020, but with likely normalcy in the next few months, the airline travel is likely to rebound, thereby creating the rising need for handheld detectors.

Challenge: Interference caused in functioning of certain medical devices when end users are scanned using metal detectors

Handheld metal detectors are used to ensure the complete safety of people at airports, commercial and government buildings, and public places.

This guarantees that none of the people are carrying any dangerous materials to avoid the act of terrorism and smuggling. Metal detectors use various technologies, such as very low frequency, pulse induction, and beat-frequency oscillation involving magnetic fields to detect the presence of metal/s. According to the Center for Devices and Radiological Health of the Food and Drug Administration (FDA), the operation of certain medical devices, including pacemakers, implantable cardioverter or defibrillators, and spinal cord stimulators, may be affected by the electromagnetic fields produced by handheld metal detectors. For instance, the electromagnetic field affects the operation of the pacemaker by shifting the pacing rate, alteration to programmed pacing therapy, loss of or near loss of consciousness, and chest pain.

Patients with implantable cardioverter or defibrillators may get inappropriate shocks to the heart, whereas people with implanted spinal-cord stimulators experience overstimulation.

Handheld Chemical and Metal Detector Industry Categorization:

This research report categorizes the handheld chemical and metal detector market based on technology, application, end user, and region

Based on Technology:

- Raman Spectroscopy

- Ion Mobility Spectrometry

- Metal Identification

- Others (Luminescence, Mass Spectroscopy, and Fourier-transform Infrared Spectroscopy)

Based on Application:

- Chemical Detection

- Explosive Detection

- Narcotics Detection

- Metal Detection

Based on End User:

- Introduction

- Law Enforcement Agencies & Forensic Departments

- Customs & Borders

- Military & Defense

- Airports

- Others (Pharmaceuticals Industry and Events)

Based on Region:

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Rest of Europe

-

APAC

- China

- Japan

- South Korea

- Rest of APAC

-

Rest of the world

- Middle East & Africa

- South America

Recent Developments in Handheld Chemical and Metal Detector Market

- In November 2021, Bruker Corporation launched the new RoadRunner explosives trace detector (ETD) for airport passenger and baggage security screening. The RoadRunner is an ETD that offers fast and accurate screening capabilities and high detection performance of ion mobility spectrometry (IMS) in a user-friendly handheld design.

- In May 2021, 908 Devices Inc. launched updates to its MX908 handheld mass spec device, including a first-of-its-kind aerosol module, to detect and identify aerosolized chemical threats; added targets allowing responders to recognize additional priority drug substances; and activation of a Bluetooth capability to export reports and device history to Android devices. These added capabilities address gaps in responders’ workflows and speed chemical detection at the point of need for multiple missions. MX908 with Aero enables real-time monitoring of aerosolized threats, including aerosolized chemical warfare agents, fourth-generation agents, pharmaceutical-based agents, opioids, and more.

- In March 2021, OSI Systems, Inc. received a contract to provide maintenance and support for the US aviation checkpoint inspection systems.

- In January 2021, Teledyne Technologies Incorporated acquired FLIR Systems, Inc. and formed Teledyne FLIR Systems, Inc. With this acquisition, it wants to expand its portfolio of security and detection solutions and digital imaging products.

- In August 2020, Teledyne Technologies Incorporated upgraded its facility called Teledyne FLIR in Elkridge, Maryland. The company invested more than USD 6 million in upgrading and increasing capabilities for future-ready businesses. The facility serves as a hub for designing and producing an array of unmanned air and ground platforms, surveillance and detection systems used by the US military and public safety agencies worldwide.

Frequently Asked Questions (FAQ):

Which are the major companies in the handheld chemical and metal detector market? What are their major strategies to strengthen their market presence?

The major companies in the handheld chemical and metal detector market are – OSI Systems, Inc. (US), Teledyne Technologies Incorporated (US), Smiths Group plc (UK), Thermo Fisher Scientific Inc. (US), Agilent Technologies, Inc. (US), Bruker Corporation (US), Leidos (US), Garrett Metal Detectors (US), 908 Devices Inc. (US), and Nuctech Company Limited (China). The major strategies adopted by these players are contracts, product launches, collaborations, partnerships, agreements, expansions, and acquisitions.

Which is the potential market for handheld chemical and metal detector in terms of the region?

The North America region is expected to dominate the handheld chemical and metal detector market due to the presence of numerous consumers and handheld chemical and metal detector device manufacturing companies.

What are the opportunities for new market entrants?

There are significant opportunities in the handheld chemical and metal detector market for start-up companies. These companies can provide handheld chemical and metal detector devices to aviation industry. Also, they can develop handheld chemical and metal detector devices that are WiFi- or Bluetooth compatible and can be integrated Industry 4.0 environment.

