Guidewires Market by Material (Nitinol, Stainless Steel, Hybrid), Product (Surgical, Diagnostic (Hydrophilic, Hydrophobic)), Application (Cardiology, Vascular, Neurology, GIT, ENT, Urology, Oncology), End User (Hospital, ASCs) - Global Forecast to 2022

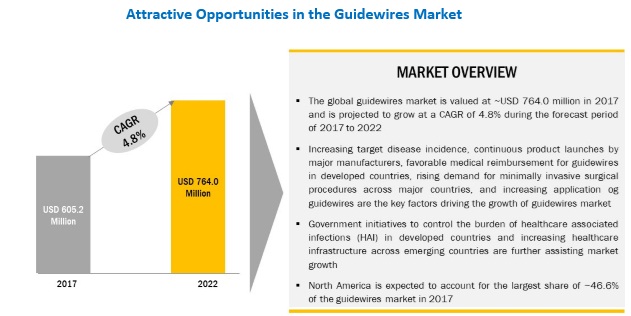

[156 Pages Report] The global guidewires market is expected to reach USD 764.0 million by 2022 from USD 605.2 million in 2017, at a CAGR of 4.8%.

By product, the surgical guidewires segment is expected account for the largest share

Based on product, the global guidewires market is segmented into surgical guidewires (further sub-segmented into hydrophilic and hydrophobic surgical guidewires) and diagnostic guidewires (further sub-segmented into hydrophilic and hydrophobic diagnostic guidewires). In 2017, the surgical guidewires segment is expected to account for the largest share of the market owing to factors such as rising adoption of minimally invasive surgical procedures for the treatment of vascular diseases among medical professionals as well as patients, owing to its procedural benefits, and availability of reimbursements for vascular treatment procedures across developed countries.

By application, the cardiology applications segment is expected account for the largest share

Based on method, the global guidewires market is divided into seven segments-cardiology, vascular, neurology, urology, gastroenterology, oncology, and otolaryngology. The cardiology segment is expected to account for the largest share of the market in 2018. The large share of this segment can be attributed to factors such as rising adoption of guidewires among cardiologists owing to procedural and technical benefits offered by nitinol materials used for manufacturing cardiology guidewires such as the biocompatibility, recovering elongation, resistivity, steerability, and super elasticity.

By material, the nitinol guidewires segment is expected account for the largest share

On the basis of material, the guidewires market is segmented into nitinol guidewires, stainless steel guidewires, and hybrid guidewires. The nitinol guidewires segment is expected to dominate the guidewires market during the forecast period. This can primarily be attributed to the growing number of target medical procedures that utilize nitinol guidewires, increasing applications of nitinol guidewires, and growing patient preference for minimally invasive surgeries.

By end user, the hospitals, diagnostic centers, and surgical centers segment is expected account for the largest share

The guidewires market, by end user, is segmented into hospitals, diagnostic centers, and surgical centers; ambulatory care centers; and research laboratories & academic institutes. In 2017, the hospitals, diagnostic centers, and surgical centers segment is expected to account for the largest share of the market due to the rising group purchasing organizations (GPOs) across developed countries, the rising incidence of target diseases, and ongoing technological advancements in the field of minimally invasive surgeries.

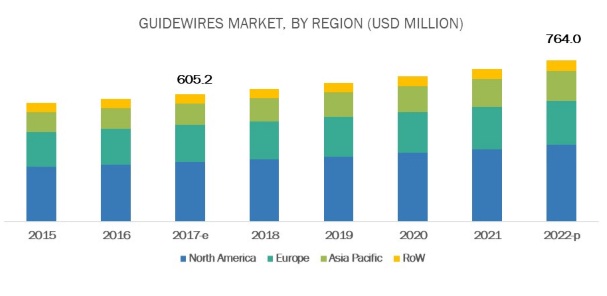

North America is expected to account for the largest share of the guidewires market during the forecast period

The report covers the guidewires market across four key geographies, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW). North America is expected to dominate the global guidewires market in 2017. increasing availability of reimbursements for guidewires among developed countries, increasing patient preference for minimally invasive surgical procedures (including atherectomy, thrombectomy, embolectomy, and gastrointestinal endoscopy), and strong market presence of key OEMs (that replicates into easy availability of guidewires) are the factors that drive the demand growth of guidewires in the region. The Asia Pacific region is expected to grow at the highest CAGR due to the increasing healthcare expenditure and growing initiatives to promote the use of guidewires during minimally invasive surgeries in Asia Pacific countries.

