Green Preservatives Market by Type (Natural preservative, Organic Acid, Essential Oil), End-use Industry (Food & beverage, Personal Care & Cosmetic, Industrial Cleaning, Household Cleaning, Pharmaceutical), and Region - Global Forecast to 2028

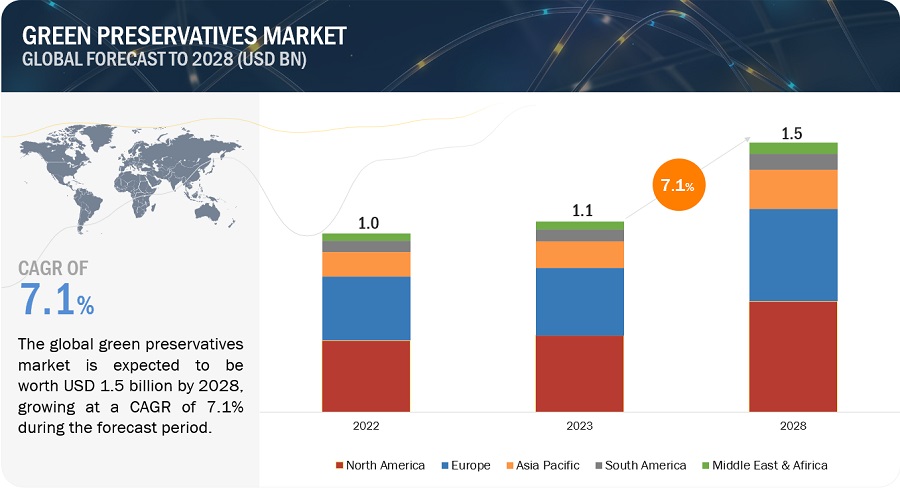

In terms of value, green preservatives market size is projected to increase from USD 1.1 billion in 2023 to USD 1.5 billion by 2028, at a CAGR of 7.1%. Green preservatives, also known as natural or eco-friendly preservatives, comprise substances sourced from plants, minerals, essential oils, and other natural elements. They act as alternatives to conventional synthetic preservatives that might be hazardous to the environment or human health. These alternatives are increasingly popular due to their perceived safety, eco-consciousness, and alignment with consumer preferences for natural, sustainable products. With properties like antimicrobial and antioxidant effects, green preservatives aid in product preservation while complying with regulations and meeting consumer demands for safer, naturally derived ingredients in various industries like food & beverage, personal care & cosmetic, cleaning industry, pharmaceutical, and others.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Growing popularity of organic and clean label products

The surge in demand for organic and clean label products is a key driver for the green preservatives market. Consumers seeking healthier, environmentally friendly options prefer products with minimal additives. Green preservatives, sourced naturally from plants and essential oils, align perfectly with these preferences. They offer a safer, eco-friendly alternative to synthetic preservatives, fitting well within organic and clean label product formulations. Manufacturers are increasingly utilizing green preservatives to meet consumer needs for safer, more natural ingredients, propelling their adoption growing industries like food & beverage, personal care & cosmetic, pharmaceuticals, and personal care products.

Restraints: Limited availability of green preservatives

The green preservatives market faces significant restraint due to the limited availability of these alternative preservative options. This constraint arises from challenges in sourcing and producing a wide array of green preservatives at a scale that meets industry demands. Natural preservatives, organic acids, and essential oils, among other alternatives, often encounter supply limitations stemming from factors like seasonal variations, cultivation constraints, and extraction processes. This scarcity poses a hurdle for manufacturers seeking to fully transition from synthetic preservatives to greener alternatives, impacting the market's growth potential and the seamless adoption of sustainable preservation solutions in various industries.

Opportunities: Expansion into new application

The green preservatives market exhibits a significant opportunity for growth by expanding into new applications across various industries. As consumer demand surges for natural and healthier alternatives, there's an open avenue to explore and introduce green preservatives beyond traditional uses in food & beverages. Opportunities abound in personal care & cosmetic, cleaning industry, pharmaceutical, and animal feed industries, where the adoption of natural preservation methods aligns with the evolving preferences for clean label products. This expansion diversifies market reach, offering innovative solutions that cater to multiple sectors, fostering a broader market landscape and stimulating the integration of green preservatives into diverse product lines.

Challenges: Competition from synthetic preservatives

One of the primary challenges confronting the green preservatives market is the intense competition posed by synthetic preservatives. Despite the rising demand for natural alternatives, synthetic preservatives maintain a stronghold due to their widespread availability, cost-effectiveness, and established track record in preservation efficacy. The established market presence and consumer familiarity with synthetic options create hurdles for green preservatives in gaining substantial market share. To address this hurdle, it is crucial to showcase the efficacy, safety, and economic feasibility of green preservatives, urging consumers and industries to transition from synthetic alternatives to sustainable and natural preservation methods.

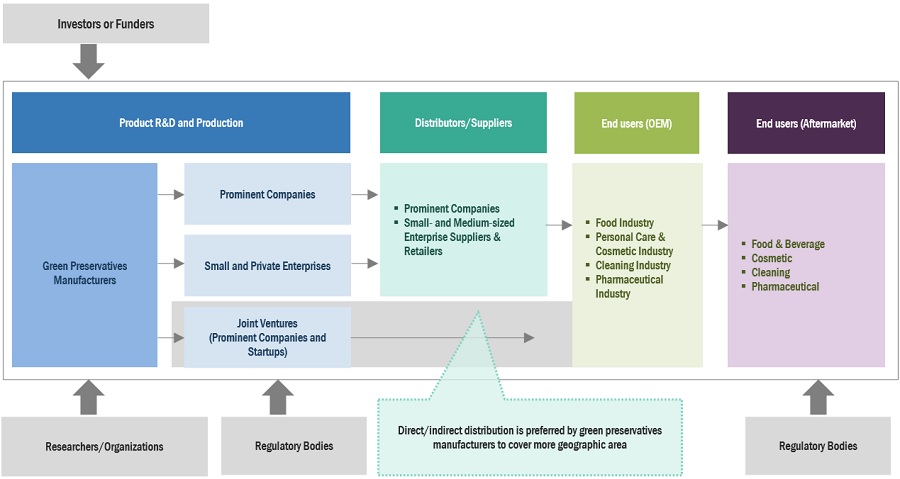

Green Preservatives Market Ecosystem

Prominent companies in this market include well-established green preservatives manufacturers. These businesses have been in business for a while and have an extensive range of products, pioneering technologies, and strong international sales and marketing networks. Top companies in this market include Kerry Group (Ireland), Kemin Industries, Inc. (US), Corbion N.V. (Netherlands), LANXESS SE (Germany), BASF SE (Germany), International Flavors & Fragrances Inc. (US), Dow Inc. (US), DSM-Firmenich AG (Netherlands), Symrise AG (Germany), and Givaudan SA (Switzerland).