What are the drivers and opportunities for the handheld chemical and metal detector market?

Factors such as increasing threat of chemical and explosives terrorism and rising focus of governments worldwide on imposing stringent regulations to ensure human and environmental safety are among the driving factors of the handheld chemical and metal detector market. Moreover, increasing threat of chemical and explosives terrorism and rising focus of governments worldwide on imposing stringent regulations to ensure human and environmental safety to create lucrative opportunities in the handheld chemical and metal detector market.

Who are the major consumers of handheld chemical and metal detector devices that are expected to drive the growth of the market in the next 5 years?

The major consumers for handheld chemical and metal detector devices are law enforcement agencies & forensic departments, customs & borders, military & defense, airports, pharmaceutical industry, and events are expected to have a significant share in this market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 HANDHELD CHEMICAL AND METAL DETECTOR MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 2 HANDHELD CHEMICAL AND METAL DETECTOR MARKET: RESEARCH DESIGN

FIGURE 3 MARKET: RESEARCH APPROACH

2.1.1 SECONDARY DATA

2.1.1.1 List of key secondary sources

2.1.1.2 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 Breakdown of primaries

2.1.2.3 Key data from primary sources

2.1.2.4 Key industry insights

2.2 FACTOR ANALYSIS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 – TOP-DOWN (SUPPLY SIDE): REVENUES GENERATED BY COMPANIES FROM SALES OF HANDHELD CHEMICAL, EXPLOSIVE, NARCOTICS, AND METAL DETECTORS

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 – TOP-DOWN (SUPPLY SIDE): ILLUSTRATION OF REVENUE ESTIMATIONS FOR ONE COMPANY IN HANDHELD CHEMICAL AND METAL DETECTOR MARKET

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 – BOTTOM-UP (DEMAND SIDE): DEMAND FOR HANDHELD CHEMICAL, EXPLOSIVE, NARCOTICS, AND METAL DETECTORS BY VARIOUS END USERS

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Approach for obtaining market share using bottom-up analysis (demand side)

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

2.3.2.1 Approach for obtaining market share using top-down analysis (supply side)

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.5.1 ASSUMPTIONS

2.5.2 LIMITATIONS

2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 41)

3.1 IMPACT OF COVID-19 PANDEMIC ON HANDHELD CHEMICAL AND METAL DETECTOR MARKET

FIGURE 10 GLOBAL PROPAGATION OF COVID-19

TABLE 1 RECOVERY SCENARIOS FOR GLOBAL ECONOMY

3.2 REALISTIC SCENARIO

3.3 OPTIMISTIC SCENARIO

3.4 PESSIMISTIC SCENARIO

FIGURE 11 GROWTH PROJECTIONS OF MARKET IN REALISTIC, OPTIMISTIC, AND PESSIMISTIC SCENARIOS

TABLE 2 HANDHELD CHEMICAL AND METAL DETECTOR MARKET, IN TERMS OF VALUE AND VOLUME, 2018–2027

TABLE 3 PRE- AND POST-COVID-19 SCENARIOS OF MARKET, 2018–2027 (USD MILLION)

FIGURE 12 PRE- AND POST-COVID-19 SCENARIOS OF MARKET

FIGURE 13 RAMAN SPECTROSCOPY TECHNOLOGY TO DOMINATE MARKET FROM 2022 TO 2027

FIGURE 14 NARCOTICS DETECTION APPLICATION TO RECORD HIGHEST CAGR FROM 2022 TO 2027

FIGURE 15 LAW ENFORCEMENT AGENCIES & FORENSIC DEPARTMENTS TO REGISTER HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

FIGURE 16 MARKET IN ASIA PACIFIC TO GROW AT FASTEST RATE FROM 2022-2027

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 HANDHELD CHEMICAL AND METAL DETECTOR MARKET OPPORTUNITIES

FIGURE 17 INCREASED GLOBAL ADOPTION OF HANDHELD CHEMICAL, EXPLOSIVE, NARCOTICS, AND METAL DETECTORS IN DIFFERENT REGIONS TO FUEL MARKET GROWTH FROM 2022 TO 2027

4.2 MARKET, BY TECHNOLOGY

FIGURE 18 RAMAN SPECTROSCOPY TO ACCOUNT FOR LARGEST SHARE OF GLOBAL MARKET IN 2027

4.3 MARKET, BY APPLICATION

FIGURE 19 CHEMICAL DETECTION APPLICATION TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2027

4.4 MARKET, BY END USER

FIGURE 20 LAW ENFORCEMENT AGENCIES & FORENSIC DEPARTMENTS TO ACCOUNT FOR LARGEST SHARE OF HANDHELD CHEMICAL AND METAL DETECTOR MARKET IN 2027

