Hand Sanitizer Market by Type (Liquid, Gel, Wipes), Composition (Alcohol Based sanitizers, Alcohol Free sanitizers), Distribution Channel (Retail, E-commerce, To Companies) End User (Healthcare, Pharma & Biotechnology, Industrial, Public Access & Commercial, Food Industry) - Global Forecast to 2027

“Rising awareness on hyfiene and sanitation are factors to boost the hand sanitizer market over the forecast period.”

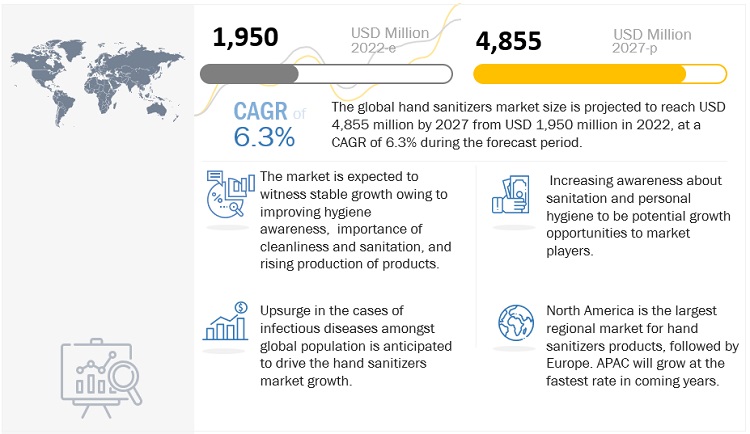

The global hand sanitizer market size is projected to reach USD 4,855 million by 2028 from USD 1,950 million in 2022, at a CAGR of 6.3% during the forecast period. Rising global awareness regarding sanitation and personal hygiene is expected to drive the demand for hand sanitizer as it is an antiseptic solution, which is used as an alternative to soap and water. Moreover, it helps in preventing some of the most infectious diseases, including COVID-19, norovirus, influenza, meningitis, hand, foot, and mouth disease and pertussis (whooping cough).

To know about the assumptions considered for the study, Request for Free Sample Report

“The gel hand sanitizers accounted for the largest market share in the hand sanitizer market, type, during the forecast period”

The Hand sanitizer marketis segmented into liquid, gel and wipes. In 2021, gel hand sanitizers accounted for a sizable market share because they are usually light and watery in the formulation and therefore have a spreadability, which allows these gel-based sanitizers to easily penetrate the skin to kill most bacteria and have witnessed unprecedented demand across the globe during the coronavirus outbreak. The ease of product availability and wider access to these types of antiseptic products will fuel the demand for these products in the coming years.

“By composition, alcohol based sanitizers hold bigger market share during forecast period.”

Based on composition, the hand sanitizer market is segmented into alcohol based sanitizers, alcohol free sanitizers. Alcohol based sanitizer are expected to dominated the market as they are more effectoive towards germ protection and are more preferred by doctors and in hospitals. However, increasing shift of people towards organic sanitizers fuels the market for alcohol free sanitizers as well.

“Retail segment accounted for the largest market share, by distribution channel”

Based on distribution channel, the distribution channel is segmented into Retail, E-commerce and direct supply to companies and other distribution channels. The retail segment accounted for the largest market share in 2021. Increasing number of these retail stores across various regions have experienced a surge in the distribution of cleansers in the market. The e-commerce distribution channel is anticipated to register faster growth during forecast years. Promising growth exhibited by e-commerce platforms in emerging countries, including India and China, is compelling manufacturers to reorient their retail strategies in these countries.

“Healthcare segment accounted for the largest market share, by end user in forecast period.”

Based on end user, the hand sanitizer market is segmented into healthcare, pharma & biotechnology, industrial, public access & commercial, food industry and other end users. The healthcare segment to hold the largest market share in 2021, while public access and commercial segment is expected to grow at the fastest rate during the forecast period. The rising necessities of sanitizers for maintenance of hygiene in healthcare and larger demands of sanitizers in commercial projects are the factor expected to drive the growth of the segment.

“APAC region accounted for the highest CAGR”

The global hand sanitizer market is divided into five regions: North America, Asia-Pacific, Europe, Latin America, and the Middle East and Africa. According to the regional analysis, the Asia Pacific is anticipated to register the fastest growth in the hand sanitizer market. The Asia Pacific exhibits a lucrative growth opportunity with the emerging economies at the forefront of development. The major factors driving the growth of the market is awareness about hygiene due to the viral infection caused by COVID-19 that started in 2019 and is prevalent since, in the region. Therefore, companies are launching innovative and different types of personal care & hygiene products in the market stressing safety factors for consumers. Also government are undertaking various initiatives and programs regarding personal hygiene and care in developing countries in Asia.