“Based on type, natural preservative is estimated to be the largest type for green preservatives market in 2022, in terms of value.”

The natural preservative is estimated to be the largest type for green preservatives market due to several factors. The market dominance of natural preservatives in the green preservatives category has also been greatly influenced by their proven safety and effectiveness in preserving product quality while satisfying regulatory requirements. Natural preservatives cater to a wide range of end-use industries such as food & beverage, personal care & cosmetic, cleaning industry, pharmaceutical, and others. Concerns about the environment and ethical considerations further boost its popularity, as it aligns with sustainable and eco-friendly choice.

“Based on end-use industry, food & beverage segment is estimated to be the largest market for green preservatives market, in terms of value, in 2022.”

The food and beverage industry emerged as the primary and most significant market for green preservatives. The perceived increase in customer preference for natural and organic products, especially in the food and beverage industry, corresponds with people's growing awareness of their health. Growing concerns about the possible health risks associated with artificial preservatives have led food and beverage firms to aggressively seek out substitutes. The use of preservatives in food and beverage products is often influenced by the constantly changing regulatory environment and changing standards within the sector.

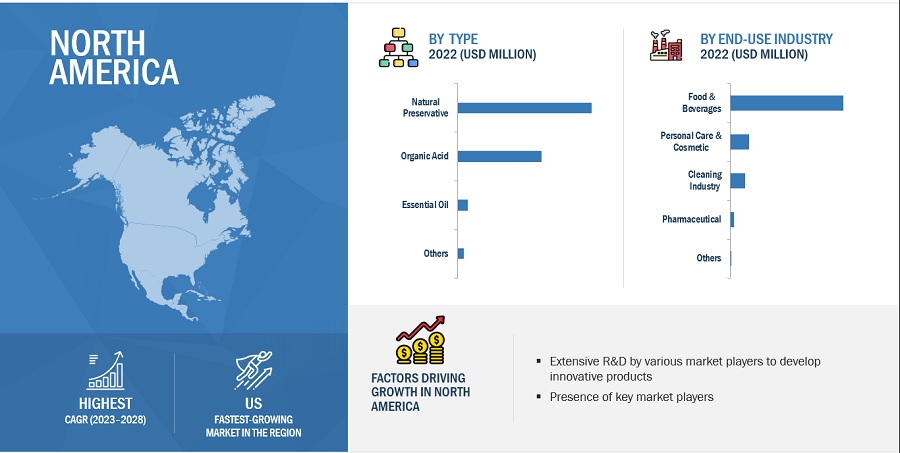

“North America is estimated to be the largest region in green preservatives market in 2022, in terms of value.”

The North America region has leading status in the green preservatives market as demand is significantly increasing because of the growing preference among North American consumers for natural and organic products, which are seen as safer and healthier options than conventionally preserved foods. This is a move away from artificial preservatives, which are thought to have potential negative effects. The growing demand for natural, or "green," preservatives is mostly due to growing knowledge of the harmful impact that synthetic preservatives have on human health. Moreover, the strategic activities and robust presence of major industry participants like Kerry Group, Dow Inc., and BASF SE all of which have their headquarters in the region which support the North American market's leadership in the green preservatives space. These businesses place a high priority on making significant expenditures in R&D with the goal of creating cutting-edge, novel solutions for green preservatives.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players profiled in the report include Kerry Group (Ireland), Kemin Industries, Inc. (US), Corbion N.V. (Netherlands), LANXESS SE (Germany), and BASF SE (Germany) among others, are the key manufacturers that holds major market share in the last few years. A major focus was given to collaborations, partnerships, and new product development due to the changing requirements of users across the world.

Read More: Green Preservatives Companies

Scope of the Report

|

Report Metric |

Details |

|

Years considered for the study |

2017–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Million) and Volume (Kiloton) |

|

Segments covered |

Type, End-use Industry, and Region |

|

Regions covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies profiled |

Kerry Group (Ireland), Kemin Industries, Inc. (US), Corbion N.V. (Netherlands), LANXESS SE (Germany), BASF SE (Germany), International Flavors & Fragrances Inc. (US), Dow Inc. (US), DSM-Firmenich AG (Netherlands), Symrise AG (Germany), and Givaudan SA (Switzerland) |

This report categorizes the global green preservatives market based on type, end-use industry, and region.

Based on type, the green preservatives market has been segmented as follows:

- Natural Preservative

- Organic Acid

- Essential Oil

- Others

- Nanoparticles

- Bacteriophages

Based on end-use industry, the green preservatives market has been segmented as follows:

- Food & beverage

- Personal Care & Cosmetic

- Cleaning Industry

- Industrial Cleaning

- Household Cleaning

- Pharmaceutical

- Others

- Agriculture

- Horticulture

- Water Treatment

- Textiles

Based on region, the green preservatives market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Arica

- South America

Recent Developments

- In 2022, Kuraray Co., Ltd., and Nissha Co., Ltd. collaborated to create Material Insert Technology utilizing green preservatives known as CLARINO, and subsequently introduced this product for sale with a focus on the mobility and consumer electronics sectors.

- In 2023, San Fang Chemical Industry Co., Ltd. has announced intentions to invest around USD 100 million, which is equivalent to USD 95 billion, in constructing a new green preservatives plant in Vietnam. The facility is scheduled to be finished by 2024, and it will have an annual production capacity of 2 million sq. meters. This will help the company to expand its production capacity.

Frequently Asked Questions (FAQ):

What are the major developments impacting the market?

The Growing demand for clean label products is expected to shift market demand.