4.5 MARKET, BY REGION

FIGURE 21 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF GLOBAL MARKET IN 2027

4.6 MARKET, BY COUNTRY

FIGURE 22 CHINA TO WITNESS HIGHEST CAGR IN GLOBAL MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 23 HANDHELD CHEMICAL AND METAL DETECTOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing threat of chemical and explosives terrorism

FIGURE 24 EXPLOSION INCIDENTS IN US FROM 2016 TO 2020

5.2.1.2 Rising focus of governments worldwide on imposing stringent regulations to ensure human and environmental safety

FIGURE 25 HANDHELD CHEMICAL AND METAL MARKET DRIVERS AND THEIR IMPACT

5.2.2 RESTRAINTS

5.2.2.1 Extremely high cost of handheld chemical, explosive, and narcotics detectors, along with longer time to market

FIGURE 26 HANDHELD CHEMICAL AND METAL DETECTOR MARKET RESTRAINTS AND THEIR IMPACT

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing efforts of law enforcement agencies to fight against drug trafficking

5.2.3.2 Surging need to improve airport security

FIGURE 27 GLOBAL AIR PASSENGER VOLUME, 2015–2020

FIGURE 28 HANDHELD CHEMICAL AND METAL MARKET OPPORTUNITIES AND THEIR IMPACT

5.2.4 CHALLENGES

5.2.4.1 Interference caused in functioning of certain medical devices when end users are scanned using metal detectors

FIGURE 29 HANDHELD CHEMICAL AND METAL MARKET CHALLENGES AND THEIR IMPACT

5.3 SUPPLY CHAIN ANALYSIS

FIGURE 30 SUPPLY CHAIN OF MARKET

5.4 TRENDS/DISRUPTIONS IMPACTING BUSINESS OF MARKET PLAYERS AND RAW MATERIAL SUPPLIERS

5.4.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MARKET PLAYERS

FIGURE 31 REVENUE SHIFT IN HANDHELD CHEMICAL AND METAL DETECTOR MARKET

5.5 HANDHELD CHEMICAL AND METAL DETECTOR ECOSYSTEM

FIGURE 32 HANDHELD CHEMICAL AND METAL DETECTOR ECOSYSTEM

TABLE 4 LIST OF HANDHELD CHEMICAL, EXPLOSIVE, NARCOTICS, AND METAL DETECTOR MANUFACTURERS, SUPPLIERS, AND DISTRIBUTORS

5.6 PORTER’S FIVE FORCES MODEL

TABLE 5 MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 33 PORTER’S FIVE FORCES ANALYSIS

5.6.1 INTENSITY OF COMPETITIVE RIVALRY

5.6.2 BARGAINING POWER OF SUPPLIERS

5.6.3 BARGAINING POWER OF BUYERS

5.6.4 THREAT OF SUBSTITUTES

5.6.5 THREAT OF NEW ENTRANTS

5.7 CASE STUDY

5.7.1 THERMO FISHER SCIENTIFIC INC. HELPS SWEDISH CUSTOMS TO INTERCEPT AND INTERDICT ILLEGAL AND DANGEROUS ITEMS SMUGGLED INTO SWEDEN

5.7.2 MS TECHNOLOGIES INC. ASSISTS SHOPPING CENTER OWNER TO REINFORCE SECURITY IN SHOPPING CENTER AND UNDERGROUND PARKING

5.8 TECHNOLOGY ANALYSIS

5.8.1 COMPLEMENTARY TECHNOLOGIES

5.8.1.1 Bluetooth Low Energy (BLE)

5.8.2 ADJACENT TECHNOLOGIES

5.8.2.1 X-ray imaging

5.8.2.2 Fluorescence spectroscopy

5.9 AVERAGE SELLING PRICE ANALYSIS

TABLE 6 AVERAGE SELLING PRICES OF HANDHELD DETECTORS, BY TYPE

5.10 TRADE ANALYSIS

5.10.1 IMPORT SCENARIO

TABLE 7 IMPORT DATA, BY COUNTRY, 2016–2020 (USD MILLION)

5.10.2 EXPORT SCENARIO

TABLE 8 EXPORT DATA, BY COUNTRY, 2016–2020 (USD MILLION)

5.11 PATENT ANALYSIS, 2015–2021

FIGURE 34 PATENTS GRANTED WORLDWIDE, 2011–2021

TABLE 9 TOP 20 PATENT OWNERS IN US, 2011–2021

FIGURE 35 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2011–2021

5.12 TARIFFS AND REGULATIONS

5.12.1 TARIFFS

5.12.2 REGULATORY COMPLIANCE

5.12.3 STANDARDS

6 HANDHELD CHEMICAL AND METAL DETECTOR MARKET, BY TECHNOLOGY (Page No. - 77)

6.1 INTRODUCTION

FIGURE 36 MARKET, BY TECHNOLOGY

FIGURE 37 RAMAN SPECTROSCOPY TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2022