Guidewires Market, By Region

Market Dynamics

Growth in the guidewires market can be attributed to factors such as increasing target disease incidence, continuous product launches by major manufacturers and favorable medical reimbursements for guidewires in developed countries.

Driver- Rising adoption of minimally invasive surgical procedures across major countries

Minimally invasive medical procedures offer significant clinical advantages over conventional open procedures, such as shorter hospital stays, faster patient recovery, higher procedural safety & efficacy, and greater affordability. Healthcare professionals are increasingly looking for therapeutic alternatives that offer safer and more effective disease management strategies for patients suffering from target diseases, including vascular diseases, cardiological diseases, urological diseases, and oncology disorders, among others. Owing to this, medical professionals are increasingly adopting minimally invasive surgical procedures over conventional open procedures due to the clinical advantages offered by the former.

In line with this, an increased number of minimally invasive diagnostic and surgical procedures have been witnessed across key healthcare markets:

- In 2017, 5,528 bariatric surgeries were performed in the UK; of these 336 bariatric surgeries are recurring. During 20162017, the percentage of bariatric surgeries increased by 3.2% [Source: United Kingdom National Bariatric Surgery Registry (NBSR, 2017)].

- As of 2017, 36,500 bariatric surgeries were performed annually in India (Source: Habilite Obesity Group, 2017).

- During 20112016, the number of bariatric surgeries increased from 0.16 million to 0.22 million in the US (Source: American Society for Metabolic and Bariatric Surgery, 2017).

- As of 2015, Germany reported 199.4 laparoscopic cholecystectomy procedures per 100,000 populations (Source: Eurostat, 2017).

- Therefore, the growing preference for MIS procedures across the globe is expected to replicate into higher demand for guidewires during the forecast period.

Restraint- High Cost of Surgical Guidewires

The current commercially available guidewires are manufactured using various materials, such as nitinol, stainless steel, Teflon or parylene, and other hybrid polymers. Hybrid polymers are also used to manufacture guidewires due to their varied benefits, such as flexibility, kink resistance, tensile strength, columnar strength, and torque. However, using these materials significantly increases the price of the product as compared to conventional guidewires. For example, the average cost of a conventional diagnostic guidewire ranges from USD 3 to USD 15 in the US, while the average cost of a hydrophilic guidewire ranges from USD 100 to USD 140.

Moreover, in developed countries, reimbursements for some minimally invasive surgical procedures may sometimes exclude the cost of guidewires. Therefore, high product costs and partial reimbursement coverage may restrict market growth to a certain extent.

Scope of the Report:

|

Report Metric |

Details |

|

Market Size Available for Years |

20152022 |

|

Base Year Considered |

2016 |

|

Forecast Period |

20172022 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

Product, Material, Application, End User, and Region |

|

Geographies Covered |

North America (US & Canada), Europe (Germany, France, UK, Spain, Italy and RoE), APAC (China, Japan, India, South Korea, Australia and RoAPAC), and Latin America, and the Middle East & Africa |

|

Companies Covered |

Medtronic plc (Ireland), Boston Scientific Corporation (US), Cook Group (US), Terumo Corporation (Japan), Abbott Laboratories (US), Stryker Corporation (US), Cardinal Health (US), Olympus Corporation (Japan), Johnson & Johnson (US), B. Braun Melsungen AG (Germany), C.R. Bard Inc. (US), Teleflex Incorporated (US), Angiodynamics (US). Major 15 players covered. |