Who are major players in green preservatives market?

Kerry Group (Ireland), Kemin Industries, Inc. (US), Corbion N.V. (Netherlands), LANXESS SE (Germany), and BASF SE (Germany)

What is the major end-use industry of green preservatives?

Food & beverage is the major end-use industry for green preservatives market during the forecast period.

What are the major factors restraining market growth during the forecast period?

Limited availability of green preservatives.

What are the various strategies key players are focusing within green preservatives market?

Key players are majorly focused on new product launch and partnering with local or regional players within the market, to attract larger market share globally. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for natural and sustainable products- Rising awareness of benefits of green preservatives- Growing popularity of organic and clean-label products- Government regulations and incentivesRESTRAINTS- High cost of green preservatives- Limited availability of green preservatives- Volatility in raw material supplyOPPORTUNITIES- Adoption in new application areas- Development of new green preservativesCHALLENGES- Strong competition from synthetic preservatives- Lack of standardization

-

5.3 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 MACROECONOMIC INDICATORSGDP TRENDS AND FORECASTS OF MAJOR ECONOMIES

-

6.1 SUPPLY CHAIN ANALYSISRAW MATERIALSMANUFACTURINGDISTRIBUTION NETWORKEND-USE INDUSTRIES

-

6.2 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.3 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRYAVERAGE SELLING PRICE TREND, BY REGION

-

6.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESSREVENUE SHIFTS AND NEW REVENUE POCKETS IN GREEN PRESERVATIVES MARKET

-

6.5 GREEN PRESERVATIVES MARKET: ECOSYSTEM

-

6.6 TECHNOLOGY ANALYSISALKYLRESORCINOLS (ARS) TECHNOLOGYBIOCATALYSIS TECHNOLOGY

-

6.7 CASE STUDY ANALYSISCASE STUDY ON DSMCASE STUDY ON CHINOVA BIOWORKS

-

6.8 TRADE DATAIMPORT SCENARIO OF GREEN PRESERVATIVESEXPORT SCENARIO OF GREEN PRESERVATIVES

-

6.9 TARIFF AND REGULATORY LANDSCAPEREGULATIONS ON GREEN PRESERVATIVES MARKETREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.10 KEY CONFERENCES AND EVENTS IN 2023–2024

-

6.11 PATENT ANALYSISAPPROACHDOCUMENT TYPETOP APPLICANTSJURISDICTION ANALYSIS

- 7.1 INTRODUCTION

-

7.2 NATURAL PRESERVATIVEINCREASING DEMAND FOR TRANSPARENCY AND TRACEABILITY OF PRODUCTS TO DRIVE MARKET

-

7.3 ORGANIC ACIDTECHNOLOGICAL ADVANCEMENTS IN ORGANIC ACID PRESERVATION TO DRIVE MARKET

-

7.4 ESSENTIAL OILANTIMICROBIAL PROPERTIES OF ESSENTIAL OIL TO INFLUENCE MARKET GROWTH

-

7.5 OTHERSNANOPARTICLESBACTERIOPHAGES

- 8.1 INTRODUCTION

-

8.2 FOOD & BEVERAGEDOMINANT END USER OF GREEN PRESERVATIVES

-

8.3 PERSONAL CARE & COSMETICINCREASING DEMAND FOR NATURAL AND ORGANIC PERSONAL CARE PRODUCTS TO DRIVE MARKET

-

8.4 CLEANING INDUSTRYSTRINGENT REGULATIONS TO DRIVE MARKET DURING FORECAST PERIODINDUSTRIAL CLEANING- Growing demand for eco-friendly cleaning solutions to drive marketHOUSEHOLD CLEANING- Asia Pacific to be fastest-growing market during forecast period

-

8.5 PHARMACEUTICALNORTH AMERICA TO BE LARGEST MARKET DURING FORECAST PERIOD

- 8.6 OTHERS

- 9.1 INTRODUCTION

-

9.2 ASIA PACIFICIMPACT OF RECESSION ON ASIA PACIFICASIA PACIFIC GREEN PRESERVATIVES MARKET, BY TYPEASIA PACIFIC GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRYASIA PACIFIC GREEN PRESERVATIVES MARKET, BY COUNTRY- China- Japan- India

-

9.3 NORTH AMERICAIMPACT OF RECESSION ON NORTH AMERICANORTH AMERICA GREEN PRESERVATIVES MARKET, BY TYPENORTH AMERICA GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRYNORTH AMERICA GREEN PRESERVATIVES MARKET, BY COUNTRY- US

-

9.4 EUROPEIMPACT OF RECESSION ON EUROPEEUROPE GREEN PRESERVATIVES MARKET, BY TYPEEUROPE GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRYEUROPE GREEN PRESERVATIVES MARKET, BY COUNTRY- Germany- UK- France- Italy- Spain

-

9.5 MIDDLE EAST & AFRICAIMPACT OF RECESSION ON MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA GREEN PRESERVATIVES MARKET, BY TYPEMIDDLE EAST & AFRICA GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRYMIDDLE EAST & AFRICA GREEN PRESERVATIVES MARKET, BY COUNTRY- GCC- Saudi Arabia- South Africa

-

9.6 SOUTH AMERICAIMPACT OF RECESSION ON SOUTH AMERICASOUTH AMERICA GREEN PRESERVATIVES MARKET, BY TYPESOUTH AMERICA GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRYSOUTH AMERICA GREEN PRESERVATIVES MARKET, BY COUNTRY- Brazil

- 10.1 INTRODUCTION

- 10.2 KEY PLAYERS' STRATEGIES

- 10.3 RANKING OF KEY MARKET PLAYERS, 2022

- 10.4 MARKET SHARE ANALYSIS

- 10.5 REVENUE ANALYSIS OF KEY MARKET PLAYERS

-

10.6 COMPANY EVALUATION MATRIX (TIER 1)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

10.7 STARTUPS/SMES EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

10.8 COMPETITIVE SITUATION & TRENDSPRODUCT LAUNCHESDEALS

-

11.1 MAJOR PLAYERSKERRY GROUP- Business overview- Products offered- Recent developments- MnM viewKEMIN INDUSTRIES, INC.- Business overview- Products offered- Recent developments- MnM viewCORBION N.V.- Business overview- Products offered- Recent developments- MnM viewLANXESS AG- Business overview- Products offered- Recent developments- MnM viewBASF SE- Business overview- Products offered- Recent developments- MnM viewINTERNATIONAL FLAVORS & FRAGRANCES INC.- Business overview- Products offeredDOW INC.- Business overview- Products offeredDSM-FIRMENICH AG- Business overview- Products offeredSYMRISE AG- Business overview- Products offered- Recent developmentsGIVAUDAN SA- Business overview- Products offered- Recent developmentsCLARIANT AG- Business overview- Products offered- Recent developments