TABLE 10 MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 11 MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

6.2 RAMAN SPECTROSCOPY

6.2.1 HANDHELD RAMAN-BASED DETECTORS WERE PRIMARILY USED TO IDENTIFY WHITE POWDERS AND CLEAR LIQUIDS

6.3 ION MOBILITY SPECTROMETRY

6.3.1 ION MOBILITY SPECTROMETRY IS WIDELY USED TO IDENTIFY EXPLOSIVES AND NARCOTICS

FIGURE 38 ION MOBILITY SPECTROMETRY WORKING PRINCIPLE

6.4 METAL IDENTIFICATION

6.4.1 HANDHELD METAL DETECTORS USE ELECTROMAGNETIC FIELDS TO DETECT METALLIC OBJECTS

6.5 OTHERS

7 HANDHELD CHEMICAL AND METAL DETECTOR MARKET, BY APPLICATION (Page No. - 84)

7.1 INTRODUCTION

FIGURE 39 MARKET, BY APPLICATION

FIGURE 40 CHEMICAL DETECTION APPLICATION TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2022

TABLE 12 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 13 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

7.2 CHEMICAL DETECTION

7.2.1 DEMAND FOR HANDHELD CHEMICAL DETECTORS IS FUELED BY INCREASING USE OF CHEMICALS IN TERRORIST ACTIVITIES

TABLE 14 MARKET FOR CHEMICAL DETECTION, BY END USER, 2018–2021 (USD MILLION)

TABLE 15 MARKET FOR CHEMICAL DETECTION, BY END USER, 2022–2027 (USD MILLION)

TABLE 16 MARKET FOR CHEMICAL DETECTION, BY REGION, 2018–2021 (USD MILLION)

TABLE 17 MARKET FOR CHEMICAL DETECTION, BY REGION, 2022–2027 (USD MILLION)

7.3 EXPLOSIVE DETECTION

7.3.1 HANDHELD EXPLOSIVE DETECTORS ARE USED BY LAW ENFORCEMENT AGENCIES, HAZMAT TEAMS, BOMB SQUADS TO PROTECT BUILDINGS AND ASSETS

TABLE 18 HANDHELD CHEMICAL AND METAL DETECTOR MARKET FOR EXPLOSIVE DETECTION, BY END USER, 2018–2021 (USD MILLION)

TABLE 19 MARKET FOR EXPLOSIVE DETECTION, BY END USER, 2022–2027 (USD MILLION)

TABLE 20 MARKET FOR EXPLOSIVE DETECTION, BY REGION, 2018–2021 (USD MILLION)

TABLE 21 MARKET FOR EXPLOSIVE DETECTION, BY REGION, 2022–2027 (USD MILLION)

7.4 NARCOTICS DETECTION

7.4.1 MARKET FOR NARCOTICS DETECTION APPLICATION IS EXPECTED TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

FIGURE 41 LAW ENFORCEMENT AGENCIES & FORENSIC DEPARTMENTS TO ACCOUNT FOR LARGEST MARKET SHARE FOR NARCOTICS DETECTION APPLICATION IN 2022

TABLE 22 MARKET FOR NARCOTICS DETECTION, BY END USER, 2018–2021 (USD MILLION)

TABLE 23 MARKET FOR NARCOTICS DETECTION, BY END USER, 2022–2027 (USD MILLION)

TABLE 24 MARKET FOR NARCOTICS DETECTION, BY REGION, 2018–2021 (USD MILLION)

TABLE 25 MARKET FOR NARCOTICS DETECTION, BY REGION, 2022–2027 (USD MILLION)

7.5 METAL DETECTION

7.5.1 HANDHELD METAL DETECTORS ARE INTEGRAL PART OF PHYSICAL SECURITY SCREENING PROCESS

TABLE 26 MARKET FOR METAL DETECTION, BY END USER, 2018–2021 (USD MILLION)

TABLE 27 MARKET FOR METAL DETECTION, BY END USER, 2022–2027 (USD MILLION)

TABLE 28 MARKET FOR METAL DETECTION, BY REGION, 2018–2021 (USD MILLION)

TABLE 29 MARKET FOR METAL DETECTION, BY REGION, 2022–2027 (USD MILLION)