This report categorizes the global guidewires market into the following segments and subsegments:

Global Guidewires market, by Material- Nitinol Guidewires

- Stainless Steel Guidewires

- Hybrid Guidewires

Global Guidewires market, by Product

- Surgical Guidewires

- Hydrophilic Surgical Guidewires

- Hydrophobic Surgical Guidewires

- Diagnostic Guidewires

- Hydrophilic Diagnostic Guidewires

- Hydrophobic Diagnostic Guidewires

Global Guidewires market, by Application

- Cardiology Applications

- Vascular Applications

- Neurology Applications

- Urology Applications

- Gastroenterology Applications

- Oncology Applications

- Otolaryngology Applications

Global Guidewires market, by End User

- Hospitals, Diagnostic Centers, and Surgical Centers

- Ambulatory Care Centers (ACC)

- Research Laboratories & Academic Institutes

Global Guidewires market, by Region

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

Key Market Players

Some of the prominent players in the guidewires market includes Medtronic plc (Ireland), Boston Scientific Corporation (US), Cook Group (US), Terumo Corporation (Japan), Abbott Laboratories (US), and Stryker Corporation (US) dominated the global guidewires market. The other key players operating in this market include Cardinal Health (US), Olympus Corporation (Japan), Johnson & Johnson (US), B. Braun Melsungen AG (Germany), C.R. Bard Inc. (US), Teleflex Incorporated (US), and Angiodynamics (US).

Boston Scientific (US) held a significant position in the guidewires market in 2016. The company has a strong geographic presence across the countries such as the US, Canada, France, Singapore, Costa Rica, Ireland, the Netherlands, Japan, China, and Turkey. The company mainly focuses on product launches and strategic collaborations to strengthen the minimally invasive product portfolio as well as to expand its customer base in the guidewires market. For instance, in July 2015, the company commercialized Safari2 Pre-shaped Guidewire, an interventional cardiology guidewire. Furthermore, in August 2014, Boston Scientific collaborated with Asahi Intecc to develop and distribute atherectomy guidewires across Japan. This development helped Boston Scientific enhance its presence in the Japanese market.

Recent Developments

- In 2017, Merit Medical Systems (US), launched True Form Reshapable Guide Wire

- In 2017, Teleflex (US), launched Spectre Guide Wire

- In 2017, Terumo Corporation (US) established new manufacturing facility in Yamaguchi, Japan to strengthen the production capacity of access guidewires used in interventional procedures

- In 2017, Terumo Corporation (US) established a new innovation center of neurovascular and endovascular intervention in California, US

- In 2017, Merit Medical Systems (US), launched InQwire Amplatz Guide Wire

Key Questions Addressed by the Report:

- What are the growth opportunities related to the adoption of guidewires market across major regions in the future?

- Emerging countries have immense opportunities for the growth and adoption of guidewires. Will this scenario continue in the next five years?

- Where will all the advancements in products offered by various companies take the industry in the mid- to long-term?

- What are the new trends and advancements in the guidewires market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Markets Covered

1.3.1 Research Scope

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.2.3 Epidemiology-Based Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