The primary interviews conducted for this report can be categorized as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C-level - 27%, D-level - 18%, and Others - 55%

- By Region: North America - 51%, Europe - 21%, Asia Pacific - 18%, Latin America – 6% , and the Middle East & Africa – 4%

To know about the assumptions considered for the study, download the pdf brochure

Lits of Companies Profiled in the Report:

- RECKITT BENCKISER GROUP

- PROCTER AND GAMBLE

- BEST SANITIZER, INC.

- THE HIMALYAN DRUG COMPANY

- 3M

- DEB GROUP LTD (S.C. JOHNSON& SON, INC.)

- CERTUS MEDICAL

- ECOLAB

- GOJO INDUSTRIES, INC.

- HENKEL CORPORATION

- UNILEVER PLC.

- VI-JON LABORATORIES INC.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.2.2 MARKETS COVERED

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 LIMITATIONS

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.2 RESEARCH APPROACH

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Key industry insights

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN & DATA TRIANGULATION

2.5 ASSUMPTIONS FOR THE STUDY

2.6 GROWTH RATE ASSUMPTIONS

2.7 LIMITATIONS

2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

5.4 ECOSYSTEM ANALYSIS

5.5 PORTER’S FIVE FORCES ANALYSIS

5.6 PESTLE ANALYSIS

5.7 TECHNOLOGY ANALYSIS

5.8 DISRUPTIVE TECHNOLOGIES IN THE HAND SANITIZER MARKET

6 HAND SANITIZERS MARKET, BY TYPE (2020, 2021, 2022, 2027, USD MILLION)

6.1 INTRODUCTION

6.2 LIQUID

6.3 GELS

6.4 WIPES

6.5 OHTERS (IF ANY)

7 HAND SANITIZERS MARKET, BY COMPOSITION (2020, 2021, 2022, 2027, USD MILLION)

7.1 INTRODUCTION

7.2 ALOCOHOL - BASED SANITIZERS

7.3 ALOCOHOL - FREE SANITIZERS

8 HAND SANITIZERS MARKET, BY DISTRIBUTION CHANNEL (2020, 2021, 2022, 2027, USD MILLION)

8.1 INTRODUCTION

8.2 RETAIL

8.3 E-COMMERCE

8.4 DIRECT SUPPLY TO COMPANIES

8.5 OTHER DISTRIBUTION CHANNEL

9 HAND SANITIZERS MARKET, BY END USER (2020, 2021, 2022, 2027, USD MILLION)

9.1 INTRODUCTION

9.2 HEALTHCARE, PHARMA & BIOTECHNOLOGY

9.3 INDUSTRIAL

9.4 PUBLIC ACCESS & COMMERCIAL

9.5 FOOD INDUSTRY

9.6 OTHER END USERS

10 HAND SANITIZERS MARKET, BY REGION (2020, 2021, 2022, 2027, USD MILLION)

10.1 INTRODUCTION

10.2 NORTH AMERICA

10.2.1 US

10.2.2 CANADA

10.3 EUROPE

10.3.1 GERMANY

10.3.2 UK

10.3.3 FRANCE

10.3.4 ITALY

10.3.5 SPAIN

10.3.6 REST OF EUROPE (ROE)

10.4 ASIA-PACIFIC

10.4.1 CHINA

10.4.1 JAPAN

10.4.2 INDIA

10.4.3 REST OF ASIA PACIFIC (ROAPAC)

10.5 LATIN AMERICA

10.5 MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES

11.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

11.4 MARKET SHARE /RANKING ANALYSIS, 2021

11.5 COMPANY EVALUATION QUADRANT

11.6 COMPANY EVALUATION QUADRANT – SME/START-UPS

11.7 COMPANY GEOGRAPHIC FOOTPRINT

11.8 COMPETITIVE SCENARIO

12 COMPANY PROFILES

12.1 INTRODUCTION

12.2 RECKITT BENCKISER GROUP

12.2.1 BUSINESS OVERVIEW

12.2.2 COMPANY SNAPSHOT

12.2.3 PRODUCTS AND SERVICES

12.2.4 RECENT DEVELOPMENTS

12.2.5 MNM VIEW

12.3 PROCTER AND GAMBLE

12.4 BEST SANITIZER, INC.

12.5 THE HIMALYAN DRUG COMPANY

12.6 3M

12.7 DEB GROUP LTD (S.C. JOHNSON& SON, INC.)

12.8 CERTUS MEDICAL

12.9 ECOLAB

12.10 GOJO INDUSTRIES, INC.

12.11 HENKEL CORPORATION

12.12 UNILEVER PLC.

12.13 VI-JON LABORATORIES INC.

13 APPENDIX

13.1 INDUSTRY INSIGHTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

Growth opportunities and latent adjacency in Hand Sanitizer Market