8 HANDHELD CHEMICAL AND METAL DETECTOR MARKET, BY END USER (Page No. - 95)

8.1 INTRODUCTION

FIGURE 42 MARKET, BY END USER

FIGURE 43 LAW ENFORCEMENT AGENCIES & FORENSIC DEPARTMENTS TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 30 MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 31 MARKET, BY END USER, 2022–2027 (USD MILLION)

8.2 LAW ENFORCEMENT AGENCIES & FORENSIC DEPARTMENTS

8.2.1 INCREASE IN TERRORISM AND POTENTIAL THREATS MAKE LAW ENFORCEMENT AGENCIES MAJOR END USERS OF HANDHELD DETECTORS

TABLE 32 HANDHELD CHEMICAL AND METAL DETECTOR MARKET FOR LAW ENFORCEMENT & FORENSIC DEPARTMENTS, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 33 MARKET FOR LAW ENFORCEMENT & FORENSIC DEPARTMENTS, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 34 MARKET FOR LAW ENFORCEMENT & FORENSIC DEPARTMENTS, BY REGION, 2018–2021 (USD MILLION)

TABLE 35 MARKET FOR LAW ENFORCEMENT & FORENSIC DEPARTMENTS, BY REGION, 2022–2027 (USD MILLION)

8.3 CUSTOMS & BORDERS

8.3.1 HANDHELD DETECTORS ENABLE QUICK AND NON-DESTRUCTIVE DETECTION OF METALS AND CHEMICALS USED IN MASS DESTRUCTION WEAPONS

FIGURE 44 CHEMICAL DETECTION APPLICATION TO CAPTURE LARGEST SHARE OF MARKET FOR CUSTOMS & BORDERS IN 2022

TABLE 36 MARKET FOR CUSTOMS & BORDERS, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 37 MARKET FOR CUSTOMS & BORDERS, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 38 MARKET FOR CUSTOMS & BORDERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 39 MARKET FOR CUSTOMS & BORDERS, BY REGION, 2022–2027 (USD MILLION)

8.4 MILITARY & DEFENSE

8.4.1 CONVENTIONAL AND HOMEMADE CBRN WEAPONS AND TOXIC INDUSTRIAL HAZARDS ARE COMPLEX THREATS

TABLE 40 HANDHELD CHEMICAL AND METAL DETECTOR MARKET FOR MILITARY & DEFENSE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 41 MARKET FOR MILITARY & DEFENSE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 42 MARKET FOR MILITARY & DEFENSE, BY REGION, 2018–2021 (USD MILLION)

TABLE 43 MARKET FOR MILITARY & DEFENSE, BY REGION, 2022–2027 (USD MILLION)

8.5 AIRPORTS

8.5.1 GROWING NUMBER OF AIR PASSENGERS AND INCREASING INTERNATIONAL CRIME RATE TO FUEL MARKET GROWTH

TABLE 44 MARKET FOR AIRPORTS, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 45 MARKET FOR AIRPORTS, BY APPLICATION, 2022–2027 (USD MILLION)

FIGURE 45 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF MARKET FOR AIRPORTS IN 2022

TABLE 46 MARKET FOR AIRPORTS, BY REGION, 2018–2021 (USD MILLION)

TABLE 47 MARKET FOR AIRPORTS, BY REGION, 2022–2027 (USD MILLION)

8.6 OTHERS

TABLE 48 MARKET FOR OTHERS, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 49 MARKET FOR OTHERS, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 50 MARKET FOR OTHERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 51 MARKET FOR OTHERS, BY REGION, 2022–2027 (USD MILLION)

9 GEOGRAPHIC ANALYSIS (Page No. - 108)

9.1 INTRODUCTION

FIGURE 46 REGIONAL SPLIT OF HANDHELD CHEMICAL AND METAL DETECTOR MARKET

FIGURE 47 NORTH AMERICA TO CAPTURE LARGEST SHARE OF MARKET IN 2022

TABLE 52 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 53 MARKET, BY REGION, 2022–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 48 NORTH AMERICA: HANDHELD CHEMICAL AND METAL DETECTOR MARKET SNAPSHOT

FIGURE 49 US TO CAPTURE MAJOR SHARE OF NORTH AMERICAN MARKET IN 2027

TABLE 54 MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 55 MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 56 MARKET IN NORTH AMERICA, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 57 MARKET IN NORTH AMERICA, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 58 MARKET IN NORTH AMERICA, BY END USER, 2018–2021 (USD MILLION)

TABLE 59 MARKET IN NORTH AMERICA, BY END USER, 2022–2027 (USD MILLION)

9.2.1 US

9.2.1.1 US to dominate handheld chemical and metal detector market in North America

9.2.2 CANADA

9.2.2.1 Initiatives taken by government and Canada Border Services Agency for prohibiting entry of illegal goods to stimulate market growth in Canada