2.5 Research Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 33)

4.1 Guidewire Market Overview

4.2 Regional Analysis: Guidewires Market, By Product

4.3 Regional Analysis: Guidewire Market, By End User

4.4 Asia Pacific: Guidewires Market Size, By Material

4.5 Guidewire Market, By Country

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Target Disease Incidence

5.2.1.2 Continuous Product Launches By Major Manufacturers

5.2.1.3 Favorable Medical Reimbursements for Guidewires in Developed Countries

5.2.1.4 Rising Adoption of Minimally Invasive Surgical Procedures Across Major Countries

5.2.1.5 Increasing Applications of Guidewires

5.2.2 Restraints

5.2.2.1 High Cost of Surgical Guidewires

5.2.2.2 Spending Cuts & Excise Duties

5.2.3 Opportunities

5.2.3.1 Government Initiatives to Control the Burden of Healthcare-Associated Infections (HAIS) in Developed Countries

5.2.3.2 Increasing Healthcare Expenditure Across Emerging Markets

5.2.4 Challenges

5.2.4.1 Dearth of Skilled Surgeons to Conduct Minimally Invasive Surgeries

5.3 Key Industry Trends

5.3.1 Strengthening Distribution Capabilities of Major Oems

5.3.2 Ongoing Consolidation of Healthcare Providers in Europe

6 Guidewire Market, By Material (Page No. - 47)

6.1 Introduction

6.2 Nitinol Guidewires

6.3 Stainless Steel Guidewires

6.4 Hybrid Guidewires

7 Guidewire Market, By Product (Page No. - 57)

7.1 Introduction

7.2 Surgical Guidewires

7.2.1 Hydrophilic Surgical Guidewires

7.2.2 Hydrophobic Surgical Guidewires

7.3 Diagnostic Guidewires

7.3.1 Hydrophilic Diagnostic Guidewires

7.3.2 Hydrophobic Diagnostic Guidewires

8 Guidewire Market, By Application (Page No. - 67)

8.1 Introduction

8.2 Cardiology Applications

8.3 Vascular Applications

8.4 Neurology Applications

8.5 Urology Applications

8.6 Gastroenterology Applications

8.7 Oncology Applications

8.8 Otolaryngology Applications

9 Guidewires Market, By End User (Page No. - 77)

9.1 Introduction

9.2 Hospitals, Diagnostic Centers, and Surgical Centers

9.3 Ambulatory Care Centers (ACC)

9.4 Research Laboratories & Academic Institutes

10 Guidewires Market, By Region (Page No. - 83)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.3 Europe

10.3.1 Germany

10.3.2 UK

10.3.3 France

10.3.4 Italy

10.3.5 France

10.3.6 Rest of Europe

10.4 Asia Pacific

10.4.1 Japan

10.4.2 China

10.4.3 India

10.4.4 Australia

10.4.5 South Korea

10.4.6 Rest of Asia Pacific

10.5 Latin America

10.4.1 Brazil

10.4.2 Mexico

10.4.3 Rest Of Latam

10.6 Middle East And Africa

11 Competitive Landscape (Page No. - 110)

11.1 Overview

11.2 Market Share, By Key Players, 2016

11.3 Competitive Scenario

11.3.1 Key Product Launches and Enhancements (2013-2017)

11.3.2 Key Agreements, Partnerships, and Collaborations (2013-2017)

11.3.3 Key Expansions (2013-2017)

11.3.4 Key Acquisitions (2013-2017)

11.4 Vendor Dive Overview

11.5 Vendor Inclusion Criteria

11.6 Vendor Dive

11.6.1 Visionary Leaders

11.6.2 Innovators

11.6.3 Dynamic Differentiators

11.6.4 Emerging Companies

12 Company Profiles (Page No. - 114)

12.1 Introduction

12.2 Medtronic

12.2.1 Business Overview

12.2.2 Products Offered

12.2.3 Recent Developments

12.2.4 MnM View

12.3 Boston Scientific

12.3.1 Business Overview

12.3.2 Products Offered

12.3.3 Recent Developments

12.3.4 MnM View

12.4 C.R. Bard

12.4.1 Business Overview

12.4.2 Products Offered

12.4.3 Recent Developments

12.4.4 MnM View

12.5 Terumo Corporation

12.5.1 Business Overview

12.5.2 Products Offered

12.5.3 Recent Developments

12.5.4 MnM View