-

11.2 OTHER KEY PLAYERSADMCAMLIN FINE SCIENCES LTD.KALSEC INC.SALICYLATES AND CHEMICALS PRIVATE LIMITEDARJUNA NATURALJIANGSU YIMING BIOLOGICAL TECHNOLOGY CO., LTD.AIR LIQUIDESHANDONG FREDA BIOTECHNOLOGY CO., LTD.CHINOVA BIOWORKS INC.GUJARAT ENTERPRISEITA FOOD IMPROVERSJUNGBUNZLAUER SUISSE AGMAYASAN A.S.LONZA GROUP LTD.

- 12.1 INTRODUCTION

- 12.2 LIMITATION

-

12.3 FOOD PRESERVATIVES MARKETMARKET DEFINITIONMARKET OVERVIEW

-

12.4 FOOD PRESERVATIVES MARKET, BY REGIONASIA PACIFICEUROPENORTH AMERICASOUTH AMERICAREST OF THE WORLD

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 GREEN PRESERVATIVES MARKET: RISK ASSESSMENT

- TABLE 2 GREEN PRESERVATIVES AND THEIR APPLICATIONS

- TABLE 3 GREEN PRESERVATIVES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 GDP TRENDS AND FORECAST, BY MAJOR ECONOMIES, 2020–2028 (USD BILLION)

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS IN TOP 3 END-USE INDUSTRIES (%)

- TABLE 6 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

- TABLE 7 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY (USD/KG)

- TABLE 8 AVERAGE SELLING PRICE OF GREEN PRESERVATIVES, BY REGION (USD/KG)

- TABLE 9 GREEN PRESERVATIVES MARKET: ROLE IN ECOSYSTEM

- TABLE 10 BENEFITS OF ALKYLRESORCINOLS (ARS) TECHNOLOGY

- TABLE 11 BENEFITS OF BIOCATALYSIS TECHNOLOGY

- TABLE 12 IMPORT OF GREEN PRESERVATIVES, BY REGION, 2017–2022 (USD MILLION)

- TABLE 13 EXPORT OF GREEN PRESERVATIVES, BY REGION, 2017–2022 (USD MILLION)

- TABLE 14 NORTH AMERICA: REGULATIONS ON GREEN PRESERVATIVES

- TABLE 15 EUROPE: REGULATIONS ON GREEN PRESERVATIVES

- TABLE 16 ASIA PACIFIC: REGULATIONS ON GREEN PRESERVATIVES

- TABLE 17 GREEN PRESERVATIVES MARKET: KEY CONFERENCES & EVENTS

- TABLE 18 PATENT STATUS: PATENT APPLICATIONS, LIMITED PATENTS, AND GRANTED PATENTS

- TABLE 19 LIST OF MAJOR PATENTS FOR GREEN PRESERVATIVES

- TABLE 20 PATENTS BY CELANESE CORPORATION

- TABLE 21 PATENTS BY BASF SE

- TABLE 22 PATENTS BY DAICEL CORPORATION

- TABLE 23 TOP 10 PATENT OWNERS IN CHINA, 2012–2023

- TABLE 24 GREEN PRESERVATIVES MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 25 GREEN PRESERVATIVES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 26 GREEN PRESERVATIVES MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 27 GREEN PRESERVATIVES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 28 NATURAL PRESERVATIVE: GREEN PRESERVATIVES MARKET, BY REGION, 2017–2021 (KILOTON)

- TABLE 29 NATURAL PRESERVATIVE: GREEN PRESERVATIVES MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 30 NATURAL PRESERVATIVE: GREEN PRESERVATIVES MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 31 NATURAL PRESERVATIVE: GREEN PRESERVATIVES MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 32 ORGANIC ACID: GREEN PRESERVATIVES MARKET, BY REGION, 2017–2021 (KILOTON)

- TABLE 33 ORGANIC ACID: GREEN PRESERVATIVES MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 34 ORGANIC ACID: GREEN PRESERVATIVES MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 35 ORGANIC ACID: GREEN PRESERVATIVES MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 36 ESSENTIAL OIL: GREEN PRESERVATIVES MARKET, BY REGION, 2017–2021 (KILOTON)

- TABLE 37 ESSENTIAL OIL: GREEN PRESERVATIVES MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 38 ESSENTIAL OIL: GREEN PRESERVATIVES MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 39 ESSENTIAL OIL: GREEN PRESERVATIVES MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 40 OTHERS: GREEN PRESERVATIVES MARKET, BY REGION, 2017–2021 (KILOTON)

- TABLE 41 OTHERS: GREEN PRESERVATIVES MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 42 OTHERS: GREEN PRESERVATIVES MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 43 OTHERS: GREEN PRESERVATIVES MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 44 GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (KILOTON)

- TABLE 45 GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 46 GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (USD MILLION)

- TABLE 47 GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 48 GREEN PRESERVATIVES MARKET IN FOOD & BEVERAGE, BY REGION, 2017–2021 (KILOTON)

- TABLE 49 GREEN PRESERVATIVES MARKET IN FOOD & BEVERAGE, BY REGION, 2022–2028 (KILOTON)

- TABLE 50 GREEN PRESERVATIVES MARKET IN FOOD & BEVERAGE, BY REGION, 2017–2021 (USD MILLION)

- TABLE 51 GREEN PRESERVATIVES MARKET IN FOOD & BEVERAGE, BY REGION, 2022–2028 (USD MILLION)

- TABLE 52 GREEN PRESERVATIVES MARKET IN PERSONAL CARE & COSMETIC, BY REGION, 2017–2021 (KILOTON)