9.2.3 MEXICO

9.2.3.1 Increased use of handheld narcotics detectors for detection of illegal drugs in Mexico to fuel market growth

9.3 EUROPE

FIGURE 50 EUROPE: HANDHELD CHEMICAL AND METAL DETECTOR MARKET SNAPSHOT

FIGURE 51 GERMANY TO EXHIBIT HIGHEST CAGR IN EUROPEAN MARKET DURING FORECAST PERIOD

TABLE 60 MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 61 MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 62 MARKET IN EUROPE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 63 MARKET IN EUROPE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 64 MARKET IN EUROPE, BY END USER, 2018–2021 (USD MILLION)

TABLE 65 MARKET IN EUROPE, BY END USER, 2022–2027 (USD MILLION)

9.3.1 UK

9.3.1.1 Strong presence of handheld chemical, explosive, narcotics, and metal detector manufacturers to boost market growth

9.3.2 GERMANY

9.3.2.1 Increased drug trafficking activities and terrorism threats to foster market growth

9.3.3 FRANCE

9.3.3.1 Urgent need for strong security measures and public safety in France to spur market growth

9.3.4 REST OF EUROPE

9.4 ASIA PACIFIC

FIGURE 52 ASIA PACIFIC: HANDHELD CHEMICAL AND METAL DETECTOR MARKET SNAPSHOT

FIGURE 53 CHINA TO COMMAND MARKET IN ASIA PACIFIC IN 2022

TABLE 66 MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 67 MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 68 MARKET IN ASIA PACIFIC, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 69 MARKET IN ASIA PACIFIC, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 70 MARKET IN ASIA PACIFIC, BY END USER, 2018–2021 (USD MILLION)

TABLE 71 MARKET IN ASIA PACIFIC, BY END USER, 2022–2027 (USD MILLION)

9.4.1 CHINA

9.4.1.1 Robust presence of many chemical plants and airports to propel demand for handheld detectors

9.4.2 JAPAN

9.4.2.1 High security at airports and country borders to promote use of handheld detectors in Japan

9.4.3 SOUTH KOREA

9.4.3.1 Increased number of workplace accidents and significant number of casualties while handling chemicals to fuel market growth in South Korea

9.4.4 REST OF ASIA PACIFIC

9.5 ROW

FIGURE 54 SOUTH AMERICA TO RECORD HIGHER CAGR DURING FORECAST PERIOD

TABLE 72 HANDHELD CHEMICAL AND METAL DETECTOR MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 73 MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

TABLE 74 MARKET IN ROW, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 75 MARKET IN ROW, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 76 MARKET IN ROW, BY END USER, 2018–2021 (USD MILLION)

TABLE 77 MARKET IN ROW, BY END USER, 2022–2027 (USD MILLION)

9.5.1 MIDDLE EAST & AFRICA

9.5.1.1 Drug trafficking and precious metal thefts to propel market growth

9.5.2 SOUTH AMERICA

9.5.2.1 Drug production, trafficking, and distribution to create opportunities for providers of handheld chemical and metal detectors

10 COMPETITIVE LANDSCAPE (Page No. - 131)

10.1 OVERVIEW

10.2 MARKET EVALUATION FRAMEWORK

TABLE 78 OVERVIEW OF STRATEGIES DEPLOYED BY KEY HANDHELD CHEMICAL, EXPLOSIVE, NARCOTICS, AND METAL DETECTOR MANUFACTURERS

10.2.1 PRODUCT PORTFOLIO

10.2.2 REGIONAL FOCUS

10.2.3 MANUFACTURING FOOTPRINT

10.2.4 ORGANIC/INORGANIC STRATEGIES

10.3 MARKET SHARE ANALYSIS, 2021

TABLE 79 MARKET SHARE ANALYSIS OF TOP 5 COMPANIES (2021)