12.6 Abbott Laboratories

12.6.1 Business Overview

12.6.2 Products Offered

12.6.3 Recent Developments

12.6.4 MnM View

12.7 B. Braun

12.7.1 Business Overview

12.7.2 Products Offered

12.7.3 Recent Developments

12.7.4 MnM View

12.8 Johnson & Johnson

12.8.1 Business Overview

12.8.2 Products Offered

12.8.3 Recent Developments

12.8.4 MnM View

12.9 Stryker Corporation

12.9.1 Business Overview

12.9.2 Products Offered

12.9.3 Recent Developments

12.9.4 MnM View

12.10 Olympus Corporation

12.10.1 Business Overview

12.10.2 Products Offered

12.10.3 Recent Developments

12.10.4 MnM View

12.11 Angiodynamics

12.11.1 Business Overview

12.11.2 Products Offered

12.11.3 Recent Developments

12.11.4 MnM View

12.12 Cardinal Health

12.12.1 Business Overview

12.12.2 Products Offered

12.12.3 Recent Developments

12.12.4 MnM View

12.13 Merit Medical Systems

12.13.1 Business Overview

12.13.2 Products Offered

12.13.3 Recent Developments

12.13.4 MnM View

12.14 Teleflex

12.14.1 Business Overview

12.14.2 Products Offered

12.14.3 Recent Developments

12.14.4 MnM View

12.15 Cook Group

12.15.1 Business Overview

12.15.2 Products Offered

12.15.3 Recent Developments

12.15.4 MnM View

12.16 Asahi Intecc

12.16.1 Business Overview

12.16.2 Products Offered

12.16.3 Recent Developments

12.16.4 MnM View

12.17 Other Comapnies

12.17.1 Business Overview

12.17.2 Products Offered

*Details on Marketsandmarkets View, Introduction, Product & Services, Strategy, & Analyst Insights, New Developments Might Not Be Captured in Case of Unlisted Companies

13 Appendix (Page No. - 148)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (75 Tables)

Table 1 Recent Launches of Innovative Guidewires, 20152017

Table 2 Medical Reimbursement Codes for Guidewires in Us (As of December 2017)

Table 3 Guidewires Market, By Material, 20152022 (USD Million)

Table 4 Nitinol Guidewires Market, By Region, 20152022 (USD Million)

Table 5 North America: Nitinol Guidewires Market, By Country, 20152022 (USD Million)

Table 6 Europe: Nitinol Guidewires Market, By Country, 20152022 (USD Million)

Table 7 Asia Pacific: Nitinol Guidewires Market, By Country, 20152022 (USD Million)

Table 8 Stainless Steel Guidewires Market, By Region, 20152022 (USD Million)

Table 9 North America: Stainless Steel Guidewires Market, By Country, 20152022 (USD Million)

Table 10 Europe: Stainless Steel Guidewires Market, By Country, 20152022 (USD Million)

Table 11 Asia Pacific: Stainless Steel Guidewires Market, By Country, 20152022 (USD Million)

Table 12 Hybrid Guidewires Market, By Region, 20152022 (USD Million)

Table 13 North America: Hybrid Guidewires Market, By Country, 20152022 (USD Million)

Table 14 Europe: Hybrid Guidewires Market, By Country, 20152022 (USD Million)

Table 15 Asia Pacific: Hybrid Guidewires Market, By Country, 20152022 (USD Million)

Table 16 Global Guidewires Market, By Product, 20152022 (USD Million)

Table 17 Surgical Guidewires Market, By Type, 20152022 (USD Million)

Table 18 Surgical Guidewires Market, By Region, 20152022 (USD Million)

Table 19 Hydrophilic Surgical Guidewires Market, By Region, 20152022 (USD Million)

Table 20 Hydrophobic Surgical Guidewires Market, By Region, 20152022 (USD Million)

Table 21 Diagnostic Guidewires Market, By Type, 20152022 (USD Million)

Table 22 Diagnostic Guidewires Market, By Region, 20152022 (USD Million)

Table 23 Hydrophilic Diagnostic Guidewires Market, By Region, 20152022 (USD Million)

Table 24 Hydrophobic Diagnostic Guidewires Market, By Region, 20152022 (USD Million)