- TABLE 53 GREEN PRESERVATIVES MARKET IN PERSONAL CARE & COSMETIC, BY REGION, 2022–2028 (KILOTON)

- TABLE 54 GREEN PRESERVATIVES MARKET IN PERSONAL CARE & COSMETIC, BY REGION, 2017–2021 (USD MILLION)

- TABLE 55 GREEN PRESERVATIVES MARKET IN PERSONAL CARE & COSMETIC, BY REGION, 2022–2028 (USD MILLION)

- TABLE 56 GREEN PRESERVATIVES MARKET IN CLEANING INDUSTRY, BY REGION, 2017–2021 (KILOTON)

- TABLE 57 GREEN PRESERVATIVES MARKET IN CLEANING INDUSTRY, BY REGION, 2022–2028 (KILOTON)

- TABLE 58 GREEN PRESERVATIVES MARKET IN CLEANING INDUSTRY, BY REGION, 2017–2021 (USD MILLION)

- TABLE 59 GREEN PRESERVATIVES MARKET IN CLEANING INDUSTRY, BY REGION, 2022–2028 (USD MILLION)

- TABLE 60 GREEN PRESERVATIVES MARKET IN INDUSTRIAL CLEANING, BY REGION, 2017–2021 (KILOTON)

- TABLE 61 GREEN PRESERVATIVES MARKET IN INDUSTRIAL CLEANING, BY REGION, 2022–2028 (KILOTON)

- TABLE 62 GREEN PRESERVATIVES MARKET IN INDUSTRIAL CLEANING, BY REGION, 2017–2021 (USD MILLION)

- TABLE 63 GREEN PRESERVATIVES MARKET IN INDUSTRIAL CLEANING, BY REGION, 2022–2028 (USD MILLION)

- TABLE 64 GREEN PRESERVATIVES MARKET IN HOUSEHOLD CLEANING, BY REGION, 2017–2021 (KILOTON)

- TABLE 65 GREEN PRESERVATIVES MARKET IN HOUSEHOLD CLEANING, BY REGION, 2022–2028 (KILOTON)

- TABLE 66 GREEN PRESERVATIVES MARKET IN HOUSEHOLD CLEANING, BY REGION, 2017–2021 (USD MILLION)

- TABLE 67 GREEN PRESERVATIVES MARKET IN HOUSEHOLD CLEANING, BY REGION, 2022–2028 (USD MILLION)

- TABLE 68 GREEN PRESERVATIVES MARKET IN PHARMACEUTICAL, BY REGION, 2017–2021 (KILOTON)

- TABLE 69 GREEN PRESERVATIVES MARKET IN PHARMACEUTICAL, BY REGION, 2022–2028 (KILOTON)

- TABLE 70 GREEN PRESERVATIVES MARKET IN PHARMACEUTICAL, BY REGION, 2017–2021 (USD MILLION)

- TABLE 71 GREEN PRESERVATIVES MARKET IN PHARMACEUTICAL, BY REGION, 2022–2028 (USD MILLION)

- TABLE 72 GREEN PRESERVATIVES MARKET IN OTHERS, BY REGION, 2017–2021 (KILOTON)

- TABLE 73 GREEN PRESERVATIVES MARKET IN OTHERS, BY REGION, 2022–2028 (KILOTON)

- TABLE 74 GREEN PRESERVATIVES MARKET IN OTHERS, BY REGION, 2017–2021 (USD MILLION)

- TABLE 75 GREEN PRESERVATIVES MARKET IN OTHERS, BY REGION, 2022–2028 (USD MILLION)

- TABLE 76 GREEN PRESERVATIVES MARKET, BY REGION, 2017–2021 (KILOTON)

- TABLE 77 GREEN PRESERVATIVES MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 78 GREEN PRESERVATIVES MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 79 GREEN PRESERVATIVES MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 80 ASIA PACIFIC: GREEN PRESERVATIVES MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 81 ASIA PACIFIC: GREEN PRESERVATIVES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 82 ASIA PACIFIC: GREEN PRESERVATIVES MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 83 ASIA PACIFIC: GREEN PRESERVATIVES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 84 ASIA PACIFIC: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (KILOTON)

- TABLE 85 ASIA PACIFIC: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 86 ASIA PACIFIC: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (USD MILLION)

- TABLE 87 ASIA PACIFIC: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 88 ASIA PACIFIC: GREEN PRESERVATIVES MARKET, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 89 ASIA PACIFIC: GREEN PRESERVATIVES MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 90 ASIA PACIFIC: GREEN PRESERVATIVES MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 91 ASIA PACIFIC: GREEN PRESERVATIVES MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 92 CHINA: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (TON)

- TABLE 93 CHINA: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 94 CHINA: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (USD THOUSAND)

- TABLE 95 CHINA: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 96 JAPAN: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (TON)

- TABLE 97 JAPAN: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 98 JAPAN: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (USD THOUSAND)

- TABLE 99 JAPAN: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 100 INDIA: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (TON)

- TABLE 101 INDIA: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 102 INDIA: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (USD THOUSAND)

- TABLE 103 INDIA: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 104 NORTH AMERICA: GREEN PRESERVATIVES MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 105 NORTH AMERICA: GREEN PRESERVATIVES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 106 NORTH AMERICA: GREEN PRESERVATIVES MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 107 NORTH AMERICA: GREEN PRESERVATIVES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 108 NORTH AMERICA: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (KILOTON)

- TABLE 109 NORTH AMERICA: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 110 NORTH AMERICA: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (USD MILLION)

- TABLE 111 NORTH AMERICA: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 112 NORTH AMERICA: GREEN PRESERVATIVES MARKET, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 113 NORTH AMERICA: GREEN PRESERVATIVES MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 114 NORTH AMERICA: GREEN PRESERVATIVES MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 115 NORTH AMERICA: GREEN PRESERVATIVES MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 116 US: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (TON)

- TABLE 117 US: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 118 US: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (USD THOUSAND)

- TABLE 119 US: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 120 EUROPE: GREEN PRESERVATIVES MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 121 EUROPE: GREEN PRESERVATIVES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 122 EUROPE: GREEN PRESERVATIVES MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 123 EUROPE: GREEN PRESERVATIVES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 124 EUROPE: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (KILOTON)