10.4 5-YEAR COMPANY REVENUE ANALYSIS

FIGURE 55 5-YEAR REVENUE ANALYSIS OF TOP 5 PLAYERS IN HANDHELD CHEMICAL AND METAL DETECTOR MARKET, 2017–2021

10.5 COMPANY EVALUATION QUADRANT

10.5.1 STAR

10.5.2 EMERGING LEADER

10.5.3 PERVASIVE

10.5.4 PARTICIPANT

FIGURE 56 HANDHELD CHEMICAL AND METAL DETECTOR: COMPANY EVALUATION QUADRANT, 2021

10.6 START-UP AND SME IN HANDHELD CHEMICAL AND METAL DETECTOR MARKET

TABLE 80 MANUFACTURERS OF HANDHELD CHEMICAL, EXPLOSIVE, AND NARCOTICS DETECTORS

TABLE 81 MANUFACTURERS OF HANDHELD METAL DETECTOR

10.7 COMPANY FOOTPRINT

TABLE 82 COMPANY FOOTPRINT

TABLE 83 COMPANY APPLICATION FOOTPRINT

TABLE 84 COMPANY END USER FOOTPRINT

TABLE 85 COMPANY REGION FOOTPRINT

10.8 COMPETITIVE SITUATIONS AND TRENDS

10.8.1 PRODUCT LAUNCHES

TABLE 86 PRODUCT LAUNCHES, JANUARY 2019–DECEMBER 2021

10.8.2 DEALS

TABLE 87 DEALS, JANUARY 2019–DECEMBER 2021

10.8.3 OTHERS

TABLE 88 EXPANSION, JANUARY 2019–DECEMBER 2021

11 COMPANY PROFILES (Page No. - 147)

11.1 KEY PLAYERS

(Business overview, Products/solutions offered, Recent developments: Deals, MNM View, Right to win, Strategic choices made, and Weaknesses and competitive threats)*

11.1.1 OSI SYSTEMS, INC.

TABLE 89 OSI SYSTEMS, INC.: BUSINESS OVERVIEW

FIGURE 57 OSI SYSTEMS, INC.: COMPANY SNAPSHOT

11.1.2 TELEDYNE TECHNOLOGIES INCORPORATED

TABLE 90 TELEDYNE TECHNOLOGIES INCORPORATED: BUSINESS OVERVIEW

FIGURE 58 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT

11.1.3 SMITHS GROUP PLC

TABLE 91 SMITHS GROUP PLC: BUSINESS OVERVIEW

FIGURE 59 SMITHS GROUP PLC: COMPANY SNAPSHOT

11.1.4 THERMO FISHER SCIENTIFIC INC.

TABLE 92 THERMO FISHER SCIENTIFIC INC.: BUSINESS OVERVIEW

FIGURE 60 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT

11.1.5 AGILENT TECHNOLOGIES, INC.

TABLE 93 AGILENT TECHNOLOGIES, INC.: BUSINESS OVERVIEW

FIGURE 61 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT

11.1.6 BRUKER CORPORATION

TABLE 94 BRUKER CORPORATION: BUSINESS OVERVIEW

FIGURE 62 BRUKER CORPORATION: COMPANY SNAPSHOT

11.1.7 LEIDOS

TABLE 95 LEIDOS: BUSINESS OVERVIEW

FIGURE 63 LEIDOS: COMPANY SNAPSHOT

11.1.8 GARRETT METAL DETECTORS

TABLE 96 GARRETT METAL DETECTORS: BUSINESS OVERVIEW

11.1.9 908 DEVICES INC.

TABLE 97 908 DEVICES INC.: BUSINESS OVERVIEW

FIGURE 64 908 DEVICES INC.: COMPANY SNAPSHOT

11.1.10 NUCTECH COMPANY LIMITED

TABLE 98 NUCTECH COMPANY LIMITED: BUSINESS OVERVIEW

11.2 OTHER KEY PLAYERS

11.2.1 SAFEWAY INSPECTION SYSTEM LIMITED

11.2.2 RIGAKU CORPORATION

11.2.3 CHEMRING GROUP PLC

11.2.4 ENVIRONICS OY

11.2.5 SHENZHEN SECURITY ELECTRONIC EQUIPMENT CO., LIMITED

11.2.6 PENDAR TECHNOLOGIES

11.2.7 ANTON PAAR GMBH

11.2.8 MS TECHNOLOGIES INC.

11.2.9 SCANNA MSC LTD.

11.2.10 C.E.I.A. S.P.A.

11.2.11 ADAMS ELECTRONICS

11.2.12 WESTMINSTER GROUP PLC

11.2.13 SERSTECH AB

11.2.14 AIRSENSE ANALYTICS GMBH

11.2.15 PKI ELECTRONIC INTELLIGENCE GMBH

*Details on Business overview, Products/solutions offered, Recent developments: Deals, MNM View, Right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 194)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

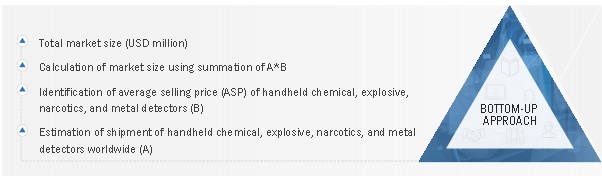

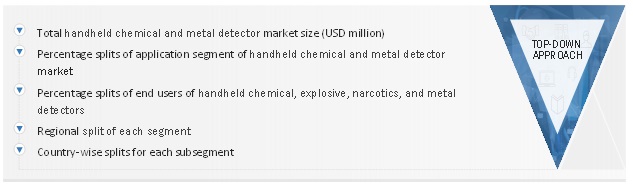

The study involved four major activities in estimating the size of the handheld chemical and metal detector market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the handheld chemical and metal detector market. Secondary sources considered for this research study include government sources; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and professional associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Secondary research has been mainly used to obtain key information about the supply chain of the handheld chemical and metal detector industry to identify the key players based on their products, as well as to identify the prevailing industry trends in the handheld chemical and metal detector market based on technology, application, end user, and region. It also includes information about the key developments undertaken from both market- and technology-oriented perspectives.