Table 25 Guidewires Market, By Applications, 20152022 (USD Million)

Table 26 Guidewires Market for Cardiology Applications, By Region, 20152022 (USD Million)

Table 27 Guidewires Market for Vascular Applications, By Region, 20152022 (USD Million)

Table 28 Guidewires Market for Neurology Applications, By Region, 20152022 (USD Million)

Table 29 Guidewires Market for Urology Applications, By Region, 20152022 (USD Million)

Table 30 Guidewires Market for Gastroenterology Applications, By Region, 20152022 (USD Thousand)

Table 31 Guidewires Market for Oncology Applications, By Region, 20152022 (USD Million)

Table 32 Guidewires Market for Otolaryngology Applications, By Region, 20152022 (USD Thousand)

Table 33 Guidewires Market, By End User, 20152022 (USD Million)

Table 34 Guidewires Market for Hospitals, Diagnostic Centers, and Surgical Centers, By Region, 20152022 (USD Million)

Table 35 Guidewires Market for Ambulatory Care Centers, By Region, 20152022 (USD Million)

Table 36 Guidewires Market for Research Laboratories & Academic Institutes, By Region, 20152022 (USD Million)

Table 37 Guidewires Market, By Region, 20152022 (USD Million)

Table 38 North America: Guidewires Market, By Country, 20152022 (USD Million)

Table 39 North America: Guidewires Market, By Material, 20152022 (USD Million)

Table 40 North America: Guidewires Market, By Product, 20152022 (USD Million)

Table 41 North America: Guidewires Market, By Applications, 20152022 (USD Million)

Table 42 North America: Guidewires Market, By End User, 20152022 (USD Million)

Table 43 US: Guidewires Market, By Material, 20152022 (USD Million)

Table 44 Canada: Guidewires Market, By Material, 20152022 (USD Million)

Table 45 Europe: Guidewires Market, By Country, 20152022 (USD Million)

Table 46 Europe: Guidewires Market, By Material, 20152022 (USD Million)

Table 47 Europe: Guidewires Market, By Product, 20152022 (USD Million)

Table 48 Europe: Guidewires Market, By Applications, 20152022 (USD Million)

Table 49 Europe: Guidewires Market, By End User, 20152022 (USD Million)

Table 50 Germany: Guidewires Market, By Material, 20152022 (USD Million)

Table 51 UK: Guidewires Market, By Material, 20152022 (USD Million)

Table 52 France: Guidewires Market, By Material, 20152022 (USD Million)

Table 52 Italy: Guidewires Market, By Material, 20152022 (USD Million)

Table 52 Spain: Guidewires Market, By Material, 20152022 (USD Million)

Table 53 Roe: Guidewires Market, By Material, 20152022 (USD Million)

Table 54 Asia Pacific: Guidewires Market, By Country, 20152022 (USD Million)

Table 55 Asia Pacific: Guidewires Market, By Material, 20152022 (USD Million)

Table 56 Asia Pacific: Guidewires Market, By Product, 20152022 (USD Million)

Table 57 Asia Pacific: Guidewires Market, By Applications, 20152022 (USD Million)

Table 58 Asia Pacific: Guidewires Market, By End User, 20152022 (USD Million)

Table 59 Japan: Guidewires Market, By Material, 20152022 (USD Million)

Table 60 China: Guidewires Market, By Material, 20152022 (USD Million)

Table 61 India: Guidewires Market, By Material, 20152022 (USD Million)

Table 62 Australia: Guidewires Market, By Material, 20152022 (USD Million)

Table 63 South Korea: Guidewires Market, By Material, 20152022 (USD Million)

Table 64 Roapac: Guidewires Market, By Material, 20152022 (USD Million)

Table 65 Latin America: Guidewires Market, By Material, 20152022 (USD Million)

Table 66 Latin America: Guidewires Market, By Product, 20152022 (USD Million)

Table 67 Latin America: Guidewires Market, By Applications, 20152022 (USD Million)