- TABLE 125 EUROPE: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 126 EUROPE: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (USD MILLION)

- TABLE 127 EUROPE: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 128 EUROPE: GREEN PRESERVATIVES MARKET, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 129 EUROPE: GREEN PRESERVATIVES MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 130 EUROPE: GREEN PRESERVATIVES MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 131 EUROPE: GREEN PRESERVATIVES MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 132 GERMANY: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (TON)

- TABLE 133 GERMANY: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 134 GERMANY: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (USD THOUSAND)

- TABLE 135 GERMANY: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 136 UK: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (TON)

- TABLE 137 UK: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 138 UK: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (USD THOUSAND)

- TABLE 139 UK: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 140 FRANCE: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (TON)

- TABLE 141 FRANCE: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 142 FRANCE: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (USD THOUSAND)

- TABLE 143 FRANCE: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 144 ITALY: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (TON)

- TABLE 145 ITALY: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 146 ITALY: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (USD THOUSAND)

- TABLE 147 ITALY: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 148 SPAIN: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (TON)

- TABLE 149 SPAIN: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 150 SPAIN: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (USD THOUSAND)

- TABLE 151 SPAIN: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 152 MIDDLE EAST & AFRICA: GREEN PRESERVATIVES MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 153 MIDDLE EAST & AFRICA: GREEN PRESERVATIVES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 154 MIDDLE EAST & AFRICA: GREEN PRESERVATIVES MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: GREEN PRESERVATIVES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (KILOTON)

- TABLE 157 MIDDLE EAST & AFRICA: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 158 MIDDLE EAST & AFRICA: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: GREEN PRESERVATIVES MARKET, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 161 MIDDLE EAST & AFRICA: GREEN PRESERVATIVES MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 162 MIDDLE EAST & AFRICA: GREEN PRESERVATIVES MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: GREEN PRESERVATIVES MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 164 GCC: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (TON)

- TABLE 165 GCC: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 166 GCC: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (USD THOUSAND)

- TABLE 167 GCC: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 168 SAUDI ARABIA: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (TON)

- TABLE 169 SAUDI ARABIA: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 170 SAUDI ARABIA: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (USD THOUSAND)

- TABLE 171 SAUDI ARABIA: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 172 SOUTH AFRICA: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (TON)

- TABLE 173 SOUTH AFRICA: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 174 SOUTH AFRICA: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (USD THOUSAND)

- TABLE 175 SOUTH AFRICA: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 176 SOUTH AMERICA: GREEN PRESERVATIVES MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 177 SOUTH AMERICA: GREEN PRESERVATIVES MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 178 SOUTH AMERICA: GREEN PRESERVATIVES MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 179 SOUTH AMERICA: GREEN PRESERVATIVES MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 180 SOUTH AMERICA: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (KILOTON)

- TABLE 181 SOUTH AMERICA: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (KILOTON)

- TABLE 182 SOUTH AMERICA: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (USD MILLION)

- TABLE 183 SOUTH AMERICA: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 184 SOUTH AMERICA: GREEN PRESERVATIVES MARKET, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 185 SOUTH AMERICA: GREEN PRESERVATIVES MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 186 SOUTH AMERICA: GREEN PRESERVATIVES MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 187 SOUTH AMERICA: GREEN PRESERVATIVES MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 188 BRAZIL: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (TON)

- TABLE 189 BRAZIL: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 190 BRAZIL: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2017–2021 (USD THOUSAND)

- TABLE 191 BRAZIL: GREEN PRESERVATIVES MARKET, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 192 OVERVIEW OF STRATEGIES ADOPTED BY KEY GREEN PRESERVATIVE MANUFACTURERS

- TABLE 193 GREEN PRESERVATIVES MARKET: DEGREE OF COMPETITION

- TABLE 194 GREEN PRESERVATIVES MARKET: TYPE FOOTPRINT

- TABLE 195 GREEN PRESERVATIVES MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 196 GREEN PRESERVATIVES MARKET: COMPANY REGION FOOTPRINT

- TABLE 197 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 198 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 199 KERRY GROUP: COMPANY OVERVIEW

- TABLE 200 KERRY GROUP: DEALS

- TABLE 201 KEMIN INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 202 KEMIN INDUSTRIES, INC.: DEALS

- TABLE 203 CORBION N.V.: COMPANY OVERVIEW

- TABLE 204 CORBION N.V.: DEALS

- TABLE 205 LANXESS AG: COMPANY OVERVIEW

- TABLE 206 LANXESS AG: DEALS

- TABLE 207 BASF SE: COMPANY OVERVIEW

- TABLE 208 BASF SE: DEALS

- TABLE 209 INTERNATIONAL FLAVORS & FRAGRANCES INC.: COMPANY OVERVIEW

- TABLE 210 DOW INC.: COMPANY OVERVIEW

- TABLE 211 DSM-FIRMENICH AG: COMPANY OVERVIEW

- TABLE 212 SYMRISE AG: COMPANY OVERVIEW

- TABLE 213 SYMRISE AG: DEALS

- TABLE 214 GIVAUDAN SA: COMPANY OVERVIEW

- TABLE 215 GIVAUDAN SA: DEALS

- TABLE 216 CLARIANT AG: COMPANY OVERVIEW

- TABLE 217 ADM: COMPANY OVERVIEW

- TABLE 218 CAMLIN FINE SCIENCES LTD.: COMPANY OVERVIEW

- TABLE 219 KALSEC INC.: COMPANY OVERVIEW

- TABLE 220 SALICYLATES AND CHEMICALS PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 221 ARJUNA NATURAL: COMPANY OVERVIEW

- TABLE 222 JIANGSU YIMING BIOLOGICAL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 223 AIR LIQUIDE: COMPANY OVERVIEW

- TABLE 224 SHANDONG FREDA BIOTECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 225 CHINOVA BIOWORKS INC.: COMPANY OVERVIEW