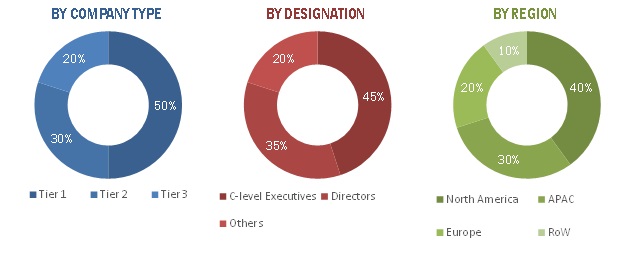

Primary Research

Extensive primary research has been conducted after understanding and analyzing the current scenario of the handheld chemical and metal detector market through secondary research. Several primary interviews have been conducted with key opinion leaders from both the demand and supply sides across four major regions: North America, Europe, APAC, and RoW. Approximately 25% of the primary interviews have been conducted with the demand side, while 75% have been conducted with the supply side. This primary data has been collected mainly through telephonic interviews, which account for 80% of the total primary interviews. Questionnaires and e-mails have also been used to collect data.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the handheld chemical and metal detector market.

- Identifying various end users where handheld chemical, explosive, narcotics, and metal detectors are used or likely to be used

- Analyzing each end user, along with major companies offering handheld chemical, explosive, narcotics, and metal detectors

- Estimating the market for end users of handheld chemical, explosive, narcotics, and metal detectors

- Tracking the ongoing and upcoming installation of handheld chemical, explosive, narcotics, and metal detectors by end users and forecasting the market based on these developments and other critical parameters

- Undertaking multiple discussions with key opinion leaders to understand different technologies designed and developed for various applications of handheld chemical, explosive, narcotics, and metal detectors, which helped analyze the impact of the developments undertaken by each major company in the handheld chemical and metal detector market

- Arriving at the market estimates by analyzing end users at the regional level; after that, combining this data to arrive at the global market estimates based on region

- Verifying and crosschecking estimates at every level with key opinion leaders, including chief executive officers (CEOs), directors, and operation managers, and then finally with the domain experts of MarketsandMarkets

- Studying various paid and unpaid sources of information such as annual reports, press releases, white papers, and databases for the company- and region-specific developments undertaken in the handheld chemical and metal detector market

To know about the assumptions considered for the study, Request for Free Sample Report

The top-down approach has been used to estimate and validate the total size of the handheld chemical and metal detector market.

- Focusing initially on the high investments and expenditures undertaken in the ecosystem of handheld chemical, explosive, narcotics, and metal detectors; further splitting into technology, application, and end users and listing key developments in major market areas

- Identifying all major players in the handheld chemical and metal detector market and their penetration in various applications through secondary research and verifying with brief discussions with industry experts

- Analyzing revenues, product mix, geographic presence, and key end users of handheld chemical, explosive, narcotics, and metal detectors to estimate and arrive at the percentage splits

- Discussing these splits with industry experts to validate the information and identifying key growth pockets across all key segments

- Breaking down the total market based on verified splits and key growth pockets across all segments

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above—the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides in the handheld chemical and metal detector market.

Report Objectives

- To forecast the global size of the handheld chemical and metal detector market, in terms of value and volume

- To describe, segment, and forecast the handheld chemical and metal detector market based on technology, application, and end user, in terms of value

- To describe and forecast the market for four key regions, namely, North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW), in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the handheld chemical and metal detector market

- To provide a detailed overview of the supply chain pertaining to the handheld chemical and metal detector ecosystem, along with the average selling prices of handheld chemical, explosive, narcotics, and metal detectors

- To strategically analyze the ecosystem, tariffs and regulations, patent landscape, trade landscape, Porter’s five forces, and case studies pertaining to the market under study

- To describe the detailed impact of the COVID-19 pandemic on the market

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market

- To analyze competitive developments such as product launches, collaborations, partnerships, contracts, agreements, expansions, and acquisitions in the handheld chemical and metal detector market

- To strategically profile the key players in the handheld chemical and metal detector market and comprehensively analyze their market rankings and core competencies2

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Handheld Chemical and Metal Detector Market