Table 68 Latin America: Guidewires Market, By End User, 20152022 (USD Million)

Table 69 Brazil: Guidewires Market, By Material, 20152022 (USD Million)

Table 70 Mexico: Guidewires Market, By Material, 20152022 (USD Million)

Table 71 Rest of Latin America: Guidewires Market, By Material, 20152022 (USD Million)

Table 72 MEA: Guidewires Market, By Material, 20152022 (USD Million)

Table 73 MEA: Guidewires Market, By Product, 20152022 (USD Million)

Table 74 MEA: Guidewires Market, By Applications, 20152022 (USD Million)

Table 75 MEA: Guidewires Market, By End User, 20152022 (USD Million)

List of Figures (39 Figures)

Figure 1 Research Design: Guidewires Market

Figure 2 Breakdown of Primaries: Guidewire Market

Figure 3 Data Triangulation Methodology

Figure 4 Nitinol Guidewires Segment is Estimated to Dominate the Guidewires Market During 20172022

Figure 5 Surgical Guidewires Segment is Estimated to Hold the Largest Share in the Guidewires Product Market in 2017

Figure 6 Cardiology Applications Segment is Estimated to Hold the Largest Share in the GuidewiresMarket During the Study Period

Figure 7 Hospitals, Diagnostic Centers, and Surgical Centers Segment are Estimated to Hold the Largest Share in the Guidewires Market for End User in 2017

Figure 8 North America to Dominate the Guidewire Market During the Forecast Period

Figure 9 Increasing Target Disease Incidence to Propel the Demand for Guidewires During the Forecast Period

Figure 10 Asia Pacific is Estimated to Be the Fastest-Growing Market for Guidewires Product Market During the Forecast Period

Figure 11 North America Dominated the Guidewires Market for All End User Segments in 2017

Figure 12 Nitinol Guidewires Will Dominate the Asia Pacific Guidewires Material Market in 2017

Figure 13 China & India Estimated to Be the Fastest-Growing Countries in the Guidewires Market During the Forecast Period

Figure 14 Guidewire Market: Drivers, Restraints, Opportunities, and Challenges

Figure 15 Government Healthcare Expenditure: Developed vs Developing Countries (20102015)

Figure 16 Nitinol Guidewires to Dominate the Guidewires Market During the Forecast Period

Figure 17 North America to Hold the Largest Share of the Surgical as Well as Diagnostic Guidewires Segments

Figure 18 North America to Dominate the Guidewire Market for All Application Segments During the Forecast Period

Figure 19 Hospitals, Diagnostic Centers, and Surgical Centers are Expected to Dominate the Guidewires End-User Market During the Forecast Period

Figure 20 North America: Guidewire Market Snapshot

Figure 21 Europe: Guidewires Market Snapshot

Figure 22 Asia Pacific: Guidewire Market Snapshot

Figure 23 RoW: Guidewire Market Snapshot

Figure 24 Key Developments By Leading Market Players in the Guidewire Market (20132017)

Figure 25 Boston Scientific Held the Leading Position in the Global Guidewire Market in 2016

Figure 26 Geographic Revenue Mix of the Top Four Market Players (2016)

Figure 27 Medtronic: Company Snapshot

Figure 28 Boston Scientific: Company Snapshot

Figure 29 C.R. Bard: Company Snapshot

Figure 30 Terumo Corporation: Company Snapshot

Figure 31 Abbott Laboratories: Company Snapshot

Figure 32 B. Braun: Company Snapshot

Figure 33 Johnson & Johnson: Company Snapshot

Figure 34 Stryker Corporation: Company Snapshot

Figure 35 Olympus Corporation: Company Snapshot

Figure 36 Angiodynamics: Company Snapshot

Figure 37 Cardinal Health: Company Snapshot

Figure 38 Merit Medical Systems: Company Snapshot

Figure 39 Teleflex: Company Snapshot

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Guidewires Market