- TABLE 226 GUJARAT ENTERPRISE: COMPANY OVERVIEW

- TABLE 227 ITA FOOD IMPROVERS: COMPANY OVERVIEW

- TABLE 228 JUNGBUNZLAUER SUISSE AG: COMPANY OVERVIEW

- TABLE 229 MAYASAN A.S.: COMPANY OVERVIEW

- TABLE 230 LONZA GROUP LTD.: COMPANY OVERVIEW

- TABLE 231 FOOD PRESERVATIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 232 FOOD PRESERVATIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 233 FOOD PRESERVATIVES MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 234 FOOD PRESERVATIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 235 ASIA PACIFIC: FOOD PRESERVATIVES MARKET, BY COUNTRY/REGION, 2019–2022 (USD MILLION)

- TABLE 236 ASIA PACIFIC: FOOD PRESERVATIVES MARKET, BY COUNTRY/REGION, 2023–2028 (USD MILLION)

- TABLE 237 ASIA PACIFIC: FOOD PRESERVATIVES MARKET, BY COUNTRY/REGION, 2019–2022 (KILOTON)

- TABLE 238 ASIA PACIFIC: FOOD PRESERVATIVES MARKET, BY COUNTRY/REGION, 2023–2028 (KILOTON)

- TABLE 239 EUROPE: FOOD PRESERVATIVES MARKET, BY COUNTRY/REGION, 2019–2022 (USD MILLION)

- TABLE 240 EUROPE: FOOD PRESERVATIVES MARKET, BY COUNTRY/REGION, 2023–2028 (USD MILLION)

- TABLE 241 EUROPE: FOOD PRESERVATIVES MARKET, BY COUNTRY/REGION, 2019–2022 (KILOTON)

- TABLE 242 EUROPE: FOOD PRESERVATIVES MARKET, BY COUNTRY/REGION, 2023–2028 (KILOTON)

- TABLE 243 NORTH AMERICA: FOOD PRESERVATIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 244 NORTH AMERICA: FOOD PRESERVATIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 245 NORTH AMERICA: FOOD PRESERVATIVES MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 246 NORTH AMERICA: FOOD PRESERVATIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 247 SOUTH AMERICA: FOOD PRESERVATIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 248 SOUTH AMERICA: FOOD PRESERVATIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 249 SOUTH AMERICA: FOOD PRESERVATIVES MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 250 SOUTH AMERICA: FOOD PRESERVATIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 251 REST OF THE WORLD: FOOD PRESERVATIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 252 REST OF THE WORLD: FOOD PRESERVATIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 253 REST OF THE WORLD: FOOD PRESERVATIVES MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 254 REST OF THE WORLD: FOOD PRESERVATIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- FIGURE 1 GREEN PRESERVATIVES MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE) - COLLECTIVE SHARE OF KEY PLAYERS

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE) - COLLECTIVE REVENUE OF ALL PRODUCTS (BOTTOM-UP)

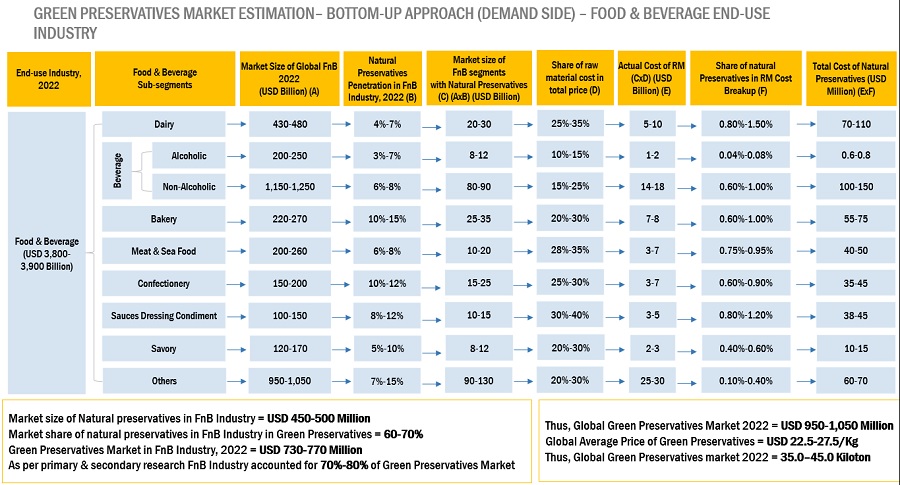

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 (DEMAND SIDE), END-USE INDUSTRY (BOTTOM-UP)

- FIGURE 5 GREEN PRESERVATIVES MARKET: DATA TRIANGULATION

- FIGURE 6 MARKET CAGR PROJECTIONS FROM SUPPLY SIDE

- FIGURE 7 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

- FIGURE 8 NATURAL PRESERVATIVES ACCOUNTED FOR LARGEST SHARE OF GREEN PRESERVATIVES MARKET IN 2022

- FIGURE 9 FOOD & BEVERAGE TO BE LARGEST END-USE INDUSTRY OF GREEN PRESERVATIVES DURING FORECAST PERIOD

- FIGURE 10 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF GREEN PRESERVATIVES MARKET IN 2022

- FIGURE 11 NATURAL PRESERVATIVE SEGMENT TO ACCOUNT FOR LARGEST SHARE IN OVERALL MARKET

- FIGURE 12 NORTH AMERICA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 US DOMINATES GREEN PRESERVATIVES MARKET IN NORTH AMERICA

- FIGURE 14 FOOD & BEVERAGE SEGMENT LED GREEN PRESERVATIVE MARKET ACROSS REGIONS

- FIGURE 15 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN GREEN PRESERVATIVES MARKET

- FIGURE 17 ESSENTIAL OIL PRODUCTION IN TOP 10 COUNTRIES

- FIGURE 18 GREEN PRESERVATIVES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 GREEN PRESERVATIVES MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS IN TOP 3 END-USE INDUSTRIES

- FIGURE 21 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

- FIGURE 22 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY

- FIGURE 23 AVERAGE SELLING PRICE TREND OF GREEN PRESERVATIVES, BY REGION (USD/KG)

- FIGURE 24 REVENUE SHIFT IN GREEN PRESERVATIVES MARKET

- FIGURE 25 GREEN PRESERVATIVES MARKET: ECOSYSTEM MAPPING

- FIGURE 26 IMPORT OF GREEN PRESERVATIVES, BY KEY COUNTRIES (2017–2022)

- FIGURE 27 EXPORT OF GREEN PRESERVATIVES, BY KEY COUNTRIES (2017–2022)

- FIGURE 28 PATENTS REGISTERED FOR GREEN PRESERVATIVES, 2012–2023

- FIGURE 29 OWNERS OF MAJOR PATENTS FOR GREEN PRESERVATIVES

- FIGURE 30 LEGAL STATUS OF PATENTS FILED FOR GREEN PRESERVATIVES MARKET

- FIGURE 31 MAXIMUM PATENTS FILED IN JURISDICTION OF CHINA

- FIGURE 32 NATURAL PRESERVATIVE SEGMENT TO LEAD GREEN PRESERVATIVES MARKET DURING FORECAST PERIOD

- FIGURE 33 FOOD & BEVERAGE TO BE LARGEST CONSUMER OF GREEN PRESERVATIVES DURING FORECAST PERIOD

- FIGURE 34 NORTH AMERICA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 35 ASIA PACIFIC: GREEN PRESERVATIVES MARKET SNAPSHOT

- FIGURE 36 NORTH AMERICA: GREEN PRESERVATIVES MARKET SNAPSHOT

- FIGURE 37 EUROPE: GREEN PRESERVATIVES MARKET SNAPSHOT

- FIGURE 38 RANKING OF TOP FIVE PLAYERS IN GREEN PRESERVATIVES MARKET, 2022

- FIGURE 39 KERRY GROUP LED GREEN PRESERVATIVES MARKET IN 2022

- FIGURE 40 REVENUE ANALYSIS OF KEY COMPANIES, 2018-2022

- FIGURE 41 COMPANY EVALUATION MATRIX: GREEN PRESERVATIVES MARKET

- FIGURE 42 GREEN PRESERVATIVES MARKET: COMPANY FOOTPRINT

- FIGURE 43 GREEN PRESERVATIVES MARKET: STARTUPS/SMES EVALUATION MATRIX

- FIGURE 44 KERRY GROUP: COMPANY SNAPSHOT

- FIGURE 45 CORBION N.V.: COMPANY SNAPSHOT

- FIGURE 46 LANXESS AG: COMPANY SNAPSHOT

- FIGURE 47 BASF SE: COMPANY SNAPSHOT

- FIGURE 48 INTERNATIONAL FLAVORS & FRAGRANCES INC.: COMPANY SNAPSHOT

- FIGURE 49 DOW INC.: COMPANY SNAPSHOT

- FIGURE 50 DSM-FIRMENICH AG: COMPANY SNAPSHOT

- FIGURE 51 SYMRISE AG: COMPANY SNAPSHOT

- FIGURE 52 GIVAUDAN SA: COMPANY SNAPSHOT

- FIGURE 53 CLARIANT AG: COMPANY SNAPSHOT

The study involved four major activities in estimating the market size for green preservatives market. Intensive secondary research was done to gather information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

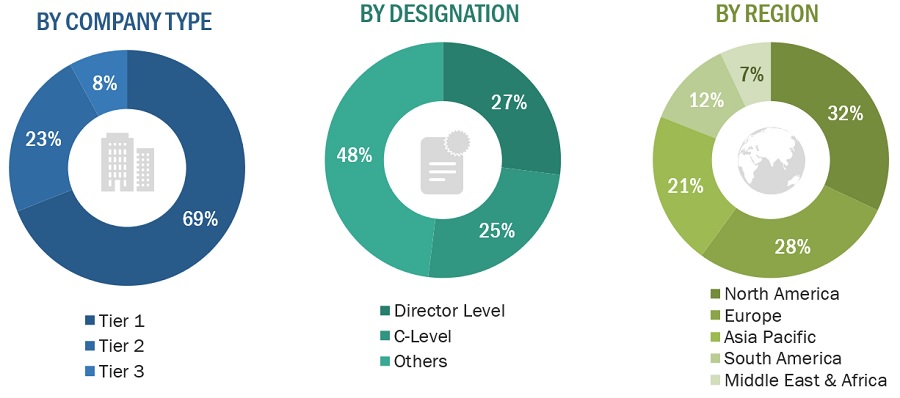

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

The green preservatives market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized from key opinion leaders in various applications for the green preservatives market. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Breakdown of Primary Participants

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Kerry Group |

Global Strategy & Innovation Manager |

|

Kemin Industries, Inc. |

Technical Sales Manager |

|

Corbion N.V. |

Senior Supervisor |

|

LANXESS SE |

Production Supervisor |

|

BASF SE |

Production Manager |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the green preservatives market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry have been identified through extensive secondary research.

The supply chain of the industry has been determined through primary and secondary research.

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Green Preservatives Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Green Preservatives Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into respective segments and subsegments. To realize the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both the demand and supply sides in the green preservatives industry.

Market Definition

Green preservatives, synonymous with natural or eco-friendly preservatives, encompass elements derived from natural origins like plants, minerals, and essential oils. These compounds find application across diverse sectors such as food & beverage, personal care & cosmetic, cleaning industry, pharmaceutical, and others. Their function involves prolonging product shelf life, curbing microbial growth, and ensuring quality standards, all without resorting to synthetic or chemical additives.

Their fundamental role lies in serving as alternatives to conventional synthetic preservatives, mitigating potential health or environmental risks. Their appeal stems from perceived safety, eco-consciousness, and resonance with consumer inclinations for sustainable, natural products. Often endowed with antimicrobial and antioxidant attributes, they facilitate product preservation while adhering to regulatory guidelines and meeting consumer preferences for safer, naturally sourced components.

Key Stakeholders

- Green preservatives manufacturers

- Raw material manufacturers

- Government planning commissions and research organizations

- Industry associations

- End-use industries

- R&D institutions

Report Objectives

- To analyze and forecast the size of the green preservatives market in terms of value and volume

- To provide detailed information regarding key factors, such as drivers, restraints, challenges, and opportunities influencing the growth of the market

- To define, describe, and segment the green preservatives market based on type, and end-use industry

- To forecast the size of the market segments for regions such as Asia Pacific, North America, Europe, South America, and the Middle East & Africa

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional end-use industry or type

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Growth opportunities and latent adjacency in Green Preservatives Market